4th Dimension: Unlock Alpha With Liquidity

A poorly understood, lesser known Investment Strategy

When you think about investment strategies, what comes to mind? If you’re like most investors, you probably think of value versus growth stocks, large-caps versus small-caps or perhaps momentum investing. But there’s another dimension that’s been hiding in plain sight, one that Roger Ibbotson and his colleagues argue deserves equal billing with these established approaches, and that’s liquidity.

Roger Ibbotson is a Yale Finance professor and the Chairman and CIO of Zebra Capital. He has written several white papers, including “Liquidity as an Investment Style” where he argues that liquidity should be given equal standing to size, value, growth and momentum as an investment style.

Before we dive into liquidity itself, let’s establish what qualifies as a legitimate investment style. William Sharpe laid out four essential criteria back in 1992. A true investment style, he said, must:

Be capable of being effectively deployed

Deliver strong, consistent returns

Be distinct from other strategies

Have a low cost of execution

These aren’t just arbitrary hurdles. They ensure that a style represents a genuine strategic choice rather than a lucky accident or an overly complex approach that collapses under real-world frictional costs of transacting.

Now let’s consider liquidity as a strategy.

Based on the Ibbotson paper, stocks with low liquidity - those that trade less frequently - tend to outperform their heavily traded counterparts over the long term. The researchers measure liquidity using stock turnover, which is simply the trading volume divided by shares outstanding. It’s elegantly simple, yet powerfully predictive.

The explanation for why this happens is actually quite straightforward. Investors naturally prefer liquid stocks because they’re easier to buy and sell, with lower transaction costs. This preference means investors will pay a premium for liquidity. Flip that around, and it means less liquid stocks trade at a discount. For patient investors willing to hold these stocks over the long-term, for whom low liquidity is not an issue, that discount translates into higher returns.

The data in the study also revealed something surprising: less liquid portfolios actually exhibit lower volatility (standard deviations) than their more liquid counterparts. With lower trading activity, there is less opportunity for human psychology - the mood swings of Mr Market - to influence the price.

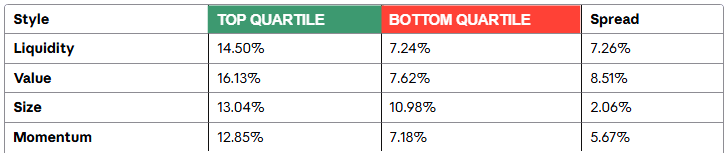

Over the 40-year period from 1972 to 2011, the differences were striking. Looking at quartile portfolios:

The low liquidity quartile (labelled ‘BEST’) delivered compound annual returns of 14.50%, compared to just 7.24% for the high liquidity quartile (labelled ‘WORST’) - a spread of 726 basis points annually, highlighting how much of a difference liquidity as a theme makes to returns. That’s competitive with the impact of value as a theme and more profound than both the size and momentum.

What’s particularly intriguing is that low liquidity stocks achieved these returns with a standard deviation of just 20.41%, lower than any other quartile in the liquidity spectrum. This challenges the conventional wisdom that higher returns necessarily come with higher volatility.

Is Liquidity Just Size in Disguise?

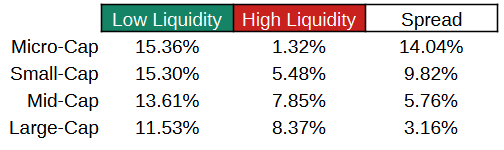

A natural question arises: aren’t illiquid stocks just small-cap stocks by another name? The answer is definitively no and the data proves it convincingly.

When the researchers created double-sorted portfolios, dividing stocks by both size and liquidity, they found the liquidity effect persists across all size categories. Even among large-cap stocks, low liquidity portfolios returned 11.53% annually compared to 8.37% for high liquidity portfolios.

The effect is strongest among micro-caps (15.36% versus 1.32%), but it’s present everywhere. You can be a large-cap investor and still benefit from tilting toward less liquid names within that universe.

Mix it up!

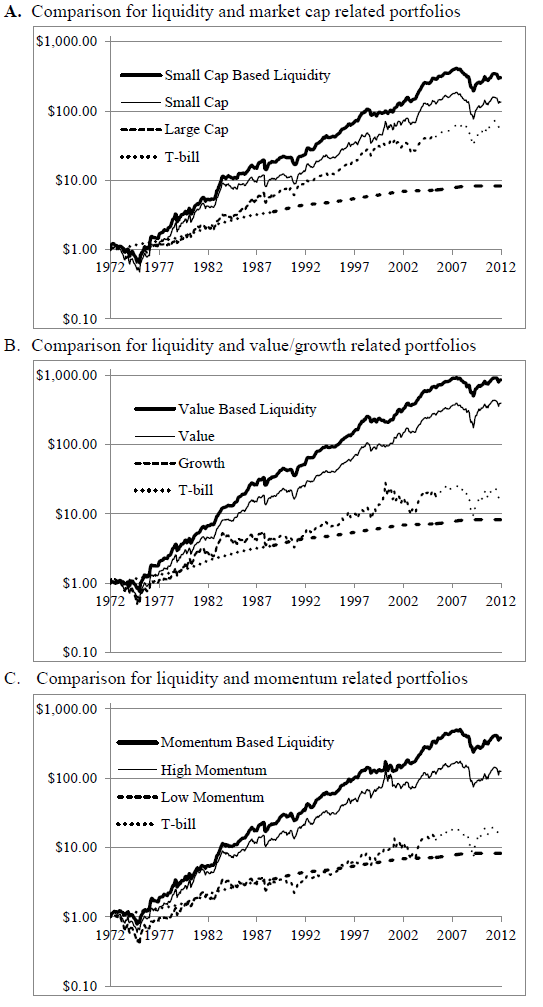

Although low liquidity translates to higher returns than focusing solely on value or momentum, the real sweet spot comes when combining them.

Low-liquidity value stocks delivered compound annual returns of 18.43%, the best performer in the value-liquidity matrix. Meanwhile, growth stocks that trade at a premium (so not conventionally considered value stocks), which had high-liquidity managed just 2.24%. The worst of both worlds produced truly dismal results.

This demonstrates that adding liquidity into the mix juices value investing returns.

Similarly, high-momentum low-liquidity stocks returned 16.03% annually, while low-momentum high-liquidity stocks limped along at 3.03%. In every case, liquidity adds something to both of these other investment styles.

This additive effect is crucial. It means liquidity isn’t redundant, it’s complementary. You can enhance a value strategy, a momentum strategy, or a size strategy by incorporating a liquidity tilt.

The Factor Perspective

For those who prefer thinking in terms of factor models, the researchers constructed a liquidity factor: long the least liquid quartile, short the most liquid. When they ran this factor through the standard tests, regressing it against market returns and the Fama-French factors (size and value), something interesting emerged.

The liquidity factor showed a negative beta to the market (-0.66) and negative correlation with size, but positive correlation with value. Most importantly, even after controlling for market, size, value and momentum, the liquidity factor still generated a significant monthly alpha of 0.31% in the four-factor model.

In plain English: liquidity captures something real that the other established factors miss. It’s not just a repackaging of existing styles.

Implementation

Here’s where liquidity really shines as a practical investment style. For a strategy to be implementable, you need some stability: you can’t have your entire portfolio turning over every month.

The research reveals that 77.28% of stocks in the lowest liquidity quartile remain there the following year. Overall, 62.93% of stocks stay in the same liquidity quartile year-to-year.

This stability is similar to size (78.73% remain) and actually better than value (51.63% remain) and momentum (only 29.03% remain). What this means in practice is that a liquidity-focused portfolio requires relatively infrequent rebalancing which is exactly what you want when you’re investing in less liquid stocks.

The Migration Premium

There’s a fascinating kicker to all this. When stocks do migrate between liquidity quartiles, the returns are extraordinary. A stock moving from across all four quartiles - from low liquidity to high liquidity in a single year - delivered an average return of 109.43%. Even moving across one quartile, from the second quartile to the first, produced 65.36% returns.

This makes intuitive sense. When a stock becomes more liquid, investors are willing to pay that premium for the added convenience. The stock gets re-rated upward. For patient investors who held these stocks before they became liquid, this represents a substantial bonus on top of the baseline liquidity premium.

The Counterintuitive Risk Profile

One of the most intriguing aspects of the liquidity style is how it challenges our assumptions about risk and return. Traditional finance theory suggests that we need to accept higher risk in order to generate higher returns, yet low liquidity portfolios achieve superior returns with low volatility. While risk and volatility are not the same thing, a reduction in volatility is certainly less risky, particularly for a leveraged investor.

Moreover, as discussed above, the liquidity factor has a negative beta to the market. During market rallies, the less-liquid stocks underperform; but during downturns, they hold up relatively well. This suggests liquidity might offer diversification benefits in addition to return enhancement.

“If you want to avoid high risks, you have to be willing to accept lower returns. Investing is not about beating the market. It’s about controlling risk. If you can do that, you’ll be a successful investor… Prioritize the downside of every investment. With limited downside, the upside will take care of itself.” - Howard Marks

The secret of what makes less-liquid stocks good investments is not that they are discounted due to having a high risk profile, but because they carry an inconvenience cost. They take longer to trade, have wider bid-ask spreads and require patience. In markets where everyone wants instant gratification, patience is rewarded.

Practical Implications

So what does all this mean for investors? Several things:

For long-term investors, a tilt toward less liquid stocks makes tremendous sense. If you’re investing for decades, not days, you don’t need instant liquidity. Why pay for something you don’t value?

For active managers, liquidity provides another dimension for alpha generation. You can enhance value portfolios, small-cap portfolios or momentum portfolios by favouring less liquid names within those categories.

For index investors, this research suggests that cap-weighted indices may be systematically overweighting liquidity - paying top dollar for the most traded stocks. Equal-weighted or fundamentally-weighted approaches might partially capture the liquidity benefit.

For risk managers, the negative correlation between the liquidity factor and the market suggests potential diversification benefits, though this needs to be weighed against the challenges of exiting positions quickly if that ever became necessary in a liquidity crisis, such as the credit squeeze of 2008.

The Bottom Line

Liquidity deserves recognition as a fourth fundamental investment style, standing alongside size, value, and momentum. It meets all of Sharpe’s criteria: it’s measurable, it delivers strong returns that persist after controlling for other factors, it’s distinct from other styles, and it can be implemented efficiently.

Perhaps most importantly, liquidity has the clearest economic rationale of any style. Investors demonstrably want liquidity and are willing to pay for it. That discount available on illiquid and so less popular stocks creates an opportunity for those who don’t need immediate liquidity and who are happy to collect the reward for being patient.

In a world where everyone is focused on the latest hot sector or trying to time the market, liquidity offers something different: a systematic, patient approach that exploits one of the market’s most reliable inefficiencies. It’s not sexy, but over four decades, it’s been remarkably effective.

The question isn’t whether liquidity works as an investment style. The evidence on that is clear. The question is whether you have the patience, the fortitude and the time horizon to take advantage of it.

The liquidity framework really aplies to mid cap names like Ubiquiti (UI). It trades under 500K shares daily despite solid fundamentals, creating exactly the kind of patience premium you're describing. The company has strong margins in networking equipment and minimal analyst coverage.