Company: Strix Group Plc

Ticker: KETL.L

Exchange: London, AIM

Market Cap: £175 million GBP

URL: https://www.strix.com

Strategy: Value opportunity

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

Strix Group Company Overview

Strix Group Plc, listed on the London Stock Exchange, is a global leader in designing and manufacturing kettle safety controls. Most leading kettle manufacturers use Strix components and technology, making the Strix name a common sight on kettle bases.

Its market dominance is significant, with its kettle controls being used daily by over 1.2 billion people in more than 100 countries, representing over 10% of the world’s population. This level of usage is comparable to that of iPhones. Despite this vast reach, Strix employs only 850 people globally, a stark contrast to Apple's 161,000 employees, highlighting the company's efficiency and low capital intensity.

Strix's dominant market position is supported by its extensive patent portfolio and effective enforcement against infringing products. The company holds a leading ~55 percent global market share in kettle controls, aiming to grow this to ~57 percent in the medium term.

Strix also produces water filtration and purification products through wholly-owned subsidiaries Astrea, Laica, Aqua Optima, and Billi. This diversified approach has helped the company maintain a robust market position and explore new growth avenues.

Brief History Of Strix Group

During World War II, Eric Taylor designed a bi-metal control thermostat for Royal Air Force bomber pilots' heated flight suits. Immediately following the war in 1946, he established a company named Otter Controls Ltd to commercialize his invention.

By 1951, now under the name Castletown Thermostats, Taylor expanded the product range to include diverse applications including thermostatic products for cars, washing machines and electric blankets.

Taylor's son, John, joined the business in 1959 and soon revealed himself to have inherited his father's inventive genius. By the end of his career, the younger Taylor had been granted some 150 patents in his own name.

In 1982, under John Taylor’s leadership, Castletown Thermostats became Strix. The company has since grown both organically and through acquisitions, becoming the market leader it is today.

Strix enjoyed its IPO, listed on the London Stock Exchange, in 2017.

Has Strix Group Been Performing Well?

Strix is a resilient and highly cash-generative business with sector-leading gross margins of around 39 percent and operating margins around 25 percent. These margins are supported by automation investments, efficiency measures, and strategic initiatives, making further improvements possible.

The company's unique working capital cycle, with customers paying in advance, reduces non-payment risk and enhances cash conversion, leading to strong free cash flow. Return on Invested Capital is ~20 percent

Despite these strengths, Strix's shareholder returns have been mixed due to questionable capital allocation decisions and unforeseen geopolitical factors.

Strix has a history of paying dividends, which appeals to income-focused investors, and the company has historically made it a priority to establish a stable payout ratio.

However, with debt levels rising in recent years, partly due to Covid19 disruption and also to finance strategic acquisitions, one might argue that dividends are being funded by debt rather than ‘actual’ free cash flow.

I have always argued that the payment of dividends, a highly tax inefficient partial liquidation of balance sheet assets, should only ever be a last resort if the company has no other use for its cash. In the case of Strix, paying out balance sheet cash and then replacing it with debt to fund growth is, in my humble opinion, insane. To make matters worse, with interest rates up sharply, it has been paying the price for its elevated debt position.

Net debt rose to £93 million by the end of 2023, equating to 2.66 times trailing twelve months' EBITDA, close to the debt covenant threshold of 2.75 times. This caused market worries of covenant breaches, leading to a 38% drop in the share price back in September 2023 (creating a value investment opportunity - more on this later).

In response to the market jitters, the Board decided to prioritize maximizing cash generation to support debt reduction. It also temporarily paused dividend payments for calendar year 2024, which is most welcomed. The share price has been steadily recovering as a result.

However, the board has announced that it plans to return to a sustainable dividend pay-out ratio of 30 percent of adjusted PAT in 2025, long before the debt it repaid, which strikes me as odd.

It is only possible to reconcile this decision if one accepts that the objective of the board is simply to increase its debt headroom, rather than prioritizing optimal debt reduction per se.

Either way, why would the management bind its hands in terms of capital allocation by committing in advance to paying dividends in 2025 when it has no idea whether more accretive uses of capital exist? Given the depressed share price, stock repurchases should certainly not be ruled out as a prudent use of surplus capital.

Questionable capital raising and allocation decisions are the only red flags in this investment thesis.

Continuing on this theme, recently, Strix announced a new equity placing of 10.9 million shares at £0.80 each, raising approximately £8 million. One investor acquired 80% of the newly allotted shares, indicating that someone certainly has strong conviction in Strix's prospects. These new funds will accelerate debt reduction and potentially lead to more favorable terms for the refinancing of the Group’s banking facility set for 2025.

However, while paying down the debt is most welcomed, an equity for debt swap is never good news owing to the dilution it introduces and the fact that equity is a more expensive form of financing. Doing so concurrently with an announced intention to return to a 30 percent dividend payout ratio, is very disappointing in my eyes. It calls into question the competence of management in matters relating to capital allocation. The company is effectively diluting shareholders, at least in part, to continue paying them a dividend. No rational shareholder would want that. What is the management thinking?

The problem, more broadly, is that the management of many British small-cap companies seem to have an innate fear that failure to pay a dividend will result in all of its shareholders deserting it and so they persist in paying dividends regardless of whether it is prudent to do so. This is a cultural thing made worse by poor advice from brokers who are conflicted (dividends need to be reinvested by recipients and who do you think benefits from that activity?)

The management of Strix ought to take a leaf out of the John Malone playbook.

Does Strix Group Have Good Growth Prospects?

Strix's growth prospects are enhanced by its strong market position in kettle safety controls and strategic expansions into water filtration and purification. The company anticipates a robust revenue CAGR in both the water and appliances categories over the next five years, potentially doubling its total revenue.

Progress in its appliances strategy is being achieved through own-brand launches, partnerships with third-party brands, and acquisitions, which are helping it expand into new categories such as health and wellness. Furthermore, Strix's focus on sustainability initiatives aligns with the current investment environment's emphasis on ESG objectives, providing structural growth tailwinds.

The company, which generates a great deal of free cash flow, is utilizing that capital to grow which is enormously encouraging from an investors perspective. Two of the recent acquisitions are LAICA and Billi.

LAICA, an Italian business, was acquired in 2020 from the Moretto family. LAICA has over 40 years of experience and an international sales network, with products sold across five continents. This immediately gives Strix a broader global footprint and access to new markets. The acquisition also expands Strix's water category and enhances its presence in the health and wellness market, aligning with its growth strategy. Essentially, By combining LAICA's water treatment range with its own offerings, Strix can provide a more comprehensive portfolio of water products to a global customer base.

Strix also recently acquired Billi, a leading Australian brand for premium instant boiling, chilled, and sparkling filtered water systems. The acquisition includes Billi Australia, Billi New Zealand, and Billi UK, all of which accelerates Strix's growth plans in the water and appliance sectors. Billi has a strong 30-year heritage of designing and producing innovative products.

Adding Billi to Strix's brand portfolio allows comprehensive coverage of the hot water dispensing market. Strix's technological capabilities are expected to enhance Billi's new product development roadmap.

"The acquisition of Billi accelerates our strategy within our Water and Appliances categories which is core to Strix's five-year plan."

Mark Bartlett, Strix's CEO

This aligns with Strix's strategy to dramatically increase revenues through a combination of organic growth, new product introductions, and strategic acquisitions in key water and appliance markets. The Billi acquisition significantly expands Strix's presence in these markets.

This is a short 6 minute interview with CEO Bartlett, following publication of the preliminary results for the 12 months to 31 December 2023:

Is Strix Group Fairly Valued?

In 2018, soon after its IPO, Strix had top line revenue of £93 million and was capitalized at 9.8x adjusted earnings with a share price of £1.41. Since that time the top line has expanded by 56 percent to £145 million, with a similar margin profile, yet the share price today stands at £0.80 capitalizing the business at 6.8x adjusted earnings and 1.2x sales against a net margin of ~25%. The business today is also more diversified in terms of products and it has better infrastructure owing to its expansion with manufacturing operations in four locations: Ramsey in the Isle of Man, Guangzhou in China (a new factory in the Zengcheng district), Vicenza in Italy, and Melbourne in Australia.

Is it just me, or do you also smell an investment opportunity here?

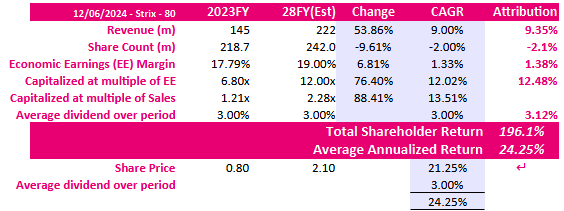

Working off modest assumptions, if over the next five years sales grow at 9 percent CAGR and the business trades at 12x adjusted earnings, then even with continued dilution of 2 percent annually, shareholders would see their investment compound at 24.25 percent annually, amounting to an almost three fold increase on the sum invested.

If the company refrains from issuing any more equity, then the total return will be even greater, and if the company aborts its dividend policy and uses surplus cash to repurchase undervalued stock – far more sensible in the given circumstances - then shareholders could see a four fold increase in investment over the next five years.

Is Strix Group A Good Investment?

The strong fundamentals of the business remain intact, with a resilient core business, dominant market position, and stable market share by value. It has demonstrated good revenue growth, recently driven by the acquisition of Billi, and continues to be highly profitable and strongly cash generative.

On the one hand, its recent acquisitions and expansion into water filtration and other products bodes well for future top line expansion. So far the acquisitions have performed very well. The company ought to be able to maintain its moat and use its entrenched position in kettle controls to cross sell its new products. Combine this with the fact that the stock is arguably oversold and there is scope for both earnings expansion magnified by multiple expansion in the not too distant future, resulting in happy times ahead for shareholders.

On the other hand, the most important element of any successful business is its management, just look at the contrasting fortunes of Apple under Steve Jobs and John Sculley as a case study. In relation to Strix, its capital allocation decisions call management competence into question. Mark Bartlett, the CEO, joined Strix almost 20 years ago in 2006 and has risen through the ranks to become the leader of the business. He comes from an engineering background and while he has proven himself in terms of new product development, commercialization strategies, strategic acquisitions and R&D capabilities, he has shown that his strengths are not capital management. As such, he will be reliant upon the counsel of others for matters relating to capital management, perhaps suggesting that the true weakness existed at the chief financial officer level, and this may explain why the old CFO was replaced earlier this year. The appointment of Clare Foster as the new CFO may lead to more financially coherent capital allocation strategies, but only time will tell.

In summary, the asymmetric risk reward skew look favourable.

Declaration: I am now long STRIX in my own portfolio. The combination of depressed share price which promises multiple expansion, the growth trajectory, the moat and the success of recent acquisitions were all too tempting for me to ignore.

Today’s interim results to June demonstrated strong progress, particularly in improving margins. The company's decision to exit price-sensitive kettle control markets and focus on higher-margin products in the Consumer Goods division has driven a rise in gross margins. Revenue in the kettle controls market increased by 5.9%, with strong growth in regulated markets like the US, UK, and Netherlands. Strix aims to enhance its market share through product launches and improved distribution, especially in Europe.

Strix's indebtedness has decreased significantly, with net debt falling to £68.8m from £83.7m, putting the company on track to achieve its goal of a net debt/EBITDA ratio of 1.5x by FY25.

While H1 results were positive, Q3 volatility in some markets, particularly in China, poses challenges. The forecast for FY24 and FY25 has been adjusted, with a slight decrease in expected revenues and profits due to these challenges. Nevertheless, the group's long-term outlook remains optimistic. Strix remains focused on innovation and margin growth, with upcoming product launches expected to positively impact future performance.

All things considered, the share price still looks to be trading at 50% - 60% of intrinsic value.