Kenmare | A Titanium Opportunity

Discounted share price, double-digit dividends and stock buy-backs

Key Facts & Figures

Kenmare is listed on the London Stock Exchange and the Euronext Dublin.

Market Cap (MM) £287.31 GBP

Enterprise Value (MM) £270.31 GBP

P/E 2.9x

EV/Revenues 0.7x

EBITDA Margin 50%

Dividend Yield 13.8%

Payout Ratio 43.2%

Last 3-Yr Rev. CAGR 23.4%

Last 3-Yr EBITDA CAGR 42.1%

Last 3-Yr EPS CAGR 109.0%

Competitive advantage - process power and cornered resource

Tailwind - growing market with increasing demand against limited supply

Investor's need to know - strong sustainable cash flows and excellent shareholder returns against a bargain share price

Company Overview

Kenmare Resources plc, an Irish company, stands out as a leading global producer of titanium minerals and zircon, operating the extensive Moma Titanium Minerals Mine in northern Mozambique, Africa.

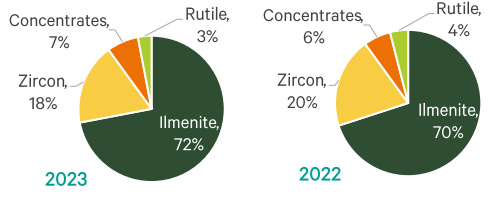

This mine, one of the largest titanium deposits globally, produces ilmenite, zircon, and rutile—crucial materials for titanium dioxide pigments, ceramics, and high-grade titanium feedstocks.

As the largest global producer of ilmenite, Kenmare contributes approximately 7% of the global titanium feedstock supply.

Titanium dioxide is essential for paints, coatings, and plastics. The increasing demand for these products, driven by global economic growth and urbanization, underpins a strong market outlook.

Zircon is critical for the ceramics industry, which is experiencing growth due to rising construction activities and consumer demand for high-quality home products.

Kenmare's established operations position the company to benefit from potential supply shortages, further solidifying its market leadership.

Strategic Positioning and Competitive Advantage

Kenmare benefits from a fully integrated mine-to-market strategy, ensuring control over the entire value chain and significantly enhancing efficiency and profitability. Over the years, the company has moved from the fourth to the first quartile in terms of industry efficiency, providing a substantial cost advantage over competitors and supporting strong cash flows through varying commodity cycles. This in turn underpins shareholder returns.

The Moma Mine, with a life span of over 100 years at current production rates, hosts high-grade mineral resources and boasts low-cost operations.

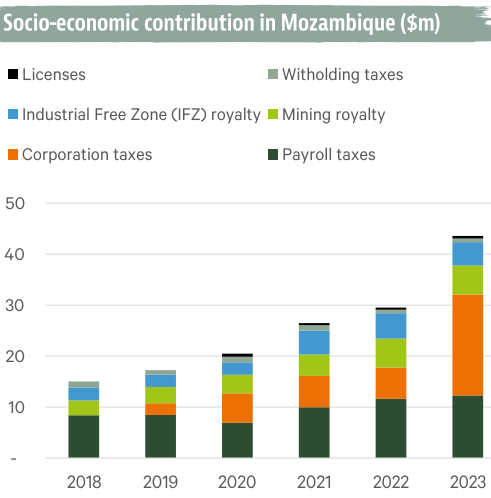

Since commencing commercial production in 2009, Kenmare has forged an enduring relationship with Mozambique authorities assuring continuation of the license to operate.

To date it has paid over $240m in taxes, including $43.4m in 2023 alone, and it is the largest employer in the Nampula province. The company also invests tens of millions into community initiatives supporting schooling, small business development, improving water supply and funding health centers.

This creates a symbiotic relationship whereby Mozambique benefits from having Kenmare operational and, in return, Kenmare benefits from the license to operate a cornered resource.

Relations are further enhanced by the company’s gold standards on environmental issues. It planted 204,000 trees in 2023 alone, it uses over 90% of its energy from renewable sources, and it has both significantly reduced its carbon emissions while always avoiding the use of toxic chemicals in operations.

Financial Performance and Growth

Kenmare has consistently demonstrated strong financial performance, driven by increasing production volumes and a favorable supply-demand imbalance in the titanium feedstock market.

The global market will require an estimated 3 million tons of new supply by 2027. Barriers to entry result from there being limited natural resources in addition to there being logistical, regulatory and political challenges in establishing new mines.

Continuous improvements in operational efficiency and cost management have bolstered profitability, with surplus cash allocated to debt reduction, large dividends, and share repurchases. The share count has reduced from 110 million in 2019 to 89 million today, permanently enhancing shareholder returns by 23.6%.

The company maintains a strong balance sheet, with a debt-to-equity ratio of just 4.3%.

Strategic Initiatives

Kenmare has invested in expanding its production capacity, including the recent expansion of the Wet Concentrator Plant (WCP) B. This expansion is expected to increase production volumes and reduce unit costs. In relation to WCP A, the company has a $341 million CAPEX schedule out to 2027 with $300 million of that occurring in 2024 and 2025, following which CAPEX drops dramatically.

Kenmare's dedication to sustainability is evident in its environmental initiatives and social investments, enhancing its reputation and aligning with investor focus on ESG criteria.

The company strives to leverage advanced mining technologies and continuous process improvements to maintain operational excellence.

Risks and Mitigation

Commodity price volatility, operational risks, and geopolitical challenges are inherent in the mining sector. However, Kenmare's low-cost operations, diversified product portfolio, and strong relationships with local communities and governments mitigate these risks. This was demonstrated in 2023 when, despite a dip in revenue due to lower commodity prices, the company still paid a near 14% dividend yield and repurchased stock.

Investors need to be aware that management changes are afoot. Michael Carvill has served as Managing Director (CEO) since 1986, but has announced his retirement. The company is in the process of finding a replacement and Carvill will remain in post until a replacement is found.

The lack of succession planning shows poor stewardship. When challenged on this point, the investor relations director countered that there are internal candidates being considered but that good stewardship involves opening the recruitment opportunity to outsiders in order to find the best person for the job. Fortunately, this is not a tech company that requires a Steve Jobs type of character innovating to thrive; instead this is a commodity mining company with a competitive advantage and a well established operating model that is very effective and difficult to derail.

Conclusion

Kenmare Resources presents a compelling investment opportunity, significantly undervalued at less than three times earnings. This undervaluation is the reason that the dividend yield reached nearly 14% last year, in addition to stock buybacks.

Based on the current price-to-earnings (P/E) ratio and dividend yield, the company could easily justify a valuation of at least double its current market capitalization. In fact, there are four analysts covering this stock and they all agree - the current share price is £3.22 while the average analyst target is £7.32 with one suggesting £10.48 would be a fairer price. This implies investors are essentially able to buy $1 of value for way less than 50 cents, potentially achieving 2x to 3x capital uplift, plus dividend yield and repurchase accretion.

The company's policy of paying 20% to 40% of profit after tax as dividends makes little sense in the current circumstances. Why would management bind its hands, committing to such rigid dividend policies when it could instead allocate capital based on an assessment of opportunity cost. At the current undervaluation, it would be far more accretive to shareholders to use all excess capital for buybacks, not to mention the tax benefits: dividends are taxed at both the corporate and personal levels, and there's a 25% withholding tax in Ireland for foreign investors, which is cumbersome to reclaim.

Subscribers will know that I view dividends as a last resort means of capital allocation as they are tantamount to a partial liquidation of the company. Its the reason that Buffett and Bezos never pay dividends. It’s just a shame that most other CEOs don’t get it (to better understand it, please see Chapter 30, Fabric of Success).

Hopefully, the incoming CEO will be more adept at capital allocation.

Whichever way you look at it, the investment case for Kenmare is compelling.

Disclaimer: I have a long position in Kenmare Resources. This information is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence before making any investment decisions.