Company: Airtel Africa (London AIM: AAF), Blue Chip Stock, FTSE100

Date: 22nd December 2022

Theme: Organic and Acquisitive High Growth

Assessment: Oversold

Author’s Strategy: Buy / Accumulate

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

Executive Summary

Airtel Africa, one of Africa’s largest mobile telecommunications companies, operates in 14 different African countries, primarily in East, Central, and West Africa. It was listed on the London Stock Exchange in 2019 and has since grown profits, reduced debt, and capitalised on new commercial opportunities.

Much of the world is saturated with payments infrastructure, arguably too much. However, Africa is at the other end of the spectrum. It has a very poor payments infrastructure which in some parts is almost non-existent.

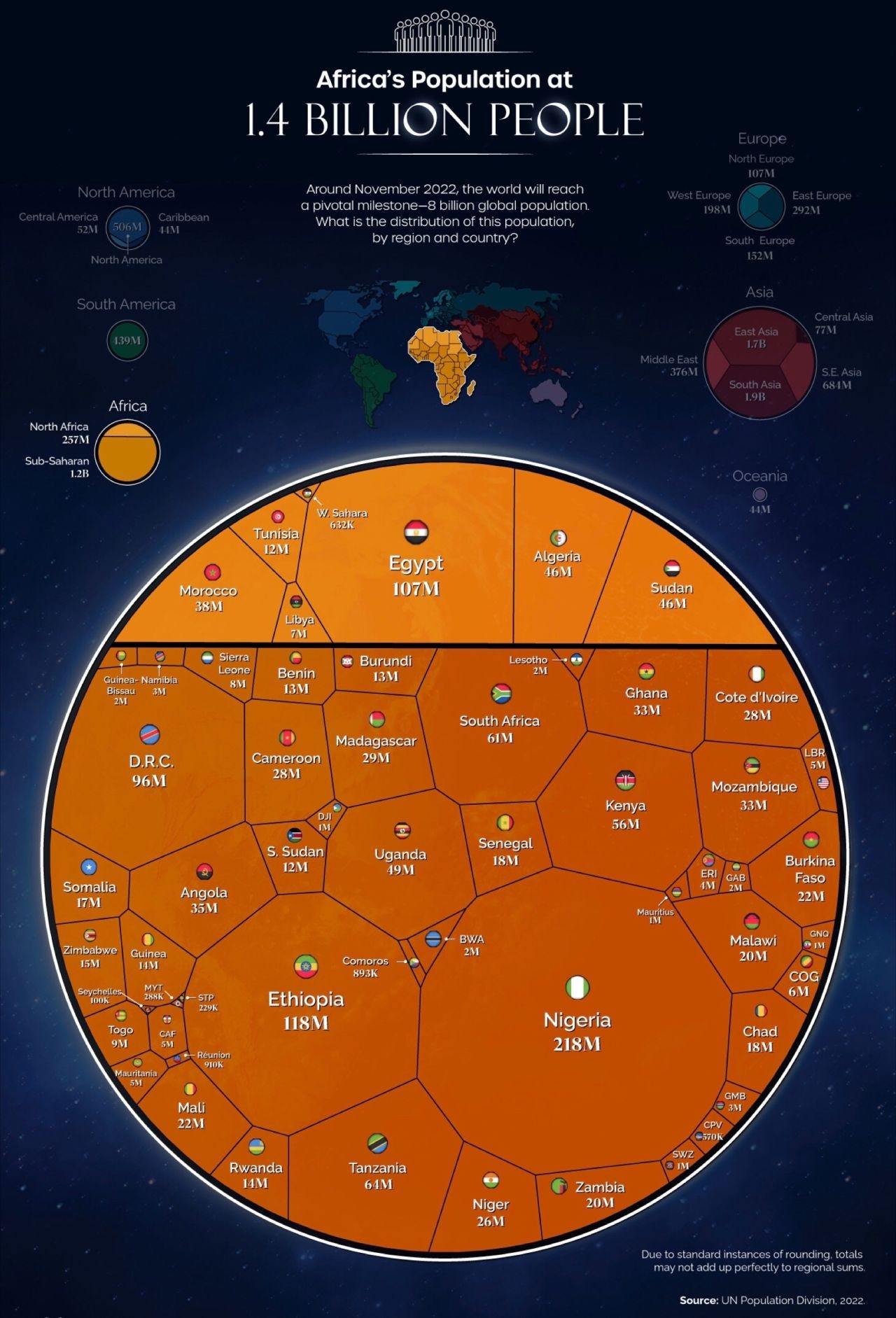

As the image above demonstrates, Africa is incredibly populous. As shown below, the population density of the African continent is greater than that of North America or Latin America, yet much of it is rural, underdeveloped and critically without access to the internet. More particularly, it is such an expansive continent that bricks and mortar banks are few and far between and there is no ATM on every street corner.

In sub-Saharan Africa less than half of the population have a bank account. There are literally tens of millions of people with little or no access to banking or other financial services. Nigeria, for example, has a population of 211m in which 55% of the adult population has no bank account.

If you are operating a business in such an environment, perhaps selling fresh food or handmade arts and crafts, how do you take payment?

The answer, until recently, is that cash is the only alternative. But the nearest bank may be hours away so that is far from ideal and it is dangerous to hoard large amounts of cash at home.

So, imagine the upside in being able to effectively connect the whole of Africa via their mobile infrastructure across a clearing network and without the need for a bank. This is why Airtel Nigeria currently has a customer base of 46.3m and it is growing rapidly. The fact that 32% of the population in African markets is aged between 10 and 24 years old provides a wonderful pipeline of future business to serve.

Both Visa and Mastercard have spotted an opportunity in Africa, but both are taking a distinctly different approach to capitalizing upon it.

Visa in Africa

Andrew Toree, Visa’s regional president for Europe, the Middle East, and Africa said that Africa is a “priority region” for the company. According to a 2017 McKinsey report, it is the world’s second-fastest growing banking market.

Visa has invested in Nigerian payments platform Interswitch (a private company), believed to be a 20% stake for $200 million. Interswitch also owns Verve, the largest domestic debit card scheme in Africa, and Quickteller, a consumer payments platform that enables money transfers, bill payments, mobile and internet air time purchases. However, it is only operational in the one African country. Expanding outside Nigeria to elsewhere in sub-Saharan Africa is Visa's next challenge.

Mastercard in Africa

Mastercard has moved into ACH (Automated Clearing House), which is a network that coordinates electronic payments and automated money transfers. ACH is a way to move money between banks without using paper checks, wire transfers, credit card networks, or cash. The primary benefit is cost. ACH transfers are usually free whereas wire transfers are expensive (the table below demonstrates this perfectly in the US).

While the existing Visa or Mastercard network connects banks, ACH can operate peer to peer. On a continent such as Africa, ACH movements of money can be initiated using smartphones.

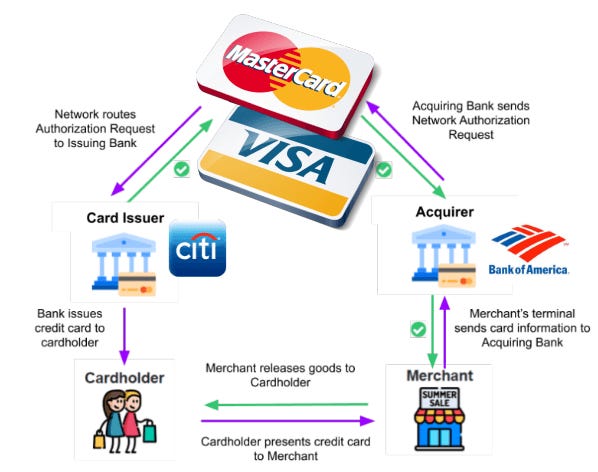

Under the current credit card business model both Visa and Mastercard are payment networks but there are four other roles. There is a bank who issues the credit card to the consumer. Then there is the merchant who accepts payment with the card which has its own bank (known as the acquirer bank). Both the card issuing bank and the acquirer bank take a cut of the fees on each payment with the residual amount going to the payment network. That’s a lot of mouths to feed from each transaction.

Under the ACH model the banks are gone, so it is far more lucrative for the payment network. Now you know why Mastercard seems to have the upper hand over Visa in Africa.

This is why Mastercard invested $100m in Airtel Africa’s mobile money subsidiary Airtel Mobile Commerce in return for a 3.75% stake. Alongside this investment, the Airtel Group and Mastercard have extended commercial agreements and signed a new commercial framework which will deepen their partnerships across numerous geographies, and across products, including card issuance, payment gateway, payment processing, merchant acceptance, and remittance solutions.

This year Airtel Africa launched mobile money services in Nigeria (Smartcash) and acquired spectrum in Kenya, Democratic Republic of Congo, Zambia, Tanzania and the Seychelles

Airtel Africa has previously stated that it intends to rapidly grow its network across the African continent and then to spin-off its Airtel Mobile Commerce subsidiary by 2025. However, if the relationship with Mastercard proves as fruitful as is anticipated, it is highly unlikely that Mastercard will allow this gateway to Africa to be acquired by others on the open market. It is easy to see how Mastercard may simply look to acquire the entire operation in the not too distant future. Whichever way it goes, Airtel Africa shareholders today are in for a rewarding ride in the next few years and it is not too late for you to jump onboard this opportunity.

Mastercard isn't the first company to back Airtel's mobile money service. TPG's Rise fund invested $200 million in March 2021 and in 2020 a partnership with MoneyGram International was announced to enable 19 million customers to receive transfers directly into their mobile wallets. Last August, Airtel Africa partnered with Standard Chartered bank to increase access to mobile financial services and to develop new products. So, Airtel Africa is expanding rapidly with backing from heavyweights in the financial services industry.

The CEO

Raghunath Mandava was instrumental in successfully leading and transforming Airtel Africa into a powerhouse telecommunications and mobile money company. He worked for Bharti Airtel for 13 years and at Airtel Africa for five years as CEO until late 2021 when he retired.

His replacement is Segun Ogunsanya who has been an important part of the Airtel Africa journey over the past decade. He joined the company in 2012 before which he held leadership roles at Coca-Cola in Ghana, Nigeria and Kenya (as MD and CEO). He previously served as the MD of Nigerian Bottling Company and group head of retail banking operations at Ecobank Transnational, covering 28 countries in Africa. He is an electronics engineer and also a chartered accountant.

Following his appointment, Ogunsanya commented:

As an African, I feel honored to have the opportunity to lead a Group that continues to make a difference to millions of people, bridge the digital divide and expand financial inclusion.

Airtel Chairman Sunil Bharti Mittal added:

He has displayed significant drive and energy in turning around the Nigeria business by focusing on network modernization, distribution, and operational efficiency. It is this commitment, together with his industry experience, strategic vision, constant customer focus and proven record of delivery that will enable him to continue to deliver our strategic objectives and to lead the Group in the next stages of its development

The business focused on reducing the company’s debt while continuing to invest in network and sales infrastructure. Within the next three years, Airtel Africa hopes to list the mobile money business as a separate entity.

Financials

In its half year results to September 2022 it reported that its customer base had grown to 134.7m (+9.7%). ARPU increased to $3.2 (+7.2% in constant currency terms). Group revenue growth accelerated to 18.5% and EBITDA margin jumped 38bps to 48.9%. The annualized mobile money transaction value jumped to $86.1bn from $62.8bn (+37%). Meanwhile, mobile revenue from voice and data is also growing at an average of 15.6% across all regions.

The business continues to invest aggressively in growth initiatives with 91% of CAPEX being used to enhance network capacity, increase coverage and to ensure reliable connectivity. This is a business that benefits from the network effect that it creates. People that are signed up to the service wish to use it as their primary method of payment and so encourage others to sign up, and so the fly-wheel keeps turning.

The company is pursuing a strategy of reducing its leverage ratios and transferring debt from the holding company into the operating companies of the group. The management continually speak of “prudent cash management“ and “strengthening the balance sheet”. This year, with both organic and acquisitive growth continuing unabated, it was encouraging to see that the total debt position remained relatively unchanged (even after a 46% increases in lease liabilities YoY). It is also worthy of note that with EBITDA expanding, the debt/EBITDA ratio contracted from 1.5x to 1.3x

The business is not without headwinds. Consumer spending generally has been impacted by global inflation and a cost of living crisis. Rising energy costs have impacted negatively on OPEX. Finally, the strong US Dollar has resulted in local currency revenues being worth less in Dollar terms (the accounting currency of the company). However, none of these challenges are unique to Airtel Africa. They apply equally to its competitors also and so this represents a great opportunity for the company to gain greater market share by capitalizing on the weakness of others. Life isn’t about waiting for the storm to pass, it’s about learning to dance in the rain! When the storm passes I am very confident that Airtel Africa will emerge stronger than ever.

Top line revenue has grown sequentially year on year since 2017 despite a global pandemic in the middle. Over the past 5 years revenue has grown at 23% CAGR and my adjusted owner earnings margins have expanded from 7.5% to 22.5% (+18% CAGR), meanwhile my adjusted owner earnings multiple has contracted from 20x to less than 4.5x. This is a business that trades at 0.99x sales(1.23x on an enterprise value basis) which is exceptionally cheap against a gross margin of 62.6% and adjusted owner earnings margin of 22.5%. More particularly, margins are still expanding at a very healthy rate. Meanwhile, both OPEX and CAPEX as a percentage of gross profits have been steadily falling and the business operates on negative working capital owing to favourable payment terms.

Conclusion

Conservatively, over the next five years, if the rate of sales growth halves to 12.5% CAGR, the share count remains unchanged, profit margins remain unchanged and the earnings multiple expands to 10x, then a shareholder at today’s price ought to expect a total return of 35.6% CAGR (including a 3% dividend payout). That would suggest that today’s share price of £1.11 will be at £4.55 in 2027. That is super conservative.

Taking a slightly less conservative view, let us say that the top line growth rate slows from 23% CAGR to 15%, the share count is reduced at a rate of 1% CAGR, owner earnings margins expand from 22.5% to 25% (2.2% CAGR) and the earnings multiple touches 15x. Now the 2027 share price is £8.89 which represents a total annual return of 54.6% CAGR (783.8% cumulative).

There is an asymmetric risk/reward skew which is exceptionally favourable at the moment.