Anexo | A Charlie Munger 'Fat Man' Opportunity

Credit Hire and Legal Services Business On Sale At A Bargain Price

Founded: 1995

Industry: Industrials

Implied Market Cap: £77m GBP

Theme: Deep Value Assessment: Buy The Dip Author’s Strategy: Long

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

Introduction

Charlie Munger once said, “If you see a fat man walking down the street, you don’t need to weigh him to know that he’s fat.” He was speaking about the way that he and Warren Buffett evaluate businesses.

You don’t need fancy spreadsheets and calculations to find wonderful investment opportunities - they are so obvious that you can’t miss them.

If the market cap of Anexo wasn’t so small, the big institutional investors would have taken this arbitrage opportunity and we would never have seen it. But institutional investors don’t fish in small ponds which is fortunate for us.

Summary

The good:

This is what Benjamin Graham called a net/net deep value trade

Priced at <48% of net tangible asset value

Market Cap £73m GBP vs Net Tangible Assets £153m GBP

Consistent double digit revenue growth, all organic

Employee numbers doubled in last 5 years to circa 1,000

Capitalized at 2.5x economic earnings, 0.55x sales, on an adjusted economic net earnings margin of 22.2%, implying c.40% economic earnings yield

De-minimis SBC payments

Leverage ratio 1.7x

Consistent ROE >20% on a P/B 0.5x

Return on Net Tangible Assets consistently c.20%

Market leading position with a reasonable moat

Durable earnings - the business is largely recession-proof

Other points worthy of note:

Consistent dividends in range 1% - 2.5% (there are far better options for capital allocation - I do not believe that this company should be paying any dividends but instead, given the depressed share prices, it should be buying back as much stock as it can.)

No history of repurchases and no immediate intention to change (this is evidence of poor decision making at senior management level when it comes to capital allocation)

Very working capital heavy. £100 of revenue requires £155 of working capital. The reason is that they fund litigation and vehicle costs with a view to being reimbursed at the end of the process. However, this is the business model and rates of return on investment are sufficiently large to make it work.

Costs are expensed immediately but the related revenue takes time to flow through, so there is an accounting mismatch; this year’s revenues were generated by last year’s costs, while this year’s costs will generate revenues in future years. So anaylsis becomes tricky.

The Numbers

The business has £222 million of Receivables on its balance sheet, Net Current Assets of £164 million and Net Tangible Assets of £153 million. Yet it only has a market cap of £75m. In other words, you could buy this business, cease operating, collect the receivables, pay down all of the debt and still double your money!

So not only are the assets of this business not reflected in the price, but there is absolutely no value ascribed to the Goodwill of the business which has a rapidly growing and highly profitable operation. It has close to 1,000 employees, top line grew at 17% last year, gross margin is consistently above 75% and adjusted economic earnings margin in the mid-20s. Yet the market has given this no value.

This company is a dream for any investor with a rudimentary understanding of mathematics and economics. The market is serving up a gift.

The share price is currently £0.60 GBP, but I see fair value closer to £2.22 GBP. That’s 3.7x.

As you will see below, my modelling demonstrates that over the past 5 years, despite revenue growth of 22%, economic earnings margins well above 20%, less than 1.4% annual dilution and a constant dividend of over 1.5%, the share price has inexplicably collapsed. That is almost exclusively down to multiple contraction having cancelled out all of the other shareholder return drivers. In 2017 the business was capitalized at 2.5x revenue, which is perfectly justifiable on a net margins in the mid 20s, but today it is available at 0.55x revenue with margins at similar levels. Madness! But great for you and me. This stock could be the bargain of the year.

For the next 5 years, I have very conservatively scaled back top line growth from 22% to 8%, assumed the same rate of dilution with no share buy-backs, assumed that margins remain largely unchanged and dividends stabilize at 1.67% (the bottom end of the long term range), but that multiples expand back to a reasonable level. If this plays out you see a 490% total return or 42.5% CAGR over 5 years. And these assumptions are super conservative so I wouldn’t be surprised if this expectation is surpassed.

I say that my assumptions are conservative because:

Top line is likely to expand as the back-log of legal claims, which were delayed due to capacity issues in the Court system during the Covid19 pandemic, are now settled. This will be augmented by settlement of claims the in the VEC segment of the business (see segment analysis below) which promises a large cash windfalls.

Margins are also anticipated to expand due to growth of the HDC and VEC higher margin segments. Additionally, margins will expand due to reinvestment of cash generated in the VEC segment into more VEC claims, meaning that the firm will be less reliant on external third party litigation funding arrangements which erode returns. Finally, margins will benefit as debt is paid down thereby reducing funding costs

The company will, sooner or later, realize that they should be pulling the stock-repurchase capital allocation lever very hard. That would result in a reduction in share count which will be far more accretive to shareholder returns than tax inefficient dividends (the company has expressed concern about impacting liquidity due to a smaller share count, but this is a red-herring because it could very easily follow a repurchase operation with a share split to restore the number of shares outstanding - the Henry Singleton play book).

If we were to assume that top line grows at 10% annually (way less than it is growing currently), adjusted economic earnings margins expanded to 24% (the longer term average is over 25%), dividends cease and share count reduces by 1.5% annually, and the business is capitalized at 10x economic earnings and 2.25x sales, now you have a 651% total shareholder return over the next 5 years (50% CAGR).

Best of all, when you learn about the business you’ll probably reach the same conclusion as me that as a long term investor there’s little or no downside here.

What’s the Business?

Allow me to introduce you to Anexo (ANX.L), a British small cap credit hire and legal services business with a very interesting differentiated model. It is arguably the market leader.

Segments include:

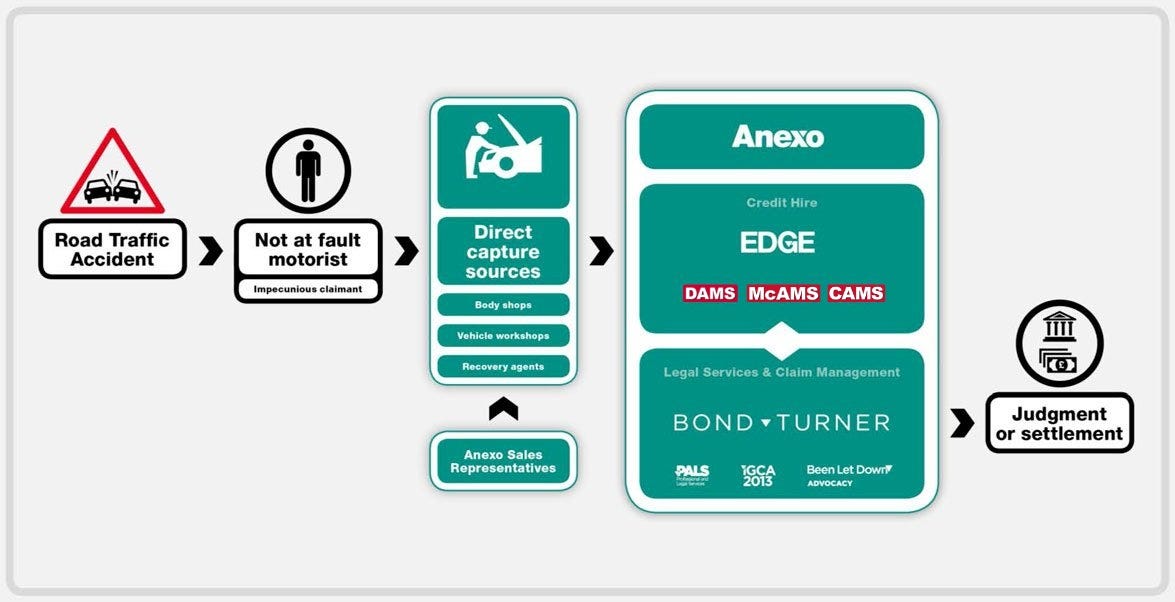

Vehicle Credit Hire (VCH) established 1996. This subsidiary is called EDGE and trades principally as DAMS, McAMS and CAMS, leases cars, motorcycles and cycles from a fleet of nearly 2,000 vehicles.

Legal Services (established 2006). Trading as Bond Turner, with a large team of lawyers supplemented by external counsel and focusing on:

Road Traffic Accidents where the claimant is impecunious and not at fault. So, someone with little money is impacted by an accident involving their vehicle which was caused by a third party. These people, clients of Anexo, do not have access to a replacement vehicle, so the company provides them with a vehicle from its fleet. This allows Anexo to charge elevated credit hire prices rather than spot hire rates for the replacement. Credit hire prices are higher because they are a bundle of the spot hire rates plus credit costs, including an element of credit risk. Anexo then provides legal representation recovering both hire charges and repair costs from the at-fault insurer at no upfront cost to our client.

This is a great business because it generates vast amounts of receivables which are owed by credit worthy insurance companies. In fact, it was this that I most wanted to draw to your attention.

[For any lawyers reading this, the English law cases that laid the foundations for this business were: Giles v Thompson (1994) which confirmed that, provided the client has a need for a hire care, charges are fully recoverable from the third party’s insurer; and, Clark v Ardington (2003) / Lagden v O’Connor (2003) which confirmed that impecunious clients are able to recover credit hire rates from the third party’s insurer.]

Housing Disrepair Claims (HDC). In the UK, due to residential house price inflation over the past two decades running far ahead of average earnings, there has been a trend away from owner occupation towards private or socially rented housing. As buy-to-let investors have dived into this asset class, human nature and greed has resulted in landlords taking the income stream but ignoring their obligations to maintain what is a serviceable asset. Data shows that 12% of social housing dwellings and 23% of private rented dwellings (more than 1.5 million properties) fail to meet the Decent Homes Standard. Additionally, almost another 1 million suffer from a Category 1 Hazard, defined as damp and mold growth. Legislation known as the Homes (Fitness for Human Habitation) Act came into force in 2019 to ensure that rented houses and flats are fit for human habitation. The law gives more power to tenants to take action against negligent or irresponsible landlords. Therein lies the opportunity for a law firm which is why Anexo established a Housing Disrepair Team. Returns of investment in this segment are stronger than the primary credit hire business, but it does not have the same scale yet. That may change over time which would result in margin expansion, a wonderful catalyst for share price appreciation.

Vehicle Emissions Claims (VEC) ~ Many motor manufacturers either knowingly or recklessly misstated the greenhouse gas emissions produced by their vehicles and so misled consumers giving rise to a legal claim against them. Anexo has recently been successful in settling a claim against VolksWagen and is proceeding against Mercedes Benz and other manufacturers. This is a large, but momentary, opportunity that has arisen in relation to a historic episode in the auto industry that will not be repeated. So while this segment is showing the highest returns on investment at present, it does not represent durable earnings. Nonetheless, the sums involved are significant for Anexo. the VW settlement was not disclosed due to the terms of the settlement, but the firm has reported that it will result in a ““net positive cash position of £7.2 million to Anexo”, which is approximately 10% of its Market Cap. Multiply that across several similar sized claims and the company has the means of paying down debt, repurchasing stock, investing in growth or paying special dividends. Either way, this is great news for the shareholders.

Accounting

Adexo adheres to accounting standard IFRS15. This establishes the principles that an entity applies when reporting information about the nature, amount, timing and uncertainty of revenue and cash flows. The way in which they do this is to apply precedent to the value of the claims that they are working on. They know that 90+% of their claims end in a positive outcome for Anexo. They also know that many insurance companies against whom they have a claim will look to settle early in return for a mutually agreed full and final settlement amount that is less than the full value of the claim. Anexo evaluates offers on the basis that early settlement enables them to reinvest in new claims and keep the fly-wheel turning. They currently have insufficient resources to accept all of the claims available to them, so they are turning business away. However, an early settlement enables them to reinvest. It also avoids waiting for the claim to be settled in Court, which has a financial benefit based on the time value of money. Finally, it avoids expensive litigation costs - these can be claimed back if the claim is won, but it consumes working capital that is better spent elsewhere. Long story short, they may settle early for 60% or 70% of the full value of the claim. Then they discount the element of the credit hire that is subject to VAT (European tax). After all of these adjustments, they arrive at a number which is in the mid-40% of the full value of their claims (90% success with a circa 35% haircut for early settlement less 20% VAT). This is the amount that they book to revenue under IFRS15 and which is added to receivables on the balance sheet (more on this in the next bullet).

Receivables are a combination of monies due imminently and adjusted revenues that the business expects to receive when its existing cases settle. I pointed out that money due on settlement of outstanding cases is not technically a "current asset" and they agreed, but said that they do not break out current and non-current receivables (so bear that in mind in your analysis). The critical point here is that they are very confident in their methodology for unrealized revenue/receivables and suggest that they are super conservative in their assumptions, so while only booking a valuation for claims in the region of mid-40% of full value, they often recover more. If this is the case, then the £222m of receivables on the balance sheet is understated which makes this an even more attractive proposition.

In the event that a claim is not settled within 4 years, the sum that had been included in the accounts for that claim is impaired (written down) although it may settle after that date in which case the full value of the ultimate settlement is added back upon settlement. You are probably wondering about the ageing of claims, so recent figures reveal that:

6% settle within 3 months

19% settle within 6 month

45% settle within 12 months

70% settle within 18 months

85% settle within 2 years

15% take longer to settle or do not settle at all

CFO Situation

The company had two CFOs resign between August 2022 and April 2023. This needs to be addressed and is not the concern that many have taken it to be.

First it is important to note that this business is quite unique. They are not manufacturing goods to be sold to customers. They are not really selling a service to a customer either.

In the road traffic accident segment (their core business) they only represent impecunious people (those that can't afford the service being provided). So, in effect, what Anexo does is to invest in the prospects of achieving a successful legal outcome on behalf of the impecunious client which it is able to enforce against the insurance company of the "at fault" third party.

That makes Anexo, de-facto, an investment company. But it is classified in the "industrial" sector because it provides leased vehicles and legal services. Said differently, this is a misunderstood business. It's almost like there is no proper category for this business and so the market has tried to push a square peg in to a round hole, but it doesn't fit. The business has more in common with venture capital funds than it does with legal services or car hire businesses. It should be noted that VC firms work on a 10% to 20% success rate whereas Anexo achieves 90+% success on its investments.

All of this to say that its financial affairs need to be managed more like a financial fund operation than a conventional goods and services business. So it isn't surprising that a CFO who is only accustomed to conventional businesses arrives at Anexo and struggles. That is the background. Now on to the facts:

Mark Bringloe was the CFO at Anexo. He has been with the company for over 12 years. He resigned in August 2022 with good reason. He is working with Alan Sellers, Chairman of Anexo, to explore opportunities in litigation finance (Funding Solutions (NW) Ltd and Litigation Finance (NW) Ltd were both incorporated in 2022). So there was nothing untoward in Mark's resignation as CFO, it was strategic and he is still involved with Anexo.

Bringloe was subsequently replaced by Mark Fryer, a CFO accustomed to conventional businesses, who struggled with Anexo being more of an investment fund (as explained above). Arguably, he didn't have the correct skill set. So in April 2023, by mutual agreement, he and the company parted company.

Gary Carrington stepped in as interim CFO at that point. Gary, a qualified accountant, was head of operations at Anexo’s legal subsidiary Bond Turner. He has been with the group since 2020.

There is a very good chance that Mark Bringloe will return as permanent CFO.

So that clears that up. No red flag here.

Audit Situation

In the most recent 2022 financial reports you will find evidence that the auditor disagreed with the company on a small sub-set of receivables. Allow me to explain this.

Essentially, as explained above, for legal reasons the company only represents impecunious people (see above for the English case law that lays the foundations for this business).

Sometimes Anexo represents a client who lied about their financial means. In other words, they were not impecunious at all, which means that recovery of credit hire rates are not allowed. Sometimes the dishonesty about other facts of the claim leads to a complete loss of the claim. In such circumstances (bear in mind that this is a legal business with hundreds of litigation lawyers as employees) Anexo sues the dishonest client for recovery of their costs. Based on its historic performance in the recovery of these monies, Anexo includes an adjusted amount in their receivables numbers.

However, the Auditor holds the view that they should take a more conservative approach by not including that money in receivables and instead including it in impairments unless and until the money is recovered.

Either way, if you look at the attached, which is from the notes of the Auditor in the most recent set of annual reports, the performance materiality of this issue on the Group is no more than £1.1m (on total receivables of £222.0m), so less than 0.5%.

I don't see a red flag here either. This is a tiny subset of receivables.

Conclusion

This is a stock that is currently trading at less than 30 cents on the Dollar. Rarely does an opportunity such as this arise. Little or no downside against such a huge revaluation potential. Recession proof, a fast growing but well established business, impressive margins, durable earnings and a reasonable moat.

Nothing more to say.

UPDATE: November 2024 - Anexo Group Plc - Investment Thesis Affirmed

Judgment was handed on a couple of preliminary issues in the Mercedes Diesel NOx Emissions case.

Bond Turner, Anexo's subsidiary law firm, acts for over 12,000 claimants in this class action against a range of auto-manufacturers.

The matter involves the use of prohibited defeat devices or 'PDD' (the alleged 'cheat' software) which was used to manipulate vehicle performance data in a fraud against consumers.

Matters two resolved by the court:

1. The German vehicle regulator (the Kraftfahrt-Bundesamt, or 'KBA') had previously determined whether PDD devices were present. The Court found in favour of the Claimants, holding that only the vehicle Recall decisions (where the KBA had discovered a PDD and required them to be removed from vehicles currently on the road) are binding. The other decisions (including the original Type Approval of the vehicle) were not binding on the Court or the Claimants. The decision means that, in respect of the German manufacturers, the Claimants can rely on their regulatory body's finding that PDDs were present in the vehicles for which recalls were issued. For those where (for whatever reason) a recall was not issued, the Claimants will still need to prove the presence of a PDD.

2. Changes to applicable European Law and changes pursuant to Brexit have no impact on this finding.

Commenting on the Judgment, Alan Sellers, Executive Chairman of Anexo Group Plc said: "Whilst this decision is not definitive for the success of the claims, it does strengthen the Claimants' position and is a significant victory in the litigation at this stage. We are very pleased with the outcome."

More particularly, by reason of the procedure adopted by the Court to efficiently case-manage all of the manufacturer emissions cases, (now known as the "Pan-NOx" group litigations), determinations of fact and law in the context of the Mercedes litigation will be binding, insofar as relevant and applicable, across the Pan-NOx Emissions litigation and will therefore likely have at least some (albeit to varying degrees) positive impact on class actions against other manufacturers being brought by the Anexo Group.

This litigation has been ongoing for the best part of a decade and has been a drag on the performance of Anexo, largely due to the debt incurred in funding the litigation. Now that the end is in sight, with settlement expected although not guaranteed in the next 6 months, Anexo will receive an extraordinarily large cash inflow which will not only boost earnings, but will improve the balance sheet by paying down its debt.

The company still trades at less than half its net asset value, so post-settlement, a re-rating is expected. The company traded at double its current share price back in 2021 when the unit economics were not as strong as they are today. At that time it declined a private equity firm's attempt to take it private at a share price of £1.50 (versus £0.75 today), so a re-rating could more than double the company's valuation in a very short time.

The investment thesis is still very much intact and assured by this news.

Minority Shareholders' Response to Anexo Plc Announcement of 23 April 2025

See https://x.com/Delta9Echo/status/1916838014275260550

If you are invested in Anexo and wish to join this minority group, please message me. So far the group collectively holds 8.2% of all outstanding shares, but this is climbing daily.