Aptiv | Driving The Future

The Best Kept Secret In The Tech-Automotive Industry Looks Too Cheap

Disclaimer & Disclosure: The author has a long position in Aptiv at present, but this may change in due course. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

URL: www.aptiv.com

Market Cap: $18.74 billion

EV: $24.4 billion

Float: 99.3%

LTM P/E: 5.37x

Debt/EBITDA: 1.7x

Introduction To Aptiv

If I were to speak about autonomous driving and state of the art technology in our vehicles, you may think that I am about to launch into a pitch about Tesla, Porsche or Toyota. But you would be wrong. Behind all of these auto-makers is a lesser known tech company that has all of these companies as its customers.

This is a very unique investment opportunity, with an unusual set of circumstances that don’t arise very often. Read on to learn more.

Aptiv PLC was incorporated in 2011 and is headquartered in Dublin, Ireland but listed on the NYSE with ticker: APTV. Formerly Delphi Automotive, it has global operations in a multitude of countries (see below) and specializes in advanced safety systems, electrification solutions, and vehicle IoT connectivity services.

Historically, the company has faced some turbulence. It was initially spun-off from General Motors in 1999, only to file for Chapter 11 bankruptcy protection in 2005. It then emerged following a major restructuring and enjoyed an IPO in 2011. Since then, in order to streamline its core automotive operations and reduce operational complexity, Aptiv has spun-off its lower-margin powertrain business (Delphi Technologies which was subsequently acquired by BorgWarner), and shifted its focus entirely to high-tech automotive solutions. In 2017, it rebranded as Aptiv to reflect this new direction, and this business is now looking very attractive.

Today, it holds a strong industry position in advanced driver assistance systems (ADAS), autonomous driving technologies, and high-voltage electrification. With over 4,000 patents granted or pending worldwide, Aptiv's expertise in system integration -offering both hardware and software solutions - sets it apart from many of its competitors. (The company has published a series of White Papers, which provide deeper insight into its products and offerings if you wish to conduct further reading.)

It also operates in adjacent markets, including commercial vehicles, aerospace and defense, telecommunications, and industrial sectors.

The company enjoys a global presence, serving a diversified customer base that includes the 25 largest automotive OEMs such as GM, Volkswagen, Ford, Tesla and Stellantis. Operating in 50 countries, with 138 major manufacturing facilities and 11 technical centers, Aptiv's global manufacturing footprint supports cost-effective production and positions the company to capitalize on emerging trends in the automotive sector.

Aptiv’s revenue distribution across North America, Europe, and Asia in 2023 was balanced, with approximately 37%, 33%, and 28% of the total revenue respectively, indicating no significant geographic concentration risk. It is further expanding in key markets like China and Eastern Europe, positioning itself for future growth.

It has formed strategic partnerships to push the boundaries of automotive innovation. For instance, in 2019, it launched Motional, a joint venture with South Korean auto-maker Hyundai focused on autonomous driving technology. It has also partnered with tech companies like Uber, Lyft and Nvidia to accelerate advancements in mobility solutions.

China accounted for 18% of its revenue in 2020, and bookings with local Chinese OEMs have reached over $1.8 billion year-to-date, marking a 27% increase from the previous year. Recognizing China’s leadership in autonomous driving, where entire cities have been served by robo-taxis for several years, Aptiv has partnered with Baidu to develop tailored autonomous driving solutions. The company’s major technical centers in Shanghai and Suzhou focus on advancing ADAS and autonomous driving technologies in this important market.

In summary, Aptiv is well-positioned to capitalize on major automotive trends, particularly in autonomous driving and connectivity. Its technological capabilities, global reach, and strategic focus on high-growth markets make it a compelling investment option in the evolving automotive sector. But the company’s ambitions extend far beyond vehicles as management has its sites on a far larger opportunity - the future of entire connected smart cities.

"Aptiv is a technology company that will usher in the next generation of active safety, autonomous vehicles, smart cities and connectivity. We bring decades of experience in solving our customers’ most difficult challenges, with the spirit and ingenuity of a start-up."

Kevin Clark, Chairman and CEO

Management and Capital Allocation

Chairman and CEO: Kevin Clark (since 2015), who holds 554,799 shares worth approximately $39 million means that he certainly has skin in the game.

CFO: Joseph Massaro (since 2016)

CTO: Glen De Vos (since 2017)

Aptiv’s management has a strong track record in navigating industry shifts and positioning the company as a leader in emerging automotive technologies.

The company maintains a balanced approach to capital allocation. It invests 7-10% of revenue in R&D, which have driven technological leadership and first-to-market innovations like satellite radio and mediated perception technology for autonomous vehicles. Capital expenditures average 5-6% of revenue, primarily focusing on expanding manufacturing in high-growth markets.

Strategic acquisitions also play a role, enhancing Aptiv’s capabilities in key areas. Notable acquisitions include Winchester Interconnect ($650 million, 2018) for signal and power solutions, Gabocom ($310 million, 2019) for cable management, Wind River Systems ($3.5 billion) for intelligent systems software, and NuTonomy for autonomous vehicle technology. These moves have broadened Aptiv's technological reach and market presence.

Management actively reallocates capital to optimize productivity. For example, Aptiv reduced its equity stake in the Motional joint venture with Hyundai from 50% to 15% by June 2024, aiming to improve margins and deliver an expected $0.90 EPS benefit in FY2025.

Aptiv returns excess cash to shareholders primarily through share buybacks, with small dividends occasionally. However, it maintains the flexibility to prioritize growth investments over shareholder returns when necessary, recognizing the importance of opportunity cost in capital allocation.

Since 2011, Aptiv has allocated $27 billion across mergers and acquisitions (36%), organic growth reinvestment (31%), and shareholder returns (33%).

We will return to the subject of buy-backs later in this investment thesis, because it plays a significant role.

The Business and Segment Breakdown

For decades the automotive industry produced dumb internal combustion engine cars and very little changed in terms of technology. However, in recent years there has been an explosion of innovation and we now have both self-driving transportation and all manner of driver assistance devices for those piloted by a human. As a result, Aptiv's total addressable market has expanded significantly.

It operates across several divisions including:

Signal and Power Solutions

Advanced Driver Assistance Systems (ADAS)

Smart Vehicle Architecture (SVA), and

Vehicle Electrification.

Signal and Power Solutions is Aptiv’s largest revenue driver, contributing about 72% of total revenue in 2023 and nearly 80% of earnings. It has maintained a stable market share of 15-18% over the past five years, benefiting from the growing electrical content in modern vehicles. This segment includes products that support electrification, reduced emissions, improved fuel economy, and off-vehicle connectivity, in which Aptiv has a market share of 12-15%, by offering the signal distribution and computing power backbone. However, it should be noted that in this specialized area it faces increasing competition from both traditional automotive companies and tech players entering the automotive industry.

In ADAS, Aptiv has consistently ranked among the top three global players with its market share increasing from approximately 15% in 2015 to 18-20% in 2023. This segment delivers key technologies and services that enhance vehicle safety, security, comfort, and convenience. Recently, it has shown strong performance, with Q2 2024 revenue growth surpassing that of the Signal and Power Solutions segment.

SVA positions Aptiv to capitalize on the shift toward software-defined vehicles, which require fewer wires but more advanced electrical components, which happens to be Aptiv’s specialty. The company has already secured $10 billion in bookings for SVA-related content, highlighting its strong future growth prospects. The increasing importance of software capabilities has been a key factor in the company’s success, which explains why Aptiv has been investing heavily in this area.

In the area of Vehicle Electrification, a more recent focus for Aptiv, the company’s market share has grown from less than 5% in 2017 to around 8-10% in 2023. This growth has been driven by rising demand for high-voltage solutions in electric vehicles (EVs).

I have only scratched the surface of all that this business offers, but if you would like to dig deeper, click the links below and/or watch this short video:

Growth

Analysts project that Aptiv will outperform the broader automotive market, with an expected revenue CAGR of 8-10% in the coming years, driven by the adoption of more technologically advanced vehicles.

Is this reasonable?

Over the past decade, despite acquisitive growth, Aptiv has only achieved a revenue CAGR of 2.4%. But times are changing and vehicles are becoming far more technologically advanced than ever before. This has accelerated Aptiv’s growth and it has enjoyed revenue growth of 6.84% CAGR from its pre-COVID level to today, despite the supply-side challenges introduced by the pandemic.

Technology is evolving so rapidly, particularly with the huge advances in AI, that strong growth in the automotive sector is all but assured in coming years. However Zion Market Research forecasts that the global automotive market will grow from $2.81 trillion in 2022 to $3.97 trillion by 2030, which is only a 4.4% CAGR.

So the question that we should be asking is whether growth in the sector will be evenly distributed, or whether certain players stand to be primary beneficiaries as the result of being at the cutting edge of that technological change. Aptiv is certainly well placed being horizontally integrated across many leading vehicle manufacturers and geographies. This means that whichever companies benefit most from the advances, Aptiv is likely to benefit. As such, its growth ought to outpace the broader industry which includes both advanced manufacturers and laggards.

Additionally, management has lowered its revenue and operating income guidance for 2024, primarily because the electric vehicle (EV) sector is currently facing challenges as the initial excitement has waned and the high end-product costs continue to act as a barrier to mass-market adoption.

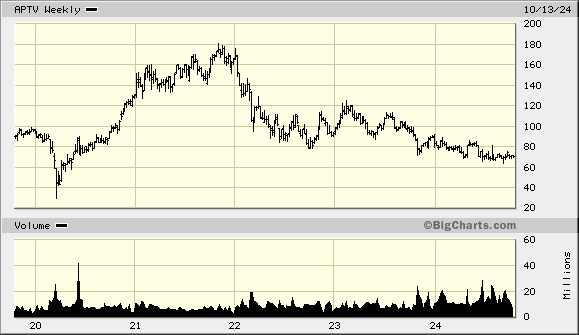

Perhaps this is why the share price has softened since its post-pandemic peak of more than double where the stock trades today. This draw-down represents an interesting entry opportunity, but it is far from the primary driver of this thesis (please read on).

Aptiv's long-term growth potential remains robust. The company's technology is not dependent on the type of engine in a vehicle - features like self-driving can be integrated into internal combustion engine (ICE) vehicles, much like autopilot in an aircraft which is powered by jet-fuel rather than a battery. Whether electric vehicles prevail or alternative technologies like clean hydrogen engines eventually take over, Aptiv will continue to be a key player in automotive innovation. This makes it far less risky a proposition than investing in a pure-play EV manufacturer.

That said, Aptiv plays a significant role in the EV market, providing 2.5 times more content to electric vehicles than to ICE vehicles. The company has derived a great benefit from the shift toward EVs, with its signal and power solutions segment generating the lions-share of its revenue and earnings. Some analysts estimate that for every 2% increase in EV adoption, Aptiv's earnings could grow by as much as 15%, outpacing the broader market. It therefore stands to reason that a contraction in the EV market may have the opposite effect.

From a valuation standpoint, Aptiv's stock has underperformed the market by 34.5% over the past year. This underperformance is largely due to negative sentiment surrounding EVs, broader economic uncertainties such as inflationary pressures, and geopolitical tensions. In fact, all recent challenges faced by Aptiv, which also include the pandemic induced semiconductor shortages and the cyclical nature of global automotive sales, are all industry-wide phenomenon. There are no fundamental issues within the business itself.

The only other issue to mention is the news that broke on 26th June that VW had entered a joint venture with Rivian to unify car operating systems. The VW group is the second largest car manufacturer in the world after Toyota, and in 2022 VW accounted for 8% of Aptiv’s revenues. Aptiv has not made any public statements specifically addressing this announcement or commenting on its potential impact, but it is worth watching future quarterly earnings to track the impact, if any, on its financial performance.

Aptiv’s growth outlook appears well supported by its impressive new business bookings. During the second quarter, the company booked $4.3 billion in new business, bringing the year-to-date total to over $17 billion, putting it on track to achieve its full-year target of $35 billion. It clearly has a strong pipeline for future expansion and the adjacent markets, including its ambitions to be at the heart of smart cities, position it well for the future.

The Curve Ball You Didn’t See Coming

In August, Aptiv announced a significant $5 billion share buyback, representing over 25% of its market cap at the time. This includes the immediate launch of a $3 billion Accelerated Share Repurchase (ASR) program under both existing and new authorizations. Notably, this comes in addition to the nearly $9 billion the company has returned to shareholders since its 2011 IPO.

The new $5 billion buy-back initiative will begin after the completion of the company’s previous $2 billion repurchase plan initiated in January 2019. In Q1 2024, Aptiv repurchased $600 million worth of shares, and management subsequently increased the full-year buyback target to $1.5 billion. Year-to-date, Aptiv has repurchased 12.7 million shares for approximately $1.03 billion, all of which have been retired.

The recent announcement to expand its buy-backs reflect the company’s growing confidence in its undervaluation.

Currently, Aptiv is trading at a trailing EV/EBITDA ratio of 8.2x, its lowest in years. The company is valued at 0.9x sales, a level not seen since 2012. With sustainable operating margins of around 11%, the stock appears undervalued as this implies an operating earnings yield of 12.25%. Given these factors, the share repurchase program seems fully justified and is likely to be highly accretive for investors.

Another factor to consider is that return on capital is currently half of what it averaged in the five years leading up to COVID, and asset turnover has decreased. At first glance, this might suggest a decline in efficiency and productivity. However, given the scale of the repurchase operation, a more plausible explanation is that the company is that the companies asset base is larger than necessary. The buy-backs will utilize that capital causing the asset base to contract, with both ROIC and asset turnover seeing significant improvements. Therefore, the repurchase strategy appears to be a well-considered move.

Additionally, short positions in Aptiv amount to over 13% of its public float, with 10.2 days to cover. This dynamic, combined with the accelerated share repurchase program, could cause a gamma squeeze creating significant upward pressure on the stock price in the near term.

Adding to the bullish case, Chairman and CEO Kevin Clark personally purchased 29,770 recently at share prices of $64.17 and $66.81, totaling $1.95 million. This increases his stake in the business to 0.21% of shares outstanding which is currently valued at around $39 million. It’s always good to see the CEO demonstrating confidence in the company that he manages. In fact, insider buying while the company is also conducting open market repurchases is an uncommon and notable signal, warranting close attention from investors.

At the time of the repurchase announcement, shares were trading at $65.30, and they have since edged higher to just over $70.00. However, this investment opportunity could have much further to run.

In early September, Wells Fargo analysts upgraded Aptiv from Equal Weight to Overweight, raising their price target from $78 to $87. They noted, "With expectations reset, we think it's time to step in." Benzinga also reported that out of 13 analysts, the vast majority were bullish and their 12-month price targets show an average of $97, with estimates ranging from a low of $63.00 to a high of $145.00 . Given the current share price of $70.00, this suggests a favourable asymmetric opportunity.

Consider this: a 25% reduction in outstanding shares leads to a 33.3% increase in the remaining shareholders' stake in future earnings and capital value. This implies a potential 33.3% return for shareholders without any improvement in the company's top or bottom line. As Mohnish Pabrai explains, he prefers situations where "heads he wins big, and tails he doesn’t lose much."

As noted above, management has lowered revenue and operating income guidance for 2024, but it raised its EPS guidance to $5.80–$6.30, driven by the uplift from the Motional deal (mentioned earlier) and the share buybacks. That would put the shares at today’s price on an earnings multiple in the range of 11x to 12x.

However, there is an unanswered question in all of this. The $5 billion figure for buy-backs represents an authorization, not an immediate commitment. Aptiv may implement the program gradually, allowing for flexibility in timing and funding sources. Yet the $3 billion ‘accelerated’ share repurchase program suggests that Aptiv has concrete plans for a significant portion of the buy-backs to happen sooner rather than later. Goldman Sachs International and JPMorgan Chase have been appointed to manage the accelerated share repurchase program. So how will it be funded?

Cash and short-term investments stand at approximately $2.16 billion, and Aptiv will certainly need to maintain a reasonable portion of this cash to finance the business and to maintain financial flexibility. So there is insufficient cash in the business to finance the $3 billion accelerated repurchase program.

Long-term debt, while only being 1.7x EBITDA, stands at somewhere around $5.5 billion and the company will want to manage its debt levels carefully, so it is unlikely that it will significantly increase its borrowing in a debt-for-equity swap. Perhaps it will use a little additional debt through the issuance of new bonds or securing new credit facilities, but it wouldn’t be wise to fund the repurchase operation primarily in this way.

So, given the discrepancy between the company's current cash position and the proposed buy-back amount, and an assumed preference not to use debt to plug the gap, how will the repurchases be funded?

The company might use future cash flows generated from its operations to fund the buy-backs over time, rather than all at once. Indeed, in its Q2 earnings figures announced on 1st August 2024, it reported that strong cash flow (up 69% YTD) would provide $434 million for share repurchases.

It could potentially sell non-core assets to raise funds for the repurchase program. The company does have a history of strategic divestments and portfolio optimization, which suggests this could be a potential option for raising funds. Indeed, reducing its stake in Motional has provided a short-term boost to the company in terms of a cash injection which will undoubtedly be used to repurchase shares.

Most likely, Aptiv will use a combination of these financing strategies, balancing between immediate repurchases and long-term financial stability.

Risks, Challenges and An Alternative Perspective

Investors ought to weigh the upside potential with the downside risk. In this regard Aptiv faces several risks and challenges, including:

1. Cyclicality of the Automotive Industry: The inherent ups and downs of the automotive market pose a significant risk.

2. Geopolitical and Trade Risks: Trade tensions and geopolitical factors threaten global supply chains. Notably, the U.S. Commerce Department has proposed banning key Chinese software and hardware in connected vehicles, citing national security concerns. The software ban would begin with the 2027 model year, while the hardware prohibition would take effect from January 2029. These measures could prevent cars with Chinese technology from being sold in the U.S., potentially prompting reciprocal bans from China on U.S. technologies. However, since Aptiv is an Irish company, it's unlikely that China would target EU technologies, which could actually benefit Aptiv by allowing it to operate in the U.S. without facing competition from Chinese firms.

3. Delays in Autonomous Vehicle Adoption: Regulatory and technological barriers could slow the growth of autonomous vehicles, impacting Aptiv's future growth potential.

4. Intense Competition: The automotive industry is highly competitive, with both traditional OEMs and new tech entrants constantly innovating. Among established players, Aptiv's main competitors include Continental AG, Bosch, and Denso Corporation, who have strong positions in ADAS, vehicle networking, and electrification. Magna International and ZF Friedrichshafen are expanding in ADAS and autonomous driving technologies, while Visteon Corporation and Lear Corporation focus on cockpit electronics and connected car technologies.

5. Rising Tech Competition: Aptiv also faces competition from technology companies such as Nvidia and Mobileye (Intel), which lead in AI and vision-based ADAS solutions. Mobileye currently dominates the ADAS market with a 70% share, thanks to its computer vision expertise and EyeQ chip technology, used by major automakers like Ford, GM, BMW, and Volkswagen.

Despite these challenges, the ADAS and autonomous driving market is projected to grow significantly, with revenues expected to reach €35 billion by 2025. Although Mobileye leads the market, Aptiv's strong order intake and diverse product portfolio position it well to benefit from this growth. Furthermore, Aptiv has healthier unit economics, with stable operating margins, whereas Mobileye has yet to achieve positive operating margins.

6. Emerging Autonomous Driving Competitors: Companies like Waymo (a subsidiary of Alphabet/Google) and Pony.ai are advancing in autonomous driving, particularly in robotaxis and autonomous trucking. Chinese firms such as Huawei and DiDi Chuxing are also investing in smart car solutions and autonomous driving technologies to establish a presence in the mobility space.

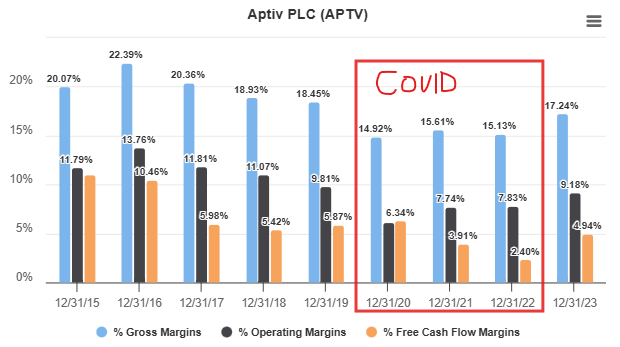

While increasing competition will always introduce pressure on margins, it's encouraging that Aptiv's FY23 margins have nearly returned to pre-COVID levels.

Is Aptiv A Good Investment?

Aptiv presents a compelling investment opportunity for those looking to gain exposure to the future of automotive technology. The company's strong technological position, global scale, and focus on high-growth areas position it well to benefit from major industry trends. While risks exist, Aptiv's management team has demonstrated the ability to navigate industry challenges and drive long-term shareholder returns, which look to continue with the huge buy-back programme just announced.

Investors should consider Aptiv as a potential long-term holding, particularly for those bullish on the transformation of the automotive industry towards electrification, autonomy, and increased connectivity. Smart cities present a very interesting opportunity for future growth and scalability of the business

The stock is not expensive but the company operates in a rapidly evolving highly competitive low-margin segment and in a world suffering from increasing nationalism and deglobalization through trade barriers and tariffs. The opportunity is, therefore, not without risks.

One final consideration; given its status as a leading player trading at a discounted valuation, Aptiv stands out in a highly competitive market dominated by large, well-capitalized companies intent on gaining market share. With a market cap of just $18 billion, its Aptiv becomes an appealing acquisition target itself for larger firms looking to expand their presence in the automotive technology sector.

Aptiv plans to spin off its Electrical Distribution Systems business (EDS) creating two independent companies, each optimally positioned to serve their customers and create value for their shareholders.

The spin-off is expected to be completed by March 31, 2026.

Aptiv shareholders retain current shares of Aptiv stock and receive pro-rata dividend of shares of new EDS company stock

New Aptiv to be a High Growth, High Margin Provider of Full Sensor-to-Cloud Tech Solutions, Including Highly Engineered Interconnects and Components Serving Diverse End Markets

New EDS to be a Leading Global Supplier of Low Voltage and High Voltage Signal, Power, and Data Distribution Solutions for Automotive and Commercial Vehicle Markets with Multiple Levers for Revenue, Earnings and Cash Flow Growth.

Kevin Clark, CEO and Chairman: “We are excited about the separation transaction for both Aptiv and EDS and believe it will deliver benefits for our customers, provide opportunities for our employees, and create significant value for our shareholders."

Announcement: https://ir.aptiv.com/investors/press-releases/press-release-details/2025/Aptiv-Announces-Intention-to-Separate-Its-Electrical-Distribution-Systems-Business/default.aspx

Aptiv will release Q4 2024 results on Feb 6, 2025.

I really liked your thesis on Aptiv. It's curious how the market sometimes contradicts itself. While palladium is cheap due to expectations that the EV transition will be fast, eliminating demand for palladium catalytic converters, Aptiv is trading cheaply because investors believe this transition will take longer than expected.

My main concerns about Aptiv are the following:

Margins seem to be deteriorating quite rapidly, from a 22.4% gross margin in 2016 to 18.5% in 2019, and now sitting at the same level as in 2019. Rising competition could be a significant concern for the company.

I'm unsure to what extent this business is affected by the cyclicality of the automotive sector. Is the company more or less affected than other automotive companies during market downturns?