Billington Holdings

Structural steel & engineering activities throughout the UK and European markets

DISCLAIMER & DISCLOSURE: The author holds a small position in Billington at the date of publication but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Short and Sweet

Unlike my normal deep dive analysis, what follows is a short write up of an investment idea that you may want to investigate further yourself. It’s a special situation certainly worth exploring.

Billington Holdings Plc (AIM: BILN), is one of the UK’s leading structural steel and construction safety solutions specialists. It has grown through acquisition and its group companies are focused on structural steel and engineering activities throughout the UK and European markets.

Trading Below Net Asset Value

When the positive long-term outlook for a company is tempered by more immediate market challenges, share prices reflect investor confusion and uncertainty. These are arguably the best times to invest.

Imagine finding that the share price of a strong company had fallen ~40% in just over a year when the fundamentals hadn’t really deteriorated.

Picture a small company capitalized at £50 million (all figures in GBP), with a fortress balance sheet - a £19 million net cash position - and so an enterprise value of only £31 million. Now if I told you that it is now at the end of a CAPEX cycle and the free-cash flow run rate is anticipated to hit £10 million - which would imply a 33% free cash flow yield - would you be left scratching your head on valuation?

The share price is so depressed, and it’s been generating such strong cash flows, that it last paid a dividend yield of 4.5%.

The company is capitalized for less than it net asset value. You could buy the business, wind it up, settle its liabilities and be left with more than you paid. That means that the market is ascribing a negative value to this profitable business as a going concern.

These were the kind of net/net opportunities that Ben Graham used to look for.

With cash of £19 million on the balance sheet and no long-term debt, why isn’t it repurchasing shares?

It’s British! That’s all I can say. Capital allocation isn’t done well in the UK.

It also has a very strong order book going forward.

So why is the share price down?

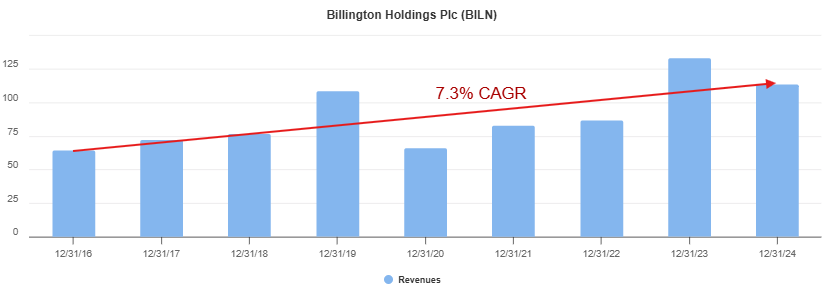

There are a host of silly reasons. Despite the disruption from the Covid19 pandemic, the company has achieved top line growth of 7.3% CAGR over the past 8 years. Financial year 2023 was an extraordinarily strong year - probably due to catching up on business delayed during the pandemic period (2020-2022 were depressed years), so 2023 was an outlier.

When compared year on year to FY23, FY24 appeared to be disappointing, but zooming out (see chart below), the long-term uptrend continues. The company achieved a 7.3% CAGR over 9 years, which is impressive for a capital intensive industrial business.

The company did report in its 2024 full year results that the market was becoming more challenging, as higher interest rate environment and geo-political turmoil can lead to project delays and pricing pressures.

But the current valuation makes no sense unless one takes the view that the business is permanently impaired - which couldn’t be farther from the truth.

History

Founded in 1947, shortly after World War II, as a family-owned steel fabrication business in Barnsley, South Yorkshire.

For its first four decades, the business grew organically, establishing itself as a key player in the UK's steel industry. This period laid the groundwork for the expertise and operational foundation that would support its future expansion.

In 1989, the company changed its name to Billington Holdings PLC, signaling a new chapter and a move toward a more formal corporate structure.

The company's evolution culminated in its UK Initial Public Offering (IPO) in 1993, when it was admitted to the Alternative Investment Market (AIM) of the London Stock Exchange. This move provided the capital and public profile needed to accelerate its growth strategy.

After becoming a public company, Billington Holdings embarked on a period of significant expansion, combining organic growth with a series of strategic acquisitions to broaden its service offerings and reduce its reliance on a single market. This evolution transformed the business from a pure-play steel fabricator into a diversified industrial group.

Key acquisitions and the establishment of new divisions were central to this strategy, expanding its capabilities into specialized areas:

Steel Profiling & Processing: The establishment of Shafton Steel Services brought in-house steel profiling capabilities.

Secondary Steelwork & Staircases: The acquisition of Peter Marshall Steel Stairs Ltd expanded the group's offerings to include secondary steelwork and specialized staircase manufacturing.

Construction Safety Solutions: The acquisition of Easi-Edge Ltd diversified the company into construction site safety solutions.

Industrial Coatings & Fabrication: The addition of Specialist Protective Coatings Ltd (SPC) provided industrial surface preparation services, while the acquisition of Tubecon introduced architectural and complex steel fabrication capabilities.

Hoarding Solutions: The group further expanded its portfolio with Hoard-it Ltd & Brand-it, focusing on sustainable site hoarding solutions.

Architectural & Complex Steel Fabrication: It expanded by acquiring specialist skills and staff from SH Structures, thus enhancing Tubecon’s (a Billington division) capabilities to offer a full-service solution for complex steel structures across sectors such as infrastructure, commercial, rail, public buildings and complex bridge projects.

This evolution created a robust group structure encompassing several specialty subsidiaries, which has made the company less exposed to the cyclical risks of the core construction sector.

Today and the Future

The company's present-day strategy builds on this diversified foundation. Billington Holdings has been undertaking a substantial five-year investment program aimed at upgrading and expanding its key facilities. These investments are focused on new production machinery and facility upgrades, with the final major investments expected to complete in mid-2025.

The completion of this program is anticipated to result in a "step-change" in operational efficiency and cash generation, with expectations of a run-rate free cash flow of about £10 million.

The company's strong balance sheet supports this projection and positions it to continue analyzing potential acquisitions to further expand its capacity and operations, suggesting a continued growth-oriented strategy.

The People and Corporate Culture

The company is led by a stable and experienced management team. Mark Smith has served as Chief Executive Officer since 2015, and CFO Trevor Taylor has been an Executive Director since 2011, demonstrating long-term leadership. The average tenure of the management team and board is approximately 10 years and 9 years, respectively.

This stability extends to the broader organization, particularly within its subsidiaries. For example, key members of the Billington Structures Ltd team have been with the company for decades, with some individuals boasting over 30 and even 40 years of experience. This high retention rate indicates a strong, positive work environment and ensures a deep pool of institutional knowledge and expertise.

Corporate Culture and Values

Billington Holdings' corporate culture is built on a foundation of ethical behavior and strong stakeholder relationships. The company's public policies and communications highlight its commitment to:

Stakeholder Engagement: Prioritizing clear, consistent, and transparent communication with employees, shareholders, customers and suppliers.

Employee Development: Fostering a supportive and inclusive environment, offering training and apprenticeship opportunities, and implementing an Employee Share Option Plan to align employee interests with company success.

Ethical Conduct: Maintaining a strict, zero-tolerance policy against bribery and corruption and adhering to high standards of corporate governance.

Sustainability: Operating in a sustainable and responsible manner, with a focus on safeguarding the environment and promoting a safe, healthy, and productive working environment.

This focus on people and responsible business practices is a significant asset, contributing to the company's resilience, reputation, and ability to attract and retain the talent needed for its continued success.

The Outlook

FY25 ended in December 2025 and results are typically reported in April.

Based on the interim results for the six months ended June 30, 2025 (reported in September), Billington Holdings faced a challenging first half of FY25 characterized by a subdued construction market and significant economic uncertainty. The business had to navigate a backdrop of low consumer confidence and intense pricing pressure for new work, which became increasingly evident across the structural steelwork sector. Furthermore, the industry more broadly struggled with the impact of government reviews of infrastructure projects, leading to deferments and delays in project initiations.

The “softer” performance in the first half of 2025 compared to the same period in 2024 was primarily driven by a combination of reduced revenue and delayed profit recognition. Revenue fell by 27.84% to £41.78 million, largely because the Group shifted toward more complex, labour-intensive contracts that required a higher proportion of productive labour relative to actual steel content. While productive hours actually increased by 5.4% during the period, the lower volume of raw materials processed resulted in lower overall turnover. Additionally, pre-tax profit dropped significantly from £4.64 million to £1.67 million due to “client-led delays” on several large contracts. These delays prevented the company from recognizing margins as originally scheduled, effectively pushing the anticipated profits into future periods.

“The timing of profit recognition on certain significant contracts, as a consequence of client led project delays, will result in the recognition of margin later than was previously anticipated. We are optimistic that the market will see some recovery in 2026 as stability and increased confidence returns to the sector. Billington, with its strong balance sheet and significant cash resources is well positioned to take advantage of improved market conditions.”

Mark Smith, CEO

Looking ahead to 2026 and beyond, the company maintains a cautiously optimistic outlook supported by a “very healthy” and diverse order book. While results for the full 2025 financial year are expected to be below original market expectations due to the aforementioned timing issues, management anticipates that 2026 will align with expectations as market stability and confidence return. The company is particularly focused on high-potential growth areas such as data centres, waste-to-energy projects, and sustainable energy transition sectors driven by government policy. With a strong balance sheet and a cash position of £18.73 million, Billington believes it is well-positioned to capitalize on a market recovery that is expected to gain momentum through 2026.

Conclusion

Given that the company trades below its net asset value, at current valuations there is a significant margin of safety. The business as a going concern is a market leader in the UK, is profitable, grows organically and by acquisition, yet it is valued at less than zero which can’t be correct. Billington certainly seems to offer an attractive assymetric risk-reward skew.

This is not a deep dive and so I shall leave it there having planted an idea in your mind that you may or may not choose to pursue. If you decide to dig deeper, please share your thoughts and findings in the comments below. It would be nice to create a community based discussion on this idea.

This is such a compelling case for a net-net situation. Trading below liquidation value while generating strong free cashflow is exactly the kind of assymetric opportunity Graham was hunting for. The 33% FCF yield post-CAPEX is wild, and the managment stability adds real confidence. UK capital allocation quirks definately create these mispricings more often than they should.

Where are you getting that 33% free cash yield? On the broker numbers I have negative £2m of free cash this year. My assumption with Billington has been that the stock is down because operating leverage here is massive, visibility is poor, and UK construction PMIs have been very weak over the past 6 months. On FY26 consensus I have it on a roughly 12% cash yield and a marginal discount to NAV, which given the macro uncertainty and business quality feels OK to me