Charlie Munger | Learn From The Best

A Legend In The Field Of Investing

Munger, Buffett and Berkshire Hathaway

Charlie Munger (1924-2023) was an American billionaire investor, businessman, and former real estate attorney. He served as vice chairman of Berkshire Hathaway, the conglomerate for which Warren Buffett is both CEO and Chairman.

Buffett has described Munger as his closest partner and his right-hand man.

The two met at a dinner in Omaha in 1959 and, on Buffett’s advice, Munger gave up on the practice of law in the 1960s to concentrate on managing investments.

Prior to joining Berkshire Hathaway, Munger ran his own investment firm, which generated compound annual returns of 19.8% between 1962 and 1975.

In 1978, Munger became Vice Chair of Berkshire Hathaway.

In his 1989 letter to shareholders, Buffett credited Munger with setting him straight on the fact that Berkshire should not pursue the Benjamin Graham "cigar-butt" version of value investing (effectively buying a low quality business at a discount to its intrinsic value when other investors have over-sold it in order to squeeze the last puff out of the cigar - a short term arbitrage investment strategy).

Berkshire switched its investment philosophy as a result and became phenomenally successful by following Munger’s mantra: “Forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices.”

Munger is known for his contrarian approach to investing. He has said, "to the extent we're contrarian, it's because we're looking for places where the consensus is wrong."

He also avoids investments that are too complex or outside of his circle of competence. He would rather profit from what is obvious than from having to grasp the esoteric.

Known for his use of "mental models," these are frameworks for thinking about problems and making decisions. He has written extensively about this concept and its application to investing and business. He is famous for looking at things on a bottom up basis which is the meaning of his quote “Invert, always invert”.

Critically, he was a proponent of long term investing. Buy and hold forever. He believed in the power of compounding. He also sought to mitigate unnecessary transaction costs and taxes that otherwise accrue as the result of frequent trading. This is the key to Berkshire’s success and it was driven by Munger.

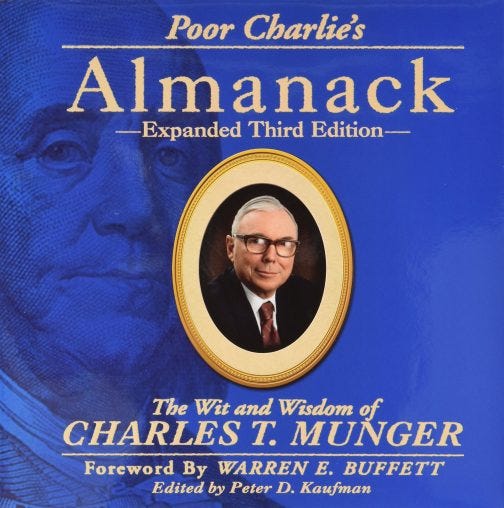

Munger introduced the concept of "elementary, worldly wisdom" in the business and finance sector in multiple speeches and in his book Poor Charlie's Almanack.

It is no coincidence that Benjamin Franklin features on the cover of Charlie’s book. We are all familiar with dollar stores, but few of us know that they originate in 1737 Colonial America, when Poor Richard, in his Almanack, declares, “A penny saved is two pence clear.” Not one to rest on the wild success of a clever maxim, Poor Richard, again, in 1758, and by then far less poor, spruced up his catchphrase to, “A penny saved is a penny got.” This will all make sense when you learn that Poor Richard was better known as Benjamin Franklin. What we know as the dollar store today all started with him.

Charlie Munger’s book is a nod to the wisdom of Benjamin Franklin.

It was Franklin that is quoted as saying, “An investment in knowledge pays the best dividends”

Charlie Munger is proof of that. Munger lived to almost 100 years of age continued working every day. He was an avid reader with a particular focus on biographies of great people. The knowledge that he has accumulated from those that came before him has certainly paid dividends. Fortunately, he has passed much of it on for us to treasure: click here