FitLife | In Great Shape For The Future

A MicroCap Turnaround Success Story, Only Just Starting To Bear Fruit

Nasdaq: FTLF

Market Cap $154 million @ share price $33.45

Enterprise Value $165 million

Net Debt to EBITDA 0.9x, Net Debt to Market Cap 0.1x

ROIC 24%

Great capital allocation (heavy reinvestment of earnings and no dividends)

First class management with proper alignment to shareholders

Capitalized at 20.6x earnings

EV/EBITDA 14.1x

Disclaimer: The author has no position in FitLife Brands Inc, but may do so in future. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

FitLife Brands Inc, based in Omaha, Nebraska, specializes in the development, manufacturing and marketing of wellness products aimed at health-conscious consumers. Its diverse product portfolio includes sports nutrition supplements, weight loss products, general wellness items and two skin care brands that arrived with acquisitions it has made.

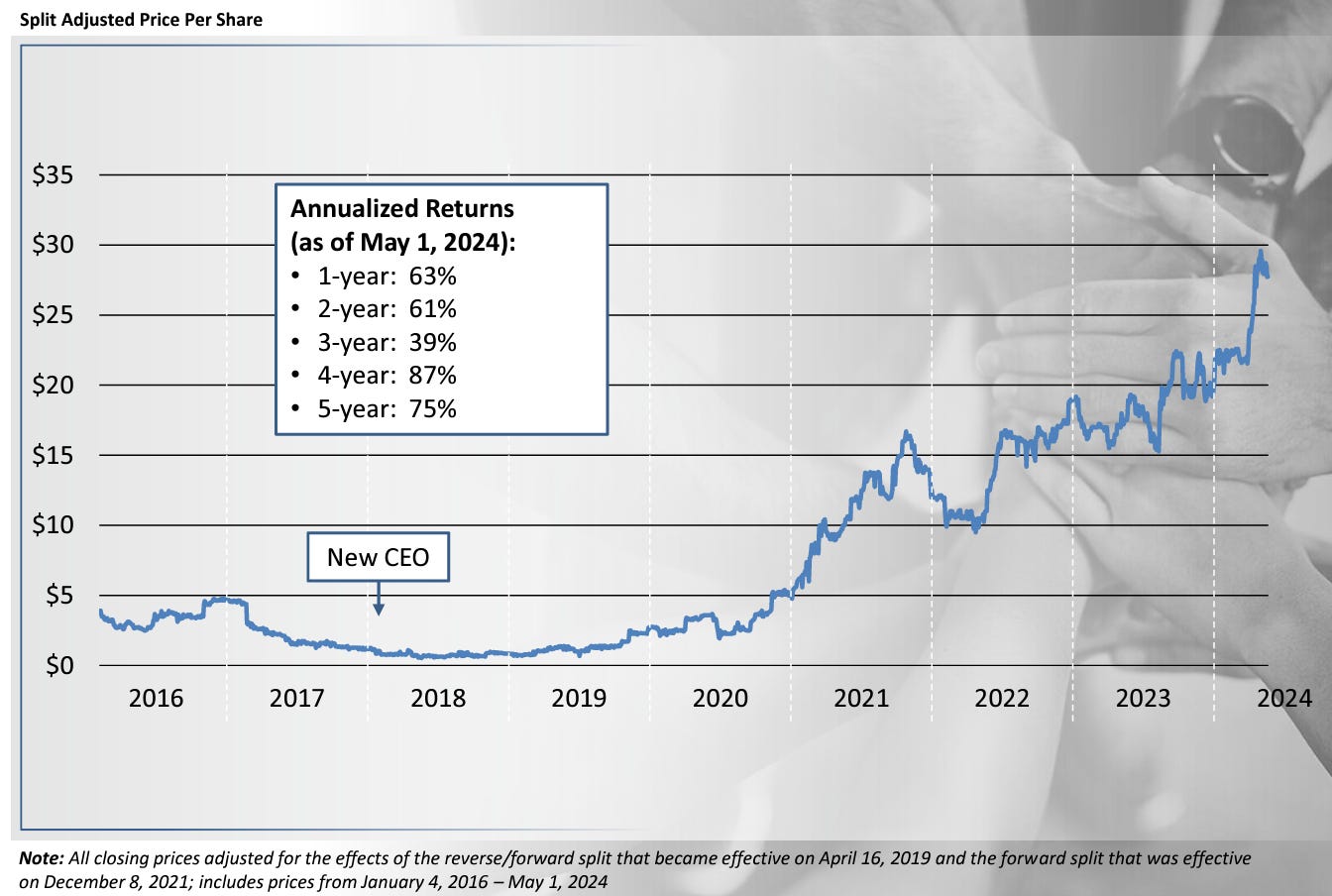

The story is a tale of two halves. Prior to 2018 it was poorly managed with changes in executive leadership occurring too frequently, leading to inconsistent strategic direction and no cohesive long-term growth strategy. However, everything changed in 2018 with a new long-term, high quality CEO who also became the majority owner of the business.

Historical Context (Pre-2018)

Starting as Bond Laboratories and incorporated in 2005, the company initially focused on sports nutrition and weight loss supplements. It rebranded to FitLife Brands in September 2013.

FitLife had one dominant distribution channel selling to GNC franchisee retailers (GNC Holdings is an American multinational nutritional company based in Pittsburgh, Pennsylvania which has a wide network of franchised retail outlets in which it sells its own products alongside those of third parties including FitLife). This strategy worked well for a few years, until GNC noticed how much product FitLife was selling through its network. In order for the franchisor to capture some of that value, it prevented FitLife from selling direct to its franchisees. In future it would it would have to sell to GNC Holdings, who would then mark it up before selling it on to the franchisees.

Not only did this trim margins by introducing another mouth to feed in the chain of distribution, but it also created concentration risk for FitLife. Previously it had a large number of customers in the form of franchisees - if any one of them decided to cease selling FitLife products it would not affect its relationship with other franchisees. But it now found itself with most of its sales concentrated with one customer, the GNC holding company. This presented a huge risk because if that single relationship broke down, almost all sales would immediately dry up.

This was the start of FitLife’s troubles. In order to reduce its reliance on GNC, it rushed into an acquisition that would allow it to diversify. However, in haste it overpaid for the acquisition and did a poor job integrating it into FitLife.

It also failed to capitalize on e-commerce opportunities in a rapidly evolving digital world.

To make matters worse, it found itself with an overly diverse product range leading to inefficiencies in both production and marketing. In short, it spread itself too thin, the business failed to define its core competence and so it became a purveyor of a multitude of products, but a master of none.

This lack of focus resulted in suboptimal resource allocation and culminated in FitLife facing challenges due to inconsistent revenue growth and frequent periods of losses. In 2017, the company reported a net loss of $1.1 million on revenue of $20.8 million and it struggled with cash flow generation. Compounding its issues, the business was overly leveraged relative to cash flows, making it difficult to raise any new capital to invest in other growth initiatives.

Collectively these issues contributed to FitLife's underperformance and created the need for a significant turnaround strategy.

Several years earlier, a hedge fund manager had invested in FitLife encouraged by its financial performance prior to the changes of distribution terms imposed by GNC. For a year or two the investment performed well, but the GNC situation changed everything and the investment turned sour.

Not one to walk away, he engaged with management in an attempt to turn the fortunes of the company around. Little by little, he became more involved in corporate affairs and eventually landed himself a position on the board.

Confident in his ability to revive the business, he exploited the depressed share price and accumulated a large stake in the business both in a personal capacity and via his hedge fund.

In 2018, he became CEO of the business, and his name is Dayton Judd.

New Leadership (2018 - Present)

Judd graduated from Brigham Young University in 1995 with a Bachelor’s Degree, summa cum laude, and a Master’s Degree, both in accounting. He also earned an M.B.A. with high distinction from Harvard Business School in 2000, where he was a Baker Scholar. He went on to qualify as a Certified Public Accountant.

In his professional career he was formerly employed at a senior level by the highly regarded McKinsey & Company management consultancy where he remained for the best part of a decade gaining a solid understanding of what success looks like in a businesses context.

Armed with this knowledge, he decided to move into the investment arena, becoming a portfolio manager at a multi-billion dollar hedge fund, Q Investments, in Fort Worth, Texas. He wanted to invest in the kind of companies that he believed had the best chances to prosper and his academic and professional experience positioned him well to interrogate both the qualitative and quantitative aspects of a corporate enterprise.

Subsequently, Judd established his own investment fund, Sudbury Capital Management, which is still operational today and it was this fund that first invested in FitLife around 2012.

The table below shows how Judd, both in his own name and through his hedge fund, Sudbury Capital Management, holds over 55% ownership of FitLife Brands. Finding a CEO so heavily invested in the company that he runs is rare, particularly when he was not the founder. But he was clearly confident in his own ability and is evidently engaged for the long-term. This is true alignment with external shareholders and something that I have learned over the years bodes well for the success of an investment.

Other significant insiders are highlighted, and there are more further down the list which are not visible in this screenshot, so the management team has skin in the game, which is refreshingly nice to see. The remainder of the ownership rights in the company, the public float, accounts for 41.7%.

Turnaround

Under Judd’s leadership, the company underwent a strategic shift by refocusing on its core competencies in sports nutrition and weight loss. It streamlined its product offerings to improve operational efficiency and placed a greater emphasis on direct-to-consumer sales channels.

The company both develops its own products and inherits others that arrive with acquired companies. The latter option is, in many ways, a safer option, given an acquired product has already been tried and tested so the R&D risk is entirely removed.

The product range caters for most types of consumers with premium higher priced lines, budget offerings for those with less disposable income, and even vegan-friendly options for the ethical consumer. A breakdown of the products is as follows:

51 protein SKUs across 6 brands

172 vitamin/supplements SKUs across 12 brands

29 skin care SKUs across 2 brands (these may at some point be divested as they deviate from the core product line).

In all it owns and manages 13 brands (there is brand overlap across SKUs which, for the eagle-eyed reader, is why the number of brands on the bullets don’t add to 13).

FitLife’s products now have a strong reputation as can be seen by their online reviews, from very large numbers of buyers, plus the Amazon recommendations of FitLife product relative to peer group competition (see image below):

In addition to strategic realignment, the company adopted a more disciplined financial approach including cost-cutting measures, along with improved inventory management.

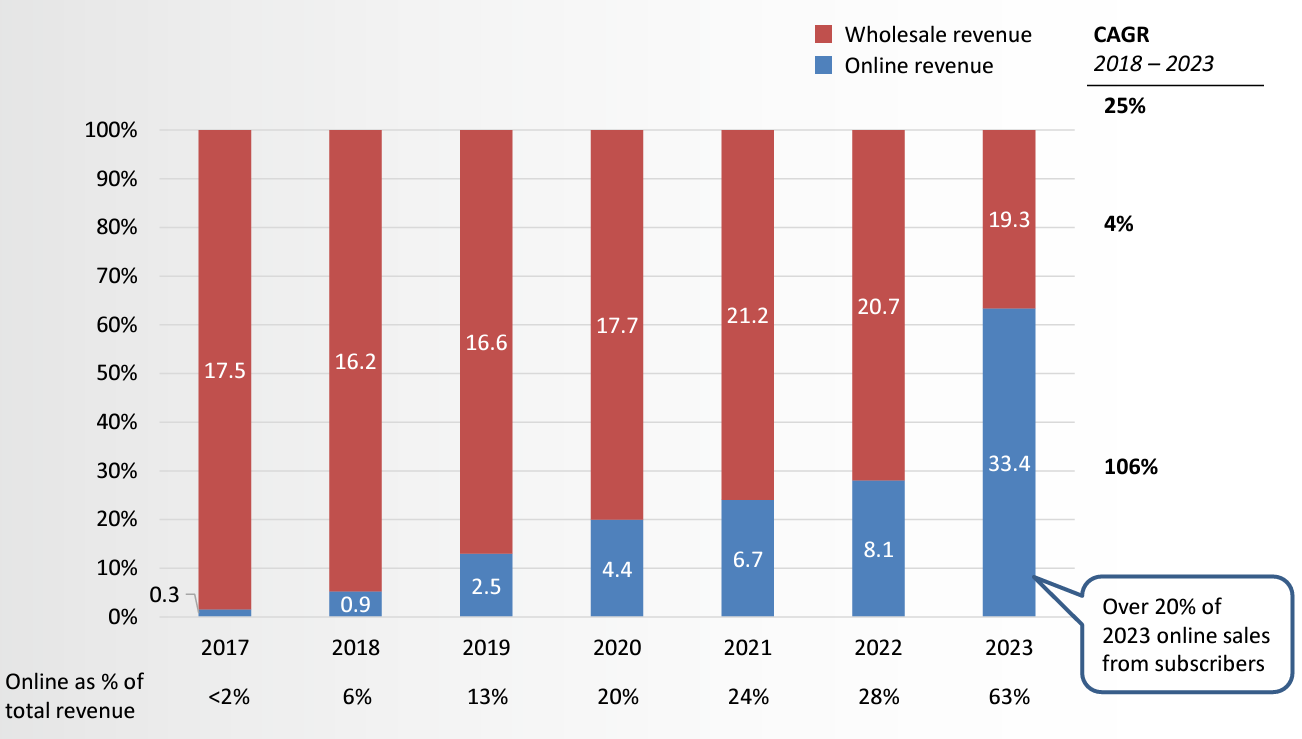

Since 2018, FitLife has demonstrated consistent sequential revenue growth, even through the Covid pandemic period. Profitability has also improved, translating to strong cash flow generation which has allowed the company to reduce debt and finance acquisitions without the need to issue additional equity.

FitLife’s operational model requires little working capital because it receives payment from customers more quickly than it is required to pay its suppliers. This means that growth is not constrained by the need to raise new working capital. This situation will improve further as sales through online channels contribute larger percentages of total sales.

Its products are currently available online via Amazon and on the company's own website, and in stores including GNC, Walgreens, Vitamin Shoppe, CVS, and others. GNC alone represented one-third of total revenue for 2023 and plays a vital role in FTLF's value creation.

To support this relationship, some of FitLife’s products are made exclusive to GNC franchises, although consumers are able to purchase these at a marked up retail price through online channels (Amazon and FitLife’s website). This means that GNC is able to offer the best price in the market on these products.

The FitLife product is supplied to GNC on tight margins which are still lucrative for FitLife, but which ensure that the FitLife products are more profitable for the retailer than competing brands. This is clever. Rather than compete with other brands on retail price, which often causes a price war and a race to the bottom which benefits no one, FitLife is instead competing one level down on its retailer profit margins.

I am reminded of the Jeff Bezos mantra, "Your margin is my opportunity". Evidently, Judd sees it exactly the same way.

The GNC relationship delivers a few key benefits:

As at 2024 there were 2,267 total GNC stores across the United States, a mix of corporate owned and franchised. Fitlife principally deals with the franchise network which accounts for about one third of the stores. So FitLife has a diverse retail network of around 750 stores through which it makes its product available to the consumer.

The GNC franchisees favour the FitLife product over and above any of its competitors products due to the higher profit margins that they generate, so displays them prominently in the store. Customers who know what they want are easily able to find the FitLife products, and those that are undecided are encouraged by the retailer to buy FitLife wherever possible. As Charlie Munger used to say, it’s all about the power of incentives!

The GNC franchisees effectively handle all marketing, promotion and advertising locally which substantially reduces FitLife’s SG&A expense.

Having preserved retail prices, any product sold direct by FitLife via online sales channels, at the premium marked up online retail price, generate very healthy margins indeed. This is a growing part of its business.

FitLife has also successfully closed several strategic acquisitions to expand its product lines and distribution channels (more on acquisitions later). This has increased the company’s presence in specialty retail stores and improved its e-commerce capabilities.

Since 2018, everything Judd has done has gone exceptionally well. He almost seems to have the Midas touch:

In September 2023, FitLife transitioned from an over-the-counter markets listing to a premium listing on the NASDAQ exchange. This has resulted a boost to the stocks liquidity, with the average traded volume increasing by a factor of five. FitLife shares have now been added to two index funds and more are likely to follow.

Investment Opportunity

This business is very capital light, consuming very little CAPEX. It has low levels of leverage and debt is only used where absolutely necessary to supplement infrequent CAPEX spending on strategic acquisitions (more on this later).

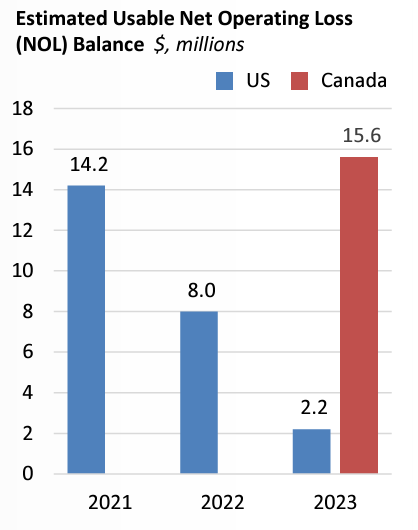

There are still Net Operating Loss (NOL) carry-forwards which will boost cash flows in the short to medium term. U.S. NOL balances will be depleted this year, but the sizeable NOL balances in Canada remain. The issue is that the company currently does far less business in Canada, and to the attrition rate of the NOL balance is slow. The company is addressing this issue having established a sales offices in Canada which will allow it to utilize more of the Canadian NOLs.

The company has a growing online presence with a strong subscriber base which helps secure recurring revenues and underpins financial performance:

This appears to be a growth story that has only just started to gain momentum, which is being driven both by strong organic growth and acquisitions.

Acquisitions

Judd recognizes that the sports nutrition and weight loss industry is highly fragmented, with a mix of major players and numerous small companies. This fragmentation presents an opportunity for FitLife to attract new customers and expand its distribution channels through acquisitions.

In the supplements industry more broadly, other players include mutli-national pharmaceutical or consumer products businesses, so FitLife is a relatively tiny fish. This, however, is a blessing. Being a microcap and operating in a huge market means that there is plenty of scope for it to grow - for instance it is able to acquire small complimentary businesses that simply wouldn’t interest the big players.

Judd’s longer-term goal is to consolidate his niche in the industry, potentially positioning FitLife as the market leading player in that niche - though that remains a distant vision for now.

Judd is also aware that smaller private companies can often be acquired at an EV/EBITDA multiple of 3x to 6x, creating an arbitrage opportunity when these businesses are integrated into FitLife, which currently commands a stronger multiple of 11.2x. There is even potential for this multiple to grow to 15x, as seen with other digital businesses in the industry.

FitLife appears poised to become a serial acquirer within its niche. Over the past four years, the company has evaluated 50 acquisition opportunities, submitted eight letters of intent, and closed three acquisitions so far (further details below).

FitLife’s strong management team is well-positioned to nurture the brands it acquires, leveraging synergies between these complimentary businesses in order to drive growth and value.

Best of all, the strong balance sheet provides flexibility to close deals without issuing new equity, resulting in value accretion for existing shareholders.

The first of Judd’s acquisitions was Nutrology, bought for $529,000 in cash. The objective was to expand the scope of FitLife’s offerings and to capitalize on growing interest among consumers in clean, healthy, and plant-based supplements. FitLife was solely interested in acquiring Nutrology’s brands and product range. The business was acquired in April 2021, and by the end of that same year its products had generated $879,000 of revenue and $346,000 of gross profit for FitLife, all of which dropped through to operating profit since it required no incremental OPEX to service the business. As such, the acquisition paid for itself within one year of the deal closing. It was a bargain, and testament to the excellent stewardship of Judd.

Next came the Mimi Rock acquisition which was funded with $4.6 million cash and $12.5 million debt. The business was in financial distress and Judd pounced on the opportunity. The business objective was to increase exposure to general health and wellness supplements, together with new online sales channels. Post acquisition, non-advertising elements of SG&A were rationalized by $1.5 million, instantly enhancing the margins achieved by the Mimi Rock part of the business. After a mere seven months, this deal boosted the operating earnings annual run-rate by $3.5 million, increasing monthly adjusted EBITDA to around $500,000.

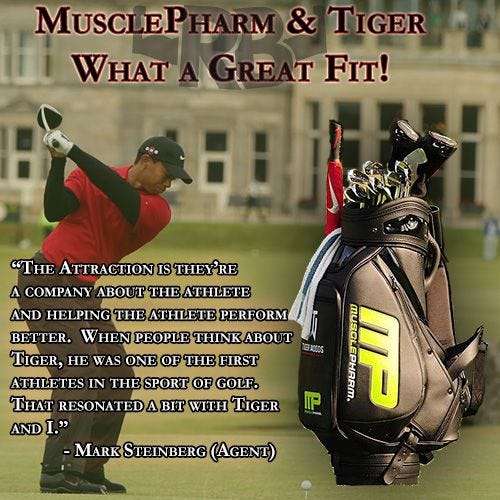

The most recent acquisition was MusclePharm and it involved $8.5 million cash and $10 million debt. This is a well-known sports nutrition brand with a 15 year heritage. It grew to over $150m in revenue in 2015, but then fell back to below $20m in 2022. This was the cause of its financial troubles. It spent heavily on advertising including celebrity endorsements from the likes of Arnold Schwarzenegger and Tiger Woods.

Due to poor stewardship, MuslePharm over stretched itself and became insolvent. Judd spotted the opportunity and acquired MusclePharm out of bankruptcy at a great price.

FitLife seems to be great at acquiring distressed assets, which certainly bodes well for future acquisitive growth, but the astute reader will spot another theme emerging. Judd is evidently a master of the turnaround, having flawlessly achieved it with both FitLife, Nutrology and MimiRock. If he can perform his magic again with MusclePharm, a business with far larger potential than the others, this could more than double the size of the FitLife business.

I am reminded of the quote from Ed Catmull in his book ‘Creativity Inc’. He said getting the team right is the necessary precursor to getting the ideas right. A good idea in the hands of a mediocre team is like giving a bottle of champagne to a child. They don’t appreciate it and don’t know what to do with it. But, give a mediocre idea to a brilliant team, they’ll either fix it, or throw it away and come up with something better. In this respect, Judd leads a brilliant team that will almost certainly get these acquired businesses firing on all cylinders.

Judd intends to now focus on doing just that, which means not being distracted by any other short-term acquisitions, but his long-term intention is to continue to supplement organic growth by bolting on new businesses. Becoming a serial acquirer in niche markets can be incredibly accretive for shareholders.

Returning our focus specifically to MusclePharm, its brand is strong and it has excellent consumer awareness owing to the tens of millions of dollars spent on advertising in the past. FitLife is now the beneficiary of all that investment, paid for by others, and Judd intends to build upon it to restore MusclePharm to its former glory.

MusclePharm’s former wholesale partners, iHerb and Coupang, have been re-engaged, while discussions are ongoing to regain shelf space at other wholesale distributors. MusclePharm products have previously been sold in Costco, Walmart, GNC, Vitamin Shoppe and others, so there is a good chance that some of these relationships can be rekindled.

It also has strong international sales and Judd plans to lean into this in order to grow FitLife, and help diversify a business which has previously been concentrated in the U.S. market. These overseas distribution channels will help the company broaden its reach for its other non-MusclePharm products. Concurrently, Judd intends to exploit FitLife’s expertise in direct to consumer sales channels, primarily its own website and Amazon, to sell MusclePharm products.

The outcome of Judd’s plan should be increased gross margins through the utilization of the direct to consumer sales channels, a synergistic rationalization of operating expenditure by exploiting economies of scale, and a significant boost to free cash flow in a capital light business.

The Market

In my conversation with Judd, I challenged him on whether he saw himself operating in a commoditized market and, if so, how he would manage this challenge. His response was swift and emphatic. He said that FitLife is a market leader in a niche which is difficult to break in to. He offered the very healthy margins being generated on his product as evidence of that. In a commoditized market, margins are quickly competed away, but FitLife seems to have strong durable margins.

According to recent studies, the global dietary supplements market is set for substantial growth between 2024 and 2030, driven by increasing health awareness and lifestyle changes. There is an increasing trend toward preventive healthcare and personalized nutrition in which consumers are seeking supplements for immunity, weight management, and overall well-being. Additionally, people are living longer and the older generations are increasingly seeking dietary supplements to support age-related health concerns, such as bone health, joint health and cognitive function.

Growth is also being fueled by the popularity of e-commerce platforms, as companies exploit the direct-to-consumer sales channels, enabling consumers to learn about various products, read the reviews of others buyers and purchase more quickly and easily than ever before.

Valued at around USD 177.50 billion in 2023, the market for these products is expected to grow at a global blended compound annual growth rate (CAGR) of 9.1% until 2030 (see table below). European and Asian markets are growing at a fast pace, playing catch up to the U.S. market which is very well established. This international growth will certainly open new commercial opportunities for FitLife going forward.

The Dr.Tobias range of products is continuing to enjoy sales growth via Amazon market place due to optimization of advertising combined with the introduction of new products. The company is also exploring digital sales channels beyond Amazon, such as TikTok and Tmall.

The dietary supplements market is subject to varying regulations and standards across different jurisdictions. These rules and regulations govern product labelling, quality control, ingredient safety, and scientific evidence supporting the claimed health benefits. This creates challenges in penetrating new markets as compliance is costly and time consuming - it is far easier to manage these challenges when operating as a major multinational pharmaceutical or consumer products business operating at scale than it is for a microcap challenger. Nonetheless, FitLife is exploring a range of options including licensing its products to overseas distributors in return for royalties on sales. In this way, the local distributor would handle local rules and regulations thereby avoiding the issue for FitLife.

Competition and Value

There are several companies operating in this space and below is a table which compares them on key metrics.

FitLife is the baby in the group in terms of market cap, but despite this its margins are strong. Due to its size, it has been able to grow far more rapidly than its competitors, driven largely by its appetite for acquisitions. This will clearly be the growth engine going forward, although having made a few sizeable acquisitions recently, no new acquisitions are anticipated in the near future, so top line growth rates may slow over the next year or two.

It is encouraging that the company does not pay dividends as this a poor means of capital allocation (see here for an explanation).

The company bought back about 20% of the outstanding shares in 2019 and subsequent buybacks focused on private transaction buybacks in order not to further diminish the public float. Generally, Judd rightly believes that the best use of capital is M&A, so his focus has been on growing the business in that way. However, in the absence of future M&A opportunities, or if cash builds on the balance sheet, it is likely that he will look to further reduce the share count.

Repurchases will be exceptionally easy to achieve given that Judd and his hedge fund hold 55% of the shares and his fund investors will want to gradually scale out of FitLife in order to diversify into other investments (FitLife is the funds largest holding, primarily because it has been invested for the long-term and Judd has overseen a turnaround which witnessed the share price increasing from 66 cents at the beginning of 2018 to $33.40 today making it a 50 bagger for his fund. For the fund and its investors, they now have huge concentration to FitLife and it would be prudent fund management to reduce that exposure).

So future shareholder returns are likely to be driven by a few factors.

Margins may increase by a couple of hundred basis points as more sales are executed directly online and synergistic savings are made following integration of acquisitions.

Revenues will grow, partly organically and partly through strategic bolt-on acquisitions.

There is a good chance that the share count will reduce, enhancing earnings per share.

The big question is around the multiple at which the business is capitalized. Will it expand or contract?

A 20x multiple implies an earnings yield currently of 5% which doesn’t meet the hurdle rate of risk-free rate plus equity premium. But on a forward basis, if top line growth remains robust and margins improve, it is certainly justifiable. More particularly, the Fed is expected to cut rates soon and that will lower the hurdle rate for equities supporting higher multiples.

But if top line growth drops due to a lack of acquisitive growth, a deterioration in organic growth, or a competitor launching a wonder product (equivalent to a GLP-1 in this industry), and if margins contract for any reason, then the multiple would almost certainly drop. If it pulls back to 16x then that’s a 20% hit for the investor.

Is there enough margin of safety at this level? Only you can decide.

I am looking at a few scenarios:

In all scenarios I have assumed that there will be no dividends paid.

Scenario 5 is the bear case which sees revenues growing at only 10% CAGR for the next five years, but margins contracting at 2.4% CAGR and no reduction in the share count. I assume that the market responds with a multiple contraction to 16x and over the five year period, the shareholder return will be 9.2% or CAGR 1.77%. In this scenario the shares would be valued at $36.55 in 2029, which discounted at the Ibbotson 10% rate would imply a fair share price today of $20.78 on a cash and debt free basis.

Scenario 1 is a conservative scenario which assume that the top line grows at 15% CAGR for five years, but everything else remains unchanged. That would imply a share price in 2029 of $67.34, discounted to a value today of $39.76.

Scenarios 2, 3 and 4 assume that more than one growth driver comes in to play with revenue increasing at 20%, margins expanding moderately, earnings multiples expanding slightly and the share-count reducing pursuant to a repurchase of 10.4% of shares outstanding. Depending on how many of these drivers come in to play, the implied value of FitLife shares today would be somewhere between $55.04 and $61.48.

These are of course hypothetical scenarios and you may choose to use a different discount rate. But at least they provide a framework with which to consider the valuation of FitLife shares today.

Conclusion

The CEO has a significant portion of his personal wealth invested in the company, aligning his interests with those of outside investors. His commitment to the long-term success of the business, combined with his strong business acumen, suggests a favorable outcome for the company and its shareholders.

The key question revolves around Judd's long-term goals. In the short to medium term, he appears focused on becoming a serial acquirer, but an exit strategy is likely. Having assumed the CEO role at FitLife by circumstance rather than design, his core identity remains that of an investment manager, which opens up several possibilities for the future:

He may step down from the CEO role and transition to Chairman, allowing new leadership to manage day-to-day operations.

Aggregating smaller acquisitions into a consolidated portfolio of complimentary brands could make FitLife an attractive acquisition target itself. This may position the company for a sale to a larger industry player or private equity firm in the medium-term.

In any case, FitLife Brands Inc. has achieved impressive success under its new leadership, with improved financial performance, a focused strategy, and favorable industry conditions. These factors make it a compelling investment opportunity.

In a conversation with Dayton Judd, I dropped the question about whether M&A scope may be broadened to encompass opportunities in other sectors.

The response was both emphatic and encouraging, "Our focus is definitely on the supplement space for right now. There are a lot of opportunities, and we have the platform and expertise to absorb them without learning a new industry or dramatically expanding our team."

This suggests that acquisitive growth is certain to continue and that FitLife will continue to grow. This company ought to be seen as a consolidation machine within a niche industry.

Share price has dropped to $10.40 (after 2 for 1 split).

Some impact from tariffs on import of ingredients from China, albeit CEO says they made some anticipatory stock purchases ahead of tariff announcement.

Buying opportunity?