Alpha Group | For FX's Sake!

Aspiring to be the undisputed global leader in FX risk management

Alpha Group International Plc (London: ALPH)

Highlights

Founder-led with strong insider ownership and long-term goals

Proven track record of accretive capital allocation driving strong growth

Ability to deploy incremental capital at highly accretive rates of return

Sequential improvements to top and bottom lines year-on-year since IPO in 2017

Significant growth potential

Fintech disruptor capitalizing on inefficiencies in traditional banking models

High customer retention rates

Well-managed with a competent board of directors

Excellent internal culture and strong corporate values

Intangible asset-based business with good operating leverage

Primarily focused on organic growth, but open to M&A opportunities

Successfully completed its first synergistic acquisition

Increasing customer base and climbing average revenue per customer

Expanding headcount to meet growing demand

Pristine balance sheet with a net cash position

Excess cash being used for share repurchases

54.75% CAGR Top line growth since IPO

Gross Margins c.80%, ROIC >40%, Payout Ratio c.10%

Introduction

Human economic activity has evolved significantly, transitioning from the hunter-gatherer lifestyle of our ancestors, through bartering systems where goods were directly exchanged, to the use of money as a more efficient transaction medium. Today, money is central to all economic activity but we use multiple currencies, giving rise to the need for currency exchange and hedging of currency risk.

This explains why foreign exchange is the world's largest financial market. According to the most recent survey by the Bank for International Settlements, trading volume in the global forex market is approximately $7.5 trillion USD each and every day.

Historically dominated by big banks, the forex market has recently seen the entry of technology-driven disruptors offering better, more cost-effective solutions. This is where Alpha Group International (Alpha) emerges as a key player, counter-positioning itself against traditional banks.

Alpha delivers specialized financial strategies and technologies to address complex financial challenges faced by corporates and institutions globally.

Founded by Morgan Tillbrook in 2010, he continues to serve as its CEO today and holds an equity stake exceeding 13%, which means that he is very much invested in the future success of the business.

The company went public in 2017 with a market capitalization of £65 million GBP, which has since surged to over £1 billion, reflecting a compound annual growth rate (CAGR) of 48%. This impressive growth trajectory is poised to continue as Alpha expands into new jurisdictions, acquires more customers, and increases revenue per customer by offering a broader array of services.

Since its IPO, Alpha’s team has grown from 30 employees in a single office to over 485 employees across eleven global offices. While headquartered in the United Kingdom, Alpha now has operations in Spain, Italy, the Netherlands, Canada, Australia, Luxembourg, Malta, and Germany. This extensive geographic spread allows Alpha to operate on a 24/7 basis across all time zones.

The Business

Alpha has expanded from offering foreign exchange risk management solutions for UK corporates to providing a multitude of complimentary services worldwide. The Group offers advanced currency management, accounts, payments, fund finance, and treasury solutions through its core business divisions: FX Risk Management (FXRM), which accounts for 69% of revenue, and Alternative Banking Solutions (ABS), making up the remaining 31%.

Alpha’s FXRM division helps corporate and institutional customers develop and implement customized FX risk management strategies. In FY2023, FXRM executed transactions worth over £25 billion, generating £76 million in revenue. The FXRM business has grown impressively as demonstrated on the chart below.

Launched in 2020 to complement FXRM, the ABS division focuses on tailored account solutions for the alternative investment sector. By FY2023, ABS had grown rapidly, generating £34 million in revenue, servicing 6,467 active accounts, and introducing new products.

Alpha has recently launched a new business division, venturing into the alternative investment market with a new digital platform for its fund finance business. This strategic move was further strengthened in December 2023 by the acquisition of an 86% controlling stake in Financial Transaction Services B.V., trading as ‘Cobase’. The remaining 14% stake in Cobase will be acquired by Alpha through a performance-based earn-out agreement that runs from 2025 to 2028.

Cobase is a cloud-based SaaS subscription fee service which, alongside bank connectivity technology, offers a central payments hub with cash and treasury management modules. Subscriptions provide recurring assured revenues and the acquisition will introduces approximately 130 new customers to Alpha.

This new business utilizes what Alpha believes to be the industry’s first digital platform for connecting borrowers with lenders. Leveraging over 1,300 existing institutional relationships, Alpha has jump-started this technology-driven division, contributing over £700k in its initial months of operation. Through Alpha, borrowers can instantly screen a large pool of lenders, while lenders gain easy access to a sizeable pool of borrowers creating a network effect. Traditional fund finance intermediaries typically work with fewer customers on an irregular basis and rely upon manual processes, so it would be difficult for them to compete. More particularly, Alpha’s first mover advantage has created a significant barrier to entry for any competitor attempting to launch a similar platform.

Alpha intends to leverage the overlap between its three divisions and the solutions that they offer. This sits at the heart of Alpha’s growth strategy.

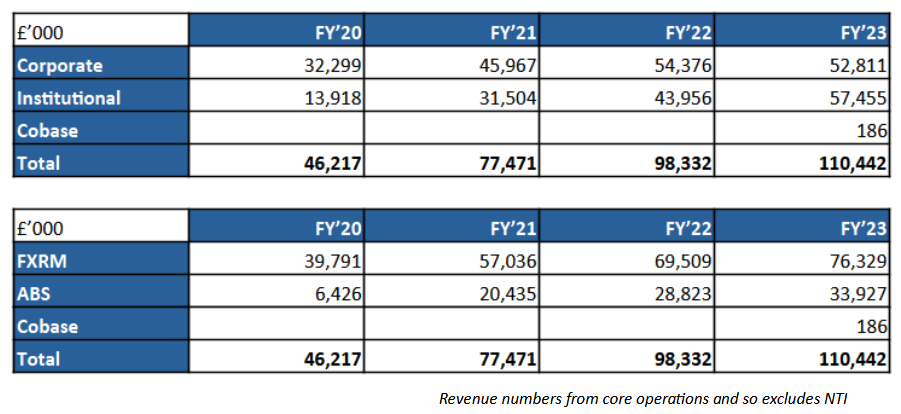

Historically, reporting has been done divisionally, looking at FXRM and ABS separately. However, as Alpha has expanded into new markets and added more products, continuing to report through these segments will make the business more difficult to understand. Consequently, in order to introduce more transparency to investors, future reporting will be split out as corporate business and the alternative investment / institutional market. The table below demonstrates the new version of revenue reporting versus the old version:

This aligns with how the business is run operationally: Corporate and Institutional divisions have separate organizational structures, leadership teams and offices. Alpha will continue to disclose the contributions that each of the service offerings contributes to the performance of each segment as shown on the diagrams below.

The corporate division is head-quartered in London with six additional international sales offices in Amsterdam, Madrid, Milan, Munich, Sydney and Toronto. Revenues are derived from the provision of FX risk management services to corporates across more than 50 countries. As at the end of the first half of 2024, corporate customers were 941, up 9% on a year earlier.

The institutional division is also head-quartered in London, albeit out of a different office than that used by the corporate division, with two further offices in Luxembourg and Malta. In addition to the provision of FX risk management services to 271 institutional customers, this segment includes alternative banking plus fund finance services to alternative investment managers and their service providers across various asset classes including: private equity, private credit, venture capital, fund of funds, real estate and infrastructure. As at the end of the first half of 2024, account numbers were 7,030, up 31% on a year earlier.

Qualitative Appraisal

Alpha's growth is driven by its high-touch, high-tech approach to customer service, which combines personalized consultancy with custom-built technological solutions. The ethos of the business is encapsulated in the three constitutional pillars which underpin its sustained growth and success:

1. Customer-Centric Focus:

Alpha collaborates with customers to design bespoke hedging programs tailored to their specific business needs, including stress testing against simulated FX market volatility. As its solutions become integrated into its customers’ financial processes, this fosters strong interdependence without the need to bind customers to minimum trade volumes or exclusivity arrangements. This in turn has contributed to 14 years of sustained growth and high levels of recurring revenue. In summary, its customer-first strategy enhances customer lifetime value.

Alpha emphasizes integrity over all else by offering simple products that are well suited to the customer’s needs, even if that means sacrificing short-term profit gains for itself. For instance, rather than chasing high margin business by touting complex options, as many of its competitors do, it has adjusted its commission structure to incentivize its sales team to favour simple lower margin solutions which are better for its customers. This resulted in the proportion of revenues flowing from complex options falling from 13% in FY22 to 4% in FY23, thereby aligning with its customer-centric objectives. Alpha’s core customer charter is both “knowing what’s right” and “doing what’s right”

New technology product development is focused around the three key customer-centric tenets: Ease of use, responsiveness and reliability.

2. Minimizing Complexity and Complacency:

Alpha avoids unnecessary bureaucracy, encouraging employees to work collectively towards shared goals in what they term the "Alpha way." This decentralized approach fosters agility, balancing autonomy with interdependence and leveraging cross-company synergies.

3. High-Performance Employee Culture:

Alpha fosters a community rich in opportunities, helping it stand out from competitors.

The depth of senior talent within Alpha’s teams supports the development of emerging talent and the scaling of the business. The focus is on nurturing talent from within rather than recruiting externally, creating a clear career path for all which is very motivational.

Employees are encouraged to think like owners, with performance targets focused on winning new business and achieving long-term customer success rather than focusing on short-term financial gains. In addition to participating in share ownership, which provides employees with a vested interest in the continuing success of the company, employees earn residual remuneration over the lifetime of any customer that they have introduced to the business – creating a direct link between employee compensation, customer acquisition and long-term customer success. This drives positive outcomes for both customers and employees, enhancing retention of both and supporting growth.

Ambitious Growth Goals

Alpha aspires to become the 'undisputed global leader in FX risk management.' It is a lofty ambition but as the old adage goes, if you aim for the moon you may never leave earths atmosphere, but if you aim for the stars you are at least likely to reach the moon! Either way, slowly but surely it is moving ever closer towards its ambition of becoming the leading non-bank provider of FX solutions.

The company’s approach to organic growth includes winning new customers, retaining existing ones, increasing wallet share, launching new products, and expanding to new jurisdictions. With less than 0.1% market share in the FX market, Alpha's growth runway is substantial.

Market Listing and Future Ambitions

In May 2024, Alpha transitioned from the AIM (Alternative Investment Market) to the Premium Segment of the London Stock Exchange, reflecting its increasing scale, maturity, and growth ambitions.

Geographic Expansion

Alpha's strategy for international expansion involves identifying key overseas markets and initially testing them from existing offices. Once proven, Alpha will establish a local office, made up of people who have worked with Alpha for a length of time and can therefore be relied upon to successfully export the company’s selling standards and culture. New additions to the office are mentored and coached to work in the ‘Alpha way’. This it refers to as its ‘Alpha Academy’ approach.

Alpha’s revenue generation has shown consistent growth in both the UK and Europe, with these regions accounting for 77% of total revenue in FY21, increasing to 86.5% in FY23. Currently, Alpha operates primarily in Europe, serving only 6 out of the 27 EU Member States. Additionally, non-EU countries such as Norway, Iceland, Liechtenstein, and Switzerland are potential future markets, indicating substantial room for expansion in Europe.

In Canada, Alpha deviated from its 'Alpha Academy' approach by exclusively employing new local personnel who were not familiar with the Alpha culture and standards. This proved unsuccessful, but the issue has since been resolved and the mistake will never be repeated.

In Australia, the relatively new office is led by a core team with over 30 years of combined experience at Alpha, and it is performing well. Both the Australian and Canadian markets have significant growth potential, with Alpha only scratching the surface of opportunities in these regions at present.

Regulations in this industry vary from one jurisdiction to another, which makes expansion into new territories more challenging than simply hitting ‘copy and paste’. Accordingly, following its recent geographic expansion, for now Alpha has completed the 'land' phase of its 'land and expand' strategy, with no immediate plans for new jurisdictions. Instead, existing offices will focus on volumetric growth.

In future, the success of the Spanish office might lead to expansion into other Spanish-speaking markets, possibly extending to South and Central America. Similarly, the Australian office could pave the way for future expansion into Asia.

Organic vs Inorganic Growth

While Alpha primarily focuses on organic growth, it also explores opportunities to acquire high-quality technology companies, as evidenced by the recent acquisition of Cobase. The company maintains a high hurdle rate for acquisitions – target companies must meet stringent criteria of adding technology, customers and products, together with the opportunity to cross-sell, and most importantly complement the Alpha culture. As such, few companies will qualify and so most of the growth will be organic.

In relation to organic growth, Alpha’s revenue per customer is on the rise, demonstrating the company’s ability to capture greater wallet share and work with larger customers as the business matures. This growth in average revenue per customer, even against a challenging macroeconomic backdrop, is highly encouraging. The table below illustrates the average revenue per customer within Alpha's FXRM division over seven years, with the year of COVID-19 being the only period without growth. This resilience during turbulent times highlights the robustness and durability of Alpha’s earnings.

Not only are average revenues per customer increasing, but the number of customers is also growing, creating a multiplier effect. In FY2023, Alpha’s FXRM division increased its customer base to 1,071 from 1,047 in FY2022, while boosting average revenue per customer from £66k to £71k. This resulted in sales growing from £69 million to £76 million, representing over 10% organic growth. Simultaneously, the ABS division saw an increase in total accounts from 4,200 in FY2022 to 6,467 in FY2023 (+54%).

Human Capital

Recent investments have shifted from back-office infrastructure and platform development to front-office enhancements, aimed at boosting sales capability and refining technology to improve the customer user experience. Historically, front-office employees see significant revenue growth over time, with average revenue per Portfolio Manager rising from £150k in their first year to over £1.5 million by their third year. With many new hires at early stages of this growth curve, there is considerable potential for future revenue increases.

Scalability and Operational Leverage

Alpha’s technology and processes are highly scalable, benefiting from operating leverage. Investments in automation reduce manual processing needs, while cloud-based technologies provide elasticity, enabling Alpha to scale operations as its customer base expands. Additionally, new business divisions offer cross-selling opportunities, increasing revenue without further investment in human capital.

Financing Strategy

To fuel growth, the business has relied on equity financing with regular share placings, while its balance sheet is kept pristine with a net cash position and no long term debt.

At first glance this appears to be odd stewardship, given that debt financing is cheaper and usually preferable to equity financing. However, the rationale becomes clear when one considers that the Alpha execution model is one of acting in a ‘matched-principal’ capacity. Rather than providing a brokerage style execution-only service in return for a fee, it becomes a counterparty to every trade and offsets its market risk - every customer trades is offset with an equal and opposite transaction executed against a banking counterparty. This leaves it with no net market exposure and only counterparty credit risk to manage. Since the business handles large amounts of customer money in this manner, the strength of Alpha’s balance sheet is essential for customer confidence and for banking counterparties extending trading credit limits to Alpha.

It is worthy of note that Alpha was self-funded and debt free from its inception up until its IPO in 2017 and so maintaining a pristine balance sheet is very much in its DNA.

Despite concerns over equity financing and dilution, Alpha has reached an inflection point where it generates sufficient free cash flow to fund growth without additional capital raising. This is supported by the fact that in January 2024, Alpha commenced a £20 million share buyback program and reported that it had been completed in the first half of 2024, prompting the initiation of a second buy back program for another £20 million.

One caveat is that this does not necessarily imply that the share count will reduce, which needs to be factored into modelling assumptions. The current plan is that repurchased shares will be held in treasury, providing an opportunity to use them to offset future dilution from stock based compensation schemes.

Macro Economics and Risk Management

Due to challenging macroeconomic conditions recently (soaring inflation, rapidly rising interest rates, shipping disruption and escalating military conflicts), Alpha opted to reduce its corporate credit exposure, leading to the removal or reduction of hedging facilities for some customers. This prudent approach to risk management, which prioritized the quality of customers over quantity, ensured Alpha experienced no meaningful defaults during a year of record-high corporate insolvency levels.

Alpha’s extensive customer base means there is no significant concentration risk, with customers spread across various continents and engaged in different industries, including financial institutions, manufacturing, retail, wholesale, construction, media, transportation, and tourism. This diversification provides a hedge against cyclicality and geo-political macro economic shocks.

In relation to institutional customers, deal flow last year was well below 2022 as funds faced increased uncertainty about the economic outlook and the impact of higher interest rates and credit spreads. Consequently, fundraising and private equity M&A activity slowed significantly. However, against this backdrop, new institutional customer accounts increased by 54%, positioning Alpha to benefit as market conditions improve.

Changes in interest rate policy and macroeconomic factors affect Alpha's performance. A sudden sharp move in rates sends shock waves through the business world impacting short-term commercial decision making. Ultimately, rate stability is more important than the prevailing rate, as certainty drives commercial activity, so as rates stabilize increasing customer activity will drive Alpha’s core revenue and long-term growth.

Margins and Net Treasury Income

It should be noted that Alpha benefits from a ‘natural interest rate hedge,’ where rising rates, which might temporarily reduce customer activity, simultaneously drive significant Net Treasury Income (NTI) from interest earned on customer balances held for purposes including customer margining. In FY2023, balances held on account increased by 30%, generating over £73 million in NTI. This hedge effect smooths customer activity peaks and troughs. However, NTI is a by-product of the solutions provided by Alpha and because of the inherent variability in interest rates it is both uncontrollable and unpredictable. As such, Alpha splits it out from core revenue on the income statement which makes analysis easier.

To provide perspective, adjusted earnings are used by management to measure the financial performance of the business and are reported to the Executive Committee and Board. This metric excludes NTI, which is not a reflection of the company's operational performance in a given period but rather a product of external circumstances. Adjusted earnings offer a better like-for-like comparison of core performance from one year to the next, see the table below:

However, from an investor's perspective, this complicates valuation. Alpha trades at an earnings multiple of 10.1x against Enterprise Value, which appears cheap. However, using adjusted earnings, this multiple rises to 27.4x, which is harder to justify and implies a meagre earnings yield of 3.6%, well under the risk free rate.

In truth, while adjusted earnings without NTI provide management with a useful performance metric, investors cannot overlook this revenue line item. It is very real and in FY2023 amounted to 2.25x core revenue. This is money being generated from what is essentially a free float which significantly enhances shareholder returns (very Buffettesque). Does that make this stock an interest rate play?

Historically, the business has generated approximately 80% gross margins. In FY2023 that appeared to increase to 86%, but a large element of that was the 100% gross margin NTI. Separating out this element implies that gross margins on core business have dipped to 55%. This is easily explained when we consider that management has spoken about a dip in core business activity due to rate volatility, that it has deliberately moved away from high margin options business in favour of lower margin simple products, and that it has opted to reduce its corporate credit exposure, leading to the removal or reduction of hedging facilities for some customers.

If we assume that rates stabilize close to current levels and that confidence returns in the economy leading to a normalization in commercial activity, the company may be able to grow both its NTI and the revenue on its core business concurrently. If core gross margins return to the 80% level and NTI is 100% gross margin business, then we could be looking at a business pushing a blended gross margin north of 90%.

Dividend Policy

Having already discussed investment in growth, share-buybacks and there being no long-term debt to be repaid, the remaining capital allocation lever available to the business relates to dividend payments.

Alpha has adopted an ill-advised progressive dividend policy, paying around 0.5% in recent years to enhance shareholder returns. Dividends are a highly inefficient means of rewarding shareholders and, in any event, a company should never bind its hands by committing blindly to one form of capital allocation at a time when the future opportunity cost of doing so cannot be known. More particularly, in recent years Alpha has issued new equity to raise much-needed capital while simultaneously distributing capital as dividends – does this make sense to you?

Dividends should ideally be a last-resort method of distributing excess capital that cannot be allocated more effectively elsewhere. Given Alpha's aggressive expansion plans and share repurchase program, there are more accretive uses of capital than paying dividends. For instance, while a dividend is a one-off payment, a reduction of the share count will benefit remaining shareholders in perpetuity.

I shan’t labour the point in this piece of analysis, suffice it to say that I devote several chapters of my book to this topic for anyone interested in digging deeper.

Investment Scenario Analysis

Let us assume that the dividend yield continues at around 0.5%.

Since the company has not expressed any intention to cancel repurchased shares, only to hold them in treasury and retain the option to use them to offset dilution from share based compensation, let us assume that the share count will remain unchanged.

If margins are retained at current levels which is a reasonable assumption and strong growth supports the existing multiples at which the business is capitalized, then shareholder returns will equal the top line growth rate plus the dividend.

Over the past five years, top line growth has averaged close to 38% annually. Is this growth rate sustainable given the increase in the size of the sales team, the acquisition of more customers, the addition of more products with cross selling opportunities, an increasing average spend per customer and the expansion of global offices? Perhaps. Only time will tell.

Eventually the law of large numbers will kick in – a new company with one customer can double sales easily by adding a new customer, but a business with 6,000 customers doesn’t find it quite so easy to double!

The table below assumes that the top line growth rate may slow and provides scenarios for a drop to 25% and 15% growth. The first column shows the total shareholder return over five years against each of these top line assumption if the share count remains the same, net margins are unchanged and the business is still being valued by the market at the same multiple of earnings. Each successive column shows what happens if those variables change.

Testing these assumptions against the recent trading update for the six-month period ending 30th June 2024, top line growth was 16% on the same period last year (including a £1 million contribution from Cobase, without which organic growth would have been 14%.)

This corresponded to a 16% increase in average client balances, which currently stand at over £2 billion. When added to Alpha’s own cash balances, this generated first half NTI of £42 million, up from £34 million last year.

Despite continuing headwinds in the institutional customer segment, total income in this six month period, including NTI, was £107m, up 18.9% on the same period last year, demonstrating the resilience of the business. Once these headwinds abate, it would not be unreasonable to expect earnings growth to accelerate further.

The adjusted net cash position has strengthened further, currently standing at £180 million. A case could be made for such a robust business with durable earnings and a pristine balance deserving to trade at higher multiples than where it trades today.

The strong cash generation and target to repurchase approximately 4% of outstanding stock this year would provide the company with the opportunity to cancel a proportion of those shares, to meet or exceed my assumption in the second column above.

As the new technology generates more high margin income and the sales team become more productive, there is no good reason why net margins shouldn’t edge higher.

It is difficult to see a downside from here. As such, the asymmetric skew on investing in this company appears very favourable indeed.

Conclusion

As a fintech disruptor, Alpha is strategically positioned to capitalize on inefficiencies in traditional banking models, which is reflected in its high customer retention rates and an increasing customer base. The company's growth potential remains significant.

It has a proven track record of accretive capital allocation driving impressive growth and it has demonstrated the ability to deploy incremental capital at highly accretive rates of return.

The most important aspect of any business is the passion and competence of the management team and this founder-led company with strong insider ownership and long-term goals ticks all of the right boxes. This is evident not only in its pristine balance sheet, but also in the excellent internal culture and strong corporate values instilled in the business.

Disclaimer: The author has a long position in Alpha Group International Plc. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

Superb FY24 Results Announcement

Highlights

· Revenue growth of 21% to £63.8m (2023: £52.8m)

· Client numbers increased 16% to 974 (2023: 838)

· Average revenue per client increased by 12%

· Headcount increased to 199 (2023: 171) - 65% are now revenue generating Front Office roles compared to 59% last year

· Underlying profit before tax margin of 49% (2023: 47%) as a result of increasing operational gearing and front office productivity

Full announcement: https://irtools.co.uk/74/story/cff2638d-4fcb-4cda-b0c0-ecda497fd04a

>> Trading Update 25 Jan 2025 <<

Great news - Investment thesis still very much in tact - Strong conviction here.

Key Highlights (unaudited)

- Revenue from underlying activities up 23% to c. £135m (FY 2023: £110m)

- Total Income of c. £221m (2023: £186m), growth of c.18%, including income from interest ("net treasury income") on client and own balances of c. £85m (FY 2023: £76m)

- Institutional 2024 revenues grew by c. 20% to c. £69m (2023: £57m). Alpha's growing product portfolio, strong demand for these products, and the team's cross-selling capabilities were key drivers in this outperformance. At a divisional level, the Institutional FXRM team delivered another strong performance. Revenue increased 17% in the period, with client numbers increasing 33% to 311 (December 2023: 233). Alternative Banking revenues increased by 20%, and account numbers increased to over 7,100 (2023: 6,467) despite the subdued levels of deal activity within the market and the knock-on effect this had on the need for accounts. The Fund Finance team continues to see strong interest in its service and is winning increasingly larger value mandates, which has resulted in revenues increasing by over 130%.

- Throughout 2024 the Corporate division continued to adapt to the more challenging macroeconomic conditions by supporting clients with their FX hedging strategies and decisions while maintaining a disciplined approach to credit risk. Corporate revenues grew by 20% to c. £64m (£53m), with client numbers increasing by 16% to 974 (2023: 838).

- Underlying profit before tax and profit margin in line with expectations following continued investment across the Group

- Strong cash and liquidity position with adjusted net cash increasing by nearly £40m to c. £217m (FY 2023: £179m) after £30m of share buybacks

- Inclusion in the FTSE 250 in June, following a successful listing on the Premium Segment of the Main Market in May 2024

- Momentum continues to build in Cobase, acquired in December 2023. Cobase operates a SaaS-based subscription fee model, and on a proforma basis, client numbers and revenues increased by 59% and 70% respectively in the year to 214 and €3m (2023: €2m). This growth in its first full year of ownership validates the acquisition rationale and supports confidence in Cobase's ability to make an increasingly meaningful contribution over time as it continues to integrate with the wider group.

- Average client balances grew to £2.3bn in Q4 (Q4 2023: £2.1bn). This increase is linked to the growth in account numbers. Interest rates received on these balances averaged 3.5% for the quarter. On an annualised basis, client balances averaged £2.1bn (2023: £1.9bn) with an average interest rate of 3.8% (2023: 3.6%), contributing to c. £85m in net treasury income in 2024 (2023: £76m). Included within this £85m figure is also circa £1m of net interest income generated on client margins ('NTI - own').

- Board transition completed as planned, with Clive Kahn assuming role of CEO on 1 January 2025. Clive Kahn, CEO, commented: "I am pleased to start my tenure as CEO by confirming strong growth and an impressive result, particularly given the challenging macro-economic backdrop. The fact that Alpha has produced such levels of growth in challenging economic times is the greatest accolade to the strength of our model and team, particularly with the strong cash generation aided by the continuing high-interest rate environment. The Group's focus will be to build on the strong foundations already established, by maintaining investment in innovation to scale the business even further, whilst continuing to deliver high returns for shareholders."