Yellow Cake | Would You Like A Slice?

A Tangential Way To Ride The AI Revolution With An Environmental Tailwind

Yellow Cake Plc (London: YCA)

URL: https://www.yellowcakeplc.com

Share price: GBP £5.55

Market Cap: GBP £1.15 billion

Enterprise Value: GBP £1.2 billion

Net Asset Value: GBP £1.74 billion (based on current Uranium prices)

Net cash GBP £133 million (no long term debt)

Favourable positive net working capital position

Disclaimer & Disclosure: The author has no position in Yellow Cake at present, but this may change in due course. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

This investment analysis is very different from most that I publish, but for investors looking for an interesting means of diversification with a strong tailwind to drive returns, this should tick all of the right boxes.

Important Background Context

First allow me to provide you with some context. In the past few years, Artificial Intelligence has exploded into our lives. Computers are now able to do things which were previously considered science fiction. But this technological advance comes at a price - it depends on groundbreaking semi-conductor technology that generates the compute power to enable the miracle of AI to happen, and those semi-conductors need to be fed lots of electricity. On average, a ChatGPT query requires nearly 10 times as much electricity to process as a Google search.

Why is this relevant? Well cloud data centers house the semi-conductors that are powering the AI revolution, so that is where the power is being consumed. As AI continues to develop and is applied to a broader range of applications, so the power consumption will increase further. Goldman Sachs Research predicts that data center power demand will increase by 160% before 2030.

The challenge is clear: How will companies running these data centers secure enough energy to keep their AI infrastructure running? More particularly, other technological advances are concurrently driving high demand for power, including the rise of electric vehicles, crypto currency mining activity and all of the other devices that we use in our everyday lives, so how can data centers ensure their energy needs are met in the face of so many competing demands?

News recently broke that Microsoft has entered into a 20-year agreement to purchase the entire electric generating capacity of Unit 1 of the reactivated Three Mile Island nuclear generating station in Pennsylvania.

This was a nuclear facility that began operation in 1974 and continued to operate until September 20, 2019, when it was permanently shut down due to economic factors - principally not being able to compete with cheaper natural gas. It should be noted that its sister generator, Unit 2, suffered a partial meltdown in 1979 in what became the most significant accident in U.S. commercial nuclear power plant history, so nuclear power comes with significant risks.

Nuclear answered all of Microsoft’s needs, particularly since nuclear power provides a stable, round-the-clock energy source, which is crucial for data center operations that require constant power. It is also carbon-free and so aligns with the company’s pledge to become carbon-negative by 2030.

Experts have warned that data centers could become a big strain on the U.S. power grid. The projected growth for North America has nearly doubled from previous forecasts and so the Microsoft move into nuclear may be the first of many similar strategic moves.

Owners of other nuclear power plants are reportedly in talks with operators of other data centers - the availability of new technology-agnostic tax credits in the Inflation Reduction Act has made nuclear power more economically viable for these partnerships.

Another example is Amazon, which recently purchased a data center site right next to the Susquehanna nuclear power plant, also in Pennsylvania. It recently announced three new agreements to support the development of nuclear energy projects, including the construction of several new Small Modular Reactors (SMRs).

Oracle’s plan to power a gigawatt-scale data centre with three SMRs further illustrates the trend towards leveraging nuclear energy.

Then there’s the rest of the world to consider. Goldman Sachs estimates that Europe, which has suffered an energy crisis triggered by the war in Ukraine, needs $1 trillion-plus to prepare its power grid for AI. It says that around 15% of the world’s data centers are located in Europe and that by 2030, the power needs of these data centers will match the current total consumption of Portugal, Greece, and the Netherlands combined.

We haven’t considered Asia, Australasia, the Middle East, Africa or South America yet, but you get the idea so I shan’t labour the point. Suffice it to say that following the move away from nuclear power due to the Fukushima accident back in 2011, the tide has turned and, out of necessity, nuclear power is back in fashion.

What is Yellow Cake?

Uranium oxide concentrate (U3O8), also known as "yellowcake," plays a crucial role in the early stages of the nuclear fuel cycle for nuclear power plants. It is the most traded form of uranium and is typically produced from uranium mines and mills.

So now you understand why the company at the focus of this analysis has such a peculiar name. The British company, Yellow Cake Plc, chose its name to directly reflect the company's core business of purchasing and holding physical uranium.

Yellowcake is a stable, yellow powder that contains about 80% uranium. Its stability makes it easy to store and to transport. It is the starting material for further processing to create nuclear fuel - a process known as uranium enrichment. [For the chemists reading this, enrichment increases the concentration of the fissile U-235 isotope creating uranium hexafluoride (UF6) gas. A minority of nuclear power plants can use fuel made directly from U3O8 without enrichment. In these cases, the U3O8 is converted directly to uranium dioxide (UO2) for fuel fabrication.]

Uranium is calculated as follows:

It is important to understand that unlike most commodities, uranium is not traded on the open market - there is no traditional spot or forward market. Instead it is a market made up of a few key players trading bilaterally, with a couple of respected industry media outlets conducting a poll of participants to establish the prevailing spot price.

Yellow Cake Plc the Company

Yellow Cake Plc presents a compelling investment opportunity in the uranium sector, particularly as nuclear power experiences a resurgence driven by the energy demands of data centers powering the AI revolution. The company's unique business model of purchasing and holding physical uranium positions it well to benefit from anticipated price increases in the commodity.

Management includes Andre Liebenberg (CEO), Carole Whittall (CFO) and five non-executive directors. Liebenberg and Whittall both hold over 100,000 shares each giving them skin in the game with a market value of approximately $1 million. Even the non-executive directors each have tens of thousands of shares which is encouraging to see.

Liebenberg is an experienced mining industry professional and has extensive investor marketing, finance, business development and leadership experience. He has over 25 years' experience in the resources industry including private equity, investment banking. He worked in finance for UBS in London and the Standard Bank Group in Johannesburg before moving into industry with roles at BHP Billiton and QKR Corporation. He holds a Bachelor of Science (B.Sc) Elec. Eng. from the University of Cape Town and a Master in Business Administration (MBA) from the University of Cape Town.

Whittall started out in finance with JP Morgan and Standard Corporate and Merchant Bank, working in corporate finance. She then moved to Rio Tinto where she held various senior commercial and business development roles before moving on to become Head of M&A at ArcelorMittal Mining and a member of its Mining Executive Team. She holds a Bachelor of Science (B.Sc) (Hons) Geology from the University of Cape Town and a Master in Business Administration (MBA) from the London Business School.

Yellow Cake may be distinguished from most other public companies because it has a unique business model. It operates as a specialist company focused solely on holding physical uranium for the long term. This provides investors with direct exposure to the uranium market without the operational risks associated with mining companies. Said differently, this is a special purpose vehicle (SPV) which enables investors to gain direct exposure to this sought after, rare commodity.

Unlike many companies in the sector that deal with uranium indirectly, Yellow Cake directly owns and stores physical uranium oxide concentrate. As of the latest information, the company holds 21.68 million pounds of U3O8 stored in Canada with a company called Cameco and in France with a company called Orano. It is important that the inventory is stored in a safe jurisdiction. There is a storage cost, which has risen in recent years, and this, together with opportunity cost of having capital tied up in uranium, represents the cost of carry.

It has a low-cost structure as the result of its unique business model that provides cost-effective access to uranium supply, expertise, and storage facilities, at remarkably low operating costs. It operates with minimal overhead, employing only two remote workers (the CEO and CFO), and targets annual operating costs being capped at 1% of NAV.

The company currently has sufficient cash to cover expenses for the next few years. But one may naturally wonder how it will fund operations once cash reserves are depleted. As an SPV for holding uranium inventory, the company does not generate cash flow so it is unable to service debt, ruling that out as an option. The choices remaining are either to raise equity capital or sell a portion of the uranium inventory. Which route the company takes will be determined based on an assessment of whether the market capitalization is above or below its NAV.

If trading at a premium, issuing new equity would crystallize that premium to benefit existing shareholders. This has occurred in the past, for instance in 2021 when the company traded at a 20% premium to NAV.

However, if trading below NAV, as is the case today, selling inventory would be more sensible, with part of the proceeds potentially used to repurchase undervalued shares. The company took a similar approach post-COVID-19 in 2020. Not only was there a squeeze on uranium supply in the market, but the stock market switched to a ‘risk-off’ mindset causing a sell off in equities resulting in Yellow Cake trading at an enormous 30% discount to its net asset value. Management seized this opportunity by liquidating part of its uranium inventory to repurchase shares at a steep discount, a move that significantly boosted shareholder returns.

Yellow Cake's strategic partnership with Kazatomprom (London: KAP), the world's largest uranium producer, provides a significant advantage. The company has an option, providing it with the right but not the obligation to acquire up to $100 million worth of uranium annually until 2027 at the spot market price, enabling the company to capitalize on positive pricing trends. Liquidity in the uranium market is often tight and so this is a volumetric option rather than a price based option. It mitigates supply risk and offers a level of operational scale and liquidity that is difficult for competitors to replicate.

Yellow Cake paid nothing for this ten year option because when it was agreed Kazatomprom had an oversupply of eight million pounds of uranium, since demand was weak at that time. It was happy to have found a large scale buyer. Given the market dynamics at that time, instead of agreeing the option, Yellow Cake may have been able to drive a hard bargain and to acquire the surplus uranium at a discount to the prevailing market prices for smaller quantities, but management understood the value of nurturing this relationship for the long term. Perhaps this was the price that it paid for the option.

In relation to this option, Yellow Cake bears no credit risk because it is not required to pay for the uranium until it has been delivered.

Below is a short video of CEO Liebenberg explaining the option:

Given its low cost structure and access to large volumes of uranium, the company offers investors exposure to uranium price increases without the operational risks and costs associated with mining companies. The stock price is very well correlated to the price of the underlying commodity.

This combination of factors makes Yellow Cake a unique investment vehicle in the public markets, offering a specialized way to invest in the uranium sector. This approach is particularly attractive given the current tight supply in the uranium market and the growing demand for nuclear power as a clean energy source.

Since its IPO in 2018, Yellow Cake has seen impressive growth. In it first five years its net asset value increased tenfold from the initial $200 million raised to $2.2 billion, positioning it as one of the best-performing metals and mining stocks on the London Stock Exchange over that period.

This growth demonstrates Yellow Cake's ability to leverage market dynamics effectively. The recent surge in uranium spot prices, which have risen from $21 per pound at the company's inception to over $82 per pound and if nuclear power is returning in earnest, this could the beginning of a long-term upward trend.

It is important to understand that the economic viability of nuclear power remains relatively stable even with significant increases in uranium prices. This is due to the unique cost structure of nuclear energy production, where fuel costs represent a small portion of the overall electricity generation cost. As such, even a substantial increase in uranium costs has a limited impact on the final electricity price.

Nuclear infrastructure, is a baseload power source that cannot be switched on and off, meaning that it cannot be idled due to changing input prices. Katusa Research suggests that the demand for uranium is nearly inelastic. Utility companies must purchase uranium for their reactors regardless of price fluctuations.

In this respect nuclear power can be distinguished from electricity generation using fuel sources like natural gas or coal, meaning that cyclicality is removed.

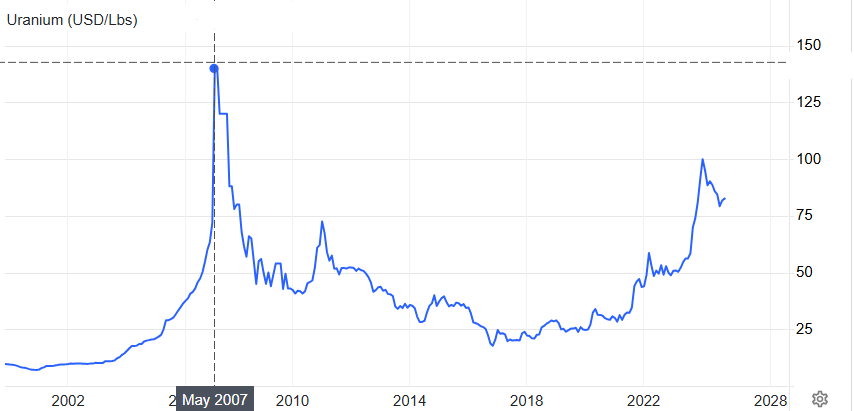

This is supported by empirical evidence:

The uranium price spike in 2007 was driven by a perfect storm of supply constraints and rising demand. Stockpiles from the 1980s were running low, while natural disasters disrupted production at major mines in Canada and Australia, causing supply to fall short of consumption. At the same time, global interest in nuclear energy was increasing, with many reactors planned or under construction. Speculative investments from hedge funds and other financial players further fueled the dramatic surge in uranium prices. Despite reaching highs of around $137 per pound, nuclear power plants remained economically viable.

This history suggests that uranium prices still have significant upside potential from current levels of $82 per pound. According to Trading Economics’ global macro models and expert consultations, uranium is expected to reach $84.15 per pound by the end of this quarter and $91.80 within 12 months.

As of 18th October 2024, at a price of $83.25 per pound, Yellow Cake’s estimated NAV was GBP £1.4 billion (£6.46 per share), relative to a market cap of GBP £1.3 billion (£6.06 per share today) - a price to book of 0.938x.

Although the market price was $83.25, exposure to uranium through layer cake could be achieved at an implied price of around $78.09, offering a potential upside of 6.6% to fair value. If Trading Economics' forecast is accurate and the supply squeeze drives uranium prices to $91.80 within a year, this would result in a 17.6% return for investors, assuming Yellow Cake trades at parity to book value by then. Over the next few years, prices could spike further, similar to the surge seen in 2007, presenting an attractive asymmetric opportunity with minimal downside risk. Could uranium prices potentially double from here? It's certainly possible.

Dynamics of Uranium as a Commodity

The uranium market is complex, illiquid and opaque. State-controlled producers account for up to 68% of global production and this means that it is in the control of technocrats rather than commercially minded people. This often leads to poor decision making. To make matters worse, there is a concentration issue with the top 10 mines producing 55% of all Uranium, so mismanagement in one or more of these will have a significant impact on global supply. This can make the market vulnerable to stock overhangs and squeezes

Politics must also be considered, particularly when one considers that the majority of the world’s nuclear reactors are situated in only five countries, and these are mostly different countries to those with the uranium reserves.

In the past Ukraine has always relied on imports of uranium from countries like Russia and Kazakhstan to fuel its nuclear power plants, but the war with Russia has disrupted its supplies. As a result it has been sourcing uranium from as far away as Canada.

Adding to the complexity of estimating supply and demand dynamics, for reasons of national security, utility companies hold unknown or unknowable uranium reserves which makes modelling very difficult. Compounding this challenge, entities like the Sprott Physical Uranium Trust Fund (SRUUF) continue to accumulate significant quantities of uranium and this also creates a supply squeeze.

Much has to be implied by the prevailing market price of uranium - the price spike in recent years strongly suggests that demand is outpacing supply. Indeed, primary mine supply of 140 million pounds falls well short of annual demand over 180 million pounds. Demand is anticipated to increase to 211 million pounds by 2028 and 227 million pounds by 2033. Supply will struggle to grow this quickly.

On the supply side there have been production cuts in major uranium-producing countries like Kazakhstan. Yellow Cake’s partner, Kazatomprom had initially intended to ramp up its 2025 production, but subsequently announced that CY2025 production would fall well short of previous guidance, as sulfuric acid availability and construction schedules lagged. Total Kazakh uranium production for CY2025 has been reset at 65.0-68.9 Mlbs. compared to the previous guidance of 79.3-81.9 Mlbs. At the same time, sanctions and export restrictions on Russia, which controls 5% of global uranium production, has a significant impact on supply volumes. Then there has been political instability in Niger, the world's 7th largest uranium producer. In combination, it has been a perfect storm and exacerbates an already tight global uranium market.

On the demand side, as discussed, the AI revolution and cloud data centers are resulting in a step change in power consumption. With a focus on generating clean power, nuclear energy has come back into fashion and geopolitical tensions have increased the need for onshore energy security. None of these themes looks likely to change in the short term and look like being key drivers into the future. In fact, the growing focus on decarbonization and energy security is likely to drive increased adoption of nuclear power globally. Additionally, the increasing use of Small Modular Reactors will create a new source of demand.

As western countries attempt to reduce dependence on Russian uranium and related services, utilities are expected to increase term contracting for uranium as they adjust to higher prices and seek to secure future supplies. The chart below demonstrates how European utilities have secured their uranium supplies until the middle of this decade while new contracts are already needed for US utilities.

As demand continues to outstrip supply, to incentivize new production, higher prices will become necessary. Mineral extraction taxes are rising and the cost of sulfuric acid, used in the extraction process, has also increased due to prevailing inflation. Import tariffs are also being added by the US to Chinese uranium. This will all be passed through to the consumer and so end-user uranium prices seem to be trending higher.

Since Yellow Cake has large inventories of uranium in storage and a fixed price offtake agreement until 2027, it becomes a beneficiary of these higher market prices.

Alternatives For Uranium Exposure

If this research has piqued your interest in adding uranium exposure to your portfolio, Yellow Cake Plc is not the only game in town. There are several other options to consider:

1. Uranium mining companies: Firms like Cameco Corporation (CCJ) and Kazatomprom (London: KAP) offer direct exposure to uranium production. These companies may provide higher potential returns but also come with increased operational risks and sensitivity to production costs.

2. Uranium ETFs: Funds such as the Global X Uranium ETF (URA) or the Sprott Uranium Miners ETF (URNM) offer diversified exposure to the uranium sector, including miners and other related companies. These provide broader market exposure but may not offer the same level of pure-play uranium price leverage and focused exposure as Yellow Cake.

[Both the larger mining companies and ETFs offer greater market liquidity when compared to Yellow Cake which provides a more specialized investment vehicle.]

3. Uranium royalty companies: Uranium Royalty Corp (URC) focuses on acquiring royalties and streams in uranium projects. This approach offers exposure to uranium prices with potentially lower operational risk than miners, but may not provide the same direct commodity exposure as Yellow Cake.

4. Other physical uranium holding companies: Yellow Cake and physical holding trusts, such as Sprott Physical Uranium Trust (U.UN), offer the most direct exposure. Comparing the two, Yellow Cake enjoys a competitive advantage through its strategic partnership with Kazatomprom. This provides a unique edge in securing supply at favorable prices, but that advantage expires in 2027.

Conclusion

At the end of my interview CEO Andre Liebenberg, I was left with one lingering question in my mind: when, if ever, will Yellow Cake sell its uranium inventory? When I put this to Liebenberg, he highlighted a key point: Yellow Cake should be seen more like an ETF - a proxy for uranium trading. The company's value is directly tied to its uranium holdings, leaving it up to shareholders to judge the commodity's direction and to buy or sell shares accordingly, as though they held the uranium themselves. He pointed out that liquidating inventory would essentially mean betting against the company's shareholders, illustrating his reasoning with a simple example: if someone invests in Yellow Cake in the morning anticipating a rise in uranium prices, and the company sells inventory that same afternoon to profit from a potential price peak, that would create an uncomfortable situation. This naturally led me to ask about the long-term vision for the business and the ultimate end-game. Liebenberg’s answer was telling. He believes that as uranium supply tightens and market demand intensifies, nuclear power generating operators will likely seek substantial uranium sources that may only be accessible through the secondary market. Given its large inventory of uranium, that would make Yellow Cake a key acquisition target, commanding a premium price as buyers look to secure its large, valuable inventory.

Yellow Cake Plc offers a distinctive and potentially lucrative way to invest in the uranium market, particularly suited for those bullish on uranium prices and nuclear power's role in meeting growing energy demands. While alternatives exist, Yellow Cake's focused approach and strategic partnerships make it an attractive option for investors seeking an almost pure-play exposure to uranium.