Google: Great Value or a Value Trap?

When You've Reached The Top, It Isn't Always Clear What Comes Next

DISCLAIMER & DISCLOSURE: The author holds no position in Alphabet at the date of publication but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Invested in Alphabet (Google)?

For over two decades, Google (owned by Alphabet, Nasdaq: GOOG and GOOGL) has been the undisputed gatekeeper of the world’s information - a leader in its field. Its search engine has been so dominant that “Google” ultimately became a verb in many languages. But in 2025, the very moat that once made Google invincible is being tested like never before, so how should investors react?

Disruption in the Market

The meteoric rise of generative AI, led by OpenAI’s ChatGPT introduced overnight disruption, reshaping how people access information. Google’s once-impregnable moat is looking shallower and investors are no longer convinced that Google’s dominance is unassailable.

Since launching in late 2022, ChatGPT has exploded in popularity, racking up an astonishing 400 million weekly active users. That’s a threefold increase in just 18 months - a clear sign that the way people interact with the internet is undergoing a massive transformation.

But ChatGPT isn’t alone. Perplexity AI has quickly become a major player, handling over 100 million queries a week and attracting about 15 million monthly users. Anthropic’s Claude, Meta’s Llama, and a growing list of others are also making their mark. Over in China, DeepSeek has emerged as a heavyweight, pulling in 47 million daily active users.

Even Elon Musk has joined the race. He was involved as an early stage investor in OpenAI, but became increasingly frustrated by what he saw as OpenAI drifting from its original open-source, altruistic roots, especially after its partnership with Microsoft. In response he launched his own xAI and its flagship chatbot, Grok. Since debuting at the end of 2023, Grok has already reached 35.1 million monthly active users and racked up an eye-popping 141.9 million website visits in March 2025 alone.

Alphabet has its own AI contender, Gemini, which is pretty powerful and definitely capable of going toe-to-toe with the likes of ChatGPT, Claude, and Perplexity. The thing is, no single AI tool - Gemini included - is likely to dominate the way Google Search once did. There’s just too much strong competition out there now, and that changes everything.

If setting up an AI large language model (LLM) is so easy - and judging by the number of LLMs, barriers to entry are not particularly high - is it likely to become a commoditized service that may struggle to monetize in the way that Google search did for so many years in the past?

Evidence suggests that Gen Z is even shifting toward social platforms like TikTok and Instagram for search, further fragmenting the market.

None of these platforms are niche - they’re now mainstream, and they’re eating into the time and attention once reserved almost exclusively for Google Search.

So where does that leave Alphabet and Google?

Cracks in the Moat: Is Google Losing Its Edge?

Over the past quarter, Alphabet, the holding company that owns Google, has lost one-quarter of its market value. For a company that was valued at well over $2 trillion, that means that its lost around $600 billion of value in just three months.

To put that in perspective, Google was founded in 1998, went public in 2004 and it took until 2017 for it to be valued at $600 billion. So, the value that took 20 years to create was wiped out in just three months.

So is this a buying opportunity? Or was Google vastly over valued prior to its recent draw-down, and is it now simply a value trap?

The numbers tell a story of mounting pressure. Google’s own paid clicks are now growing at their slowest pace on record.

But it’s not all doom and gloom. Although growing at their slowest pace, paid clicks are still increasing. In the most recent quarter, Search revenue grew 9% year-over-year, buoyed by a 2% rise in paid clicks and a 7% increase in revenue per click.

However, if the trend continues and the growth rate in paid clicks turns negative, then the financial health of this segment of the Alphabet business will deteriorate significantly. Based on the chart above, how far away is that from happening?

Interestingly, in the transcripts to the recent U.S. v. Google antitrust law suit, Apple’s Senior VP of Services, Eddy Cue, testified that Safari’s search volume (powered by Google) declined in April for the first time in 22 years, attributing the drop to the rise of AI-powered alternatives. The market reacted instantly, sending Google’s stock tumbling over 9% in a single day.

Search Still Rules the Roost… But for How Much Longer?

Let’s be clear, ‘Search’ is still Google’s crown jewel. It brings in more than half of Alphabet’s total revenue, and for now, it's still the company’s biggest cash cow. But the winds are shifting.

As previously discussed, Google has its own AI chat bot in the form of Gemini, but it’s not the same. It’s a lot more expensive to serve up an AI-generated response than a simple web search, and those clever AI summaries don’t leave much room for Google to do what it’s always done best - monetize eyeballs clicking on links. The whole business model that turned Google into a tech giant doesn't translate neatly to the AI world.

Personally, I used to lean on Google Search all the time. It was my go-to for everything: news, recipes, trivia, work research. But these days? Not so much. Now imagine that same trend playing out across hundreds of millions - or even billions - of people. That’s the kind of existential threat Google is facing.

Why do I use Google search less these days? I want fast, accurate, unbiased information, and I don’t want it filtered through an auction system where the highest bidder wins my attention. I was never the customer in that model, I was the commodity. Sure, we all went along with it because, for a while, the value we got in return made it worth it. But times have changed, and frankly, there’s a better deal on the table now.

Traditional search feels clunky in comparison. You get a page full of blue links, then it’s up to you to click around, read, compare, and try to piece everything together. It takes time. With AI, it’s totally different: I just ask the question and get the answer. No digging, no detours. It’s like the difference between pedaling a bike uphill and being driven straight to your destination. Both get you there, but one leaves you sweating and the other gives you a smooth, effortless ride.

That said, Alphabet is far from a one-trick pony. It has a stable of other services (see the graphic below) but very few of them are capable of being monetized in the way that search did. Consider G-Mail, one of the most popular email services, which delivers an enormous amount of utility to its users, yet little or none of that value has been captured by Alphabet.

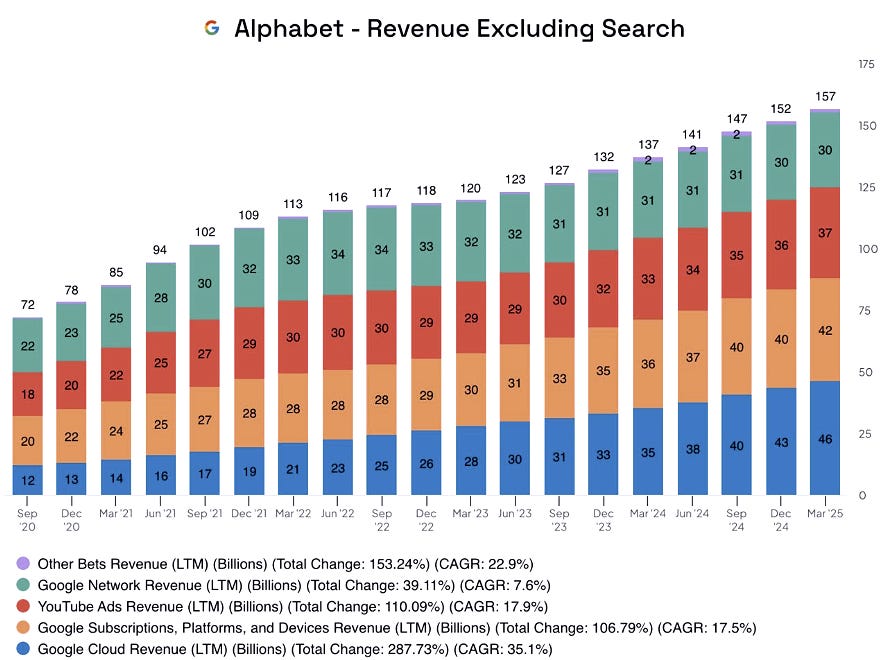

That having been said, there are parts of the Alphabet empire that are producing attractive cash flows. The company’s other segments - YouTube, Cloud, Subscriptions, and more - are all thriving. Together, they’re now pulling in $157 billion a year, more than double what they earned just four and a half years ago. So yes, the world is changing fast, but Google still has plenty of cards left to play.

Cloud, which is essentially IT infrastructure as a service (IaaS), has seen revenue grow rapidly, with operating income recently turning positive. This suggests that after years of heavy investment this part of the business will increasingly be contributing to profitability.

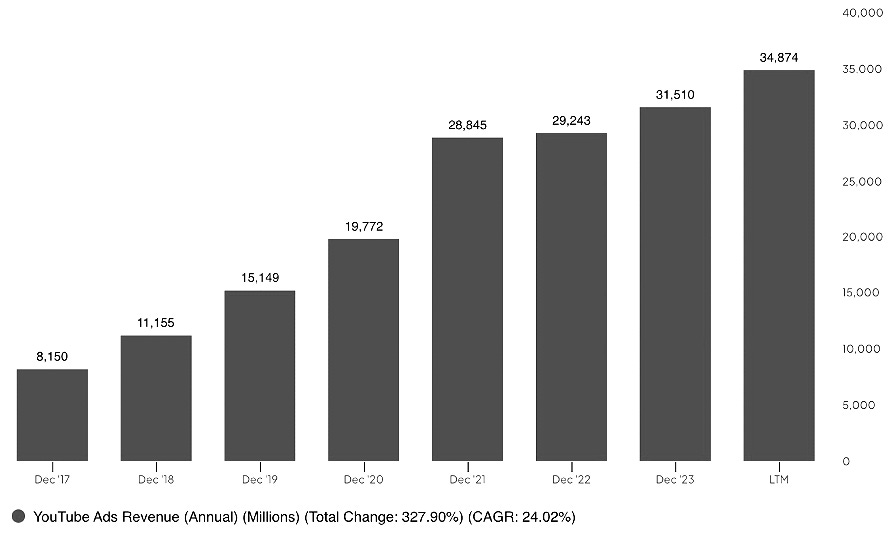

YouTube, with 2.7 billion active monthly users, has seen its advertising revenue soar. It climbed from just over $8 billion in 2017 to over $35 billion today (see below) - a 24% CAGR. On the basis that Alphabet acquired YouTube back in 2006 for a mere $1.6 billion, that deal looks like the bargain of the century.

Then there are Alphabet's "Other Bets" that operate separately from its core Google operations. In the grand scheme of things, these are still largely insignificant in terms of revenue contributions (purple slither at the top of the bars on the chart below). This segment includes a diverse array of ventures such as Calico (focused on longevity research), CapitalG and GV (venture capital investment arms), GFiber (formerly Google Fiber, providing high-speed internet services), Verily (life sciences and healthcare), Waymo (autonomous vehicles), Wing (drone delivery), and X (the "moonshot" factory for experimental projects). These reflect Alphabet's strategy of investing in innovative and potentially transformative technologies outside its core search and advertising business in the hope that one or more will become a future engine for growth.

While this diversification provides Alphabet with a cushion, if Search falters, the impact on overall revenue growth and earnings could still be significant.

Valuations: Beware of Optical Illusions

Here’s where things get interesting for investors. Alphabet’s price-to-earnings (P/E) ratio has dropped to 17x, its lowest in over a decade. At this valuation, expectations are muted; shareholders don’t need everything to go perfectly to see a reasonable return. If Search growth slows or even plateaus, robust double-digit expansion in other segments could still deliver solid results.

But earnings numbers are not always as reliable as they first seem.

Back in 2015, the company took a stake in SpaceX. Fast forward to the first quarter of 2025, and SpaceX’s valuation got a boost. Why? A share buyback led analysts to conclude that the buyback price reflected the value of the entire company - a pretty shaky assumption. The result? An $8 billion unrealized gain appeared on Alphabet’s books thanks to this upward revaluation of its SpaceX stake. That single adjustment inflated Alphabet’s net income by 46% and helped earnings per share hit $2.81, comfortably beating Wall Street estimates.

But here’s the thing: Alphabet didn’t actually sell any shares. No money changed hands. No new revenue flowed into the business. This wasn’t a windfall - it was a paper gain, the result of mark-to-market accounting. On paper, it looked like a blockbuster quarter. In reality, it was more of an accounting illusion than a business triumph.

Strip out that SpaceX boost, and Alphabet’s earnings picture changes significantly. Suddenly, that seemingly reasonable price-to-earnings ratio of 17x? Not so reasonable after all. Normalizing earnings, its P/E is actually closer to 25x.

Is Alphabet (Google) A Good Investment?

At the Berkshire Hathaway annual meeting last weekend, something Bill Ackman said really stuck with me. When he's trying to judge the strength of a company and its moat, he asks a simple but powerful question: what would happen if this company suddenly stopped operating? Think about TSMC or Microsoft - if either disappeared overnight, the ripple effects would be enormous. There is either no viable alternative or else the switching costs are incredibly high. Five years ago, I’d have said the same about Alphabet and Google. But today? I’m not so sure. What does it offer that you can’t easily find elsewhere?

In his book ‘7 Powers’, Hamilton Helmer describes "counter positioning" as a strength of disruptors. But I think that framing misses the point. To me, it's less a power for the newcomer and more a death knell to the incumbent.

Counter positioning happens when a challenger shows up with a radically different business model that the established player can’t adopt without wrecking its own cash machine of a business. It’s the corporate equivalent of a ‘check-mate’ move in a game of chess. The incumbent sees the move, knows the threat, but can’t respond - game over. That’s how the disruptor takes the crown, while the industry leader is left powerless to stop it.

In this context, I can't help but wonder if Alphabet hasn’t slipped into the same trap that doomed Blockbuster. Remember how Blockbuster dominated movie rentals? It saw streaming on the horizon but chose not to go all in. Why? Because it was raking in over $500 million a year from late fees. Streaming would’ve killed that revenue stream overnight. So it didn’t push into streaming, then along came Netflix wiped it out.

Google wasn’t blindsided by AI - it had the talent, the resources, and a decade long head start over most others. Yet, it was OpenAI, a relative newcomer, that beat them to the punch with a game-changing launch. So you have to ask: was Alphabet too afraid to disrupt its own golden goose? If so, what can we read into that? Why was it so afraid of ushering in the era of AI? Has its fear now become a reality? Was this a pivotal moment for Google?

Even the greatest companies - those that once looked untouchable - eventually get worn down by the forces of change. Look at IBM, Intel, and Kodak. These were giants, industry leaders with seemingly unbreakable moats. Yet over time, all were left behind in the evolutionary cycle of a company’s life. Today, they’re just shadows of what they used to be. Could Alphabet be the next name to add to this list?

Whether or not Alphabet is a good investment at these levels very much depends upon your outlook. If you believe Google can adapt, leveraging its many initiatives, diversifying revenue streams, and maintaining relevance in a rapidly evolving landscape, then today’s valuation could be a rare buying opportunity.

But if you think the shift toward conversational AI and alternative search platforms marks a permanent erosion of Google’s dominance, the stock’s relative “cheapness” might be justified.

One thing’s clear: the days of Google’s unchallenged supremacy are over. The next chapter will be defined by how well it can innovate, compete, and defend its core business in the age of AI.

What do you think? Is Alphabet a buy at these levels?

Great thoughts here… I’ve been back and forth on Google for quite some time… it’s nice reading that someone else is having a very similar struggle… right now I’m of the mindset of Google will find a way, but definitely see all the paths towards irrelevance, too (at least from a Growth stock perspective 🤷♂️). Subscribed!

Brilliant analysis, thank you James!

And the answer is...?

<:)