Company: Howdens Joinery

Ticker: (London: HWDN)

Market Cap: £3.5 billion GBP (share price 650 pence)

URL: https://www.howdenjoinerygroupplc.com

Strategy: Buy and hold

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

The UK-based building supplier, Howdens Joinery (LON: HWDN), is a hidden gem in the building supply industry with a unique business model that sets it apart from traditional retailers.

Founded in 1995 by Matthew Ingle, the business has established itself as a market leader which is growing impressively. It offers a business model tailored exclusively to serve tradespeople, which has proven to be a winning strategy.

This article delves into the key aspects that make Howdens Joinery a successful business, its competitive advantages, and its profile as an investment opportunity.

A Different Perspective

Most people analyze businesses by looking merely at the numbers, but this misses the most important factor in any enterprise. If you want to understand the business, study its founder and its management.

A perfect example is Apple. It floundered under Sculley’s leadership in the mid-1990s. Steve Jobs rescued the company from the jaws of insolvency and the rest, as they say, is history. It went on to become one of the most successful and powerful businesses of all time. Same business, different people.

This is why I always study the people behind the enterprise.

Matthew Ingle founded Howdens in Yorkshire in 1995. It had 14 depots and achieved first year sales of a mere £1m. Today its sales are close to £2.5 billion, that’s 2,500x growth in three decades.

The story is quite remarkable.

Matthew's life was a blend of privilege and adversity. His father's family thrived in the tannery business, while his mother's family pioneered mass production joinery and established Magnet, a British kitchen retailer. Despite this privilege, Matthew faced significant disadvantages.

Unbeknownst to him at the time, Matthew grappled with dyslexia and dyspraxia, conditions that were left undiagnosed as he departed school in 1971 at the tender age of sixteen, carrying a sense of failure.

Matthew's headteacher, recognizing his struggles, often encouraged him to skip lessons in favor of walking the headmaster's dogs. It was only later that Ingle discovered the creative and problem-solving gifts often associated with people on the autistic spectrum.

Despite lacking awareness of his potential, Ingle possessed charm, a keen sense of humor, and a knack for figures. When his peers pursued higher education, he began his career at a timber yard, humorously labeling himself as "bottom of the wood pile." In this role, he gained invaluable knowledge in joinery and customer relations, courtesy of the yard's manager.

He moved on to participate in Magnet's management training program and climbing the corporate ladder, but economic woes at the time resulted in the company scaling back, and he was made redundant in 1994.

These setbacks, together with the industry knowledge that he had acquired, ultimately fueled the birth of Howdens Joinery.

Ingle pitched his kitchen sales concept to a large furniture retailer in the UK called MFI. The idea revolved around moving from being a retailer to becoming an effective wholesaler. Needless to say, MFI backed him and he started his journey as a subsidiary of the MFI group.

“Selling kitchens trade-only to builders was a new concept in 1994 and I must thank Derek Hunt from MFI for having faith in us and for backing the idea. When Howdens first started trading a year later, with just 40 people and five kitchen ranges, I could not imagine the journey we would undertake”, Matthew Ingle

MFI subsequently ran into difficulty and Ingle became CEO in 2005 amid a reorganization, but it was soon evident that Ingle’s kitchen subsidiary was the only viable part of the business. MFI eventually collapsed, but Howden’s Joinery was spun off as a stand alone business. Since then it has gone from strength to strength.

As testament to the integrity of the man himself, despite MFI going down, Howdens took on all the pension liabilities and financial debt of the legacy MFI operations.

Ingle stepped down in 2018, but his was a company built around a particular type of culture and he wouldn’t retire until he had found the correct successor. Someone who shared his values and thought in the same way that he did. The search took four years and Andrew Livingston, then CEO of Screwfix Direct, a division of Kingfisher plc, was the man for the job.

“Andrew was at Screwfix and at B&Q before coming to Howdens. It may have taken us some time to find him, but it was worth it. You need exactly the right person; someone who is capable; someone who has a proven track record; and someone who really wants to do the job. Like me all those years ago, I believe Andrew is the right man in the right place at the right time.”

The Commercial Approach

Ingle’s approach to business is at the heart of what makes this company such an interesting investment opportunity. I only scratch the surface in this article, but he has written a book documenting it in detail:

“Do something that you’re good at, that makes money, that gives the customer what they want, when they want it, and at the right price, and for goodness’ sake DO NOTHING ELSE!”, Matthew Ingle

Production

Recognizing the pitfalls of outsourcing to China, Ingles aimed to produce products in British factories.

The company's manufacturing strategy focuses on producing in-house only those products that are simple, high-volume, and represent a significant portion of a kitchen's profitability. This approach leads to Howdens manufacturing approximately one-third of the products it sells, outsourcing the rest to specialists for better quality and efficiency.

Sales

The company's name was meticulously chosen to evoke a sense of a longstanding family firm. It was inspired by a vintage print featuring a Houdan chicken, which also became the company's logo.

Ingles plan included establishing depots on the outskirts of towns, complete with parking and burger vans, ensuring convenience for customers. Additionally, he offered tradespeople free coffee while they waited, convinced that such small gestures made a significant difference.

Howdens Joinery offers several compelling value propositions for tradespeople:

Superior Service: With over 800 small depots spread across the U.K., around 85% of their trade customers are within five miles of their local store. This proximity allows tradespeople to quickly access the products they need from a trusted source. Additionally, Howdens provides white-glove service and delayed payment terms, ensuring that tradespeople can pay for their purchases after the installation is complete, thereby easing cash flow concerns.

Product Availability: Howdens' "in-stock" model ensures that kitchen installers can swiftly obtain the necessary items and replace parts if needed. This rapid product availability not only saves time but also enables tradespeople to complete more projects each year.

Aligned Interests: Tradespeople can mark up the products they install, earning from the Howdens products they sell in addition to their labor charges. This proprietary product offering prevents retail customers from bypassing tradespeople to buy directly from Howdens, fostering alignment between the company and tradespeople.

Great Kitchen Value: Howdens offers high-quality kitchens at competitive prices, supported by scale advantages and vertical integration.

The emphasis on serving trade customers results in stickier, longer-term relationships and a focus on delighting professional customers.

Corporate Culture

While establishing the business was a significant feat, Matthew's distinctive approach to its long-term success was equally noteworthy.

This part of the investment thesis is key. Ingle empowers his employees to act autonomously. There is no top down command and control, the business operates on a decentralized bottom up basis. Very few companies achieve this, but those that do tend to thrive.

“Any idiot can impose and exercise control. It takes a genius to ensure freedom and to release creativity. Any third rate person can make things more complex and complicated. It takes a first rate wise person to make them simple again.” Dee Hock, founder and CEO of VISA.

He abolished corporate jargon, pointless meetings, and middle management, transforming each depot into a decentralized small independent business.

Employees' ownership mindset is promoted, with 100% of employees being shareholders.

It has a model under which 10% of net profits before tax are distributed to employees, with 5% going to the depot manager and the other 5% being split amongst the remaining employees. The business operates on a PBT margin of around 33%, which is reduced to 23% after distributions. This approach contributed to Howdens consistently ranking among the top businesses to work for.

Its down to each depot manager to agree the discounts that are a big part of Howdens’ appeal to its regular customers. Howdens’ culture is all about wanting the builder to win. Happy customers will come back. And the more business they do, the greater the discount on their orders. Howdens’ prices are determined at the depot level and aren’t published, depot managers take ownership of all pricing and costs.

The autonomy given to depot managers empowers them to make localized decisions, such as product selection, pricing, and customer service, based on local supply and demand trends. This approach eliminates the need for centralized decision-making and results in better operating performance.

As such, depot managers are financially incentivized to grow but only at appropriate margins. All decisions are decentralized and they grow only when it creates value for the depot. Hiring an additional person at the depot, for example, dilutes the staff bonus pool unless that new person creates enough value to offset their cost. But if they can generate more than their cost then that’s an entirely different conversation.

If each Howdens depot is managed correctly with optimal efficiency, it will be challenging to compete with it at the local level; if that's the case across most of its 880+ depots, then the company at large will have an impressive economic moat that couldn’t have been achieved with a centralized command and control approach.

“As I joined last July I was struck by many qualities of the business with its very strong customer-centric culture, differentiated business model, and the excellent leadership team who are focused on driving performance. As I have spent time in the business this year, above all else, I have been struck by the talent and unwavering commitment of Howdens’ 12,000 associates. They are the lifeblood of this business”, Peter Ventress, Chairman

Business Overview

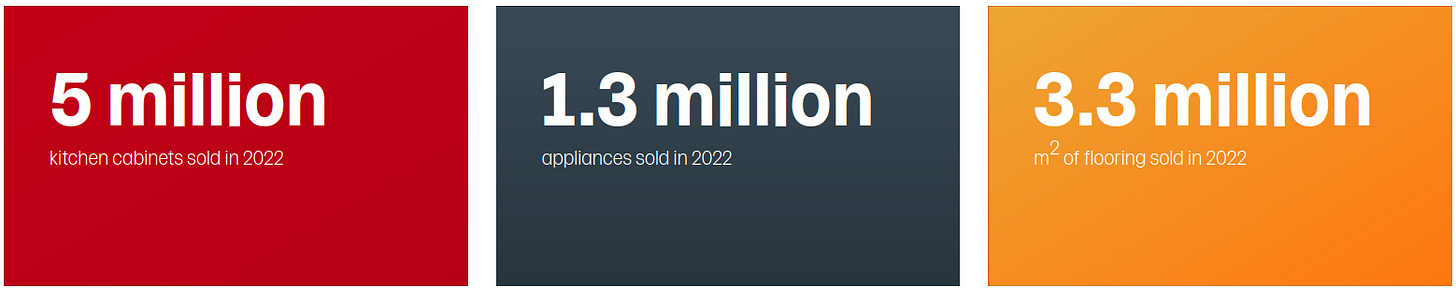

The business is the UK’s number one trade kitchen supplier, it offers a range of joinery products (1 in 4 doors sold in the UK is from Howdens), and it sells appliances including an exclusive range of Lamona appliances across cooking, cleaning, and cooling. In fact, since its launch in 2009, Lamona has grown to become the UK’s biggest selling integrated appliance brand by volume. Howdens also sells other market leading brands including Neff, Bosch, AEG, Hotpoint, Zanussi, Beko and Rangemaster.

Most kitchen sellers in the UK target retail customers, but the problem is that there’s no recurring revenue with that model. A kitchen will last decades and so a retail customer today will not be seen again for a generation. By contrast, selling to tradespeople, as Howdens does, results in a constant flow of repeat business - trade customers love the quality and service so they keep coming back.

Howdens’ culture is all about wanting the builder to win. Satisfied customers tend to become loyal ones and the more business they do with Howdens’, the greater the discounts they can enjoy on their orders.

It operates through a network of over 800 small format depots in the U.K. and approximately 60 locations in continental Europe, particularly in France.

Howdens' has a unique pricing strategy, as explained above, where each depot sets its own prices and customer discounts. They maintain secrecy regarding prices, so each trade-customer may have different pricing, allowing builders to safeguard their own profit margins.

An additional benefit of being a trade supplier rather than a retailer is that Howdens is able to strategically situate its depots in un-glamorous industrial locations and its repeat business curtails advertising expenses, thereby effectively managing overhead costs.

Howdens Joinery's kitchen-related revenue accounts for approximately 80% of its total revenue, with the remainder coming from joinery, doors, and other trade-related accessories.

To demonstrate that Howden’s offers better value than its competitors, consider that the company sells roughly 40% of all U.K. kitchens by volume but accounts for only 25% of kitchen revenue share in the U.K. Howdens , primarily focusing on the low to mid-range kitchen segment which is its strength. The top end of the market is typically bespoke kitchens rather than mass produced units, so the larger revenues at the top do not necessarily translate to better margins. Howdens occupies the best segment for profitability.

The company's revenue is predominantly driven by residential end markets, with little exposure to home-building.

Its depots, which are designed to cater to professional installers, are compact and efficient, costing around £350,000 to build and generating impressive revenue of £2.7 million per depot.

Moat

“Our trade-only, in-stock model is hard to replicate and compete with, and we have initiatives in place to make it more so. We are delivering value to our customers at all price-points as we continue to gain market share and we are well set up for further success”, Andrew Livingstone, CEO

Howdens' moat is built on several pillars.

Howdens' network of small, efficient depots is a key element of its success. The addition of new depots enhances network effects, attracting more customers and making product acquisition and distribution more efficient. With 85% of UK customers living within 5 miles of a Howdens depot, the company's proximity makes it convenient for tradespeople to acquire the necessary materials for their projects.

The company's vertical integration and exclusive focus on professional customers results in long-term, sticky relationships. This position is challenging to attack from the ground up, as it requires significant capital investment and time to build relationships with tradespeople. Howdens' consistently high return on equity and sector leading profit margins demonstrate its strong competitive position.

In 2015, Howdens was granted a Royal Warrant, a prestigious acknowledgment of the company's consistent provision of high-quality products to royal households for a minimum of five years. This accolade is held by approximately 800 companies and, while a relatively minor aspect of the moat thesis, it underscores Howdens' reputation as a reliable and trustworthy operator, offering additional economic benefits.

Management

Howdens' management team is led by CEO Andrew Livingston, who has successfully steered the company through a period of expansion and international growth.

Livingston is focused on financial incentives tied to pre-tax profit and cash flow, aligning their interests with shareholders.

The company has followed a balanced capital allocation approach over the last decade, including dividends, share buybacks, and capital expenditures.

“In February 2023, the Board decided that the Group will undertake a new £50m share buyback programme which we will aim to complete over the next 12 months. This is in addition to the £250m share buyback programme announced last year, which was completed during the second half of 2022” Peter Ventress, Chairman

Risks and Opportunities

Howdens' approach to international expansion distinguishes it from many other British firms, as it proceeds with caution and at a measured pace. This year, the company intends to launch 30 new depots, with five of these being situated in Ireland. Moreover, in the relatively unexplored markets of Belgium and France, which collectively match the size of the UK market, there are already 60 outlets in operation.

The strategic concentration of outlets in and around Dublin and Paris, as opposed to scattering them across the country, appears to be effective in elevating brand visibility and ensuring that the needs of trade professionals are met through nearby depots.

Howdens has identified several avenues for growth:

Depot Expansion: The company aims to increase its depot count in the U.K. from 800 to around 1,000 depots in the medium term. Additionally, its foray into the French, Irish and Belgium market has shown promise. There is plenty of expansion potential in all three of these markets, but there are also new markets yet to be explored.

“We believe our addressable market in the UK for the markets we currently operate in is around £11.5bn compared with Howdens’ UK revenue of around £2.3bn.” Peter Ventress, Chairman

Existing Depot Profitability: Howdens is investing in refreshing its depots to improve their appeal and operational efficiency, driving increased store traffic.

Digital Capabilities: The company is making significant investments in digital capabilities to enhance customer interactions, allowing tradespeople to place orders online and check local stock, ultimately saving time and improving service.

Brand Awareness: Howdens aims to increase brand awareness among homeowners so that people ask tradesmen not just to fit a kitchen, but to fit a Howdens kitchen.

Vertical Integration: Howdens is expanding its manufacturing capabilities to cover a broader range of products, including high-end stone countertops, to increase its reach across a kitchen's 'bill of materials.' This was seen with the 2022 acquisition of Sheridan Fabrications Ltd, a leading industry specialist for the manufacture, fabrication, laser templating and installation of premium work-surfaces.

On the flip side there are risks and possible headwinds. Investing in a consumer business in a foreign market entails certain risks, such as changes in consumer tastes, trends, or government actions. Additionally, economic factors, such as inflation, falling rents, and home values, could affect demand for Howdens' products.

Economics and Valuation

With a market capitalization of £3.5 billion ($4.2 billion) the company generated TTM revenue of £2.3 billion ($2.9 billion), so it is capitalized at approximately 1.5x sales.

The business generates consistent gross margins above 60% with economic earnings margins around 13.5%.

The business grows organically and the balance sheet is exceptionally strong balance sheet. The company maintains a healthy financial position with £118 million ($149 million) in net cash and no financial debt.

The business seems to produce more cash than it requires and so it has consistently engaged in share buy-backs and payment of dividends. It offers a dividend yield that has averaged 2.2% over the past 5 years and has garnered attention from 16 analysts as of September 1, 2023.

Over the past five years, sales have grown at a 10.5% CAGR, margins have expanded by over 200bp, and the share count is 12% lower than it was in 2017. Throw in the annual dividend and the result for shareholders has been a total return of 54.9% or 9.14% CAGR. The return would have been better had the stock not experienced a multiple contraction of around 25% from 2.06x sales to 1.56x sales.

Looking out over the next five years, the business has a target of 1,000 UK depots versus the current 816, along with expansion opportunities in France, Belgium and the Republic of Ireland. Additionally, revenue per depot has shown historical growth of 3.5% per year on average.

Let us assume that the law of large numbers results in a slow down in the rate of growth, so the compounded growth of the business becomes 8%. I am assuming that the share count reduction continues at the same rate, so another 12% reduction by 2028. Economic earnings margin stabilize at 13.5% and dividend yields remain constant. In such circumstances we would be looking at a share price of £9.27 in 2028, a total return of 58.5% (CAGR 9.65%).

If economic earnings margins expand to 14% sales growth continues at 10% per annum, and sales multiples expand from 1.56x to 1.68x then all else being equal, the total shareholder return becomes 115% (16.5% CAGR).

Conclusion

Howdens Joinery is a standout company in the building supply industry, driven by its unique business model, decentralized management approach and empowerment of its employees, plus its strong competitive position. While the current valuation may not be attractive for those bearish on the UK consumer or housing market, it is certainly worth a closer look for more optimistic investors.

The valuation is not cheap, but neither is it expensive. If the company continues to thrive and to expand, shareholders will do well.

“It is better to buy a great company at a fair price, than a fair company at a great price”, Charlie Munger

Howdens is undoubtedly a company worth getting to know, offering potential for significant growth and a competitive edge in its niche market.