META (Facebook) | Entirely Uninvestable

Incalculable Risk, Impossible To Value, Destroying Shareholder Equity

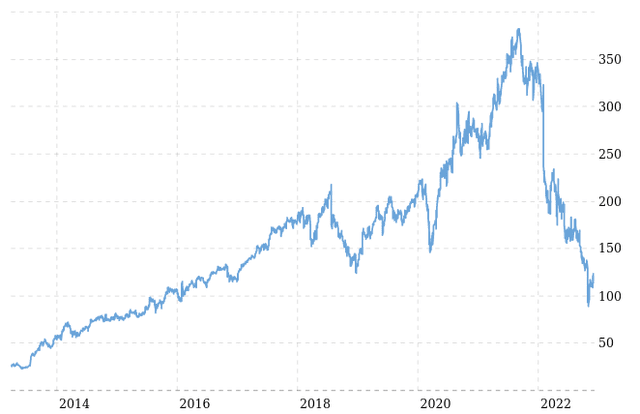

The share price fell 75% during 2022

Is this a buying opportunity or should the stock be avoided?

Did you know that Mark Zuckerberg is destroying shareholder equity?

The Facebook investment thesis broken

We explain why we are avoiding Facebook/META as an investment

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

META META 0.00%↑, formerly Facebook, has fallen from grace during 2022. Peak to trough, from a 52 week high of $352.71 (Dec 2021) to a low of $88.09 (Nov 2022), it was down 75%.

So what gives?

Investing Wisdom

Too many people assume that the price will return to its prior peak and so buy before the 300% bounce. This is foolish and founded on a “get rich quick” mentality. It is pure speculation. Go to a casino if this is how you think. Investing must be based solely on business fundamentals. Price action is a distraction so ignore it.

A stock that has fallen 90% is a stock that had fallen 80%, appeared cheap, and then halved in value again! If you buy after a large price correction and the price continues to decline then your capital is in jeopardy. Be smart.

When you buy a used car it doesn't matter how great it has been in the past, you need to look under the hood to see if the engine will perform in future.

The META Engine

The engine at META is Mark Zuckerberg and so he will be the focus of this article. I will reveal things that you likely never knew and which will almost certainly change your view on META as an investment.

There is no doubt that Zuckerberg has seen more success than I will ever see, so who am I to criticize him?

The answer is that I am a professional investor and I analyze businesses for a living. When comparing companies on a side-by-side basis it is all too clear which are well managed and which are not. Allow me to explain.

A Lucky Tech Geek Or A Businessman?

The first app that Zuckerberg built which was called FaceMash. It compared the faces of Harvard students and allowed users to rate how attractive they were. It proved enormously popular, attracting 22,000 views in its first four hours.

However, the site violated Harvard's ethical policies and it acquired the images needed for the site by hacking into the school's student ID system. Needless to say, it was shut down by the university in a matter of days.

Zuckerberg was very nearly expelled. Had that happened he would have almost certainly disappeared into obscurity and we would have ever heard of him. This was the pivotal moment.

Loathed to dispose of his hard work, Zuckerberg evolved FaceMash into what he then called “The Facebook” which was a social networking site where students at Harvard could connect with one another.

It went viral. Lady luck smiled kindly on young Zuckerberg.

Zuckerberg never set out to build a commercially successful social network, it happened by accident. At 19 years of age he didn’t dream up the worlds best advertising business. Instead he had student level prosaic objectives that led him to create a sophomoric application in his University dorm which became universally popular. By pure chance he hit the jackpot.

So what can we conclude?

Zuckerberg was evidently exceptionally bright and technologically innovative. But he is a tech geek, not a shrewd businessman.

By contrast, if you read the Jeff Bezos annual shareholder letters from the late 90s you will see that he was an entrepreneurial visionary. His objectives for Amazon were entirely commercial and his business acumen led to him creating one success after another (from the first online book stores into one of the world’s most dominant e-commerce businesses and then to the world’s most successful cloud computing service to name just a few).

It is for this reason that I don’t like the term FAANG stocks. It groups together companies that operate in entirely different dimensions. Sure they are all tech based phenomenons, but some are steered by high quality management and others are not.

I fear that META falls into the latter categorization and I shall explain my reasoning.

A Self Confessed Lack of Commercial Ambition

The first red flag that I would like to bring to your attention is that Zuckerberg refers to META, previously Facebook, not as a business but as a social project.

Almost ten years ago in Zuckerberg’s original letter to shareholders filed in conjunction with the S-1 (the initial registration that is filed with the SEC prior to the IPO) in 2012, he states:

Facebook was not originally built to be a company. It was built to accomplish a social mission, to make the world more open and connected. We think it is important that everyone who invests in Facebook understands what this mission means to us.

Then he goes on to say:

We don’t build services to make money, we make money to build better services.

Zuckerberg has stuck to this line over time. We have seen that play out recently in his pivot towards the Metaverse in which he is taking the largest bet of his life.

He changed the company’s name to META and is allocating obscene amounts of corporate capital to what is essentially a less promising bet than gambling red or black on a roulette wheel.

This simply isn’t commercially rational behaviour. More particularly, I don’t think that Zuckerberg really cares about its commercial success.

It is almost as though Zuckerberg has a god complex. He feels that he is doing god’s work. He is delivering what he thinks people need. His past success has given him a false sense of superiority. He believes he can do anything.

I fear that he is wrong and he is likely to discover that the hard way.

You may be asking, “why shouldn’t he do this? After all it is his company”.

Well, the answer is that Zuckerberg decided to IPO Facebook and to sell shares on the public market. Investors wanted exposure to the advertising business attached to the successful and proven social media platform. They did not ask for exposure to incalculable tangential risk. So Zuckerberg is breaching his fiduciary duty towards his shareholders.

Zuckerberg is burning (the only way to describe it) shareholder capital at a rate of more than $10bn per year and it is impossible to comprehend how he will amortize that investment anytime in the near future, if ever.

If Zuckerberg is so convinced of his META strategy, then he ought to set up a new business vehicle to pursue that goal independently of Facebook. He has enough financial clout to raise the requisite capital and he can then invite others to invest in that new business venture. Said differently, give investors the choice. But don’t take them somewhere that they don’t want to go, against their will.

This is why the META share price has collapsed. Shareholders are running for the exit. Zuckerberg is out of control. He is not acting rationally and he is not being fair to his investors.

We should also spare a thought for the long standing employees of META who have a considerable portion of their wealth in the company because they have been remunerated in stock based compensation. These people have seen their wealth decimated over the past year as the result of poor decision making by their CEO. These people helped develop Facebook and build it into the success that it has been, but their past work has now been tied to something that they may not believe in. It really is not a nice way to operate.

The other thing to bear in mind is that the stock could fall another 70% and Zuckerberg’s lifestyle is unlikely to be affected because he would still be immensely wealthy. The same is not true for his other shareholders. As such there is no alignment of interests between the CEO and the META investor base.

No one is capable of buying enough shares to out vote Zuckerberg. The business is run not democratically, but as a quasi-dictatorship. Accordingly, we will never see activist investors influencing the direction of the META business in the way that they did at Twitter. There, activists Elliott Management and Silver Lake ejected CEO Jack Dorsey and implemented change culminating in the Elon Musk acquisition. That will never happen at META. It can never happen at META.

So, if you invest in META, you are in it for the ride and your say doesn’t matter. Zuckerberg is behind the wheel, he is prone to making erratic decisions, you have no idea of the final destination (and arguably neither does he), so you take a back seat, throw caution to the wind and hope for the best.

Is that how you invest your wealth?

I hope not.

This is why I argue that META is uninvestable. But it doesn’t end there.

Finding Other Ways To Destroy Shareholder Capital

Let us turn our attention to the aggressive share buy back policy of recent years.

The key role of a CEO is capital allocation. Everything else flows from this.

Capital allocation done well is accretive to shareholders, but done badly it is nothing short of a breach of fiduciary duty towards the investors. Can you guess which bucket Zuckerberg falls into?

In 2017, Zuckerberg decided to initiate repurchases of META stock and he continued buying back shares regardless of price.

Know this, every share bought back in the six years that followed is now deep underwater. If a stock is over priced by the market, and if the company pays that premium valuation to repurchase its stock, then it is destroying shareholder equity. Fact.

Henry Singleton understood this well, as does Warren Buffett. When their stock was over priced they used it as currency to fund acquisitions. When their stock traded below intrinsic value, they bought it back. Timing is everything. This kind of business prowess is exactly the kind of key indicator that an intelligent investor ought to look for in the management of the businesses in which they invest. The long term compound returns generated by both Teledyne and Berkshire Hathaway speak for themselves.

Against that backdrop, I look at META and I don’t like what I see. Zuckerberg’s approach is the opposite to that of Singleton and Buffett.

It is evident that price was never a consideration for Zuckerberg. He bought 435 million shares for an average $257 per share (the shares trade for less than half of that today!)

Share buy backs are one of the most abused aspects of US corporate finance and this was no exception. It appears that the motive for the repurchase operation during the period 2017 to 2020 was to offset any dilution from shares given to insiders. The share count has barely changed during this four year period. So stock was given at a discounted prices to insiders and then covered in the market at premium prices. So META was buying high and selling low! Insiders were becoming immensely wealthy and this was being paid for by eroding shareholder equity.

Really? How did shareholders ever stand for this? Well the answer is that when the shares gain a cult following and trade higher and higher, shareholders turn a blind eye to the obvious. Inevitably the bubble would burst at some point and now shareholders are taking notice. I’m afraid its too late. You don’t shut the stable door after the horse has bolted!

It gets worse. In 2021 META paid $50 billion on repurchases, yet it only earned $39 billion.

The average price paid per share increased from $257 per share to $330. This compares to $114 today. Did Zuckerberg have no comprehension of the intrinsic value of his business or did he simply not care? Did he understand the economics of share buy-backs and choose to ignore it, or is he economically illiterate? Either way, one might argue that he is not a fit and proper person to be running a public company in which the wealth of so many others is tied up.

Those who understand money create it, those that don’t destroy it. Is this the kind of CEO that you want to invest in?

And it continues. In 2022 buy backs total $24 billion against $18.5 billion in profit, so Zuckerberg appears to be destroying capital more quickly than he makes it.

This kind of repurchase operation is not returning capital to shareholders. On the contrary, it is destroying the capital of shareholders.

So over a period of just under six years Zuckerberg spent 78% of profit and 50% of operating cash flow to reduce the shares outstanding from 2.89bn to 2.69bn, a mere 200 million reduction. Said differently, META spent $112 billion (almost half of the company's current market cap) to shrink the shares outstanding by less than 7% cumulatively.

The eagle eyed reader will have spotted that META bought back 435 million shares and so will be asking how the share count has only reduced by 200 million. The answer my friend is blowing in the wind (oh sorry, slipped into Bob Dylan lyrics to escape the misery of having looked into the META abyss). No, the answer is to be found in the Stock Based Compensation line on the cash flow statement, the one that the management tells you is a non-cash item that you should ignore. Only fools will fall for that one. The other 235 million shares were given to insiders at the expense of shareholders!

If you are a long term shareholder and you fell for that old accounting slight-of-hand then I’m afraid that you probably deserve to have seen a total shareholder compounded return of zero since 2017.

Hopefully it was a lesson learned for the future. Don’t invest in businesses with poor CEOs that evidently do not understand the economics of capital allocation and who enrich insiders at the expense of investors.

Twitter (TWTR) was another example. Elon Musk bought the company for little more than its 2013 IPO price which, when accounting for inflation, resulted in a zero annual compound return over a decade (Jack Dorsey, the insider, took his personal wealth from zero to $4.5 billion over the same period).

Palantir (PLTR) is another one. In fact, this abhorrent behaviour is rife in silicon valley. Caveat Emptor! Watch out for obscene stock based compensation in the cash flow statements and vote with your capital by NOT investing!

When spending the majority of profit buying shares at high prices to offset the dilution that makes insiders rich, you need money from somewhere. This massively profitable company had $29bn in cash in 2017 and no debt; today it has $26bn in debt and $15bn in net cash. So the balance sheet has also seen a dramatic deterioration due to the poor decisions of Zuckerberg.

Performance Since IPO

Following its IPO, Facebook sales were almost exponential over the decade increasing 3077.8% from where they were in 2011 to where they were by the end of 2021. At the same time net margins, principally from advertising revenue, increased from 18% to over 33%. A combination of strong sales growth and margin growth is just what every shareholder wishes for. All else being equal, on the back of sales growth and improved margins alone, the share price would have gone from $38.23 to $4,835.69 (+12,500%) in a decade.

But all else was not equal.

First, by the end of 2021 the share count had expanded 27.1%, which diluted shareholders substantially (as discussed above).

Second, back in 2011 Facebook shares were trading at an eye-watering 122.8x earnings meaning that early shareholders paid a hefty premium for the stock and in so doing gave away a great deal of the future upside.

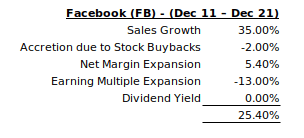

Over the course of the decade the earnings multiple contracted by 80% and stood at 23.3x by the end of 2021. This essentially shaved 13% annually off the total return that would have otherwise been achieved by shareholders. So rather than enjoying compounded growth of over 40.4% a year, Facebook shareholders compounded at 25.4% (see table below showing cumulative annualised returns).

Then came the revelation in February 2022 that user numbers had declined for the first time in the history of the business and the market sold off heavily driving the earnings multiple down further. Throughout 2022 the share price continued to trend lower as investors ran for the exits. At the time of writing the share price is $118

The result is that anyone that held the shares from Dec 2011 until today has now achieved a ten year compound annual growth rate of 11.9% rather than the 25.4%. What a difference a year can make on a decade of compounded growth!

Facebook's challenge is that its users are its product. It doesn't charge most users for the service that it provides and instead sells the captured attention of its users to advertisers. The users are the unit of production and there are only so many people in the world and so many hours of attention capable of being captured each day.

Facebook is close to saturation point. Accordingly, sales growth is likely to be muted over the next decade, unless Facebook is able to reinvent itself and monetize its user base in some other way. Last year it poured $13 billion into new ventures in an attempt to achieve this objective. It also tried to reinvent itself by changing its name to META. All of this looks desperate, it points to earnings not being particularly durable and it does nothing to inspire confidence amongst investors. Hence the sell off.

So, with no clear path to sales growth, and net margins already at 33% highly unlikely to expand further, where will growth come from over the next decade? Sure, Facebook may get lucky with some augmented reality venture, but then again it may not. It's difficult to make a solid investment case on calculable risk versus reward.

Without sales and margin expansion, shareholder returns can only come from multiple expansion (there needs to be a business catalyst for that to happen) or a return of capital to shareholders via share repurchases or dividends. Both would be a major shift of policy for the company which is accustomed to reinvesting all of its earnings.

Conclusion

It is a concern when the CEO decides to reinvent the company by spending more than $10bn of shareholder capital every year and taking debt from zero to $26bn in just a few years.

This has been driven by Zuckerberg's desire to accomplish social missions, an intellectual challenge rather than anything commercial. However, we ought to think about how reflexive this pivot has been.

Anecdotally we know that the younger generations don't use Facebook because they see it as a social network for their parents generation. They prefer TikTok or SnapChat or anything but Facebook. If you would like to test this thesis ask any kids that you know if they use Facebook and see how they respond.

The key issue with a social network is that it is entirely dependent upon a herd mentality. Said differently, there is no sense in using a different social network to your friends. As such, the very thing that helped META go viral is likely to be its eventual undoing as the young herd is now moving in a different direction.

This doesn't bode well for the future of META as a social platform. Has the business exhausted its TAM (target addressable market) and is its existing market share likely to contract dramatically in coming years? With 2bn active daily users it is difficult to see how it could expand its user base further. When one reaches the peak of a mountain the only way forward in any direction is down. Perhaps, in desperation at a bleak outlook, Zuckerberg has been forced to pivot in a new direction and to try to reinvent the business by changing its name and its core objective.

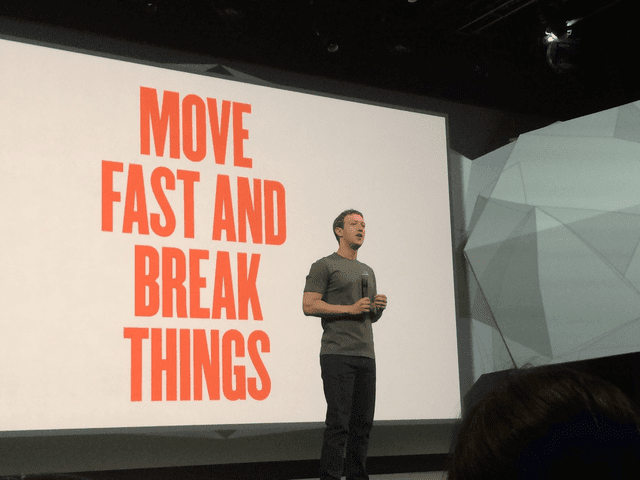

“Move fast and break things” has for a long time been the META mantra for how things happen within the company. My fear is that Zuckerberg has taken this to the limit and may have moved too fast and broken the entire Facebook business.

The CEO of the company that you invest in becomes the steward of your wealth. Choose carefully. Choose wisely. I have pointed to many red flags in this article.

META is no longer a good investment opportunity because it is not possible to calculate risk. It does not operate with commercial objectives, it is driven by a social-good agenda. It is pure speculation. It is a gamble on the unknown. It is, in my opinion, uninvestable.

I'm not saying that the share price will not increase from here. It may do. If a herd of financially illiterate people throw their money at the company then the price goes up. It happened with Gamestop and AMC, despite being entirely irrational. META may become another meme stock with a cult-like following on social media which would influence its share prices.

What I am saying is that this is not something for the intelligent investor. I have no position and I would avoid META in favour of better opportunities. If you already have a position then if I were you I would divest and find a better home for your money.

Just because the share price is down 75% doesn’t make it cheap.

> When you buy a used car it doesn't matter how great it has been in the past, you need to look under the hood to see if the engine will perform in future.

The article started great with the above quote, but then spent nearly the entire time talking about the past save for a few anecdotal comments about AR maybe working and something something young kids and heard mentality.