Name: ITV Plc Ticker: ITV Exchange: LSE (UK)

Founded: 1955 Industry: Broadcasting Sector: Media

Implied Market Cap: £3.170bn GBP

Theme: Value Assessment: Oversold Author’s Strategy: Buy / Accumulate

Date: 9th January 2023

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

Investment Thesis

The business is worth far more on a sum of parts basis than is implied by its share price

The share price has been hit by negative sentiment around advertising revenues in a recession, but the stock is vastly over sold

There is potential for a spin-off of the production business which would unlock value

Switching capital allocation from dividends to share repurchases would be sensible and be accretive to shareholder value

Despite the current macro and geopolitical uncertainty ITV is making significant strategic progress and is well positioned to deliver Phase 2 of its More Than TV strategy, through growing ITV Studios and delivering at least £750m of digital revenues in M&E by 2026. It has a robust balance sheet and is allocating capital well by investing in digital acceleration. Additionally, the business appears to be worth far more on a sum of parts basis than its market cap implies, so there is a great deal of value to be unlocked. All of this will create long-term value for shareholders.

The Business

ITV Plc (London: ITV) is a British free-to-air public broadcast television network, the oldest and the largest commercial broadcaster in the UK.

It was founded in 1955, is headquartered in London, and was launched as Independent Television (subsequently shortened to ITV) in order to provide competition to the BBC Television (British Broadcasting Company).

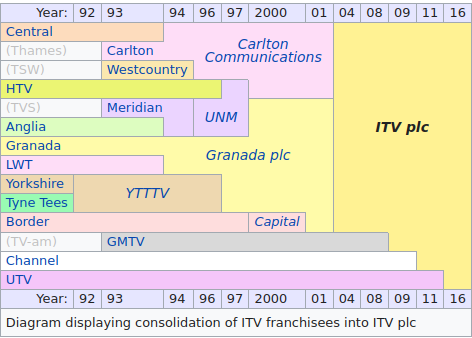

For four decades it existed as a network of fifteen separate companies which provided regional television services across the UK. After several mergers, the fifteen regional franchises are now held by two companies:

ITV plc, which holds 13 licences covering England, Wales, Northern Ireland, Southern Scotland, the Isle of Man and the Channel Islands.

STV Group, which holds 2 licences operating only in Central and Northern Scotland

ITV delivers content through:

Linear television broadcasting on its family of free-to-air channels, including ITV, ITV2, ITV3, ITV4, ITVBe, ITV Encore, CITV, ITV Breakfast and CITV Breakfast

ITV Hub, an over-the-top service on 28 platforms, including the itv.com website

Pay providers, such as Virgin and Sky TV

Direct content deals with services including Amazon, Apple, and Netflix.

Revenue is generated through licencing deals and advertising.

ITV owns ITV Studios which is the production arm of the business. It produces a large proportion of ITV's networked programming, currently around 50%, with the rest coming primarily from independent suppliers (under the legislation known as the Broadcasting Act 1990, at least 25% of ITV's total output must be from independent companies. Hence the name ITV or Independent Television). As such ITV is looking to move closer to a 75:25 ratio by increasing the amount of in-house programming that it produces.

It also operates as an unscripted independent producer of content in the United States; and produces content for local broadcasters in Australia, Germany, France, Italy, the Netherlands, Sweden, Norway, Finland, and Denmark. It creates original programming across 60 production labels and sells its catalogue of 90,000+ hours to overseas broadcasters and platforms around the world. In December 2022 it announced that it had sold over 1,000 hours of content to broadcasters across the Asia Pacific region including Taiwan, Korea, Japan, India, New Zealand and Australia.

This is particularly relevant because as recently as October 2022, reports were circulating that ITV was considering selling a stake in it production arm.

What caught my attention is that several analysts suggest that the production arm may be worth more than the valuation ascribed to the entire group holding company at the moment. Citi bank “If the company could find a way of changing perceptions of the value of the ITV Studios business this could be meaningfully accretive to valuation”.

In other words, there is value to be unlocked in this investment.

CEO Carolyn McCall has commented that the value of ITV Studios is not reflected in the share price and so the business is exploring options to help recognise its undervalued asset.

Bear in mind that there is a battle ongoing between the streaming TV providerse Netflix, Amazon Prime Video, Hulu, Disney+ and Apple TV. There is insufficient meat on the bone to feed all of these businesses and so it will almost certainly be a question of the survival of the fittest. That in turn means investing heavily in content that appeals to audiences. ITV is good at that and arguably leaders in reality TV shows. If you were a streaming service would you want to share ITV content with other broadcasters or might it be advantageous to block competitors by taking an ownership stake in ITV?

Either way, the business is not resting on its laurels. It is growing at an impressive pace and is pushing ahead and meeting its strategic growth targets.

Most of the growth is organic in nature, although the business is also acquisitive when opportunity arises.

ITV has built scale in creative markets since 2012, acquiring a number of production and distribution businesses in the UK, US and Europe as it grows an international content business. In addition, ITV has made a number of investments into ‘digital-first’ and US digital content companies as the business looks to expand its digital assets and exposure to new types of content and distribution.

In Q3 2022 it acquired Plimsoll Productions in order to strengthen its natural history content. The prior acquisition was in 2017 when it bought the French Tetra Media Studios and Italian Cattleya. Its largest acquisition to date was back in 2015 when it acquired Talpa Media for over £500m.

Top line growth of circa 6% is being driven by double digit growth from ITV Studios (+16% or +13% on a constant currency basis) and the digital segment. The non-advertising revenue is growing at 13% and since this represents over 50% of total revenue, as this trend continues the 6% top line will improve significantly. The drag on sales growth came from the Media & Entertainment (M&E) segment which was down 2% YoY and advertising revenue also down 2% YoY, prinicpally against tough comparables in 2021 which saw a post-Covid19 surge. Notably, however, advertising revenue is still well ahead (+6%) of 2019 pre-pandemic levels and digital advertising revenue is up 13% YoY.

It is making good progress on its new, free, ad-funded streaming service ITVX. On 8th December 2022 it was rolled out across devices and platforms with the launch of new and exclusive content. ITVX will supercharge the streaming business providing viewers with a content-rich destination rather than a catch-up service. At the same time it will generate valuable audiences at scale to meet the desire of advertisers for both mass reach and data-led addressable advertising, targeting millions of viewers. This will drive significant digital viewing and revenue growth, enabling ITV to deliver at least £750m digital revenues by 2026.

ITV Studios

ITV Studios will exceed 2019 revenues in 2022 with an exciting pipeline of scripted and unscripted programmes as it further diversifies the business by genre, by geography and by customer.

With its strong position in a growing market, ITV Studios is expected to deliver revenue growth in excess of its 5% medium-term target in 2023

It remains committed to delivering its ITV Studios adjusted EBITA margin guidance of 13% to 15% from 2023.

Media & Entertainment

ITVX, will be rolled out across devices and platforms in the coming weeks with the full launch of new and exclusive content on 8th December. It will launch with over 10,000 hours of free content available including:

exclusive weekly premieres aimed at attracting young and light viewers, such as:

Litvinenko starring David Tennant; A Spy Among Friends with Damian Lewis and Guy Pearce; natural history series, A Year on Planet Earth; teen drama Tell Me Everything; and reality game show Loaded in Paradise - all produced by ITV Studios labels

one of the largest free film libraries with over 250 titles and over 200 series available at launch

20 FAST (free ad-supported TV) channels and ITV's 6 linear channels

ITVX will enable ITV to continue to provide the largest free ad-funded premium streaming service in by revenue

ITV TAR for the full year 2022 is expected to be down between 1% and 1.5% on 2021's record year and this will represent high single digit revenue growth compared to 2019. In Q4, ITV will broadcast the FIFA World Cup, which will benefit TAR in November and December. There however remains a high degree of economic uncertainty

Ecomomics

ITV is growing its top line at about 6% which is ahead of both the moving average on both a 3yr and 5yr basis. The newly launched digital services ought to ensure that this momentum continues.

Gross margins have been very stable at circa 25% over the past decade.

What caught my eye is that neither the OPEX nor the CAPEX have increased very much, if at all, as the top line has expanded. This suggests the kind of operating leverage that shareholders covet because it means that more of the marginal increases in revenue fall through to owner earnings.

This has been born out in fact as my owner earnings margin (an adjusted free cash flow number) has steadily expanded from circa 15% to 20% over the course of the last decade. There is no indication that this trend is at an end.

The business is not particularly capital intensive, which effectively means that capital ought not be an impediment to growth and the return on invested capital is running steadily above 30%.

Stock based compensation is reasonable at 1.5% to 2.0% of Owner Earnings per year. A small number of shares are bought back in order to prevent dilution of external shareholders. As such, stock based compensation is a cash expense to the business where stock is issued in lieu of salary. This is a far more legitimate way to align interests of shareholders with senior management and stands in stark contrast to the SBC abuse seen in many US companies which is tantamount to a transfer of wealth from shareholders to insiders.

The number of shares outstanding is little changed in a decade. This strikes me as odd because the CEO clearly believes that the market has underpriced the stock relative to the intrinsic value of the business. The sensible thing to do in such circumstances would be to repurchase discounted shares which is incredibly accretive to shareholders. In fact, it is preferable to paying out tax inefficient dividends, yet ITV has always paid a relatively large dividend, currently circa 4% but in recent years over 6%. This I believe to be a mistake in capital allocation by the management.

ITV's balance sheet is robust and it continues to have good access to liquidity. In September 2022, ITV redeemed its 2.125% Eurobond using available cash, in order to reduce gross cash and gross debt. ITV had total liquidity of £932m, comprising total cash of £382m (which includes £50m of restricted cash) and committed undrawn facilities of £550m. In fact, the leverage ratio has contracted from more than 4x to 2.5x today

The company has a significant net pension surplus, so no issues there.

Valuation

In terms of valuation, if we assume that sales increase to £4.5bn by 2027 (CAGR 5%), sharecount remains unchanged, owner earning margins stabilise at circa 20% and the stock trades at a multiple of 11x owner earnings (currently 4.5x) then we are looking at a total shareholder return of 217% (26% CAGR). Add in a 4% dividend yield and the total shareholder return pushes out to 30% CAGR over the next 5 years.

That implies that the shares will be trading around £2.51 in 2027 which, on a NPV basis (discounted aggressively at 10% PA), suggests a valuation today of £1.56 to £1.76 against a share price today of £0.79.

This is a conservative valuation. The chances are that sales will increase at a faster rate than 5% and owner earnings margins may expand beyond 20%. If sales grow at 7%, margins expand to 22% and if management embark on stock buy-backs at these discounted levels in lieu of paying dividends, then shareholders could expect to see a 371% total return over the next five years (36.3% CAGR). That would put the NPV of the shares to a £2.31 level.

In support of this valuation, the stock is currently trading at 0.88x sales which, on a 20% adjusted earnings margin offers an earnings yield of nearly 23%. That is just too good for any intelligent investor to ignore. On the basis that most investors would settle for an earnings yield of closer to 9% in the current environment, this stock could support a sales multiple of 2.2x which is equivalent to the owner earnings multiple of 11x mentioned above.

Whichever way we look at this, there is a significant margin of safety in this stock which trades at unjustifiably low prices. In other words, the risk/reward skew is incredibly favourable.

Management

In terms of management, the current CEO, Dame Carolyn McCall, has been in office for 5 years since 2018. Prior to that she was CEO of airline Easyjet for 7 years and before that CEO of publishing giant Guardian Media Group for 4 years. She has a wealth of marketing and media experience and has a personal stake in ITV worth circa £1m, so she has skin in the game (on which subject, insiders have been actively buying shares in the company over the past 12 months with absolutely no insider selling, which is always encouraging to see).

Conclusion

ITV is an underpriced business with an assymetric skew to the upside. The undervaluation opinion is supported by a similar view of the CEO and analysts including Citigroup.

The only reason that I can see for the shares to be out of favour in the market is that ITV relies in part upon advertising revenue for its income and in a recession advertising spend drops.

However, as we have seen, it makes a lot of money by selling content internationally.

The ITV Studios part of the business that produces the content is arguably worth the share price alone without the advertising and other revenue that ITV generates.

My price target is 156 pence versus 77 pence today.