Knowing When It's Time To Bail Out

Whether it’s work, investing, or life itself, how do we know when its time to exit?

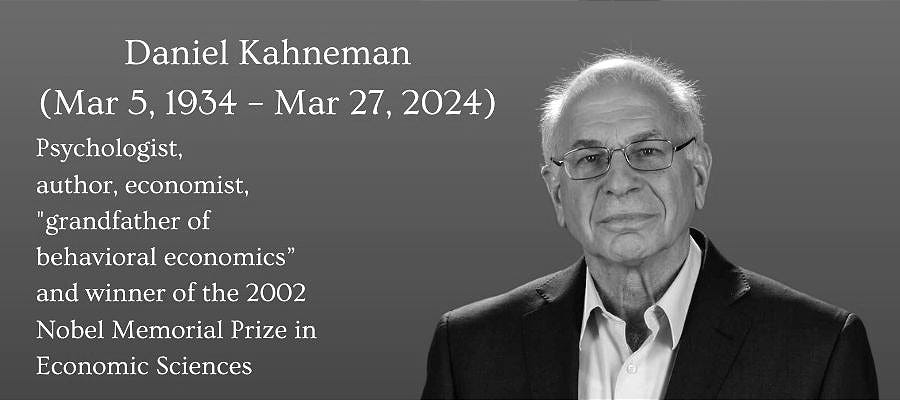

This article marks the first anniversary of the death of Daniel Kahneman- psychologist, author, economist, Nobel laureate and father of behavioural economics. It provides valuable lessons for us all. A special thank you to Jason Zweig of the Wall Street Journal for inspiring me to write it.

Some people retire early, while others keep working until their final breath. Consider Rose Blumkin, who worked until she was 103, or Charlie Munger, who remained active until he passed at 99. Warren Buffett, at 94, is still going strong.

Investors follow similar extremes. Some trade rapidly - opening and closing positions within a single day - while others, like Philip Fisher, liked to buy and hold forever (figuratively speaking). Buffett, once again, exemplifies this mindset, holding stakes in companies like GEICO and American Express for over 60 years.

So, whatever the context, when is the right time to bail out?

The Power of Quitting

Annie Duke, a former top-earning professional poker player, transitioned from high-stakes gambling to writing about decision-making. With a background in cognitive psychology, she bridged the worlds of academia and poker.

In her 2022 book Quit: The Power of Knowing When to Walk Away, Duke made a striking observation:

“Quitting on time will usually feel like quitting too early.”

Why? Because making the right exit means leaving before the consequences of staying too long become obvious.

Bailing Out Gracefully

Daniel Kahneman, the Nobel Prize-winning psychologist who revolutionized our understanding of human decision-making, understood this concept better than most. His research with Amos Tversky dismantled the myth of purely rational decision-making, showing that human choices are often shaped by biases, emotions, and inconsistencies. His research formed the foundation of behavioral economics, earning Kahneman the title of the "grandfather of behavioral economics".

His 2011 bestseller Thinking, Fast and Slow revealed how instinct often overrules logic in ways we don’t even realize.

But in March 2024, Kahneman made a decision that stunned even those closest to him.

After the death of his wife in 2018, Kahneman began a relationship with Barbara Tversky, herself an emeritus Stanford Professor and the widow of his longtime collaborator Amos Tversky, who had died many years earlier. The two octogenarians enjoyed each other’s company and lived together in their old age.

Last March, they flew together from New York to Paris to unite with his daughter and her family. Together they spent days enjoying the sites, sounds and fine cuisine of the French capital city. They basked in the unseasonably good weather, visiting museums the ballet, and generally enjoying life with family and friends.

Kahneman, had turned 90 earlier that same month. On March 22nd, he sent a farewell email to several dozen close friends. His email stated, “This is a goodbye letter I am sending friends to tell them that I am on my way to Switzerland, where my life will end.”

The next day, he left for the Dignitas clinic in Switzerland and, on March 27th, voluntarily ended his life.

Kahneman was in good health. He had no known cognitive decline, no terminal illness, and was actively working on academic research papers the week of his death.

For a man who had achieved so much in life and was considered an expert in decision making and human behaviour, the abrupt and very deliberate end of his life came as a shock to everyone.

Why Did He Do It?

In his final email, he explained:

“I am still active, enjoying many things in life (except the daily news) and will die a happy man… I am ninety years old. It is time to go… Not surprisingly, some of those who love me would have preferred for me to wait until it is obvious that my life is not worth extending. But I made my decision precisely because I wanted to avoid that state, so it had to appear premature.”

This brings us back to Annie Duke’s insight: “Quitting on time will usually feel like quitting too early.”

Kahneman also understood the peak-end rule - the idea that we judge experiences by how they end. By choosing his exit, he ensured that those who loved him would remember him as he was - sharp, engaged, and in control.

The Lesson

There is no magic formula - what works for one person may not work for someone else. Only you can know when the time is right for you.

Whether it’s work, investing, or life itself, knowing when to bail out is one of the hardest decisions we face. If we wait until the choice becomes obvious, it might already be too late.