Kwak Noh-Jung and the Rise of SK Hynix

The High Bandwidth Memory (HBM) Revolution Powering AI, But Is It Investable?

Disclaimer & Disclosure: The author has no position in SK Hynix at present, but this may change in due course. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

SK hynix (South Korea: A000660)

Founded in 1983, headquartered in Icheon, South Korea

URL: www.skhynix.com

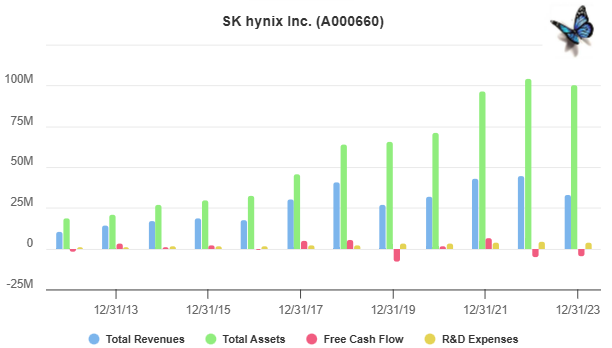

Market Cap $97 billion USD / Enterprise Value $111 billion USD

Float: 78.4%

10 year Revenue growth: 12.48% CAGR

SK Hynix is a market leader in high-bandwidth memory, working with NVIDIA to power the AI revolution. But is it a good investment? Let’s dive in and find out.

The Memory Market (important context)

From the 1970s through the 2000s, the memory industry grew at rates reaching up to 70% a year, which was truly staggering. Yet Don Valentine, the founder of Sequoia Capital and an early investor in companies like Intel and Apple, made a very accurate observation. He noted that although memory chips were essential for the development of the personal computer industry and the broader computing revolution, and despite requiring tremendous engineering skill and massive capital investment to produce, they had become commoditized products where manufacturers had to compete primarily on price. This meant that most of the economic benefits from their innovations flowed to their customers and those in the memory business ended up capturing relatively little of the societal value being created. More particularly, they often destroyed capital through heavy investment just to keep up with the competition.

“From 1997 to 2012 memory-chip manufacturers collectively destroyed USD $9.5 billion of investors’ capital across multiple boom-bust cycles”

McKinsey & Company

Things became so bad that nine memory companies illegally colluded to fix prices and were prosecuted in both the US and EU. Fines totaled USD $730 million and some executives served jail time.

However, today the memory business is entirely different. Three companies dominate: Samsung and SK Hynix from South Korea, and Micron from the U.S. The chart below shows how a very fragmented market has consolidated into a de-facto oligopoly.

Together they hold more than 85% market share with Samsung being the market leader, SK Hynix in second place and Micron at the back of the pack. The chart below is interesting because it demonstrates that in DRAM memory, SK Hynix appears to be gaining market share at the expense of Micron.

Today these companies tend to compete less on price and more on technological prowess. They differentiate themselves through innovations such as higher memory capacities, faster data rates, and improved power efficiency. This is not only better for the computing industry because it fosters a rapid rate of evolution, but gross margins for memory producers have improved markedly. These companies have finally been able to capture a more significant piece of the value that flows from their technological innovation.

Competing on price would be as damaging to themselves as to their competitors, making it an irrational strategy. This creates a situation where simple game theory comes into play.

Instead of colluding - which would violate antitrust laws - they seem to signal each other during earnings calls. These signals often reflect their interpretation of the market conditions and their intended responses. For example, they might comment on softening demand and an intention to scale back production, avoiding an supply overhang which would otherwise cause prices to crash. The other two companies respond in a similar manner, thus maintaining price stability to benefit all three players.

This form of indirect coordination, which doesn’t violate legal boundaries, was first described by French economist Antoine Augustin Cournot in 1838 and is now known as a Cournot oligopoly. In other words, as the result of consolidation, the memory industry is now behaving far more rationally with a focus on profitability rather than gaining market share at any cost.

Another factor reducing the cyclical volatility of the memory market is the breadth applications requiring memory chips. Once focused primarily on desktop computers and servers, memory now powers smartphones, tablets, TVs, vehicles and so much more. The rise of big data, artificial intelligence, and the internet of things (IoT) has diversified demand, which helps offset downturns in any individual sector.

Memory production is heavily reliant on cutting-edge manufacturing processes. Unlike logic chips, where older technologies can still be used for more simple applications, memory chips demand the most advanced and cost-efficient production methods. This creates an "up or out" dynamic, where companies must continuously invest in the latest technologies or risk losing their competitive edge.

So, while prices and gross margins have stabilized, the need for continuous innovation requires significant R&D investments, leading to high operating expenses (OPEX), offset only by economies of scale.

Capital expenditures (CAPEX) are also extremely high. Building high-end memory fabrication plants ("fabs") costs billions of dollars and requires immense technical expertise. For those who succeed, the rewards are substantial, but getting it right is difficult. The combination of high OPEX and CAPEX not only pressures companies to maximize output to achieve economies of scale, but also creates substantial barriers to entry, making it nearly impossible for smaller players to compete. To illustrate the scale, replacing Micron's manufacturing and R&D facilities is estimated to cost between $70 to $100 billion.

SK Hynix vs The Competition

Amid a global race to strengthen chip industries, major powers like the U.S. and China are pouring substantial subsidies and implementing regulatory measures to support their domestic semiconductor sectors. U.S. subsidies are set to benefit companies like Micron, while China’s CXMT is projected to account for over 10 percent of global DRAM production in 2024, rapidly improving its technological edge in the sector. In response, the Yoon Suk Yeol administration of South Korea, which relies on the chip industry as the cornerstone of its export-driven economy, has introduced a package of measures aimed at supporting its domestic semiconductor sector.

Samsung is feeling the strain more than its local competitor SK Hynix. In a recent public letter, Jun Young-hyun, head of Samsung’s chip division, acknowledged the company’s shortcomings, stating, “We have triggered concerns about our technical competitiveness with some forecasting the possible crisis facing Samsung.”

Unlike SK Hynix, which focuses solely on memory, Samsung's business is far more diversified. In addition to competing with Micron and SK Hynix in memory, it also rivals Qualcomm, MediaTek, Apple, and NVIDIA in non-memory semiconductors, competes with TSMC and Intel in the foundry segment, and competes with Apple in consumer electronics like smartphones, tablets, and wearables. Samsung also manufactures TVs, home appliances, audio equipment, and has a presence in the 5G, telecom infrastructure, and battery markets. While this broad portfolio has allowed Samsung to benefit from synergies and vertical integration, it may have overstretched its focus, losing its competitive edge in some areas.

This diversification strategy, along with leadership changes - marked by the founder’s grandson taking over as Executive Chairman - has led to management restructuring and market uncertainty. Samsung's recent underperformance, including missed profit targets, has caused its share price to dip as investors allocate their capital elsewhere, raising concerns about its ability to maintain its industry leadership amid fierce competition.

However, there are more fundamental reasons that explain why SK Hynix is performing better than Samsung. It excels in manufacturing efficiency and its advanced manufacturing processes, particularly in the production of HBM chips, are more efficient and faster than those of Samsung and Micron, giving it a clear edge in the market.

In terms of technology leadership, SK Hynix has also outpaced its competitors by being an early adopter of cutting-edge memory technologies like HBM3E. This forward-thinking approach has allowed the company to capture a significant share of the high-performance computing and AI markets, where these advanced memory solutions are essential.

Finally, SK Hynix’s workplace culture sets it apart from its competitors. Kwak’s emphasis on inclusivity and adaptability contrasts with the challenges faced by companies like Samsung, which have struggled with organizational dynamics.

Meanwhile, SK Hynix, the world’s second-largest memory chipmaker, leads in cutting-edge high-bandwidth memory (HBM) technology. It reported record-high earnings in Q3 2024, fueling expectations that it could surpass Samsung as South Korea’s most profitable chipmaker by year-end. HBM sales showed strong growth, up more than 70% from the previous quarter. Total revenue for the quarter rose 94% year-on-year to 17.6 trillion won. It forecasts HBM sales increasing to 40% of its total DRAM revenue in the fourth quarter, relative to 30% in the third quarter, and added it expects memory chip demand for AI servers to grow further next year as global tech companies are racing to develop generative AI. The chipmaker plans to increase capital spending to the mid-to-high 10 trillion won range to help respond to higher-than-expected HBM demand.

SK Hynix and HBM

For those unfamiliar with HBM, it’s basically stacked DRAM chips that are largely used to accelerate high-end GPUs and other AI processors, the kind of chips that are mainly used for large language model training, but are also found in networking and high-performance computing (HPC) applications. Large language model training is the foundation for generative AI models. When you stack DRAM and connect it in close proximity to a processor, actually within the processor’s package, you can run it at a faster speed, increase the connection count for many times more bandwidth, and reduce power consumption. All of this comes at a price as HBM is expensive to produce.

For the past couple of years SK Hynix was the world’s only HBM supplier, and its two major competitors, Samsung and Micron, were happy to let SK Hynix have that market. From their perspective, HBM was a tiny niche that consumed lots of capital, and they believed that greater returns could be made on standard DRAM.

Then the DRAM market collapsed in 2022, chip makers found themselves with excess production capacity and significant operating losses. The collapse was devastating, with DRAM prices dropping almost 70%. However, one memory manufacturer, SK Hynix, was faring better than its competitors. The reason for this difference was that SK Hynix was selling HBM, a product that remained profitable throughout the downturn.

Needless to say, Samsung and Micron are now both expanding in the HBM space. However, the complex manufacturing process and advanced technology required for HBM production have limited the industry's ability to rapidly expand supply.

SK Hynix acknowledged that while it is investing to meet next year's demand, it is facing limitations in manufacturing capacity. To address this, the company plans to reduce legacy manufacturing processes, such as those for HBM3 and DDR4 chips, and expand its capacity for producing HBM3e chips.

Due to the supply squeeze, customers are now signing long-term contracts to secure HBM supply and SK Hynix has indicated that its HBM capacity is fully committed for 2024 and 2025, suggesting a tight supply-demand balance in the near term.

“We expect upside movements in demand and downside movements in supply, meaning demand will remain outpacing supply next year. This is why we believe customers are looking to establish long-term supply contracts for HBM.”

Kim Woo-hyun, CFO, SK Hynix

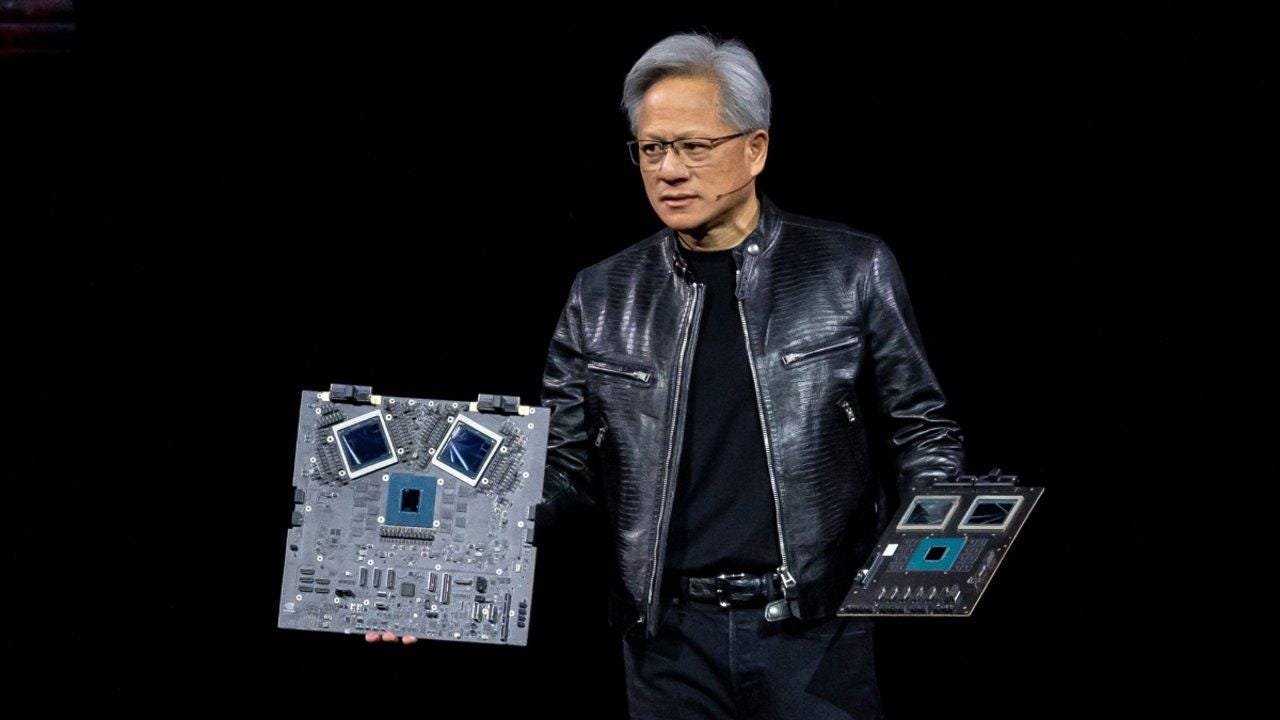

The highly anticipated Nvidia Blackwell AI chips use HBMs made by SK Hynix, and those are driving much of the demand.

Industry analysts project that the current HBM shortage will expand in 2024, with an estimated undersupply of around 15%. A supply-demand balance is unlikely to be achieved for up to 3 years and these supply constraints are likely to maintain pricing power for HBM manufacturers.

Kwak Noh-Jung and SK Hynix

Kwak Noh-Jung, the current CEO of SK Hynix, is known for his deep technical expertise, collaborative management style, and forward-thinking vision. Kwak has been instrumental in driving SK Hynix to new heights since taking over the leadership role in 2022. Under his guidance, SK Hynix has cemented its position as a global leader in memory and storage technologies, doubling down on HBM and surfing the AI wave.

Kwak’s rise to prominence within SK Hynix is a testament to his technical prowess and leadership capabilities. His journey began with significant roles within the company, starting as the head of the DRAM Product and Technology Division. His keen understanding of memory technologies and semiconductor manufacturing processes quickly garnered recognition, earning him promotions to Chief Operating Officer before being appointed CEO in 2022.

Kwak’s academic background also contributes significantly to his technical acumen. Before joining SK Hynix, he was an associate professor at the Korea Advanced Institute of Science and Technology (KAIST), a prestigious institution in South Korea known for its rigorous focus on science and technology. His time at KAIST helped shape his understanding of complex semiconductor technologies, providing a strong foundation for his future leadership roles. This background has allowed him to guide SK Hynix through some of the most technically challenging innovations in the memory market, particularly in the realm of HBM.

One of Kwak’s most notable achievements is his recognition on the global stage, having been awarded the prestigious Intel Technology Award three times. This accolade highlights how pivotal he has been to advancing semiconductor manufacturing and to making SK Hynix a critical player in the global tech industry.

Kwak is not just a technical expert but also a visionary leader with a distinctive management style. One of his key strategies has been fostering a partner-centric approach to business. Under his leadership, SK Hynix has built strong, symbiotic relationships with industry giants like Nvidia and TSMC. These partnerships have enabled SK Hynix to collaborate closely with some of the most influential players in the semiconductor industry, ensuring that its memory and storage technologies remain cutting-edge and aligned with market needs.

Kwak’s leadership emphasizes collaboration not just externally but internally as well. He has worked tirelessly to cultivate a corporate culture at SK Hynix that is both adaptive and inclusive. This has been particularly important as the company continues to grow and expand its operations globally. His focus on diversity ensures that employees from different backgrounds feel empowered and valued, fostering an environment that encourages innovation. This inclusiveness is not just a moral stance but also a strategic one, as diverse teams are often better equipped to tackle complex challenges and bring fresh perspectives to the table.

Another hallmark of Kwak’s leadership is his focus on talent development. Recognizing that innovation in the semiconductor industry requires top-tier talent, Kwak has made it a priority to attract, develop, and retain the best minds in the business. SK Hynix frequently hosts forums and events that showcase its technological leadership. SK Hynix’s more inclusive and flexible corporate culture positions it as a more attractive destination for top talent, which in turn fuels its innovation and growth.

Kwak’s vision is not just about hiring the best but also about ensuring that employees have ample opportunities for growth within the company. By investing heavily in talent development, Kwak is securing SK Hynix’s long-term future, ensuring that the company has the intellectual resources necessary to stay ahead in the highly competitive semiconductor industry.

In every successful business, the leader tends to have a particular set of personality traits and the corporate culture tends to converge on an optimal approach. Steve Jobs, Jeff Bezos and others fit this mould and so too does Kwak Noh-Jung, despite not being the founder.

Under Kwak’s leadership, SK Hynix has embarked on several ambitious initiatives that aim to strengthen its position in the rapidly evolving semiconductor market. Kwak has been a driving force behind SK Hynix’s push into the AI space, with the company pledging to invest over $103 billion by 2028 in the development of advanced memory chips tailored for specifically for AI applications. This investment highlights Kwak’s belief in the critical role that AI will play in shaping the future of technology and the central role SK Hynix will play in that ecosystem.

Kwak has played a key role in advancing the development of HBM3E, a next-generation memory chip designed for high-performance computing systems. The company has claimed that its manufacturing process for the world’s first 12-layer HBM is 8.8 times faster than its competitors, giving it a significant competitive advantage over rivals like Samsung and Micron. By vertically stacking 12 layers of 3 GB DRAMs it achieves a total memory capacity of 36 GB which is a huge step up from its 24 GB predecessor. To achieve this, the company made each DRAM chip 40% thinner than before and stacked vertically using TSV4 technology. It has accelerated memory operations to 9.6 gigabits per second (Gbps), the highest memory speed for an HBM, essential for AI applications, including large language models.

SK Hynix Valuation

Despite being a super capital intensive business, this company has rewarded shareholders with a 400% capital appreciation over the past ten years. It is now arguably a far better company than it was a decade ago having gained a market leading position in the most cutting edge memory technology.

However, it remains a very capital intensive business relying on both debt and equity financing in order to grow. Relative to its gross profit, it spends inordinate amounts of money on R&D and CAPEX, which is necessary simply to remain relevant, and it also requires a great deal of working capital.

Against this backdrop I struggle to understand how or why it pays dividends. More particularly, in 2022 its payout ratio was over 75%, paying out 1.3 trillion South Korean Won (~$1 billion USD) while it simultaneously increased its debt by over 4.5 trillion South Korean Won (>$3.25 billion USD). This makes no sense to me - if it needs capital in its business then it ought to retain capital in the business.

Return on invested capital has averaged high single digits since 2019, before which it was generating much more reasonable double digit returns.

Despite SK Hynix being the most efficient operator in the memory space, its asset turnover is declining and so on an economic basis it is becoming far less efficient.

As the chart below demonstrates, despite growing top line and gaining a more dominant position in the market, this company appears to be experiencing declining unit economics.

Why has the share price performed so well? It's up 37.6% year-to-date, 58.1% over the past 12 months, and has delivered an 18.4% compound annual growth rate (CAGR) over the last five years.

Is this just a case of irrational exuberance, with investors snapping up anything related to AI?

Are investors focusing on the wrong metrics?

Or is there something I'm missing? (If I have overlooked something, feel free to share your insights in the comments below.)

Another key factor to consider is the state-aid being offered by China and the U.S. to competitors of SK Hynix which is causing real concern within the South Korean government because of the impact it may have on both SK Hynix and Samsung.

Yet another consideration is the question of how much future demand has been brought forward by a surge in demand for very expensive GPUs due to the explosion of AI, but what does that mean for future demand? Will a high peak be followed by a deep trough?

We know that SK Hynix will be operating at full capacity through the next couple of years, but that is already factored into the share price which has risen sharply this year. But what happens after that to both demand and to the share price?

Long-term debt has surged in recent years, climbing 250% from 2020 to 2023 and 600% from 2017 to 2023, reflecting the capital-intensive nature of this business. This debt financing has been augmented by small amounts of equity financing over the past four years. However, despite consuming all this capital, average revenue has risen just 33% over 2017 levels. It’s almost as though the company is running up a down escalator - making limited progress while consuming a disproportionate amount of energy and resource to get there.

Warren Buffett once advised investors to stay within their circle of competence, and I must admit, this situation pushes me beyond mine. This is a well-run company producing a vital product that underpins computing, our electronic devices, and the AI revolution. However, that doesn't automatically make it a great investment. I am struggling to feel comfortable about the economics of this industry or this business, but the share price suggests that the market sees things differently, so I am more than happy to be educated (please do leave comments).

Is SK Hynix A Good Investment?

Kwak Noh-Jung’s leadership at SK Hynix has been characterized by a strong emphasis on innovation, collaboration, and talent development. His technical expertise and distinctive management approach have propelled the company to a leading position in the semiconductor industry, particularly in the areas of high-bandwidth memory and AI semiconductors. With continued investments in advanced technologies and an expanding network of global partnerships, SK Hynix is poised to maintain its competitive edge in the fast-changing tech landscape.

However, the semiconductor industry has historically consumed as much capital as it has generated, and this trend seems likely to persist. Despite the consolidation of the sector into a three-way oligopoly, it remains uncertain whether these dominant players will fully leverage their position to create truly outstanding businesses from an economic viewpoint.

Is this the right industry for your investment? Or could your capital be better utilized elsewhere? That decision ultimately rests with you.

I linked to your post for my Monday EM links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-october-28-2024 I don't think I have seen other Substackers, except maybe Douglas Kim's Korea focused Douglas Research Insights https://douglasresearch.substack.com/, cover SK Hynix although alot of funds own it and its a key semicon player...