McBride Plc (London: MCB)

Market Cap: £229m GBP (share price £1.32)

Enterprise Value: £374m GBP

LTM ROIC: 24.6%

EV/EBITDA: 4.2x

Net Debt < 2.25x EBITDA (target 1.5x)

Disclaimer: The author has no position in McBride Plc. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

McBride Plc, a British company, is a leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, such as laundry detergents and dishwashing liquids. It also has a presence in the Asia Pacific market.

The chart below demonstrates that in Europe, the top six producers of white label cleaning products account for two-thirds of the market with a long tail of smaller producers. McBride is by far the market leader.

The company faced significant commercial challenges in recent years that led to a sharp decline in its share price, but has made significant progress in recovering from losses driven by inflationary pressures and supply chain challenges.

It should be noted that these challenges were industry wide and not exclusively an issue for McBride. For instance, in October 2019, rival Reckitt Benckiser (LON:RB) reduced its full year outlook for operating margins as a result of similar challenges.

The issues for the company compounded when the Covid-19 pandemic and the Ukrainian war arrived. In combination they impacted distribution logistics and introduced inflation that caused input prices to soar. For McBride this was bad news as a significant proportion of its sales are structured on long-term fixed price contracts with major supermarket chains and discount retailers. This meant that its output prices were fixed, while its input prices rose dramatically. To make matters even worse, the company had no hedging strategy in relation to its input costs and no contractual rights to renegotiate pricing with its customers as a result of the extraordinary circumstances, which only just fell short of force majeure. McBride appealed to its customers but they were largely unsympathetic and not prepared to renegotiate.

In 2022 the companies share price hit a low of 16 pence. However, since then the recovery has been robust. Its share price has already increased 8x from its low, today trading at £1.29, although still well short of its 2018 high.

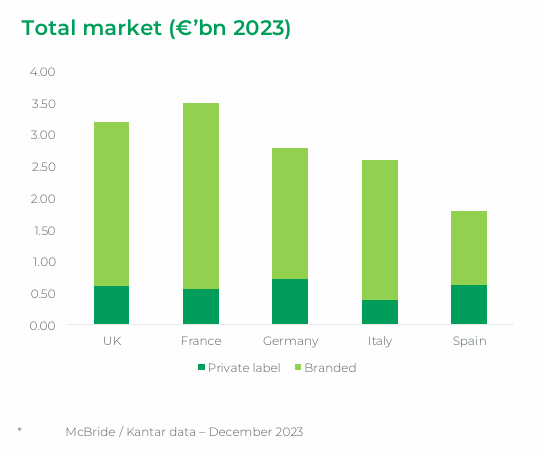

The turnaround situation has delivered momentum which is far from over. In particular, the high inflation environment which initially acted as a head-wind, has become a tail-wind. It has resulted in a cost of living crisis across Europe, leading consumers to make the switch from branded cleaning products to private label products, for which McBride is a market leading supplier. Discount supermarkets such as German ALDI and LIDL have been in the ascendancy, opening many new branches and gaining market share from the premium grocers. All of this creates greater demand for McBride’s products.

Since 2019, branded products have seen a contraction of 7%, while white label products have seen their volumes increase by 8%. This suggests that not only are people switching, but people are consuming more of the white label products - perhaps because they can afford to do so given their lower cost. If the trend of switching from branded products to white label (private label) products continues, the growth runway looks good:

Even more encouraging is that McBride’s share of this growing segment of the market is increasing faster than the segment is expanding, indicating that McBride is capturing the lions-share of the growth and its dominance as a market leader is increasing:

The CEO of McBride Plc is Chris Smith. He joined the company in 2015 as Chief Financial Officer, before being appointed Chief Executive Officer on 11 June 2020.

The man he replaced, Ludwig de Mot, had only been in office for seven months before ‘stepping down with immediate effect’. Although no reason was given, it seems likely that his views diverged from those of the board, particularly since he was replaced by an insider having more familiarity with the company's long-term strategic objectives.

Since becoming CEO, Smith has focused on improving the operational efficiency of the business and the company has reported steady financial performance.

The company has undergone restructuring efforts to streamline operations, cutting operating costs and renegotiating sales agreements to include price adjustment provisions in certain circumstances. The business has also introduced an input cost hedging strategy which will make it more resilient in future.

Asset turnover metrics are all up significantly, which certainly indicates that the company is working its capital harder than before. Despite employee numbers having reduced by 14% since 2020, revenues are up 28%, so the efficiency is there for all to see. Gross margins have stabilized in the mid-30s percent and operating margins have returned to around 5% (a level not seen since before the troubles).

The transformation effort is still underway with a plan mapped out until FY28, earmarked to deliver a net £50m benefit to the business.

Both revenues and gross margins are increasing in tandem, which has brought about improvements in cash flows. In April, the company raised its guidance for the fiscal year ending June 30, projecting adjusted operating profit to be 10% above market expectations with a continued reduction in net debt. When the fiscal year ended McBride confirmed that it had met this guidance, reporting adjusted operating income of £66.4 million and reducing net debt to £131.5 million, a £30 million decrease since last June - £20.8m of which came in H1 2024 alone. This suggests that debt reduction is accelerating, which is great news.

Despite this achievement, the company’s decision not to further increase its guidance disappointed the market, leading to a 10% drop in the share price. This could present a buying opportunity.

The company is likely to continue generating significant cash flow, enabling it to further reduce its debt. Ultimately, surplus capital is likely to to applied to either a resumption of dividend payments or, preferably at current valuations, share buy-backs which would be more accretive to shareholder returns.

The benefits of the cost-cutting measures that McBride undertook to restore profitability are not yet fully reflected in the company’s earnings and the company targets an EBITDA margin of over 10%, almost double where it is today. The tables below demonstrate how ROCE has improved in all five segments of the business and again this is not fully reflected in the company’s value:

The enterprise value of McBride is just 4.2x estimates of fiscal 2024 EBITDA and 6x fiscal 2024 normalized earnings. Both ratios will come down as net debt declines and, on a three year forward basis, the company could be trading at approximately 3x EBITDA, suggesting that there is still a significant amount of upside in this company.

>> Trading Update 17th January 2025<<

The Group expects to report first half adjusted operating profit approximately 8% ahead of the same period last year (on a constant currency basis). Full year adjusted operating profit is expected to be in line with internal expectations.

Group revenue was 2.9% higher than the prior year period on a constant currency basis, with volumes up 5.9%. Private label volumes grew by 2.4% and contract manufacturing volumes increased by 69.0%, driven mostly by the successful launch of two new multi-year contracts with large FMCG clients over the past six months.

Customer service levels have continued to improve, delivering the increased volumes and supporting further opportunities for strategic partnerships with key customers.

The Group also continues to make good progress on debt management. Net debt at the period end was £117.6m (30 June 2024: £131.5m). On a 12-month trailing EBITDA basis, net debt cover was circa 1.3x (30 June 2024: 1.5x).

The recent, new, long-term financing facilities have allowed the normalization of the Group's capital allocation options. As a result of this and the ongoing strong trading performance, the Board intends to re-instate annual dividends in relation to the current financial year. The details will be announced at the time of the final results in September 2025.

The Group's interim results will be announced on 25 February 2025.

I have discovered that a provision of the RCF states that, "no dividends will be paid to shareholders until there is an exit event, being a change of control, refinancing of the RCF in full, prepayment and cancellation of the RCF in full or upon the termination date of the RCF, being May 2026."

I don't view this as a problem, as dividends are not an efficient way to allocate capital. Next week, I will publish a special post discussing the issues with dividend policies that every shareholder should be aware of.

Importantly, there appears to be no restriction on share buy-backs, which would be far more accretive to shareholder returns given the current share prices.