Nexus Infrastructure Plc (London AIM: NEXS)

URL: https://www.nexus-infrastructure.com/

Share Price £1.35 GBP / Market Cap £12.2 million / EV £14.14 million

Net Asset Value £31.57 million

Zero Long-Term Debt

Restructured and Streamlined

Diversified via New Acquisition

Disclaimer & Disclosure: The author has no position in Nexus Infrastructure at present, but this may change in due course. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

Introduction

What do you do if you manage a business with multiple subsidiaries that trades at a significant discount to the sum of its parts?

If feasible, you break it up to realize its full value.

Now imagine that you were able to sell the two smaller parts of the business for a disproportionately large percentage of the groups total market cap, meaning that you are left with the largest part of the business at a huge implied discount to its intrinsic value.

Next, you could use the proceeds of sale to acquire 80% of the outstanding shares, thereby crystalizing the mis-pricing of the market to the advantage of the company and its shareholders.

That would be a smart move, right?

Well, this is exactly what happened at Nexus Infrastructure Plc (Nexus).

The Nexus Business

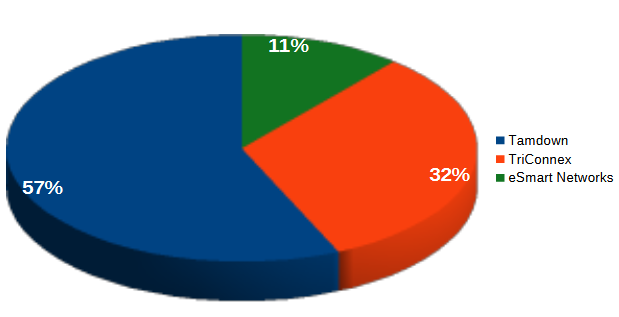

The 2022 segmental breakdown of Nexus by revenue was:

Nexus completed the sale of its TriConnex, the company's multi-utilities business, and eSmart Networks, the energy transition infrastructure division. Both were acquired by FWCP Spark (UK) Holdco Limited, a wholly owned subsidiary of private equity firm FitzWalter Capital. The total cash consideration for the sale was £77.7 million.

The remarkable thing about this deal is that it was agreed in December 2022, completing in February 2023, when the market cap of the entire Nexus group was £79.8 million. Quite why FWCP Spark didn’t simply acquire the entire group, which it could have done for a very similar price, remains a mystery. But it becomes clear which party in this deal achieved the better outcome.

“[The deal is] a positive outcome for our shareholders and stakeholders, crystallizing the value of TriConnex and eSmart Networks, while ensuring that Tamdown is well capitalized for the future as it continues to make operational progress."

Richard Kilner, Nexus Chairman

Most of the proceeds of sale were used, by way of tender offer, to repurchase just over 80% of shares outstanding at a cost of £60.55 million. The remainder was retained by Nexus to strengthen the balance sheet and ensure adequate working capital for Tamdown, the company's sole remaining operating business.

Tamdown is engaged in civil engineering for residential housing developments. It delivers essential infrastructure including earthworks, building highways, substructures including basements, and installing drainage systems. In short, all of the essential work that needs to be completed at the outset of a large housing development project before the construction of the housing units begins. This is hugely beneficial because the work schedules of Tamdown are unaffected by other subcontractors as it is always the first on site.

After the divestment of TriConnex and eSmart Networks, Nexus saw changes in its leadership. CEO Mike Morris and CFO Alan Martin stepped down to join FWCP Spark, the acquiring company, as employees and directors to oversee TriConnex and eSmart Networks in their new setup. Despite this transition, Morris retained a significant equity interest in Nexus, 8.84% valued at over £1 million GBP, maintaining a seat on the board as a non-executive director. Martin has fully exited the business.

Following their departure, Charles Sweeney, previously the Chief Operating Officer, was promoted to CEO, and Dawn Hillman, former financial director of TriConnex and Group Company Secretary, stepped up as CFO. Sweeney and Hillman each own smaller equity holdings worth about £50,000, relatively modest compared to their salaries, while Kilner, Chairman since 2016, holds shares valued at only £10,000. Increasing their financial stakes in Nexus using their own personal wealth would strengthen their alignment with external shareholders and would be nice to see. While all three may receive shares through long-term incentive plans, this isn’t the same thing and tends to misalign interests, contrary to popular opinion.

Nexus’s two largest shareholders are Peter Gyllenhammar AB, a Swedish activist investment firm with a 28% stake, and Otus Capital Management, a hedge fund with 13% ownership. Gyllenhammar’s strong investment track record and significant holding in Nexus add a noteworthy layer of interest to this investment thesis.

Is Nexus Infrastructure Plc A Good Investment?

Management believes that there are strong long-term fundamental growth drivers for Tamdown, given the structural undersupply of housing in the UK. The recent change in government has resulted in commitments to increase the scale of housebuilding throughout its term in office. This should act as a tailwind for the business over the next few years at least.

In the words of management, the business has been right-sized for the current market conditions, which it believes will position it well for the anticipated recovery in the housebuilding sector.

“We see the pickup in the housing market coming. Tamdown will benefit… not just the existing multi-phase developments we've got, but also in the pipeline of new opportunities that we see with greater transparency now as the months go forward.”

Dawn Hillman, CFO

The new leadership team at Nexus is prioritizing cost-cutting and margin improvement while also steering the company towards diversification in critical infrastructure. This shift aims to create a more resilient and less cyclical business model, allowing Nexus to tap into long-term growth opportunities that are less susceptible to short-term economic changes and volatility compared to its traditional focus on housebuilding.

In line with this strategy, in October 2024, Nexus announced the acquisition of Coleman Construction & Utilities Ltd, a civil engineering and construction firm, for up to £5.38 million. This acquisition strategically complements Nexus’s operations, as it introduces the Group to new sectors and adds services that align well with its long-term goals.

Coleman specializes in water, rail, highways, rivers and marine infrastructure, diversifying Nexus’s activities beyond its primary focus on housebuilding infrastructure.

The acquisition is expected to immediately enhance Nexus’s earnings, with Coleman having reported revenue of £8.3 million and adjusted EBITDA of £700,000 in its latest financial year.

"Coleman has grown significantly over the years to become a leading civil engineering and construction business. Throughout this journey, we have remained committed to the highest standards in health and safety, quality, and customer satisfaction and our success is a testament to our exceptional team. Now with the support of Nexus, we are poised to further develop our business”

Barry Coleman, Co-Founder and Managing Director of Coleman

The earnings-accretive Coleman acquisition is anticipated to bolster Nexus’s financial position which will aid in the turnaround of its core Tamdown division.

It is clear to see how the restructuring plan will deliver diversification, securing high-quality contracts, enhancing operating margins and improve cash generation. Management has indicated that the two-year turnaround plan is advancing well, with operational benefits already beginning to materialize.

"I am very pleased with the progress we have made against our strategic plan. During the year, Tamdown continued to focus on operating discipline and the management of costs whilst delivering a high-quality service to its clients. The team's hard work and innovative thinking has further improved productivity in spite of the challenging market conditions. The business is very well placed to benefit from the widely anticipated upturn in the housebuilding sector.”

Charles Sweeney, CEO

Risks

Over the past 18 months, the housing market has faced a downturn, driven mainly by rising interest rates following inflationary pressures from the Ukraine conflict. The prolonged housing boom since the financial crisis, supported by expanded money supply and low real-term interest rates, has ended. Housing prices, which surged during the “everything bubble,” have not yet adjusted to the reality of tighter monetary conditions, leading to an affordability issue that has sharply reduced demand for new homes.

It is worth pointing out that for many years, the UK has emphasized a housing shortage, yet every street seems to have an abundance of “For Sale” signs outside homes. This suggests that the issue may not be a shortage of housing supply, but of affordable housing specifically - a distinction often conflated by media and seemingly not fully grasped by the new government either.

The government has set an ambitious goal to build 1.5 million new homes over the next five years. While previous governments have consistently fallen short of similar targets, the current administration has introduced mandatory housing targets for local authorities, reformed the National Policy Planning Framework, and streamlined the planning process to remove regulatory barriers that have previously stalled development.

However, the recent national annual budget is significantly raising public sector debt, which was already at an eye-watering 104% of GDP - nearly double its long-term average. The problem is that more government borrowing is achieved by issuing more government bonds, the increased supply of which pushes their price lower and bond yields higher. In short, it pushes up borrowing costs. The rise in debt is aimed at funding huge amounts of public infrastructure spending, but it also increases the fragility of the UK economy and the announcement has already weakened currency. For a country that is a net importer, a weaker currency is inflationary, introducing more upward pressure on rates. Finally, the new government has increased the minimum wage threshold and concurrently increased National Insurance paid by employers in respect of each employee. The combination of higher interest rates, inflated input costs and increased labour costs is not good for business and may compress margins if these costs cannot be passed through. Counter to objective it may suppress house building because on the supply side the cost of building increases, while on the demand side affordability of mortgages decreases.

On the positive side, Nexus’s strategic pivot into civil engineering and construction through its acquisition of Coleman positions it to benefit from increases non-housing government spending over the next five years. Coleman operates in critical infrastructure sectors that support national priorities related to climate adaptation, environmental protection, societal needs, and energy security. These sectors offer long-term growth potential and are less affected by short-term economic fluctuations.

Another risk worth calling out is customer concentration risk. Five of its clients each account for more than 10% of its revenue, so losing a major customer could significantly impact the company’s financial performance. Nevertheless, Nexus works with many of the UK’s established homebuilders (including Taylor Wimpey, Persimmon, Vistry Group, Barratt Homes, and Bellway) and has built a strong reputation over its 45 years in operation, making it unlikely that these clients would look elsewhere.

Tamdown competes by tender for contracts offered by the big building firms and it has historically won at least one out of every three bids, with the current year-to-date win rate improving to one in 2.4. Management attributes this high win rate to Tamdown's focus on multi-phase developments, which currently make up approximately 75% of sales. These large-scale projects involve fewer competitors, as only a limited number of firms can provide services at the necessary scale.

On average, multi-phase developments take around eight years to complete, with each phase requiring a separate tender. However, once the initial phase is secured and a relationship with the developer is established, housebuilders tend to retain the same contractor for the remainder of the development.

Financials and Valuation

The market valuation of Nexus may not fully reflect the potential and asset base of its restructured business. Additionally, investors ought to be encouraged by Nexus' new management team and their execution of the company's strategic plan.

First, consider the balance sheet. Nexus holds £9.2 million in cash and equivalents, a substantial amount relative to its market cap of £12.2 million. Nexus has no long-term debt; its only long-term liability relates to capital leases. Its net asset value stands at £31.6 million against an enterprise value of just £14.4 million, compelling figures that potentially highlight its undervaluation.

This is what makes Nexus a special situation.

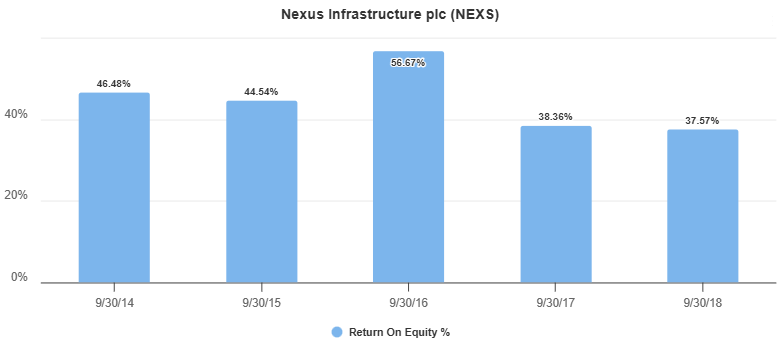

Trading at a discount to book value isn’t unusual - it’s a product of returns generated by the business. A business generating low returns on equity needs to trade at a discount to book value in order to produce the requisite earning yields to attract investors.

Prior to the economic turbulence of the early 2020s, Nexus was consistently profitable for decades, including during the 2008 financial crisis. For a business operating in the cyclical housebuilding industry this is noteworthy.

In the years leading up to the 2020s, it had consistently achieved gross margins in the high teens, sometimes nearing 20%. Operating margins averaged around 6.5%, with free cash flow margins in the low to mid-single digits. While not extraordinary, these returns supported healthy Returns on Equity (RoE) as the chart below demonstrates.

Then came the economic turbulence introduced by Covid-19, the invasion of Ukraine, high inflation and a spike in interest rates. The house building industry was hit hard and these challenges caused RoE to turn negative for the first time.

Inflation was a particular problem because tenders for contracts are at a fixed price that is set in advance. So inflationary pressure was entirely absorbed by Nexus. It is unlikely that 11% inflation rates will return any time soon.

The business was also hit by the bankruptcy of a customer, Ilke Homes in 2023, which resulted in lost sales and a one-off write-down in receivables.

It was a perfect storm, which was bruising but not life threatening for Nexus. It prompted the restructuring of the business - focusing on cost reductions, diversified revenue streams, and insulation from future economic volatility - all of which positions Nexus to regain profitability while being a more robust business in future. With a government ramping up infrastructure spending, Nexus’s shift to critical infrastructure appears timely. Capitalized at 0.39x book value, Nexus only needs to reach a RoE of 3.9% to produce a 10% earnings yield, and if RoE returns to half its historical highs, achieving around 20%, the earnings yield would reach 50%, implying an earnings multiple of just 2x.

The valuation looks very cheap offering a favourable asymmetric risk/reward skew.

Five key drivers shape shareholder returns: revenue growth, improved margins, multiple expansion, share count reduction, and dividends.

For the fiscal year ending September 30, 2024, Nexus expects revenue of £56.7 million, in line with market forecasts. While lower than pre-Covid levels, this figure comes from only one division, whereas the company previously operated three. Plus revenues from the Coleman acquisition will further contribute in the next fiscal year.

Nexus is restructuring at a cyclical low, yet its Tamdown order book has risen 23% year-over-year to £51.5 million. Additional contracts worth £15.9 million were secured post-year-end, pushing the order book to £67.4m, so the momentum continues.

Nexus’s operating leverage is a double-edged sword. In downturns, fixed costs can weigh on margins, but in an upturn, this leverage can lead to outsized gains as revenues rise. As Nexus exits the cyclical low, margins are already recovering; Tamdown’s gross profit margin improved to 13.5% in its recent half-year results, up from an average of 8.2% in the financial years 2021 to 2023, reflecting the benefits of cost controls and operational enhancements.

Nexus expects to return to profitability within the next year, as the housebuilding market recovers and its operating leverage takes effect. Analysts project that Nexus could maintain RoE between 12% and 18% over the medium to long-term, implying earnings yields of 30% to 45% on today’s book multiple, equating to a forward earnings multiple in the range 2.2x to 3.3x. Such valuations will attract investors, likely driving up the share price and expanding the multiple.

Looking again at the five drivers of shareholder returns: revenue is growing, margins are improving, and there is strong potential for multiple expansion, creating a powerful compounding effect on shareholder returns.

On share count reduction, Nexus’s management has shown openness to buy-backs, having recently reduced shares outstanding by 80%. If the stock price remains below intrinsic value, further buy-backs are plausible.

Finally, I need to address my least favourite and most mis-used capital allocation lever: dividends. The company has committed to paying a dividend and implied that it will adopt a progressive dividend policy - why? There is a common misconception among corporate leaders and shareholders alike that dividends are the secret to wealth creation, so paying them will enhance the appeal of Nexus as an investment. However, dividends are usually entirely the wrong way to allocate capital - I shan’t labour the point as I have expressed my views on dividends in detail before. If you are interested please see: Dividends: The Naked Truth

Conclusion

Nexus is a micro-cap company that remains largely under the radar of professional investors. It’s listed on London’s Alternative Investment Market (AIM), a platform typically dominated by retail investors who are attracted by AIM’s tax advantages. Unlike professional investors, these retail participants are generally less inclined to perform in-depth analysis, and it’s worth noting that UK retail investors often differ in approach from their North American counterparts.

On the surface, Nexus might not appear attractive when viewed through typical online screeners. Its revenue has declined, which might seem unfavorable without understanding that this is due to the divestment of two out of its three business segments. Additionally, the company’s recent shift to negative profitability can be a red flag for those who overlook the cyclical nature of the business.

However, for investors willing to look beyond these initial impressions and examine the specifics of this unique situation, Nexus presents an intriguing opportunity.

"Tamdown competes by tender for contracts offered by the big building firms and it has historically won at least one out of every three bids, with the current year-to-date win rate improving to one in 2.4. "

how many of the big building firms competitors is there in the market?

"Inflation was a particular problem because tenders for contracts are at a fixed price that is set in advance. So inflationary pressure was entirely absorbed by Nexus. It is unlikely that 11% inflation rates will return any time soon"

I am not sure regarding inflation going forward, and I expect a lot of volatility in the coming years, unless/as long as geopolitics reaches new equilibrium.

Therefore I am interested if going forward, they have some inflation protection clauses in their contracts...?