Manolete Partners | Perfectly Placed for 2023

Recession Looming, Inflation Soaring, Insolvencies Climbing: The Perfect Time To Invest!

Date: 15th December 2022

Theme: Small cap organic compounder

Assessment: Oversold

Author’s Strategy: Buy / Accumulate

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

Executive Summary

Manolete Partners (London AIM: MANO), a small cap UK company, is a real hidden gem.

Input costs are soaring, interest rates are rising, money supply is contracting and many over leveraged companies that thrived during the ZIRP (zero interest rate policy) era are now struggling. To make matters worse, extraordinary inflation has caused a cost of living crisis which means that people have far less disposable income in their pockets so spending is also down. Businesses are feeling a concurrent buy side and a sell side shock. The result, inevitably, is a spike in corporate insolvencies which is bad for the economy as a whole, but good news for MANO which is in the business of insolvency litigation funding. This is a perfect counter cyclical play.

First, an historic piece of relevant trivia for you. Champerty is an old word that describes the practice of a third party funding litigation. The practice was outlawed in medieval England on the basis of purity of justice: those with no standing in a legal action should not meddle in it. However, attitudes have changed and the emphasis in modern times is on access to justice. In 2010, Lord Jackson in his review of civil litigation costs recognised the fact that third party funding enables greater access to justice for litigants and in doing so provides a “social good”. Addressing the issue in 2013, Lord Neuberger, the president of the UK Supreme Court, said that “access to the courts is a right and the State should not stand in the way of individuals availing themselves of that right.” As such, champerty is permitted and so third parties are able to provide litigation finance.

More particularly, insolvency is the only area of law in the UK where the rights in a legal claim may be purchased by a third party. This is because the Insolvency Act 1986 uniquely allows a Liquidator and Administrator ("Office Holder") to sell an insolvent company's legal claims to third parties, for the benefit of creditors. These powers were further extended by the Small Business Enterprise and Employment Act 2015, which allow the Liquidator and Administrator to sell the claims that arise in their capacity as an Office Holder of the insolvent company to a third party.

Manolete Partners benefit from this legal anomaly and so own 95% of their claims.

Acquiring a legal claim, rather than funding it, puts MANO in the driving seat as it is in complete control of the management of the case and so it is perfectly placed to minimize losses, control costs and so maximize gains.

Cases often become too financially risky for an unfunded claimant to pursue and so, as costs mount over time, some of these claims are withdrawn for want of funding. Defendants play on this dynamic using delay tactics to prolong litigation in order to drain energy and financial resource from the claimants. This is entirely inequitable as it often cheats claimants out of the justice that they deserve. The legal system has always been a game of whit over merit and this is why the best lawyers earn the big bucks! Unfortunately, this means that the party with the deepest pockets all too often wins a legal case and this is usually not the meritorious claimant.

This is where MANO adds value. It has the financial fire power to support the case. A fully funded legal claim has real credibility because the defendant knows that MANO has the ability to go the distance if required. As such, early settlements are far more likely. Not only does this bring cases to a conclusion far more quickly, but it reduces the legal costs involved which results in far higher rates of return on capital.

MANO is a pure investment company which is what makes it such an attractive opportunity. It leverages external resource to do all of the heavy lifting (legal and insolvency work) and so the only constraint to growth is the amount of capital it has to invest in acquiring new cases. Additionally, unlike venture capital firms focused on seed funding of start-ups, everything is more predictable with insolvency litigation: length of time until payback, likelihood of success, magnitude of payback.

Insolvency practitioners and their legal counsel acting on behalf of the claimants like to use MANO to fund a claim because they are guaranteed payment for their services. In fact, MANO finds that insolvency practitioners encourage their clients to use the service which ensures recurring revenues.

MANO’s works with from small insolvency firms through to big four accountancy firms. It also acts on behalf of banks and His Majesty’s Revenue and Customs (HMRC) to recover monies owed.

In the niche field of insolvency litigation funding in the UK, MANO has a 67.5% market share.

It is able to cherry pick the most viable claims and typically accepts 30% of those offered to it. This too ensures higher rates of success. It also appears to be an enviable position because it implies that if MANO was minded to expand its investment portfolio with a view to accelerating its growth, it could do so without the need to acquire new customers.

In house expertise is formidable. For example, Stephen Baister with a doctorate in law and formerly the Chief Bankruptcy Registrar (a senior insolvency judge), sits on the board of directors of MANO alongside others that are legally qualified in this field. This means that the monthly case appraisal process is performed by experts.

For the second year in succession, it is the only firm to be ranked by Chambers and Partners in Band 1 for Insolvency Litigation Funding. Mena Halton, who is the only Band 1 ranked lawyer for Insolvency Litigation Funding in the UK, joined in 2014 and leads a legal team of twelve lawyers across the country. Mena recently joined the MANO Board as Managing Director.

Steven Cooklin, CEO and founder of MANO, is a chartered accountant by training and immensely passionate about the business. It was founded in 2009 and enjoyed an IPO in 2018. Cooklin owns approximately 15.7% of the shares in the business and so is well aligned with his investors (Insider Ownership 17.34%, Institutional Ownership 5.93%). Over the past couple of years I have built a rapport with Mr Cooklin and we speak several time each year. He is always happy to give me his time and to address any questions that I may have. Most recently he stated that “The impact of Covid-19, and its consequences on the global economy, is likely to underpin Manolete's strong growth prospects for the foreseeable future".

Business Analysis

The balance sheet is very strong (Debt/Equity 25.9%. Interest coverage on an adjusted EBITDA basis circa 35x. Current Ratio 6.29x) and finances are well managed.

The investments in insolvency cases made by MANO are classified as financial instruments and so are required to be reported pursuant to IFRS-9 (International Financial Reporting Standards). This creates a challenge when analyzing the business because an investment in an insolvency claim is capitalised on the Balance Sheet as an asset of the business. These assets (cases) are marked-to-market on a regular basis and valuations are assessed based on the net settlement value of the claim adjusted by the probability of success. Prior to settlement of the cases these adjustments are recorded on the Income Statement as 'unrealized revenue'. Subsequently, when the case settles an adjustment is made and 'unrealized revenue' becomes 'realized revenue'. Similarly external professional costs incurred during the litigation process are capitalized on the balance sheet as part of the investment in the cases and these are released to the income statement as COGS at the conclusion of the claim.

This problem is not peculiar to Manolete Partners. Amazon has a similar issue with its stake in companies such as Rivian and Berkshire Hathaway with its investment portfolio. Accrual accounting that takes account of mark-to-market revaluations of unrealized money is misleading for investors and so income statement numbers mean little or nothing.

This approach is not tax efficient as it brings forward a tax liability on yet to be realized revenue without associated cost mitigation (more on this later).

All of this to say that the IFRS accounting rules were not designed with a MANO kind of business in mind.

Cash flows are not a good guide of value for this business because it continually churns cash resources to invest in new and existing cases. It generates a cash outflow at the operating level despite producing fantastic returns on capital invested.

Additionally, its auditor insisted that investment in cases not be recorded in the cash flow statement as CAPEX, but instead be included as cash from operations. This makes some sense when one considers that investment in a legal case is not capital expenditure that will depreciate over time. Instead it is, de-facto,the operating business of the company to buy rights in cases with a view to receiving a valuation uplift at a later date. So it is operational activity. However, if the company is constantly reinvesting proceeds of cases into new cases then including the ever increasing levels of investment in operating cash flows means that the cash flow from operations is unlikely to ever be positive. This is misleads some investors, particularly those who are fixated on discounted cash flow models.

Accordingly, some major adjustments are required to be made by the financial analyst appraising this investment opportunity.

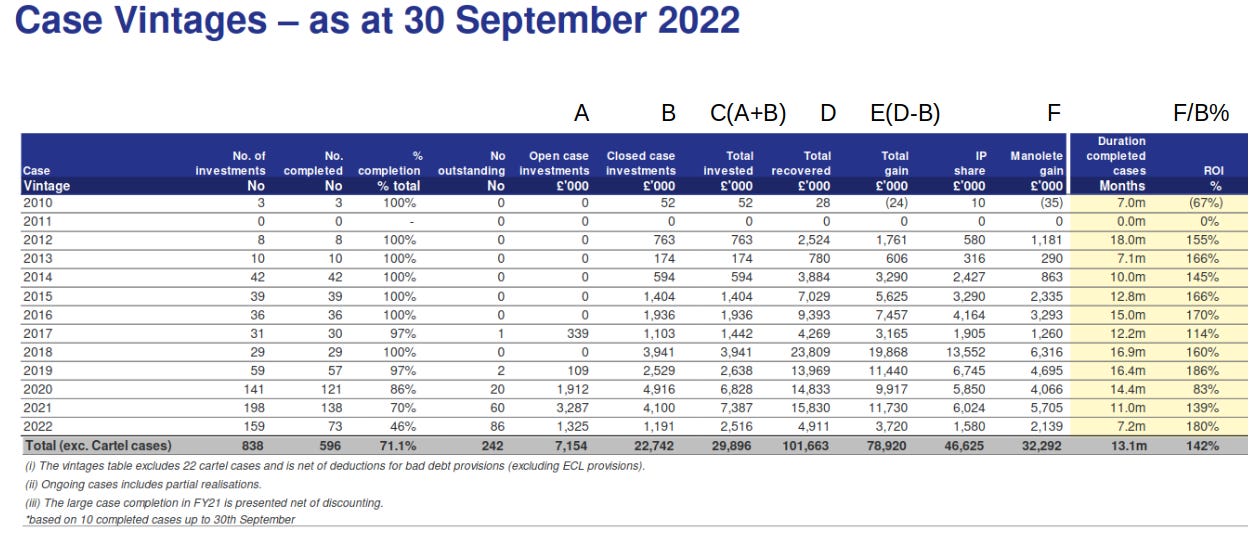

The key data is a consistent long term Gross ROI* of approximately 142% with no shortage of opportunity to reallocate capital in order to benefit from compounding at the same rate. MANO also has an agreed revolving credit facility of £25m with HSBC to enable it to capitalize on new opportunities for which it may have insufficient cash reserves.

[* Gross ROI is the unadulterated return on money invested in settled cases based on the sum recovered in the legal action. It seems to be an industry standard amongst litigation financing firms. It does not account for money currently invested in yet to settle cases and does not factor in OPEX expenditure. As such, the ROIC numbers will be significantly lower. The interesting part worth noting is that the business operates with very high operating leverage. In other words, as the volume of cases increases and generates a gross ROI of 142%, the operating cost base only increases marginally meaning that more and more of the gain being made on litigation drops to the bottom line as the business grows. This means that ROIC numbers will trend higher and higher as the company benefits from economies of scale.]

Please note that the table above, published by the company, is a snapshot in time. Many of the numbers at the bottom on the grey bar are cumulative numbers with the entire history of the company’s performance laid bare for all to see above. So the “Manolete gain” column is the return on invested cases that the business has generated to date since its inception after deducting the capital investment in the case and distribution of money to the Insolvency Practitioner. Again, it does not factor in the operating expenditure of the business.

It is necessary to compare these tables, year on year, to calculate the marginal changes in each period. So in March 2022, column F showed the Manolete gain at little over £27m yet here just six months later it is over £32m and so the business generated a gain on settled cases of approximately £5m in that half of one year.

In the same way, it is possible to calculate the new investment in cases each year using the difference in column D from one period to the next.

Investors should be aware that MANO consistently delivers triple digit ROI, but investors must appreciate that investments begin life with unrealized value being a risk adjusted expected return on investment. Litigation concludes, on average 11 months later whereupon returns are crystallized but settlement may take a further 12 months.

From 2017 until 2021 realized revenues increased at 46.1% CAGR with one, not to be repeated, exception. The Covid pandemic delivered a double shock to MANO. First, Courts of Law were not sitting during the strict lock-downs and so far fewer existing cases were resolved. Second, in relation to new cases, the market was artificially suppressed by unprecedented UK Government intervention designed to protect businesses from insolvency during lock-down.

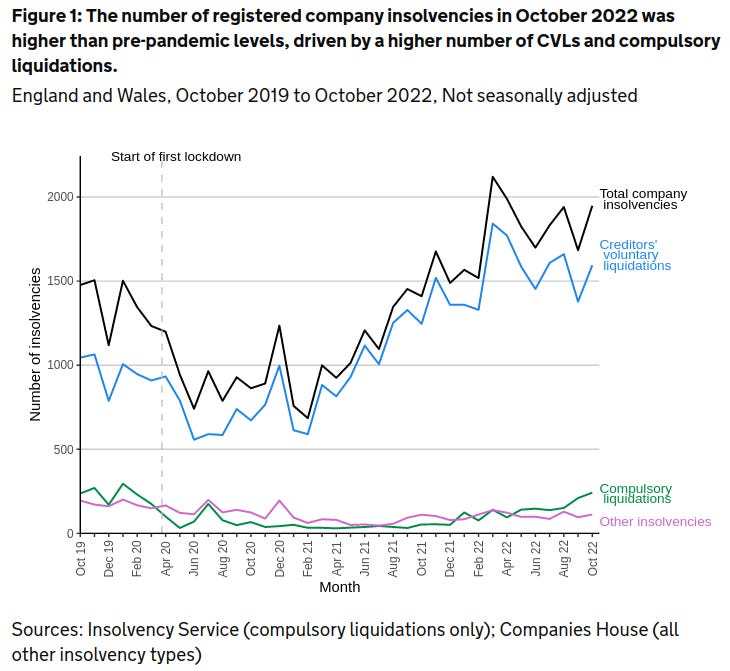

Government measures were enacted in June 2020 and ended on 30 September 2021. Ironically, rather than avoiding insolvencies it merely delayed them. This meant that when the government intervention ceased, insolvency numbers spiked. This was followed by the extraordinarily high inflation and monetary policy tightening of 2022 which has pushed more companies over the edge. The net result is that insolvency numbers are now way higher (see Figure 1) than pre-Covid and are anticipated to rise further into the recession of 2023. Consequently, MANO is already seeing a significant up-tick in new cases.

The Covid pandemic has delivered another gift for MANO. Banks were required to provide businesses with loans under the Government’s Bounce Back Loan Scheme. Due to the urgency of the crisis, due diligence was necessarily relaxed and widespread fraud ensued. Now the banks are seeking to recover money from fraudulent claimants.

Barclays Bank has instructed MANO to act for it in this regard. It issued 345,006 loans worth £10.8bn under the scheme. Other UK banks are watching this pilot project from the sidelines and it is anticipated that they too will instruct MANO to act for them. The banks were indemnified by the UK Government for any consequential losses from the issuance of these loans, but they do have a duty to recover money paid to fraudulent claimants. Compulsory liquidation proceedings have been issued against approximately 100 suspected fraudsters so far. Whatever money MANO claims back, it will retain half and the balance goes to the Government. So this looks like being a golden goose that will keep laying golden eggs for many years to come.

One last point worthy of mention is the Cartel Cases. These are fundamentally Competition Law claims but all assignor companies are insolvent and in liquidation so MANO owns all of its Cartel case claims. Liability has been established in all the claims against a number of leading truck manufacturers for operating an illegal price fixing cartel during the years 1997 to 2011. The task for MANO is to prove the quantum and causation of the claims. Law firms working in conjunction with MANO and the Liquidators of the various companies have been assembling the evidence to tens of millions of pounds of truck purchases over the cartel period. The claims are for the over-charge element of the truck purchases plus interest. The Board has always conservatively held the value of these claims at a highly discounted level and so in all probability these will ultimately recover significantly more value for shareholders. Judgement in related cartel claims bought by British Telecom Plc and Royal Mail Plc are due imminently. These are seen as test cases which will have a read across on the valuation of the Cartel Cases in the portfolio of MANO (the carrying value of its 22 Cartel cases is £12.2m as at 31 March 2022.)

Issues To Consider

The dividend policy of MANO remains confused. At IPO it was poorly advised that it needed to pay a dividend in order to attract institutional investors. Many shareholders subsequently lobbied the company to cut dividends entirely because the opportunity cost of not applying all capital to growth was way too high. The company instead fudged the issues by reducing the dividend by circa 66% without providing a clear message as to its motives. Some invariably misconstrued this as the dividend being cut due to poor performance which couldn’t be further from the truth. The share price was negatively impacted as a result which was a great shame, but presented another golden opportunity for a wonderful entry point for the canny investor.

The other issue, which actually turned into more of a positive, was a profit warning issued on 9th September 2022. As explained above, IFRS-9 requires the company to report unrealized revenue based on mark-to-market assessments of value. This creates a tax liabilities on revenue not yet received which is cash flow disadvantageous. Bear in mind that the assets held by MANO are highly illiquid third party rights in insolvency litigation, for which there is no market to use for price discovery purposes, so it would not be unreasonable to book these assets at cost until the litigation is at an end. In this way there is no unrealized gain on the income statement and tax liabilities are not pulled forward. On the same basis, the external professional costs incurred in litigation should arguably be expensed rather than capitalized as that too would reduce the tax burden. I had lobbied the company to make these changes but no action was taken. Then, in September 2022, MANO received an adverse judgement on one of its larger cases. This required a significant adjustment to the unrealized profit line of the income statement, hence the statutory profits warning which unsurprisingly resulted in a significant dip in the share price. However, the good news is that as a result of this incident the company is now taking a more prudent view of the valuation of its portfolio of cases which will result in better cash flows going forward. The other piece of good news is that legal counsel has advised MANO that the High Court judgement in the aforementioned case was flawed and an application for leave to take the matter to the Court of Appeal has been granted (something not easily achieved). It should be noted that this was extraordinary as it is the first time in the company’s 13-year history that it has found the need to take a case to the Court of Appeal. The appeal case will not be heard until sometime in 2023, but it is more probable than not that the judgement will be overturned in favour of MANO which would nullify the reason for the profit warning and the written down profit will be reinstated on the income statement.

Conclusion

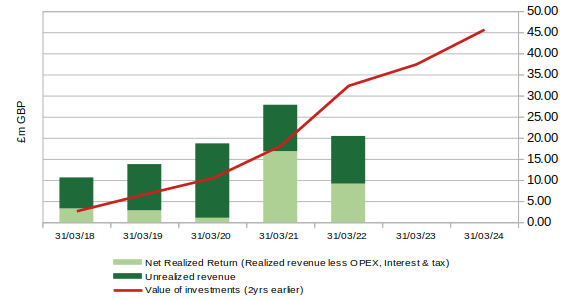

As explained above, a MANO case typically takes 11 months to complete and a further 12 months to settle. The chart below accounts for this by plotting investments made two years earlier against the returns on investment (realized and unrealized combined).

Since IPO in 2018 until 2021 it is evident that return on investment has been exceptionally strong.

The closure of the Courts during Covid lock-down is clear to see in the dramatic fall in realized returns in 2020. However, when the Courts re-opened in 2021, realized returns rebounded strongly.

The gap between the line and the bar that appears in 2022 is testament to the integrity of the company. Unrealized revenue is assessed based on the probability of a successful outcome which is a derivative of how far progressed the litigation process is. Due to the Covid effect, the progress of claims was curtailed and this impacted on the unrealized valuation ascribed by the company, seen clearly here.

The good news is that the company is playing catch-up and so the bars seen on this chart will, in coming years, not only correlate to the strong upward trend in the value of investments, but they will also include the 2022 shortfall.

Of note is that the gross cash generation from completed cases from prior year vintages stood at £21m in the first 8 months of this year. That strongly supports the past years’ unrealized profit estimates. It compares favourably to £15.6m gross cash generation for the entire 12 months for the year ended 31 March 2022.

With a Market Cap of circa £110m GBP, an enterprise value of £104m GBP, adjusted earnings margins tending towards 40% and IRRs being achieved of well over 130%, in the next year or two top line revenues will be through the £50m mark and adjusted earnings will be pushing through £20m, so the forward adjusted earnings multiple is little over 5x. That implies an owner earnings yield of close to 20% and takes no account of the growth path of the company.

We are heading into challenging recessionary times will provide a wonderful tail wind for MANO. Demand for its service are anticipated to sky rocket and they are already accelerating sharply.

November 2022 saw a record number of new case investments, 27 in a single month. December is tracking at the same run rate.

This business is a serial organic compounder in a market with a TAM (target addressable market) of £1.5bn per annum, according to Professor Peter Walton at the University of Wolverhampton, which is far larger than the existing MANO portfolio, indicating a long runway of growth potential ahead.

The other interesting part about this investment opportunity is the ownership structure:

Long term investors

CEO Cooklin and family own a 16.51% stake (insider ownership totals 17.34%)

Moulton Goodies, investment vehicle of famous Venture Capitalist Jon Moulton, owns 26.53%

Mithaq Capital, a Saudi family office, owns 17.32%

Michael Faulkner, CEO of River & Mercantile, backed Manolete since 2009 inception, owns 12.78%

TOTAL = 74%

This means that only 26% of the stock is available in the market. Institutional ownership is relatively insignificant at 5.93% at present. Why is this significant?

As the company grows its market capitalisation, it will qualify for inclusion in the FTSE250 index. This will require all of the FTSE250 tracker funds to invest and so this will skew the demand/supply dynamics. MANO will need to increase its market cap by approximately 3x to get there, but that isn’t such a big ask. Earnings are accelerating over the next couple of years and the stock may also benefit from multiple expansion as operating leverage kicks in.

In summary, this is a growth oriented business with high profit margins, operating in an expanding market, with a very favourable risk reward skew, an exceptionally high return on capital, with a leading industry position and a unique service offering. Best of all, it is not currently on the radar of most investors and being a small cap it doesn’t yet meet the market cap threshold for big institutional investors, but it soon will and that will act as yet another catalyst to drive this stock higher.

Update following audited results for FY ended March 2024

Following that challenging Covid period, the insolvency market picture has now completely changed, presenting Manolete with the most attractive trading conditions since the business was formed in 2009. Significantly higher prevalent interest rates, heightened concerns over geo-political conflicts in Eastern Europe and the Middle East and the withdrawal of the largescale financial supports provided by the Government to UK businesses during the Covid-19 period, has resulted in the highest level of UK insolvencies for 30 years. Insolvency Service statistics from January 2024 show the number of Creditor Voluntary Liquidations, the largest constituent part of the UK insolvency market, in 2023 was at its highest level since 1960.

The Company delivered strong performance in the year ending 31 March 2024, with a record 311 new case investments, up from 263 in FY23. This growth reflects the Company’s expanding network of insolvency practitioners and lawyers across the UK, allowing it to capitalize on a market that has rebounded from the static conditions caused by the government's temporary Covid support measures.

Financially, the Company reported a 27% increase in revenue, reaching £26.3m, compared to £20.7m in FY23. Operating profit stood at £2.5m, a significant improvement from the £3.1m operating loss in the previous year. There were 251 case completions, generating £24.2m in realized revenue, and gross cash recoveries from completed cases amounted to £17.7m. The Company ended FY24 with 418 live cases in progress, up from 351 in FY23.

There have been more material and positive developments relating to the Company's cartel cases in recent months. Early in calendar year 2023, the judgments for the large truck cartel cases relating to BT Group Plc and Royal Mail Group Limited were handed down with significant damages and interest being awarded to the Claimants. Following publication of these rulings, an independent expert valuation firm has assessed the value of Manolete's 22 cartel cases. The cartel case carrying valuation as at 31 March 2024 was £15.1m and the valuation therefore represents Manolete's percentage ownership of the overall case valuation. These claims are currently stayed pending resolution by means of alternative dispute resolution (negotiated settlement) which is likely to be successful based on the precedent set by the BT and Royal Mail claims. In the event that a mutually agreeable settlement is not reached, the case is expected to be decided by Court hearing in September 2025. This implies at at some time in the next 12 months, the financial position of Manolete will change significantly and a re-rating is likely.

Despite carrying a net debt of £12.3m, which the business expects to pay down when the Cartel cases settle, the Company has agreed to revised covenants with HSBC, transitioning to cash-based rather than profit-based measures, and reducing its debt facility size to £17.5m.

With a significantly improved business performance, a growing team, and a high number of corporate insolvencies in the UK, the Company is well-positioned for sustained growth, further supported by a recovery in larger case investments in the latter half of FY24.

UPDATE: Interim Results November 2023 - When increasing insolvencies becomes good news!

MACRO: In the UK, insolvency volumes saw an uptick amidst a challenging corporate operating environment exacerbated by higher interest rates and inflation. Recent data reveals a notable 25% increase in the number of businesses experiencing critical financial distress between Q2 and Q3 2023. Approximately 480,000 UK businesses are currently grappling with 'significant' financial distress, marking an 8.7% increase from Q2 and a 4.7% rise compared to the previous year. Sectors causing heightened concern include construction (up 46% from Q2 to Q3), real estate and property (up 38%), followed by the retail sector. The confluence of factors such as high inflation, elevated interest rates, weakened consumer activity, and an uncertain economic environment collectively intensifies the pressures on businesses.

MICRO: In the context of the macro backdrop, and after almost two years of the UK Government's efforts to temporarily suppress insolvencies during the Covid pandemic, UK insolvencies and Creditors Voluntary Liquidations (CVLs) have surged to levels comparable to those seen during the 2008 financial crisis. Larger company insolvencies, primarily entering the process via Administration, have also rebounded to pre-pandemic levels. Manolete, a company specializing in insolvency litigation financing, began benefiting from increased business in H2 FY23, resulting in robust growth. H1 FY24 financial results exhibit continued strong growth across all key performance indicators, with a notable 104% revenue increase compared to H1 FY23. Profitability numbers YoY are misleading because of an extraordinary write-down that occurred last year, but the company is generating positive cash flows and the portfolio of cases is growing at an impressive rate. The Company ended H1 FY24 with 417 live cases in-progress, a 58% increase over the previous period-end. In anticipation of greater volumes of work, the business has expanded its litigation team by 15%. All of this implies that a key inflection point has been reached and current levels of profitability are likely to be the start of far better things to come.

It should also be noted that the initial surge in insolvencies post-April 2022 was driven by a sharp and sustained rise in CVLs, mainly representing smaller companies with lower claim values. This resulted in an 18% lower average completion value per case in H1 FY24 (£79.3k per case) compared to H1 FY23 (£96.8k per case), excluding an exceptionally large single case. The recent seven-month period has witnessed a sustained recovery to pre-pandemic levels of Administration appointments, and as the insolvency market evolves through the current business cycle, the Directors anticipate a return to higher average case sizes, reflecting a greater mix of larger company insolvencies.

The Cartel cases are expected to settle in 2024 which will result in a large extraordinary cash flow event to the upside.

Last but by no means least, the pilot project undertaken to recover monies fraudulently claimed during the pandemic under the Bounce Back Loan (BBL) scheme, has been been a success. The volume of these claims is anticipated to increase from Barclays bank, Manolete's partner in the pilot project. Additionally, a second major UK bank will be appointing Manolete to act on its behalf in this regard. This is high margin business which will augment cash flows from underlying insolvency work.

In summary, all looks good and 2024 promises to be a good year for shareholders. It is entirely baffling why a company which finds its prospects to be better than ever has a share price trading at the lowest end of its 5 year range, but this almost certainly looks like a fantastic opportunity to jump in or to scale up.