Richard Feynman | Learn From The Best

What a Math and Physics Genius can teach us about Investing

Who Was Richard Feynman?

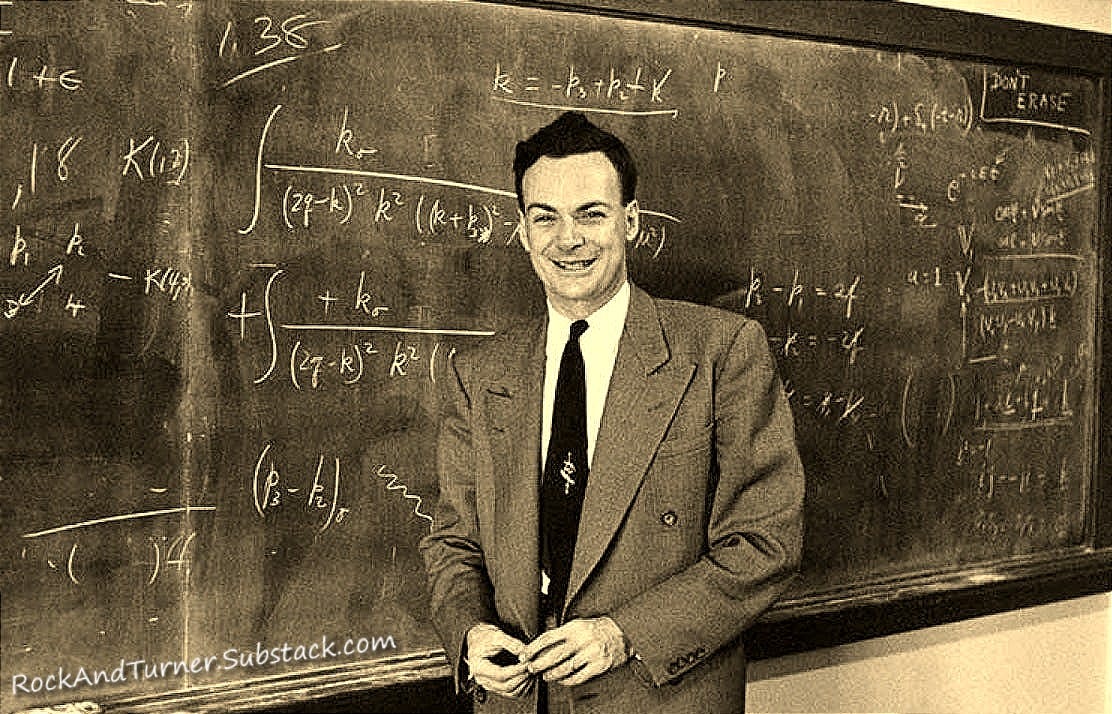

Richard Feynman was a brilliant American physicist and mathematician who revolutionized quantum mechanics and electrodynamics. At just 24, he was handpicked to join the Manhattan Project, Robert Oppenheimer’s top-secret team of the brightest minds working on nuclear weapons during World War II.

When Feynman delivered his first technical physics seminar at Princeton University, it was attended by legends like Einstein, Wolfgang Pauli and John von Neumann. Einstein took a professional interest in Feynman’s work, suggesting his classical theory method could be useful in understanding gravity within general relativity.

Later, in 1965, he won a Nobel Prize for his groundbreaking contributions to physics.

Known for his creative problem-solving and out-of-the-box thinking, Feynman is considered one of the most influential physicists of the 20th century.

By adopting Feynman's problem-solving approach, investors are able to develop a more robust, flexible and insightful method for evaluating companies and making investment decisions. This approach complements traditional quantitative analysis, potentially leading to more accurate valuations and better-informed investment choices.

What Does Feynman Have To Do With Investing?

Feynman’s approach to physics and mathematical problem solving was rather unconventional and this, together with some of his more complex discoveries have practical applications in the financial world.

Just as Charlie Munger used to preach, ‘invert, always invert’, Feynman did much the same in the world of science. He started with an imaginative, almost philosophical idea, and then used math to prove it worked. It's like he used his imagination to solve a puzzle, then used math to check his answer, instead of relying on math alone to find the solution which is what everyone else did.

“I would rather have questions that can’t be answered than answers that can’t be questioned”

Richard Feynman

Feynman believed that it was a mistake to twist facts to suit theories, instead of theories to suit facts. If his idea proved wrong mathematically, he would simply use what he had learned to formulate a new idea and then test that.

“It doesn't matter how beautiful your theory is, it doesn't matter how smart you are. If it doesn't agree with experiment, it's wrong… As I get older, I realize being wrong isn’t a bad thing… It’s an opportunity to learn something”

Richard Feynman

Feynman's approach revolutionized the field of Physics by providing a more intuitive way to understand quantum mechanics, while still maintaining mathematical rigor.

Applying Feynman's approach to investment analysis offers a fresh perspective on company valuation and investment decision-making, avoiding the bias that corrupts the findings of most investors.

Nobel Prize-winning economist Ronald Coase summed it up well when he said that if you torture the data long enough, it will tell you what you want to hear. Most equity analysts have a preconceived idea of what they want to conclude from the data and they simply hunt for a construction that supports their theory. It’s really a case of doing things arse-backwards (another wonderful Munger phrase).

“The first principle is that you must not fool yourself and you are the easiest person to fool”

Richard Feynman

A truly effective analyst will not possess all the answers, but they excel at asking the right questions.

“We absolutely must leave room for doubt or there is no progress and no learning. There is no learning without having to pose a question. And a question requires doubt. People search for certainty. But there is no certainty… We never are definitely right, we can only be sure we are wrong.”

Richard Feynman

Jeff Bezos, the hyper-intelligent founder of Amazon, understood this intuitively. He would never assume that his theory was right until proven wrong; instead he assumed that the theory was flawed until proven to be correct. This deliberate skepticism prompts a fresh perspective and ensures that pertinent questions are raised.

Feynman understood the limits of knowledge and seemed to have a Socratic approach to life.

Socrates, the ancient Greek philosopher, always emphasized the value of questioning everything and maintaining intellectual humility. He is credited with saying, "The only true wisdom is in knowing you know nothing”. He encouraged continuous inquiry and openness to new ideas, rather than closing one's mind based on faith or preconceived notions.

Feynman would counsel that we need to learn how doubt is not to be feared but welcomed.

“It's OK to say, ‘I don't know’.”

Richard Feynman

Feynman recognized that, “Looking back at the worst times, it always seems that they were times in which there were people who believed with absolute faith and absolute dogmatism in something. And they were so serious in this matter that they insisted that the rest of the world agree with them. And then they would do things that were directly inconsistent with common sense in order to maintain that what they said was true.”

Consider what Feynman is saying here in the context of financial markets The dot-com era is a great example. Companies with no prospect of ever generating profits, but instead burning through ever larger piles of capital, were being valued at nonsensical prices. Conventional wisdom in relation to the appraisal of an investment opportunity was eschewed in favour of irrational exuberance. Fear of missing out trumped common sense.

Some may argue that we are witnessing something similar with Crypto currencies.

The key takeaway is that whether you study science or engage in the world of investment analysis, the golden rule is to keep your eyes open, keep your ears open and most importantly, keep your mind open.

Instead of immediately diving into financial statements, begin by formulating a broad theory about the company's potential based on qualitative factors. Consider:

The company's competitive position in its industry

Its innovative capacity and adaptability to market changes

The quality of its management team and corporate culture

Its long-term growth strategy and market opportunities

Based on this qualitative assessment, create a conceptual model of how you believe the company might perform in various scenarios. This model would be more flexible and imaginative than traditional financial models - then use financial data to test the theory.

Feynman has influenced the investment world indirectly in so many ways.

Consider the Feynman-Kac formula, which provides a powerful link between probability theory and differential equations, originally devised for application in mathematics and physics. Today it is used in real-world financial decision-making, particularly in derivative pricing and risk management. For instance:

The formula underpins the Black-Scholes model, which revolutionized options trading and led to the establishment of structured options markets and pricing models for path-dependent and exotic options.

Investment banks and hedge funds use the formula (and its derivatives) to price and hedge complex financial derivatives.

Portfolio managers and risk analysts can use such techniques for portfolio optimization in the presence of stochastic factors applied to interest rate and credit risk models.

As Charlie Munger used to say, formulate a lattice of mental models from various disciplines which may then be applied more broadly to investing.

“The world is much more interesting than any one discipline”

Richard Feynman

Conclusion

By starting with a qualitative theory, you will gain a more comprehensive view of the company beyond just numbers. This method will encourage you to identify broader trends and patterns that might not be immediately apparent in financial data alone.

The Feynman approach acknowledges the inherent uncertainty in financial markets, allowing for a more nuanced analysis of potential outcomes.

Starting with qualitative analysis rather than diving head first into the numbers will help investors to avoid becoming too anchored to specific financial metrics or historical performance. This approach could be particularly valuable for long-term investment strategies, as it considers a wider range of factors that might influence a company's future performance.

Ultimately, to be a good investor you need to possess a curious mind and have a passion for digging into the details in the search for answers to your questions.

“Nobody ever figures out what life is all about and it doesn't matter. Explore the world. Nearly everything is really interesting if you go into it deeply enough.”

Richard Feynman

I am not the first to draw parallels between Feynman’s work and the goals of investors. Much of this work is beyond the scope of this post, but if you are interested I attach the academic paper:

Further reading:

Feynman is one of my favorites, love the way he exuberantly tackled problems with such curiosity. The fun of stock investing is really testing a hypothesis and seeing what happens, the money is secondary to the fulfillment gained by the journey.