Company: H&T Group Plc (London AIM: HAT)

Market Cap (£m GBP): 181.2

Free Float: 86.3%

Date: 19th September 2023

Theme: Organic and Acquisitive Growth

Assessment: Oversold

Author’s Strategy: Buy / Accumulate

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

Established in 1897 by Mr Harvey and Mr Thompson, today H&T Group Plc is a market leading pawnbroker in the UK serving over 100,000 customers annually.

For more than a century it grew incrementally by opening more pawnbroking branches in London and other parts of the UK. Today it boasts a network of 273 stores which is anticipated to increase by approximately 70 over the next four years (+25%). It has opened over 50 in the past 5 years and so this target looks realistic (All new stores are profitable on a run rate basis no later than their second trading year.)

2006 was a pivotal moment when the company became a publicly traded company, listing on the London Stock Exchange. This move allowed the company to raise capital for further expansion and diversification of its financial services.

Although it has expanded into ancillary ventures such as gold purchasing and foreign exchange products to supplement earnings, the heart of its operation remains firmly rooted in pawnbroking and associated retail services (both new and pre-owned products) as the following breakdown demonstrates:

The company has targeted all demographic segments of the British pawnbroking market. In recent years, the acquisition of Albemarle & Bond gave H&T a presence in the high-end pawnbroking market, while the Money Shop acquisition gave H&T a presence in the short-term lending market. Both are growing markets. H&T now has a presence in all major segments of the pawn business.

Having increased its market share in pawnbroking by either outlasting or consuming many of its competitors, the company's robust finances and dominant position enables it to meet the growing demand for small-sum, short-term credit. This establishes a strategic, long-term competitive advantage for earnings growth.

The Landscape

We are currently undergoing a cost of living crisis and many see an outright recession on the horizon. This has been caused by soaring inflation which has prompted a rapid response from central banks in the form of unexpected interest rate hikes which have caught people off-guard.

Anyone struggling to make ends meet and needing to raise a relatively small sum of money over the short term has limited options.

Imagine that you max out your credit card and exhaust your available overdraft facility. Where do you go to raise money until your next pay day?

In 2014/15, the UK's Financial Conduct Authority introduced landmark reforms to curb "extortionate" and "predatory" lending by payday lenders which forced many to close their operations nursing huge losses. So that door to raising cash has closed.

There are always black-market routes to raising cash, but it is ill-advised to borrow from loan-sharks operating in the underworld.

So what do you do?

H&T offers the perfect solution.

Customers enter into a consumer credit agreement with H&T, incurring daily interest charges on a loan secured against the value of the asset that they pledge. Loans typically have a six month contractual term, but customers have the freedom to repay the loan whenever they choose, only paying interest calculated on a daily basis for the actual duration of the loan and with no penalties for early repayment.

This setup allows customers to borrow exactly what they need and only pay interest on that specific amount for the period that the money is needed.

Notably, unlike other types of credit, eligibility for these loans is based on the value of the item to be used as collateral, not the customer's creditworthiness, meaning customers typically don't undergo credit checks. Not only does this mean that money is available quickly and without fuss, but for those people with poor credit this may be the only means of raising cash.

The Business

For H&T, in the event of default there is no recourse to the customer, only the pledged asset. This results in a lack of potential risk or harm to consumers which means that regulators don’t see the need to regulate pawnbroking activity. In fact, in 2018 the British regulator, the Financial Conduct Authority (FCA), conducted a review of the market and stated that pawnbroking was not deemed to be an area in need of regulation.

From H&Ts perspective, pawnbroking model is inherently low risk. The loan to value (LTV) of the collateral being pledged is typically 65% so recovery of sums loaned is assured. Better still, loans are based on trade values which are significantly below retail, so the actual LTV based on retail recovery values is way below 65%.

99% of H&T’s pawnbroking loans are secured against jewellery, gold and watches, with the remaining 1%, by exception, perhaps against a car or a luxury handbag. Unlike many other pawnbrokers, they do not lend against electronic items as H&T is focused on assets that have inherent underlying intrinsic value that will not erode as the item ages. So no Apple iPads, Sony PlayStations or televisions. H&T have the contractual right to sell the item in order to recover sums not repaid and all items accepted as collateral are readily marketable and relatively easy to monetize.

Additionally, unlike other forms of collateralized lending such as the mortgaging of real estate, H&Ts collateral is already in their custody and remains that way for the term of the loan.

There are also limited risks in terms of costs exposure associated with claims management. There is no need to take a customer to court to resolve a default situation. Instead, the short-term nature of lending and the quality of the collateral both provide effective safeguards against losses. Unlike bank loans, capital losses are exceptionally rare and so loss provisions are not required.

This is a super clean business that has stood the test of time.

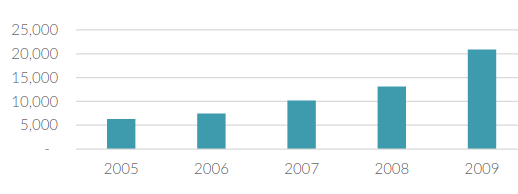

Historical performance demonstrates resilience during challenging economic periods. In fact, while most other lenders suffer impairments of their loan assets during economic downturns, the same is not true for H&T. There is an uptick in demand during recessions and the collateral held avoids capital losses. This appears, to all intents of purpose, to be a recession proof business. Take a look at the table below which shows annual pre-tax profit and see if you can spot the impact of the 2008 financial crisis:

The average loan size stands at approximately £200 and the average term of the loan tends to be around four months.

The current economic situation which has brought about a cost of living crisis for many has resulted in record pledge book growth at H&T. 2022 was us 51% on 2021, and 2023 has been stronger than 2022.

The Investment Case

The Moat

A crucial aspect of any pawnbroking enterprise revolves around the relationships it forges with its clientele and the local community it serves. The items pledged as collateral often hold both sentimental and monetary value. Entrusting these valuables to a third party is not a decision made lightly, and conducting transactions in person with a reputable and trusted business is key.

This acts as a barrier to entry into the industry and H&T's illustrious 125-year history, celebrated in 2022, attests to its well-established reputation in this regard. In 2022, 87% of loans were extended to existing repeat customers which suggests strong recurring revenue. There was also a remarkable 40% year-over-year increase in new customer numbers, so in combination this bode well for the future.

H&T's customer base is financially constrained, and so the company must remain vigilant. It maintains appropriate controls to address risks associated with anti-money laundering (AML) and stolen goods. Automated AML monitoring procedures are designed to identify and provide alerts to any in-store suspicious activity. The scale of the group enables it to deploy this kind of technology and so gives it a competitive advantage over its smaller independent rivals.

The Good

Demand for pledge lending remains at record levels. As at June 2023, the H&T pledge book grew 14% to £114.6m (December 2022: £100.7m; June 2022: £85.1m).

The business is pursuing a multi-channel approach to sales and its online channel originated a record 23% of total sales compared to 14% a year earlier. Much of this may have been due to the company looking to move inventory more quickly by reducing margins on big ticket items such as high value watches. Inventories stood at £37.5m at the midpoint of the year versus £35.5m at the end of 2022, but having peaked at over £40m in April. Margins are expected to normalize in the second half of this year.

Scrap profits were up.

Foreign currency transaction volumes increased 19% and are at record levels with net income up 12% year on year.

Headcount increased from 1,423 to 1,637 which is 14% growth. This almost perfectly mirrors the growth in the pledge book and demonstrates the confidence of the management in the expansion of the group’s footprint and market share. Employee related costs, which account for approximately 59% of total operating costs, increased by 21% year on year. Two thirds of this is the increase in headcount, the remainder is down to inflationary wage pressures.

The business is constantly looking to improve and seeks to offer related ancillary services to its customers in order to enhance both the top and bottom lines. The recent acquisition of Swiss Time Services Limited will bring watch repair and servicing expertise in-house. The acquisition is expected to be immediately earnings enhancing. Watches represent a growing part of the H&T business and a further growth opportunity.

The Bad

Regular readers of my analysis will know that capital allocation is something that I insist on scrutinizing carefully. It is the litmus test for good management.

In the case of H&T, management doesn’t score well. Any company with a progressive dividend policy is walking into a boxing ring with its hands tied behind its back. See this John Malone article to understand why I say this.

Given the strong growth opportunity available to H&T, there are evidently better capital allocation opportunities, yet it insists on paying out large tax inefficient dividends.

In recent years the business has raised capital via both the debt and equity markets to fund acquisitions, to support the pledge book growth, to increase inventory and to finance the rollout of its plans for 70 new stores over the next 4 years.

I am sure that you would agree that it would be incompetent to raise capital through debt and equity markets to pay dividends, but in effect this is exactly what has happened. Management won’t see it this way, but whether you use available cash to pay dividends and then turn to capital markets to fund growth, or you use available capital to fund growth and turn to the capital markets to pay dividends, its all the same and just a matter of presentation.

In September 2022, the company raised £16.9m through a new equity offering. A few years ago the share count was 36.6 million, today it is 42.3 million, so shareholders have been diluted 13.5%.

The company increased its revolving credit facility by c.43% to £45 million (expiring in December 2025), with the option to extend for a period of up to two further years. This is available at interest rates of between 2.4% and 3.3% above SONIA, with a no-use reduction of 50% in respect of the undrawn portion of the facility.

All of this is evidence that the business needs new capital. So why is it leaking capital in the form of dividends from taxed corporate earnings when that money could have been reinvested in a tax deductible manner?

To make matters worse, the interim dividend is up 30% from 5.0p to 6.5p per share on a larger number of shares! So even more capital leakage that is being covered through capital market activity.

Madness!

The shares are arguably undervalued and so even if there was no opportunity to reinvest in growth, repurchases of shares would be far more accretive to shareholder returns than tax inefficient dividends.

Dividends should only be paid when there are no better uses available for balance sheet capital. That is not the case here, so the progressive dividend policy and capital allocation decision making is a big red flag. It will act as a drag on shareholder returns as I shall attempt to demonstrate below.

I raised this issue directly with the senior management of H&T.

Chris Gillespie, the CEO responded “The majority of our shareholders (particularly institutions) want, and value, dividends.” To me this says that he is perfectly happy to allow the tail to wag the dog. To hell with financially prudent capital allocation in the best interests of the business, we will pay dividends come what may because that is what I believe my shareholders want.

If shareholders wanted regular income, wouldn’t they buy corporate bonds instead of equities!

The situation became worse when Dianne ‘Di’ Giddy, the company’s CFO, responded, “…we look to balance capital allocation between investing in growing our business and meeting our shareholder’s needs… We raised £16.9m of additional equity in October 2022, and have since looked to increases the Group’s level of debt to be more or less in line with the level of additional equity raised. We have achieved this in July of this year through the recent increase in our Bank Funding Facility by a further £15m to take the total facility to £50m, bringing the level of gearing on balance sheet back in line with the position we had pre the equity issue in 2022.”

I couldn’t believe what she was saying. The CFO is the person charged with managing the capital of the business. Here she is saying that she needed to raise capital in the form of both equity (which dilutes shareholders) and debt (which impairs the balance sheet), because the capital that they had was being paid away as dividends. And she supports this position!

More concerning is that the CEO and CFO were both unprepared to consider the merits of my argument. They have their playbook and, come what may, they refuse to deviate from it. This is hugely disappointing. Closed-minded business leaders are a red flag in my book.

Valuation

Other than the capital allocation decisions, the business appears to be well run. Gross profits are consistently between 55 and 62%.

Just like banking, this is a very capital intensive industry with approximately 70 pence of working capital required to generate 100 pence in sales. There appears to be little or no operating leverage, as OPEX appears to be reducing very slowly relative to the growth of the business. In 2015 the business allocated 70% of gross profit to operating expenses and, having peaked at 77% in 2018, it is now back at 70%. It would be nice to see a management focus on reducing OPEX relative to gross profits in order to generate further margin expansion. Approximately 5% of gross profit is allocated to growth CAPEX while maintenance CAPEX averages approximately 3% of gross profit.

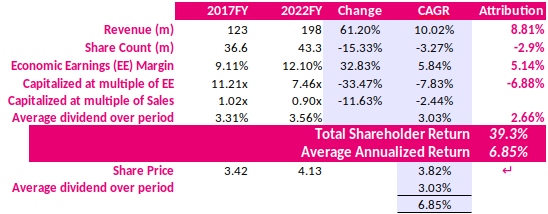

In the five years from 2017 until 2022, the share price increased from £3.42 to £4.13 today which is an annualized 3.82% share price appreciation. Augmented with an average dividend of 3.03% generated an annualized shareholder return of 6.85% and a total return of 39.3%.

This breaks down as follows:

An annualized 6.85% just about met an intelligent investor’s hurdle rate during the ZIRP period, but now that interest rates are higher, this is unlikely to be very attractive to investors going forward. The good news is that there appears to be a significant amount of untapped value in this company.

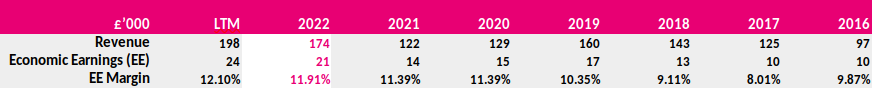

As you will see from my adjusted numbers below, revenue has steadily increased year on year and so too have margins. This has meant that economic earnings have grown even faster than the top line.

So how does this investment look for the next five years?

I am assuming that the combination of continuing organic and acquisitive growth, together with the other initiatives of the group result in a cumulative annualized growth rate of 12% to the top line. I am also assuming that there may be further dilution in line with the past 5 years at approximately 3% CAGR. I assume a small amount of margin expansion, but that the major boost to shareholder returns will come from multiple expansion because the company appears to be capitalized at too low a multiple to both sales and earnings. My final assumption is that the dividend policy continues unchanged.

The outcome would be an average annualized return of 19.4% and a total return of 143% with a 2028 share price of £8.65 as set out in the table below:

Alternatively, let us assume that the company stops paying dividends and retains all of its earnings to reinvest in growth. This will bring down borrowing requirements and funding costs. 100% retained earnings being invested back into the business at an 11% return on invested capital will compound over the five year period at a greater rate than reinvestment of only 75% of earnings. So I optimistically assume that it will result in the top line expanding by 16% per annum. The lower financing costs and greater investment in growth ought to result in scale efficiency and so margins expand a little more. I have also assumed that the company will not issue any further equity. The outcome is a 24.8% annual return for shareholders and a 202% total return by 2028. The share price would be £12.49:

Even in a bear case, where top line only grows at 8% CAGR in the next 5 years, dividends continue as now, dilution continues at historic rates and margins remain at similar levels to today despite the increased scale of the business, we still have an impressive return. I have maintained the margin expansion in all of these scenarios because the stock looks over sold and I believe that it should be capitalized at closer to 1.2x revenue rather than the 0.9x where it trades today.

Is H&T Group Plc A Good Investment?

For me, with a CEO and CFO who are both patently inept when it comes to capital allocation decisions, I couldn’t invest my fund’s money into H&T. It’s a shame because the company is, in most other respects, reasonably attractive.

For those unconcerned with the sub-par ability of the management, there is a favourable asymmetric skew and the margin of safety looks good. I see very little if any downside risk.

This is certainly not a buy and hold forever investment, but it does appear to offer a robust business in a defensive sector with good growth ahead and an undervaluation in the market as a bonus. This means that an entry today may show a good return in the coming years. As the upside potential is realized it would be worth considering switching funds into alternative opportunities, but on short to medium term basis, the net present value based on the above scenarios would suggest that the stock today is worth somewhere in the £5.00 to £7.00 range, yet it trades at only £4.13. In other words, it is trading at something between 60% and 80% of its intrinsic value.

The questions for you are, Do you care about the mediocre management? How does it stack up against other investments in your portfolio? Is it worth switching funds into H&T? Only you can decide.

I have recently been in correspondence with the CEO and CFO or H&T. I have added their responses to the body of this article at the bottom of the section titled "The Bad". I have also changed the conclusion titled, "Is H&T Group Plc A Good Investment?" to reflect their feedback.

Thanks for the article. Curious if your view on the stock has changed given the recent sales growth despite a decline in share price.

Unfortunately, capital allocation remains unchanged but upside looks more compelling with a better macro backdrop.