Value Investors Are Barking Up The Wrong Tree

Not All Cheap Stocks Are Cheap, Not All Expensive Stocks Are Expensive

Following on from the piece that I wrote last week about valuing growth stocks with reference to the Nifty Fifty, I follow up with a look at what really drives shareholder returns.

The fact of the matter is that most investors are barking up the wrong tree and looking in the wrong places.

In the absence of additional leverage, a company's ultimate capacity for growth hinges on its return on invested capital.

Let's consider a constant perpetual return of 10%. If the company channels all its profits back into the business and starts with an initial capital of $100m, it will amass $110m by the end of the first year, $121m by the second year, and so on.

The company experiences compounded growth at the same pace as its return on invested capital, which translates to a 10% compound annual growth rate (CAGR).

Now consider the same company operating in a parallel universe, but this time it only reinvests 50% of earnings into the business and pays out the remainder as dividends. This company will only compound its value at 5% per year. Instead of having an intrinsic value of $121m at the end of year two, that value is only $110.25m.

You are probably thinking, ‘what about the dividends?’

The answer is, ignoring the double tax jeopardy that applies to dividends (paid out of taxed corporate earnings and then subject to income tax when received), they don’t come close to compensating for compounded growth over time.

Here we have looked at a short 2 year time horizon, but let’s broaden that out to a decade.

Below we have Reinvestment Corp which ploughs all of its earnings back into growth and Undervalued Corp which has a 50% dividend payout ratio and reinvests the balance.

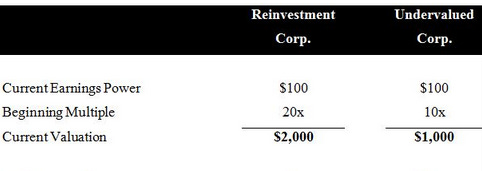

Let us assume that they both have the same initial earnings power, generating $100 per year. Now, let’s also handicap Reinvestment Corp with a market capitalization of 20x earnings (we’ll assume that the market is over exuberant on growth prospects). By contrast, Undervalued Corp trades on a PE ratio of 10x, which most value investors may deem to be cheap.

So, at the outset, Reinvestment Corp has a market cap of $2,000, while Undervalued Corp is valued by the market at $1,000. Remember, both are generating $100 of earnings at this stage.

Which would you buy?

There isn’t enough information to answer that question. The earnings multiple is not enough.

When we dig deeper we discover that Reinvestment Corp is generating 25% Return on Invested Capital (ROIC), while Undervalued Corp is generating only 10%.

Now we have what we need.

We know that Reinvestment Corp is compounding at 25% (One hundred percent of 25%, because it reinvests all of its capital in growth). Undervalued Corp is only compounding at 5% (Fifty percent of its 10% return).

Growth = ROIC x Reinvestment Rate

Before we look how all of this washes out over a 10 year time horizon, let us further handicap Reinvestment Corp by assuming that at the end of the decade both companies are capitalized at 15x earnings. This is a beneficial multiple expansion for Undervalued Corp, but a multiple contraction for Reinvestment Corp which is a drag on shareholder returns.

Reinvestment Corp has paid no dividends while Undervalued Corp has paid out $629 in dividends over the period, but the compounding effect on retained earnings means that Reinvestment Corp is now generating $931 in earnings while Undervalued Corp is only generating $163.

Since they are both capitalized at 15x earnings, Reinvestment Corp is valued at $13,970 (a shareholder return of 7x), while Undervalued Corp is valued at $2,443 plus the gross dividend of $629 (a shareholder return of 3x).

Charlie Munger summed this effect up perfectly in “The Art of Stockpicking”: “If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result.”