Introduction

“SBC” is arguably the most abused aspect of corporate finance today. It stands for Stock Based Compensation but I would argue that Significant Bleed on Capital would be more appropriate. It is not only distorting the stock market, but it is also impairing shareholder returns.

This article will shock and disgust you in equal measure. It will allow you to view corporate finance through a different lens and hopefully to avoid making the wrong investments.

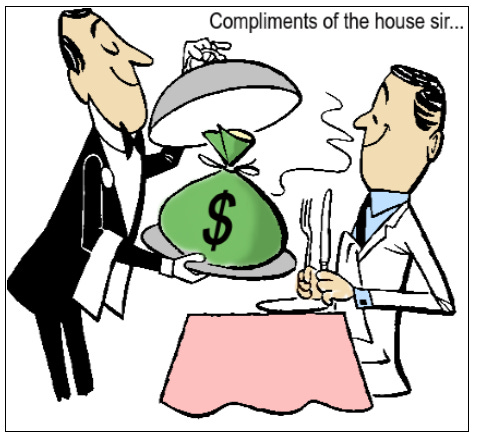

Know this: there is a payer for every payee and what unjustly enriches one financially hurts the other. In the case of SBC, unless a fair balance is struck between investors and management (very rarely does this happen), one side will walk away smiling while the other is being robbed.

In truth, SBC is very poorly understood by all concerned. Often the insiders don’t recognize the injustice that it creates and shareholders don’t notice that their wallet has gone missing until it’s too late.

All of this leads to enormous equity market distortions that negatively impact shareholder returns as was specifically pointed out by leading fund manager Terry Smith of Fundsmith in his shareholder letter, January 2023.

In extreme situations SBC has been abused by corporate management as a means of funding lavish lifestyles by rewarding themselves at unconscionable levels of remuneration.

Allow me to demonstrate with some real SBC abuse examples:

Twitter enjoyed an IPO in 2013 and was acquired, 9 years later in 2022, by Elon Musk. Accounting for inflation, the price per share paid by Elon Musk was lower than the IPO launch price. So in 9 years investors received zero total return on their investment because no dividends were ever paid. Meanwhile, SBC took CEO Jack Dorsey’s wealth from zero to $4.5bn.

In its 20 year life, Tesla TSLA 0.00%↑ has generated cumulative profits of $9bn. Meanwhile, for the 12 months ending September 2022 it paid out $4.5bn SBC, following $2.1bn paid a year earlier and $1.7bn the year before that. This is in addition to Musk’s 2018 pay package which gives him the right to purchase stock in 12 equal tranches of 8.45 million shares each at a strike price of $70. He received $10bn in the first quarter of 2021 alone and the entire package is worth well over $50bn.

Frank Slootman, CEO of Snowflake SNOW 0.00%↑ , joined in 2019 and presided over a blockbuster IPO a year later. Slootman received SBC of 3.7 million stock options exercisable at $8.88 per share which, over the four year term of his contract, when the shares were trading at $400, was equivalent to $1.2 billion per year of service. This means he would make around $100 million per month, $23 million per week, $4.6 million per day or $577,000 per hour. Did I mention that this is a loss making company that isn’t even close to breaking even?

In its 2020 report, Palantir PLTR 0.00%↑ recorded $1.41 billion in stock based compensation expenses for its trailing twelve months. This amounted to 117% of the company's top line revenue. Said differently, the company was paying out more to its insiders than it was generating from its customers. It doesn’t take a genius to work out that if more value is going out the back door than comes in the front door, then an investor has absolutely no prospect of a favourable outcome. Palantir is not alone:

These businesses are consuming themselves from the inside.

Rather than these companies being run for the benefit of their shareholders, the way that it is supposed to work, these companies are being run for the benefit of their overpaid management teams at the expense of shareholders. Who wants to invest in a company like that?

What Is Stock Based Compensation (SBC)?

Stock being used as currency is not a new concept. Henry Singleton was a master of it. When Teledyne TDY 0.00%↑ stock was mispriced in the market, trading at multiples of earnings as high as 70x and 80x, he would use those shares as currency to make acquisitions. Why not?

If I have something that I believe to be worth $1 and you are prepared to enable me to swap it, one-for-one, for something that I believe to be worth $2, I’ll take that deal.

This is exactly what Singleton did. As a piece of related trivia, in 8 years ending in 1969, he purchased 130 companies this way. Warren Buffett did something similar at Berkshire Hathaway $BRKA when purchasing Gen-Re in 1998.

So what does this have to do with stock based compensation?

The answer is that stock based compensation centers on the same principle of using stock as currency in lieu of cash, but this time for remunerating employees rather than acquiring companies.

If a company is young and not yet generating positive cash flows then it makes a great deal of sense to pay staff with shares instead of cash. This is exactly what happened at the height of dot-com mania at the turn of the millennium.

The problem is that it has now been taken to extremes and is being abused by corporate America and to a lesser extent elsewhere in the world.

Shareholders Beware!

Capital markets exist to enable a company to raise money for investment purposes in order to grow the business. The two options available are the debt market and the equity market: raising capital by issuing bonds or by selling equities.

The latter is usually more expensive because, either directly or indirectly, buyers receive a share of all future income generated by the company plus a share in the uplift in the valuation of the business, and this happens in perpetuity. It is for this reason that if a company reduces its long term debt below target levels, it may utilize the free headroom to engage in a debt for equity swap (borrowing to reduce the share count).

It should therefore be obvious that gratuitously issuing shares at a significant discount to fair value in the form of SBC is entirely the wrong direction of travel.

More particularly, this will either cause the share count to increase or else require the business to engage in stock buy-backs in order to offset dilution of existing shareholders.

But a share repurchase program is no free lunch. It often bears an enormous cost for the shareholders as it creates friction in the business which acts as a drag on growth and earnings.

So many CEOs convince themselves that backwards and upside-down math makes sense. They issue hundreds of millions of dollars of SBC and buy it back in the market using after tax dollars. Forget about the frictional costs of the transaction itself, it is so inefficient to do it this way when instead the company could deduct cash compensation from taxable earnings.

Does this make sense to you?

If the company is repurchasing stock using balance sheet cash (a reduction in shareholder equity) and at the same time gifting those shares to insiders, then shareholder equity has been destroyed for no tangible benefit to shareholders as the share count is unchanged.

Management may claim that SBC effectively defers cash payments to employees and so acts to free up capital, but that argument is entirely defeated if the deferred amount is simply used to buy shares in the market.

Wouldn’t it be better to simply use the cash to pay the employees?

If a stock buy-back happens at a time when the shares are overpriced in the market then the premium being paid over intrinsic value comes out of corporate capital, a further destruction of shareholder equity (more on this later with reference to Apple).

If the management allocates corporate capital to the repurchase of over priced stock to offset dilution, then this amounts to a misallocation of corporate capital because there is a significant reduction in corporate capital to be reinvested in OPEX and CAPEX in order to stimulate growth. This results in either an under performance of the business relative to its true potential or else a requirement for the business to tap the debt markets for additional capital in order to bridge the gap. This latter option is detrimental to the balance sheet and so by extension to the shareholders. It is not even a debt for equity swap because the share count is unchanged.

To make matters worse, corporate management has a habit of dressing up the buy-backs as a return of capital to investors when in fact they are anything but beneficial to investors.

Either the management is being entirely disingenuous or else they sincerely believe in their own warped version of reality.

Do you want to be invested in a company run by such people?

Some will argue that SBC aligns interests of management with those of shareholders.

Nonsense!

Imagine that you are a CEO moving from company to company every four years (the average tenure of a career CEO) and a large part of your remuneration is received as RSU, PRSUs and stock options. It doesn’t take a genius to work out that you are only motivated to drive the share price up even if to do so would be detrimental to the health of the business and against the long term interests of external investors.

Why would you engage in long term strategic CAPEX spending when doing so increases your D&A and so negatively impacts short term earnings?

Why wouldn’t you simply cut OPEX expenditure to the bone, perhaps by slashing advertising spend, in order to benefit from a short term earnings uplift at the expense of longer term revenue growth?

Why wouldn’t you shrink your share count through repurchase operations, even where it is not the best option for allocation of capital, so that EPS receives an artificial boost?

In short, rather than aligning interests of management and investors, SBC often creates a misalignment.

The problems with SBC and share buy-backs runs much deeper still.

SBC Results In Market Distortions

Deutsche Bank Global Research revealed that the key driver of the stock market rally since the financial crisis of 2008 is stock buy-backs.

The chart below demonstrates who has been buying equities in the US and it is clear to see that “Non-Financial Corporations” (read companies buying back their own stock) is the driver.

Over the 10 year period 2009 to 2019 corporate buy-backs totalled $4 trillion USD. The bull run of the past decade was, to a very large extent, fuelled by artificial demand for stock as a result of nefarious SBC activity.

This was further exacerbated by the rise of passive investing because most of the key indices calculate weightings based on the market cap of constituents. So corporate buy-backs inflate the market cap, which gives the company a larger index weighting and more passive funds flow in to the shares inflating the bubble still further. Then the company repurchases more stock and the cycle repeats. [Did you know that at their peak the FAANG stocks (5 companies) accounted for over 27% of the S&P500 Index (comprising 500 companies)?] Now you know the root cause of the asset price bubble and meteoric rise in the value of these companies from 2009-2022. The stock price was entirely detached from fundamentals, which is why they were trading on such eye-watering multiples of earnings.

As a case study, since 2012 Apple AAPL 0.00%↑ was buying back shares at the rate of $7 billion per quarter and since 2018 it increased that to an average $20 billion a quarter! It has spent approximately $500 billion buying its own shares (see chart below). Much of this was necessitated by egregious SBC.

For the twelve months ending September 2022, Apple paid $22.6 billion in SBC, a 13.54% increase year-over-year. These numbers are staggering. Bear in mind that Apple has 36,786 employees, so this amounts to $615,000 per employee on average in addition to cash salary and other benefits.

Apple is far from being a cash strapped start-up. It is sitting on a cash pile of $38 billion and so is more than able to pay insiders without resorting to SBC.

Choosing to remunerate its staff with SBC rather than cash and then forcing itself into the market to repurchase stock in order to offset dilution regardless of price is, frankly, poor corporate stewardship. It is evident from the red line on the chart above that share price does not factor into the pace of buy-backs.

Repurchasing stock at a price above intrinsic value destroys shareholder equity. This is why Warren Buffett only repurchases Berkshire Hathaway stock when the market price falls below his measure of intrinsic value. Similarly Henry Singleton repurchased 90% of Teledyne equity between 1972 and 1984 but only when the market price advantageously fell below intrinsic value which is the only time it is accretive to shareholders.

Tim Cook, by contrast, seems not to care about destroying shareholder equity. At the end of 2017 Apple equity was $140 billion and it has steadily been eroded due to over priced stock buy-backs, today standing at less than $50 billion.

Tim Cook is not alone in this kind of economically illiterate behaviour. Mark Zuckerberg has done something similar in recent years which I cover in detail as part of another article (for more details please follow this link: META (Facebook) | Entirely Uninvestable ).

It is worth pointing out that both Warren Buffett and Henry Singleton have always paid their insiders, including all C-Suite executives, entirely in cash. They never entertained the idea of SBC because, other than enriching insiders, it makes no sense and it is so incredibly disadvantageous to shareholders.

In the Berkshire Hathaway Owner’s Manual, Buffett wrote the following to investors:

"...we can guarantee that your financial fortunes will move in lock step with ours... We have no interest in large salaries or options or other means of gaining an edge over you. We want to make money only when our [shareholders] do and in exactly the same proportion".

Refreshingly different. So much better!

Mindlessly buying back stock at any price qualifies as management incompetence in my book.

There are multiple levers that management is able to pull when it comes to capital allocation. They can utilize it for CAPEX or OPEX spending in order to grow the business, they can pay down debt, they can pay dividends to shareholders or they can buy-back stock if the price is right. Which lever they should pull ought to be determined by evaluating opportunity cost in terms of the accretive shareholder value produced by each alternative.

Not Always A Good Deal For Employees Either

Some companies argue that SBC is absolutely necessary for employee retention purposes.

I have no idea what happened to the old fashioned concept of a person being happy doing what it is that their work involves and earning a fair market wage. The proposition that SBC motivates people falls down during market corrections in any event. Allow me to explain.

In the fourth quarter of 2021, Palantir had a share price of $30. Eighteen months later and it is trading at just over $6.

Now this is a company that has engaged in egregious SBC as stated in the introduction. Its employees are receiving a meaningful proportion of their remuneration by way of SBC options, issued with delayed vesting provisions at price levels that are now deep under water and so employees have been tied to a sinking stock price.

Investing is all about having the right temperament and most people don’t have it. In fact, there are very few CEOs that are able to emotionally distance themselves from the stock price, so what chance does the average non-financial sector employee have?

So, lets think this through. An employee is issued SBC at $30 just over a year ago and would have done the math on what that is worth. They will be buying cars and houses based on their new sense of wealth. They’ll believe that their windfall will help to feather their retirement nest and life is good.

Suddenly the stock is down 80% from its peak, potentially down 70% from where it was issued to the employee. The employee would have paid taxes on it at the higher level and so is no longer in a good place. This is stressful for employees. It is unlikely to make them happy. They are likely to be so distracted by the volatility of the share price that they become ineffective at what it is that they are supposed to be doing at work. In fact, they may be so aggrieved at their paper loss that they seek employment elsewhere.

Wouldn’t it simply have been better to pay them in cash and let them make their own investment decisions?

If the company is well run and the culture is good then people will want to stay there and work there. They may also choose to invest voluntarily, but why would an employer force it upon them?

There are companies that have a policy requiring executive employees to have a significant stock ownership position, Constellation Software being a case in point. It mandates equity participation by way of cash salary sacrifice. In other words, the employee is buying the stock at market prices with his own earnings rather than it being presented as cream and a cherry on top of his regular salary.

The benefit of this approach is that it provides management with meaningful skin in the game which ought to keep them focused when strategic decisions need to be made. Any corporate under performance resulting in capital value deterioration is painful to insiders in the same way that it hurts outside investors. As such, insiders are truly aligned with shareholders rather than adopting a laissez-faire attitude when gifted SBC in addition to a full salary.

Poor Disclosure Practices

Disclosure practices around SBC are generally abhorrent. Most companies will publish Non-GAAP earnings numbers, sometimes referred to as EBITDA, which are effectively an adjusted cash flow number. In that calculation they will discount SBC as a cost on the basis that it is a non-cash expense. This proposition is ludicrous.

Warren Buffett sums it up nicely:

“If options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And, if expenses shouldn’t go into the calculation of earnings, where in the world should they go?”

Plenty of income statement items are partially or entirely non-cash. Depreciation is non-cash, but it still reflects the very real cost associated with a company’s long-term assets.

It is worth pointing out that many of the same CEOs who choose to exclude SBC from Non-GAAP earnings also focus on EBITDA which conveniently excludes depreciation!

To make matters worse, when a company engages in a share buy-back operation in order to offset the dilution that would otherwise occur as a result of the SBC issuance, then it is simply dressing-up the operating cost to the shareholders in a different guise. It is moving SBC into the Cash from Financing section of the Cash Flow Statement which boosts free-cash flow numbers and so also Non-GAAP earnings.

Terry Smith points out that:

“As long as accrual accounting is the standard, the ‘non-cash’ argument simply does not pass muster.”

Deferred income taxes are non-cash but are nevertheless recorded in the P&L account.

Some revenue may also be non-cash, but we certainly don’t see many companies removing it from their results.

Executives proffer all sorts of excuses for excluding SBC from adjusted earnings but none has ever admitted it is because the truth is unlikely to be well received by shareholders.

Excuse 1 ~ Valuations of stock options use pricing models that rely on assumptions for the risk-free rate and for share price volatility. This makes them difficult to quantify and so they are excluded.

My response: Financial statements are full of assumptions including the useful life of assets in calculating depreciation and the valuation of long term assets on the balance sheet. Utilizing assumptions does not justify ignoring the numbers entirely. Said differently, attributing a zero valuation to SBC by ignoring it will always be further from reality than a valuation based on a slightly flawed assumption.

Excuse 2 ~ To include SBC results in double-counting because the shares paid to employees would be reflected as both an expense item in the income statement and in the share count that is used as the denominator for per share measures such as EPS.

My response: This may be a good argument for investors not using per share metrics which are flawed in so many ways (through reducing the share count EPS can be made to increase while revenue and profit are falling), but as an excuse for not including legitimate costs in the business in earnings numbers it fails. There is no good reason for excluding SBC from measures such as Operating Margins or EBITDA margins (it isn’t EBITDAC: Earnings Before ITDA and Compensation is it?)

If the management manipulates SBC in this way to flatter the company accounts then this ought to act as a red flag to investors.

The disagreeable accounting practice of ignoring inconvenient truths is nothing more than smoke and mirrors aimed at misrepresenting the performance of the business. It often results in companies being significantly overpriced in the market which can never end well.

Terry Smith points out that 60% of companies in the S&P Dow Jones Technology Select Sector Index exclude SBC from their adjusted earnings numbers. He also points out that all of the companies in the index whose SBC exceeds 5% of top line revenue choose to remove it as a cost from their adjusted earnings. Honesty and integrity are once again called into question.

All of this management obfuscation amounts to an average of approximately $600m for each company being wrongly added back into adjusted earnings numbers. On a trailing average earnings multiple of 23x for that index, this results in an overstatement of the value of constituent companies by an average of $13.8bn each. At peak valuations in November 2021 the overstatement would have been substantially higher.

In order to introduce balance to this article, I would like to point out that to their credit, Microsoft MSFT 0.00%↑ and Apple always favoured the use of GAAP earnings and so have never published adjusted earnings. As such SBC is always included in their accounts.

Facebook META 0.00%↑ and Google GOOGL 0.00%↑ , which has previously excluded SBC from their adjusted earnings calculations, both changed their stance in early 2017.

Facebook commented:

“Given that stock is an important part of our compensation structure, we believe that investors should focus on our financial performance with stock based compensation included.”

Google’s position was similar:

“SBC has always been an important part of how we reward our employees in a way that aligns their interests with those of all shareholders. Although it’s not a cash expense, we consider it to be a real cost of running our business because SBC is critical to our ability to attract and retain the best talent in the world. Starting with our first quarter results for 2017, we will no longer exclude stock based compensation expense from Non-GAAP results.”

These are all signs of honest and responsible management when it comes to accounting practices. So the question that we have to ask is why don’t other companies follow suit?

However, in relation to cash rich leading tech companies such as Microsoft, Apple, Meta and Google, why do they need to use SBC at all? One would imagine that people would fight to work at companies at the leading edge of technological innovation so attracting talent ought not be an issue. The working culture at these places is legendary with wonderful benefits on offer including complimentary food, sports, social facilities and even sleep pods if anyone requires a quick nap. So retaining staff doesn’t justify it either.

Perhaps it is a competition issue. Perhaps these companies are the root cause of the problem. I am just speculating, but it may be possible that these behomoths of tech offer SBC because it is easy to justify on the basis that it represents a far smaller proportion of their sales and earnings yet it makes life very difficult for younger companies that may someday disrupt the industry to attract the talent that they need. Maybe this explains why the younger tech companies in the table at the beginning of this article are paying SBC at levels that represent such a high proportion of their top line: it is the only way that they are able to compete for staff with the big boys. Maybe the Competition Authority need to look at this as an anti-trust matter.

Quantification Problems For Investors

The next problem for investors is one of quantifying the true cost of SBC. The true cost cannot be known until the options or PRSUs are exercised.

Imagine that you work for company ABC Inc. Its shares are trading at $10 and you are awarded options that vests in 1 year and allow you to buy 100,000 shares at a discounted strike price of $9. On the face of it, if you could exercise today then you could sell the shares for a $1 profit and so earn $100,000. But you can't exercise today. But the company will report SBC today on its income and cash flow statements at a cost of $100,000.

If the share price drops below the strike (2022 was a year that left those holding SBC options deep underwater) then you are aggrieved as an employee and unhappy - not good, particularly since you were taxed at the value when issued and you are unlikely to now receive that value!

If the share price at the vesting date is $15 then you exercise at $9 and sell the stock in the market to lock in your $600,000 windfall. (So much for aligning interests of shareholders with insiders: empirical evidence suggests that the insiders cash-in at the first opportunity!) So where does that $600,000 come from? Well, on exercise of your option the company is obliged to give you your 100,000 shares which means that either it issues new shares (so diluting existing shareholders) or else it buys stock from the market to offset dilution and so the company, out of corporate capital, pays $15 per share in order to sell them back to you at the $9 strike price! No rational investor would buy high and sell low, but this is what the company management is doing at the expense of its shareholders. So the company is depleting its cash reserves in the sum of $600,000 which reduces shareholder equity by the same amount. Either way, the cost to the company at exercise of the options is $600,000 and this represents allocated capital that it no longer available to invest in the growth of the business or to be returned to shareholders.

As you can see, it is impossible to account for SBC accurately in the income statement at issuance because the true cost is not known at the time of issuance.

More particularly, this is a cost that most shareholders don't properly account for when investing (more fool them!)

This is a huge problem during a bull run of the kind seen between 2009 and 2021. The value being booked as SBC was far smaller than the actual cost of that SBC because at the vesting date the stock was always trading significantly higher. It explains why over $4 trillion of stock was bought back by US corporations during this period and this represents a huge invisible cost to shareholders.

Take Twitter as an example, In the 2014-19 period, SBC resulted in 193 million shares being issued by Twitter to its employees. During this time the share price fluctuated between $16 and $36. Accordingly, SBC recorded in the corporate accounts totalled $3.1billion, but the actual economic cost was $5.3billion. Are you surprised that the total return to shareholders of Twitter from 2013 until it was taken private in 2022 was 0%? All the money was going out of the back door!

The same is true for many other companies, particularly in the tech sector. This will go down in the history books as “the great SBC scandal” of the 21st century.

This would be less of a problem if there was adequate disclosure of the real costs of SBC so that analysts could calculate the effective opportunity cost each year. Accounting Standards ought to require reporting all SBC at fair value with all changes in fair value recorded in the income statement.

This is one omission in accounting principles which is hard to understand, easy to rectify and where the investment community would see a real benefit.

In the interim, analysts will have to adapt accounting data to provide more realistic economic assessments. Alternatively, perhaps your best option is simply to reject the culprits of SBC abuse as viable investment opportunities and simply move on to companies with better corporate stewardship.

In A Deep Hole And Getting Deeper

Companies will often argue that since SBC is offered by others in their industry, they too need to play the game in order to attract talent. While I understand why some may take this view, I do not accept it for the following reason.

Financial markets are designed to efficiently allocate scarce capital to the most productive use of that capital. The same is true in relation to the allocation of labour. A successful company will generate cash that enables it to grow and that requires more human capital. So the most successful companies attract the most and the best workers.

Now consider a situation where companies don’t use cash to remunerate employees. Instead they offer stock, something that is not limited in supply: they can theoretically print as much as they like. Any company, successful or not, is able to attract workers with promises of ever greater riches. The result is that skilled labour is being pulled into businesses that are not necessarily the best place to economically utilize that expertise but those that are able to make the the most attractive SBC based promises.

What happens next is a Soros reflexivity loop where companies continuously compete with each other for labour based on the size of the SBC that they are able to offer. Being theoretically unlimited in supply, this competition drives the size of SBC on offer ever higher. The chart above shows that this is exactly what has happened over the past 20 years. It also explains why Apple is paying SBC equivalent of $650k per employee and why Palantir issued SBC amounting to 117% of top line revenue in 2020.

Where does it stop?

Have we already gone way too far?

As Charlie Munger says:

“If you find yourself in a deep hole, stop digging!”

That seems like good advice in this context.

Too few in executive management grasp this, or perhaps they don’t want to understand it because they like the idea of a golden goose forever laying golden eggs.

Conclusion

While SBC may be a valuable tool for business development and employee retention when used appropriately, egregious SBC abuse (as has occurred on an increasing basis over the past 25 years) can have disastrous consequences for external investors.

Not only does it eat into the total returns that a shareholder ought to receive from being invested in the business, but it also causes market valuation distortions that may lead to erroneous investment decisions.

Generally, with the exception of cash strapped start-ups, SBC is usually evidence of a significant disconnect between the interests of management and those of shareholders.

It’s nothing short of a scandal, but many shareholders are blissfully unaware of what

is happening and so acquiesce in this practice. In fact, during the bull run of the past decade shareholders defaulted to wilful blindness because share prices were providing handsome returns and so everyone seemed to have a license to print money.

Since management knows that they are able to milk the system in this way unchecked by shareholders they do it again and again, in ever larger denominations.

I hope that this article serves as a wake up call.

As investors we need to vote with our money. Avoid investing in businesses that adopt what can only be described as unreasonably excessive SBC plans and this, in time, may influence the requisite change in corporate behaviour. It will also result in better investment returns for you as you are not collecting water in a leaky bucket.