Company: Adyen

HQ: Amsterdam, Netherlands

Ticker: (Amsterdam: ADYEN)

Market Cap: €19.5 Billion Euro (share price €650)

URL: https://investors.adyen.com/

Strategy: Long term buy and hold

Is Adyen A Good Investment?

Recent share price volatility may have provided a wonderful entry opportunity for an investment in this fantastic company which, until now, was always vastly over priced.

Although I don't typically start my analysis with numbers, I feel that you need to understand from the outset why it is worth you spending your time reading this rather lengthy piece of analysis.

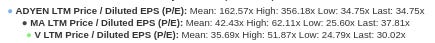

While Adyen, Visa, and Mastercard are not identical in their business models (which will be explained later), they all operate within the payments sector and share significant operating leverage, making them comparable in certain respects.

The chart below, along with the accompanying data, illustrates how these companies have been valued relative to their earnings and sales since Adyen's initial public offering (IPO) in 2018.

Note on the chart how at Adyen's IPO in 2018, it was valued by the market at an eye-watering multiple of approximately 200x earnings, it then reached a peak of 356x earnings, but has recently come down to levels similar to Visa (V) and Mastercard (MA), hovering around the mid-30s.

While these figures are based on unadjusted reported data, they provide a compelling justification for closer examination of the Adyen business. Is now the right time to establish a position?

Read on and formulate your own opinion.

Who Are Adyen?

At a very high level and before we drill into the detail, please understand this. The payments industry is exceptionally complex, with each country having unique payment processes and infrastructure. Some countries have strict laws relating to payments, making it challenging for global merchants to navigate the payment landscape. This created an opportunity for a company to solve this complexity and to improve on the way payments were processed. This is what Adyen does.

Established in 2006 in Amsterdam, Adyen is a Dutch company co-founded by a team of entrepreneurs, including Pieter van der Does and Arnout Schuijff, who currently hold the positions of CEO and CTO.

The founders have a history as serial entrepreneurs. They played pivotal roles in the inception of Bibit Global Payment Services in 1999, which was later acquired by the Royal Bank of Scotland in 2004. Following the acquisition, Bibit was integrated into WorldPay, and Peter van der Does had a contractual obligation to remain involved for two years to facilitate the transition, possibly as part of an earn-out arrangement.

“I had to run it under the umbrella of a larger company that made all sorts of decisions that I wouldn't personally make,” confessed Peter van der Does, reflecting on his time at WorldPay.

This holds significant relevance because Pieter van der Does gleaned valuable insights from his Bibit experience. In particular, he learned not only what works, but also what doesn’t work very well and what could have been done better or differently if the clocks could be wound back.

The sale of Bibit essentially enabled him to start again and to do it better second time around. For this reason, in 2006, he started a new payment services business and called it ‘Adyen’, which means ‘start again’ in the creole Sranan Tongo language.

Pieter van der Does knew that existing payments technology consisted of a patchwork of systems built on outdated infrastructure. He knew that he could do so much better by providing an integrated service, and in the 17 years that have followed he has certainly proven that to be the case.

“We believed that if you could make this product of the highest quality possible, then you’d be able to sell it to the best companies in the market. So we had a very unusual market entry strategy and a very ambitious plan - we know this market, we're going to build something that outperforms and we directly target the high-end.”

Pieter van der Does, interview with Techleap

Adyen has since gone from strength to strength. It took five years to reach critical mass (payments is a volume business) and it became profitable in 2011. Its growth rate has been very impressive ever since.

Adyen processed €767.5 billion in 2022 and, based on H1 2023 figures, it looks sure to process over €860 billion in 2023, so the growth continues unabated.

Adyen’s Management

Management is guided in its decision making by what is best in the long-term. No short term thinking here. It is also entirely customer focused.

I detect the influence of visionary corporate leaders such as Steve Jobs and Jeff Bezos in the approach being deployed here. It seems evident to me that Pieter van der Does has studied successful CEOs and possesses a keen grasp of how to effectively manage a high-growth enterprise and how best to make critical decisions.

This level of competence is exceptionally rare but very promising from an investors perspective. The very intelligent decision not to pay a dividend serves as a prime example of this discerning approach. Many European CEOs adhere to a conventional playbook that reflects a lack of insight into which capital allocation levers to pull and when to pull them. This is evidently not the case with Pieter van der Does and Adyen more generally. In that respect he is what William Thorndike might consider as being an Outsider, which for those familiar with Thorndike’s book, will know that this is a huge compliment.

With financially competent management taking a long-term perspective and growing the business at such an impressive rate, this business is a gem for investors as it promises to compound over the long-term.

Pieter van der Does focuses on recruiting only the right people and is prepared to wait for the correct opportunity to arise before investing in its most valuable asset, human resource.

“We are not led by short-term trends, and hire specifically to meet our long-term needs. To scale our culture of speed and autonomy as we grow, we keep our talent standards high and only hire exceptional people that quickly gain traction.”

Pieter van der Does, Co-founder and CEO

This tells you something about the company’s DNA. It has very strong processes that work well, and it isn’t prepared to compromise.

For several years now Adyen would have liked to have grown its team at a faster rate but had been unable to hire enough top-quality talent. Rather than settle for mediocrity, it decided to wait until the right people became available. It’s approach is commendable and speaks to uncompromising ethos of the business.

That having been said, there was an opportunity cost associated with this kind of discipline and they now see the impact of a sales team size that did not match the company’s ambitions, particularly in North America. In the current economic climate, when the top tech firms have been downsizing their workforce, Adyen is moving against the crowd and picking up the people that it needs.

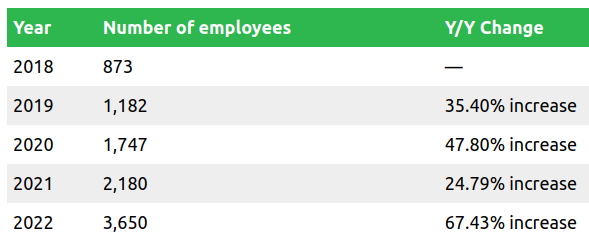

The team is now enlarged with 551 new employees in the first half of this year alone, bringing the total up to 3,883 full time employees (this is a truly global business operating out of 27 offices around the world and employing 115 different nationalities.) The growth in head count at 16.5% ought to give an indication of how rapidly the company anticipates growing in the years ahead. For a company operating at this size, to grow at this rate speaks volumes about the huge potential that lays ahead. Just to put things in perspective, it has been growing impressively now for 5 years:

Adyen believes that by the end of 2023 it will have the requisite head-count to fulfill its medium term objectives. This means that investment in growth will slow and operating leverage is likely to kick-in, as fixed costs are spread over a growing volume of transactions and more revenue.

Gain A Better Understanding of Adyen

The digital payment landscape has evolved into a complex value chain compared to the simpler cash-based transactions of the past. In the bygone era, when cash was king, central banks issued notes and coins that were used to transact with immediate settlement.

The relatively recent shift to digital payments posed a significant challenge, in particular verifying whether the buyer had sufficient funds in their bank account to settle the transaction and who would hold the credit risk in the intervening period.

To meet this need, payment networks were established to verify the availability of funds. Mastercard and Visa are the largest.

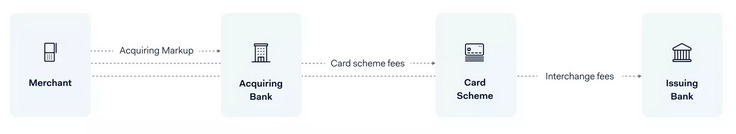

To understand the value that Adyen offer, it is first important to understand a typical payment card transaction. There are five key participants (see diagram). Let's assume you're the credit card holder and you intend to make a purchase from a merchant.

In this scenario, Citi serves as the Card Issuer, providing you with a credit card and a line of credit.

The merchant also utilizes a bank to handle the financial aspects of their business, known as the Acquirer (as it acquires the merchant). In this example we consider Bank of America Merchant Services to be the acquiring bank.

The fifth and final player in this process is Visa or Mastercard, serving as the network that connects the acquiring bank to the issuing bank. They essentially function as the communication protocol layer that facilitates global inter-bank communication.

Now, when you swipe your card at the merchant, your card data is transmitted to the acquiring bank. In this example, Bank of America employs the credit card protocol via Visa or Mastercard to contact Citibank for payment authorization. The green check-marks on the diagram indicate that Citi sends payment approval back to Bank of America through the payment protocol, which in turn informs the merchant that the transaction has been approved. As a result, you, the cardholder, can leave the store with your purchased items.

The crucial point to grasp here is that even if you have a Visa or Mastercard in your wallet, you are not their direct customer. This holds true for merchants as well. The banks are the customers of Visa and Mastercard.

So far so good. Now, let's delve into the revenue structure involved in these transactions. A fee is levied on the amount you pay to the merchant for your purchases. Suppose you spend $100 on groceries; the merchant may only receive $98, while the remaining 2% is divided between Citi, Bank of America and Visa.

The issuing bank shoulders most of the risk, having extended a credit line to you, which means it bears the credit risk associated with your potential default on repayment. Consequently, it claims the majority of the transaction fee. The payment network (Visa/Mastercard) and the acquiring bank each receive a smaller portion of the balance for facilitating the transaction. The acquiring bank carries only counter-party risk to the issuing bank.

It's important to note that the fee isn't always fixed at 2%. The actual fee amount varies based on various factors which are beyond the scope of this article, but the approach is always the same.

These fees, known as interchange rates, are determined during negotiations between the protocol provider and the issuing bank. The acquiring bank is relatively passive, lacking influence over the transaction. Its primary goal is to acquire as many merchants as possible, so it must accept whichever payment method the merchant's customer chooses to use.

You may be wondering how Adyen fits into this structure, so please allow me to explain.

Adyen steps into the shoes of Bank of America as an Acquirer, but with far better technology than Bank of America (or any other bank) has to offer. In that respect it is disrupting the payments market and displacing conventional banks in the process. Banks are not very innovative and Adyen has a huge competitive advantage in terms of counter positioning which is winning it new customers on a continuing basis.

Adyen has a “full stack” system which allows it to combine a number of roles (gateway, processor, risk manager and acquirer) into a single service as the diagram below demonstrates. This is what I mean when I say that they are streamlining the payments process. Adyen’s full-stack is a distinct competitive advantage because for merchants, it is often cheaper and more convenient to use Adyen, rather than have multiple contracts with payment gateways, processors and acquiring banks.

Adyen’s Customer Base & Business Model

The really nice thing about Adyen’s business is that it is incredibly sticky. Once the infrastructure is in place with the customer, if Adyen doesn’t give the customer an excuse to switch, why would it change provider? If Adyen is a market leader in terms of technology, any switch could only be motivated by price but very few customers are prepared to sacrifice quality of service for a relatively insignificant cost saving. Remember that the lions share of the interchange fee goes to the card issuer.

The chart above shows Adyen’s take rate in basis points. So for every $100 processed, Adyen receives 17.4 cents. If the Interchange fees are 2%, as described above, the other 182.6 basis points go to the Issuing bank and the network provider, so those operating as acquirers, including Adyen, are unable to exert very much influence over customer behaviour by reducing the price of their service (a 10% price reduction on the acquirer’s take rate could mean 1.75 basis points difference on a total cost of 200 basis points - it just doesn’t move the needle.

In terms of Adyens decline in take rates over the last 8 years, the company attributes this to its tiered pricing model, so as its large customers drive more transactions through Adyen, lower tiers of prices apply. It is essentially a volume discount model.

Adyen states it sees take rate as "an outcome, not a driver" of its business model, instead focusing on the scalability of its platform.

To support the assertion that the product is sticky, over 80% of Adyen’s growth in H1 2023 came from existing customers.

Oh, did I mention that Adyen’s customer base includes Facebook, Uber, H&M, eBay, Tiffany & co, GAP, McDonald’s, Airbnb. Spotify, Cathay Pacific, Netflix, Just Eat and Microsoft?

Payment flow to any business is like blood flow to you and me - you wouldn’t jeopardize it by selecting a second rate service provider, only the best will do. Not only that, but the ancillary services offered by Adyen together with its transparent pricing model are preferable to anything offered by other acquiring banks. As such, all of these businesses have chosen to switch to using Adyen. For me this serves as validation of the Adyen service.

One caveat here is that enterprise customers typically incorporate a backup payment processor within their systems. This contingency planning ensures that if one payment processor experiences downtime, the system can seamlessly switch to the alternate processor to handle transactions. By way of example: Shopify employs both Stripe and Adyen for payment processing, Booking.com utilizes Braintree and Adyen, while Netflix employs Adyen and Checkout. This means that it would be easy for a customer to shift more of its payment processing from one to another if they chose to do so, something that may be influenced by the relative costs charged by each company.

This kind of rebalancing as between providers is an odd dynamic of the payment market because it isn’t a question of winning a customer or losing a customer, it is more nuanced and relates to winning or losing share of that customers transaction flow.

Movements of volumes as between providers ebbs and flows over time. It is particularly pronounced at the moment in the US online segment because the high inflation macro-economic environment together with corresponding spikes in interest rates means that customers are very cost focused and may be tempted to move to a lower priced service and to compromise on quality.

Pieter van der Does says that Adyen has seen this behaviour in the past, but invariably the business all comes back because for large enterprise customers it is the value add that Adyen can offer which really makes the difference. Said differently, you may switch from driving a Porsche to a Ford when money is tight, but as soon as things pick up you switch back to the Porsche. It is for this reason that Adyen refuses to enter into a price war and to compete on price.

The Adyen Product Offering

The distinctive advantage of Adyen lies in its utilization of a unified worldwide payment platform, offering a seamless, all-in-one solution for payment processing. Adyen's platform is designed to streamline operations, reduce costs, and improve the payment experience for both merchants and customers.

It also incorporates robust risk management measures to safeguard against fraudulent transactions.

The company operates across three segments and each saw increases in volume in H1 2023: Digital Payments +23%, Unified Commerce +36% and Platforms +3%. Each of these will be explained in more detail below:

Digital payments (60% of the business). As mentioned earlier, Adyen functions as an acquiring bank, assisting global merchants in facilitating online payments while accommodating over 250 payment methods, delivering a seamless checkout experience for customers. Merchants can effortlessly incorporate Adyen into their website or opt for one of Adyen's point-of-sale (PoS) systems for physical retail stores.

What sets Adyen apart is the superior quality of its system, which enhances conversion rates by minimizing friction during the payment process for customers. For instance, how often have you attempted to make an online purchase only to be redirected to an external payment page? How did that make you feel about entering your credit card details? The truth is, such redirection often causes anxiety for many people, leading a significant portion to abandon the checkout process without completing the purchase. Adyen's solution to this problem is seamless integration into the merchant's website, featuring an embedded checkout flow that instills greater trust in customers and results in increased conversion rates, a clear advantage for the merchant.

Adyen also incorporates built-in validation processes, such as verifying the validity of the payment card number and whether the card brand is accepted by the merchant. This minimizes the number of declined transactions, thereby boosting the authorization rate, which is also beneficial for the merchant.

Adyen is constantly innovating and in the first half of 2023 alone it announced multiple product launches within its Digital product suite, including Trusted Beneficiaries, Data-Only, and its certification to utilize the FedNow(R) Service, the Federal Reserve’s instant payment infrastructure.

Data Only entails Adyen willingly sharing pertinent authentication data with payment network providers to make more informed authorization decisions in regions lacking stringent authentication regulations. Trusted Beneficiaries enables shoppers in the checkout stage to add a business to their list of trusted companies. Once added, merchants won't require re-authentication when the shopper makes future purchases, resulting in increased conversion rates and decreased fraud.

Furthermore, Adyen can collaborate with merchants to issue branded physical or virtual payment cards. This offers numerous advantages, particularly when combined with Adyen's merchant services, leading to even higher conversion rates and the prevention of fraud through the implementation of card controls and customized authorization. Notably, merchants also stand to benefit from a share of the interchange fee and gain valuable insights from connected data.

All of this additional value explains why customers prefer Adyen over competitors and are willing to pay a premium for its services. While clients may pay a slightly higher take rate, they enjoy enhanced authorization and conversion rates, ultimately translating into higher revenues. Additionally, they benefit from advanced functionality, including robust fraud detection. It's a true win-win situation for all parties involved and clarifies why Adyen opts not to engage in price competition.

Adyen's Unified Commerce (25% of the business) offers a robust tool that enables businesses to centralize all their payment operations into a single system, providing a unified perspective on their entire customer base and transaction history.

Through this unified commerce solution, customers can make purchases across various channels (online, in-person, in-app) using a single payment platform. This not only streamlines the payment process but also empowers businesses to offer diverse cross-channel experiences.

The process of reconciliation becomes straightforward, aiding businesses in gaining profound insights into their customers' behaviors and purchasing patterns across different channels. Consequently, this facilitates the creation of seamless, interconnected loyalty programs, enhancing customer engagement. With end-to-end control over transactions, businesses can personalize their services and foster customer loyalty. In-depth knowledge of customers and their purchasing habits allows merchants to make informed decisions regarding capital allocation for growth. Thus, Adyen doesn't merely provide payment infrastructure; it delivers a comprehensive Software as a Service (SaaS) data solution.

In this aspect, Adyen significantly outpaces its competitors. There is no other global player capable of offering such a comprehensive suite of services within a single platform. For example, Adyen collaborated with McDonald’s to develop its mobile app, allowing customers to place and pay for orders directly within the app. This innovation reduces the need for counter staff to handle cash transactions, resulting in cost savings for McDonald’s. Furthermore, in the past, McDonald’s accepted cash at the counter without gathering any customer information, such as whether they were regular customers, their typical orders, or their spending habits. Adyen's technology has transformed this scenario, enabling valuable commercial insights that are now indispensable for McDonald’s and collectively inform operational decision-making.

Adyen for Platforms - The third key pillar for Adyen is catering to platforms such as eBay, Shopify, and Amazon Marketplace, accounting for 15% of its business. These platforms serve as the primary revenue source for an increasing number of small and medium-sized enterprises (SMEs). Adyen's expanded presence in this sector positions it in direct competition with companies like Stripe, which traditionally target SMEs directly. Presently, approximately one-third of SMEs receive payments through platforms, but it is expected to rise to three-quarters over the next decade, suggesting substantial growth opportunities lie ahead. While Adyen has had a long-standing partnership with eBay for over five years, growth in eBay transactions has slowed. However, when we focus on newly acquired platform customers, excluding eBay, this segment is experiencing an impressive annualized growth rate of 82%. In the context of these platforms, Adyen operates behind the scenes, rendering its services invisible to the end customer. For instance, Airbnb can leverage Adyen's technology and banking capabilities while maintaining their own branding.

Fourth Segment in the future: In the future, Adyen aims to leverage the Platforms segment as a launching pad to provide additional financial services, such as banking-related offerings or Banking as a Service (BaaS). For instance, given Adyen's comprehensive understanding of each merchant's cash-flow patterns, it becomes more straightforward to facilitate debt financing if a merchant requires investment to expand their business. These loans would be extended by financial institutions like banks, private equity firms, or hedge funds, with the merchant automatically repaying them from the revenues generated in subsequent years.

This expansion into financial services will constitute a fourth pillar of Adyen's business in due course. Notably, Adyen has recently acquired acquiring bank status, eliminating friction from the system as it no longer relies on third-party entities. Adyen's core objective remains enabling merchants to "Accept Payments Anywhere," and their infrastructure is meticulously designed to achieve this aim. As an acquirer, there may be instances where Adyen needs to temporarily host or hold payments, and they have secured a banking license in the European Union (EU) to facilitate this process.

“An essential part of our competitive advantage is the efficiency of our single code base…We are building Adyen knowing that our product offering will constantly evolve. As consumer preferences become even more technology-driven, additional revenue opportunities will emerge and we will engineer our product to capitalize on them…The low-cost nature of our single platform positions us to build highly scalable solutions while generating incremental net revenue at minimal additional cost.”

Pieter van der Does, H1 2023 Shareholder Letter

In short, Adyen is reinventing the payment process as better described in the cute corportate video below:

Adyen’s Pricing and Numbers

The conventional pricing approach within the payments industry is often unclear, making it challenging to decipher the breakdown of processing and interchange fees among the various stakeholders in a transaction. Adyen, on the other hand, has revolutionized this by adopting a transparent pricing model that it exercises significant control over. Adyen employs an interchange++ model, as elaborated below.

Payment card processing comes with three fees:

In this model, Adyen first gathers the interchange fee mandated by the issuing bank, the scheme fee imposed by the network protocol provider, and then applies its own contractual fee for its services as a merchant bank, which is added as an additional layer. This approach resembles a cost-plus pricing model which customers prefer.

Adyen Financials & Capital Allocation

When analyzing Adyen it is important to understand the unusual presentation of numbers at the top of the income statement and the fact that in the most recent half yearly numbers they have changed their approach to top line reporting. It is merely a legal construct of splitting out monies collected on an agency and principal basis.

Below you will see below that what they class as Revenue appears to have fallen 80% but this is entirely down to the change in accounting approach.

The Revenue numbers appearing at the top include the monies collected by the acquiring bank in its capacity as collection agent for the other players in the payment cycle (the issuer and the network provider) in addition to revenue received by Adyen in its capacity acting as principal in its contracts with Merchants.

It is the market’s misinterpretation of the dip in the Revenue number that has caused much of the adverse share price reaction (therein lies our investment opportunity).

The Net Revenue number, a non-IFRS measure, is the all important metric and represents Adyen’s own revenue including any ancillary fees such as for the provision of foreign exchange services, less costs of goods sold which is principally point of sale equipment manufacturing costs, less monies collected by Adyen acting in its agency capacity.

I have restated these numbers:

You will observe that both the revenues owing to financial institutions and the costs incurred from financial institutions have been restated in such a way that it has no impact on the Adyen numbers underneath.

Now, it becomes evident that the market's anxiety over declining revenue is baseless. It is like a Chicken Little, ‘sky falling down’ moment in the market.

Adyen recorded a 22% increase in revenue during H1. Furthermore, it's important to note that the actual gross margins of the company exceed the assessments of many financial experts. The disparity arises because some analysts incorrectly calculate the margin using 'collected revenue' as the denominator instead of the true Adyen revenue figure.

I concede that the gross margin dipped by 109 basis points year on year, but on a gross margin of circa 95%, it doesn't really move the needle.

It's worth highlighting that while revenue has seen impressive growth, operating expenses have also risen (mainly due to a 14% expansion in the workforce), resulting in a 15.6% decrease in Operating Income for this period. However, the larger workforce has yet to contribute to revenues, so this is merely a temporary setback.

Adyen is emerging from an investment phase which should drive accelerated revenue growth and operating leverage from 2024. As the revenues scale up against a more static cost base, the unit economics become more and more attractive.

“…the time that we can say “we did it” is still far out. We know that growth will not always be linear, and while we saw net revenue growth decelerate in H1, we did not see any substantial developments that structurally change our medium to long-term opportunity. In addition, we anticipate our business model's high operating leverage to kick in as we move out of this accelerated investment phase in 2024.”

Pieter van der Does, H1 2023 Shareholder Letter

Finance income experienced substantial growth in H1 2023, primarily due to higher interest rates on held funds.

Ultimately all of this resulted in net income remaining flat in the first half of the year relative to the corresponding period of 2022.

In simpler terms, despite substantial investments in expanding the business both in terms of products and manpower, net earnings remained unchanged, which is an impressive feat in itself. Without these investments, net earnings would have been considerably higher.

The willingness of the management to forego short-term earnings for the long-term benefit of the business speaks volumes about their leadership quality.

As of the latest information available, Adyen's market capitalization stands at €19.5 billion, implying a trading multiple of approximately 12.5x annualized sales. However, when considering a debt-free and cash-free basis, this figure looks more like 8.4x.

While 12.5x is a substantial multiple, when viewed against the backdrop of substantial gross margins, it translates to a gross earnings yield of 7.6%. If we adopt the 8.4x figure, the gross earnings yield climbs to 11.3%. Taking into account its growth trajectory, these valuations appear reasonable, contrary to the market's opinion.

Similarly Adyen is capitalized at 34.7x earnings, but net of cash and long-term debt, its real valuation is closer to 22.7x which starts to look like veritable bargain with growth rates where they are.

Although Visa and Mastercard operate as network providers and therefore belong to a different segment of the payments industry compared to Adyen, it's worth noting that Mastercard and Visa have essentially saturated their available markets. In contrast, Adyen still possesses a vast untapped market opportunity. Adyen's growth rate is at least twice as fast as that of the other two, which, as an investor, makes it a more valuable prospect to me.

I recently wrote an article on Valuing High Growth Stocks which proved that what may first appear to be a high valuation multiple may in fact turn out not to be so. Capitalization multiples can often be very misleading. On this basis, for a company such as Adyen, its current market price may in fact represent a bargain.

It should also be noted that the company does not engage in acquisitions and grows entirely organically.

“At Adyen we have a great preference for simplicity. Because if it’s simple, it’s easier for us to control it. So therefore we never made an acquisition. We only run one system. We only have engineers that are educated in the languages we use within the company. The board still oversees every hire, regardless of the role. You cannot be hired at Adyen without speaking to one of the six board members. The reason we do it is to put the bar high to ensure that only the best talent joins Adyen.”

Pieter van der Does

Consider this scenario for a moment: While the balance sheet shows a cash reserve of close to €6.5 billion, a large portion of this cash is merchant float due to the nature of the business. Adyen’s own cash is best calculated as the cash and cash equivalents on the balance sheet less payables to merchants and financial institutions plus receivables from merchants and financial institutions, which was around €2.3 billion as of June 30th 2023. This is over 10% of its market capitalization. It exhibits a reluctance to engage in acquisitions, and has completed the period marked by significant investments in organic growth. This prompts the question of how the company will deploy its surplus capital. Notably, Adyen does not distribute dividends, a stance I wholeheartedly endorse (as discussed in my article on John Malone). So, might it opt for large-scale stock repurchases akin to the approach employed by Henry Singleton? It's a possibility. Given its present market capitalization and available cash reserves, Adyen could potentially reduce its outstanding share count by around 10%. Furthermore, considering its potential to generate substantial future cash flows, there exists the prospect of further share count reduction over time. Singleton, during his tenure, bought back a remarkable 90% of Teledyne's stock, delivering exceptional returns to shareholders. Adyen, in due course, may very well do the same.

The Competition

Adyen's focus on providing a single platform for all payment processing needs sets it apart from the competition. Some examples include:

Shopify, a popular e-commerce platform allows businesses to create online stores and sell products. While Shopify offers payment processing capabilities, it does not offer the same level of cross-channel insights and unified commerce as Adyen and has in fact utilized the services of Adyen.

Klarna is a payment processing platform that allows businesses to offer flexible payment options to customers. Adyen partners with Paybright in Canada and Affirm in the US to offer buy now, pay later flexible payment options to shoppers at checkout to meet their specific needs.

Stripe and PayPal are other payment processing platforms that allow businesses to accept payments online and in-person. Neither offers the same level of cross-channel insights and unified commerce as Adyen. The differences here are more nuanced:

The main difference between Stripe and Adyen is that Adyen is a merchant account provider, whereas Stripe is a merchant aggregator, also known as a payment service provider. This means that Adyen offers independent merchant accounts for better stability, while Stripe provides aggregate merchant accounts ideal for small businesses.

Another difference is their pricing models. Adyen uses interchange-plus pricing, which is typically the most affordable model, especially as you make more sales. Even with Adyen's minimum monthly invoice requirement, you'd likely pay less overall compared to Stripe's flat-rate pricing if you have a high-transaction business. Adyen always puts customers first, not only being the lower cost provider of payment infrastructure generally, but also helping merchants to reduce their usage costs. So Adyen is trying to drive down the element of interchange costs taken by issuers (typically 150 basis points), perhaps through the supply of data, so that it can pass that saving through to the merchant. This means that the merchant receives a cost benefit without prejudice to Adyen’s margins (typically 17 basis points). A small discount from the issuer can make a far bigger difference to the merchant than any price reduction that Adyen could offer due to the margin differentials.

In terms of global reach, Stripe is generally better known than Adyen and has a larger international reach. Stripe has 20% of the market share, whereas Adyen only has 11%. That said, Adyen tends to have a bigger market share in Eastern Europe, South Asia, and South America

Stripe is known for its easy-to-use interface. Adyen, on the other hand, offers a lot of security options, such as customizable risk rules and settings, as well as card tokenization. Card tokenization is similar to encryption as it codifies customer data to render it unreadable in the event of a data breach or other exposure.

Ultimately, the choice between Stripe and Adyen will depend on the customer businesses needs and preferences. If it is a small business looking for an easy-to-onboard and easy-to-use method of taking card payments, Stripe is often the preferred choice. But for for large sophisticated business looking for more commercial functionality, better stability and more competitive pricing, Adyen is the better option. For this reason Adyen has major brands such as Uber, McDonald's, LinkedIn, Booking.com, Microsoft, H&M, eBay, Netflix, Spotify, Amazon, Shopify, Nike and Facebook (now Meta) as customers. Meanwhile Stripe will be used by the florist with a single shop, a chef with his own restaurant a market street trader, none of whom need a sophisticated solution and perhaps don’t have the sales volume to qualify for Adyen in any event.

Moving on to focus on competition on a geographic basis, a key issue to bear in mind is that the US market will be more difficult to crack than perhaps Adyen first imagined.

Adyen's success took root in the European e-commerce landscape, where its distinct competitive edge stemmed from the multitude of localized payment methods and diverse currencies in the region as the diagram below demonstrates:

Adyen’s service to European merchants immediately enabled them to accept payment in any of these forms which meant that Adyen was fulfilling a key need in Europe.

In contrast, the United States payment landscape is considerably more streamlined. If a business can accommodate payments through Visa, Mastercard, American Express, Paypal, Google Pay, and Apple Pay, it's likely well-equipped to accept payments from virtually any consumer, so the value that Adyen offers is lower than it had been in Europe. Not only that but the landscape is more competitive including the likes of PayPal’s Braintree which acts as a gateway and a merchant acquirer. However, where Adyen offers real added value is to the US merchants that operate on a global scale which need to deal with the diverse array of payment methods used outside of the US. This explains why Adyen has as its clients Microsoft, Airbnb, Uber, eBay and McDonald’s.

Additionally, Adyen is expanding on other continents including Latin American and the Asia Pacific region. In the case of the latter payment methods are even more fragmented than in Europe which bodes very well for Adyen:

Global growth has been truly impressive but efforts to expand into APAC and LATAM are relatively young and so the growth runway stretches far into the future with an enormous TAM.

Conclusion

In the global enterprise e-commerce sector, Adyen currently holds a substantial 20% market share. It's worth noting, however, that enterprise e-commerce represents only 10% of the broader merchant acquiring market. As a result, Adyen's market presence in the larger merchant acquiring field is 2%. This highlights the intensely competitive and fragmented nature of this industry, where more than 3,000 merchant acquirers worldwide are competing primarily at the local level. The positive aspect of this situation is the significant potential for consolidation, as traditional acquirers are gradually replaced by modernized platforms, with Adyen leading the way in this transformation.

It has always been said that the credit card companies earned more out of the aviation industry than the aviation industry earned itself. In the same way, Adyen stands to be a second order beneficiary of the rapid expansion of the e-commerce space. Everything purchased needs to be paid for and Adyen provides the market leading infrastructure.

This is a business that has almost no inventory costs, storage costs, logistics costs or delivery costs. Payment processing is a beautifully clean business that is infinitely scalable.

Over the last five years, Adyen has achieved a compounded annual growth rate of 44% in its processed volume. Adyen aims to grow revenues at a CAGR of 25 to 30% in the coming years, while guiding for EBITDA margins to move back up to 65% over the long-term (temporarily down in the mid 40s).

Scale economies are certainly evident, particularly in terms of working capital requirements which have steadily declined year on year, now being a small fraction of what it was only five years ago.

The single most important factor in any successful investment is the quality of the management and their operating model.

The business is guided by the eight principles of the Adyen Formula:

These values have remained constant since the founders created them. Above all else, the customer comes first. The company is constantly evolving.

Adyen has very high customer retention rates. None of its large customers have ever left, so it certainly has the correct recipe for success and every new customer acquired is pure growth.

Not only are customer retention rates very high, but the volume of payments being processed with each customer is also increasing. The digital segment grew 21% in volume which is faster than the growth rate in e-commerce generally.

However, it is taking no chances with key customers. Adyen has cemented its relationship with eBay through the issue of warrants that entitle eBay to acquire shares in the payment company subject to certain thresholds being achieved in terms of volumes of payments processed. eBay has already exercised some of these warrants and so has a vested interest in trading through Adyen. Eventually eBay may own 5% of Adyen through this mechanism.

Winning Shopify is also a major coup because it previously used competitors of Adyen to process payments but is now switching to Adyen. This serves as evidence that the Adyen offering is market leading and capable of winning more business from competitors.

Shareholder communication at Adyen is first class and the management is entirely candid and honest, guided by long-term objectives.

Stock based compensation is very modest and used sparingly. In fact in 2022, SBC was only granted to Mariëtte Swart and Alexander Matthey among the six managing directors. This limited allocation of SBC stands out as highly atypical, particularly within the technology sector, distinguishing Adyen from its American counterparts. A key factor contributing to this distinction is the Netherlands' 20% bonus cap, which restricts financial institutions from offering bonuses to their staff that surpass 20% of their yearly base salary. In the US, stock based compensation is the most abused aspect of corporate finance and is tantamount to a wealth transfer from shareholders to insiders (see No Such Thing As A Free Lunch). As an investor Adyen’s discipline around insider remuneration is a huge plus, and I would rather be invested in Adyen than a US equivalent.

Capital allocation decisions are excellent.

This is a solid well run business with a robust balance sheet. It has over €2.3 billion in cash and cash equivalents with no long term debt, and a debt to equity ratio of only 7.6% and a net asset value of €2.7 billion. It has an S&P investment grade rating of A-.

All of this means no direct exposure to the higher interest rate environment that is acting as a drag on the earnings of other businesses. In fact, the opposite is true as it earns more now on interest and investment income. In short, Adyen is very well positioned to capitalize on any opportunity that may present itself in the future.

“We have always maintained a strong balance sheet to enable rapid and flexible execution…We are building Adyen knowing that our product offering will constantly evolve. As consumer preferences become even more technology-driven, additional revenue opportunities will emerge and we will engineer our product to capitalize on them.”

Pieter van der Does, H1 2023 Shareholder Letter, H1

As noted in the article, Adyen doesn’t engage in acquisitions, but it may be tempted to acquire itself through stock repurchases at current levels. With €2.3 billion in net cash, it could reduce its share-count considerably. It certainly needs to do something with its ever growing pile of cash which is otherwise a huge drag on returns on invested capital.

With an enterprise value of only €17 billion (their actual cash balance is closer to €2.5 billion as explained above), it also represents an interesting acquisition target, particularly for financial institutions offering merchant services with a large existing client base but without the Adyen technological edge. The acquisition would not only secure the financial institutions existing relationships, but add a great deal of value to Adyen post acquisition. It would certainly be a case of 2+2=5.

For the ordinary investor, Adyen is not cheap on any conventional measure, but good companies rarely are. As Charlie Munger always says, “Better to buy a great company at a fair price, than buy a fair company at a great price.” I think that sums it up nicely.

There are so many value unlocks on the horizon that today’s price may appear to be a bargain in a few years from now.

What’s not to like about this business? If any business is a buy and hold forever, this looks like being it.

If you want to learn more, Adyen is holding an investor day on 8th November. You can register here .

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

>>> AWESOME RESULTS - INVESTMENT THESIS VERY MUCH STILL IN TACT <<<

AMSTERDAM, February 13, 2025 — Adyen (AMS: ADYEN) announced financial results for the half year ending December 31, 2024.

H2 2024 key metrics

- Net revenue* was €1,082.7 million, up 22% year-on-year.

- Processed volume was €666.4 billion, up 22% year-on-year, 28% excluding a single large volume customer.

- Of these volumes, total point-of-sale volumes were €137.1 billion, up 48% year-on-year.

- EBITDA* was €569.2 million, up 35% year-on-year, with EBITDA margin* landing at 53%.

- Free cash flow conversion ratio* was 88%, with CapEx* at 5% of net revenue.

Full-year 2024 key metrics

- Net revenue* was €1,996.1 million, up 23% year-on-year.

- Processed volume was €1,285.9 billion, up 33% year-on-year, 27% excluding a single large volume customer.

- Of these volumes, point-of-sale volumes were €232.7 billion, up 46% for the full year.

- EBITDA* was €992.3 million, up 34% year-on-year, with EBITDA margin* landing at 50% for the full year, compared to 46% in 2023.

- Free cash flow conversion ratio* was 87%, with CapEx* at 5% of net revenue for the full year, compared to 4% in 2023.

Ethan Tandowsky, CFO:

“We are proud to have delivered a strong year of growth further cementing our position as the trusted partner of choice for global businesses. Once again, expanding our relationships with existing customers was a key driver of our growth, reinforcing the vast opportunity that remains.

“Strengthening these partnerships contributed to net revenue growth reaching 22% for H2 and 23% for the full year, a true testament to the significant value we continue to provide. As we continue to build Adyen for the long-term, we are pleased with our performance in 2024, and remain confident about delivering on our financial objectives in the years ahead.”

Earnings video conference will take place at 3 pm CET (Central European Time) on February 13, 2025 : https://investors.adyen.com/events/earnings-call-h2-2024

ADYEN and PayPal collaboration ~ 20 August 2024 update

Adyen has become PayPal's first Fastlane distribution partner. Many people shopping on line like to 'check out as guest' without logging in to the vendor's platform. However, doing so typically takes longer, which consumers dislike and often results in the customer failing to complete the purchase, which is bad for the merchant.

Fastlane is designed to tackle this problem. Fastlane is a service offered by PayPal which facilitates a more streamlined guest checkout process, using the PayPal email ID set up, which promises to reduce the time to check out by 32% compared to a traditional guest checkout and to deliver an 80% conversion rate into completed sales, which is a big step up.

Adyen will offer Fastlane to accelerate guest checkout flows for its enterprise and marketplace customers in the U.S., with plans to extend this offering globally in the future.

Adyen and PayPal have collaborated for several years, allowing Adyen's clients to offer PayPal's payment options, including PayPal, Venmo, and PayPal's Buy Now, Pay Later solutions. The Fastlane collaboration is the next step in this journey.

"The expanded partnership with PayPal further strengthens Adyen's ability to provide global enterprises with seamless payment flows and top-quality guest shopping experiences," said Pieter van der Does, co-founder and co-CEO, Adyen. "PayPal is a payment brand name that shoppers trust, and we're excited to take our collaboration another step further in the US, utilizing our combined expertise to raise the bar for our customers.''

It should be remembered that after 15 years of PayPal serving as the eBay payment method, its services were terminated in favour of Adyen. This was driven by a desire for greater control over the checkout experience and the ability to offer more diverse payment options to its global customer base. The move was expected to provide cost savings for sellers, increase revenue for eBay, and simplify the user experience by keeping transactions on-site. Additionally, eBay aimed to gain a competitive advantage in the evolving ecommerce landscape and improve its data collection capabilities, which aligns it to other major online marketplaces like Amazon and Alibaba.

Gracious in defeat, PayPal is now looking to leverage Adyen's superior payments infrastructure to distribute its own niche product offerings. This looks like being a win/win for both parties.

The Adyen investment thesis goes from strength to strength.