Dirty Money | An Out Of Favour Industry

Overlooked, Unloved, But There's Money In It If You Are Interested

In a world captivated by cutting-edge technology and the relentless pursuit of the next big thing, it’s easy to overlook the quietly thriving industries right under our noses. While unprofitable AI ventures continue to attract massive investment despite burning through capital, a handful of savvy investors are turning their attention elsewhere. Eminent figures like Mohnish Pabrai and Guy Spier are heavily leaning into seemingly dull but highly cash-generative businesses that offer far more attractive risk weighted returns. Intrigued by this contrarian approach and inspired by my fellow investor Hugo Navarro, I decided to dig deeper into one of these overlooked opportunities: the metallurgical coal business. You are likely to be surprised by my findings.

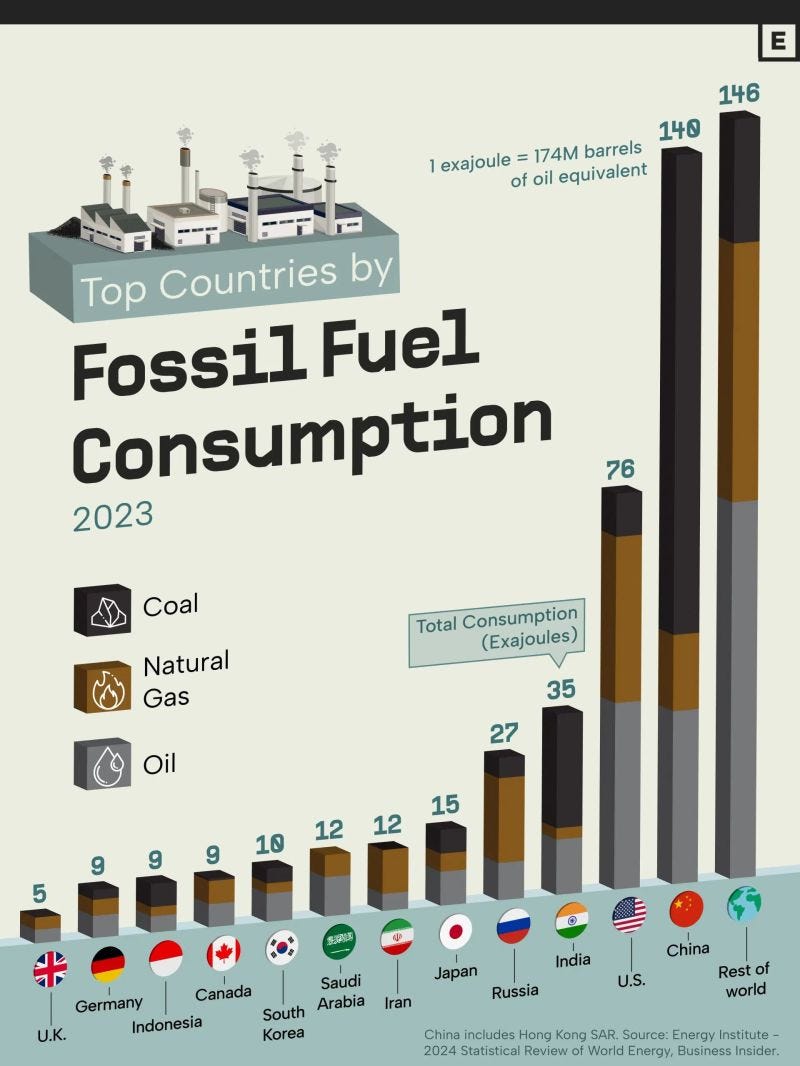

Climate change policies will at some point result in a complete phase out of hydro-carbon fossil fuels such as coal, but that may be many decades away.

Meanwhile, Environmental, Social, and Governance (ESG) initiatives have led to coal being viewed unfavourably, prompting many large fund managers to divest from the industry entirely.

While this may create the appearance of responsible investing, it is important to recognize the limitations of such actions. When a fund manager divests from coal, it simply results in a transfer of ownership; the coal business itself continues to operate unchanged. As a result, this divestment has no real environmental impact, despite allowing companies to claim ESG compliance and enabling them to charge higher management fees for appearing environmentally conscious.

Does this approach make sense to you? To me, it seems illogical.

The truly intelligent investors recognize that their investment decisions have no environmental impact one way or another, and so allocate capital based on risk weighted returns, rather than trading on nonsensical ideology.

The Coal Market

In 2020, the coal industry faced a bleak outlook. Coal prices had plunged during the pandemic shutdowns, and most mining companies were burdened with significant debt. All the while, ESG divestments were weighing on market caps.

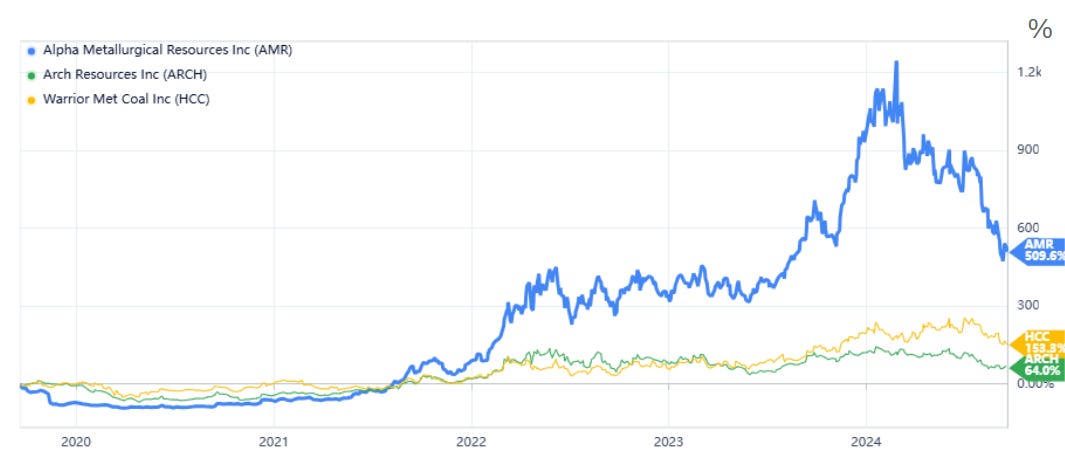

However, when lockdowns ended and economies reopened, coal prices began to rise. The surge intensified after Russia’s invasion of Ukraine, sending prices soaring. Miners that were once on the brink of collapse suddenly became highly profitable. Many completely paid off their debts and distributed substantial returns to investors. Consol Energy, for example, saw its stock price jump from a low of $3.40 per share in 2020 to over $100 in 2023—a 29x increase. Alpha Metallurgical Resources (AMR) experienced an even more dramatic rise, going from $1.90 in 2020 to a high of $452 earlier this year—an astounding 238x increase—while retiring a third of its outstanding shares.

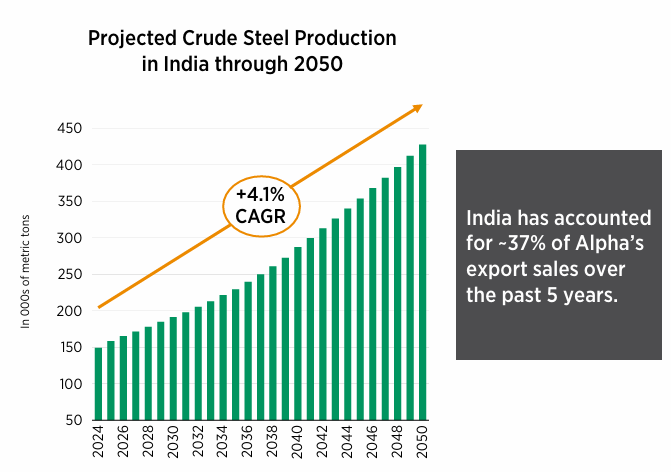

These black swan events are unlikely to repeat, but the industry is experiencing shifting dynamics, with traditional markets like Europe seen moving away from hydro-carbon fuels due to decarbonization efforts, while demand is growing strongly in Asia, particularly India and Southeast Asia (see chart below).

So while many investors wrongly consider coal to be a dying industry, the chart above suggests quite the opposite being true.

Accordingly, several high profile investors have been building a contrarian position in coal assets believing that they will generate outsized returns in the years ahead.

Now that I’ve captured your undivided attention, let’s explore the market in more detail.

The coal market is divided into several distinct categories, each with its own characteristics and market dynamics. Generally there are five types of coal that can be subdivided into three groups defined by their use: power generation, metal production and specialist applications. Each type of coal has its own unique market behaviour, leading to varied responses to global economic trends, technological advancements, and policy shifts.

- Coal in Power generation

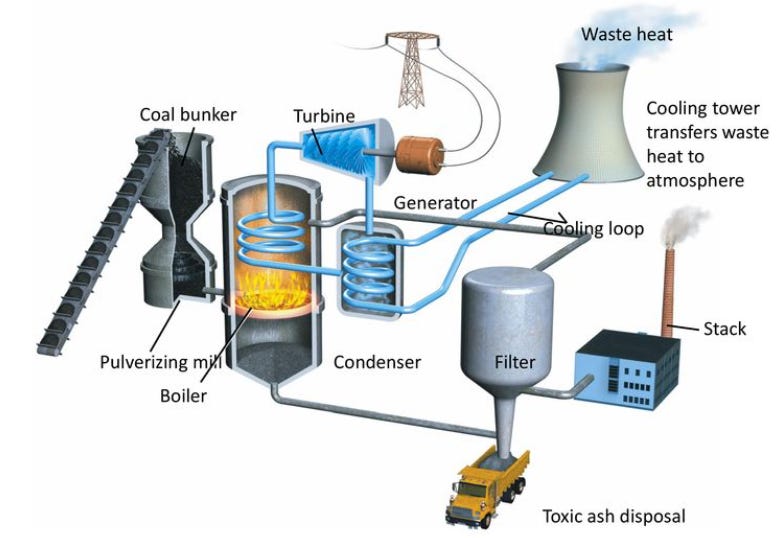

Thermal coal, mainly used for electricity generation, is classified into various sub-categories based on its quality, such as bituminous, sub-bituminous, and lignite.

The demand for thermal coal is influenced by electricity consumption patterns and competition from other energy sources, especially renewables. Prices in this segment are also affected by environmental regulations and carbon pricing. Major producers of thermal coal include China, India, and Indonesia.

Lignite (Brown Coal) is the lowest rank of coal and is typically used in power generation near the mining sites due to its low energy content and high moisture. Its demand is largely domestic, with prices that are more stable but vary greatly by region. Major consumers include Germany, Turkey, and parts of Eastern Europe.

- Coal in Metal production

Coking coal is a vital component in steel production, particularly in blast furnace operations, accounting for 70% of the world’s steel output. Steel production requires around 0.78 tons of coal to make one ton of steel. But blast furnaces require the highest quality and most expensive type of coal, which has been labelled Metallurgical coal.

Its demand is closely tied to the steel industry, making it sensitive to global economic growth and infrastructure development. Steel production has few substitutes for coking coal, which further solidifies its position in the market.

One partial substitute is Pulverized Coal Injection (PCI) coal and so its demand is closely linked to, but distinct from, metallurgical coal. The price of PCI coal is influenced by both steel production and broader energy markets. Because it functions as a substitute product, PCI coal can be more volatile in pricing.

Major exporters of Metallurgical coal include Australia, the United States, and Canada. It tends to exhibit greater price volatility than thermal coal, given its specialized use and sensitivity to fluctuations in the steel market.

Global steel prices and metallurgical coal prices are generally closely correlated, though this correlation can fluctuate over time due to various factors. The coal price significantly affects steel production costs, so when coal prices increase, steel producers typically pass on these costs to consumers, leading to higher steel prices. The opposite is true when coal prices decline, which results in a decline in the cost of producing steel.

However, it should be noted that other factors also influence steel prices, including iron ore prices, global economic conditions, supply and demand dynamics, trade policies, and advancements in steelmaking technologies. As such a cyclical dip in the activity within the construction industry or the automotive industry, will negatively impact demand and so the market price for metallurgical coal.

Regional variations in market conditions and the use of different steel production methods can also affect the strength of this correlation.

The correlation is not perfect, due to time lags following the change in one before an impact in the other is seen. However, over the long term, as short-term fluctuations balance out, the correlation between metallurgical coal and steel prices typically ranges from 0.7 to 0.9, indicating a strong positive relationship.

Research by Wood Mackenzie suggests that global demand for coal used to produce high-quality steel is expected to continue surpassing supply in the near-term.

One very interesting aspect of the Metallurgical coal investment thesis is often overlooked. Many people think of coal as the fuel of the 19th century, while the 21st century is all about renewable energy. But steel is used in all areas of renewable energy and coal is required to make that steel! For instance, steel is used extensively in agriculture where biomass is produced. Steel is used as a base for solar thermal panels and in pumps, tanks and heat exchangers. A steel pile is the main component of a turbine in tidal energy systems and it is also used to fabricate wave energy devices. For hydro-electricity, steel is needed to reinforce concrete dams. And last, but by no means least, almost every component of a wind turbine is made with steel, from the foundation to the tower, gears and casings. In short, if we want more renewable energy, then we need steel, and if we need steel then we need metallurgical coal (at least until hydrogen power becomes a viable alternative - see below).

- Coal in Specialist applications

Anthracite, with the highest carbon content, is used in specialized industrial processes and for some heating applications. Due to its limited production and specialized use in industries like water filtration and silicon metal production, anthracite commands higher prices. Its scarcity and niche market keep demand relatively stable.

The Smart Money Is In Metallurgical Coal

There are several reasons why Metallurgical coal is more appealing for an investor:

Thermal coal is typically more localized as high transportation costs become difficult to justify relative to the low market price of the fuel. However, as an input material for the production of steel which can be passed through to the consumer, metallurgical coal is traded more globally as the transportation costs are easy to recover further down the supply chain. This is evidence of more price elasticity in the Metallurgical coal market, which has to be better for the coal producer. Additionally, Metallurgical coal is often sold via quarterly benchmark prices or on the spot market, while thermal coal tends to be sold through longer-term contracts. This means that Metallurgical coal producers have the ability to sell to whomever offers the best price without being fixed into long term offtake agreements.

While thermal coal is directly affected by climate policies and the global shift toward renewable energy, the steel industry requires fuels with a high calorific value for metal smelting and substitution of metallurgical coal is difficult, particularly since progress in harnessing hydrogen power has been painfully slow. This would suggest more longevity in the Metallurgical coal market.

Thermal coal demand often fluctuates with electricity usage, exhibiting seasonal patterns, whereas metallurgical coal is less seasonally affected.

Caveats

As political pressure builds to move away from coal, incentives will encourage the steel industry to find alternatives to fossil fuels or at least to reduce their consumption of Metallurgical coal. This is already in evidence with advances in steel production, such as the adoption of electric arc furnaces (EAFs).

Electric arc furnaces (EAFs) are significantly more environmentally friendly than traditional blast furnaces, emitting 70% less carbon dioxide per ton of steel since they rely on electricity rather than coal. However, EAFs have several disadvantages compared to blast furnaces.

First, EAFs are only cost-effective in regions with abundant, reliable electricity and a well-developed electrical grid. Second, operating EAFs is generally more expensive than operating blast furnaces. Finally, EAFs are limited to producing steel from scrap metal, as they cannot manufacture virgin steel from iron ore.

While EAFs may be greener, recycled steel is not always a suitable replacement for virgin steel. Recycled steel can contain impurities that may impact its yield strength or hardness. Virgin steel, known for its consistency, is favored by precision industries like automotive and aerospace manufacturing. Its ability to be engineered to exact specifications makes it essential for high-stress applications, such as bridges, skyscrapers, and rail tracks. So Metallurgical coal will continue to be in demand.

While the hydrogen economy poses a significant long-term threat to Metallurgical coal demand, the transition is likely to be gradual. Hydrogen can be used as a reducing agent in steel production, potentially replacing coal-based blast furnaces. However, the shift to hydrogen-based steelmaking requires substantial infrastructure change and investment. The next decade may not see dramatic changes, but beyond 2030, we could see accelerating declines in demand as hydrogen technologies mature and become more widely adopted.

The exact timeline and extent of this shift will largely depend on policy decisions in addition to technological advancements and economic factors. Adoption of hydrogen technologies will likely vary by region which could ultimately create a two-tier market, with some regions maintaining coal-based production longer than others.

The other factor to consider is ongoing exploration of hybrid technologies that use both hydrogen and coal in varying proportions, which would lead to a gradual phasing out of Metallurgical coal rather than a sudden shift.

I feel that it is safe to assume that Metallurgical coal demand will remain supported in the short-to medium-term.

For more on the hydrogen economy, see: Hydrogen | The New Oil

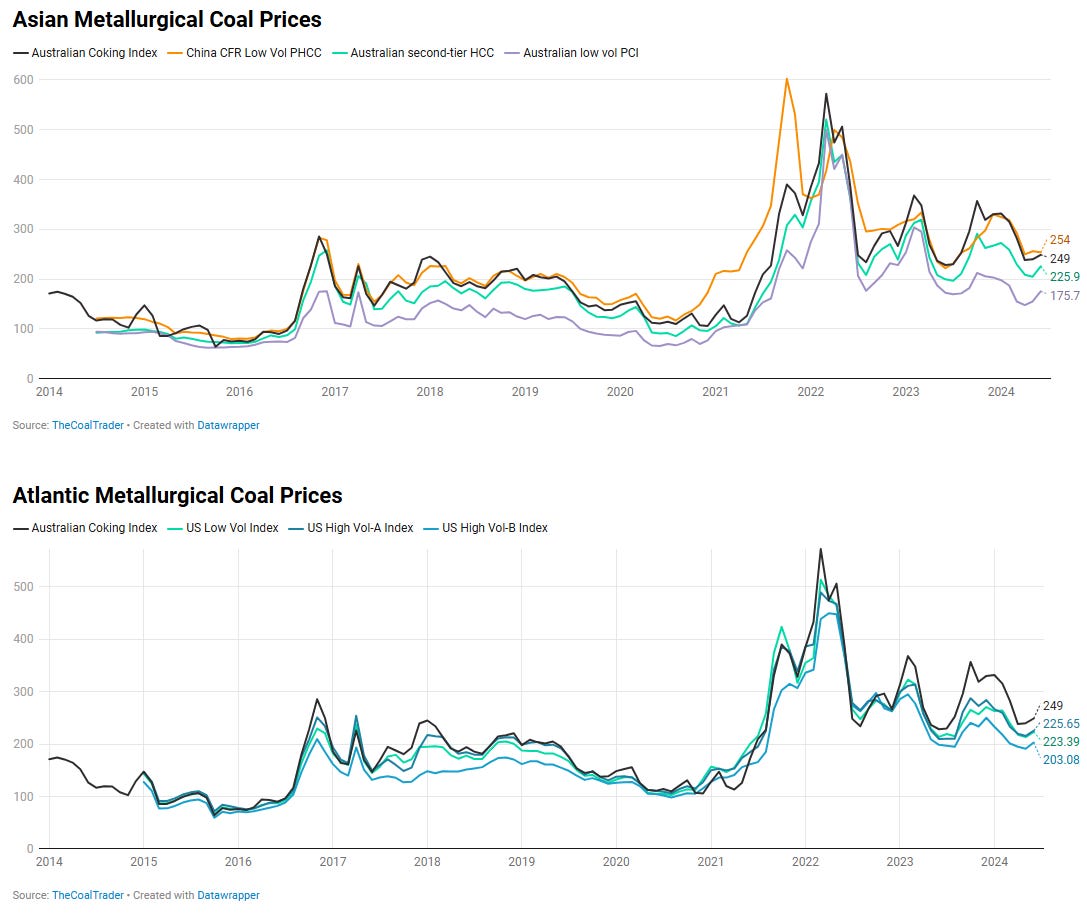

However, the open market price of metallurgical coal is driven by a host of factors, as alluded to above. This causes cyclical volatility, which was particularly pronounced following the Covid19 pandemic (see charts below). The recent announcement by China of renewed economic stimulus (24th September) caused an uptick in coal prices as steel production is anticipated to increase.

The other thing to consider, particularly in the US is that The Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law (BIL), brought non-residential construction forward (see chart below). When construction is pulled forward, it means a period of drought up ahead. This will not impact those concerned primarily with exporting their Metallurgical coal, but may impact those with a relatively large exposure to their domestic U.S. market.

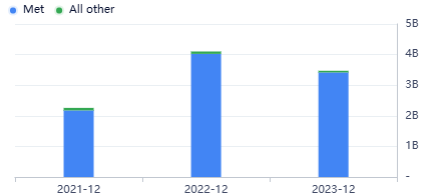

In combination, the effects of Covid19 and the IIJA created a wave of higher metallurgical coal prices that producers have been riding in recent years. The extraordinarily high coal prices seen in 2021 and 2022 have landed coal producers windfalls in revenues and earnings which are unlikely to be repeated. As such, all modelling ought to be undertaken based on normalized levels rather than figures from recent years.

Investment Opportunities in Metallurgical Coal

China is both the world's largest producer and consumer of metallurgical coal. It continues to increase output to meet domestic demand, but currently relies on imports to bridge the supply/demand gap, especially for certain coal qualities.

India is rapidly expanding production, encouraged by Government initiatives to boost self-sufficiency, but is currently still heavily dependent on imports to meet rising demand.

Australia is the world’s largest metallurgical coal exporter by far with BHP and Anglo-American being major players.

BHP’s recent US$40 billion takeover bid for Anglo American is mainly about copper. However, a successful takeover would also make BHP an even larger metallurgical coal miner. BHP has recently been offloading its lower-quality metallurgical coal mines to the likes of Whitehaven Coal in the belief that steelmakers will gravitate towards higher quality as they seek to reduce blast furnace emissions. Anglo’s Queensland coal mines produce the hard coking coal that BHP is keen on.

The U.S. is also a coal miner, offering a diverse range of coal qualities. It is expanding its Asian market presence as European demand declines. Russia has vast coal reserves and is strategically positioned to serve both European and Asian markets, but sanctions as a result of its invasion of Ukraine has impacted demand for its coal, so the U.S. players are capitalizing on the opportunity to capture market share although exports are still below pre-Covid19 levels, but the recovery is well underway and the new Chinese economic stimulus should accelerate that process.

This analysis focuses on three key U.S. players scaling-up operations: Alpha, Arch and Warrior. Before diving into analysis on key U.S. mining companies, it is important to understand the dynamics that drive success in this industry.

Coal is a commodity industry, meaning that having the lowest production costs is a significant competitive advantage. The method of mining used greatly influences a mine’s costs. Surface mining is the most affordable approach, with dragline mining being the cheapest option. It works best for coal located near the surface with minimal overburden, such as at Arch Coal’s Black Thunder mine in Wyoming’s Powder River Basin. The shovel-and-truck method is better suited for thinner seams of coal and softer, shallow overburden, a technique commonly used in the Powder River Basin, Illinois Basin, and Northern Appalachian Basin (NAPP).

Underground mining primarily uses two techniques: longwall and room-and-pillar. Longwall mining is the most efficient, particularly in thick, continuous coal seams, offering high coal recovery rates but requiring significant upfront investment. Once operational, it must run continuously to remain cost-effective, as seen at Consol Energy’s PAMC mine in NAPP. Room-and-pillar mining, on the other hand, is more adaptable to varying geological conditions and has a lower initial cost, though it recovers less coal. This method is prevalent in Central Appalachian mines.

Another key cost factor is transportation access. Mines reliant on a single rail line are often at the mercy of the railroad, which can eat into profits. Mines with multiple transportation options, including barge access or a second rail line, gain flexibility and leverage. Appalachian coal enjoys proximity to Atlantic coal terminals, while Warrior Basin coal benefits from closeness to export terminals in Mobile, Alabama. In contrast, Illinois Basin coal can be barged to New Orleans, albeit at a higher cost, and Powder River Basin coal is largely landlocked, limiting its export potential as U.S. consumption declines.

With this background knowledge, let’s dive in to three key players as potential investment targets.

Alpha Metallurgical Resources Inc

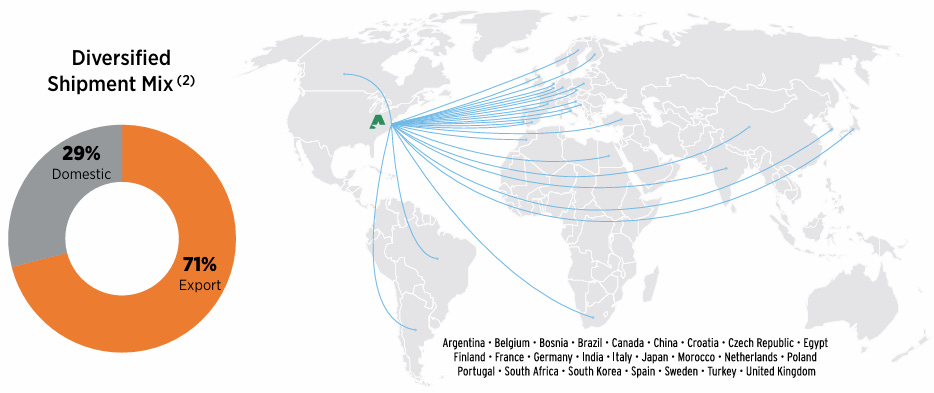

With customers in 25 countries and significant port capacity, Alpha Metallurgical Resources Inc (NYSE: AMR) is a leading U.S. supplier of metallurgical coal for the steel industry.

The company operates 21 underground and surface coal mines, plus coal preparation plants in Virginia and West Virginia. It controls approximately 316 million tons of coal reserves and 514 million tons of in situ coal resources. In fact, Alpha accounts for one in every five tons of metallurgical coal produced in the U.S.

Additionally, as a 65% owner of Dominion Terminal Associates, Alpha enjoys a majority share of storage capacity at the Newport News facility providing it with a direct link to its export markets.

Andy Eidson has served as chief executive officer and director since January 2023, but has worked his way up the hierarchy through various roles since joining the business in 2010. As such, he is very much an insider having been promoted from within, which is always good to see. Prior to joining Alpha, Eidson held several financial positions across industry sectors, including at PricewaterhouseCoopers LLP, Eastman Chemical Company, and most recently Penn Virginia Resource Partners, where he led mergers and acquisitions projects for the coal segment.

Management is first rate with a keen focus on cost control and productivity improvements. Management improved inventory turnover and accounts receivable collection, both of which helped improve working capital requirements. However, it should be noted that it also reduced accounts payable days, thereby strengthening its relationships with suppliers. Then came the divestiture of non-core assets, as management took the strategic decision to focus on high-quality metallurgical coal operations. The result was improved return on assets (ROA) due to more efficient asset utilization.

Metallurgical coal accounts for almost all of Alpha’s business with a tiny green slither barely visible on the chart below representing other types of coal in their product mix.

This is a cyclical business and weakening steel demand has negatively impacted metallurgical coal markets in 2023. Waning demand, coupled with significant geopolitical uncertainty across the world has brought about market challenges. This cyclicality will introduce turbulence in revenue and earnings, but the company is very well placed to weather economic downturns or short-term market volatility.

Regardless of short term challenges, Alpha has not taken its foot off the pedal and is making long-term strategic decisions. Management has demonstrated the ability to prudently allocate capital to projects with measurable ROI and fast payback. For instance, it is entering the development phase of Kingston Sewell, a new underground mine in Fayette County, West Virginia, that will produce a low-volatile product. With surface site development and slope excavation underway, it expects to mine the first production cuts in late 2025.

If D&A is taken as a proxy for maintenance CAPEX, which is not unreasonable, over the past few years growth CAPEX has certainly ticked up significantly. It is also worthy of note that despite many labelling the coal sector as a declining industry, full time employee numbers, which fell due to the Covid-19 pandemic, are back up to peak levels.

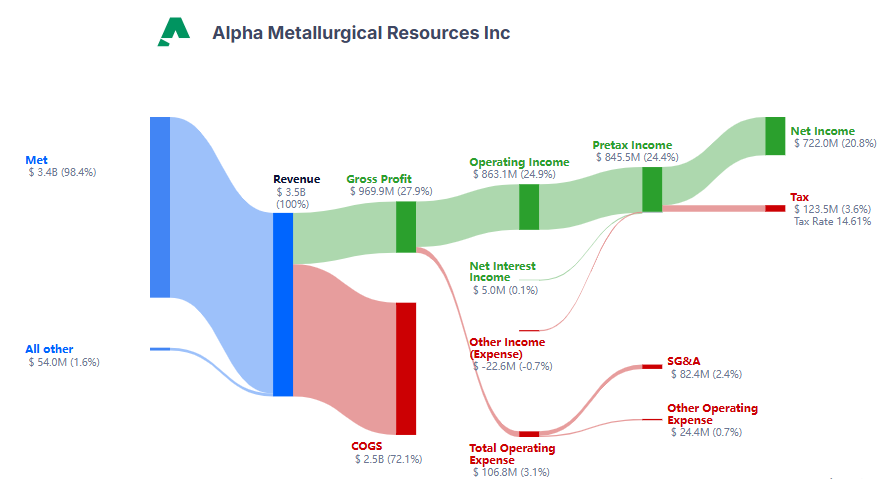

In order to understand the way in which the companies income statement breaks down, please see the graphic below.

Strong net margins and good cash conversion results in consistent free cash flow generation, which the company has utilized to achieve significant debt reduction and improve its balance sheet.

Long-term debt has reduced from $551 million in Q1 2021 to zero. The company now has a net cash position of $327 million. In the unlikely event that it needs it, the company also maintains an undrawn $155 million revolving credit facility.

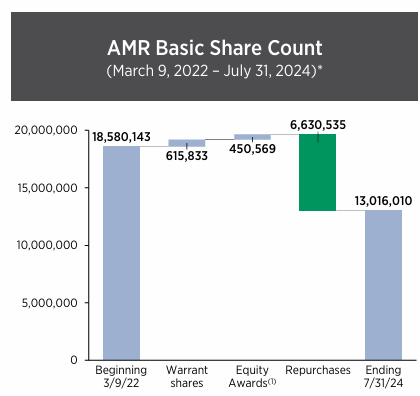

Having repaid its long-term debt, and with significant increases in shareholders' equity due to retained earnings growth, the company has been allocating surplus capital for the purpose of buying back shares. This is important for a variety of reasons, but since ESG group-think has swept through the market, demand for shares of businesses in this sector has dipped, so the buy-backs plug that gap. In recent years it has reduced share count by 28% (see graphic below). This trend is likely to continue, and at this rate, the company could be taken private by the end of the decade!

The company is capitalized at attractive multiples: it has a NTM P/E of 7.8x, EV/EBITDA of 4.1x and EV/Sales multiple of 0.76x. For a company that generates a ROIC of 32% and with a payout ratio of just 5%, there is certainly potential for a re-rating.

In short, Alpha Metallurgical Resources offers an attractive investment opportunity for those seeking exposure to the Metallurgical coal sector, making it a compelling consideration for investors with a medium-term horizon. This company certainly presents a compelling investment opportunity based on its strong market position in metallurgical coal, robust financial performance, cost discipline and potential for value creation through clever capital allocation including repurchases of shares that are highly accretive to those invested.

Arch Resources Inc

The next company for us to consider is Arch Resources Inc (NYSE: ARCH). This is one of the world's largest coal producers, engaged in U.S. metallurgical coal production. The company operates large, modern mines that consistently set the industry standard for safety, environmental stewardship, and productivity.

Arch Resources CEO is Paul Lang, appointed in 2020 having served in various roles within the company since 1998. He is something of a veteran of the industry. The former CEO who served from 2012 was John Eaves. He has assumed the role of Executive Chairman and so is still very much involved in the business.

Management has a keen focus on cost control and productivity improvements. Its operational excellence together with investments in efficiency and automation have bestowed upon it a low-cost producer status, which further enhances its competitiveness.

It generates consistent free cash flow and, similar to ARM, has embarked on significant debt reduction to improve its balance sheet. As of Q3 2022 it had achieved a net cash position of $105.2 million. The debt that remains has been refinanced with a term loan at improved rates, significantly reducing its funding costs. The majority of debt is now due in 2025 and beyond.

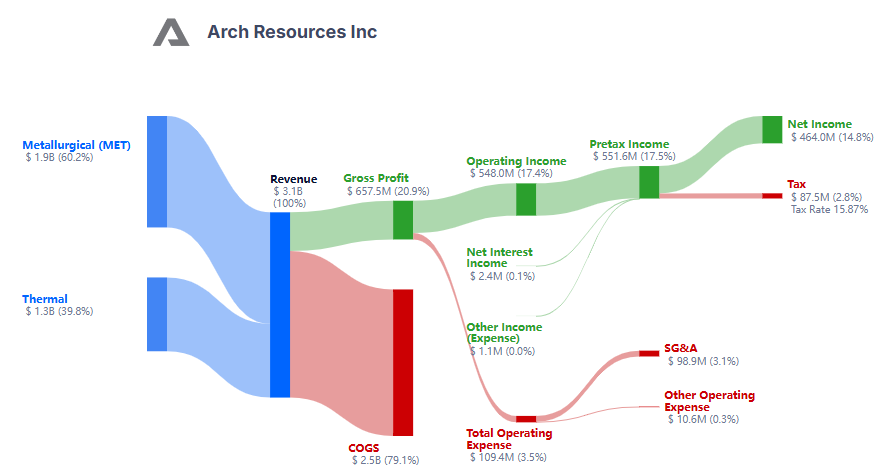

Below is a similar graphical break out of the income statement as that shown for AMR above.

Although the domestic market is Arch’s primary market, Europe and Asia are major sources of revenue.

As with Alpha, Arch is ramping-up its coal production potential. It has its new Leer South project, with high-quality metallurgical coal reserves.

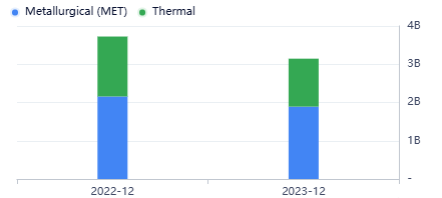

In the last few years, the company was seen strategically pivoting away from thermal coal, focusing on high-quality and higher margin metallurgical coal operations instead (see chart below). When a key industrial player makes this choice, it reinforces the investment case for metallurgical coal over thermal coal, but there is a twist in this story.

Recently, there seems to have been a shift in strategy with the announcement of the merger of Arch Resources and Consol Energy, which is a strong player in the thermal coal market. This pivot may be explained on the basis that diversification across coal types and end markets provides more stability and flexibility enabling it to better weather market fluctuations. The merger may also have been influenced by a desire to serve growing demand in Asian markets, where coal use remains strong. One thing is certain - the combined entity will have an ownership interest in approximately 25 million tons per year of export coal capacity across two marine export terminals on the U.S. Eastern seaboard and have strategic connectivity to ports on the West Coast and Gulf of Mexico. The potential to optimize this expanded export capacity and logistics capabilities is expected to enhance reliable, efficient coal delivery to global customers.

The merger will create a diversified coal producer, owning 11 mines, with a broad portfolio of high-quality metallurgical and thermal coal. The two companies have announced an all-stock merger of equals to create a new entity called Core Natural Resources. The combined company will be valued at approximately $5.2 billion and the merger is expected to close by the end of the first quarter of 2025, subject to regulatory and shareholder approvals.

Jimmy Brock, CONSOL's CEO, will serve as Executive Chairman of the new company, while Paul Lang, Arch's CEO, will become the Chief Executive Officer. The company will be headquartered in Canonsburg, Pennsylvania which is Consul’s existing headquarters, but will maintain a presence in St. Louis, where Arch is currently situated.

“Core Natural Resources will enjoy the benefits of CONSOL’s growing seaborne thermal business focused on industrial applications coupled with Arch’s significant exposure to attractive global metallurgical coal markets. Together, we expect to realize meaningful operating synergies through the optimization of support functions, greatly enhanced marketing opportunities, and a significantly expanded logistics network, which will enhance our ability to deliver coal reliably and efficiently to our global customers.”

Paul Lang, CEO Arch

“Our assets are highly complementary, resulting in increased diversification across coal types, end uses, and geographies. In addition, Core Natural Resources is expected to have a strong balance sheet, ample liquidity, and robust free cash flow to deliver industry-leading capital returns.”

Jimmy Brock, CEO Consul

The combined company is expected to generate $110 million to $140 million in annual cost and operational synergies within 18 months post-merger. It represents a significant consolidation in the U.S. coal industry, creating a major player in both domestic and international coal markets. The transaction is expected to be accretive to free cash flow for both Arch and CONSOL in the first full year following close.

On a pro forma basis, excluding the impact of synergies, Core Natural Resources would have generated approximately $1.4 billion of free cash flow in 2023, and would have had a net cash position of approximately $260 million as of June 30, 2024.

Accordingly, post merger, its strong cash flow and balance sheet is expected to provide significant financial flexibility which will support robust capital returns in a wide range of market environments as well as the possibility of further value accretive M&A activity.

Unlike ARM, it seems to favour returning capital to investors in the form of dividends with a variable dividend policy which is contingent upon market conditions. It has returned $422.9 million to shareholders since Q4 2020.

Warrior Met Coal Inc

The third and final Metallurgical coal business in this already lengthy analysis is Warrior Met Coal (NYSE: HCC). It emerged from the Chapter 11 bankruptcy of Walter Energy in 2015.

Warrior’s CEO is Walter Scheller who also served as the CEO of the bankrupt Walter Energy previously. Despite having the same name, Walter Scheller was not the founder of Walter Energy. The company was founded in 1946 by Jim Walter.

Walter Energy had significant debt, having made a major acquisition of Western Coal Corporation in 2010 in 2010. Then the cyclical nature of the coal industry led to a downturn in coal prices. By July 2015, metallurgical coal was trading at around $80 per ton, down from about $300 per ton at the time of the acquisition. It could no longer fund its $3.15 billion debt and so slipped into insolvency.

Walter Scheller was appointed CEO of Walter Energy in 2011 after the major acquisition, so he arguably inherited the balance sheet problem. After the bankruptcy filing, Scheller led the company through the restructuring process. This transition effectively rescued the core assets of Walter Energy from bankruptcy, allowing them to continue operating under the new Warrior Met Coal entity.

Having experience the trials and tribulations of Walter Energy, Scheller is unlikely to repeat the mistake that led to the demise of that company. Indeed, the balance sheet for Warrior Met Coal shows a net cash position of around $550 million and the company has enjoyed consistent free cash flow generation which resulted in a return of $1.4 billion to stockholders since 2017.

Metallurgical coal, or met coal, is classified into several grades based on its volatile matter content: low, medium, and high. Surprisingly, the highest quality and most valuable met coal is the one with lower volatile matter and higher carbon content. Thus, despite the name, "low-grade" coal is actually considered the highest quality.

In the U.S., this premium grade of coal is predominantly found in West Virginia's Central Appalachian Basin and Alabama's Warrior Basin. This is where the name "Warrior Met Coal" comes from, reflecting its regional origin in Alabama's Warrior Basin.

Today Warrior is a large-scale, low-cost producer and exporter of premium quality metallurgical coal. It operates underground mines in Alabama's Blue Creek coal seam, known for its high-quality characteristics - it contains very low sulfur, has strong coking properties and is of a similar quality to coal referred to as the premium HCC (hard coking coal) produced in Australia.

It has only three mines (two are active and one is in development). The Blue Creek Mine expansion project is a major growth driver projected to increase production capacity by ~54% and add ~50 years of expected production. In fact the net present value of the Blue Creek project stands at over $1 billion alone.

Of particular note is that Warrior produces stronger margins than the other two companies in this analysis, but has the lowest return on invested capital. This would indicate that Warrior is more capital intensive, and far less efficient in the use of its assets. This is supported by its low asset turnover numbers. Perhaps the fact that it exports 98% of its coal internationally makes the business less efficient (I am only speculating).

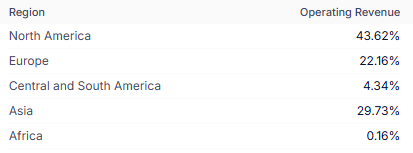

Geographical Revenue Breakdown (based on 2023 data):

Europe: $791 million

Asia: $478 million

South America: $346 million

United States: $32.96 million

This unusual distribution of customers certainly distinguishes Warrior from the other two. Some investors may view the geographic spread of customers as a good thing, others might like to see a heavier weighting to the more stable domestic market which is not subject to volatility in FX rates and shipping costs.

Side-by-Side Analysis

It is very difficult to compare these companies on a side-by-side basis because of the subtle nuances between business models. It’s almost like comparing an apple with an orange and a banana.

Additionally, the entire profile of Arch will change after the Consol merger completes, so its historic numbers are of little value in revealing what the future holds. Will the diversified thermal and metallurgical coal strategy pay off? Or will the other companies with an almost pure play focus on metallurgical coal be the better strategy?

The Blue Creek expansion will certainly make a big difference to Warrior, but Alpha has its Kingston Sewell project and Arch has Leer South, so all three are likely to see growth in output which is difficult to model at this stage.

We then need to consider that for some income investors, dividends may be important, while others will favour the tax efficiency and more accretive nature of buy-backs.

In short, what fits the portfolio of one investor may not fit for someone else.

I have prepared some key statistics below which ought to allow you to review these companies for yourself.

I have also run my own models and assumptions for the next five years and I am happy to share the results.

I see fair value for Arch Resources shares at $139 versus $124 today, so it is trading at a discount. At today’s price, assuming top line growth continues at an average of 5.7% annually, the share count remains unchanged, margins expand by about 300 basis points and the business is capitalized at 1.27x sales versus 0.81x today (supported by current margins), an investor would make a total return of 149% by 2029 (CAGR 20%). The merger may significantly impact these assumptions leading to a swing in either direction.

I see fair value for Alpha Metallurgical shares far higher at $380 versus $200 today, representing a large discount. I assume top line growth at 7% annually, which is far lower than the 16% achieved over the last five years. I also assume an average annual reduction in the share count of 5%, which is consistent with the last five years. Finally, I assume efficiency drives margins to expand by 100 basis points, with the business being capitalized at 1.35x sales versus 0.78x today (which can be supported by current margins). In this scenario, an investor today would make a total return of 218% by 2029 (CAGR 26%). Not only do the returns look better, but there is no merger to be concerned about, so AMR looks better. The share buy-backs make a huge difference to shareholder returns.

I see fair value for Warrior Met Coal shares at $57.4 versus $52.4 today, so that too looks to be trading at a discount. I have assumed top line growth continues at an average of 11.6% annually and the share count remains unchanged as it has in the past. I have factored in the higher margins that this business produces and assumed that it can support a capitalization of 1.49x sales - which is actually a contraction on the 1.65x multiple it enjoys today. Based on these assumptions, an investor today would make a total return of 80.1% by 2029 (CAGR 12.5%). The multiple contraction combined with a lack of buy-backs makes a big difference here.

On this analysis, my preference would be Alpha Metallurgical Resources.

As between the other two, it is difficult to say which comes in second place. It ought to be Arch Resources, but the merger will dilute margins due to more thermal coal being introduced into the product mix. Will the synergistic cost savings be enough to balance that? Will the merger go well, or will there be integration issues? Only time will tell, so Arch is a higher risk proposition.

The legendary investor Mohnish Pabrai is investing heavily in Metallurgical coal, but he too has been undecided on where best to invest his money. In Q3 2023, he invested in AMR, and ARCH. He then adjusted his holdings in Q4 2023, reducing positions AMR while increasing his stake in ARCH and adding a new position in HCC. Then, in Q1 2024, he significantly reduced his holdings in HCC and ARCH. As of May 2024, he had sold some more ARCH shares and increased his position in AMR, perhaps due to a price pullback.

You may have formulated a different opinion, but the chart above suggests that the market has generally been far more bullish on Alpha Metallurgical Resources over the last few years, and the recent pull back may have opened up a nice entry opportunity. I’ll leave you to decide!

Further reading: The Economist: Is coal the new gold?

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions. The author may have a position in securities named in this article and may change those position at any time

In your opinion, what would it take to kill the thesis, and what would be the downside on e.g. AMR if that where to happen?