Growth projections of 20+% CAGR for the next two decades

Strong tailwinds: governmental support being provided from all major economies

Strong demand as the result of incentives to decarbonize industry

Hydrogen has been said to be the new oil for the 21st century

This is not a fantasy, it is happening right now on a global scale

Different ways to play the Hydrogen investment opportunity and pitfalls to avoid

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

Hydrogen Investment Thesis

Hydrogen is increasingly being promoted as a clean fuel that can help to address the climate crisis as the world transitions away from dirty hydrocarbon fuels such as oil and gas.

Whatever your views on the climate change issue, politicians are driving change globally and every investor needs to sit up and take notice. This article explains the benefits of hydrogen, its properties, uses, and why you might like to consider including a hydrogen investment in your portfolio. It explores potential pitfalls of investing in this space and some interesting investment opportunities that you may like to consider.

Hydrogen has several properties that make it attractive as an investment opportunity:

There is a natural demand for hydrogen as an alternative fuel source. It is a clean and versatile energy carrier that can be used in various sectors that have, until now, been very difficult or not financially viable to de-carbonize. These include shipping, aviation, power generation, heating and heavy industry such as the steel or chemicals sector. If hydrogen is the only way to achieve the requisite emission abatement targets, it will be in high demand.

Hydrogen is the solution to climate change that governments are pursuing. Even the US, which has a history of being a climate change scpetic, is throwing its weight behind hydrogen1. Why? The governments of all major economies are backing hydrogen and the US cannot afford to be left behind (although the diagram below shows that the US are playing catch-up. The attraction of hydrogen in the race to net-zero carbon emission targets is that it can be combusted in engines, turbines and fuel cells to produce heat and electricity with no greenhouse gases, such as carbon dioxide. Instead, it only emits water vapour and small amounts of nitrogen oxides, depending on the combustion process and the fuel source. For this reason there are huge grants and government subsidies being made available in the Hydrogen space.

Hydrogen energy companies are well positioned to capitalize on their expertize. Hydrogen is an abundant element in the universe but it is not freely available on Earth. It is usually bound to other elements, such as oxygen in water, carbon in methane, or nitrogen in ammonia. Therefore, hydrogen must be extracted from these compounds through various processes, such as electrolysis, steam methane reforming, or gasification. This requires specialist skills and expertize. Additionally, the infrastructure for hydrogen, which is not yet widely available, includes the production facilities, the storage tanks, the pipelines or trucks, and the fueling stations or ports. Developing the infrastructure for hydrogen is another huge opportunity for companies specializing in the hydrogen space.

Before hydrogen becomes a mainstream fuel the logistical challenges associated with producing, storing, and transporting it must be overcome. This will requires significant investments and collaborations between governments, industries, and communities. That fly-wheel has already started turning and it is gaining momentum fast.

The scale and variety of hydrogen projects is trully astounding.

Toyota’s Woven City, a prototype city at the base of Mount Fuji, will offer a fully connected ecosystem powered solely by hydrogen fuel cells.

Emitting nothing but water from its tailpipe, the Toyota Mirai is the world’s first production hydrogen powered car.

Airlines are creating hydrogen powered aircraft such as the Airbus ZeroE.

France, Germany, Switzerland and other European countries have hydrogen fuel-celled trains replacing old dirty diesel trains. A full tank enables them to operate for 18 hours without further refuelling in which time they cover 600 miles at speeds of up to 115mph. In the US, the San Bernardino County Transportation Authority have ordered a hydrogen powered train which will go into service in 2024.

Many countries are using hydrogen to power commercial vehicles.

Even Saudi Arabia, the oil kingdom, is moving heavily into hydrogen. I bet that caught your attention!

In its $500 billion city named NEOM, power will come from green hydrogen power. The project is the world’s largest utility scale, commercially-based hydrogen facility powered entirely by renewable solar energy. It is due to be complete by 2026 and will mitigate the impact of 5 million metric tonnes of carbon emissions per year.

In the knowledge that the best days of the oil business are behind it, Saudi Arabia’s ambition is to become the world’s largest supplier of hydrogen. Saudi Arabia has less than 0.7GW of renewable energy in operation but plans to meet half of its power needs from renewables by 2030 (the equivalent of 15,000 barrels of oil per day).

The Hydrogen Rainbow

There are various means of producing hydrogen and I shall only touch on three in this article.

Currently, most hydrogen is produced from fossil fuels, such as natural gas, which is neither sustainable nor carbon-neutral because it produces carbon dioxide emissions. This is known as grey hydrogen (see the diagram below).

Grey hydrogen may be converted to blue hydrogen if the carbon dioxide is captured and stored, making the hydrogen carbon neutral.

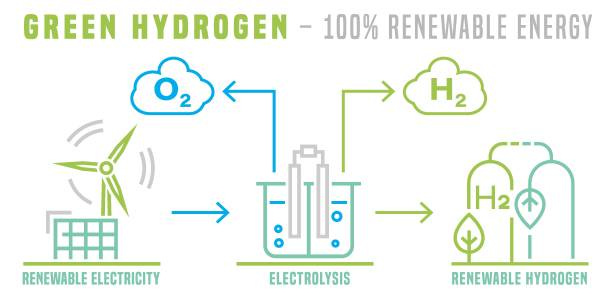

Better still, if the use of fossil fuels are avoided entirely in the production of the hydrogen by instead using renewable energy sources such as solar, wind, or hydro power, then there are no carbon emissions. This is known as green hydrogen.

So why don’t we only create green hydrogen? The answer to this question is economics.

Blue hydrogen carries the cost of carbon capture and storage on top of the cost of producing grey hydrogen. However, carbon credits and/or taxes are pivotal in redressing the balance and tipping the the scale in favour of producing blue hydrogen. As such, carbon neutral blue hydrogen is the most popular at the moment.

The cost of producing green hydrogen can be 1.3x to 5.5x the cost of producing blue hydrogen – the wide range is due to the varying LCOE (levelized cost of electricity). Accordingly, green hydrogen is not yet feasible in most cases from a cost perspective but that is changing as the LCOE tends lower.

All else being equal, parity will be achieved when the LCOE falls below approximately $20 USD/MWh. Currently, as the chart below demonstrates, wind and solar are trending in the right direction but are still at about $30 to $35 USD/Mwh.

The global average LCOE for renewables implies that on-shore wind and low cost solar photo-voltaic cells could reach cost parity with blue hydrogen by 2030. This may be accelerated by a reduction in electrolyzer costs. As discussed above, in Saudi Arabia where solar power is in abundance, green hydrogen will be produced from 2026.

Where to Invest and Where Not to Invest

Hydrogen is typically produced via electrolysis, an electrochemical process in which water is split into hydrogen and oxygen. So electrolysers are used in the production of hydrogen.

As such, there is a great deal of focus on increasing electrolyser production capacity in the market. By way of example, the European Green Deal has targets of 500GW of hydrogen electrolyser capacity installed in the EU by 2050 and a 40GW target by 2030.

Does this mean that investing in electrolyser producers is a good play on the hydrogen market? Maybe, but probably not.

As of March 2023, UK Electrolyser maker ITM Power is the most shorted stock in London. Investors are betting on an additional decline in the share price, despite an 83% fall since early 2021.

Investing in electrolyser producers looks like a very dangerous game because valuations are too high and there is an asymmetric skew to the downside.

The large number of companies entering the electrolyser space will inevitably drive down the prices of electrolysers. This may be analogous to the solar wafer market back in 2007 when producers invested heavily and enjoyed government subsidies which resulted in the market becoming saturated with suppliers and solar wafers became an oversupplied commodity.

So if not investing in electrolyser producers, where should you invest?

An Interesting Hydrogen Investment Opportunity

Aker Horizons, is a market leading Norwegian renewable energy company that is investing in and developing various clean energy solutions, including hydrogen power. It is part of the Aker Group2, which was established back in 1841 and so has a long history of commercial success including energy solutions and infrastructure projects. For this reason it is my hydrogen investment of choice.

Aker Horizons aims to become a leading player in the hydrogen value chain, from production to distribution to utilization. It has a proven execution model and unique end-to-end asset integration and optimalization capabilities, so aims to emerge as the most efficient hydrogen value chain integrator on a global scale.

The company sees hydrogen as a complementary solution to its other renewable energy sources, such as wind and solar, and a way to address the challenges of energy storage, grid stability, and sector coupling.

Remember the hydrogen rainbow mentioned above? Aker Horizons produces hydrogen, to make it blue it offers a carbon capture service and to make it green it has wind and solar expertise. In short, it does it all.

Aker Horizons also recognizes that the development of a hydrogen economy requires collaboration, innovation, and investment from various stakeholders, including governments, companies, and communities. Therefore, the company is committed to working with others to accelerate the deployment and adoption of hydrogen power and contribute to the global effort to mitigate climate change.

Most importantly, it will build, own and operate large-scale green hydrogen production facilities in Europe, Asia, and America. This will ensure a high degree of recurring revenue.

The business model is centred around co-developing and co-owning projects with partners through JVs. By entering in to long-term purchase and offtake agreements it will achieve long term certainty in relation to cash flows at the same time as lowering its commercial risk by locking in prices.

Aker Horizons provides modularized, plug and play facility architecture which is digitally configured to individual projects. This helps keep development costs down while speeding up the time required for projects to be completed. Once completed it will provide safe and reliable operations, it utilises data and AI to improve performance, it offers unmanned operations of facilities using state-of-the-art remote inspection and common centralized control room, and then offers effective trading and logistics operations. This truly is an end-to-end service that others will struggle to match.

I have already discussed how the electrolyser market will grow exponentially in years to come and explained why investing in electrolyser manufacturers is not a wise move. Now consider that for all of those electrolysers to be useful, they need to be integrated into large industrial sites. This requires large-scale system integration competence and credibility in conservative industries like petrochemicals and materials, which is exactly where Aker Horizons operates. More particularly, if the electrolyser market becomes over supplied, the price of electrolysers falls and so Aker Horizons will see its input costs drop and so its profits will expand. Finally, on this topic, if the electrolyser opportunity is valued at $20 billion USD (as has been estimated) and electrolysers typically account for 20% of hydrogen project CAPEX, then the TAM on the development opportunity for companies such as Aker Horizons ought to be valued at close to $100 billion USD.

Returns may then be enhanced further by way of yield compression. The green agenda is becoming more important to institutional investors, many of whom invest based on ESG criteria. There is an increasing amount of money looking for green investments, particularly those with a relatively stable long term cash flow. Aker Horizons has a minimum investment threshold of 10% IRR and it ought to be able to achieve better returns than that. So if it is able to develop projects with an IRR of perhaps 15%, it ought to be able to monetise those with a substantial capital uplift by offering them to market on a securitized basis at high-single digit yields (this is a common financial strategy with wind and solar de-risked projects). This would enable Aker Horizons to scale up quickly without over leveraging the balance sheet.

There are other developers of hydrogen projects including power utilities such as Iberdrola in Spain and Enel in Italy. However, hydrogen is a small piece of their business model and so investing in these other companies provides the investor with a very small exposure to the huge potential growth opportunity that the hydrogen market offers. Aker Horizons offers a far more significant exposure to the nascent hydrogen market. It provides exposure to hydrogen, wind power, solar power plus some new evolving technologies thrown as a potential bonus.

Aker Horizons already has a pipeline of projects ranging from modest (14MW) to large (450MW). Several projects are in Norway, but it also has projects in Chile and Uruguay.

It has an invitation from Saudi Aramco (with which it has a relationship via AKER Cognite) to discover opportunities for hydrogen projects in Saudi Arabia. Saudi Aramco is investing $5bn USD in the Helios Green Fuels project.

Aker Horizons forecasts that the TAM for Hydrogen will grow at a rate of above 20% CAGR for the next 20 years.

These figures are independently supported by analysis from the Hydrogen Council which conservatively expects the market to reach an annual hydrogen production of 546Mt by 2050 which is 7x current levels. Independent research conducted by Bloomberg New Environmental Finance arrived at a peak number of 696Mt which adds credence to these expectations.

Of that addressable market AKER Horizons would only need c.4% market share to meet its 2030 target of 5GW instsalled capacity and, at the same market share it would have 30-40 GW of installed capacity by 2040.

In addition, Aker Horizons is involved in several other hydrogen-related projects and initiatives. For example, the company is a partner in the H2 Green Steel project, which aims to produce fossil-free steel using green hydrogen instead of coal or natural gas. Aker Horizons also supports the Norwegian government's hydrogen strategy and participates in various hydrogen clusters and networks, such as the Norwegian Hydrogen Forum and the Hydrogen Council.

Make no mistake, this is what I call a “tree” investment. Plant the seed of the investment today and you’ll enjoy the tree after 5 to 10 years. Others may be planting pretty flowers in the spring, they’ll enjoy their colour in the summer, but they’ll have withered by the fall.

In other words don’t expect immediate gratification from an investment in AKER Horizons. Fortune favours the brave and the patient. The company is investing in capital intensive infrastructure that will yield wonderful returns for many years to come, but this requires time.

By way of example, Aker Horizons owns a significant stake in SuperNode which is developing cable technology to enable the renewable electricity age across Europe. It uses superconductor technology to conduct electricity with super efficiency. The Russian invasion of Ukraine has accelerated Europe’s move away from dependency on gas for power. This is the future.

The Aker Horizons buisness is made up of four segments, each of which is inter-related, but all having different business dynamics provides investors with broad based renewable energy exposure:

The diagram below shows the International Energy Agencies path to net zero by 2025 and the pale blue shaded area shows the area in which Aker Horizons is active. It is clear to see that this company is perfectly placed to benefit from the global energy transition that will occur in the decades to come.

The shares are listed in Norway (AKH) priced in NOK, but also in Germany (7QF) priced in Euro. The last trade print in Norway was at 10.63 NOK. The company has 1.5bn NOK of subordinated convertible debt with a strike price of 43.75 NOK which is close to where the shares traded at the beginning of 2021. AKER Horizons fell out of favour with investors as rates started to climb and pre-profit businesses became unfashionable. The share price is well below the highs seen a few years ago. For me that makes it an interesting time to buy and hold.

An Alternative Way To Play Hydrogen

Thinking ‘outside the box’, there is another way to gain investment exposure to the Hydrogen market.

It all comes together in the chemistry. To produce hydrogen energy we need catalyzers in the electrolysis process.

Platinum is a catalyzer and, being a rare commodity, will inevitably appreciate in value as demand from electrolyzer manufacturers ramps up.

Sylvania Platinum (SLP), listed in London, is a market leading platinum group metals miner. The valuation is currently very attractive.

This reminds me of American Express which has made more profit from the aviation industry than any airline has ever made. Sometimes it is worth investing obliquely.

Below is a diagram prepared by Goldman Sachs in a note to its clients offering investment ideas of companies that are directly or indirectly exposed to the hydrogen economy. They seem to have missed the platinum opportunity. But what this diagram demonstrates is just how deep the hydrogen opportunity is. Just look at the names and scale of the businesses listed, and this is just the tip of the iceberg.

Conclusion

Hydrogen is a promising clean fuel that will contribute to the transition to a low-carbon and resilient future. However, hydrogen must be produced and used in a sustainable and responsible manner, with a focus on reducing emissions, enhancing efficiency, and improving affordability. Hydrogen is not a silver bullet or a panacea for the climate crisis, but it is an invaluable tool in the toolbox of clean energy solutions.

The Hydrogen market is only just starting and it has a huge runway ahead of it.

Is it too big an investment opportunity to ignore? I think so.

In the US, the California Fuel Cell Partnership outlined targets for 1,000 hydrogen refuelling stations and 1million hydrogen fuel cell electric vehicles by 2030. At a federal level the ‘H2@Scale’ initaitive launched by the Department of Energy (DOE) provides funding for projects focused on hydrogen production and utilization in the US. Almost $26bn of US taxpayer money available for hydrogen projects thanks to three recent laws – the Inflation Reduction Act, the Bipartisan Infrastructure Act and the Chips Act.

Aker ASA is a Norwegian industrial investment company with ownership interests concentrated in oil and gas, renewable energy and green technologies, industrial software, seafood and marine biotechnology sectors.

A very interesting article on Hydrogen published by Japanese bank Nomura. Here is an excerpt which they claim to be a game changer:

"....In an effort to build trust and support, earlier this year the EU announced the formation of the European Hydrogen Bank (EHB), established as a major funding scheme to ramp up the hydrogen value chain. The EHB is seen as a market-making tool supporting both the domestic production and consumption of renewable and low-carbon hydrogen and the import of hydrogen and its derivatives, including the provision of guarantees to commercial banks...."

See the entire article here: https://capitalmonitor.ai/partner-content/green-hydrogen-will-unlock-scalable-opportunities-in-clean-energy/

Dear Emanuel,

Hi, I appreciate your blog very much and read all of your posts. Being an investment novice, I look forward very much to learn more from you and admire your work a lot.

Thank you, the hydrogen idea is interesting. I wonder if you have found any charts / evidence to show that hydrogen powered vehicles / aircraft / ships are steadily stealing market share from electric / hybrid / ICE ones? As I am guessing that the market for source of energy of mobile vehicles is most likely a winner takes all market, as after all, it is quite unlikely that any city will develop several separate sources of recharging / refueling infrastructure for all types of vehicles.

I have found several interesting stocks / points that I would like to ask your opinion on:

1/ For Airtel Africa,

I have read that the E payment in Africa is very fragmented.

What would be the final total addressable market?

What competitive advantages that the company has in comparison to other competitors?

After several years, would you imagine that this company will become a market leader and be consistently profitable?

Or are there any other formidable competitors that is backed by huge capital and likely leading the market into price war?

2/ For Alibaba thesis,

I notice that the growth of cloud has slowed down last year [arguably due to COVID policy], but I want to check if our assumption of long term growth of cloud market is right in China or not. I fear that the demand for cloud service for China [Economy mostly mostly based on industrial] is very different from US [Economy mostly based on virtual / financial / software] such that we cannot project the same results in China.

Have you found any market research material on the customers of cloud service in China and their usage trend, whether it is reasonable to project that their use will increase in the long term?

I heard that government customers have switched to state owned enterprise cloud service, so who are the customers of private cloud service [game developer / financial institution etc] ?

And if the trend of 5G / IOT / Big data in manufacturing continue its path of development, would those manufacturers use private cloud service in the manufacturing process or install their own local computer network [thereby forfeiting any benefits to private cloud service]? Which is more cost efficient?

3/ Micron:

I heard famous investors like Pabrai and Li Lui invest heavily in Micron. Initially I tend to agree their judgement that the DRAM market is gonna to grow and is currently already consolidated. But I found that Chinese DRAM companies [e. CXMT, YMTC] are already offering similar products albeit slightly lagged performance, but at 20-30% discount to Micron / Samsung / SK hynix products. I am wondering whether Li Lui and Pabrai are underestimating Chinese companies to level up production capacities and pose threat [I think cheaper slower DRAM though can still be a threat if it is cheap enough]. If we read history, the production throne of DRAM has been switched from US to Japan to Korea over decades.

What made China unable to closely follow Western companies?

Is it the lack of top manufacturing equipment [EUV lithography] or the highly likely political forbiddance of usage of Chinese DRAM products by US government?

Or is it that even if they can catch up, it would mostly take up to a decade as their current market share is below 1%? I have read that the LCD and solar equipment markets are already occupied Chinese companies, though once they were occupied by Western companies like DRAM market too.

4/ Kaspi $KSPI

I recently read an interesting stocks - Kaspi, which operates on Kazakhstan and listed on LSE. It is a combination of E-commerce, payment, fintech and bank for the country, which already occupied the market and highly profitable from what I read.

Can watch a video of the stock here: Artem Fokin from Caro-Kann on Kaspi

$KSPI https://www.youtube.com/watch?v=1y1hDtHvM_Q&t=1145s

Do you think that the numbers are too good to be true? Would appreciate if you can write a thesis on it if it is worth for investment, like elaborating more on the valuation, TAM, competitors and risks.

5/ For the blog, would like to kindly make some suggestions, for example,

a/ occasional follow up on the chosen companies, their development and whether the thesis holds, [sometimes if there are not much new ideas, just some revision of old ideas is better, actually only 1-2 good ideas like Alibaba / Manolete every 1-3 years are already enough; inaction may be better than action];

b/ some write up on historical companies that are highly profitable or falls miserably at the end, how to valuate them at that historical juncture and what lessons can we learn from them.

Regards and take care,

YY