Domino's & Kroger | Retail Robotics Pt. 2

Is It Better To Invest In Consumers Of Tech Rather Than Producers?

Disclaimer & Disclosure: Save for Amazon, the author currently has no position in any of the businesses mentioned in this post, but that may change. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

Just over a week ago I published the first in this series on investment opportunities in retail robotics with a focus on Ocado. At that time I promised that there would be a second part to the series, so here it is.

Invest in Consumers not Producers of Robotics

Brothers Tom and Jim Monaghan opened a pizza restaurant in 1960 and, from that one location, it has grown to thousands of franchises over the last few decades, creating a business valued at over $15 Billion which we know as Domino’s Pizza (DRZ).

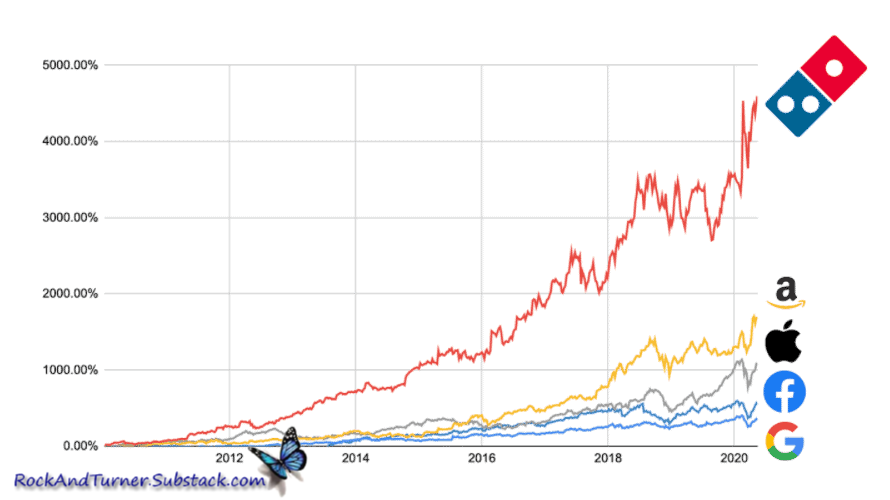

However, the most remarkable part of this story is that from an investment perspective, Domino's Pizza has outperformed even major tech companies (see chart below):

How has this happened?

Ironically, it outperformed big-tech companies because it embraced technology.

Its competitors, including Papa Johns, Marco's Pizza, Little Caesar's and Pizza Hut, all have an online ordering and delivery services, but none has performed as well as Domino’s. Why?

It all comes down to execution.

While its competitors are pizza companies with an ordering app bolted on, Domino's has so deeply embraced technology that it would be better described as an e-commerce company that sells pizza. It isn’t incrementally better, it is fundamentally different.

Domino's Pizza began utilizing technology to enhance its business in 2007 when it launched its online and mobile ordering system. This was the year that the iPhone was launched and so it was very much at the cutting edge of embracing technology, well ahead of any of its competitors. The mobile app significantly boosted digital sales, and today over 60% of domestic orders come through digital channels.

As early as 2008, in an industry first, it allowed customers to follow the progress of their order from placement to delivery with a tracker service which customers loved. These little things create a huge edge over the competition as people preferred Domino’s for its added convenience.

Then came ‘Pizza Builder’, an online tool that enabled customers to customize their pizza with their preferred crust and toppings, visualizing the creation on their computer screen.

These early technological advancements laid the foundation for Domino's digital transformation and it never stopped innovating.

More recently the company integrated six siloed ordering sites into a single powerful platform, reducing the ordering process from 13 steps to just 4 and doubling online orders. The company has embraced AI, big data, and cryptocurrencies to enhance sales. It also pioneered the use of various ordering methods, including smart voice assistants, social media, and text messaging.

Additionally, Domino's became the first company to deliver pizza by drone and autonomous vehicle, using machine learning and AI-driven analytics to optimize delivery routes. These technological advancements, combined with menu improvements, led to Domino's share price increasing by 50x over eight years.

Below is a short advert showcasing Domino’s autonomous vehicle delivery:

The moral of the story is that when new technology comes into existence, it isn’t necessarily the companies producing it that benefit the most. Those that embrace it to enhance an otherwise non-tech business can be the biggest winners.

This is the connection between Domino’s and the Kroger Company. It isn’t the only connection, they are both in Warren Buffett’s Berkshire Hathaway portfolio - which is no coincidence!

The Kroger Company’s Digital Advantage

History doesn’t repeat, but it rhymes. Having explored how Domino’s achieved outstanding success, we would be unwise to ignore a different company in another industry taking a very similar approach.

Kroger Co. (NYSE:KR) is positioning itself as a pioneering force in the grocery industry by heavily investing in technology, particularly through its partnership with Ocado, the British retail logistics and robotics technology company discussed in Part 1 of this series of investment ideas.

This is not merely an operational enhancement but a transformative quantum leap designed to provide a competitive edge in a growing digital marketplace.

Founded in 1883, Kroger has evolved into a multifaceted retail organization, primarily operating supermarkets, multi-department stores, and fulfillment centers across the United States. It holds a prominent position in the U.S. grocery market, being one of the largest supermarket chains by revenue. The company operates over 2,700 supermarkets across 35 states and the District of Columbia, with a significant portion of its sales derived from its grocery business (97% of its consolidated sales).

This scale allows Kroger to negotiate better terms with suppliers, optimize logistics, and reduce operational costs. The company’s centralized purchasing and distribution methods further enhance efficiency, enabling it to maintain competitive pricing while ensuring product availability. The scale of operations also allows Kroger to invest in technology and infrastructure that smaller competitors may find challenging to match.

Kroger's collaboration with Ocado focuses on developing state-of-the-art customer fulfillment centers (CFCs) that leverage robotics and artificial intelligence to streamline operations. This includes:

On-Grid Robotic Pick (OGRP) service

Robotic arms for packing customer orders

Automated Frameload (AFL) for efficient order dispatch

These technologies enhance operational efficiency, reduce labour costs, and improve order fulfillment speed. This reflects its commitment to enhancing delivery capabilities and improving the overall efficiency of its inventory management and order fulfillment processes.

As consumer preferences shift towards online shopping and delivery services, Kroger's integration of Ocado’s innovative solutions demonstrates a forward-thinking approach in a dynamic retail environment. Kroger emphasizes that its investment in Ocado technology ensures zero compromise on selection, convenience, and pricing for customers - key factors that drive consumer loyalty.

It can now meet increasing customer demand for online shopping while enhancing profitability.

This profound investment in technology not only amplifies digital sales, which increased by approximately 12% in 2023, but also promises to bolster Kroger's competitive positioning against traditional rivals and emerging digital-first entrants including Amazon.

As was the case with Domino’s in the pizza market, Kroger's approach contrasts sharply with that of its competitors, many of whom lag in technological investment or integration. By continuously refining its digital interfaces and customer-facing apps to ensure a reliable and user-friendly experience, Kroger is able to gain market share.

Its focuses on four strategic pillars:

Fresh: Leveraging data and science to improve produce distribution and reducing time from farm to the table ensures that Kroger is able to meet its commitment to freshness.

Our brands: The company noted a shift in customer purchasing patterns, with budget-conscious consumers increasingly opting for lower-priced items and focusing on essentials. So Kroger's private label products, known as ‘Our Brands’, enables the company to offer better value to the consumer without compromise to quality. The initiative has been so successful that its sales growth has outpaced national brands. It also produces targeted lines, such as its Mercado range of Hispanic-inspired products, to meet the needs of a very eclectic customer base. These products are produced both in-house at Kroger's 33 food production plants and by external white-label manufacturers, ensuring a diverse range of offerings. Over one quarter of Kroger's roughly $110 billion in nonperishable and fresh food sales (about 75% of revenue) stems from its private-label portfolio, which accounted for over $31 billion in sales in 2023.

Personalization: Kroger has developed a robust customer loyalty program, which is a cornerstone of its business strategy. The company serves approximately 62 million households annually, and over 95% of customer transactions are linked to a Kroger loyalty card. This extensive data collection allows Kroger to understand customer preferences and shopping behaviors, enabling personalized marketing and promotions. The emphasis on enhancing customer loyalty through value and convenience is a significant competitive advantage, as it fosters repeat business and strengthens the customer relationship. It leverages advanced data analytics, through its 84.51° subsidiary and the deployment of large language models enabling it to boost ROI on marketing expenditures and enhance customer satisfaction while optimizing inventory and improving supply chain efficiency. This data-driven approach not only enhances customer satisfaction but also supports the growth of alternative profit streams, such as Kroger Precision Marketing, which provides media capabilities for consumer packaged goods partners. The ability to monetize data insights and traffic generated from its retail operations is a unique advantage that differentiates Kroger from many competitors who may not have such sophisticated data analytics capabilities. Additionally, the company is utilizing AI for dynamic pricing - maximizing profits on high demand items while reducing prices on slower-moving inventory.

Seamless: This pillar focuses on omnichannel convenience having established 2,200 pickup and 2,450 delivery locations, embracing automation and scalable technology and providing a frictionless shopping experience across digital and physical platforms. As highlighted in its SEC filings, the emphasis on a ‘Seamless’ digital ecosystem - encompassing delivery, pickup, and online shopping options - stands as a crucial differentiator for Kroger, solidifying customer retention and driving future growth.

By integrating these four pillars it is able to anticipate and adapt to shifts in consumer behaviour swiftly and effectively. With an increasing digital presence and a commitment to innovation, Kroger stands to gain considerable market share and customer loyalty, reinforcing its position as a winner in the survival of the fittest evolutionary battle unfolding in a rapidly changing retail landscape.

The Ocado robotics and AI implementations are expected to significantly reduce operational costs and improve margins. Better still, the modular nature of Ocado's technology allows for scalable implementation across Kroger's network.

Rodney McMullen, Chairman and CEO of Kroger, who owns 0.53% of the company - worth $220 million at today’s share price making him the largest individual shareholder - offers insights into the benefits offered by Ocado technology (filmed summer 2024):

In a market increasingly driven by online shopping, Kroger anticipates that digital sales will grow at a double-digit rate, outpacing traditional grocery sales, which explains its proactive approach to adapting to changing consumer behaviour.

At its core, Kroger's retail operations encompass the sale of a vast selection of grocery items, including fresh produce, meat, dairy, bakery goods, and packaged foods. In addition to grocery items, Kroger operates retail pharmacies within many of its supermarkets, providing prescription medications and health-related services. The company also features fuel centers, allowing customers to purchase gasoline conveniently while shopping for groceries, making it a one-stop shopping destination for consumers.

In addition to its tech-infrastructure initiatives, Kroger is committed to growing its alternative profit businesses (pharmacy, fuel, and other non-grocery segments). It currently operates fuel stations and pharmacies at 60% and 80% of its locations, respectively, so there is scope for further expansion. This diversification is expected to enhance overall profitability and contribute to the operating margin.

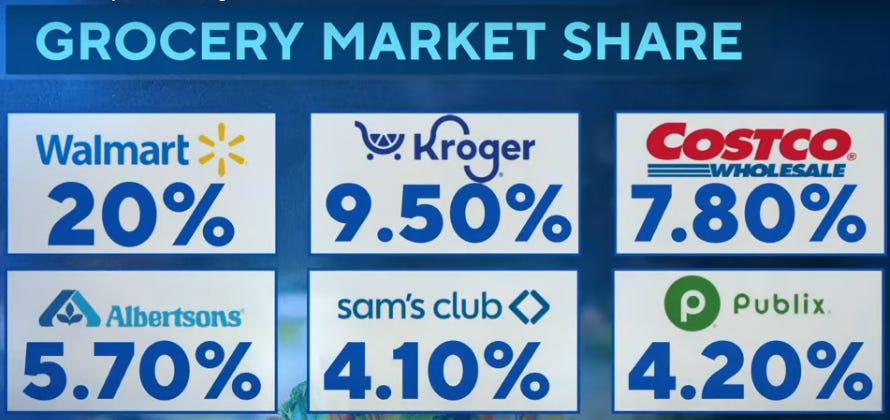

The company boasts an ingrained presence in communities across the U.S. claiming to be a top-two grocer in most of its major market areas. This claim is largely supported by the data, with Kroger ranking number two in the U.S. grocery market by market share at 9.5%, second only the mighty Walmart (NYSE:WMT) at 20%.

Can Kroger close the gap? Warren Buffett believes so, which is why Berkshire Hathaway has a 6.91% stake in the business, making it the second largest shareholder.

On October 2022, Kroger announced the $24.6 billion acquisition of Albertsons, which would push its market share to 15.2%. However, On February 26, 2024, the Federal Trade Commission (FTC) filed an administrative complaint and lawsuit aiming to block the acquisition, citing concerns that the transaction would be anticompetitive and harm consumers. Kroger's legal teams have been actively engaging in court proceedings against the FTC's challenges. A ruling on the litigation is pending, with various hearings scheduled. The legal dynamics suggest that Kroger and Albertsons are defending their position vigorously, asserting that the merger would ultimately benefit customers by creating a more formidable competitor to Walmart and other retail giants. Significant developments are expected in the coming months, but the success of the merger remains uncertain.

If successful, the merger is anticipated to provide incremental accretion and synergies that will enhance Kroger's market position and operational efficiencies. It aims to enhance its logistics infrastructure and expand its reach, which could significantly magnify the benefits derived from its technological enhancements. The potential $1 billion in synergies anticipated from this merger, particularly through the convergence of digital capabilities, further highlights the scalability of Kroger's technological investments.

Competition and Threats

Walmart Inc. (WMT): As the largest retailer in the world, Walmart poses a significant competitive threat to Kroger. Walmart's extensive network of supercenters and its aggressive pricing strategy allow it to attract a broad customer base. Additionally, Walmart has made substantial investments in e-commerce and delivery services, enhancing its competitive edge in the online grocery segment.

Amazon.com Inc. (AMZN): Amazon has transformed the retail landscape, particularly with its acquisition of Whole Foods Market and the expansion of its grocery delivery services through Amazon Fresh and Prime Now. The convenience of online shopping and the integration of grocery services with its vast e-commerce platform make Amazon a formidable competitor.

Costco Wholesale Corporation (COST): Costco operates on a membership-based model, offering bulk products at competitive prices. Its focus on value and quality, along with a loyal customer base, positions it as a strong competitor in the grocery sector, particularly among price-sensitive consumers, although it is not in the online order and delivery space - customers are required to visit one of its warehouses to shop groceries.

Albertsons Companies, Inc. (ACI): Albertsons operates a variety of grocery store formats and has a significant presence in the U.S. market. Its focus on local brands and customer loyalty programs which mirror some of Kroger's strategies, making it a direct competitor in several regions. As noted above, Albertsons and Kroger may be merging.

Target Corporation (TGT): Target has increasingly expanded its grocery offerings, integrating food and household products into its retail strategy. Its emphasis on a pleasant shopping experience and competitive pricing makes it a relevant competitor in the grocery space.

In addition to these national players, Kroger faces competition from numerous regional chains and specialty grocery stores including Publix and Ingles Markets.

Financial Performance and Growth Metrics

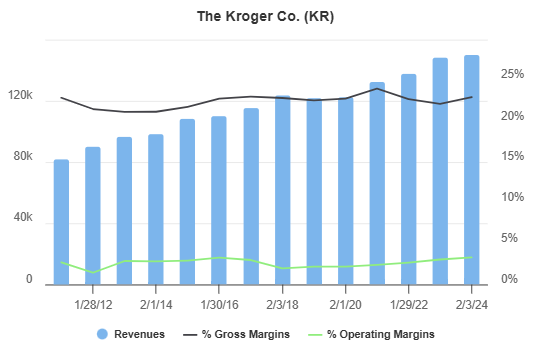

This is a well run business with relatively stable margins and sequential revenue growth year-on-year. However, the pace of top line growth has slowed and in recent years it has been driven more by inflationary price rises than by volumes.

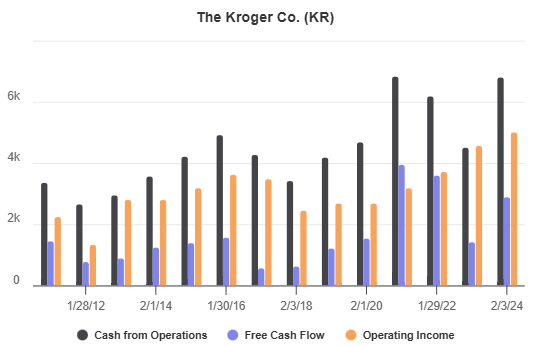

However, the unit economics continue to improve. From the chart below we can see that Operating Income and Cash from Operations are both trending higher. Free Cash Flow has followed a similar path, interrupted only in 2023 when Kroger experienced an extraordinary change in working capital requirements relating to a short-term spike in inventories and accounts receivable.

Generally, Kroger generates significant free cash flow, which provides the company with the flexibility to invest in growth initiatives, increase dividends, and return capital to shareholders.

In terms of growth initiatives, Kroger has raised its full-year capital expenditure guidance from a range of $3.4 billion to $3.6 billion to a new range of $3.6 billion to $3.8 billion, reflecting its commitment to investing in its infrastructure.

Kroger has demonstrated a strong financial performance, achieving adjusted net earnings per diluted share of $4.56 in the most recent full financial year, marking an 8% increase compared to the previous fiscal year. This upward trajectory in earnings can be attributed to effective operational strategies and cost management, even amid significant one-time expenses such as the sizeable legal settlement relating to an opioid class action. Additionally, Kroger's ability to generate $6.8 billion in cash flows from operations shows solid underlying financial health, and the company has returned value to shareholders through consistent dividends.

Valuation

At the time of writing, Kroger is trading at $58.58 (21st November 2024). Buffett bought his stake in the last quarter of 2019 when they were substantially undervalued. The subsequent pandemic, which could not have been foreseen, provided a strong tail wind for grocery businesses with delivery capabilities, so Berkshire Hathaway is already up by almost a factor of three. But it may not be too late to invest because the tech boost described herein, which propelled Domino’s for over a decade, is really just starting for Kroger.

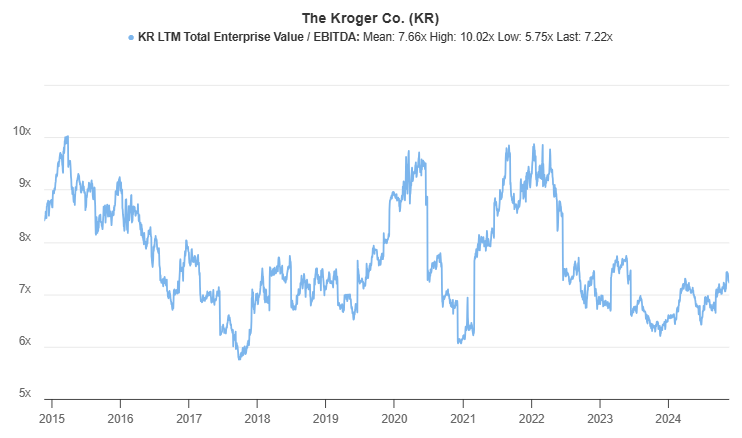

As the chart below demonstrates, on an EV/EBITDA basis, Kroger is trading towards the bottom end of its 10 year range and perhaps even lower than when Buffett invested. Many investors become anchored on price and may be deterred from investing based on the chart above because the company is close to peak historic valuations. However, a company can be better value at a higher price if its unit economic have significantly improved.

Additionally, on an LTM basis, it is being capitalized at little over 15x earnings. Albertson’s valuation is lower (11.2x earnings), so if the merger is successful and synergies are achieved as anticipate, shareholders in Kroger today could find themselves invested in the combined business at a forward earnings multiple of less than 13.5x. That would be a veritable bargain.

Conclusion

Both Domino’s Pizza and Kroger Company distinguish themselves in their respective industries through the adoption of cutting-edge AI and robotic automation. Either offers a wonderful way of gaining exposure to the benefits of this technology which is still in the early stages of its evolution.

Is Domino’s Pizza A Good Investment?

Berkshire owned 1.28 million Domino's shares worth about $549 million as of Sept. 30 at around $430. Today the share price is hovering around $457, so it is still possible to open a position at a similar price to that paid by Buffett. This is a company which has robust gross margins consistently holding around 38% for the last six years. Operating margins are 18% and free cash flow margins above 10%. The ROCE (return on capital employed) is hovering around 70%. This is such a well run business, made more efficient through technology, that it is nothing short of a cash generating machine. For those investors liking dividends, it has a payout ratio above 30%, in addition to buying back its own stock, alongside investing in growth.

Over the past five years, sales have increased at 9% CAGR, the share count has reduced by nearly 19% and gross margins have improved by 400 basis points. Together with a 1% dividend yield, this has produced a 13.4% annual shareholder return (87.6% total return) despite an earnings multiple contraction from 32x to 27x.

Management has reported a significant slowdown in revenue growth recently indicating that external factors, such as rising credit card debts and potential slowdowns in disposable income for lower-income consumers, have played significant role.

Despite these pressures, Domino's continues to generate solid earnings. In recent reports, the company has shown resilience with income from operations increasing year-over-year, primarily fueled by higher franchise royalty revenues and efficiency improvements. With strong operational management, the company has maintained an impressive operating income growth outlook, projected at around 8% in absence of foreign exchange impacts.

Looking ahead, management expressed confidence in their long-term growth strategy, which includes aggressive store expansion plans and technology initiatives to enhance franchise performance globally. They remain optimistic about implementing strategies that focus on value for consumers, which they believe could drive sales and margin improvements further.

It certainly ticks all of Buffett’s boxes including having a strong brand, generating high returns on invested capital, has pricing power as evidenced by its strong consistent margins and has established a moat through its differentiated service that others would struggle to replicate.

Management have certainly always delivered in the past and Buffett clearly has confidence the company, so who am I to argue?

Is Kroger Company A Good Investment?

Kroger presents a more compelling investment case for value-oriented and income-focused investors due to its strong cash flows, solid dividend yield, and robust market position.

It’s heavy investment in robotics and AI technology position it well to perform more efficiently than its competitors and to win further market share. If the merger with Albertsons is approved, the current valuation could be a veritable bargain.

While Kroger reported a revenue of approximately $150.04 billion for the fiscal year 2023, with a modest increase of 1.2% year-over-year, past performance shows stronger growth in 2022 (7.5%) and 2021 (4.1%). More particularly, the company continues to adapt to changing consumer preferences, particularly with increased online sales which ought to drive future sales - the growth of digital sales was up 12% in 2023.

The net earnings for Kroger stood at $2.16 billion for 2023 and appear to have increased to $2.8 billion on a LTM basis, showing resilience even in a challenging economic environment and the company has maintained a relatively good return on equity (ROE) of 23%.

Gross margins are very stable at around 23%, while the deployment of technology and other efficiency improvements are driving cost savings the are showing in significant improvements to operating and profit margins - something that is likely to continue.

It generates significant cash flows providing it with capacity to fund operations, maintain a payout ratio of 30% resulting in an average dividend yield of 1.8%, reduce its share count by 18.3% over the past five years and invest in ambitious technological growth projects.

In terms of capital allocation, until 2019 the ratio of share repurchases to dividend expenditure was 4:1, however that has recently flipped with the majority of capital being used to pay dividends and the quantity of buy-backs falling dramatically. The prioritization of dividends is disappointing as they are often the least accretive and most tax inefficient means of allocating capital. This strategic shift seems to have been initiated to prioritize de-leveraging and to manage capital more effectively following the announcement of its proposed merger with Albertsons, but it isn’t clear why the buy-backs were sacrificed rather than the dividends.

Either way, even if sales growth averages 2.5% over the next five years compared to historical 4.8%, the reduction in share count reduces to 1% annually from 3.3%, a small profit margin improvement of 20 basis points together with a multiple expansion of four turns (taking it closer to the S&P500 average), plus a 1.7% dividend yield, total shareholder returns would be over 82% or 12.75% CAGR. These are conservative assumptions, particularly if the Albertson merger succeeds.

Summing Up

On balance, Kroger appears to be more favourable than Domino’s Pizza at this time, although for a long-term investor both are likely to be successful investments.

UPDATE - 14th Dec 2024

The proposed $24.6 billion merger between Kroger and Albertsons has been halted after federal and state courts ruled in favor of the Federal Trade Commission (FTC) and state attorneys general. The FTC and regulators challenged the merger, citing concerns over reduced competition, potential price increases, and fewer choices for consumers.

A federal judge in Oregon issued a preliminary injunction blocking the merger, while a judge in Washington state issued a permanent injunction. Kroger has subsequently terminated the merger agreement, concluding it was "no longer in its best interests to pursue the merger."

Albertsons has filed a lawsuit against Kroger, alleging that Kroger failed to make a "good faith" effort to secure the merger and harmed Albertsons' shareholders and employees.

Kroger will instead embark on a $7.5 billion share buy-back program.