Ocado | Retail Robotic AI Revolution

Are Robots A Threat? Or Are They An Interesting New Investment Opportunity?

Disclaimer & Disclosure: The author has no position in Ocado, but that may change. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

As we stand on the cusp of a new industrial revolution, the rise of robotic automation in the workplace has become a red hot issue that's impossible to ignore. From factory floors to office spaces, robots and AI-powered systems are increasingly taking on tasks once performed by human hands and minds.

Should we view robotic automation as a looming threat to job security and the human workforce, or embrace it as an exciting investment opportunity?

This is the Part 1 of investment ideas that explore how investors are able to gain exposure to AI and robotic automation. Part 2 may be found here.

Why Should I Care About This Investment Thesis?

Ocado Plc (London: OCDO) is an exciting company due to its innovative Ocado Smart Platform, which revolutionizes online grocery retail through advanced robotics and AI, allowing for highly efficient order processing. It has partnerships with major retailers worldwide and a growing online grocery market of its own, so Ocado is well-positioned for significant growth.

More particularly, its technology extends beyond groceries, as evidenced by its first non-grocery client, McKesson Canada, showcasing versatility in application. The short video below demonstrates the unique Ocado offering:

During the pandemic, Ocado was priced as a high-growth technology stock, with its market cap soaring to a peak valuation of £22 billion. This was driven by surging online grocery demand, Ocado's positioning as a cutting-edge technology company with an innovative e-commerce platform and automated logistics fulfillment centers, together with optimism about its technology licensing potential, and high expectations for future growth in e-commerce.

The fact of the matter is that the market’s perception of the company has shifted. Once seen as a high-growth tech stock, it is now being valued more cautiously as a mediocre industrial business. Consequently, Ocado's valuation has plummeted by around 75%, bringing its market capitalization down to roughly £3 billion.

This may create an interesting investment opportunity for those who are able to see that the business is through the recent turbulence and has a clear path to profitability and growth. The Group anticipates turning cash flow positive during financial year 2026

While Ocado was arguably over-valued when viewed as a pandemic winner, it is quite possibly now oversold, which presents an interesting opportunity for investors to assess.

Backstory

Ocado was founded in 2000 by former Goldman Sachs bankers with the vision of revolutionizing grocery shopping through online retail and automated fulfillment. It name was originally “Last Mile Solutions” which reveals the initial intent of the founders.

It is both an online grocery retail business, through its joint venture with Marks & Spencer, and a technology solutions provider offering automated warehouse and delivery capabilities to other retailers.

It has three segments:

The Retail segment provides online grocery and general merchandise offerings to customers within the United Kingdom, and relates entirely to the Ocado Retail joint venture. Revenue from online grocery orders is recognized at a point in time when the customer obtains control of the goods.

The Logistics segment provides the CFCs and logistics services for customers in the United Kingdom (Wm Morrison Supermarkets Limited and Ocado Retail Limited). Revenue is recognized as the services are provided to the UK Partners.

The Technology Solutions segment provides end-to-end online retail and automated storage and retrieval solutions for general merchandise to corporate customers both in and outside of the United Kingdom. Revenue relates to the provision of the Ocado Smart Platform (“OSP”) as a managed service to the Group’s grocery retail Partners (more on this later).

Ocado has always been at the cutting edge of technology. In the beginning it disrupted grocery shopping in what was a highly competitive oligopoly dominated by the large supermarket chains.

At the turn of the millennium it entered this market with a fundamentally different proposition - online ordering and delivery. It was the first in the UK to offer this service.

Needless to say, others subsequently copied, but Ocado has always been a leader at the cutting edge of technology and so continued to innovate.

In 2009 it witnessed the revolution of smart phone technology and was the first online grocery business to launch an iPhone app and then an Android app the following year, both of which were hugely successful.

The company rapidly acquired customers, growing from 50,000 orders a week in 2006, to 150,000 eight years later.

The IPO happened in 2010, listing on the London Stock Exchange, with capital raised being used to grow the business further.

A key turning point for Ocado came in 2013 when it signed Morrisons, a large UK supermarket chain, as its first strategic customer for its e-commerce technology. This was pivotal as it marked the beginning of Ocado's transformation into a technology solutions provider - a tech company.

Then in 2014 robotic automation began to develop and, in 2017, the first Ocado robotic automation service went live at the Erith CFC to serve Morrisons.

International expansion continued in 2017 with the signing of international deals with Bon Preu in Spain, Groupe Casino in France, ICA in Sweden, Kroger in the U.S., Sobeys in Canada, Aeon in Japan, Coles in Australia, Alcamp and Auchan in Poland and Lotte in South Korea.

Kroger is the U.S. supermarket chain in which Berkshire Hathaway is heavily invested. Let’s hear what the Rodney McMullen, CEO of Kroger, has to say about working with Ocado technology:

While Ocado's technology business continued to thrive, Ocado Retail was also expanding. Initially, it operated as a partnership with Waitrose, the grocery segment of U.K. retailer John Lewis. However, in 2019, they were replace by Marks & Spencer, another British retailer, which is now in a 50:50 joint venture with Ocado Retail.

The Technology

The Customer Fulfilment Centres (CFCs), powered by the Ocado Smart Platform (OSP), are at the leading edge of warehouse management technology. This is proprietary technology which has been battle-tested and protected by over 2,600 patents filed or granted.

They use of state-of-the-art robotic technology, with each automaton able to pick and pack a 50-item order within minutes. Even more impressive is Ocado's warehouses have so many robots guided by AI that they are said to be able to complete 50,000 orders in just 5 minutes.

This not only enables it to reduce headcount, a huge cost saving, but it introduces great time efficiencies also. The sales pitch is quite simply to help retailers grow their operations faster and with higher profit margins. Who wouldn’t want that? It certainly explains why large supermarkets around the globe have been anxious to sign up.

Typically a company will deploy one CFC, and when they witness the improvements it introduces to the unit economics of their business, they add more. This is how the business is growing. This process sits at the centre of this investment thesis and highlights the huge potential that may lie ahead for Ocado.

For instance, Kroger in the US has deployed CFCs in Cincinnati, Groveland, Atlanta, Dallas, Pleasant Prairie, Romulus, Denver with two more coming online in 2025. It currently aims to have 17 operational within a relatively short time.

The Phoenix facility, which is expected to go live in 2025, will be a 200,000-square-foot facility representing an $89 million capital investment by Kroger and is expected to create approximately 700 jobs within its first five years of operation. This facility will use Ocado's automated warehouse technology with digital and robotic capabilities to serve customers across Arizona.

It is encouraging that Ocado is constantly innovating, constantly striving to disrupt the status quo. As a company of problem solvers, it plans to continue finding unique ways to improve its OSP and expand its uses - both within and outside of retail.

It refers to its customers as partners, which demonstrates the way in which it operates. It works with its ‘partners’, constantly innovating to support their needs. It explains that its partners will always share in its technological progress, allowing the partnership to move forwards together towards achieving a common goal: to change the way the world shops for goods.

To this end, in January 2022 it unveiled its ‘Ocado Re:Imagined’ initiative introduces seven new technology solutions to its OSP aimed at improving operating and capital efficiency. These will deliver greater efficiency in terms of execution speed, expected to increase units picked per hour to over 300, while reducing capital intensity by around 15%.

Kroger, for example, has been implementing Ocado's latest automated technologies, such as On-Grid Robotic Pick (OGRP) and Automated Frameload (AFL), across its network.

A Bumpy Road Travelled

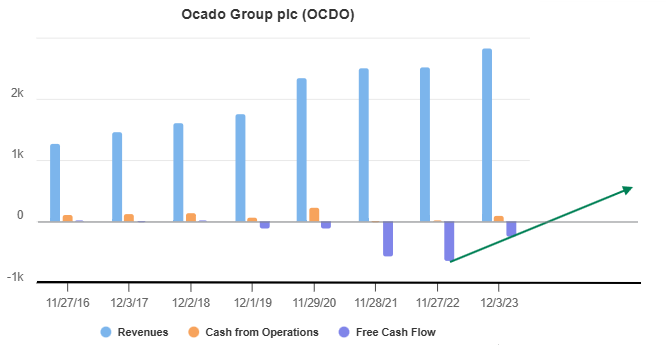

Despite its innovative technology, Ocado has faced significant challenges - the past five years have been a roller-coaster ride for the business and its share price as demonstrated by the chart below.

Due to the nature of its home delivery service for high quality grocery shopping, Ocado’s value soared during the Covid19 lock-down period. However, in the years that followed, restrictions were eased and consumers, tired of being stuck at home, relished the opportunity to experience in-store shopping again.

The share price has returned to levels last seen during the 2015–2018 period. This is surprising, given the significant progress Ocado has made in recent years in customer acquisition, top-line growth, and its clear trajectory toward positive cash flow. From 2015 to 2018, revenue grew from £1.1 billion to £1.6 billion at a 34% gross margin. Today, revenue is approaching £3 billion.

This discrepancy might suggest a potential buying opportunity, and the investment thesis appears to be aligning. However, there are additional factors that warrant consideration.

While the pandemic boosted demand for online grocery services, it was not smooth sailing for Ocado. Unlike larger traditional grocery chains with extensive resources, Ocado struggled to meet the surge in demand during Covid-19 restrictions. The company faced challenges such as a shortage of truck drivers and an electrical fire at its largest automated warehouse in Erith. These issues caused a drop in weekly orders and per-van deliveries. Fortunately, a sharp increase in average order size during the pandemic offset these obstacles and drove sales higher.

However, the post-pandemic environment brought new difficulties. The war in Ukraine triggered soaring inflation and a cost-of-living crisis, prompting shoppers to shift toward discount supermarkets. This was a setback for Ocado, which, having partnered first with Waitrose and later with Marks & Spencer, caters primarily to the premium end of the U.K. grocery market.

The Road Ahead

To properly assess this business it is important to understand its fee structure.

The retail segment operates in the same way as any other business, but the the Technology Solutions segment is very different.

Customers are required to make a sizeable upfront capital investment to build a new CFC - in addition to the cost of land, they need to build the warehouse and incorporate all of the Ocado technology. This is a sizeable challenge for the sales team without Ocado adding to the upfront expense by seeking to generate profits prior to the CFC being operational.

Consequently, designing the CFC and building the customer OSP is not a separate performance obligation and no revenue can be assigned to satisfying these aspects of the contract.

Each contract is considered on a case-by-case basis and a typical Ocado Solutions contract has a single performance obligation. The ability to derive independent benefit is a key determinant, defined broadly as the service being operational and able to fulfil an order.

So, to summarize, Ocado’s capacity-linked fee structure, in its tech segment works as follows:

Partners pay certain fees upfront when signing a new deal;

During the preparation and development of Customer Fulfillment Centers (CFCs), partners pay fees that reflect the future size of the CFC and costs associated with adapting the platform to their needs;

Once CFCs are operational, partners pay ongoing fees that are linked to:

Sales achieved

Installed capacity within the CFC

Service criteria

As partners take on more capacity over time, these fees grow.

The fee structure is designed to match Ocado's cash outflows during the build stage, but will not earn any profit generating revenue until the facility is operational -typically about two years after initial CFC construction.

This results in a significant delay between the OPEX spent in acquiring the customer, and revenue flowing from that customer, requiring significant amounts of working capital to bridge the gap.

Another challenge with this structure is Ocado's lack of control over how quickly customers utilize the full capacity of the CFCs. Customers often increase capacity gradually, which means it can take several years for a CFC to reach its optimal revenue-generating potential. Consequently, the success of Ocado's business model heavily relies on the effective implementation of its technology by partners. This dependency adds unpredictability to profitability and complicates accurate modeling of future cash flows.

Nonetheless, from a broader perspective, Ocado has made significant progress by securing 13 grocery sector partners to date. Together, these partnerships are expected to channel over £20 billion in annual sales capacity through the Ocado Smart Platform (OSP). Ocado will earn a share of these revenues through its fee structure, and as partners expand the OSP solution to new locations, this figure is likely to grow. For context, these partners collectively represent over £300 billion in annual sales. With grocery shopping increasingly shifting online, Ocado's cutting-edge technology positions it well to capitalize on this growing trend.

The company has faced the challenge of achieving sufficient scale to benefit from operating leverage. However, the pursuit of this scale has required substantial OPEX, particularly in selling, general, and administrative (SG&A) costs and research and development (R&D) investments, which have significantly impacted short-term profit margins.

Ocado is now approaching critical scale, positioning it for profitability. CAPEX is decreasing as a percentage of sales, capacity utilization is improving, and margins are expected to strengthen. EBITDA margins are projected to eventually stabilize in the mid-to-high teens, driven by strong operating leverage. Concurrently, the Re:Imagined initiative, which focuses on reducing OPEX, is anticipated to deliver measurable benefits in the financials over the next few years. The company is on track to achieve cash flow positivity and is expected to break into profitability in the second half of 2026.

Moving forward the key will be in demonstrating the long-term value of its technology and achieving consistent profitability. This will be achieved through its global land-and-expand model in the grocery industry, but also via its plans to diversify into other industries which would also benefit from market leading warehouse automation.

Ocado's technology is now price-competitive in markets beyond grocery, with a serviceable opportunity valued at $130 billion. The company has already signed its first non-grocery client, McKesson Canada, in 2023

The Geographic Logistics Challenge

A key challenge Ocado previously faced was serving a geographically dispersed population while relying on a limited number of large, centralized CFCs.

To overcome this, the company adapted its technology for deployment in smaller fulfillment centers.

This strategic shift allows Ocado to position its fulfillment network more effectively, enabling it to serve a larger number of retail customers.

Financials

Ocado has exhibited strong revenue growth and is showing signs of financial improvement despite still operating at a loss. With reductions in both capital expenditure (CAPEX) and operational expenditure (OPEX), the company is on a clear trajectory toward positive free cash flow. Revenues are expected to continue growing while expenses decrease, suggesting that operating leverage will become increasingly evident in the years ahead.

Financial Highlights (H1 2024):

Revenue Growth: Group revenue increased by 13% to £1.5 billion.

EBITDA Surge: Adjusted EBITDA more than tripled, rising from £16 million to £71 million.

Cash Flow Improvement: Cash flow improved by £101 million, driven by EBITDA growth, stringent cost control, and reduced CAPEX.

Liquidity: The group maintains robust liquidity with £747 million in cash reserves and a £300 million undrawn credit facility.

Technology Solutions: Revenue grew by 22%, supported by an expanding recurring revenue base driven by indexation and new technologies.

Ocado Retail: Achieved 11% growth, reaching over 1 million active customers, aided by competitive pricing and increased capacity utilization.

Operational Highlights:

Technology Solutions: Ocado continues to expand its live modules, reaching 112 by mid-year, with expectations to exceed 120 by year-end. These modules underpin long-term growth through a reliable recurring revenue stream.

Logistics: The division is delivering stable EBITDA while achieving significant labor productivity gains in fulfillment centers.

Retail Performance: Ocado Retail is capitalizing on rising capacity utilization and customer acquisition driven by competitive pricing strategies.

These metrics have led Ocado to raise its full-year guidance, with positive trends expected to persist in the near term.

At an EV/Revenue multiple of 1.2x and with forecast EBITDA margins expected to stabilize in the mid-teens over the coming years, Ocado presents an intriguing opportunity.

However, it is not without its caveats. In particular, Ocado has reported pre-tax profit in only three of its 23 years, testing the patience of long-term investors as it burned through capital to drive growth.

Some may argue that past investors may have entered too early in Ocado’s journey, while today’s investors could potentially benefit from the heavy investments made over the last two decades.

One thing is certain - Ocado is now at a pivotal moment in its journey. Only you can decide if the potential rewards sufficiently outweighs the risks. Whether the scales tip toward opportunity or risk depends on your assessment of its financial trajectory and the capabilities of its leadership team.

Before deciding, it is worth reflecting on one final consideration: the management team’s role in navigating Ocado’s future.

Management

The leadership team at Ocado is undeniably intelligent and highly competent. However, they have faced challenges in achieving success within the capital-intensive industry in which they operate. Their strategy has been to forgo short-term profitability to focus on technological development and customer acquisition.

This approach may be justified, as Ocado’s product is particularly “sticky.” Once a customer invests tens of millions in building out a Customer Fulfillment Centre (CFC), they are likely to remain committed for many years. This stickiness supports recurring revenues and compounded growth, suggesting that the management’s long-term strategy might indeed be sound.

The red flag in this thesis relates to a misalignment in interests between management and shareholders. This issue has been contentious, with investors voicing dissatisfaction over the company’s remuneration policies.

Despite a declining share price and mounting losses, management has continued to reward itself generously. Shareholders have borne the brunt of the company’s capital burn, including dilution, while the executive team has chosen to enrich itself.

In 2023, over 30% of shareholders voted against the remuneration package, which included a £2 million payout for CEO Tim Steiner (£755,000 salary and £1.19 million bonus), even as Ocado reported losses of £501 million and its share price dropped by more than 50%.

The top five directors collectively received nearly £7 million in compensation during the same period.

This trend isn’t new; in 2019, Steiner was awarded a controversial £58.7 million pay package - a difficult figure to justify for a company grappling with profitability.

The proposed 2024 bonus scheme has further fueled criticism. If certain performance targets are met, Steiner could earn up to £14.8 million. The target involves Ocado’s share price reaching £29.69 within three years - an ambitious goal considering its current price of less than £3.60. Nonetheless, shareholder advisory groups have labeled the scheme “excessive” and “materially above market norms.”

A deeper concern is the structure of these packages, which tie rewards to share price performance. This creates incentives for short-term share price inflation at the expense of long-term company health.

For instance, management could hypothetically cut all advertising, sales, marketing, and R&D expenses to slash operational costs and boost short-term profits. This would temporarily inflate earnings per share (EPS), leading to valuation multiple expansion and a share price surge. The executive would qualify for a huge bonus, but just imagine what damage a lack of R&D, sales, marketing and advertising would do to the long-term prospects of the business. The company would be less competitive, lose market share and may never recover. The management would have banked their bonus, while shareholders are left suffering.

History is littered with examples of this kind of thing - such as IBM under Lou Gerstner and Intel under Brian Krzanich, where similar strategies led to irreparable corporate damage.

The only distinguishing factor is that unlike Gerstner and Krzanich, Steiner is Ocado’s founder, having served as CEO for nearly 25 years. He seems deeply committed to the company’s success, viewing it as his life’s work. This passion makes the remuneration strategy even more puzzling. As Steve Jobs once noted, founders of this nature tend to be “missionaries” rather than “mercenaries.” Perhaps Steiner is a rare combination of the two.

Adding to investor unease is the disparity between executive compensation and worker pay. Critics have pointed out that Ocado has yet to commit to paying all workers the real Living Wage of £12 per hour, lagging behind some competitors. This discrepancy raises questions about the leadership’s priorities and commitment to fairness.

These patterns in management behavior might deter some investors, raising doubts about the company’s alignment with shareholder interests. However, others may view this as a pivotal moment for Ocado. If the leadership team is willing to commit to ambitious performance targets, such as an eightfold increase in share price within three years, some might interpret this as a bold gamble worth taking.

Conclusion: Is Ocado Group A Good Investment?

In conclusion, Ocado presents a compelling investment opportunity for those willing to look beyond its recent challenges.

The company's innovative Ocado Smart Platform, with its advanced robotics and AI capabilities, positions it at the forefront of the e-commerce and automated logistics industries.

While Ocado has faced setbacks, including the post-pandemic shift in consumer behaviour and operational difficulties, it has shown resilience and adaptability.

Key points supporting the investment thesis include:

Expanding partnerships: Ocado has secured 13 partners in the grocery sector, representing over £20 billion in annual sales capacity through the OSP platform.

Technological leadership: With over 2,600 patents filed or granted, Ocado's proprietary technology remains a significant competitive advantage.

Diversification potential: The company's expansion into non-grocery sectors, exemplified by its partnership with McKesson Canada, demonstrates the versatility of its technology.

Improving financials: H1 2024 results show a 13% increase in group revenue and a significant improvement in adjusted EBITDA.

Path to profitability: Ocado is expected to become cash flow positive in the second half of 2026, driven by reduced CAPEX, increased capacity utilization, and improved margins.

While risks remain, including the capital-intensive nature of its business model and dependence on partner implementation success, Ocado's innovative technology and growing market presence make it an intriguing prospect for investors seeking exposure to the future of retail and logistics automation.

This is the end of Part 1, but next week I will explore a different way to play this robotic revolution in Part 2 of this series. If you would like to receive it, sign up below: