DISCLAIMER & DISCLOSURE: The author, James Emanuel, holds a position in Enterprise Group, but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Last October I analyzed a fast growing Canadian company - Enterprise Group:

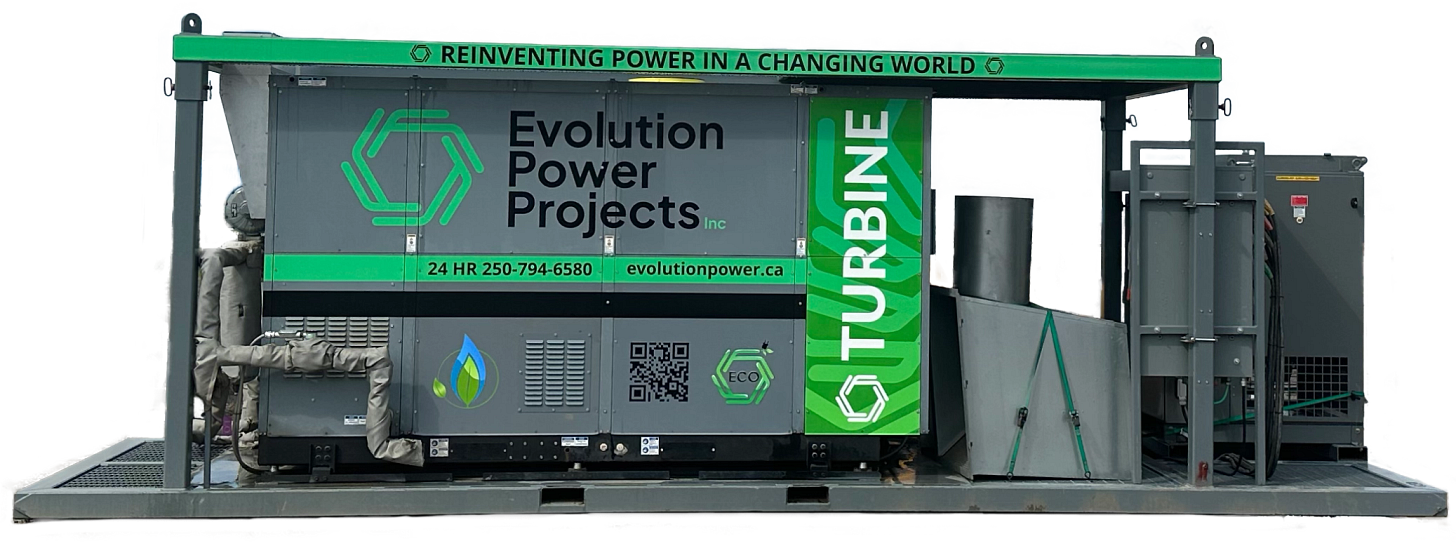

Enterprise Group (Toronto, TRX:E) has been on quite a journey in recent years, with a series of big moves that have reshaped its business. Things really took off with the acquisition of Evolution Power a few years ago, which marked a major shift into supplying power generators. And the momentum hasn’t slowed - this year’s acquisition of FlexEnergy Canada is set to push growth even further.

The company’s approach to site infrastructure is built on three main pillars: mobile power systems, mobile office and command structures, and lighting solutions. These offerings are particularly crucial for clients operating in remote, challenging environments such as northern Canada, where extended periods of darkness and extreme cold demand robust, reliable infrastructure. While mobile power solutions are at the forefront, the company’s comprehensive suite of ancillary equipment and services sets it apart from competitors, enabling it to deliver end-to-end infrastructure solutions.

Enterprise Group has made a bold move with its recent acquisition of Flex Canada, paying $20 million for a business that, on paper, appeared to fetch a premium price at about 4.3x trailing three-year EBITDA. That’s notably higher than Enterprise’s historical ceiling of 3x. But scratch beneath the surface and the numbers tell a different story. The real driver behind the deal was Enterprise’s urgent need to expand its fleet of power generators, with very few available for purchase. By acquiring Flex Canada, the company gained instant access to 17 turbine units,each of which would cost around $900,000 if bought new, putting the value of the physical assets at roughly $15 million. That suggests the actual price paid for FlexCanada’s operating business was closer to $5 million, or just over 1x EBITDA. Given the added benefits, service contracts, and strategic foothold it brings, this looks like a bargain.

The acquisition is immediately accretive. Not only does it grow Enterprise’s fleet by 17 turbine generators, but it also introduces advanced 2.0-megawatt units, enhancing power generation capabilities and positioning the company for future growth. At the end of 2024, Enterprise had about 30 power generators. By the close of 2025, that number will more than double to approximately 61, thanks to the 17 acquired units, 10 new turbines on order from FlexEnergy, and additional ex-rental units expected to come off lease. As these turbines are deployed, likely by 2026, the company’s earnings capacity will more than double, with incremental improvements expected along the way.

Yes, the equity raise diluted shareholders by just under 20%, but the capital has been put to effective use. With the turbine fleet doubling, shareholders essentially swapped 100% of the old Enterprise for 80% of a significantly larger and more profitable version. It’s a trade that’s likely to pay off handsomely.

Until now, about 17% of the generator fleet consisted of Capstone units, which have shown limited reliability in the harsh Canadian environment. These units struggled with extreme cold and had narrow fuel tolerance, making them ill-suited for remote field work. In contrast, FlexEnergy turbines have proven highly effective, even in minus 52°C conditions, and can operate on a wide range of field gases. They’ll now form the backbone of the fleet, which will vastly improve operational efficiency and earnings power. From here on, all new generators will be FlexEnergy models and the Capstone units will be marginalized and earmarked for special use cases.

FlexEnergy’s technology is known for its reliability, low emissions, and exceptional fuel flexibility. It gives Enterprise a critical competitive edge, especially when competing for contracts that demand dependable and environmentally responsible alternatives to diesel. And it’s not just about tech: FlexEnergy only manufactured about 30 turbines a year, with Enterprise snapping up a third of them. Now, with FlexEnergy expanding its production capacity, Enterprise will be able to secure more units as it scales up.

The acquisition has also positioned Enterprise as the exclusive supplier, renter, and servicer of FlexEnergy turbines in Canada. This cements its leadership in natural gas-to-electric power solutions, a market that’s booming across sectors such as remote power, manufacturing, and the energy-hungry AI data center space.

What’s more, the deal includes several long-term lease and service contracts tied to turbines already in the field, generating a reliable stream of recurring revenue. Enterprise also gains access to a skilled team of Flex specialists, ensuring continuity and excellence in turbine operations, both temporary and permanent installations. This strengthens the company’s ability to scale across Canada and serve a broader customer base with flexible, cost-effective power solutions.

While some investors were frustrated that few shares were repurchased under the Normal Course Issuer Bid, it was largely a matter of timing. A dip in the stock price, triggered by U.S. tariffs on Canada, coincided with blackout periods surrounding the acquisition and the Q1 results release. Now that the dust has settled, and with the market recognizing the strategic value of the deal, the share price is already rebounding. Still, management has made it clear: if the stock dips again, they’re ready to step in.

For now, though, capital is better deployed into growth. This is a capital-light business where turbines pay for themselves in as little as 18 months and generate income for two decades or more. Reinvesting in expansion is the smart play, but management hasn’t ruled out share buybacks down the line as cash flow builds.

Enterprise is also broadening its horizons. Historically rooted in Alberta and British Columbia’s oil and gas sector, it’s now exploring opportunities in new geographies and industries - from First Nations partnerships to mining and AI-driven data centers. In September 2024, it hired a Vice President of Business Development in Calgary to accelerate sales and marketing in these new markets.

Despite some short-term pain from project delays at a major LNG facility - impacting Q4 results - the outlook is strong. That project is now back on track, set to begin operations by mid-2025.

Enterprise had an exceptional Q1 in 2024, and against the odds, Q1 2025 came close to matching it. With an expanded fleet and the LNG ramp-up imminent, Enterprise is busy responding to a wave of RFPs. Even winning half of those would make H2 a record period, with Q3 likely to surpass Q1.

Management expects to maintain gross margins around 50% and EBITDA margins above 40%, with financial flexibility enhanced by a new $41 million credit facility from BMO. That facility consolidated existing debt and slashed financing costs by 400 basis points - another boost to margins.

Insiders, who already own about 28% of the company, continue to build their positions - clear evidence of confidence in the road ahead.

In short, the investment thesis remains not just intact, but stronger than ever. And with the share price still 10% below where major investors bought in during the last capital raise - before any acquisitions were announced - Enterprise today represents a bigger, stronger, and more profitable business, available at an even better price.

Listen to this podcast at the top of this page to learn more.

Share this post