Haivision | A High Potential Vision

High Margins, Great Management, Long Growth Runway, Net Cash, Low Valuation

Disclaimer & Disclosure: The author has a position in Haivision. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

Market Cap $145m CAD (share price $5.15)

EV $144m CAD

EV/Sales 1.07x

Gross margin 73.5%

Float 58.8% (Insiders hold 31%, of which 14% is held by the CEO)

Last 5 years revenue growth 19% CAGR

MOI Global 2025 Best Investment Ideas pitch video/podcast (including a detailed breakdown of the business by its CEO)

Why Should I Be Interested In Haivision?

I was introduced to this company by a reader of my Substack who reached out via private message. It piqued my interest, appearing to be a small but high-quality business with an impressive management team, a market leading position and favourable growth prospects. The deeper I went, the better it looked, so here I’ll share it with you.

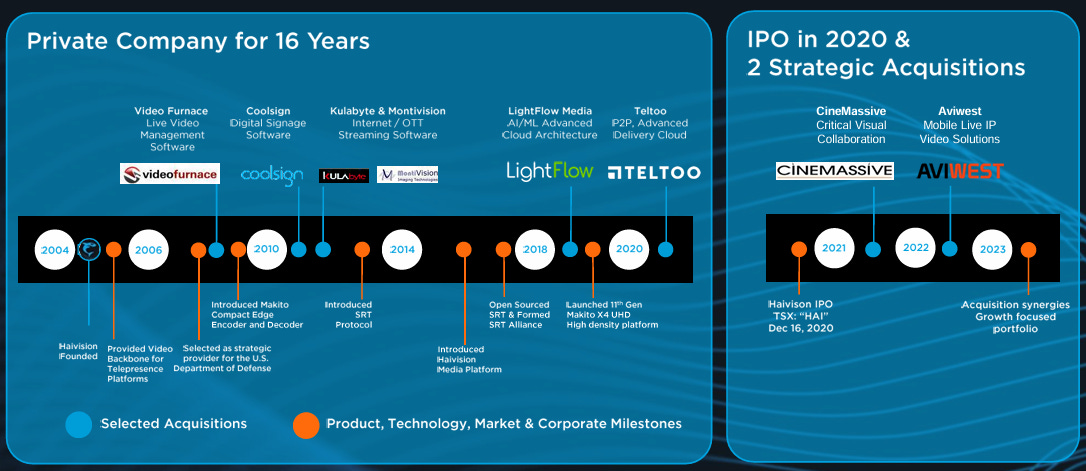

Haivision Systems Inc. (TSX: HAI), based in Montreal, Canada, started as Hajtek Vision Inc. but rebranded in June 2004. Fast forward to December 16, 2020, and the company went public reaching a market capitalization of $277 million CAD. Today? It’s trading at around half that, even though its revenue has grown by 62% and gross margins stay strong at over 70%. So what’s the deal?

Turns out, Haivision has been going through a major restructuring. This includes folding in acquisitions made after its IPO, shutting down low-margin operations, and switching to a channel partner model. These moves created short-term challenges that masked the company’s organic growth. But the fundamentals are solid, and there’s a good chance the market is mispricing this company with a strong position in a niche market that promises compounded growth in the years ahead.

Haivision’s Strong Management

Leading Haivision since day one is its founder, Miroslav (Mirko) Wicha. He’s been Chairman and CEO since 2004. Before the IPO, he grew the company’s revenue at an impressive 22.7% annual rate over 16 years, taking it to $80M+, all while being self-funded from an initial $8M investment.

Mirko isn’t new to success. With over 30 years of experience in senior management and global sales, he started at Hewlett-Packard and later joined Silicon Graphics. During his time there, he helped grow the business from $86 million to over $1 billion in just five years.

If you’re unfamiliar with Silicon Graphics, it was a major player in early computing. It powered Hollywood hits like Jurassic Park and Terminator, made processors for the Nintendo N64, and its campus is now the home of Google HQ. Oh, and Netscape, the first-ever internet browser, came out of Silicon Graphics. Long story short, it was a tech giant that only hired the best. The fact that Mirko was part of Silicon Graphics caught my attention.

After Silicon Graphics, Mirko joined Alias Research, where he turned around their struggling European operations. That company was later sold to - you guessed it - Silicon Graphics.

Today Mirko and his family own 13.78% of Haivision, while insiders collectively hold 31.3%. Earlier this year, Mirko personally bought an extra ~$200k worth of shares on the open market. His ownership is now worth ~$20 million, which is 20x his cash compensation and 10x his total compensation. He is certainly backing himself with a nice amount of skin in the game.

Let’s hear from Mirko directly:

It’s not just CEO Mirko Wicha steering the ship—Haivision’s management team is packed with experienced pros who know the video tech world inside and out. Here’s a quick intro:

Peter Maag (Chief Strategy Officer & EVP of Strategic Partnerships):

Maag has been Mirko’s right-hand man for over 15 years, having previously worked together at Autodesk. He focuses on strategy and building key partnerships to keep Haivision ahead of the curve.Dan Rabinowitz (Chief Financial Officer & EVP of Operations):

Rabinowitz has been with Haivision since the beginning. With 30+ years of experience in finance and management, he’s had stints as CFO at FinanSure, TUSC, and Peapod. He’s the guy making sure the numbers and operations run smoothly.Jean-Marc Racine (Chief Product Officer):

Racine joined Haivision in January 2023 as part of a larger strategic reorganization of the company's product development teams, aimed at realizing synergies related to Haivision's recent acquisitions. Racine brings 25 years of experience in product and marketing, having previously held the role of Chief Product Officer at Synamedia and starting his career as a hardware engineer on the team that delivered the world's first real-time MPEG2 encoder. He co-founded Farncombe Tech, a video and security company that was later sold to Cartesian.

Haivision’s leadership isn’t just experienced, they’re a tight-knit group, with many of them having worked together for over 15 years. That mix of continuity, deep industry knowledge, and proven success makes them a major strength for the company.

In Which Market Does Haivision Operate?

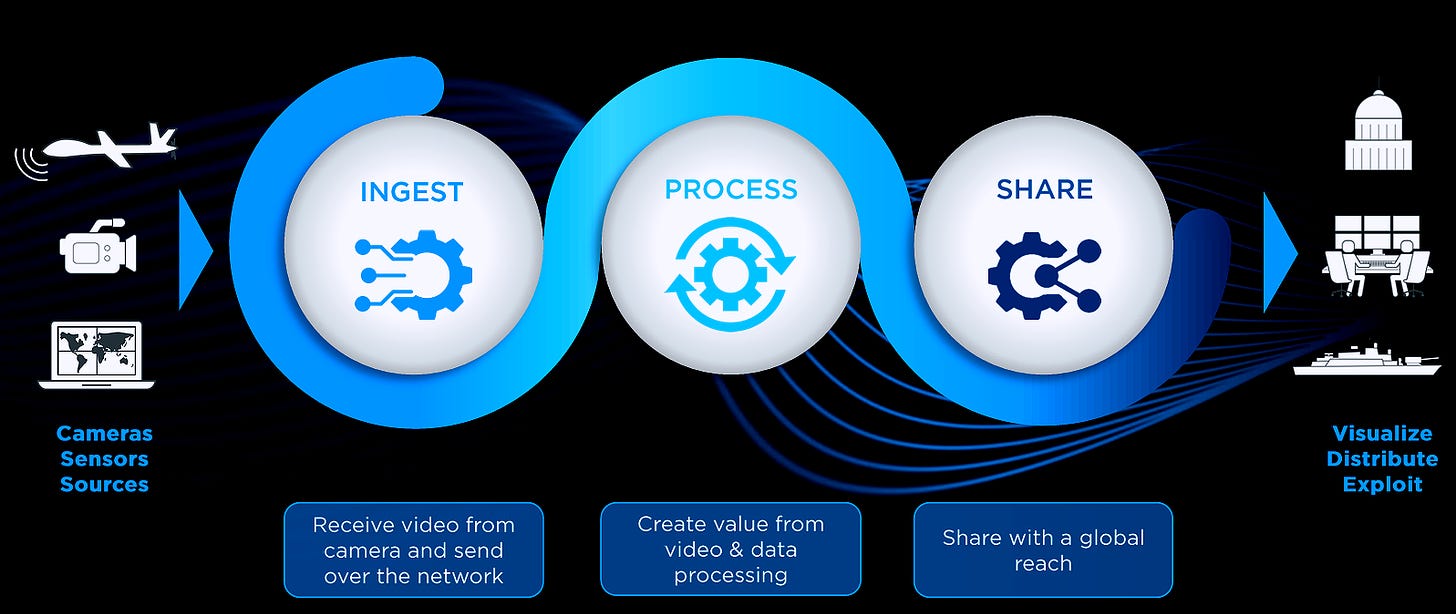

Haivision specializes in real-time video networking and visual collaboration solutions that are mission-critical for its clients. In plain terms, they’re a big player in the video streaming world, offering end-to-end tools for encoding, recording, managing, publishing, and securely distributing video content.

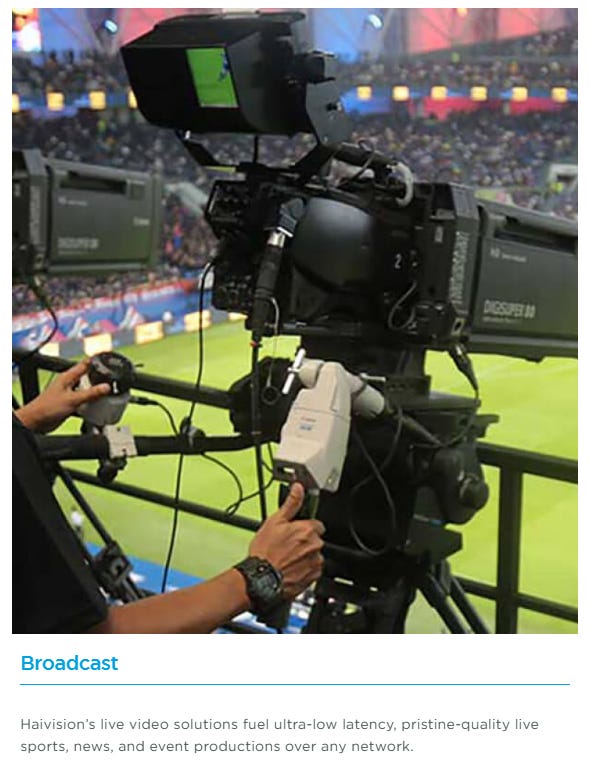

Streaming news, entertainment, and live sports are booming, but there is a long road ahead before it completely displaces satellite and cable delivery. Haivision is carving out its place as a leader in this fast growing market while continuing to diversify across multiple segments.

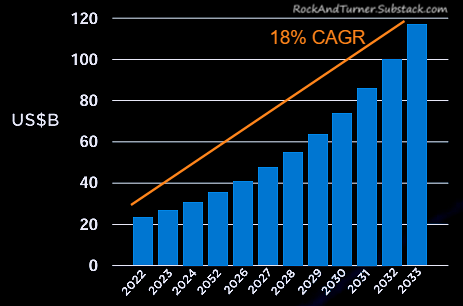

Independent research suggests that the growth rate for the video infrastructure market globally will be 18% CAGR over the next decade, and Haivision aspires to be the market leader in the high-value segment of this market which it estimates will be worth $15 billion by 2033.

A Quick Look at key Competition

Haivision’s competitors each bring something unique to the table:

Wowza Media Systems (PE backed: Clearhaven Partners) is a big player in live streaming with over 60,000 clients. It’s affordable and has a solid streaming engine, but it lacks advanced features and has a narrower focus compared to Haivision. Interestingly, Wowza and Haivision seem to share some customers. This raises questions - is this about redundancy strategies, ensuring resilience against failures and minimizing downtime, or are these customers transitioning from one provider to another? I havn’t been able to answer this question.

Telestream (PE backed: Genstar Capital) is a privately-owned company that has grown steadily through acquisitions. Their tools are very scalable, handling anything from small events to massive global broadcasts. But, their tools, like Wirecast, can be pretty complex and have a steep learning curve. While pricing is flexible, it can get expensive if you want the fancy stuff. Finally, a new CEO took over as recently as 2023. This really sets it apart from Haiviaion. Metaphorically, I prefer to invest in Michaelangelo with the vision and passion to create the masterpiece that is the Sistene Chapel, rather than someone who is subsequently employed simply to maintain what someone else created.

Akamai Technologies (Nasdaq: AKAM, market cap $14.4bn USD, ≈4x sales) was founded by an ex-MIT professor. It’s all about internet connectivity. Its massive HD network delivers high-quality video streaming worldwide. However, it can be complex to implement and costly.

Brightcove (Taken private by Bending Spoons) is highly rated by smaller and medium sized users for its user-friendly, feature-packed platform. It operates in 70+ countries and specializes in video management, monetization, and analytics. But its pricing isn’t great for companies with lots of content, so it’s not exactly in Haivision’s league. It’s partnered with Akamai for smoother video delivery but has struggled with profitability and slow revenue growth. This has lead to it being acquired by Italian tech company Bending Spoons S.p.A., best known for mobile apps, which is in the process of taking the company private.

IBM (part of the larger group) offers a powerful enterprise-level video platform with features like AI-powered closed captioning and video search through IBM Watson AI. The Red Hat acquisition has strengthened its hybrid cloud capabilities, bolstering the service it’s able to offer to those with complex streaming needs. However, IBM Video Streaming generally receives lower user ratings than Brightcove and its not very cost-effective.

Despite all this competition, Haivision stands out. They’ve got diverse revenue streams, are leaning into high-margin recurring revenue, and dominate in Government & Defense markets. Plus, their cutting-edge tech, SRT protocol which is now an industry standard, their innovative founder led management and excellent customer service set them apart.

Additionally, three out of the six featured businesses, including Haivision, are private businesses. The IBM offering is a segment within the broader group, so it is not a pure play in streaming. That only leaves Akami, capitalized at around 4x sales, and Haivision available at close to parity.

Finally, Brightcove, which has struggled with profitability, has recently been taken private by the Italian software house Bending Spoons. Haivision is a better business and trades at a fraction of the price paid for Brightcove. It may become a takeover target itself, although I suspect that Bending Spoons may have tried and failed to acquire it before turning its attention to Brightcove instead.

Haivision’s Diverse Revenue Streams

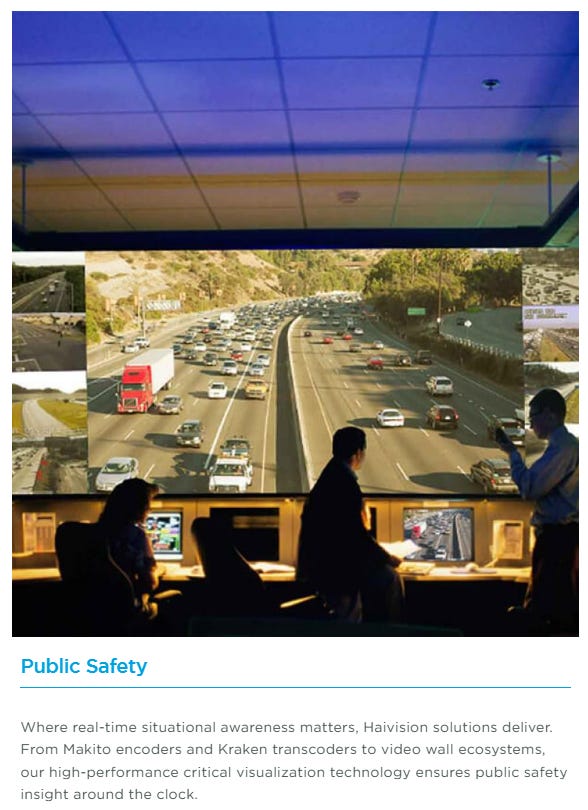

Haivision’s business isn’t tied to just one industry. Its solutions are used across a variety of sectors, including broadcast, enterprise, government, healthcare, and the military. This diversification gives the company a strong foundation and resilience to market changes.

Big Customer Base, No Concentration Risk

One of Haivision’s strengths is its broad customer base, which means it isn’t overly reliant on a single client or industry. Here’s a snapshot of its key sectors:

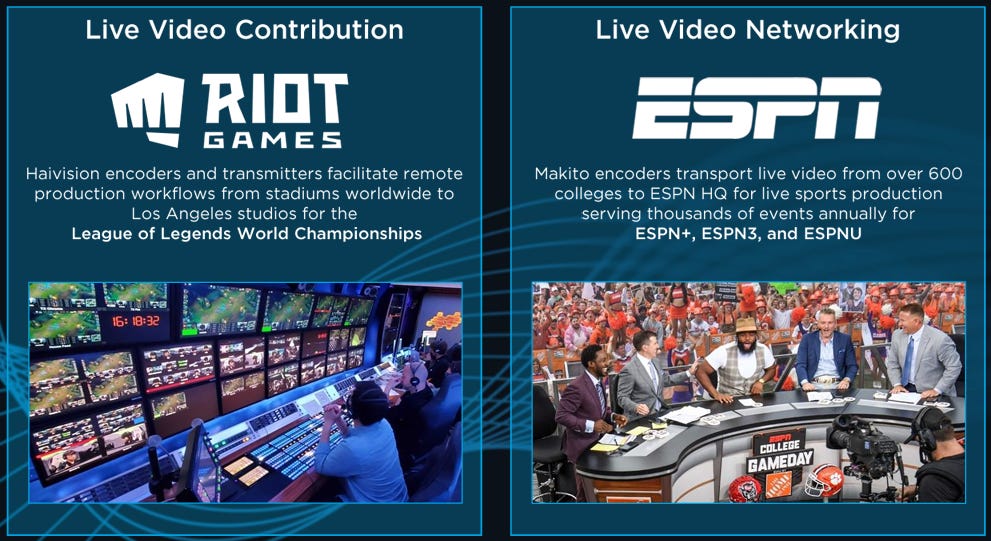

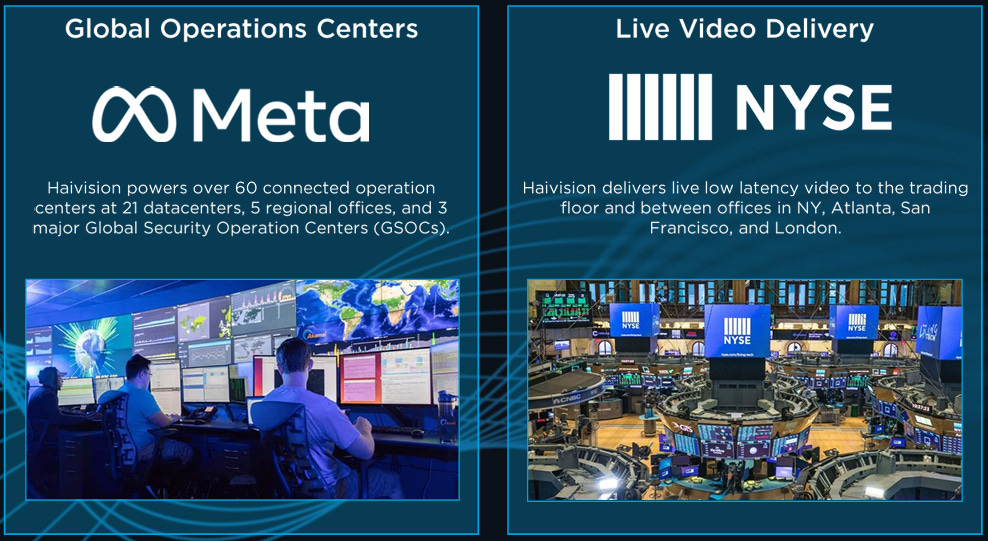

Media & Entertainment: Haivision provides technology to some of the biggest names in the industry.

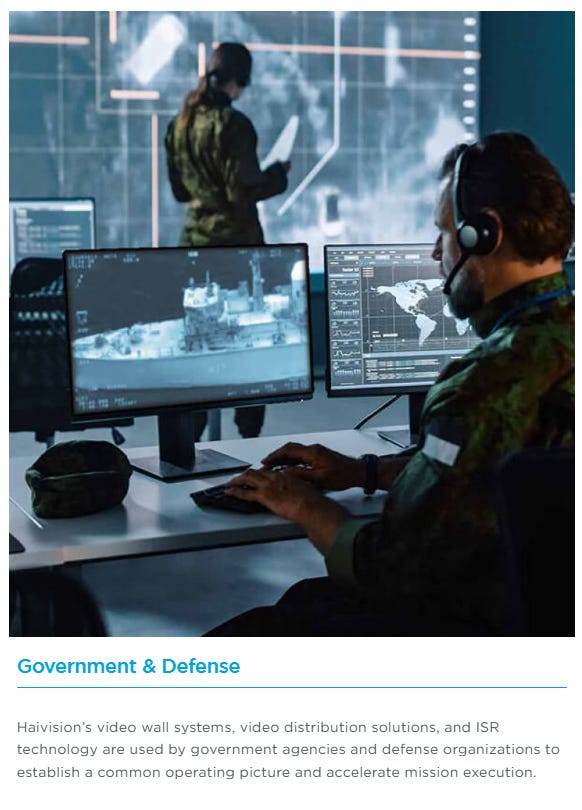

Government & Defense: This is where Haivision’s "mission-critical" solutions shine. They serve heavyweights like NASA, the U.S. Department of Defense, U.S. Air Force, U.S. Navy, U.K. Ministry of Defense, and Japan’s Maritime Self-Defense Force. Their video walls are used by Homeland Security and law enforcement for monitoring large public events like marathons.

These government and defense contracts come with strict security clearance requirements, creating a high barrier to entry for competitors. This adds a solid moat around Haivision’s business.

Enterprise: Haivision also powers live video delivery for commercial giants like the New York Stock Exchange, Meta, Microsoft, and others.

Revenue Breakdown

Haivision’s revenue is mainly hardware-driven, with about 80% coming from products like video encoders, decoders, transcoders, and transmitters. These tools compress and transmit video using the Secure Reliable Transport (SRT) protocol (more on that in a bit).

The remaining 20% comes from service/maintenance contracts and software offerings. Haivision aims to grow this high-margin, recurring revenue segment as part of its long-term strategy.

The business model is summed up as follows:

The Story of SRT: Haivision’s Game-Changing Innovation

Haivision invented Secure Reliable Transport (SRT)1 to shift video transmission from traditional methods like satellite and cable to the more versatile Internet Protocol (IP). But the road wasn’t easy. Competition heated up as others introduced rival protocols, sparking a battle for market share.

In a bold move, CEO Mirko Wicha decided to open-source the SRT code in 2017, betting that wider adoption and faster development would follow. It worked like a charm. Over 600 companies now use SRT as an industry standard, and in 2019, Haivision even won an Emmy Award for this groundbreaking technology that securely and efficiently transports video over public networks.

Since going open source, SRT has become one of the most widely adopted video transport protocols, steadily replacing RTMP which was last updated in 2012 and is clearly on its way out.

The industry-wide shift from legacy protocols like RTMP to modern IP-based solutions like SRT is creating massive opportunities for Haivision. As broadcasters, news stations, and sports venues upgrade their video equipment, they’re increasingly choosing IP-based protocols and SRT is quickly becoming the standard.

This short video provides a better understanding of the benefits of SRT:

Even Haivision’s competitors now include SRT in their encoders, and the creation of the SRT Alliance - a consortium supporting SRT’s adoption - with over 600 members has cemented its success. Big names like YouTube, Microsoft, Sony, Google, AWS, SK Telcom, AMD, Cloudflare, Tencent, Alibaba are all onboard, making it clear that SRT is here to stay.

This broader industry shift is expected to accelerate over the next 3–5 years, fueling demand for SRT-compatible products and giving Haivision a clear growth runway.

Hear what customers say about SRT:

Even though SRT is now open source, Haivision still leads the pack. As the driving force behind the SRT Alliance, it stays closer to the protocol’s evolution than anyone else, allowing it to integrate updates into its products faster than competitors. SRT offers the best balance of performance across key metrics like latency, quality, and reliability, giving Haivision a competitive advantage.

Haivision’s Operations and Products

Beyond protocol transitions, demand for real-time video content - especially live sports - is booming, with the market forecast to grow at a double-digit rate through to the end of the decade.

Haivision is well-positioned here, offering best-in-class hardware that’s essential for mission-critical live streams where reliability, quality, and low latency are non-negotiable. While its products aren’t the cheapest, they’re often compared to the iPhone in their segment - premium quality worth paying for.

Haivision’s gross margins of 70%+ speak to both the quality of its products and its pricing power. Even in a hardware-heavy business, it raised prices by ~10% in 2022 to offset inflation and supply chain costs.

Despite being primarily hardware-focused, Haivision runs a capital-light business model by outsourcing manufacturing to select partners in the U.S., Canada, and France. CAPEX is minimal, allowing the company to heavily invest in R&D to stay at the forefront of innovation and deliver cutting-edge solutions to its customers. This combination of innovation, premium quality, and operational efficiency positions Haivision to thrive in a rapidly evolving market.

Haivision celebrated its 20th anniversary in 2024 and this short video provides an overview of what the company has become and achieved over the past two decades:

As seen in the video, the company has a range of product offerings:

Makito Series video encoders and decoders for end-to-end transport of secure and high-quality HD video;

Video transmitters and mobile encoders for video contribution over bonded unmanaged IP networks;

Haivision Kraken, a video transcoder for mission-critical intelligence, surveillance, and reconnaissance, situational awareness, and field monitoring applications;

Haivision Hub for Government, a video network service for live and low latency video streaming between government agencies and public cloud delivery services; and

Haivision Media Platform that manages, shares, and delivers secure corporate communications, real-time video feeds, and broadcast IPTV.

Software and service offerings include:

Haivision SRT Gateway, a broadcast solution for secure routing of live video streams across different types of IP networks;

SRT Streaming Protocol that optimizes streaming performance across unpredictable networks;

Command 360, a software platform for real-time visualization of business-critical information;

BeOnAIR transmission bundle;

Haivision EMS, an element management system for centrally managing and monitoring encoders and decoders;

Haivision Play Pro, a free app for securely playing or streaming live SRT feeds from anywhere over the internet; and

Haivision Play, series of high performance video player applications for mobile devices, desktops, managed set-top boxes.

MoJoPro, which stands for Mobile Journalism Professional, is a broadcast contribution app that enables journalists to instantly stream live HD video from the field with their mobile device into on-prem and cloud-based production workflows.

Haivision’s Growth Strategy

In 2020, Haivision went public, raising equity capital to exploit the growing demand for real-time video solutions. The IPO marked a pivotal moment, enabling the company to strengthen its position in key areas like command centers, AI-driven Intelligence, Surveillance, and Reconnaissance (ISR), and 5G market leadership.

Since the IPO, it has made two highly accretive acquisitions. CEO Mirko Wicha has a proven track record of successfully integrating acquisitions, having executed well on eight since Haivision’s inception (see diagram below). The impact of these moves is expected to become more visible by the second half of 2025, setting the stage for accelerated growth.

The pre-IPO acquisitions were:

Video Furnace (2009): Providing Haivision with software distribution capability alongside its contribution heritage.

CoolSign (2009): Providing Haivision signage capabilities within live real-time video streams.

Kulabyte (2010) and Montivision (2010): Together these provided Haivision with over-the-top internet streaming expertise.

Lightflow (2019): Providing artificial intelligence and machine learning expertise within the video streaming ecosystem.

Teltoo (2020): Enhanced delivery capability with WebRTC low latency browser to the desktop technology, scalability and advanced analytics.

The recent post-IPO acquisitions, which are key to future growth, were:

CineMassive (2021): Strengthened Haivision’s capabilities in real-time, mission-critical visual collaboration for defense, government, and enterprise. Rebranded as Haivision Mission-Critical Systems (MCS), this acquisition led to a significant contract with the U.S. Navy (more on that shortly).

CineMassive’s CineNet management software allows seamless management of content across rooms, displays, and applications. By merging CineMassive with Haivision’s existing capabilities, the company aims to expand its footprint internationally and in first responder and public safety markets. This acquisition promises higher margins and scalability but temporarily impacted revenue as Haivision phased out lower-margin streams before the offsetting high-margin business has gained momentum. Full benefits are expected to become evident by the second half of 2025.

As mentioned above, Haivision MCS recently secured a massive five-year production agreement with the US Navy’s NAVSEA, valued at $82 million CAD ($61.2 million USD). This builds on its ongoing success with the Navy’s CANES program, where Haivision’s video encoding and playback tech plays a crucial role in ship-wide video distribution.

The integration of CineMassive has been a game-changer here, particularly its Command 360 visualization platform, which strengthens Haivision’s defense applications. Haivision is now at the forefront of combat visualization and situational awareness solutions - critical for mission planning and real-time decision-making.

Aviwest (2022): Added wireless IP-based video capabilities, complementing Haivision’s wired solutions. Aviwest’s unique IP bonding technology and SST protocol ensure ultra-low latency, reliability, and adaptability, even in fluctuating network conditions. Haivision plans to integrate Aviwest’s technology into defense, first responder, and public safety verticals while extending its presence in North America. This combination of wired and wireless solutions is expected to enhance Haivision’s position as a comprehensive provider in the video transmission space.

The company’s number one priority is to grow both organically and through strategic acquisitions as its CEO and CFO explain in this short interview:

In addition to acquisitions, Haivision has embarked on two strategic partnerships to drive innovation and product offerings:

Shield AI Partnership: Haivision has teamed up with Shield AI to integrate its Kraken video processing platform with Shield AI’s Kestrel object detection solution. This collaboration enhances situational awareness for defense customers, allowing for faster, life-saving decisions by automating object detection and tracking in video feeds:

Air!5G Consortium with Airbus Defence and Space: Haivision is part of a European IPCEI (Important Project of Common European Interest) backed initiative to develop private 5G solutions for secure and reliable communications. This project, managed by Airbus, positions Haivision as a key player in next-gen 5G technology, with the first products expected in fiscal 2025. Participation also provides access to R&D grants and favourably priced development loans.

Haivision’s focus on live events, sports, and broadcasts - bolstered by its investments in private 5G networks - is creating new growth avenues. Cellular-bonded private 5G networks are particularly exciting and expected to be a significant driver of revenue in 2026 and beyond. The IPO and subsequent strategic moves have set Haivision up for long-term success, with top-line growth poised to accelerate as its innovations and partnerships bear fruit.

Other Strategic Initiatives

It isn’t all about building and acquiring. Haivision pursues a strategy of cutting the weeds and watering the flowers. A such it isn’t afraid to cut underperforming segments.

In April 2023, the company made a bold move to exit its lower-margin managed services business, including the House of Worship market (which provided video streaming solutions for churches and ministries). Streaming religious services has low barriers to entry because performance, low latency and security are far less important, so it was becoming a commoditized unattractive market. Exiting this segment was the correct thing to do and while it led to a short-term dip in cloud solutions revenue, it allowed the company to focus on delivering more specialist, mission-critical solutions that align with its core competence, which attract less competition and are more profitable.

The company has also stepped away from offering bespoke solutions that relied heavily on supplying third-party components. Haivision has pivoted from being a systems integrator to a manufacturer in the control room space. Previously, Haivision’s integrator approach meant bundling third-party components (like displays, cables, and mounts) with its offerings, which added complexity, delays, and bloated inventories.

Now, Haivision’s channel partners handle third-party components, a new source of revenue that they welcome, allowing Haivision to focus on its own cutting-edge hardware and software. It is very much a win/win situation that encourages channel partners to favour working with Haivision.

This shift has also streamlined operations, cut down inventory, and made it easier to scale, especially in international markets. By ditching these lower-margin, labour-intensive operations, Haivision has simplified its business model, boosted gross margins, and doubled down on proprietary, high-value solutions.

Another strategic move was launching a rental program for its transmitter products after acquiring Aviwest. This initiative enables customers to recognize an ongoing operating expense rather than a larger upfront capital expense, making it a more attractive proposition. It also keeps customers future-proofed, as they can easily upgrade to the latest technology during their rental term.

Competitors already offer similar rental options, and so this initiative was born out of necessity in order to remain competitive. Customers now have maximum flexibility, choosing to buy equipment outright, rent it for individual events (perhaps the Olympics or FIFA World Cup) or opt for a long-term rental contract. They also have the option of accessing software via cloud subscriptions or on a pay-as-you-go model.

This move delivers clear benefits as it increases recurring revenue, increases the margin earned on each product over its life-span, and makes sales easier to close.

Haivision’s leadership is proving adept at pivoting based on market opportunities and customer needs. All these changes - exiting non-core markets, streamlining operations, transitioning to manufacturing, and rolling out rental programs - are part of a broader strategy to enhance profitability, grow recurring revenue, and solidify the company’s leadership position in mission-critical video networking and visual collaboration. This dynamic decision-making showcases a forward-thinking management team focused on long-term success.

Financials and Valuation*

*All numbers are quoted in Canadian Dollars, unless stated otherwise

Haivision’s shares have taken a hit recently, likely due to short-term headwinds from the integration of recent acquisitions and the decision to exit the House of Worship business, which temporarily impacted earnings. However, the underlying fundamentals are improving, setting the stage for for long-term growth. It’s a classic case of short-term pain for long-term gain, and the future looks bright.

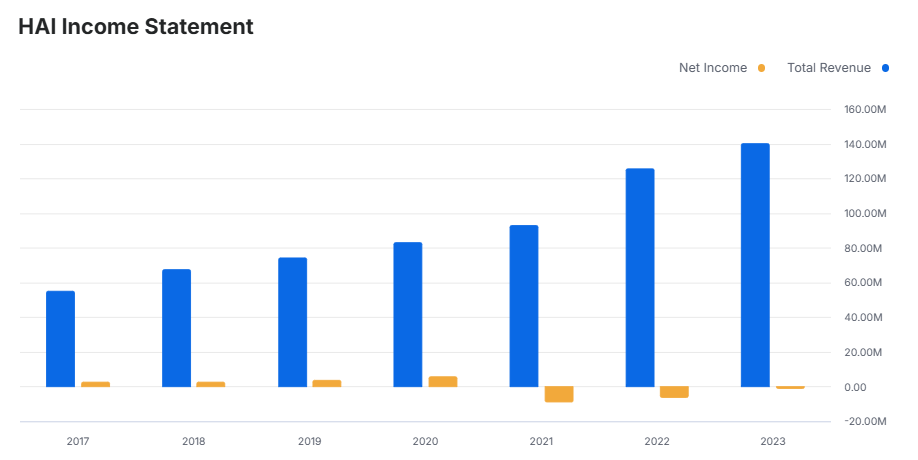

The chart below shows how revenues are climbing sequentially year on year, but that the restructuring costs have temporarily impacted net earnings.

Gross margins are climbing toward 75%, driven by increased adoption of software-only and virtual machine deployments, which have fixed costs that scale well with higher revenue. Operating leverage is also kicking in - OPEX as a percentage of gross profit has dropped over 1,000 basis points in the past six years. With gross margins holding steady around 75%, Haivision’s profitability is set to rise sharply as revenues grow.

A 14% reduction in headcount and the disappearance of non-recurring extraordinary expenses, largely strategic restructuring costs and professional fees, have contributed to the cost savings. There have also been decreases in amortization and depreciation expenses, plus technology and communication costs, as operations are becoming more efficient. As a result, EBITDA margins, currently in the mid-teens, are projected to surpass 20% within the next two years.

Haivision’s balance sheet is in great shape, with a net cash position of $13.9 million as at Q3’24, compared to just $1.7 million in long-term debt. The company also has access to a $35 million revolving credit facility (expandable to $60 million), of which only $3.4 million has been used. This financial flexibility supports continued growth and investment in growth.

At a share price of $5.15, Haivision’s market cap is $145 million, with an enterprise value of $144 million. For 2025, the company has guided over $140 million in revenue, with adjusted EBITDA margins expected to improve by 100 - 200 basis points. This means Haivision is currently trading at just 1x next year’s sales - a bargain considering its forecast 20% EBITDA margins and double-digit revenue growth expected over the next few years.

Is Haivision A Good Investment?

Haivision is a compelling blend of innovation, strategy, and execution. Its leadership, diversified revenue streams, and focus on high-growth markets position it for sustained success. This is a small-cap business that is punching well above its weight and not likely to remain a small-cap for long.

It has an incredibly sticky business - its customers rely heavily on its products, which are at the cutting-edge of available technology. The solutions it delivers are designed with a focus on reliability, addressing the critical needs of users and it offers an exceptional customer support and maintenance commitment. In short, there is simply no incentive for customers to switch.

Strategic acquisitions and partnerships are complimentary to the in-house product development that flow from the continual investment in R&D, all of which creates a competitive advantage for Haivision.

Haivision’s highly scalable solutions allow customers to expand their video streaming capabilities seamlessly as required. This translates to high recurring revenues high and robust organic growth before new customers are added into the mix.

In an industry forecast to grow at 18% a year for the next decade, it appears that Haivision ought to easily be able to achieve double-digit top line growth in the years ahead. As a point of reference, over the past five years it grew its top line at an annualized 19.3%, despite huge disruptions caused by Covid19, regional wars, high inflation, a jump in borrowing costs, a shortage of semi-conductors, plus manufacturing and shipping disruptions.

So double-digit revenue growth seems entirely achievable and in combination with the company’s exceptional gross margins and favourable operating leverage, this points to expanding profit margins and strong earnings power in the years ahead.

But that’s not all. In January 2024, Haivision secured approval to repurchase up to 2.01 million shares over a 12 month period (about 10% of its float) under a Normal Course Issuer Bid (NCIB). By July 2024, the company had already repurchased 462,100 shares at an average price of $4.33, spending just under $2 million CAD.

During its Q3 2024 earnings call, management indicated a strong likelihood of renewing the program, citing confidence that the stock’s current valuation doesn’t reflect its true value. To keep the buybacks rolling, Haivision also implemented an Automatic Share Purchase Plan (ASPP), ensuring shares can still be repurchased during blackout periods.

There are four key drivers of shareholder returns: revenue growth, margin expansion, multiple expansion, and a reduced share count, and all look likely to improve. When these factors combine, the multiplier effect could significantly reward investors.

Even with conservative assumptions, the potential upside is eye-popping. If we assume Haivision grows revenue at just 11% , reduces share count by 2% annually, improves margins by 400 basis points, and earns an 18x multiple, the stock would deliver a total return of 302% over five years - or 32.1% annualized. Discounting that back at 10% suggests the stock should trade closer to $13 per share, well above its current price of $5.25. Remember, these are conservative assumptions.

At a valuation near parity with its revenue, Haivision’s current price doesn’t reflect its robust business model, impressive margins, and growth potential. For investors, this could be a rare opportunity to buy into a high-quality, high-margin compounder with plenty of room to grow.

Haivision was pitched at the MOI Global Best Ideas of 2025 investor event, and this includes a special feature ~ a detailed breakdown of the business by its CEO which is a must listen: MOI Global 2025 Best Investment Ideas pitch video/podcast .

White paper explaining SRT, its history and why SRT will drive the future of broadcast contributions: https://www.bbright.com/news/bbright-white-paper-srt-contribution-over-ip-encoder-decoder-gateway/

Haivision FY24 Earnings Release (15 Jan 2025)

Revenue

Annual revenue for 2024 was $129.6 million, reflecting a $10.3 million decrease from 2023, which was largely anticipated. The decline stems from the company’s strategic shift from systems integration to manufacturing and its decision to exit certain markets, such as the house of worship sector.

The house of worship segment alone accounted for over $8 million of the revenue decrease. Management deliberately exited this low-margin market, where solutions like Zoom, Google Meet, or Microsoft Teams are more cost-effective and sufficient for customer needs. Competing in a commoditized space like this wasn’t viable for Haivision, and exiting it was a sound decision. Similarly, the low-margin systems integration segment is now managed by channel partners.

With this restructuring completed, Haivision has positioned itself for growth by focusing on high-margin business lines, bolstered by recent acquisitions. A short-term revenue delay due to U.S. federal budget approvals and government procurement issues—exacerbated by the ongoing administration change—was noted. Importantly, this is a timing issue, with delayed revenue expected to flow into 2025.

Gross Margins

Despite revenue challenges, gross margins improved to 73.1%, up from 70.5%, driven by supply chain efficiencies and cost-saving measures.

Profitability

Operating profit surged 345% to $5.5 million, while adjusted EBITDA grew 17% to $17.3 million, underscoring the success of restructuring efforts that reduced annual expenses by $8.2 million.

Net income reached $4.7 million, a significant turnaround from a $1.3 million loss in 2023. Adjusted EBITDA margins improved to 13.4% from 10.6% last year, with a near-term target of 20%, signaling significant upside potential.

However, Q4 challenges from delayed government revenues impacted adjusted EBITDA margins, which dipped to 9.8% compared to 15.9% in Q4 2023. This short-term headwind dragged on annual improvement but is expected to reverse in 2025, supported by new product launches and cross-selling opportunities from recent acquisitions.

Achievements in 2024

In addition to the completion of the two year strategic transition of the business, Haivision achieved several milestones in 2024, including receiving a $61.2 million U.S. Navy production agreement for advanced combat visualization systems and winning industry awards for innovation in live video and cloud-based production solutions. It also joined the Panasonic Partner Alliance for live video production workflows with Kairos; joined the Sony Cloud Production Platform for low latency live video in the cloud; and partnered with Grabyo, a London-based live cloud production platform, enabling integrated solution for live multi-camera productions. The company is also at the forefront of technology for transmitting live video over 5G networks as was showcased at the Paris Olympics. France Television provided exclusive coverage of the Paris 2024 Olympic surfing competition utilizing Haivision's private 5G video transmission ecosystem, for which it was awarded the IBC Innovation Award.

Future Outlook

Management remains optimistic about returning to historical revenue growth rates exceeding 15% by 2026. CEO Mirko Wicha emphasized Haivision’s strategic repositioning and readiness to capitalize on growth opportunities in 2025 through product innovation and increased demand in key markets.

While no major M&A activity is planned for 2025 (barring exceptional opportunities), the company is building cash reserves for potential acquisitions in 2026 and beyond. Haivision maintains access to a $35 million revolving credit facility (expandable to $60 million), with minimal utilization to date.

The company spent $3.6 million on share buybacks during the period but prioritizes cash accumulation to support its growth strategy and consolidate its position as a market leader.

My View

I remain incredibly bullish. This is a great market leading company in a growing market with great management available at a great price. It's exactly what I look for. It is a large position in my portfolio.

Please make your own investment decisions - this is not to be construed as investment advice. It is for information purposes only.

Thanks for the detailed report on this very interesting company.

Because you are more or less comparing it to Apple, I would like to know what kind of moats you see at Haivision.

Apple has wide moats in the following categories:

Network moat - iMessage in the USA

Switching cost moat - once you have several devices and services, it becomes increasingly difficult and expensive to switch to a new system

Brand moat - the brand has a very strong appeal

With Haivision, based on my current understanding, I would say:

Technology leadership moat - currently, thanks to the further development of the protocol, Haivision can transfer new features to its new hardware more quickly, so as long as there are new, interesting features, this could remain. But the past has shown that a technology moat can also be very narrow and shallow.

Because Haivision is more aimed at B2B customers, I am unsure whether the brand or switching cost moat applies here to the same extent as with an end customer. I think B2B customers will always choose the cheapest solution that meets their requirements.

The open source protocol does have a high adoption rate, but it should be easier for imitators to at least penetrate the chain of necessary devices.

Did you also look at the following during your analysis:

1. Competitors --> I've only looked superficially, but I think that EVS Broadcast Equipment offers at least similar products.

2. Patents: Does Haivision have some kind of protective moat through hardware patents?

What still surprises me:

70% gross margin and then 9.8% EBITA margin, doesn't that mean that there is still a big lever for optimizing expenses here?

The high gross margin obviously underlines that Haivision's products are very good, but it probably attracts more and more competitors as their reputation increases.

Which tool do you use to see that the CEO has bought more shares?

Thank you for your thoughts!