Olin | Good Old Fashioned Business

Solid Foundations, Durable Earnings and Market Leading Position

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

Company: Olin Corporation

Ticker: (NYSE: OLN)

Market Cap: £6.2 billion USD (share price 51 USD)

URL: https://www.olin.com

Strategy: Watch and Strategically Accumulate

Investment Theory Context

When two of the greatest business builders of the last 50 years say the same thing, it would be foolish to ignore them.

“I very frequently get the question: 'What's going to change in the next 10 years?' And that is a very interesting question; it's a very common one. I almost never get the question: 'What's not going to change in the next 10 years?' And I submit to you that that second question is actually the more important of the two.' Jeff Bezos, Amazon

“Don't focus on what's going to change in the next 10 years. Instead, focus on what's not going to change. Because that's where your opportunity lies.” Steve Jobs, Apple

A moving landscape is difficult to predict and one cannot build a house upon sand. Instead, a strong business stands on solid foundations that are not moving and not changing.

If, at least theoretically, the value of a company is the sum of the discounted value of all its future cash flows, then longevity is key. So while Wall Street obsesses over quarterly numbers, most investors miss the most important aspect of investing and fail to ask how durable earnings are.

By way of example, in the early 1990s Netscape launched the first internet browser creating a new market. In less than 18 months it captured 90% market share, attracted a flood of investment at inflated valuations, but by 1997 its business was destroyed by Microsoft (a story for another post perhaps). Had investors valued Netscape on the basis of a lifespan of less than five years, it would never have been worth what investors believed it to be worth.

Too much changed in a very short period of time, which is always likely in a new high-tech market. Isn’t it odd that this remains a huge risk which is rarely if ever factored in to the pricing calculus of investors?

“We’re never interested in creating markets – it’s too expensive. We’re interested in exploiting markets.” Don Valentine, Sequoia Capital

To continue this line of reasoning, it is noteworthy that, for investors, longevity alone is not enough.

Consider this: Just over a century ago, the aviation industry was born when the Wright brothers pioneered mankind’s ability to fly. This was as high-tech as it got back then. People had been moving around on foot or on horse back for centuries, cars were just coming into being but few could afford them, and for long distance travel ships were slow and inconvenient. Against that backdrop, commercial aviation took off (pardon the pun).

The likelihood was that this new revolutionary form of transport would endure and it certainly has. So longevity was all but assured. So, if you were around back then, do you think would you have been tempted to invest in commercial aviation as the next big thing? Many did. It was a mistake.

As Warren Buffett has pointed out, the worst sort of business is one that grows rapidly, requires significant capital to engender growth, and then earns little or no money.

The airline industry has been a disaster zone for investors and over the years it has consumed far more capital than it has ever created. Deregulation has led to excessive expansion, intensifying competition and squeezing profit margins. Cyclicality in oil and fuel prices, economic recessions, and labour disputes have created a perfect storm for the industry. In general, it has been a miserable sector to be invested in.

“The way to become a millionaire is to start with a billion in the bank and then to buy an airline!” Warren Buffett, Berkshire Hathaway

“From the era of the Wright Brothers and the inaugural flight at Kitty Hawk, investors have continually funneled capital into a seemingly bottomless pit. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favour by shooting Orville down.” Warren Buffett

There are so many parallels today. How many great technology businesses can you think of which provide wonderful utility to customers, but which are awful businesses for investors because they consume far more capital than they create.

The take away here is that a good investment needs to be generating good levels of free cash flow in a manner that is sustainable over the long term.

So sometimes its best to focus on the simple, the obvious, the company that requires low levels of invested capital, which operates with good margins and limited competition in a market that ensures durable earnings.

With that in mind, allow me to introduce one such good old fashioned businesses, Olin.

Olin Corporation

Olin was originally established as the Equitable Powder Company by Franklin W. Olin in East Alton, Illinois, in 1892. This is a business that has thrived for 130 years and is likely to be around for many decades or a century more, so it has that magic longevity ingredient. Today it employs 8,000 people in more than 15 countries with customers in nearly 100 countries around the globe.

Initially it supplied blasting powder to coal fields in the Midwest, but swiftly diversified into manufacturing small arms ammunition. During World War I, the company played a significant role by producing brass for military use.

In the midst of the Great Depression, Olin acquired Winchester Repeating Arms (you may be familiar with Winchester Rifles). It eventually sold its shotgun manufacturing division but retained ammunition production. Remarkably, it continues to manufacture bullets with brass today.

Olin occupies a prominent market position in small-caliber ammunition, and in 2020, it took over complete management and operational control of the Lake City Army Ammunition Plant. This move solidifies the stable and predominantly recurring revenue characteristics of the segment.

In fact, Olin anticipates doubling this segment of the business within two years, and is already on track to achieve that.

But this isn’t its core business.

Over the years, through various investments and divestments, the company has emerged as the world's largest and most cost-effective manufacturer of chlor-alkali, strategically integrated into numerous high-profit sectors.

During the 2015 merger of Dow and DuPont, where assets were divested to address antitrust concerns, Olin seized the opportunity to strengthen its standing in the industry. Through a $5.5 billion acquisition, Olin secured Dow Chemical's U.S. chlor-alkali and vinyls businesses, as well as global divisions in epoxy and chlorinated organics. This strategic move propelled Olin to the forefront as the leading global producer in several key areas, including chlor-alkali (with the highest chlorine production capacity), membrane caustic soda, chlorinated organics, epoxy materials, and, specifically in North America, chlorine, bleach, and hydrochloric acid.

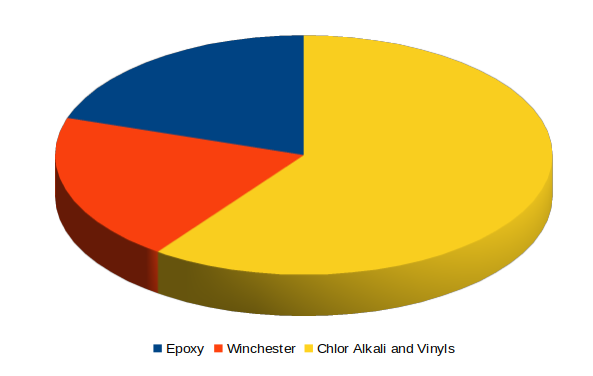

The breakdown of significance to the group by segment is not easy to establish since all of its markets are cyclical and so ratios vary from one accounting period to another. So without putting numbers on it, historically the following pie chart gives you an approximate idea of segment splits by contribution to corporate economics:

It is important to understand that in each segment, it is a market leader.

Going forward the the epoxy segment will contract, while the others expand. This is entirely deliberate and reflects Olin's commitment to focusing capital where it can be used most productively.

The Epoxy segment faces structural challenges characterized by a significant increase in China's production capacity adding approximately 20% to the world's productive capability over the last two years. Concurrently, the demand from both China and Europe, which collectively represents 75% of the global demand, has experienced a noticeable decline. In combination this has hit the Epoxy market hard.

In response, Olin is proactively pursuing a strategy of optimizing reinvestment economics by meticulously aligning its operations with the evolving market dynamics. As part of this initiative, in March 2023, Olin announced the discontinuation of operations at its epoxy resin plant in Terneuzen, the Netherlands, and the cessation of solid epoxy production at its facilities in Gumi, South Korea, and Guaruja, Brazil. These decisions will incur restructuring charges spread over the next three years, but they align with the broader strategy implemented in 2022 of reducing epoxy resin production.

"This is another step in realigning our global epoxy assets to the most cost-effective asset base to support our strategic operating model," Scott Sutton, CEO

While the Epoxy sector is a longer term structural issue that the business has dealt with through restructuring, it has adopted a different approach in relation to short term declining ECU values.

Chlorine and caustic soda are elements of the Electro-Chemical Unit (ECU), with hydrogen being the third. They are produced during the same process, and so one cannot be produced without the other (see diagram below).

Bearing in mind that one element cannot be produced without the other, it becomes clear that this will result in operational challenges for Olin. This is because the cyclical demand for each element is rarely, if ever, in sync. This means that when demand for one element is high, the other is typically low.

Historically, Olin, and other companies operating in this industry, have always managed their business according to the strong side of the ECU. So during peak demand for caustic soda, its production would be optimized, but this would result in an over-supply of an already depressed chlorine market. The same happens the other way around when chlorine peaks and caustic soda demand is in a cyclical downturn. The result is that the good unit economics generated on the strong element are offset by poor unit economics on the weaker element.

Scott Sutton, who had been on the board of Olin for several years and so understood the business well, became CEO following the Covid pandemic and decided to change the way that Olin managed its operations.

He recognized that chasing the strong side of the ECU made no sense if it requires paying customers to take away the over-supplied weak side. To make matters worse, they chased the strong side to such an extent that it too became over-supplied which impacted the market globally on both sides of the ECU, resulting in depressed unit economics.

So instead of managing the business according to the strong side of the ECU, Sutton decided to manage Olin according to the demand for the weaker element. This would not only improve the unit economics of the weak element, but it would contract supply for the strong element thereby enhancing margins there also.

Many were skeptical of this new approach, but the results speak for themselves. 2018 was a cyclical peak and Olin generated ~$1.2 billion in EBITDA. In a cyclical trough, seen in 2016 and 2020, EBITDA dropped to between $600 million and $800 million. However, after the changes introduced by Sutton, peak EBITDA doubled to ~ $2.4 billion , while the 2023 trough was $1.4 billion (better than the prior peak!)

Olin is taking this a stage further. If other producers over supply the market resulting in a depressed commodity price, Olin will happily idle portions of its asset base, refusing to participate in weak markets. It then engages in what it refers to as ‘parlaying’ activity to manage the surplus under-priced liquidity in the market. It will happily buy the cheap commodity from other producers if they sell for less than the cost of production, because it is more cost effective to be a buyer on the open-market in such circumstances than producing the commodity at a loss. As a market leader, Olin's production decisions have a substantial impact on the supply-demand equilibrium. The company believes that this proactive approach, known as the 'Value Accelerator Initiative,' will not only expedite the inflection point but also alleviate the severity of the ongoing cyclical bottom. As the market recovers, Olin releases its inventory thereby capturing a profit at the expense of other producers. It’s a very smart way to operate.

Anticipating a demand inflection on the horizon, Olin made the strategic decision to drastically cut back its production in the fourth quarter of 2023 to preserve value.

This dynamic form of management is refreshingly rare. Decisions are being taken based on what is best for the company and its shareholders.

The business has currently dialed down operations to 50% capacity for a quarter or two during the current down cycle, but even at that level, subject to an inflection point coming later in 2024, it will generate an annualized positive levered free cash flow - the sign of a very robust business. Not only does this indicate that it has more room to dial down its capacity further if required (unlikely), but it bodes awfully well for free cash flow generation when it dials back up to 100% capacity.

Free cash flow generated by this business is likely to be significantly higher permanently, when compared to the pre-Sutton era, again with trough levels well above prior peak levels (see chart above). This bodes well for investors as that capital will be used to strengthen the balance sheet and reduce the share count (more on this later).

In terms of market dynamics in the chlor alkali industry, future demand growth exceeds future supply growth which is all favourable for Olin and it has expressed confidence in that outlook.

Furthermore, Olin's low-cost production gives it a competitive edge. This is achieved by access to advantageous natural gas liquid-based ethylene feed-stocks secured through long-term supply agreements with Dow Inc. and is complemented by Olin's ownership of power assets.

Olin is also in the process of creating a hydrogen energy business by capturing and selling the by-product of its existing ECU manufacturing process. This will boost margins further because almost all of the revenue will drop to the bottom line and we are heading into a hydrogen based economy (see Hydrogen: the next Oil)

In 2023, Blue Water Alliance (BWA) began operations after receiving all necessary regulatory approvals. This is a joint venture between Olin and Mitsui & Co. Ltd.

Olin holds 51% interest and exercises control in BWA.

BWA was founded to foster efficiency, sustainability, and excellence in the global shipping and management of caustic soda, potassium hydroxide (KOH), and ethylene dichloride (EDC) - ECU based derivatives.

Olin's operational strategy, which prioritizes value optimization over volume growth, demonstrates strategic acumen and contributes to the development of a more resilient mid-cycle EBITDA margin profile.

Olin is steadfast in its commitment to adeptly manage its market participation - its ‘parlaying’ activity and this is an extension of that initiative. It is purchasing liquidity on the open market and seeks to be the biggest trader in this market. In other words, it acts on both sides of the market depending on commodity pricing.

It is also important to understand that the price of the commodities that Olin trades are not fixed globally in the way that gold has a universal price. Instead there are very significant regional variations. The BWA alliance will enable Olin to exploit arbitrage opportunities as it will be able to buy at one price in one geographic region, and sell at a higher price elsewhere.

So far the market has not fully valued BWA, so arguably Olin is worth far more on a sum of parts basis.

The COVID-19 pandemic significantly slowed down operations for many companies, including Olin. However, as the crisis abated, Olin emerged as a leaner and more profitable entity, having witnessed the permanent closure of several competitors. A similar thing may happen during the current ECU downturn. It is a matter of survival of the fittest. The weak die off and the strong get stronger.

Riding the gradual economic recovery, Olin, with its leaner operations and higher-margin focus, managed to generate up to $2.7 billion in EBITDA and over $1.5 billion in free cash flow in 2022.

Leveraging this cash flow, the company diligently reduced its debt, which coincidentally now also stands at approximately $2.7 billion net of cash. Even in the face of a downturn in 2023, management remains confident that the business can produce close to $1.5 billion in EBITDA and $1 billion in free cash flow.

Looking ahead, it is anticipated that very few new competitors will enter the market over the next decade, yet population growth and industrial demand continue to drive demand. Organic growth for ECU product is forecast to grow at approximately 3% CAGR over the period. So TAM expands while the number of players in the market is likely to contract.

Olin has received a BBB- rating from Fitch for both its long-term issuer debt and senior unsecured debt, with a stable rating outlook. This rating is attributed to the company's market-leading position in its primary product lines, competitive cost positioning, its high degree of vertical integration and strong cash flow profiles. The rating is only constrained by the cyclical nature of many of the company’s products, something that is entirely beyond its control.

With Olin's financial position now rock solid and no immediate need for growth capital expenditure, the question arises: what should be done with any accumulated cash?

Unlike commodity-based businesses that require capital reserves in order to maintain long-term sustainability, Olin's diverse assets, encompassing caustic soda, chlorine, epoxy, vinyls, and bullets, are poised to endure for decades to come.

Currently, the company's enterprise value is a mere 1.4 times its top line revenue against a free cash flow margin ranging from 14% to 20%, offering investors an attractive earnings yield of 10% to 14%. Consequently, the optimal course of action at present is to initiate share repurchases which at these price level is hugely accretive to shareholder value. This this is a strategy that Olin has diligently been pursuing.

In the past two years alone, the company has successfully bought back 20% of its shares. At this rate, it could transition to private ownership in less than five years. As the number of outstanding shares diminishes, accompanied by an increase in revenue and expanding profit margins, the value of each share will rise.

While repurchases are the priority at the moment due to the favourable economics, it recently demonstrated that it is willing to deploy some of its cash towards acquisitions (particularly the profitable White Flyer targets business). CFO Todd Slater explained that they will only engage in this kind of activity if the acquisition is more accretive than repurchasing shares.

“Being clever at capital allocation means finding opportunities that deliver even more value to shareholders than just share repurchases. Those may come through alliances. It may come through ventures. It's possible it could come through acquisitions just like the White Flyer acquisition that we did. It's all of those things.” Scott Sutton, CEO, Olin Corporation

My only caveat to the ‘clever capital allocation’ based on an opportunity cost appraisal is that the company insists on paying dividends come what may. This seems to suggest that management does not entirely practice what it preaches.

At the current share price I don’t believe that Olin should be paying dividends at all. Any surplus capital should be allocated to repurchases as that would be far more accretive to shareholder returns (If you are interested in why I say this, my thoughts on dividends are all articulated in this John Malone article and on repurchases in this Henry Singleton article).

In any event, there is still ample reason for adding Olin to my portolio. When the broader market catches up and recognizes Olin's potential, the company's valuation multiple is likely to expand. When considering the combination of all the positive factors explained above, it becomes evident that investing in Olin's shares presents a highly favourable risk/reward balance at present. This is why I have invested and many investment funds (41 at the last count) are diligently holding Olin stock in their portfolio.

In terms of numbers, over the past five years revenues have compounded at 9.57% and economic earnings margins have expanded significantly from mid single digits to high teens as both growth CAPEX and maintenance CAPEX have reduced - capital intensity is reducing. This implies that D&A will reduce going forward which bodes well for operating profit margins. With margins trending upwards, and debt levels being paid down, there is a great deal of scope for multiple expansion in coming years.

Even if top line growth slows to 5% on a CAGR basis, I don’t see any downside risk and my very conservative calculations suggest an average annualized return of more than 22% over the next five years (including an average dividend yield of 2.5%).

My 5 year conservative share price target would be in the region of $127 per share. If we were to adopt the Ibbotson approach to equity risk premium relative to risk free rates and discount by a rounded 10%, that suggests a net present value of $78 for Olin stock relative to a share price $51 today. It could very easily be more if capital allocation is optimized for shareholder returns (such as cessation of dividends in favour of stock repurchases).

Over the medium term, I can’t see this stock doing anything but going up, but given the cyclical nature of this industry it is unlikely to be a smooth linear path - the upward trend is likely to be turbulent. It requires an investor with conviction over a medium to long term time horizon, happy to ride the waves.

This turbulence influences the valuations of companies active in the sector. Currently we are in a down period which means that corporate valuations are depressed. All this means is that now is arguably a good time to take a position at an interesting entry point. In cyclical markets one certainty is that downs are followed by ups , so the next phase of the cycle will be up but may require patience - a year or more.

As always, this analysis is my opinion and for information purposes only. You must do you own research before investing. What do you think about Olin? Please share your thoughts in the comments below.

UPDATE

Olin Announces $2 Billion Share Repurchase Program

On December 12, 2024, Olin Corporation announced an increase in its share repurchase authorization to $2.0 billion (circa 30% of the shares outstanding at current levels). The company's board approved a new $1.3 billion share buyback program, which complements the existing $0.7 billion remaining under Olin's previous repurchase plan.

The timing and execution of the share repurchases will depend on market conditions and other factors, indicating a strategic approach to capitalize on opportunities and deliver higher shareholder returns. The new 2024 Share Repurchase Program has no expiration date and does not obligate the company to acquire any particular amount of shares.

This move reflects Olin's confidence in its earnings potential and cash flow generation.

Olin Announces Fourth Quarter 2023 Results

Highlights

Fourth quarter 2023 net income of $52.9 million, or $0.43 per diluted share

Quarterly adjusted EBITDA of $210.1 million

Share repurchases of $711.3 million in 2023

Expect 2024 adjusted EBITDA to improve from 2023

Scott Sutton, Chairman, President, and Chief Executive Officer, said, "Through the challenging economic environment of 2023, Olin successfully demonstrated our unique winning model by delivering $1.3 billion of adjusted EBITDA and corresponding cash flows enabling the 2023 repurchase of approximately 10% of our outstanding shares. As we are confident in our Company's future and the strength of our earnings and cash flow, we plan to continue our capital allocation strategy, while committing to maintain an investment-grade balance sheet and achieving additional investment-grade credit ratings. We are seeing success with our 'value accelerator initiative'. We anticipate our initiative supports an improved 2024 adjusted EBITDA as compared to 2023."