Is Novo Nordisk Better Than Eli Lilly?

The Powerhouse from Bagsværd at an Attractive Valuation

DISCLAIMER & DISCLOSURE: The author holds a position in Novo Nordisk at the date of publication but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Why Should I Care About Novo Nordisk?

In the quiet Danish suburb of Bagsværd, a pharmaceutical titan’s influence is impossible to miss. Novo Nordisk began as a local insulin manufacturer but over the course of a century, has transformed into a global leader in diabetes and obesity treatments.

The numbers are staggering: its market cap now exceeds Denmark's GDP. It directly fuels the national economy and paid DKK 26 billion in taxes last year. Its impact is undeniable - accounting for nearly half of Denmark’s GDP growth in 2024 and driving 70% of the country’s exports. But this isn’t just a Danish company. Novo Nordisk is global in every sense. With R&D centers in China, Denmark, India, the UK, and the US, operations in 13 countries, it employs over 77,000 people around the world and provides access to its products in 170 countries.

“In 2024, we served more than 45.2 million people living with serious chronic diseases, while our global sales and operating profit both grew by 26% at constant exchange rates.”

Lars Fruergaard Jørgensen, CEO

The company’s roots are in the treatment of diabetes and today it produces over 50% of the world’s insulin supply, but it does so much more as you’ll soon discover.

From September 2016 until mid 2024, the stock was on a tear, up 750%, reflecting the incredible success of this business. It was a stock on many people’s watch list with investors waiting for a pull back to create a more compelling entry opportunity. Patience has been rewarded and over the past 10 months the company has more than halved its market cap, losing its crown as Europe’s most valuable company, overtaken by software giant SAP and luxury brand LVMH. So is now a good time to invest?

Let’s dive into the remarkable story of this company and then explore how attractive it is as an investment.

From Death Sentence to Medical Miracle

Before the 1920s, a diabetes diagnosis was a death sentence. The human body, unable to process glucose, would succumb to the slow, destructive creep of high blood sugar. But everything changed in 1921. Canadian surgeon Frederick Banting had a hunch: if he could tie off the pancreatic ducts in dogs, maybe he could isolate the mysterious substance-insulin-that seemed to control blood sugar. John Macleod, a skeptical but supportive professor at the University of Toronto, provided lab space and paired Banting with Charles Best, a bright and eager medical student.

Banting and Best worked tirelessly, often through the night, struggling with crude equipment and countless setbacks. But their persistence paid off. By the summer of 1921, they had managed to extract insulin which they injected into a diabetic dog, restoring its health. The results were astonishing.

With help from biochemist James Collip, they refined the extract for human use, and in January 1922, they performed a medical miracle: a 14-year-old boy named Leonard Thompson, dying of diabetes, received an injection of insulin. He recovered almost instantly. The news spread like wildfire, and soon, insulin was saving lives around the world.

Across the Atlantic, Danish physiologist August Krogh saw hope for his diabetic wife. After visiting Toronto and obtaining permission to bring insulin extraction methods back to Europe, he partnered with Hans Christian Hagedorn to establish the Nordisk Insulin Laboratorium in 1923. This was the seed that would grow into Novo Nordisk, a global leader in the field of diabetes treatment.

The story of Banting, Best, Macleod and Krogh is one of a discovery that transformed diabetes from a fatal disease into a manageable condition, hope was restored to countless families, and the world of medicine was changed forever. Today there are 590 million people globally living with diabetes who are no longer subject to a death sentence - aging populations, poor diets, and sedentary lifestyles are factors predicted to drive this number closer to 850 million by 2050 meaning that long after his death, Banting’s work will still be saving many lives.

Banting and Macleod received the Nobel Prize for their discovery and, very honourably, Banting shared his prize money with Best, recognizing his essential contribution.

The Insulin Legacy and Beyond

Novo Nordisk continued to pioneer research into insulin production and the company made history in 1982, becoming the first to market human insulin identical to that produced naturally in the human body.

Today, it dominates the global insulin market, but its real leap came with the development of GLP-1 receptor agonists, especially semaglutide, the active ingredient in drugs including Ozempic and Wegovy.

This breakthrough turned Novo Nordisk into one of Europe’s most valuable companies.

What Is Semaglutide?

For most of its history, Novo Nordisk focused on supplying insulin, yet today it finds itself developing drugs that prompt the pancreas to release insulin by mimicking a hormone called GLP-1, or glucagon-like peptide 1.

The history of GLP-1 development is fascinating. The natural GLP-1 hormone is rapidly broken down in the body - it has a half-life of less than 2 minutes - making it impractical as a therapeutic agent and unsuitable as a drug because it degraded so rapidly - patients cannot be expected to take the medication every 2 minutes.

By the mid-1990s, most pharma companies had abandoned pursuing the development of GLP-1 based treatments for this reason. But Lotte Bjerre Knudsen, who began her career at Novo Nordisk in the early 1990s, had grit and determination. She became interested in GLP-1 after seeing early studies that suggested its potential in treating diabetes.

Knudsen was tasked with one last attempt to make the hormone viable as a drug. By attaching a fatty acid chain to the GLP-1 peptide, she dramatically extended its half-life, resulting in once-daily and eventually once-weekly treatments. For this, she earned the prestigious Lasker Medical Research Award in 2024.

‘Semaglutide’ is the generic name used by Novo Nordisk for its GLP-1 products.

More Than Just An Insulin Hormone

When people began to use these new drugs there were unintended, but most welcome, side effects which resulted in their application being extended.

Semaglutide works by regulating blood sugar levels and slowing down the rate at which food leaves the stomach, often creating the feeling of fullness. Almost immediately, doctors noticed that patients on these drugs lost weight.

It was a breakthrough with a twist of irony. Obesity is one of the main drivers of type 2 diabetes - the very disease Novo Nordisk has been working to treat for decades. So by helping patients lose weight, the company was now tackling the root cause before the disease even developed.

The scale of the obesity crisis is staggering. In the U.S., 41.9% of adults and 17% of children are classified as obese, according to the Center for Disease Control and Prevention (CDC).

Obesity, recently reclassified as a disease1, suddenly had a new treatment pathway.

Beyond the health implications, obesity is a major financial problem, placing a heavy burden on overstretched healthcare systems. It costs the U.S. healthcare system an estimated $173 billion a year, as it’s closely linked to other chronic conditions. That gives governments and health organizations a powerful incentive to support treatments that can turn the tide.

It’s no surprise then that demand for these drugs has surged. The global obesity problem has become a major tailwind for Novo Nordisk - and it all started by accident.

Over 1 billion people worldwide grapple with obesity, a number climbing steadily due to poor diets and too little exercise. As a result, analysts estimate the 2032 obesity drug market will be worth $150 billion - up from $40 billion in 2023 - so almost a four-fold increase.

Gross margins are 85% and, while the cost of producing a dose is low compared to its market price, hefty R&D and marketing expenses reduce net margins to around 35%. Nonetheless, the business is highly profitable and resilient.

Since diabetes and obesity are chronic conditions, patients often rely on medications like Ozempic, Wegovy, or insulin for years. Additionally, brand trust, built over decades, keeps doctors and patients loyal. All of this creates a sticky customer base, where retention rates are implicitly high, driving predictable, recurring revenue that’s the envy of many industries.

The business is also remarkably non-cyclical. Diabetes and obesity don’t take a break during economic downturns, making Novo’s revenue streams resilient. With high profitability and low cyclicality, the endocrinology sector is a rare gem - an industry where growth and stability coexist, making it a fertile ground for Novo Nordisk to thrive.

The Miracle Drug

The story doesn’t end there because GLP-1 drugs have shown promise beyond diabetes and obesity.

Dopamine pathways evolved to help us survive - simplistically, food and sex trigger a dopamine hit in the brain. It feels good, so we do it again. Dopamine also explains addictions to nicotine and alcohol. GLP-1s influence neurological impulses and dopamine pathways, helping users suppress some of these cravings - so these miracle drugs may be capable of helping people quit drinking and smoking.

There’s more - these medications have even proven effective at tackling heart failure according to a pair of studies published in The Lancet2 and The New England Journal of Medicine3. HFpEF (heart failure with preserved ejection fraction), stiffens the heart muscle and stops it from filling with blood properly - it affects more than half of patients with heart failure. Once patients with HFpEF are hospitalized for heart failure, their five-year mortality can be as high as 65 percent. These studies found that heart failure hospitalizations for those taking the GLP-1 went down by 70 percent - these kinds of success rates are unheard of in clinical trials.

GLP-1s may also be able to treat other conditions with trials ongoing, focused on non-alcoholic steatohepatitis (NASH) otherwise known as non-alcoholic fatty liver disease (NAFLD), chronic kidney disease, sleep apnea, metabolic dysfunction-associated steatohepatitis (MASH), hempophilia, sickle cell disease and even Alzheimer’s.

“We also are building the cardiovascular, liver and kidney-related pipeline, where we again see progress in both Phases I, II and III. And given that we defined that focus area only a couple of years ago, it's gratifying to see that level of clinical activity at this point in time. And finally, obviously, we are super happy with the progress that we're also doing in rare disease, specifically in the hemophilia space, but we also now see progress of our sickle cell disease assets, which obviously again speaks to a disease area with a huge unmet need.”

Martin Holst Lange

Executive VP of Development & Member of the Management Board

If regulators greenlight these expanded uses, it could open entirely new revenue streams to supplement the already booming diabetes and weight loss product lines offered by Novo Nordisk. This suggests that the explosive growth seen in recent years may be set to continue for many years to come.

Competition

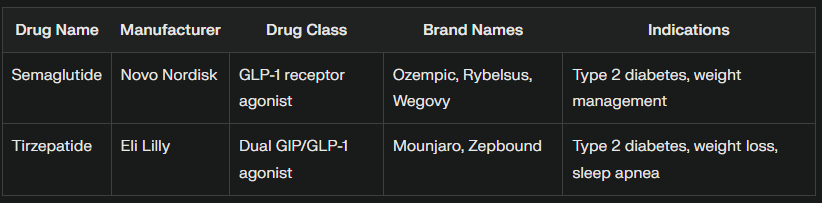

Eli Lilly (LLY) is Novo Nordisk's most immediate competitor. Its Tirzepatide products - Mounjaro and Zepbound - have emerged efficacious alternatives to Novo Nordisk’s Semaglutide products - Ozempic and Wegovy. (Nordisk’s Semagultide and Lilly’s Tirzepatide are similar, but different4).

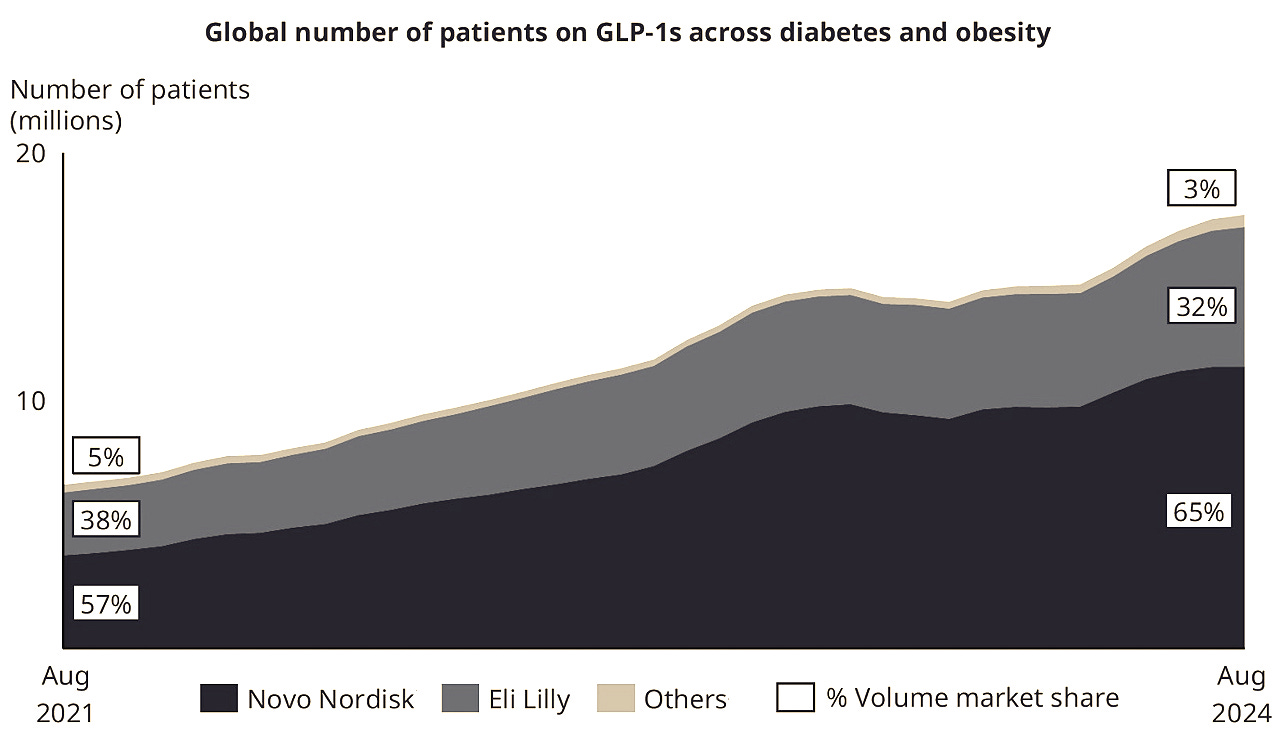

Both of these companies now dominate the GLP-1 market in what has become a de-facto duopoly, with others like Sanofi (SNY) and Pfizer (PFE) lagging behind.

Global shortages have pressured both firms to scale production, and Novo is investing billions to meet demand.

Compared to the sprawling portfolios of some pharma giants, Novo Nordisk’s business is refreshingly straightforward. Novo Nordisk is a global leader in endocrinology, developing innovative therapies for diabetes, rare blood disorders, obesity, and hormone-related disorders, while also funding significant research and supporting education in the field. This concentrated focus allows the company to channel its expertise into a single domain.

This has enabled the company to build a reputation as a specialist in this field - it has earned the trust of healthcare professionals and this has enabled Novo Nordisk to become entrenched in the healthcare system and to command premium pricing.

But is high pricing the best strategy? Hold that thought, I’ll delve into the benefits of ‘scale economics shared’ later.

Scaling as a Strategy

What sets Novo apart operationally is its vertically integrated supply chain controlling every stage of production, from raw materials to finished products. This integration strengthens its competitive position by reducing dependency on external suppliers and has been achieved over years of organic growth augmented with complex and costly acquisitions. This manufacturing prowess is a key strength because producing complex biologics like semaglutide at scale is a feat few rivals can match.

In order to meet increasing demand and ensure a stable supply Novo Nordisk has continued to invest heavily in scaling up manufacturing capabilities. Growth CAPEX and acquisitions have consumed large amounts of capital in 2024, a trend continuing in 2025. However, this is short-term pain for long-term gain.

The acquisition of three fill-finish sites formerly run by contract and development manufacturer Catalent Inc., expands its production capacity in the United States, Belgium and Italy. It has also expanded existing production facilities in Denmark, France, Brazil and China. will significantly improve supply stability and increase output.

Multiple Growth Engines

Novo Nordisk exploits every opportunity to grow and build on its century long history of success. These include:

Organic Growth (R&D)

Acquisitions

Investing in Research

Global Expansion

Let’s deal with each in turn.

1. Organic Growth (R&D)

Drugs typically benefit from 10 to 12 years patent protection before generics or biosimilars enter the market. The table below shows the patent status on Novo Nordisk’s semaglutide products, demonstrating that Novo Nordisk will enjoy a legal monopoly for many years to come.

The key with patents in the pharmaceutical sector is to constantly introduce next-generation drugs, so that by the time a patent expires, customers no longer demand that older version - they will have transitioned to something new and improved which will be protected by a new patent for another 12 years.

Novo Nordisk boasts an enviable drug pipeline, with next generation therapies like CagriSema and Amycretin already being developed in the wings.

The following tables, grouped by the condition that they are designed to treat, demonstrate the strength of its pipeline, and the stage of clinical trials for each:

Even if only half of these succeed, the addressable market could grow significantly.

AI Turbo Charges Development

Novo Nordisk is actively embracing artificial intelligence (AI) in its drug development processes, particularly through strategic partnerships and cutting-edge technologies, aiming to bring new treatments to market faster and more efficiently.

The company has expanded its collaboration with Valo Health, leveraging Valo's Opal Computational Platform™, which uses AI to identify novel drug targets and accelerate the development of small molecule therapies. This partnership aims to develop up to 20 novel drug programmes, with Novo Nordisk investing up to $4.6 billion in potential milestone payments and R&D funding.

Additionally, Novo Nordisk is utilizing AI in its internal R&D efforts, combining AI with high-throughput experimentation to assess over one billion virtual molecules and screen approximately 2,500 compounds in the lab, significantly speeding up the discovery process.

Finally, the company is collaborating with other AI-driven biotech firms, such as Cellarity and Metaphore Biotechnologies, to develop innovative therapies for conditions like metabolic dysfunction-associated steatohepatitis (MASH) and obesity.

Novo Nordisk is a company that not only strives to be the best, but leaves no stone unturned in its efforts to maintain its market leading status.

2. Acquisitions and Investments in other Companies

Novo Nordisk has made several strategic investments and acquisitions over the past few years, primarily focusing on expanding its technological capabilities, strengthening its R&D pipeline and entering new therapeutic areas.

Acquisition of Emisphere (2020) - the acquisition specifically targeted Emisphere's Eligen SNAC oral delivery technology, which is used in Novo Nordisk's oral GLP-1 receptor agonist, Rybelsus (semaglutide). The acquisition eliminated future royalty payments on the technology, providing important cost savings. Securing a key technology for oral GLP-1 delivery is key as GLP-1 pills don’t need to be shipped in cold storage like injectable versions, so distribution is easier and cheaper. Orally ingested medication is also preferred by consumers over a requirement to inject the drug.

Acquisition of Dicerna (2021) - enabled Novo Nordisk to gain access to Dicerna's RNA interference (RNAi) technology. Historically, Dicerna's RNAi technology was focused on hepatocytes, but Novo Nordisk is exploring its use beyond liver targets. The acquisition opens opportunities to treat rare diseases such as familial hypercholesterolemia, heart failure, and NASH. It enhances Novo Nordisk's cardiometabolic drug development capabilities and expands its pipeline in RNAi-based therapies.

Acquisition of Forma Therapeutics (2022) - aimed to expand Novo Nordisk’s presence in sickle cell disease and rare blood disorders, marking its entry into a new therapeutic area.

Investment in Asceneuron (2024) - it led a $100 million Series C Financing in Asceneuron, a clinical stage biotech company developing small molecules targeting tau protein aggregation, a driver of neurodegenerative disease. The financing will be used to advance Asceneuron's lead asset ASN51 into Phase 2 clinical development for the treatment of Alzheimer's disease.

Acquisition of Catalent (2024) - As mentioned earlier, this provided Novo Nordisk with three fill-finish manufacturing sites located in Anagni (Italy), Bloomington (USA), and Brussels (Belgium). From 2026, this will dramatically increase the company’s fill-and-finish capabilities - part of a broader strategy to serve millions more patients and maintain their market leadership position in the GLP-1 space.

These acquisitions reflect Novo Nordisk's commitment to leveraging external innovation to complement its internal research and development efforts, with the goal of maintaining its leadership in cardiometabolic diseases and expanding into new therapeutic areas.

3. Investing in Research

The Novo Nordisk Foundation plays a major role in advancing research in endocrinology. It funds initiatives that deepen our understanding of the endocrine system and related diseases like diabetes, obesity, and hormone disorders. One example is the Novo Nordisk Chair in Endocrinology at KU Leuven, which focuses on uncovering the root causes of these conditions. Its partnerships extend to professional groups like the Pediatric Endocrine Society, helping boost education and awareness in child-focused endocrinology.

The Foundation also invests in the next generation of scientists through the Danish Diabetes and Endocrine Academy (DDEA), offering young researchers valuable training, networking, and research opportunities.

With such deep involvement in cutting edge research, accessing the brightest minds in the field, the Foundation has built a strong and lasting edge in the field.

4. Global Expansion

Currently, 70% of the Novo Nordisk’s revenue is generated in the US. This means that the scope for expansion globally is huge. Excluding the US and China, it only generates 17.2% of revenue from the rest of the world - so there is a huge addressable market just waiting to be conquered.

Semaglutide has transformed diabetes and obesity care in high-income countries, but access in low- and middle-income countries (LMICs) remains extremely limited. In response, Novo Nordisk works with stakeholders to implement patient support programmes, solutions targeted at vulnerable patient groups and other affordability initiatives

For instance, since 2001, the company has had an Access to Insulin Commitment that guarantees low-priced human insulin in 77 countries which are identified by United Nations as Least Developed Countries or by the World Bank as low-income countries. Its commitment extends to countries where large middle-income populations lack sufficient health coverage and to selected organizations providing relief in humanitarian settings.

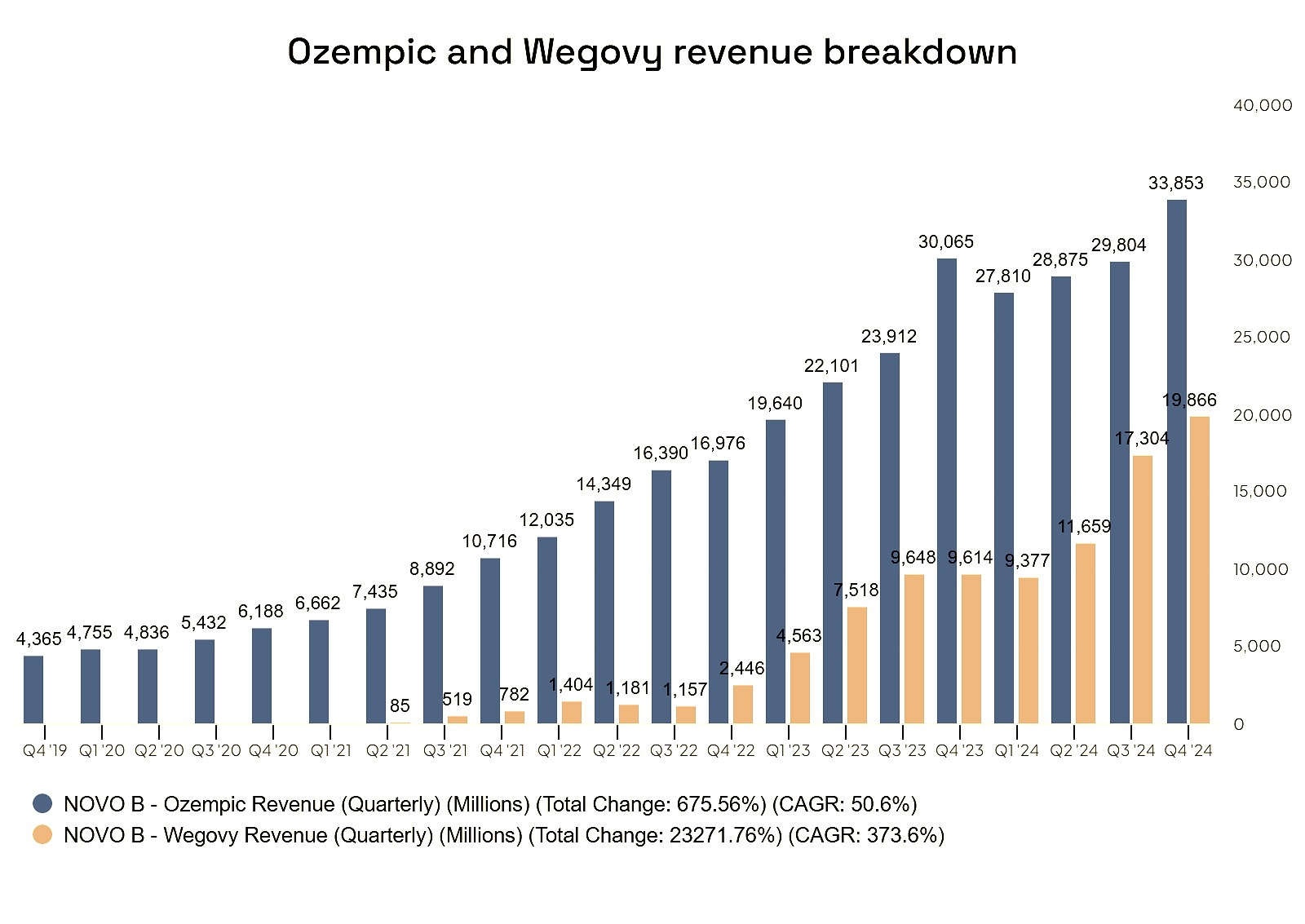

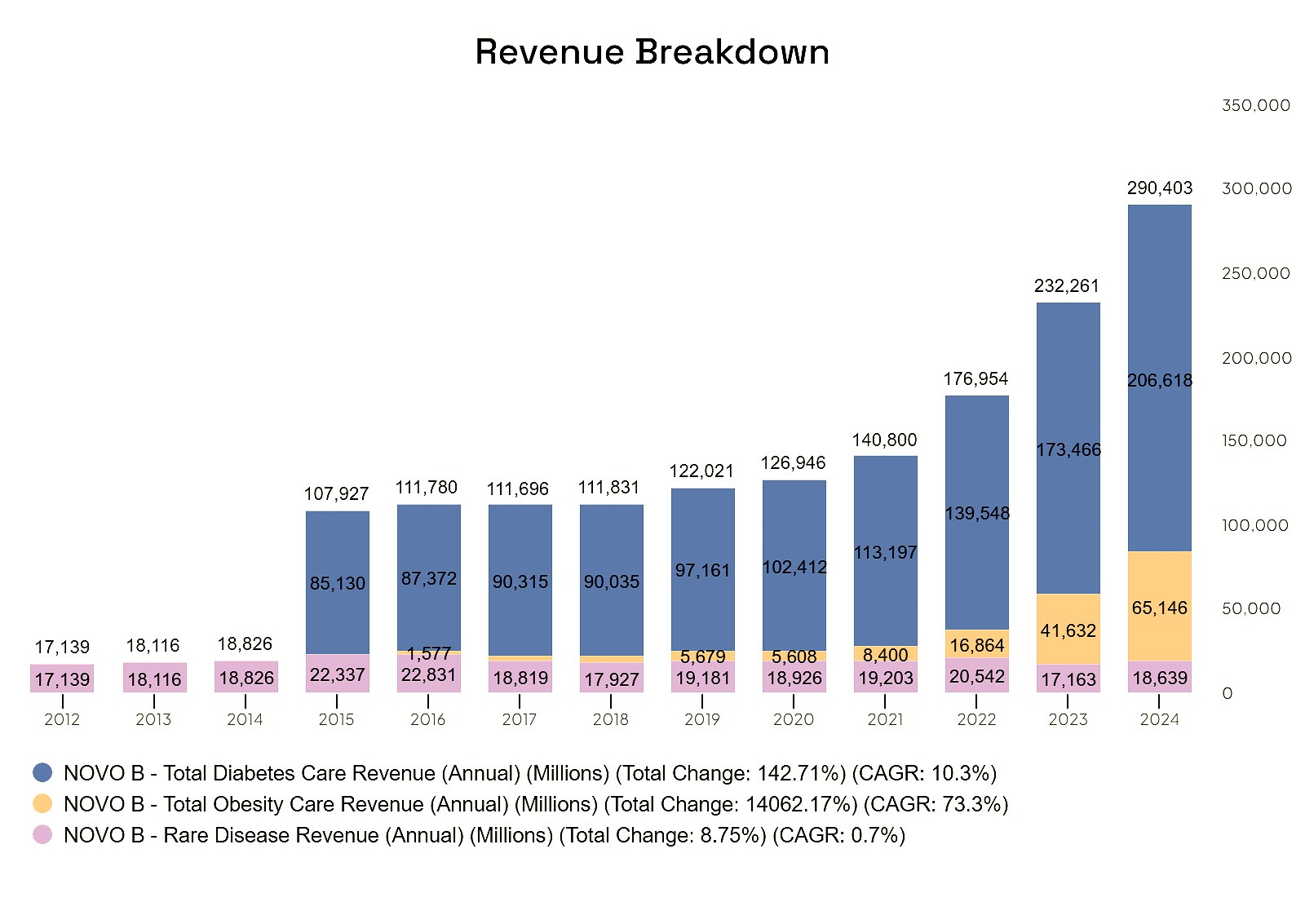

Historically, growth has been very impressive (see charts below). There is no reason to expect this to slow down anytime soon as there is a huge target addressable market to attack - both geographically and in terms of product penetration. While the U.S. is Novo Nordisk’s largest market by far, it has only just started to penetrate much of the global market.

Share Price and Intrinsic Value Often Diverge

Novo Nordisk the business goes from strength to strength. However, its share price has experienced a 52% draw-down in recent weeks. So what’s happening?

Geo-political issues, particularly the economic policies of President Trump, have hit all markets hard. This has nothing to do with the quality of Novo Nordisk, but has impacted its price nonetheless.

However, there are a host of company specific reasons for the remainder of the sell-off.

Price correction: At its peak share price of over 1,000 DKK per share at the end of June 2024, the company was arguably over priced. Irrational exuberance in the market combined with momentum chasing algorithms and passive investing distortions saw price run too far ahead of intrinsic value. In the two years from June 2022, the stock price rallied 163% (62% CAGR), well ahead of economic fundamentals. A correction was needed, but a pull-back of over 50% looks excessive. The pendulum may have swung too far the other way.

Margins have compressed: Historically, the company’s manufacturing costs amounted to a small fraction of sales. However, the GLP-1 boom changed that, expanding CAPEX significantly in 2024 to meet skyrocketing demand. But it's an investment in scale. As production and top line sales expand, manufacturing efficiencies will kick in and margins ought to rebound - perhaps even improve on historic levels.

Sales growth: Top line growth this year is expected to be in the 16 to 24% range - a dream scenario for most companies - but for Novo Nordisk it would mark the slowest growth in three years so the market reacts.

Test results disappoint: Clinical tests for new drug CagriSema revealed a 22.7% weight loss in patients, outshining Eli Lilly’s Zepbound at 21% - yet it fell slightly short of 25% expectations and the market took that badly.

This final bullet is worthy of deeper exploration, because the market appears to be missing something important.

Investors seem fixated on the latest weight loss figures - but that’s missing the point.

Does it matter whether a drug produces a 21% or a 23% weight loss? For an obese person looking to reduce body weight, both are outstanding results. The battle between Eli Lilly and Novo Nordisk will most likely be won on an entirely different metric - price.

Lower Prices Could Make Novo Nordisk Even Stronger

Both Novo Nordisk and Eli Lilly are under growing pressure from health authorities to bring down the cost of their obesity drugs. That might sound like bad news for margins, but it could actually be a huge opportunity. Lower prices typically mean more demand. And as production ramps up, costs per unit come down—potentially keeping profits intact thanks to economies of scale.

This kind of strategy - where companies pass cost savings on to consumers rather than hoarding the profits - is what investment manager Nick Sleep called ‘scale economics shared’. It’s a powerful growth engine. Giants like Costco and Amazon have built entire empires on it. Lower prices drive higher volumes, build customer loyalty, and create a competitive moat that smaller players can’t cross.

A great historical example is Texas Instruments which used to be a leader in the semi-conductor space. Back in the day, they believed they needed high prices to recoup heavy R&D and capital investment. Only then would they cut prices to chase volume, but by then the product was outdated.

Then came Morris Chang - who would later found TSMC. He flipped the script. Instead of waiting, he pushed Texas Instruments to start at full capacity and keep prices low from day one. He even slashed prices regularly - regardless of whether the market demanded lower prices - just to stay ahead of the competition. Critics thought he was reckless. He wasn’t. The strategy worked brilliantly.

Despite parallels between semi-conductor and drug development in terms of heavy investment in R&D to produce something with a limited market life, Novo Nordisk hasn’t followed the Morris Chang playbook - at least not until recently.

Ironically, being pushed to lower its prices by health authorities, which have forced it to invest heavily in expanding production capacity, might turn out to be the best thing that’s happened to it. By leaning into scale economics shared, Novo could turn its already-high barriers to entry - tight regulations, strong patents, complex manufacturing - into an even more unassailable competitive edge.

In the past year, we’ve seen both Novo Nordisk and Eli Lilly pivot toward broader access. Novo launched its own online pharmacy, NovoCare, offering Wegovy at up to a 63% discount. It also teamed up with telehealth platforms like HIMS to expand its reach. Eli Lilly took a different tack, launching new dosage options for Zepbound (7.5mg and 10mg), giving patients a menu of price points - it also partnered with telehealth providers to expand distribution channels.

So, let’s stop obsessing over whether Novo’s drugs deliver 23% weight loss or 25%. The real value lies in how much of the market it can capture - and that comes down to the scale, efficiency, and vertical integration of its operations. That’s why Novo has been pouring money into expanding its manufacturing footprint.

Disparate Valuations

The valuation gap between Eli Lilly and Novo Nordisk is hard to ignore. Lilly is trading at a staggering 75 times last year’s earnings, while Novo sits below 18 times. Let’s put this another way - despite having very similar unit economics, if you were buying these companies outright, you could have three Novo Nordisk’s for the price of one Eli Lilly!

Maybe there’s a long/short strategy worth exploring here.

One analyst tried to justify the gap by pointing to expected growth. In 2024, Lilly grew revenue by 32% compared to Novo’s 26%. Looking ahead to 2025, Lilly’s growth rate guidance has a 32% midpoint, whereas Novo’s more conservative guidance sits closer to 20%. Back in September 2024, when Lilly traded at 56x earnings and Novo at 39x, this analyst argued that based on the diverging growth expectations, looking forward to 2028, the implied forward earnings multiple for both companies was the same at approximately 22x.

But fast-forward to today, and that logic has clearly unraveled. Lilly’s multiple has ballooned to 75x, while Novo’s has shrunk to 18x. That spread has widened - not narrowed - and it’s no longer easy to explain away with growth assumptions. Especially when those assumptions stretch several years into the future. Maybe Novo is sandbagging with conservative estimates that will beat expectations. Or maybe Lilly is projecting an optimistic best case. Either way, the current valuation gap looks increasingly hard to defend.

What's even more curious is how their stock prices are now moving in opposite directions, despite both benefiting from the same long-term GLP-1 tailwinds.

A few recent examples:

Dec 20, 2024: Novo’s stock tanked 18–20% after CagriSema weight loss results fell short of expectations. Lilly’s stock? It jumped over 7%.

Apr 17, 2025: Lilly announced strong results for an oral weight-loss drug and soared 17%. Novo dropped 7%.

Apr 30 – May 1, 2025: Lilly missed its EPS forecast and cut full-year guidance. Its shares fell 12%. Meanwhile, Novo climbed 2.5%.

It seems the market now views bad news for one as good news for the other, as if they’re locked in a zero-sum game. That’s an odd way to look at two companies riding the same global wave of demand for weight-loss drugs - but it does create volatility. And for opportunistic investors, that could open some attractive entry points on either side of the trade.

A Nokia Moment?

The heavy reliance of the Danish economy on the fortunes of Novo Nordisk has raised concerns of a "Nokia moment" - a reference to Finland’s economic struggle after the collapse of its once-mighty tech giant. Economists caution that while Denmark’s labour market is more flexible than Finland’s, placing so much national fortune on one company is risky.

Novo’s share price drop in December 2024 triggered a 13% plunge in the entire Danish blue-chip index. It was a wake-up call: what’s good for Novo is good for Denmark, but the same principle also works in reverse.

Nonetheless, Novo Nordisk is no Nokia. It has a history dating back over a century and operates in an entirely different industry. The dynamics of the pharmaceutical industry are nothing like those of electronic tech.

Novo is embedded in global healthcare, with a diversified pipeline and manufacturing excellence. Additionally, the pharmaceutical industry is highly regulated, requiring years of clinical trials and significant financial investment, estimated at $2.6 to $2.9 billion per drug. Novo’s expertise in navigating these regulatory frameworks and its first class reputation gives it a considerable advantage.

This is no Nokia moment.

Novo Nordisk: A Powerhouse with Room to Run

Novo Nordisk doesn’t just have blockbuster drugs - it has a fortress balance sheet, rock-solid financials, and enviable discipline in how it runs the business.

The company holds an investment-grade credit rating, backed by strong, consistent cash flow and a moderate level of debt. Most of that debt is in long-term Eurobonds, spaced out with staggered maturities to avoid refinancing risk. It’s the kind of prudent, low-drama financial management that long-term investors love.

Profitability? Off the charts. Gross margins hover around 85%, and operating margins around 45%, highlighting Novo’s disciplined capital allocation and efficient operations. Return on capital employed sits near 89%, while free cash flow clocks in at an impressive 29% of sales - giving the company plenty of firepower to reinvest in growth without sacrificing profitability.

The financial transformation since entering the weight-loss market has been dramatic. From 2015 to 2020, Novo was growing revenue at a modest 3% per year. Since 2020, that number has exploded to ~22% annually - a clear sign that obesity drugs have changed the game.

In 2020, the obesity segment made up less than 5% of Novo’s total revenue. By 2024, it’s approaching 25% - and still climbing. Diabetes treatments continue to grow steadily, but it’s the obesity segment that’s put rocket fuel behind the top and bottom lines.

There's also a sleeping giant in Novo’s pipeline: Rare diseases. Still in the early stages, this segment could mirror the explosion we’ve seen in weight-loss therapies -especially as GLP-1 medications show promise across a range of new applications. Think: smoking cessation, alcohol dependence, Alzheimer’s, liver conditions, cardiovascular disease. The addressable market keeps expanding, and Novo is right at the center of it.

Importantly, Novo Nordisk remains the global leader in GLP-1 treatments. It controls 65% of the patient base, but only 55% of the market by value - which tells us one important thing: Novo is pricing more aggressively than its competitors. That ties back to the scale economics strategy, offering lower prices to grow volume and lock in long-term dominance.

Looking ahead, sales are forecast to grow between 16% and 24% in 2025, with growth expected to accelerate back toward the 30% range in 2026 and beyond. Thanks to operating leverage, operating profit is projected to grow about 300 basis points faster than revenue - a sign that margins still have room to expand as volumes increase.

Novo Nordisk is not only a winner today, but its business is poised to win for years to come.

Management: A Different Kind of Leadership

If you're tired of mercenary CEOs with short-term incentives and golden parachutes, Novo Nordisk will feel like a breath of fresh air.

This is a company that plays the long game. It’s been around for over 100 years and in that entire time, it’s only had five CEOs. That’s not just a statistic - it’s a window into a deep-rooted culture of promoting from within, valuing institutional knowledge, and building leadership that’s personally invested in the long-term success of the business.

At the helm today is Lars Fruergaard Jørgensen, a Novo lifer who joined the company in 1991 and became CEO in 2017. He’s not a hired gun parachuted in from outside -he’s someone who has grown up inside the organization, having held leadership roles in IT, corporate development, and economics. He understands the company from the inside out.

CEO Lars Fruergaard Jørgensen, a company veteran who’s been with Novo since 1991 and has led as CEO since 2017. With over eight years at the helm, Jørgensen brings continuity and deep institutional knowledge, honed through roles in IT, corporate development, and economics.

Jørgensen comes from a family of farmers, and he often draws parallels between agriculture and pharma. In both industries, the work you do today won’t bear fruit for years, but you do it anyway - to safeguard and enhance something valuable for the next generation. That mindset is rare in modern corporate leadership, and it shows. Under his leadership, Novo Nordisk has successfully transitioned from a pure-play insulin manufacturer to a GLP-1 specialist pharma business.

Optimizing Equity Participation While Retaining Control

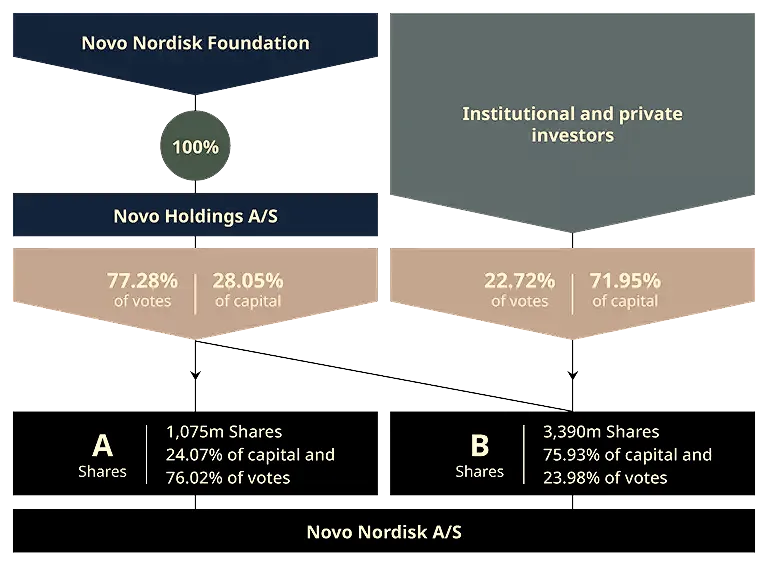

One of the more unusual features of Novo’s structure is its ownership: the Novo Nordisk Foundation owns just 28.1% of the shares, but controls 77.3% of the votes through a dual-share structure. At first glance, this might seem unfair to minority shareholders. But in practice, it acts as a stabilizing force. It shields the company from activist investors and hostile takeovers, allowing management to focus on long-term innovation and sustainable growth instead of chasing quarterly earnings targets.

This stability extends to the company’s tone and transparency. Earnings calls are honest, even when the news isn’t good - whether it’s supply issues or competitive threats, management doesn’t sugarcoat it.

That said, Novo’s approach to capital allocation is very… European. The company seeks to maintain a dividend payout ratio of around 50% of net income. This is an arbitrary nonsensical approach when capital allocation ought to always be determined based on opportunity cost and dividends usually carry the highest opportunity cost5.

While management has bought back nearly a third of its shares over the last 20 years, at Novo Nordisk repurchases are placed firmly at the bottom of the capital allocation list of priorities. Management has said it doesn’t expect to launch a buyback program in 2025, citing increased CAPEX investment and a commitment to maintaining the dividend.

From a stewardship perspective, this is disappointing. Reducing buybacks at precisely the moment the stock is cheapest is a huge missed opportunity. In such circumstances, repurchases are far more accretive to shareholder returns than dividends.

Risks: What Could Go Wrong?

Novo Nordisk is a powerhouse with strong fundamentals, but like any business, especially in pharmaceuticals, it faces a range of risks. The good news? Most are well understood and actively managed. Still, they’re worth watching so here are the key risks:

1. Clinical Trial Outcomes

Success or failure in drug trials - particularly in high-profile areas like weight loss and diabetes - can swing the share price sharply. One bad data readout can erase billions in market cap. It’s the nature of the business.

2. Regulatory Hurdles

Drugs don’t get to market without green lights from regulators like the FDA (U.S.) or EMA (Europe). Approvals and rejections have material impacts on corporate success.

3. Competitive Threats

A new product or clinical success from a rival can upend expectations overnight. GLP-1 drugs might be dominating now, but the innovation race never stops.

4. Macro Conditions

Currency fluctuations can all eat into profits - especially for a business like Novo that operates in dozens of countries and reports in Danish kroner.

5. The Patent Cliff

Patent protection is finite, and when it ends, generic manufacturers pounce. In markets like China, where patents are shorter, that cliff edge arrives even faster. Generics can sell copycat drugs at a fraction of the price, thanks to no R&D overhead - a recipe for commoditization.

6. Pricing Pressure

Governments and insurers are cracking down on high drug prices - although as discussed earlier, that isn’t necessarily a problem. Big companies are better placed to offer the most competitive pricing and Novo Nordisk is one of the biggest.

7. Supply Disruption

Remember 2022? The FDA declared a shortage of semaglutide drugs, opening the door for compounding pharmacies to step in with their own (cheaper and unapproved) versions. This ate into Novo’s market share and undercut its pricing power. Thankfully, in February 2025, the FDA declared the shortage over and ordered these operations to cease by May 22. Novo is investing heavily in manufacturing capacity to avoid a repeat.

8. Unknown Side Effects

Even the most rigorously tested drugs can deliver surprises post-approval. That risk can’t be eliminated, only mitigated through deep clinical trials and strong post-market surveillance.

9. Legal Headaches

In today’s litigious environment, lawsuits are part of the game - especially for drug makers. It may not be fair, but it’s reality.

10. Geopolitical Friction

The drift toward protectionism and nationalism is bad news for global operators. Whether it’s supply chains, tariffs, or restrictions on cross-border drug approvals, political shocks can disrupt business as usual.

11. Substitutes and Alternatives

The rise of GLP-1 drugs for weight loss has been remarkable - but is it permanent?

Alternatives like bariatric surgery, lifestyle interventions, and other non-pharma solutions could reduce long-term demand.

Is Novo Nordisk A Good Investment?

Novo Nordisk is more than a company, it’s a global force in healthcare. Its drugs have saved millions of lives, and its future is filled with promise. With strong management, deep moats, scalable operations, and a long-term focused vision, it's not only a healthcare innovator but potentially one of the most compelling long-term investments of our time.

It may be that once-in-a-generation compounder, attractively priced, that all investors are searching for.

With global reach, market leadership, an R&D pipeline brimming with promise and a runway that’s only getting longer, the future is looking very bright.

From transforming diabetes care to unlocking the potential of GLP-1s across obesity, addiction, cardiovascular, and neurodegenerative disorders, this is a business that is likely to touch all of us at some point in our lives.

Novo Nordisk is perfectly positioned to ride the secular tailwinds of chronic disease and aging populations. And if it embraces ‘scale economics shared’, lower prices are likely to make its moat even wider.

Yes, the share price has stumbled. But the fundamentals haven’t. In fact, they’ve strengthened. The stock now trades at just 18x earnings, a far cry from Eli Lilly’s valuation at over 70x. That looks like market mispricing.

When the market forgets what it's worth - it's your chance to remember.

Now, to the question we started with: Is Novo Nordisk better than Eli Lilly?

They’re both giants in the GLP-1 space — essentially a duopoly — and both have world-class pipelines. From a drug development standpoint, it’s hard to say one is truly better than the other.

But when it comes to valuation, the picture changes.

Even the best companies can be poor investments if bought at the wrong price. Right now, Eli Lilly looks priced for perfection. Novo Nordisk? It’s on sale.

If you're starting a position today, Novo Nordisk looks like the far better buy.

Although the World Health Orgainization (WHO) recognized obesity as a disease in a consultation conducted in 1997, it wasn’t until 2013 that the American Medical Association (AMA) recognized it as a disease. This was followed by the World Obesity Federation publishing a position statement in 2017 aligning with the AMA and the UK’s Royal College of Physicians recognizing it as a disease as recently as 2019.

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(24)00469-0/abstract

https://www.nejm.org/doi/10.1056/NEJMoa2313917?url_ver=Z39.88-2003&rfr_id=ori:rid:crossref.org&rfr_dat=cr_pub%20%200pubmed

Tirzepatide is a dual agonist of the glucose-dependent insulinotropic polypeptide (GIP) receptor plus the glucagon-like peptide-1 (GLP-1) receptor. This means it mimics the action of both hormones, leading to improved blood sugar control and weight loss. Comparing this to Semaglutide:

Novo Nordisk manufactures under the brand names Ozempic (for type 2 diabetes), Rybelsus (oral form for diabetes), and Wegovy (for weight management and obesity). Eli Lilly manufactures as Mounjaro (for type 2 diabetes) and Zepbound (weight management).

How dividends destroy shareholder value: https://rockandturner.substack.com/p/how-dividends-destroy-shareholder-value

Novo Nordisk Cuts Ties With HIMS & Joins Forces With WeightWatchers

Novo Nordisk has announced that starting July 1, 2025, WeightWatchers will begin selling Wegovy for a one-time price of \$299. This special pricing will also be available through Novo's other telehealth partners until July 31. The move marks a significant shift for WeightWatchers, which filed for Chapter 11 bankruptcy protection in May. The company had previously blamed some of its struggles on competition from weight-loss drugs like Wegovy. Now, it seems WeightWatchers has adopted the mindset of "if you can't beat them, join them."

In a related development, Novo Nordisk revealed it has ended its partnership with Hims and Hers Health (HIMS), citing concerns over the telehealth company's sale of compounded copies of Wegovy and its marketing practices. The popularity of these cheaper, compounded alternatives -made legal during a Wegovy shortage declared by the FDA in 2023 - helped fuel sales for HIMS and other platforms. However, this came at the expense of Novo and Eli Lilly, both of whom manufacture original, FDA-approved weight-loss medications. While the tactic may have provided a short-term boost for HIMS, it didn’t help its standing with major pharmaceutical partners.

With the FDA declaring an end to the shortage and setting a May 22 deadline for compounders to cease sales, Novo took the opportunity to formally cut ties. Dave Moore, executive vice president at Novo Nordisk, commented that the company will continue working with partners who align with its values and who help improve access to approved medications - an unmistakable message that HIMS no longer fits that bill.

Looking ahead, Novo remains in active discussions with other potential partners and continues to work with platforms like Ro and LifeMD (LFMD), both competitors to WeightWatchers. The broader goal is clear: Novo wants to convert users of compounded versions into patients on its officially approved treatment, regaining control over a market that had drifted due to temporary supply gaps. Novo couldn't have hoped for a better new distribution channels for its weight loss treatment than WeightWatchers. This is undoubtedly a major coup.

PHARMACEUTICAL INVESTING - THE REALITY OF THE TARIFF THREAT

The Trump administration’s ambition to bring pharmaceutical manufacturing back to the United States is a bold one, but it faces steep near-term obstacles making it unachievable any time soon.

Eli Lilly CEO, Dave Ricks, noted that shifting production from countries like Ireland and India is not a matter of months. It would take years and require billions of dollars in investment. The minutiae of specifications set out in the complicated regulatory approvals needed for manufacturing facilities are not transferable, plus the specialized workforce and infrastructure required, make quick reshoring impossible.

The pharmaceutical industry’s global supply chains further complicates the picture. Around 80% of active pharmaceutical ingredients used in U.S. drugs are sourced internationally, primarily from China and India. Disrupting these well-established networks with tariffs could create significant ripple effects throughout the healthcare system.

In that context, even if the process started today, it would not yield any tangible results until well after President Trump's term in office. More particularly, any tariffs imposed would do little to encourage domestic production. Instead, they would penalize imports without delivering the intended boost to U.S. manufacturing and push healthcare costs higher. Worse still, essential medications, from diabetes treatments to advanced cancer therapies, could face delays or shortages, with serious consequences for patients and providers alike. By steering clear of direct interference in the pharmaceutical supply chain, policymakers are likely aiming to avoid the kind of healthcare-related backlash that could undermine their broader economic or political goals.

So, taken together, the regulatory hurdles, economic costs, political sensitivities, and sheer logistical complexity make the idea of pharmaceutical tariffs unlikely.

The administration appears to recognize this, focusing instead on sectors such as semiconductors and cell-phones that can be repatriated more quickly and with less public resistance.