Kaspi | Fin-Tech Super-App Business

Ever wish you found Amazon or Mercado Libre Before they traded at High Multiples?

DISCLAIMER & DISCLOSURE: The author has no position in Kaspi at the time of publication but that may change. The views expressed are those of the author at the time of publication and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Why Should I Care?

Some businesses create such a significant societal impact that they achieve rapid success and exponential growth. As a result, they command staggering valuations, often placing them beyond the reach of most investors. Think of companies like Amazon or Mercado Libre in Latin America.

Now, imagine investing in one of these companies before its valuation soared. Not only would you benefit from the business’s underlying growth, but as the market recognized its potential, multiple expansion would further amplify your returns.

A $10,000 investment in Amazon at its IPO would be worth over $25 million today. So it’s well worth looking for the next Amazon type of business.

Enter Kaspi. This company quietly transitioned from the London Stock Exchange to a U.S. listing in January 2024, with little fanfare. Backed by a world-class management team with a two-decade track record of outstanding results, Kaspi is still in the early stages of its long-term growth journey—making it a company worth paying attention to.

Too good to be true?

Well you haven’t heard the best part yet. This is a business that is targeting $2 billion in net income this year, yet has a market cap of little over $20 billion and has been growing at over 25% annually. That means it is capitalized at just over 10x this year’s earnings and 8x next year’s.

I thought that might get your attention!

Why is it so cheap?

That’s a great question.

Kaspi is headquartered in Kazakhstan - a country many people might struggle to locate on a map. That unfamiliarity alone may deter some investors. But history has shown that initial hesitation about emerging markets often fades over time.

Consider Taiwan - once viewed with skepticism, yet today, investors confidently hold TSMC. The same happened with South Korea, now home to giants like Samsung and Hyundai. Even Argentina’s political instability didn’t stop Mercado Libre from becoming a prized portfolio asset.

The fear of the unknown is a common theme in investing. That’s why, as part of this analysis, I’ll break down where Kazakhstan is and why Kaspi presents such an intriguing opportunity.

Kaspi (NASDAQ: KSPI): A Super-App Powerhouse

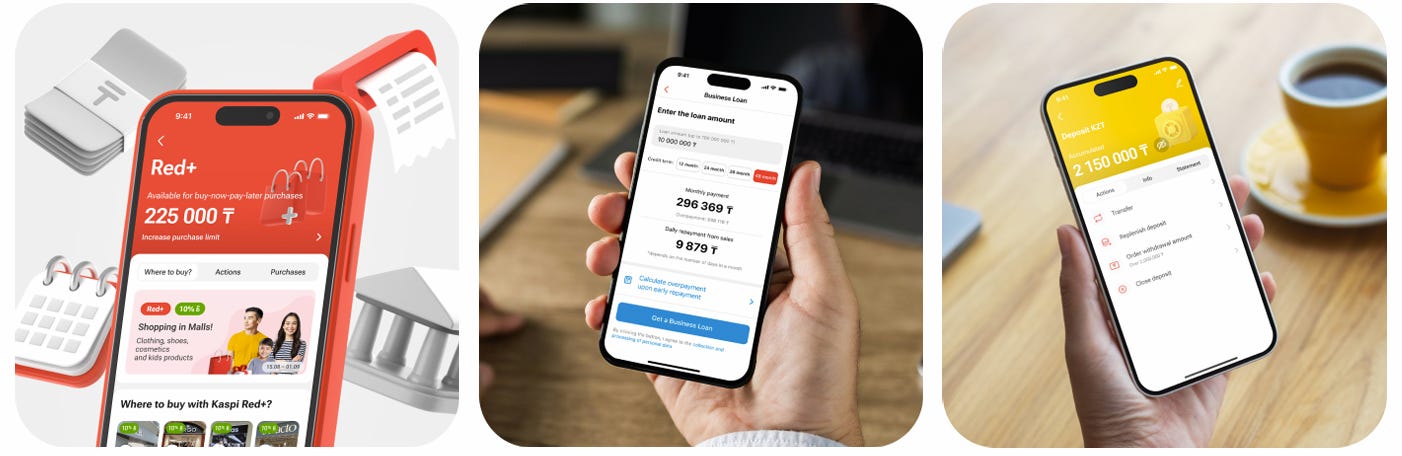

Kaspi is a one-of-a-kind business, seamlessly integrating payments, fintech services, e-commerce, and essential government functions - all within a single super-app.

Founded in 2007, Kaspi started by offering market-leading financial services before expanding into other industries.

From shopping, banking, and payments to money transfers, groceries, travel, and government services, Kaspi offers an all-encompassing digital ecosystem.

But make no mistake - Kaspi isn’t just a tech company with a flashy app. The real value lies in the vast business empire behind it.

To grasp its scale, imagine a single company combining the capabilities of PayPal, Amazon, Affirm, Klarna, Square, American Express, Block, Bank of America’s retail banking, Booking.com, Walmart’s online division, US Postal Service mail lockers and Shopify, then you are probably half way to understanding Kaspi. It does all of this and much more.

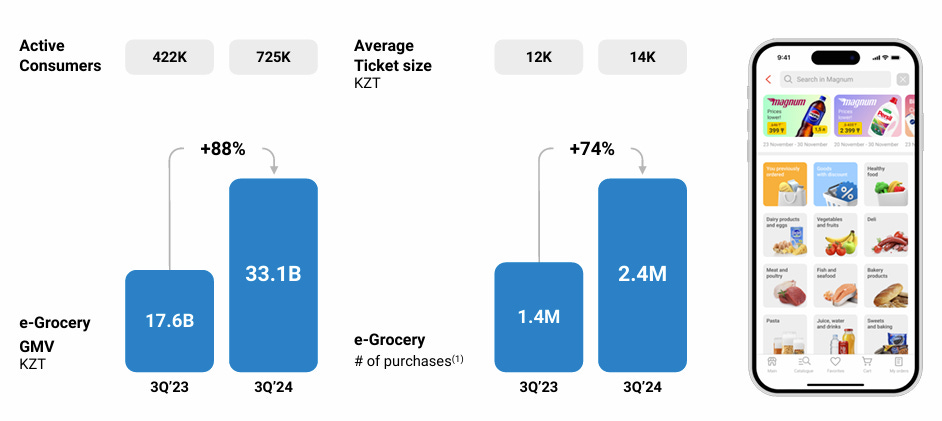

Kaspi operates Kazakhstan’s largest payment network and the country’s second-largest bank. In February 2023, it further expanded its reach through a $155 million joint venture with Magnum, one of Kazakhstan’s largest supermarket chains. Simply put, Kaspi is a dominant force across multiple industries.

Payments:

e-Commerce, Magnum grocery shopping, Delivery logistics:

Banking and finance:

It enjoys unparalleled engagement and profitability. Its strong execution, customer-first approach, and strategic expansion efforts position it as a high-growth, high-margin investment opportunity in an underappreciated market.

In 2020, the company’s successful IPO was celebrated as London's largest that year, but in January 2024 the company decided to move its listing to the Nasdaq, so it is now U.S. listed, driving higher liquidity.

While the company is still educating investors on its unique business model, it now has the potential to capture global attention and increase institutional awareness.

In short, Kaspi offers significant upside potential for investors seeking under the radar and largely undiscovered fintech leaders.

Founder & CEO

Mikhail Lomtadze, the CEO and co-founder of Kaspi, has been instrumental in shaping the company’s journey. He initially led Kaspi Bank from 2007 to 2018 before transitioning to CEO and Chief Ecosystem Officer of Kaspi Group in November 2018. At just 49 years old, he has already achieved remarkable success, with plenty of room to grow.

Here’s the full story.

In 2004, Vyacheslav Kim—a highly respected Kazakhstani businessman, economist, and financier (as well as a martial arts expert with black belts in kendo and taekwondo) - sold a 51% stake in Kaspiyskiy Bank to Baring Vostok Capital Partners1, a private equity fund, where Mikhail Lomtadze was a partner. This partnership combined Kim’s entrepreneurial spirit with Lomtadze’s financial expertise, setting the stage for something extraordinary.

Following the acquisition, the bank rebranded from Kaspiyskiy to Kaspi. In 2007, Lomtadze took the helm as CEO, bringing with him a Harvard MBA and international experience.

One of their boldest moves was shifting focus from business banking to consumer financial services - a decision that led to forfeiting 95% of their balance sheet.

Under Lomtadze’s leadership, Kaspi aggressively invested in technology, pioneering online lending and mobile banking at a time when these services were still in their infancy. This shift transformed the company from a traditional bank into a tech-driven powerhouse, gradually expanding into a full-fledged digital ecosystem.

But what truly sets Kaspi apart is its structure. Unlike traditional banks or fintech firms, Kaspi operates as a product-driven company - an approach that has fueled its extraordinary success.

Why is Kaspi Special?

Kaspi’s super-app model is a key differentiator, seamlessly integrating payments, e-commerce, travel, grocery, and government services into a single platform.

You might be wondering - what exactly does Kaspi offer in terms of government services? The answer is extensive. Through the super-app, users can:

Register a marriage or the birth of a child and obtain official certificates

File tax reports and pay tax liabilities directly to the government

Register a business

Transfer vehicle ownership

Handle various other bureaucratic tasks effortlessly

While Kaspi doesn’t have exclusive rights to these services, its seamless integration with public systems enhances user reliance and deepens market penetration. This shrewd move by management increases engagement, creating strong network effects that reinforce Kaspi’s competitive moat.

Kaspi’s fintech services include Buy Now Pay Later (BNPL) products, which benefit from its deep integration into the daily lives of nearly the entire adult population in its domestic market. Thanks to this reach, BNPL approvals are typically completed in seconds - while maintaining a world-class cost of risk below 2%. By offering BNPL, Kaspi not only drives higher consumer spending but also strengthens engagement within its ecosystem.

Kaspi’s e-commerce marketplace, which began with electronics, has expanded into a wide range of products and services, resembling Amazon in its breadth. However, what sets Kaspi apart is its strategic partnerships with offline retailers - much like Shopify it helps them transition to digital.

Through the Kaspi super-app, users can handle virtually everything they need in daily life - quickly, easily, and within a single platform. This comprehensive offering cements Kaspi’s role as an indispensable part of its users’ everyday routines.

Kaspi’s Niche Market & Geographic Advantages

Kaspi has earned a BBB- investment grade credit rating from Fitch, reflecting its financial strength and international credibility. However, for many Western investors, Kazakhstan remains an unfamiliar market. So what is it? Where is it?

Kazakhstan, the world’s largest landlocked country, spans ~2.7 million square kilometers—an area as large as France, Spain, Germany, Italy, the UK, Sweden, Norway, the Netherlands, and Switzerland combined.

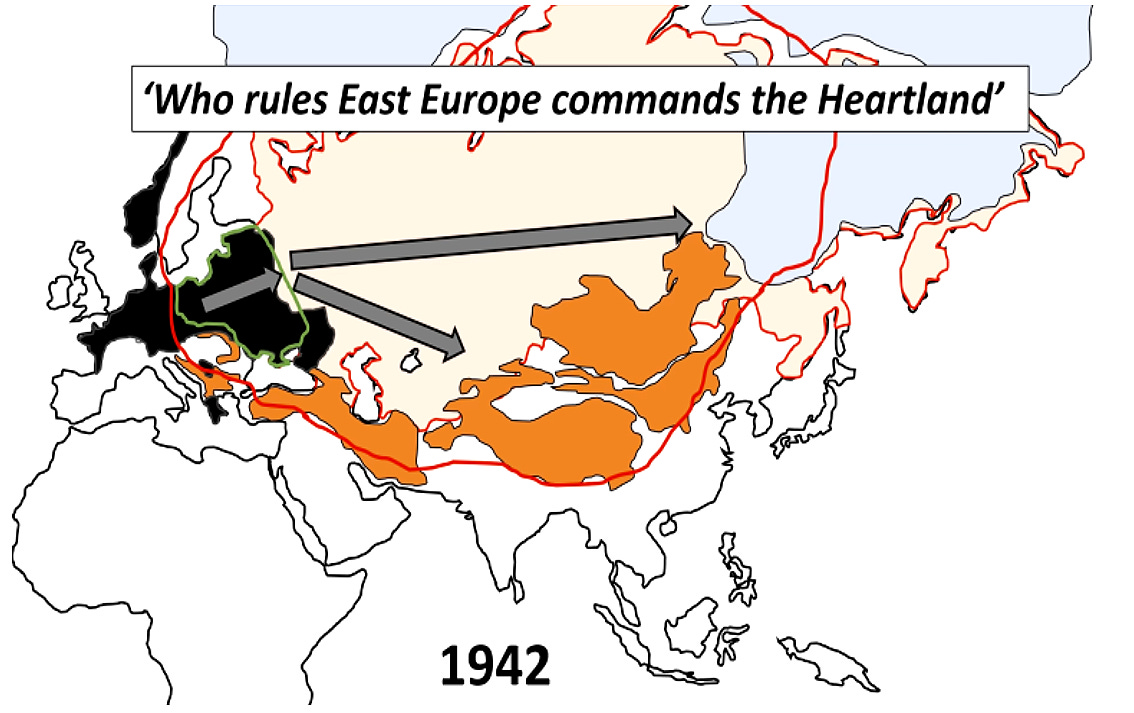

Its vast natural resources and strategic position between Europe and Asia make it geopolitically significant. This led Sir Halford John Mackinder, one of the founding fathers of geopolitics, to label it the “Heartland” in his 1904 theory, arguing that “Whoever controls this territory will become the ruler of the world”.

The Heartland, which stretches as far as Ukraine, has played a pivotal role in shaping major historical events - from Nazi Germany’s attempted expansion during World War II to modern conflicts like the Russo-Ukrainian war.

Russia’s southward policy has long been a strategic effort to expand influence and maintain control over Central Asia and the South Caucasus. Still today this remains a key pillar of Russia’s foreign and security agenda.

Interestingly, during World War II and the cold war that followed, the U.S. engaged in several significant military conflicts, all of which occurred outside the Eurasian Heartland (see map below). This deliberate strategy, focusing on the Rimland (the area surrounding the Heartland), was a cornerstone of U.S. foreign policy shaping its military interventions and global posture.

Kazakhstan, the largest country in Central Asia and the ninth largest in the world, sits at the very center of the Eurasian Heartland, making it a region of immense geopolitical and economic significance. For instance, it plays a crucial role in international trade - with eleven major transit corridors, it remains a key link in China’s Belt and Road Initiative.

Without delving too deeply into geopolitics, it’s clear that Kazakhstan’s strategic location positions it as a key player in the region’s future.

Returning our focus to economics, Kazakhstan stands out as the most prosperous nation in Central Asia, with vast mineral resources and enormous economic potential. The country's economy is dominated by its oil and gas sector, accounting for approximately half of its exports. Kazakhstan has attracted hundreds of billions of dollars in foreign investments since gaining independence, thanks to its rich natural resources, which include almost every known element on the periodic table including uranium and copper. It also has considerable agricultural potential, with its vast steppe lands accommodating both livestock and grain production.

The country is actively evolving its economy and governance. Kassym-Jomart Tokayev2, who has served as the President of Kazakhstan since June 2019, has unveiled a comprehensive plan focused on economic reforms, including industrialization, diversification, and a move toward green energy. The country aims to become one of the 30 most advanced nations globally by mid-century, shifting from a resource-intensive growth model to a cleaner, more sustainable one. Kazakhstan is also developing its IT sector, with plans to increase IT service exports to one billion dollars by 2026.

This brings us back to Kaspi. Government initiatives like "Digital Kazakhstan" have fueled fintech growth, creating fertile ground for Kaspi to thrive. This has created a flywheel effect - Kaspi’s innovations support national digitalization goals, while government policies provide an environment for Kaspi to expand.

For instance, the government's focus on IT development has led to enhanced digital infrastructure, including better internet connectivity and 5G rollout. This provides a more robust foundation for Kaspi's mobile-only super-app strategy, enabling faster and more reliable services for users. This in turn supports Kaspi's GovTech platform, which integrates government services into its super-app, aligning perfectly with the country's digitalization efforts. It is truly a symbiotic relationship.

Kazakhstan has undergone a significant shift from a cash-based to a cashless economy, with 90% of transactions now digital (up from ~10% in 2016). Kaspi has been central to this transformation, demonstrating a deep integration into the daily life of the entire population.

Kaspi has built a closed-loop payment system, similar to American Express, bypassing Visa and Mastercard. As of 2025, more than two-thirds of all domestic electronic transactions flow through Kaspi, cementing its dominance across payments, e-commerce, fintech, and government services.

In fact, with a population of only 20 million in Kazakhstan, Kaspi has over 14 million active users (those that don’t use it tend to be either children or older generations that are not tech savvy). More particularly, 67% of its users access the platform daily. This level of adoption is rare, and it makes Kaspi the second most engaged app globally after WeChat in China.

While Kazakhstan’s regulatory landscape is evolving, government backing for digitization and financial inclusion serves as a strong tailwind for Kaspi, ensuring its continued growth in a market where it operates as a quasi-monopoly.

The Customer Proposition

Kaspi’s super-app model isn’t just a convenience - it’s a reinvention of digital engagement, blending financial services, e-commerce, and government interactions into a single, indispensable platform. This isn’t just an app; it’s an entire digital ecosystem.

What makes Kaspi truly exceptional is its obsessive focus on the customer, reminiscent of great business leaders including Sol Price, Sam Walton, Jim Sinegal, and Jeff Bezos.

While many companies claim to be customer-centric, Kaspi actually embeds customer insight into its DNA. Decisions are directly shaped by feedback from half a million customers every month. It not only collects suggestions on how it might improve, but calls users back to refine its understanding and deliver precisely what they need.

Kaspi’s mission is to improve people’s lives - not just as a slogan, but as the core principle driving its operations.

This commitment to constant iteration mirrors the agility of nature itself - an ongoing process of evolution where only the strongest ideas survive.

The bold decision to eliminate an entire credit card division because of negative customer feedback, despite its massive profitability, is something almost no other company would dare attempt. This is radical customer-first thinking, a rare trait that differentiates industry leaders from market disruptors.

Kaspi’s Amazon-style e-commerce marketplace, growing at 65% YoY, is another testament to its rapid expansion. But where it diverges from the usual playbook is its seamless integration with local businesses, logistics, and even government services - a strategy that transforms it into an irreplaceable infrastructure rather than just another shopping app.

While Kaspi faces competition from local players and global giants, its focus on product quality and customer experience has enabled it to maintain a competitive edge. Additionally, its closed-loop payment system and the ability to offer diverse services, including government services, set it apart from the rest.

Consider that Kaspi has expanded into the automotive market with Kaspi Auto, offering a seamless, end-to-end car-buying experience. Customers can now purchase a vehicle, finance it, register the transfer of ownership (via government services), and secure insurance - all within the Kaspi ecosystem on a single super-app.

This level of integration and convenience is unmatched. As far as I’m aware, no other platform - including Amazon, MercadoLibre, or Alibaba - delivers such a comprehensive suite of services in one place. This is a perfect example of what makes Kaspi truly unique.

Growth

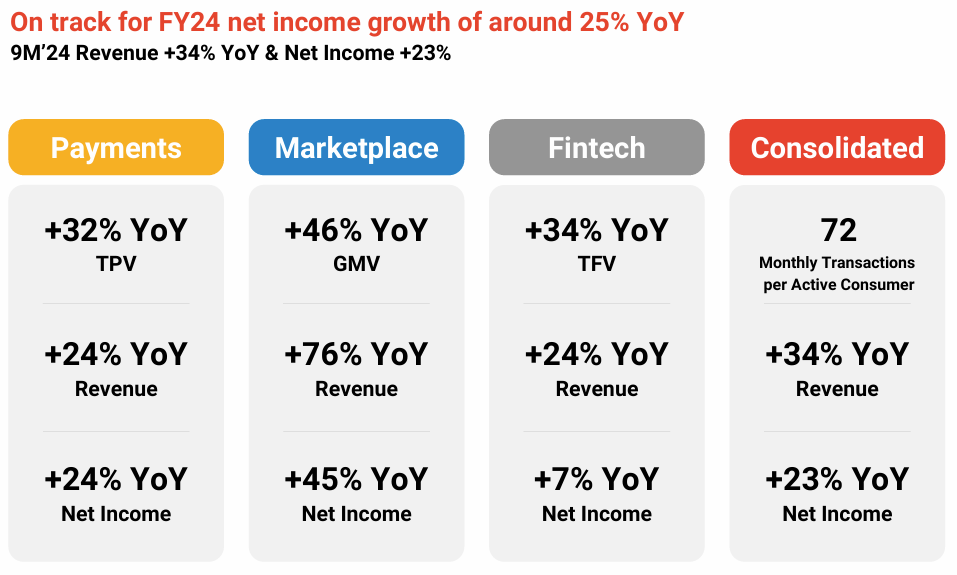

Kaspi operates very efficiently within all three of its segments showing strong growth sequentially.

Despite requiring heavy investment, Kaspi’s new e-commerce and grocery businesses turned profitable within their first year - a remarkable achievement. This demonstrates the company's ability to scale efficiently while maintaining healthy margins.

Better still, it continues to grow rapidly.

In fact, such is its operating efficiency, unlike many tech-driven companies, Kaspi maintains strong profitability across all verticals. This is achieved because the company maintains financial discipline by limiting capital burn and focusing only on sustainable, high-margin services.

Kaspi is very opportunistic as was demonstrated by its entry into the travel sector. During the Covid-19 pandemic, when all other travel businesses were struggling and cutting back on spending, it saw that as a wonderful opportunity to launch its own travel business. This turned out to be a good strategic decision. Starting with airline tickets, it soon added train ticket, then vacation packages. It now has a host of new ideas around travel.

Kaspi currently has over 14 million users and over 7,000 merchants. It constantly asks itself what else it could do to improve the lives of both groups and it continually explores new verticals. Mikhail Lomtadze says that Kaspi still has a strong pipeline of new ideas.

Growth will come from deeper penetration in underdeveloped verticals and the company has one eye on the service sectors including the provision of plumbers and electricians.

As recently as the third quarter of 2024, Kaspi launched digital gift cards:

Most of the services that have been covered are consumer focused, but as mentioned earlier Kaspi also provides key services to merchants. These include the recently launched business deposit banking accounts.

The sheer breadth of Kaspi offerings is simply staggering and constantly expanding.

But it should be noted that Kaspi seems to understand its limitations. For instance, while Kaspi Bank is involved in the insurance business offering a variety of insurance products, including life insurance, health insurance, property insurance, and vehicle insurance, as part of their comprehensive financial services, it does not directly underwrite insurance policies; instead, it collaborates with other insurance companies to provide these services to its customers.

This is yet another aspect of people’s lives that may be managed via the Kaspi super-app.

The really interesting part of this investment thesis is that when asking Mikhail Lomtadze, CEO, how he thinks about reaching market saturation in Kazakhstan, he laughs and says that that he doesn’t see the world through the lens of having a finite number of customers, instead he perceives customers as assets to whom he can sell an increasing number of services. Through that lens he says Kaspi is only at the beginning of its journey.

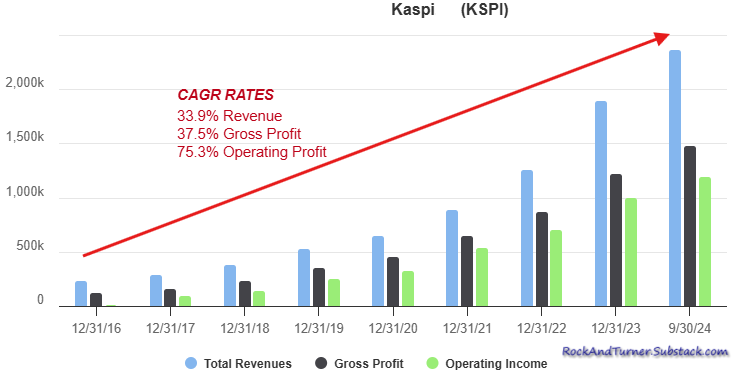

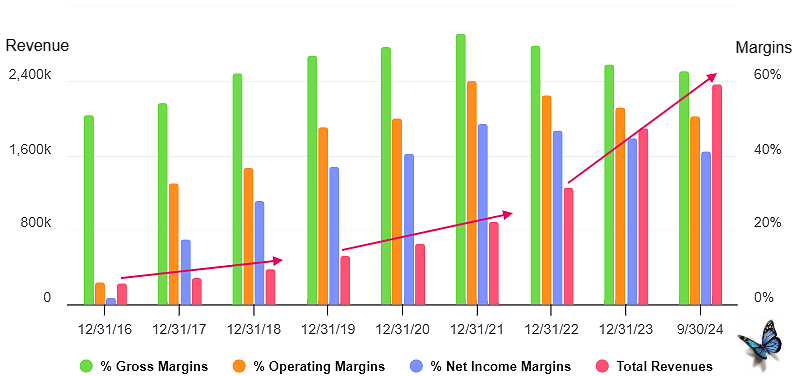

The chart below demonstrates how, as revenues have grown at an increasing rate, operating leverage is clearly in evidence. Back in 2016 when gross margins were ~50%, operating margins were ~6% and net margins less than 2% (see the large gap between the top of the green bar and the tops of the orange and blue bars for that year). Fast forward to the last few years and while gross margins have expanded into the mid 60% range, operating margins are now firmly above 50% and net profit margins are over 40% (the gap between the green, orange and blue bars has compressed).

These are incredibly impressive margins and entirely sustainable. In fact, as more services are added and revenues expand, the benefit of combining them all in the same single super-app means that margins may well improve further.

But the growth story doesn’t end there. Beyond its domestic market it also has its sights on expanding into new territories. In October 2024 it announced that it had acquired 65.41% of the largest online market place in Turkey, known as Hepsiburada. The deal completed on 29th January 2025. It was financed entirely with cash.

“My vision for Hepsiburada has always been one of sustainable growth and increased value creation. Kaspi, with its focus on improving people’s lives through innovative solutions and status as a NASDAQ listed company, is the ideal partner to help Hepsiburada deliver on the next phase of its growth.”

Hanzade Doğan, Founder of Hepsiburada

Turkey is a country with many cultural similarities to Kazakhstan, so replicating its success in this new jurisdiction is the plan. More particularly, with a population of over 85 million, versus only 20 million in Kazakhstan, this deal increases Kaspi’s addressable target by a multiple of ~5x.

“The Turkish market is attractive to us due to its structural and economic similarities with Kazakhstan. The market size, with a population of over 85 million, is critically important for us. However, the main determining factor was the company itself. Hepsiburada has a strong management team and focuses on creating services that improve lives.”

Mikhail Lomtadze

From the table below it can be seen that Hepsiburada is larger in terms of both active consumers and merchants, but on the performance metrics it isn’t even close to Kaspi. In terms of GMV (Gross Market Value) per consumer Kaspi generates more than double. So the plan is for Kaspi to roll out its successful strategy within the Turkish business to improve it operational efficiency and performance. The potential is clear.

As Kaspi expands internationally, it must navigate new regulatory environments and local competition. However, the company's emphasis on quality services and customer satisfaction provides a solid foundation for overcoming these challenges.

Is Kaspi A Good Investment?

Kaspi is an impressive fintech company with a proven track record of innovation and customer-centricity. Its integrated super-app ecosystem, strong growth in e-commerce, and profitability in challenging sectors like grocery make it a compelling investment opportunity. With expansion into Turkey and possibly beyond, Kaspi offers substantial upside potential while maintaining a dominant position in its home market.

Returns on Equity (ROE) are very high (over 80%), despite very modest levels of debt in the business - the debt/equity ratio is only 20% which is surprising given that the business has its foundations as a bank (a leveraged industry due to its deposit base). The high ROE explains why the business is capitalized at around 8x book value which does not look unreasonable in the circumstances.

At a $20 billion market capitalization, Kaspi is priced at ~10x earnings which looks like a bargain for such high profitability, exceptional engagement metrics, strong founder led management and huge growth potential. The expansion into Turkey alone nearly quintuples its addressable market, providing a strong catalyst for future earnings growth.

To provide a balanced perspective, it’s important to address a short-seller report on Kaspi, published by Culper Research in September 2024.

Culper Research is a short-selling firm, so it has a vested interest in seeing Kaspi's stock price decline. While the report presents specific allegations and references, it's crucial to consider the potential for bias and selective presentation of information.

The report primarily raises concerns about Kaspi’s links to Russia, alleging that the company conducts business with Russian entities and provides services to Russian citizens - a point that it claims is significant given sanctions imposed on Russia following its 2022 invasion of Ukraine.

However, context is key. Kazakhstan and Russia share deep historical ties. Kazakhstan was part of the Soviet Union from 1936 until its dissolution in 1991, and at that time, only Russia and Kazakhstan remained as the last two Soviet republics. Given this historical backdrop, economic and business connections between the two countries are not surprising.

Another peculiarity of the report is its focus on Kazakhstan under the presidency of Nursultan Nazarbayev. However, Nazarbayev stepped down in June 2019, and his successor, President Kassym-Jomart Tokayev, has since been actively reforming the country’s governance and economy. As detailed earlier, these reforms mark a clear shift from past leadership, raising the question: how relevant are past administrations to Kaspi’s current operations? Is Culper Research simply throwing mud in the hope that some will stick?

Either way, following the Culper Research report, a number of small, opportunistic law firms attempted to file a class-action lawsuit against Kaspi on behalf of shareholders, hoping to capitalize on the claims. However, the deadline to file a lead plaintiff motion - February 18, 2025 - has passed. So far, there has been no public confirmation of any lawsuit being filed, suggesting that the case may not have gained traction or that the facts alleged do not support a claim.

Mikhail Lomtadze, CEO of Kaspi, dismissed Culper Research’s publication as a typical short sellers’ attack. The company stated that being the first Kazakhstani company to list on NASDAQ, with its historic connection to the Soviet Union, has made it a target for short sellers in the U.S.

“The report is inaccurate and misrepresentative, created deliberately to mislead investors. We are a public company under strict regulatory control. Our shares were traded on the London Stock Exchange starting in 2020, and now they are traded on Nasdaq. We disclose information regularly in full compliance with regulatory requirements. Furthermore, we underwent stringent due diligence as part of our recent Nasdaq IPO. We have strong confidence in our products, financial statements and compliance mechanisms. As always, our focus remains on our long-term strategy.”

Mikhail Lomtadze

This isn’t the first time a Kazakhstani company has faced attacks by short sellers. In 2023 Hindenburg Research issued an investigation accusing Freedom Holding Corp. of breaching anti-Russian sanctions and falsifying financial reports. Later that year, two independent international legal firms conducted due diligence and found the accusations to be groundless.

One should also consider that President Trump is intent on ending the war between Russia and Ukraine. His efforts to date suggest that he is seeking to bring this conflict to an end by aligning himself with Putin and Russia. Only yesterday, 24 February 2025, did the U.S. take the unprecedented step of voting against a UN General Assembly resolution that condemned Russian aggression in Ukraine by aligning its vote with Russia, North Korea, Belarus and Iran. This all suggests that Russian sanctions may soon be lifted which would further devalue the Culper Research allegations.

In conclusion, Kaspi is a very interesting company, but an investment opportunity with some hair on it. The Culper Research allegations have resulted in a drop in the stock price (see chart below) while the fundamentals of the business remain strong and unchanged. Is that an opportunity to invest at a favourable price? Only you can make that decision.

This analysis is for information purposes only, so please do not rely on it to make investment decisions. Do your own research and seek professional advice before investing.

If you enjoyed this analysis, you’ll love the Amazon investment thesis:

Baring Vostock Capital Partners was formed by an American following the end of the cold war, focused on investments in Russia and the Commonwealth of Independent States. It is is best known for its early stage investment in Russian search engine, Yandex, but has invested billions of dollars in over 67 companies since inception. The fund was a joint venture between Baring Asset Management and Sovlink, a Russian-American merchant bank. Baring Bank’s ties to Russia traced back several centuries and Barings was the primary international bank for the Russian Emperors. The firm’s stake in Kaspi has been transferred to Baring Private Equity, and as of January 2025, it holds a 23.3% stake in Kaspi.

In 1999, Tokayev became the deputy prime minister, and in October of that year with the endorsement of the Parliament, he was appointed as prime minister. From 2002, Tokayev served as foreign minister and state secretary, where he continued to play an active role in the field of nuclear non-proliferation. He was the director-general of the UN Office at Geneva from 2011 to 2013 and served twice as a chairman of the Kazakh Senate from 2007 to 2011 and 2013 to 2019.

Dear James,

I am an investor from Singapore and I love the work you are doing. Thank you. Regarding Kaspi, I am also on the fence. But to your point on what happens to Kaspi if all sanctions are lifted and that russian deposits flow out, Kaspi has put out a statement(you must have seen this) that only a small percentage of deposits are foreign.

Only 2.8% of our customer account balances come from non-residents of

Kazakhstan

As of 2Q2024 only 2.8% of our total customer accounts were held by non-residents.

Only 4.5% of our total customer accounts growth has come from non-residents between the

start of 2022 and end of the first half 2024.

Non-residents are all foreign nationals without a Kazakh permanent residence permit.

Only 0.3% of our Marketplace GMV comes from purchases by non-residents

Merchants connected to our marketplace must have a legally registered business entity in

Kazakhstan. Our ability to identify consumers and merchants distinguishes us from most

major marketplace businesses around the world. Both a consumer and a merchant have

bank accounts with us. When a marketplace transaction happens the flow of money is from

a consumer’s bank account with us to a merchant’s bank account with us.

During the first half of 2024, only 0.3% of our Marketplace Gross Merchandise Value (GMV)

came from purchases by non-residents. We deliver orders only within Kazakhstan.

https://ir.kaspi.kz/media/Kaspi.kz_Responds_to_Investor_Questions.pdf

My concern is the depreciation of the Kazakh currency relative to the USD as this could cause reported numbers in USD to decrease. This can only be counteracted with growth and an enormous amount of growth similar to what Meli did in Latin America.

Thanks for everything James! Blessings, Kingsley

Hi James,

I came across your (excellent) article - quite intriguing company I was not yet familiar with.

Have you received some answers from their IR team yet?