Kinsale Capital | Riding A Long Wave

Excess and Surplus Durable Earnings Generation, Great for Shareholders!

Disclaimer & Disclosure: The author has a position in Kinsale Capital. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

Why Should I Care About This Investment Thesis?

A bank may be described as having a government license to borrow money cheaply, while being able to lend it out at a premium1, generating healthy returns on someone else’s capital - what a great business! This explains why Warren Buffett has long been enthusiastic about investing in banks, including notable names like Bank of America, Goldman Sachs, JP Morgan and Wells Fargo.

Another great business type is a casino because the odds are always skewed in favour of the operator and against the players, ensuring durable profitability. To borrow a Charlie Munger metaphor, its like entering a butt-kicking competition against a one-legged man - you simply can’t lose!

Now, imagine merging the best features of banking, enhancing them, and combining them with the advantages of running a casino. What do you get? An insurance business!

While a bank is able to access capital at preferential rates, an insurance company receives insurance premiums at zero cost. These are collected upfront and held for an extended period before being used to pay claims with the surplus released to profit at the expiry of the policies. This capital pool, which Buffett refers to as ‘Float’, can be invested to generate additional returns for shareholders, on top of the profits that flow from the core insurance business. So in this respect it is a superior model to that of a bank.

In relation to the underwriting of insurance policies, if done properly the odds are even more favourable than those available to casino operators. The house edge, or mathematical advantage a casino has over players in a gambling game, is the percentage of total bets made by players that the casino will retain as profit. Whether playing Blackjack, Baccarat or Craps this is no more than 2%, while a Roulette table operates with a 2.7% advantage in favour of the house. The casino’s long-term profitability lies in consistently applying these slight edges over a large volume of bets. Insurance companies operate on exactly the same basis but their advantage can be 10% or more.

Insurance offers a distinct advantage: unlike bank deposits, loans, or casino visits, which are purely discretionary, insurance is often required by law or regulation. This legal mandate ensures relatively stable demand and minimizes the cyclical nature of the industry.

Finally, in very general terms, traditional banking growth is constrained because lending is anchored to the size of the deposit base. In contrast, the insurance industry is unconstrained because insurance premiums on the book of underwritten risk are priced to cover insurance claims and generate profits.

This highlights why Buffett considers insurance companies a cornerstone of the Berkshire Hathaway empire and why it has been a critical driver of its exceptional returns over the years.

All of this hinges on competent management, as even the best business models can fail in the wrong hands:

Kerry Killinger, CEO at Washington Mutual Bank and Greg Becker, CEO of Silicone Valley Bank, both played a significant role in the demise of their bank by mismanaging assets and risk. First Republic Bank, Lehman Brothers and Bear Stearns serve as other notable examples of failed banks caused by poor leadership.2

From 1995 to 2009, Donald Trump served as chairman of Trump Entertainment Resorts and held the CEO title for five of those years. During his 13-year tenure, the casino empire lost a total of $1.1 billion and twice declared bankruptcy.3

Even insurance companies are not immune to failure. Fred Carr, CEO of Executive Life, was blamed for its bankruptcy by investing too heavily on high-yield risky junk bonds. Similarly, Hank Greenberg was widely criticized for his role in building AIG’s risky financial products division which invested heavily in mortgage-backed securities and credit default swaps, leading to severe liquidity problems during the 2008 Great Financial Crisis. It required a $205 billion bailout from the Federal Reserve.4

The morale of the story is that it is critically important to find the right business with first class competent management, which is exactly what Buffett has always done.

Berkshire Hathaway has a multitude of primary insurance and reinsurance businesses within its group, and that number continues to grow with the recent addition of Alleghany Corporation in October 2022. But it all started 70 years earlier with GEICO (Government Employees Insurance Co.)

In 1951, at the tender age of 20 while studying at Columbia Business School, Buffett invested more than half his net worth in GEICO stock - believe it or not, this was $13,000. In 1996, GEICO became a wholly owned subsidiary of Berkshire Hathaway. Buffett has since referred to GEICO as one of his best investments and it has been a pivotal part of his investment success.

Buffett identified GEICO as an exceptional insurance company for several reasons. Unlike other insurers, GEICO’s fundamentally distinct business model gave it a clear competitive edge. Its low-cost model enabled it to offer competitive premiums while maintaining superior profit margins. The company demonstrated strong financials, superior underwriting profit margins, and quality management combined with enormous growth potential. Additionally, the alignment of interests between insiders and external investors further enhanced its appeal. In short, the simplicity of GEICO’s business model made its cash flow generation highly predictable, and its ability to generate substantial Float further enhanced its appeal.

The company that forms the focus of this investment thesis may be even better than Geico.

The Business and the Backstory

Kinsale Capital Group (KNSL) was founded in 2009, entering the insurance market with a focus on providing customized insurance solutions in the excess and surplus (‘E&S’) sector.

E&S insurance is a specialized type of coverage designed for risks that are too high or unique for traditional insurance companies to underwrite. Kinsale is able to operate in this segment of the market, which is underserved by traditional insurers, enabling it to flourish with lower competition while generating more attractive margins.

The company was founded by Michael P. Kehoe, who has had an impressive career in the insurance industry, culminating in his current role as the Founder, Chairman of the Board, and Chief Executive Officer of Kinsale Capital Group, Inc.

In terms of education, he earned a B.A. in Economics from Hampden-Sydney College and a Juris Doctor (J.D.) from the University of Richmond School of Law, subsequently becoming a member of the Virginia State Bar, a position he has held since December 1992.

Throughout his career, Kehoe has showcased exceptional entrepreneurial skills within the insurance industry. Identifying inefficiencies in the market, he envisioned a company that would adopt a fundamentally different approach to excess and surplus (E&S) underwriting. His goal was to create a business that stood out from the competition by combining in-house underwriting expertise with the strategic use of technology and data analytics.

This vision became the foundation of Kinsale, a company committed to understanding client needs and leveraging technological advancements to deliver tailored insurance products. Kinsale has earned a strong reputation for its innovative underwriting and risk management practices, alongside a steadfast commitment to customer service, key factors that provide a significant competitive edge.

Kinsale’s journey began in the aftermath of the 2008 financial crisis, perhaps by luck or maybe by strategic design, in a more constrained market environment. During a deep recession, when the competition has battened-down its hatches, it becomes far easier for new entrants to gain traction and win business.

Since then, Kinsale has achieved remarkable growth, expanding its product portfolio to include general liability, professional liability, and property insurance, among other lines. This diversification has reinforced its position in the E&S marketplace. The company writes specialty commercial insurance in 50 states and the District of Columbia.

In 2016, Kinsale went public on the New York Stock Exchange, which provided additional capital for expansion and allowed the company to further invest in technology and talent acquisition.

Kehoe retains a 3.82% stake in the company worth about $430 million at today’s share price, so he certainly has skin in the game. Moreover, Kinsale fosters an owner mindset across its workforce, with both management and employees encouraged to participate in equity ownership, aligning everyone with the company’s long-term vision (see short video below):

Under Kehoe's leadership, Kinsale has become one of the fastest-growing insurance stocks in the market. As an investor and author, I have always advocated the importance of great leaders over all else, simply because the same company with a different leader is not the same company (I explore this topic and more in this MOI podcast).

In Kehoe I see a long-term focused founder CEO who demonstrates all of the key attributes present in highly successful entrepreneurs.

“Kinsale’s goal is to provide long-term value to our stockholders by generating exceptional profit and growth. We achieve this by consistently generating underwriting profits, ensuring steady investment returns, and practicing sound capital management. We differentiate ourselves from our competitors with a strategic use of technology, rigorous expense management, and by maintaining control over our claims and underwriting processes.”

Michael Kehoe, Founder & CEO

The business is exceptionally well managed on every level, as can be seen by the credit rating of Kinsale, rated excellent by AM Best (founded in 1899, AM Best is the world's first credit rating agency with a particular focus on the global insurance industry):

Not Incrementally Better, But Fundamentally Different

Insurance is a commodity business where customers are primarily influenced by price and exhibit little loyalty to specific companies. To thrive in such a market, Kehoe has broken from convention in his operating model to create a cost advantage, a specialization advantage, and a technology advantage.

The Cost Advantage

The ‘expense ratio’ in insurance parlance is a measure that captures OPEX including employee salaries, sales commissions, advertising costs, admin and other general expenditure as a percentage of earned insurance premiums.

Kinsale has an expense ratio of around 20%. To put that in context, its immediate competitors, including Lloyd’s of London5 names, have expense ratios ranging from mid 30% up to 40%. This speaks to the efficiency achieved by Kehoe in his operations.

Conventional wisdom, which has shaped the operations of most insurers, is that outsourcing of underwriting reduces costs by eliminating the need for maintaining a full in-house underwriting department while enabling the company to adjust its underwriting capacity as it experiences fluctuations in workload due to seasonality and other factors. In other words, it was designed to enable insurers to streamline operations and respond to market changes with greater agility.

Kehoe rejects this operating model and has departed from this convention, recognizing that outsourcing of underwriting comes with an embedded conflict of interest. As Charlie Munger used to say, ‘show me the incentives, and I’ll tell you the outcome.’ In this case, the incentives in the industry were wrong and the outcomes were unfavourable. Delegating underwriting to sales people, often third-party brokers, creates a misalignment of interest because they are paid based on premium volume, not based on profitability. This causes them to focus entirely on volume, ignoring the risk versus reward dynamic that drives profitability.

Kinsale never delegates underwriting, which is a model analogous to that deployed by Geico and Progressive in the personal-auto insurance market. Not only are expense ratios improved, but loss ratios are also better due to risk being more accurately priced. In combination, this explains Kinsale’s significant outperformance.

Furthermore, as the Kinsale business has grown and enjoyed the benefits that flow from economies of scale, it has gradually reduced its expense ratio. This enables it to be more competitive on pricing, which delights customers, wins market market share and drives profitability through volume growth.

The Technology Advantage

Technology is at the heart of Kinsale’s winning formula.

By leveraging predictive modeling and advanced data analytics, it can forecast market trends and make informed decisions regarding pricing and underwriting, ensuring that it aligns products with customer needs more effectively.

By integrating technology into the development of new insurance products, Kinsale is able to offer innovative solutions that address emerging risks in various industries. This positions the company favourably against competitors that may take longer to innovate or adapt.

This very disciplined approach to underwriting and its robust risk management practices help it to mitigate losses and enhance profitability.

Kinsale has also implemented digital platforms to streamline its operations, improve customer interactions and expedite claims processing. It has introduced self-service portals and mobile applications that allow clients to access information conveniently. This automation has reduced manual errors and sped up responses, providing a superior experience for customers when compared to competitors with more traditional, slower processes.

Finally, the data analytics enable it to swiftly adapt its pricing strategies based on prevailing market conditions. This agility enables Kinsale to remain competitive even in fluctuating environments, allowing it to capture market share from competitors that may be slower to adjust.

The Specialization Advantage

Kinsale focuses on smaller insurable risks, a segment with far less competition. While larger industry players compete intensely for high-value deals, driving margins lower, Kinsale capitalizes on overlooked smaller opportunities that offer higher profitability.

A key differentiator is Kinsale’s ability to create bespoke insurance products tailored to the specific needs of niche clients, setting it apart from competitors that predominantly offer generalized solutions.

This advantage is amplified by the less sophisticated competition in this segment. Traditional insurance operations are often bureaucratic and process-driven, stifling innovation and resulting in mediocrity.

In contrast, Kinsale thrives under the leadership of a founder passionate about optimizing operational efficiency. The company’s disciplined management, strategic focus, and commitment to innovation are remarkable.

Michael Kehoe explains Kinsale’s business and how it has a competitive edge:

Kinsale Capital Financial Performance

The business has historically delivered stellar growth and market leading returns:

Strong Growth Rates: KNSL's revenue growth significantly outpaces the sector, indicating robust demand for its products.

Superior EPS Performance: The company has demonstrated exceptional EPS growth compared to the sector, aiding investor confidence.

As the table below demonstrates, insurance specific key performance metrics are exceptional.

Let’s explore some of these metrics in more detail:

The growth in gross written premiums, net income and net operating earnings speak for themselves. Book value per share is almost doubling every three years.

Returns on equity above 30% speaks for itself.

The combined ratio is a key performance indicator used in the insurance industry to measure a company's profitability and financial health. Essentially it is calculated as:

Combined Ratio = (Incurred Losses + Expenses) / Earned Premiums

Or,

Combined Ratio = Loss Ratio + Expense Ratio

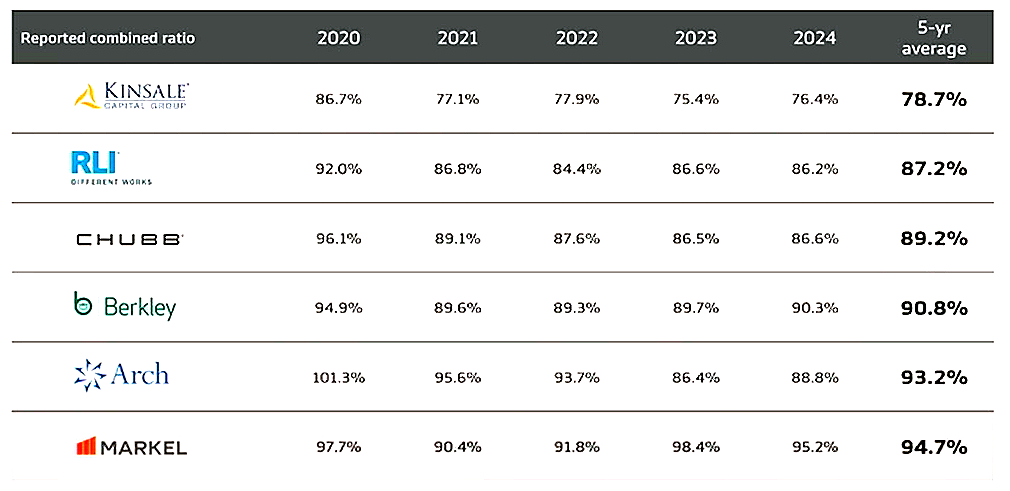

If the combined ratio is below 100% then the insurance company is profitable. For example, a combined ratio of 95% means that for every $100 received in premiums, the company is paying out $95 in claims and expenses, resulting in a $5 profit. A combined ratio above 100% indicates that the business is loss making on its insurance underwriting. Ergo, the lower the percentage, the more profitable the enterprise. Over the last five years Kinsale’s combined ratio has gone from 85%, which is excellent, to 75%, which is outstanding. (To put this in perspective, GEICO’s combined ratio was 90.2% in Q3 2023. Top insurance performer Chubb Ltd achieved a net combined ratio of 89.6% in 2023.)

To provide context, this is how Kinsale’s combined ratio has smashed the competition in recent years:

Beyond its strong underwriting performance, Kinsale reported a notable increase in net investment income on its ‘Float’. This growth was driven by an expanding investment portfolio, fueled by robust operating cash flows and rising interest rates. The annualized gross return on investments reached 4.3% year-to-date, up from 3.9% in the previous year. This boost not only enhances underwriting earnings but also accelerates Kinsale’s overall growth trajectory.

Capital Allocation

Kinsale prioritizes using capital to fuel business growth which is commendable.

However, its approach to excess cash is less compelling. The company offers a dividend yield of approximately 0.2%, which raises the question: “why bother?” This yield does nothing to attract income-focused investors, nor does it satisfy those who recognize dividends as one of the least efficient methods of capital allocation - so this policy arguably pleases no-one.

The company also conducts modest share repurchases, which, while beneficial, would be more impactful if the dividend were eliminated and those funds redirected toward increasing the quantum of the buybacks. This aspect of Kinsale’s capital allocation strategy is the only disappointing element of an otherwise stellar business.

Regarding share repurchases, management recently stated during an earnings call that they believe modest quarterly buybacks, combined with the potential for larger, opportunistic repurchases, best serve long-term shareholders.

Growth

With a technological edge and a highly efficient, low-cost business model, Kinsale is uniquely positioned to be a stand-out winner in its niche market.

The company's management presented a long-term perspective on growth, suggesting that they anticipate annualized growth in the 10% to 20% range while consistently maintaining a high operating return on equity.

In terms of growth, Kehoe estimates that the segment of the insurance market in which Kinsale operates is worth around $115 billion annually and that his company currently accounts for approximately 1.6% of that business, so there is a long runway ahead.

Doubling or trebling in scale from here ought to be an easy target to achieve. Could it reach double digit market share? Why not? Let’s hear what Kehoe says about it (see the short video below):

To date Kinsale has focused entirely on organic growth and Michael Kehoe has stated emphatically that the company has no interest in M&A at this time.

However, in 2022 it did acquire real estate property adjacent to its headquarters in Richmond, Virginia, for $76.2 million, through a wholly owned subsidiary. The property is comprised of two office buildings totaling over 580,000 square feet situated on approximately 29 acres of land. It is subject to a long-term lease with the seller, but ultimately intended to allow for future expansion as well as serve as an investment opportunity. The acquisition was funded primarily through a draw from the Company’s unsecured revolving credit facility.

Kinsale Capital Valuation

Kinsale’s is capitalized at 25.9x earnings and 5.5x sales, a premium relative to the sector averages, which reflect the market's expectations of future growth.

Although multiples appear high, as the old adage goes, ‘you get what you pay for’. When buying and holding for the long-term, for a fast growing business, multiples are entirely misleading - this topic was explored in detail in “The Fallacy of Price Centric Investing” for anyone interested in further reading to understand this better.

This valuation discussion reminds me of Warren Buffett's 9th October 1967 Letter6 to his Partners. In it he compared the person who tries to turn security analysis into a science (the ‘quant’) to the person who treats it more as an art form. He suggested that the quant would say, “Buy at the right price and the company (and stock) will take care of itself,” while the person oriented to qualitative factors would say, "Buy the right company and the price will take care of itself.”

He goes on to say, that while money can be made with either approach, the evaluation of a business for investment purposes should always involve a combination of both qualitative and quantitative factors. However, most insightful is his comment that, “The really sensational ideas I have had over the years have been heavily weighted toward the qualitative side where I have had a high-probability insight".

For me, Kinsale falls into this bucket. The real money will be made from understanding the qualitative aspects of this business, which are truly exceptional and are never going to be found on a spreadsheet. That having been said, even the best companies at the wrong price will make for a bad investment, so valuation always matters.

You will need to formulate your own opinion on valuation. Much will depend on your investment time scales. For a long-term investor interested in riding the Kinsale wave, with a huge growth runway ahead and outstanding unit economics, these valuations do not look unreasonable to me.

Conclusion: Is Kinsale Capital A Good Investment?

By way of recap, Kehoe was kind enough to sum it all up for us:

Kinsale Capital is carving out a distinctive position in the insurance market through its focus on niche segments, agile pricing strategies, and commitment to disciplined underwriting. By harnessing technology in data analytics, digital platforms, and innovative product development, Kinsale outpaces its competitors and offers superior services to its clients.

It operates in a higher margin segment of the industry, operating in the lowest percentile in relation to costs, with a long growth runway ahead of it. Kinsale Capital Group exemplifies a growth-oriented company with a robust operational model in the insurance sector. It offers superior revenue and EPS growth compared to its peers, alongside an optimistic market outlook. However, the valuation is high relative to sector averages, something each investor will need to assess himself.

The share price has recently pulled back over 20% from its high of $548, today trading at around $425. Could this be an attractive entry point? I’ll leave you to decide.

The profit metric for banks that captures the difference between rates paid on deposits versus rates received on loans is called the net interest margin (NIM). It's worth noting that while net interest margin is a crucial metric, banks also use other measures to assess their performance, such as the loan-to-deposit ratio, efficiency ratio, and return on assets.

Lloyd’s of London is the world’s specialist insurance and reinsurance market. Lloyd’s was founded by Edward Lloyd in 1688 and is foundational in the insurance industry. The Lloyd's market is home to over 50 managing agents and over 80 syndicates, which offer an unrivalled concentration of specialist underwriting expertise and talent.

Kinsale Capital Exceptional Q3 2025 Results

Highlights for the quarter included:

- Diluted earnings per share increased by 24.3% YoY to $6.09

- Diluted operating earnings per share increased by 24.0% YoY to $5.21

- Gross written premiums increased by 8.4% YoY to $486.3 million

- Net investment income increased by 25.1% YoY to $49.6 million

- Underwriting income was $105.7 million in Q3, achieving a combined ratio of 74.9%

- Annualized operating return on equity was 25.4% for the nine months ended September 30, 2025

Chairman and Chief Executive Officer, Michael P. Kehoe commented:

“Our business continues to produce strong results across the market cycle as we execute our model of disciplined underwriting and technology-enabled expense management. We remain confident in our strategy and our ability to deliver long-term value to our shareholders,”

Thans for sharing (ps. also long Kinsale). Main short term worry is the market turning more 'soft' in the next years which could result in some temporary headwind. Nothing to worry about long term, but something to be mindful. Solid growth (but lower than expected by Wall Street) usually results in agressive price movements which could offer attractive entry/expansion points for the diligent buyer.