Manolete Partners | Special Investment

An Extraordinary Business Model With The Ability For Long-Term Compounding

DISCLAIMER & DISCLOSURE: The author has a position in Manolete Partners. The views expressed are those of the author at the time of publication and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Why Should You Be Interested?

Imagine I told you I had a groundbreaking investment pitch in the rapidly evolving tech sector, focused on artificial intelligence (AI). You’d likely want to know more. AI is the hot topic of the moment, drawing in massive, often irrational investments and driving stock prices in the sector to unjustifiable levels.

In stark contrast, if I were to say that I have a pitch focused on the mundane world of corporate insolvency law, you would probably feel your eye-lids start to close as the soporific effect of a dull industry washes over you. Yet, this is exactly what creates the best kind of investment opportunity - a company overlooked by the market, trading at a huge discount to intrinsic value and with catalysts that will soon lead to a rerating of the stock. I thought that might grab your attention!

The last time I introduced a company like this to the investment community, it was up 200% in a year and up 500% within three - this business looks equally compelling.

So, allow me to introduce you to Manolete Partners (London: MANO), an incredible company that I’ve been following closely for a number of years and recently met with its CEO.

At its core, Manolete is a financial investment firm - a fact that the market has largely misunderstood. Most classify it as an industrials business, specifically in consulting or legal services, which couldn’t be further from the truth.

Manolete operates much like a venture capital private equity (VCPE) firm but focuses on a highly niche and economically favourable area: insolvency litigation claims (I’ll explain what these are shortly). In this underexplored market, it achieves a remarkable success rate of 93%, far surpassing the odds in traditional VCPE. Moreover, its typical payback period on investments is just 24 months - another advantage over VCPE firms.

However, there is another key attribute that makes Manolete extraordinary.

Most companies, even the best ones, face challenges when reinvesting capital. Organic growth often dilutes existing returns on capital, while acquisitions, though tempting, are fraught with risks. Many acquisitions fail to deliver the expected benefits and frequently introduce unforeseen complications, ultimately destroying value. Consequently, management teams in most other businesses often default to distributing surplus capital as dividends, resulting in slow or stagnant growth.

Manolete is a rare exception. It enjoys virtually unlimited opportunities to reinvest in organic growth at exceptionally high, accretive rates of return. This ability allows the business to compound rapidly year after year without interruption.

To truly appreciate this investment, you need to shift your focus from its income statement - which can be misleading for reasons I’ll explain later - and view it as a balance sheet-driven business. This distinction is key to understanding why it doesn’t screen well and why it’s largely misunderstood by the investment community. That misunderstanding is where our opportunity lies.

Not only does Manolete possess the attributes of a stellar investment - strong recurring compounded growth - but its share price has been unfairly punished, trading at a significant discount to its intrinsic value. In combination, the rate of compounded growth will be amplified by the expansion of the valuation multiple once the market wakes up to this opportunity - the two will have a multiplier effect on shareholder returns. This is precisely what makes this hidden gem so exciting.

A Truly Extraordinary Business

Manolete, founded in 2009, demonstrated the robustness of its business model over its first nine years as a private company. Then, in 2018, the company entered its next phase of growth by increasing its investment base through an IPO on AIM (the Alternative Investment Market of the London Stock Exchange, which is largely made up of micro-cap enterprises).

The IPO raised £16 million in gross proceeds at a placing price of 175 pence per share, giving the company a post-money valuation of £76.3 million. This capital injection was vital for the company’s compounding strategy, as it reinvests earnings at strong marginal rates of return to grow its net asset value.

It invests in bona fide legal claims that have historically delivered strong double digit returns on capital invested. Even more compelling, there are no shortage of such claims becoming available, so Manolete’s earnings can be reinvested to generate similarly strong returns, over and over.

Demand for Manolete’s services is so robust that the company can afford to be highly selective, accepting only 30% of the legal claims offered to it. This disciplined approach ensures high success rates while underscoring significant growth potential. As earnings grow, Manolete could expand its portfolio by increasing the number of claims it accepts, accelerating its growth with ease.

In the past, the company was poorly advised, often distributing earnings as dividends rather than optimizing reinvestment to maximize compounded growth. However, after lobbying from shareholders, Manolete stopped paying a dividend, greatly improving its capital allocation strategy.

It’s rare to come across a business with such unique compounding dynamics, consistently strong returns, and the ability to reinvest nearly unlimited capital at exceptionally high rates of return. What sets Manolete apart even further is its position as a market leader in its field, benefiting from limited competition thanks to relatively high barriers to entry due to the specialist skill and knowledge required to operate in this niche investment area.

The Concept of Champerty

To understand the Manolete business model, it’s important to begin with some key legal and historical context.

The concept of ‘Champerty’ originates from medieval England and refers to the practice of third-party funding of litigation. Back then, it was outlawed to protect the purity of justice. The logic was simple: if a dispute doesn’t involve you, stay out of it - third parties have no right to interfere in the legal affairs of others.

But this created a major problem. What happens when someone has a strong legal claim but lacks the financial resources to pursue it? Without the means to afford legal action, claimants were forced to abandon valid claims, leaving justice accessible only to those with deep pockets. This inequity was unacceptable, as it enabled wealth - not merit - to determine the outcome of disputes.

To address this, the law evolved. Champerty was ultimately recognized as providing a “social good,” allowing third parties to finance legal claims and so ensuring that access to justice wasn’t restricted by financial constraints. This paved the way for the emergence of third-party litigation funding, where justice could truly be blind to wealth.

This legal evolution gave rise to a new industry of litigation financiers which developed around two key mechanisms:

Conditional Fee Arrangements (CFA): A “no win, no fee” model.

After the Event (ATE) Insurance: Indemnification for legal costs awarded against the claimant if the case was unsuccessful.

However, this system wasn’t perfect either. The balance of power had tilted too far in favour of claimants, allowing them to litigate essentially “risk-free” while leaving defendants at a distinct disadvantage.

To address this imbalance, the Jackson Reforms were introduced in April 2016. These reforms prohibited claimants from recovering CFA uplifts and ATE insurance premiums from defendants.

This shift undermined the traditional litigation financing model, but created an opportunity for Manolete which deployed a very different model which only works in the realm of insolvency law - explaining why Manolete focuses exclusively in this niche area.

Insolvency law in the UK is unique in that it not only allows third party funding of litigation, but it goes a step farther. It permits the outright sale of legal claims to third parties. I cannot overstate the importance of this nuance - it sits at the heart of this investment thesis - allow me to explain:

When an insolvent company has been wronged - often by dishonest corporate management - it lacks both the funds and the operational leadership to pursue litigation. More particularly, the former management will invariably be the defendants.

Imagine dishonest corporate management who extract capital from a business, driving it into insolvency – which effectively means that it has insufficient funds to pay its creditors (suppliers, employees, tax authorities, utilities and banks). How does the legal system enable the wrongdoers to be brought to justice and for money to be recovered for the benefit of all the creditors?

The Insolvency Act 1986 addresses this by allowing legal claims of insolvent companies to be sold to third parties. This was deemed appropriate as it would benefit all of the creditors if moneys could be recovered to meet at least some of the outstanding payment obligations.

Manolete steps into this space as a “white knight.” By purchasing these legal claims, the company essentially “stands in the shoes” of the insolvent business, pursuing claims against the culpable officers. These claims often target personal assets, such as homes, to recover funds.

To grasp how this works it is important to understand that a company is a distinct legal entity - a “legal person,” separate from its shareholders. This concept can be confusing for non-lawyers. In the investment community we speak about shares, which wrongly suggests that we buy and sell a fractional ownership of a business. In truth, shareholders don’t own the company. Instead they buy a percentage of the rights in the business - the right to vote, the right to receive any distributions of earnings and the right to have their liability limited to the value of their shareholding. The company stands as an entirely independent legal entity and it owns the legal right to bring a claim against those that do wrong to it.

By acquiring the claim of an insolvent company, Manolete seeks justice for the insolvent company’s creditors, holding wrongdoers accountable and recovering funds that might otherwise be lost - while also locking in a return on its own investment in the case.

This explains how Manolete is able to function very differently from other firms engaged in litigation financing. It is not so much involved in litigation financing, but in litigation investing.

Why Is The Manolete Partners’ Model Better?

Under the traditional model of third party funding, if you have a legal claim and I provide you with financing to fund your litigation, you retain complete control - you remain the claimant. You may decide to settle early and to accept a sum which is far less than you truly deserve. Alternatively, you may choose to continue pursuing the case even after your prospects for success diminish. You are probably unqualified to assess legal or financial risks and your decisions may be motivated by exogenous factors including a decline in your health, family issues or stress at work. As your funder that is a huge risk to me and it leaves me vulnerable to a poor outcome. This is how most other litigation funding models work - and why I don’t particularly like them.

Manolete avoids this risk entirely by acquiring claims outright. This allows it to abandon cases when the chances of success wane or to fully commit to winning cases - much like managing a portfolio of equity investments. Manolete becomes the claimant and has complete discretion over case management. This approach enables the company to minimize losses, control costs, and maximize returns. It’s a huge advantage.

Additionally, defendants recognize Manolete’s financial strength and its ability to see cases through to the end if necessary. This often deters prolonged litigation, reducing delays, cutting legal costs, and improving returns on capital.

So, as a finance provider, Manolete operates as a pure investment company comparable to a venture capital private equity (VCPE) firm, but with a far superior model. Here’s how the two compare:

Specialized Market Niche:

While VCPE firms compete in an overcrowded space chasing promising but hugely unpredictable early stage business, Manolete dominates a specialized and underpenetrated niche. With a 67% market share in UK insolvency litigation, competition is minimal due to high barriers to entry.High Success Rates:

VCPE firms expect 90% of their investments to fail, relying on the remaining 10% to generate outsized returns to an extent that they more than compensate for the losers. In contrast, Manolete has a historical success rate of approximately 93%, flipping the risk-reward ratio and leaving very few losses. This stability makes the business easier to manage because it is far more predictable, thereby mitigating operating risk.Faster Payback Periods:

While VCPE firms are often required to wait 5–10 years before exiting an investee to realize a gain, Manolete’s insolvency litigation cases typically conclude within 12.7 months, perhaps with another year required for enforcement and settlement - so a two-year average payback cycle.Immunity From Macro Economics:

The IPO market exhibits cyclical patterns characterized by alternating periods of high activity ("hot" markets) and low activity ("cold" markets). These cycles are driven by factors such as changes in economic conditions, investor sentiment, and the aggregate demand for capital and have a huge impact on the prevailing value of investment made by a VCPE firm. Manolete is immune from macro economics.

Scalability and Flexibility:

Manolete leverages external legal and insolvency professionals for casework, enabling its team to focus solely on case management. This model is highly scalable and adaptable to economic cycles, ensuring efficiency during periods of both high and low levels of insolvencies. In contrast, VCPE firms don’t enjoy the same levels of flexibility.Growth Potential:

VCPE firms regularly wait for an extended period while waiting for an opportunity to deploy capital. Manolete’s growth is limited only by its available capital for acquiring new cases - demand for its services far outstrip supply and it regularly finds itself turning viable opportunities away.

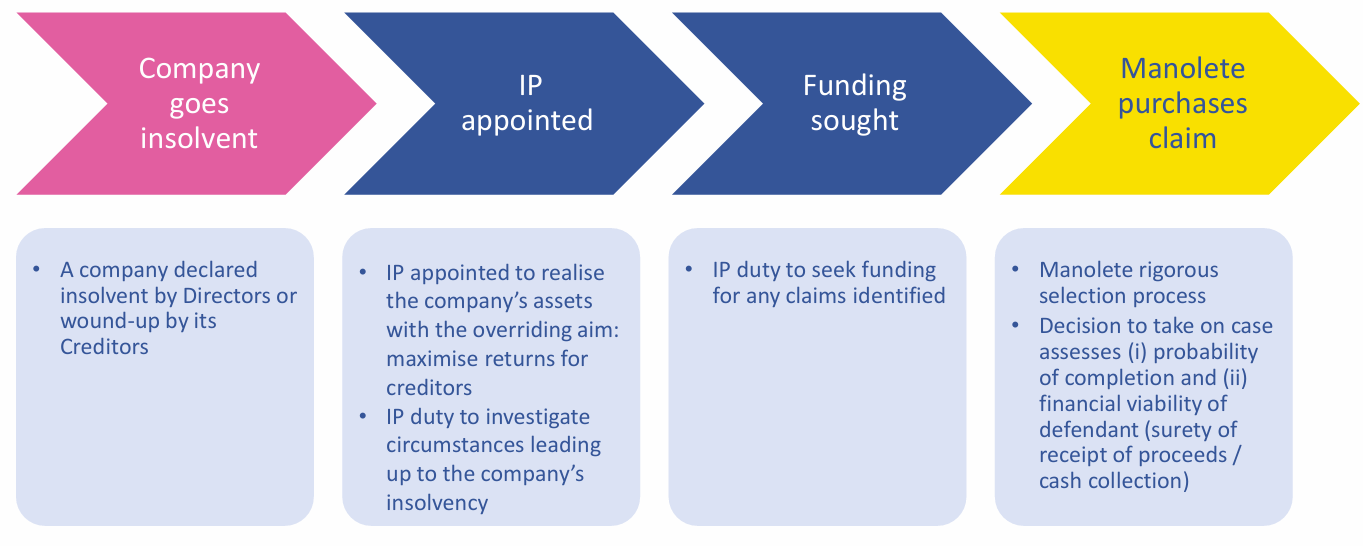

The Manolete Workflow and Ecosystem

Manolete’s operating model is supported by a mutually beneficial ecosystem. Insolvency practitioners (IPs) and their legal counsel prefer working with Manolete because it guarantees payment for their services and offers recurring business - advantages not typically provided by individual claimants. In turn, these practitioners often recommend Manolete to clients requiring third-party litigation funding.

Manolete’s client base spans small insolvency firms, Big-Four accountancy firms, banks, and His Majesty’s Revenue and Customs (HMRC) – any party with a vested interest in recovering money owed due to insolvency.

Competition

As explained earlier, insolvency litigation financing was traditionally conducted under conditional fee arrangements (no win, no fee), which still dominate the market (blue segment in the pie chart). However, the Jackson reforms undermined the appeal of that approach and made the Manolete methodology more appealing. A such, this far superior model is steadily gaining traction (the yellow segment is growing) and in this part of the market Manolete commands an impressive 67% share.

Unlike conventional lawyers, who are typically unwilling to put capital at risk, Manolete operates as a financing house. Manolete is not incrementally better, but fundamentally different. Its unique approach and willingness to acquire claims provides a significant competitive advantage, creating high barriers to entry and solidifying its market dominance.

An illustrative example of Manolete's competitive strength occurred in 2020, when RBG Holdings (Rosenblatt Group), a rival, launched an insolvency litigation financing division which it very deliberately called "Islero." The name referenced the bull that killed the legendary bullfighter Manolete in 1947. It was an intentional challenge to Manolete Partners and an attempt to claim some of its market share. However, despite this bold move, Islero has failed to make a meaningful impact in the insolvency litigation sector, while Manolete has only grown stronger.

This story also explains the Manolete Partners’ logo:

Management

Manolete is led by a team of seasoned professionals, with strong leadership at the helm and notable expertise across its operational and legal functions. However, certain areas of the management structure leave room for improvement.

Steven Cooklin – CEO and Founder

Steven Cooklin, a chartered accountant by training, founded Manolete in 2009. His unwavering passion and dedication to the company are evident, as he has continued to lead the business for 16 years, even after the IPO secured his personal financial success. Cooklin and his family retain ownership of over 10% of the company’s outstanding shares, ensuring his interests are closely aligned with external investors.

Mena Halton – Managing Director

Mena Halton, an award-winning insolvency lawyer, joined the company in 2014 and leads the growing nationwide legal team. As Managing Director of the operational side of the business, Halton has been instrumental in driving its success. Her team’s strength is reflected in the numerous awards the company has received over the years, including being the only firm ranked Band 1 for Insolvency Litigation Funding by Chambers and Partners for multiple consecutive years.

Several members of Halton’s in-house legal team also hold prestigious positions, including senior roles at R3 (the UK insolvency trade body) and part-time Deputy District Judge appointments. This group of highly skilled professionals operates from regional offices across Great Britain, ensuring comprehensive coverage and expertise nationwide.

Stephen Baister – Board Member

Stephen Baister, who holds a doctorate in law and is the former Chief Bankruptcy Registrar (a senior insolvency judge), serves on the board of directors. His extensive knowledge and experience in insolvency law add valuable intellectual and strategic strength to the management team.

In this short video, you can hear directly from the management team (picture, left to right: Stephen Baister, Steven Cooklin and Mena Halton):

Mark Tavener – CFO

In contrast to the strong leadership demonstrated by Cooklin, Halton, and Baister, the company’s CFO, Mark Tavener, falls short in my humble opinion. Tavener joined Manolete as CFO and Executive Board Director in October 2019, post-IPO, bringing experience from Deloitte’s audit team. While his accounting background provides foundational expertise, he is by no means an entrepreneurial CFO. He is happy to maintain the status quo and doesn’t seem to ask himself, ‘could we do anything differently to improve the finances of the business?’

In particular, he adopted his predecessors approach to meeting accounting standards. This approach has thrown up a number of issues from both a tax and cash flow perspective. It also caused an entirely avoidable profit warning in September 2022. Yet still Tavener refuses to change his approach (more on this in the ‘Accounting Standards Challenges’ section below).

Additionally, despite being a board member and being asked to take a stake in the business, Tavener has only purchased a derisory 500 shares in the company, reflecting a lack of meaningful personal commitment to its success.

Given these shortcomings, I would argue that the company would benefit from identifying a more dynamic and strategic CFO who can better support its growth ambitions.

Non-Executives

Non-Executives are intended to introduce constructive challenge to the business and to approach matters, such as executive remuneration, with an arms’ length perspective.

Whether or not strong independent challenge has been introduced to the board by the existing non-executives is largely unknown, but one area of concern is the relatively recent announcement of a long-term incentive plan (LTIP). It was devised by the company’s remuneration committee with the assistance of external consultants.

Why use external consultants? Was it to compensate for the lack of competence of the non-executives? Or was it done as a form of indemnity - we all know the old saying: ‘no one was ever fired for hiring McKinsey!’ Either way would be disappointing.

The outcome was even more disappointing. The poorly designed LTIP is linked to the share price - always a bad idea as I shall explain:

The share price of a public company is often dislocated from the economic intrinsic value of the business. So remunerating executives based on share price will lead to perverse outcomes:

Despite enhancing the intrinsic value of the business (as Manolete management has done), the share price has declined resulting in no performance reward.

In other cases, a company may become temporarily over valued in the market resulting in windfall bonuses for management that are entirely undeserved.

Why remunerate management for something entirely beyond their control?

Management should not be encouraged to become fixated on the share price, which is all too often an unwelcome distraction. Their undivided attention should be on the business. So remuneration should be linked to economic variables of the business that management is capable of enhancing - enhancing the Net Asset Value of the business in the case of Manolete.

There is nothing wrong with long-term management incentives, per se, but they need to be benchmarked to corporate performance not to the share price. This is why stock-based compensation is all wrong.

This all speaks to the competence of the remuneration committee.

COVID-19: A Headwind Turned Tailwind

In its first 11 years, there was no stopping the growth of this company. It went from strength to strength and demonstrated the robust nature of its business model.

- The Headwind

However, The Covid-19 pandemic brought a double shock that initially acted as a significant headwind:

Court Disruptions: Courts of Law were largely inactive during strict lockdowns, delaying the resolution of existing cases.

Government Intervention: Unprecedented measures by the UK Government to shield businesses from insolvency artificially suppressed the market for new claims.

These two extraordinary factors, unavoidably stifled growth.

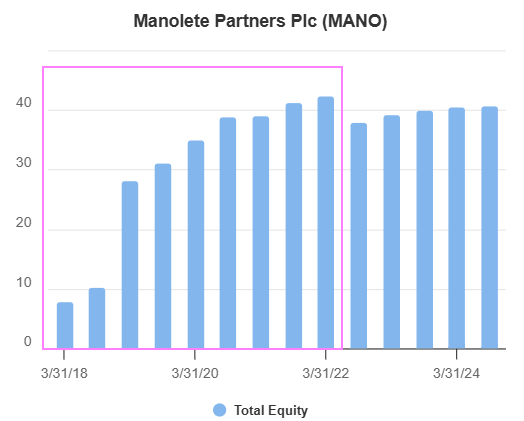

As mentioned earlier, this is a business that compounds its net asset value by continually reinvesting its earnings at strong marginal rates of return. As such, the equity line on the balance sheet is very important.

From 2020 to 2022, the number of new claims on the company’s books dropped sharply because of reduced insolvencies caused by government support. However, since cases already in progress pre-pandemic continued to resolve during this period, the full impact of the slowdown was only seen two years later, in 2022. This explains the dip and stagnation in equity growth observed from that point (outside the pink box).

The Covid-19 pandemic was a once in a century event and is highly unlikely to be repeated anytime soon, so the downturn seen by Manolete should not be confused with cyclicality. Over the last 30 years, corporate insolvencies in England and Wales have consistently averaged around 17,500 annually, so this is not a cyclical business. Instead this headwind should be viewed as an extraordinary black-swan event.

- The Tailwind

The situation began to reverse when the UK Government’s emergency measures ended in September 2021. Rather than preventing insolvencies, these measures had merely delayed them. Once the intervention ceased, insolvency rates surged.

The extraordinary economic conditions of 2022 exacerbated the issue. High inflation and tightening monetary policy created an increasingly challenging environment. Rising input costs and higher interest rates left many companies, which had thrived during the era of zero-interest-rate policies (ZIRP), struggling under heavy debt burdens. At the same time, the cost-of-living crisis significantly reduced consumer disposable income, delivering a dual blow to businesses through both supply-side and demand-side shocks—a perfect storm.

The situation in the UK worsened further when a newly formed left-leaning government, driven by political ideology, introduced controversial economic policies in its budget which hindered, rather than helped troubled businesses.

In combination, these things have pushed many businesses to the brink of collapse.

While this is troubling news for the broader economy, it creates a unique opportunity for Manolete , which is well-positioned to thrive in this environment.

The chart illustrates how insolvency rates dipped to their lowest levels in 30 years during the pandemic but have since swung to unprecedented highs by 2023. This surge in insolvencies has created a strong tailwind for Manolete with the company is experiencing record levels of demand for its litigation financing services and the number of cases on its books has reached an all-time high.

Given the two-year time lag between acquiring claims and realizing returns, this renewed momentum is only just beginning to be reflected in the company’s financial performance. This surge in claims in 2023, given the 24 month payback period, will start to show through in 2025 and beyond - none of this is currently reflected in the share price (more on that later).

“The impact of Covid-19, and its consequences on the global economy, is likely to underpin Manolete's strong growth prospects for the foreseeable future".

Steven Cooklin, CEO

What started as a headwind during the COVID-19 pandemic has transformed into a powerful tailwind for Manolete. The company is now poised to benefit from the highest levels of insolvency activity in decades, setting the stage for strong growth in the years ahead.

Other Extraordinary Earnings

Bounce Back Loans (BBL)

The COVID-19 pandemic unexpectedly provided Manolete with a short-term revenue opportunity through the Government’s Bounce Back Loan Scheme (BBL).

Under the scheme, British banks were required to issue emergency loans to businesses, with minimal due diligence due to the urgency of the crisis. This led to widespread fraud. While the Government indemnified banks against losses, banks have been recovering funds on behalf of the Government by targeting fraudulent claimants.

Manolete brokered a deal to assist with these recoveries, splitting recovered sums approximately 50:50 with the Government. For example, Barclays Bank, which issued 345,006 loans worth £10.8 billion under the scheme, engaged Manolete to assist in recovering funds from fraudulent claimants.

Although this revenue stream is valuable, its longevity is uncertain. A recent change in UK Government may bring a shift in policy, potentially ending this initiative. For now, however, it provides a welcome source of additional earnings.

Cartel Cases

Manolete has also invested in claims related to competition law, stemming from an illegal price-fixing cartel operated by several leading truck manufacturers between 1997 and 2011. These claims involve tens of millions of pounds in truck purchases, with all claimants being insolvent companies in liquidation whose claims have been assigned to Manolete.

The landscape for these cases became more favorable after Royal Mail and British Telecom (BT) successfully sued the same cartel companies, winning significant damages and interest. Since liability has already been established based on the same fact pattern, Manolete no longer needs to prove liability in its cases.

Manolete has strategically delayed committing capital to complex litigation, instead shrewdly waiting for the precedent to be set. With liability already proven, its focus is now on negotiating out-of-court settlements or allowing the court to determine damages if settlements cannot be reached.

Current Status: The cartel claims are presently stayed (suspended by the court) pending alternative dispute resolution (ADR). Settlement discussions are ongoing with multiple defendants, with progress varying on a case by case basis. For those unwilling to settle, Manolete plans to proceed to trial, with a court window set for November 2025.

Financial Impact: The company conservatively estimates a £15 million windfall from these claims, expected within the next 12 months. This will provide a substantial boost to earnings. While part of this will go toward paying down debt incurred to fund the claims, the majority will be reinvested into new cases, supporting future compound growth.

Accounting Standards Challenges

Income Statement

Manolete’s investments in insolvency cases are classified as financial instruments and are reported under IFRS-9 (International Financial Reporting Standards). This accounting standard requires companies to report unrealized revenue, which is a valuation based on hypothetical increases or decreases in the value of balance sheet assets. These valuations rely on prescribed methodologies that are inherently subjective and untestable, as the business does not intend to liquidate those assets at the reporting time.

As a result, accrual accounting that includes unrealized returns as revenue, is inherently misleading for investors - the income statement numbers become a work of fiction.

This problem is not peculiar to Manolete. These accounting requirements present challenges to Amazon, with respect to its stake in companies such as Rivian, and for Berkshire Hathaway in relation to its investment portfolio. In fact, Buffett addressed this issue in his 2023 annual shareholder letter in which he says, “The primary difference between the mandated figures and the ones Berkshire prefers is that we exclude unrealized capital gains or losses.”

Interestingly, Manolete voluntarily adopted IFRS-9 early, in April 2015, ahead of the mandatory January 2018 implementation date. This methodology was used in financial information presented by the Company in its admission documentation when applying for admission to the AIM market prior to its IPO. I can only speculate as to the reasoning behind this decision - It would have allowed the company to include unrealized revenue in its income statement numbers which perhaps it believed would allow it to achieve a better IPO valuation.

The company has a high degree of latitude in how it implements IFRS-9 for the very illiquid assets in which it invests. The approach chosen by Manolete has caused issues for the business and ought to have evolved over time.

The current CFO arrived in 2019 and perhaps adopted the methodologies of his predecessor without any thought to whether or not there might be a better way.

To aid in your understanding, this is how the company implements IFRS-9:

An investment in an insolvency claim is capitalized on the Balance Sheet as an asset of the business.

These assets are assessed regularly, based on an estimated net settlement value of the claim adjusted by the perceived probability of success - both entirely subjective variables.

Prior to settlement of the cases these adjustments are recorded on the Income Statement as 'unrealized revenue'.

When the case settles an adjustment is made and 'unrealized revenue' becomes 'realized revenue'.

External professional costs incurred during the litigation process are capitalized on the balance sheet as part of the investment in the cases and these are released to the income statement as COGS at the conclusion of the claim.

What’s wrong with this approach?

First, it pulls forward tax liabilities on earnings not realized and it compounds the issue by optimizing that tax liability as external professional costs are not expensed when incurred. In short, requires more working capital and acts as a drag on corporate performance.

What kind of corporate finance executive would think that this was a good idea?

To make matters worse, this approach resulted in a profit warning in September 2022 when the booked unrealized revenue diverged by approximately £5 million from reality following an adverse legal judgement.

Is there a better way?

The accounting standards contain guidance on how best to meet the IRFS-9 obligation. For illiquid instruments, such as insolvency litigation claims, there are a host of alternative valuation methods suggested. The guidance acknowledges that different methods will yield different outcomes and it implies that any defensible methodology is acceptable. More particularly, it guides that there is a requirement to consider at least two scenarios using relatively simple modelling, without the need for a large number of detailed scenario simulations.

Scenario-based modeling in the case of Manolete , what might these scenarios look like?

Scenario 1: The real possibility that some of its legal claims are unsuccessful, either failing at a Court hearing or being abandoned prior to that if the prospects of success diminish during the course of legal proceedings. This would yield a value of zero for those ‘assets’.

Scenario 2: If Manolete wanted to divest its interest in its portfolio of claims by selling them to another party prior to resolution, how easy would that be to achieve? Would there by any buyer out there willing and able to take them on? If so, what kind of discounted price might the business need to accept to make the portfolio attractive to a prospective buyer? This is the closest the company can get to a mark-to-market appraisal, notwithstanding the fact that there is no market for these legal claims. On the basis that there are few if any buyers, the valuation that this scenario yields would be anything from zero to heavily discounted.

Scenario 3: Assessing a final settlement value on a probability weighted basis (the sole method used by the company at present). This is very difficult - not only does it require the business to second guess a judicial outcome, but it also necessitates a guess as to the sum of money capable of being recovered from the defendant if the claim is successful.

Using Scenario 3 alone, as is the case now, is suboptimal. However, taking an average of these three scenarios would likely yield a carrying value closer to the cost of the claim, if not a discount to cost, presenting a more defensible and conservative methodology for Manolete to adopt.

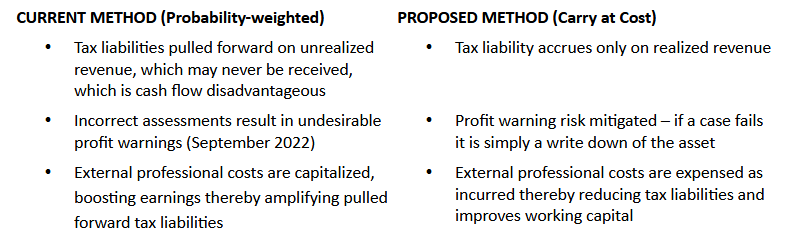

Assuming that its legal claims are carried at cost, then comparing the current methodology to the proposed methodology:

Cash Flow Statement

If we are unable to rely on the Income Statement, is the Cash Flow Statement any more reliable for investors?

The answer, unfortunately is no.

This is because the company’s auditor asked that investments in claims be recorded as cash flow from operations instead of CAPEX, as it argued that rights in litigation are considered non-depreciating assets while CAPEX is usually depreciable. The company obliged, whereas it should have probably objected.

Accounting in the manner prescribed by the auditor gives rise to a new issue. As the company is constantly reinvesting its returns in an ever expanding number of new cases, the cash flow from operations is now unlikely to ever be positive.

So operating cash flows look awful - presenting a false picture of the business.

Balance Sheet

Since the income statement and cash flow statement are unreliable, the balance sheet becomes the primary focus for investors.

As the company generates strong marginal returns on its reinvested earnings, it experiences a compounding effect which shows through in the net asset value of the business.

While the NAV of the business has stagnated for a few years for the reasons outlined above, it is now at an inflection point, with strong growth expected moving forward.

While we are discussing the balance sheet, it is worth pointing out that the company has a £17.5 million revolving credit facility (RCF) with HSBC, of which £11.9 million is drawn down, leaving £5.6 million headroom. Loan refinancing is due in June 2025. While HSBC has supported the business for a decade, likely due to CEO Steven Cooklin’s prior role at HSBC Investment Bank, the company is in early discussions with other lenders to find teh best terms on the RCF or expansion funding.

Nonetheless, the balance sheet is strong and becoming stronger as the company’s cash collections continue to roll in.

Performance Numbers

Record Case Completions and Revenues

In the six months to 30th September 2024 (H1 FY25), Manolete achieved record performance:

Cases Completed: 137, the highest in company history.

Realized Revenues: £15 million, up 60% year-on-year.

Cash Collections and Net Revenue

The company typically collects cash from defendants within 12 months of case resolution, providing clear visibility into near-term operational cash flow.

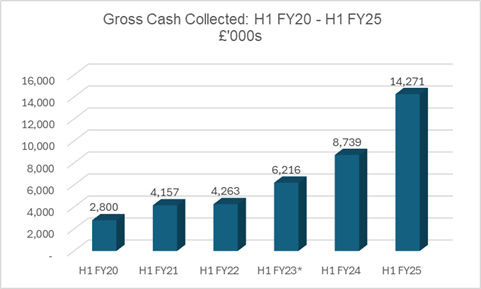

Cash collections in H1 FY25 from 253 completed cases (spanning earlier and current financial periods) rose 63% to £14.3 million - another new record.

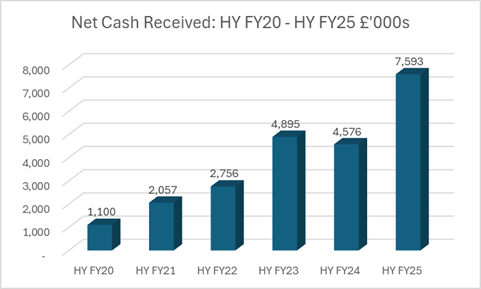

Net Realized Revenue was £7.6 million (after legal costs and payments to insolvent estates), marking a 66% increase from the prior year.

Manolete’s operating leverage has significantly improved. For context:

When net cash receipts were lower, operating cash flow was negative (operating expenses exceeded receipts).

Since H1 FY22, cash profits have outpaced net cash growth, demonstrating robust operational efficiency.

In H1 FY25, strong cash generation covered all operating costs (£4.5 million) and funded 413 live cases, while reducing net debt by £1.25 million to £11.9 million as of 30th September 2024.

Return on Invested Capital (ROIC) has improved sequentially, showcasing effective capital utilization.

[* Note: for the three graphs above, a single exceptional large case cash receipt in H1 FY23 has been excluded to assist with underlying trend visibility]

In H1 FY25, new case enquiries stood at 437, up 27% year-on-year, indicating robust growth in demand.

The workforce has expanded from 12 employees in 2019 to 29 in 2024, a 250% increase over five challenging years, reflecting the company’s growth ambitions.

ARRCC (Average Realized Revenue Per Completed Case)

H1 FY25 ARRCC: £109k (+35% from £81k a year earlier).

Pre-COVID ARRCC: Approximately £200k.

The company is steadily recovering to pre-pandemic levels, with potential to surpass prior highs. Professor Peter Walton’s report on the insolvency litigation market (conducted pre-COVID) estimates the UK market enforces claims worth £1.5 billion annually, with an average case recovery of £250k. This suggests Manolete’s ARRCC has significant upside and its target addressable market gives it a great deal of scope to multiply in size from here.

The ARRCC is important because the cost of litigating a claim involves similar amounts of time and effort, regardless of the sums involved. So a portfolio of larger sized cases will enjoy greater operating leverage, boosting marginal returns. Accordingly, the combination of higher case volumes and larger case sizes will lead to a material transformation in the profitability of the business.

Return Metrics

As of H1 FY25, the total value invested in resolved cases: £39 million. Total returns accruing to Manolete on these same cases has been £84 million. This equates to a Gross ROI of 115%.

Gross ROI is a standard industry metric, but excludes working capital invested in unresolved cases, operating expenses and the time value of money. As such, I am not a huge fan of this number.

I’ve broken down the numbers to create my own metrics. While these are rough and contain noise, they paint an interesting picture:

Key Insights from the Chart

The Blue Line: This represents the cumulative total investment by the company since 2016, encompassing both OPEX and CAPEX related to insolvency claims. From FY 2016 to FY 2024, the company has allocated a total of £75.61 million to OPEX + CAPEX.

The Red Line: This indicates the cumulative sums recovered from closed cases that have accrued to Manolete over the same period (2016–2024). Although the average investment typically has a two-year payback period, comparing inflows and outflows without adjusting for this lag still offers a reasonable cash flow proxy. Notably, the red line consistently surpasses the blue line, signaling sustained positive real cash flows (the gap between the red and blue lines representing the relatively stable 16.7% annual returns).

The Yellow Line: This incorporates the anticipated outsized cash inflows from cases currently being litigated, such as the significant cartel cases. By the end of calendar year 2025, cumulative OPEX + CAPEX is projected to reach approximately £85 million, while total recovered sums are expected to approach £121 million. This would result in a cumulative 42.16% uplift achieved on capital invested at various stages over the nine-year period (represented by the wine red bar).

The Green Bars: The green bars represent the cumulative return on capital from closed cases across successive time frames. The first bar reflects 2016–2017, the second 2016–2018, the third 2016–2019, and so on. Before the pandemic in 2020, returns were robust, ranging between 30% and 45%. However, the pandemic brought significant disruptions as discussed earlier. Given the 24-month lag between investment and recovery, combined with these disruptions enduring for a couple of years, it negatively affected Manolete’s returns from 2020 through to 2024 (as is clearly evident from the chart).

However, the company has emerged from this challenging period. Record cash collections and accelerated investments in new cases suggest a strong recovery ahead. The surge in insolvencies in 2023 will begin to reflect in Manolete’s results in FY 2025, with even greater impacts in FY 2026 and beyond. Cash reinvested in 2025 will start to deliver returns by 2027, aligning with the typical 24-month payback period.

As case volumes rise and operating leverage strengthens, returns on capital are expected to climb back above 30%. Assuming a stabilization at 36%, and considering the 24-month payback period, this equates to a 16.7% compound annual growth rate (CAGR) on invested capital.

The catalysts that drive this business are sums invested (which are growing) and returns on money invested (which are improving). Combine these with scope for significant multiple expansion (more on this in the next section) and the possibility of share repurchases given the huge discount to intrinsic value, and Manolete appears to be the perfect set up for any intelligent investor.

Is Manolete Partners a Good Investment?

Economic theory holds that the value of a business is not a multiple of today’s earnings, but the net present value of all future cash flows. If Manolete reinvests all of its returns in new cases, and is able to achieve 16.7% CAGR going forward, the company’s net asset value could double approximately every four years.

Manolete currently has £46 million invested in cases, a figure that could rise to nearly £70 million as its open cases - especially the significant cartel cases - are resolved. If the company reinvests all of this to expand its portfolio of cases and achieves a 16.7% net annual return, the value of the portfolio could grow to £151 million by 2030.

This is best demonstrated by extending the chart that we examined earlier (2025 numbers are estimates):

If portfolio growth is further augmented by debt, the potential for even greater returns emerge. Currently, the company pays 4.7% above the Sterling Overnight Index Average (SONIA), which itself is 4.7%, resulting in a total cost of debt of 9.4%. Given the potential to generate 16.7% returns on this borrowed capital, this set up will be highly accretive.

Let us assume that accelerated growth is achieved with the prudent use of debt financing, leading to a portfolio valuation of £170 million by the end of the decade. Discounting this at 8%, the net present value (NPV) of the business is £115 million.

Now compare this with the current market cap’ of the company and it becomes clear why Manolete appears significantly undervalued - arguably by a factor of at least 3x.

When Manolete’s shares floated in 2018 at £1.70, they quickly soared to £5.40 within six months - a staggering +317% increase. At the time, the market recognized the company as a rare, long-term compounding opportunity. Yet today, despite far stronger unit economics, the share price has dropped to £0.77, less than half its IPO valuation and down 86% from its high.

What happened to the share price?

There have been a number of factors which have weighed on the share price, some of which have already been discussed. A summary, in chronological order:

In 2020, Emergency Government measures that caused insolvency numbers to temporarily collapse, negatively impacting investor sentiment;

The profit warning in September 2022, caused by silly accounting methods and which was entirely avoidable, did nothing to win back investor confidence;

In July 2023, the PACCAR Supreme Court ruling affected litigation funders relying on damages-based agreements (DBAs). However, this was irrelevant to Manolete since it owns its claims and doesn’t rely on DBAs. Despite this, the share price dropped as the market unfairly grouped Manolete with other litigation funders.

In October 2024 a budget introduced by the new Labour government in the UK reduced the tax incentives for investing in stocks listed on the Alternative Investment Market (AIM), causing a broad selloff of AIM stocks, including Manolete.

Crucially, none of these challenges were related to the company’s underlying business, which remains robust. Recent performance metrics show clear signs of recovery and growth following the pandemic disruption and the company is stronger across every metric (except ARRCC) than ever before - and ARRCC numbers are rapidly improving, likely to soon surpass prior highs.

Key valuation multiples (annualized):

Price/Net Realized Revenue: 2.23x

Price-to-Earnings (P/E): 5.47x

NTM EV/EBITDA: < 1x - Have you ever seen such a quality company trading at such a ridiculously low EV/EBITDA multiple?

Whatever way you look at it, this business is priced way too low, providing it with a high margin of safety and an exceptionally favourable risk/reward profile. I remain convinced that the company is poised for a significant re-rating, delivering strong shareholder returns.

Long-term, high-conviction investors dominate Manolete’s shareholder base:

CEO Steven Cooklin and Family: Own 10.79% of the company.

Moulton Goodies: The investment vehicle of Jon Moulton, a renowned venture capitalist, holds 26.53% (he was a pre-IPO investor).

Mithaq Capital: A Saudi family office owns 17.55%.

Michael Faulkner: CEO of River & Mercantile, an early backer since Manolete’s 2009 inception, holds 12.70%.

The continuing conviction of its long-term oriented investors further underscores the quality of this business.

In total, these investors own 67.6% of the company, leaving only 32.4% of the stock available for public trading. With just £11 million worth of stock available on the open market, if you want to take a meaningful position, it requires patience1. However, it also means that the share price is highly sensitive to any influx of new investment. A relatively small amount of buying activity could trigger a significant re-rating, although with the stock trading at less than 25 pence on every pound of value, there is plenty of opportunity to buy this one all the way up to fair value.

With its deeply discounted market cap, there’s a possibility that one or more of its major shareholders could attempt to take the company private. While this could serve as another catalyst for unlocking value for investors entering today, I believe it would be a mistake.

Manolete is inherently suited to being a public company. The business’s value is maximized by reinvesting all earnings into expanding its portfolio. As a private company, however, the only way for investors to extract value would be through regular dividends - an approach that directly conflicts with the objective of optimizing compounded growth.

In contrast, as a public company, the dynamic changes significantly. As the company’s capitalized value grows over time, shareholders can unlock value by selling small portions of their holdings at progressively higher share prices instead of relying on dividends. This approach preserves the company’s ability to optimize reinvestment and compounded growth.

While Manolete remains a micro-cap, institutional investors will remain uninterested as they can’t acquire enough stock to significantly impact their fund's overall performance. However, as the company’s valuation recovers to a level more commensurate with its intrinsic value, the market cap’ will increase significantly and institutional investors will start to take notice. It may then transition from the Alternative Investment Market to the premium segment of the London Stock Exchange, at which point it will be included in the FTSE indices and attract investment from passive funds.

As I said in the opening of this analysis, the last time I introduced a company like this to the investment community, it was up 200% in a year and up 500% within three. This business looks equally attractive at this time. If it doesn’t at least double this year, I would be amazed.

This company has every catalyst for impressive shareholder returns. This could be a rare opportunity to invest in a high-quality, undervalued compounder at the bottom of its cycle - making this an ideal time for contrarian investors to act. Time to back up the truck?

It is worth noting that the London Stock Exchange operates SETSqx (Stock Exchange Electronic Trading Service) for smaller less liquid stocks. To improve market efficiency it focuses liquidity in four daily ten minute auction events (07:50, 08:50, 10:50. 13:50 and 16:30), which facilitates more efficient trading. All orders are electronically collected from the order book and a matching algorithm calculates the price at which the maximum number of shares can be executed. This can result in a delay in order execution, so beware. If you place an order with permission to trade outside of regular trading hours, trades may occur outside of these auctions on a regular open market basis if matched with similar orders.

Trading update, 29th April 2025

Highlights for FY25:

· Record new case investments of 282 (FY24: 276) - excluding extraordinary Bounce Back Loan cases

· Record new case referrals of 896 (FY24: 731)

· Record volume of case completions at 272 cases (FY24: 251)

· Gross cash recoveries of £25.6m (FY24: £17.7m)

· Net cash income from completed cases £13.3m (FY24: £10.8m)

· Estimated total revenue of £30.8m (FY24: £26.3m)

· EBIT of £3.2m (FY24: £2.5m)

· Net Debt £11.1m (FY24: £12.3m)

· New bank facilities agreed with HSBC

Steven Cooklin, Chief Executive Officer, commented: "The past year has seen Manolete achieve record KPIs across all key metrics of the business and outperform market forecasts. Given the strong tailwinds presented by the challenging UK and global business environments, we expect to build upon those achievements in the forthcoming year."

A key metric is the ARRCC (average realised revenue per completed case) which stood at £108k (FY24: £96k). The ARRCC is important because the cost of litigating a claim involves similar amounts of time and effort, regardless of the sums involved. So a portfolio of larger sized cases will enjoy greater operating leverage, boosting marginal returns. Accordingly, the combination of higher case volumes and larger case sizes will lead to a material transformation in the profitability of the business. The continued positive trend towards larger average case sizes is in line with the Board's previously stated expectation that average case completion sizes would likely increase as the number of medium and large company insolvencies returned to their normal levels in the UK insolvency market following the withdrawal of the UK Government's significant financial support to businesses over the Covid period of March 2020 - April 2022, as well as the temporary suspension of key insolvency laws during that same period. Pre-covid the ARRCC stood at ~£200k and it is anticipated that it will return to that level - the trend seems to confirm that expectation.

The Company enjoyed a record FY25 in terms of all its key operating metrics and finished the year with 438 live cases in progress (FY24: 418) with an estimated Net Book Value of £41.8m (FY24: £40.2m) which gives the Board confidence in the prospects for the current financial year. In anticipation of another busy year ahead, the Company will welcome two new senior level hires into the existing 15-strong in-house legal team during the first four months of the new trading year.

Today Manolete Partners has announced that it is replacing its CFO.

https://d2ysp6t8sg26jc.cloudfront.net/2025-04-07/9585D/e69a39b50380c15f54c3b42b5d3994b06dd2ff79.pdf

This is welcome news and long overdue. He wasn't the right man for the job.