Our series on mental models continues with Part #2. If you haven’t read the first two, here are the links:

Mental Models #1 - The need for a lattice of mental models, Charlie Munger

Mental Models #2 - Commercial democratization as a mental model

Mental Models #3 - Incrementally better isn’t enough, be fundamentally different

Mental Models #4 - Ideas have no value

Mental Models #5 - Scale economic shared

Mental Models #6 - coming soon

There are more to follow in the weeks ahead. Don’t miss them, sign up and we’ll send them directly into your inbox:

Consider this, a great business is not necessarily one that produces the best goods and services - instead it is the company that produces the most customers. Take McDonald's, for instance. It neither produces high quality food, nor does it offer a particularly enjoyable dining experience, yet in terms of profitability it outperforms restaurant businesses focused on creating gourmet food and providing the best service. Why? Because McDonald's excels at producing a vast customer base.

Consider the car brand Ferrari, renowned for its ultimate luxury and production of some of the most technologically advanced iconic road cars available. However, these vehicles come with an exorbitant price tag, limiting Ferrari's ability to attract a wide customer base compared to brands like Porsche or Toyota.

Operating at the pinnacle of the automotive industry's margin spectrum, Ferrari boasts a 48 percent gross margin, albeit at the expense of volume. In contrast, Porsche maintains a gross margin of 29 percent, while Toyota adopts an aggressive pricing strategy, resulting in an 18 percent gross margin.

Despite Ferrari's impressive margins, its production volumes pale in comparison to its counterparts. In 2022, Ferrari achieved a record production rate of 1½ cars per hour. In contrast, Porsche delivered approximately 40 vehicles per hour, while Toyota churned out a staggering 1,024 vehicles per hour. Consequently, while Ferrari boasts net profits of $1 billion, Porsche's profits hover around $5 billion, and Toyota leads the market with profits closer to $20 billion.

While Ferrari occupies a niche luxury segment, Toyota stands as the dominant force in automotive production. Producing customers is everything and Toyota produces the most.

In a world where exclusivity often reigns supreme, the vast majority of people are left wanting. This pent up demand, if unlocked, creates a huge amount of value and the company holding the key is able capture a sizeable piece of that value.

Many of the world's most successful businesses have thrived by democratizing goods and services, making them more affordable or accessible to the average person. This strategy has proven to be a powerful force for commercial success across various industries.

Henry Ford's vision to produce affordable cars revolutionized personal transportation, making it accessible to a much broader segment of society. Similarly, Southwest Airlines transformed air travel by introducing very low fares, competing not just with other airlines but with ground transportation.

Other examples of successful democratization include McDonald's making dining out affordable and consistent, Clairol bringing hair coloring from salons into homes, Uber disrupted the taxi industry and IKEA offering stylish furniture at accessible prices. In the financial sector, Bank of America expanded access to essential banking services for ordinary people. Technology companies like IBM democratized computing and Amazon brought retail directly into a consumers home. Even innovative startups like Dollar Shave Club have disrupted established markets by offering quality products at lower prices through new business models.

But why is this democratization such a powerful force for commercial success? For one, it dramatically expands a company's market reach. When you make your product accessible to a wider audience, you're not just increasing sales; you're building brand recognition and loyalty on a massive scale. It's the difference between being a niche luxury brand and a household name.

Moreover, this approach often drives innovation. When companies strive to offer high-quality products at lower price points, they're forced to think creatively, streamline processes, and embrace new technologies. This not only benefits the consumer but also keeps the company agile and competitive in an ever-changing market landscape.

There's also a feel-good factor that shouldn't be underestimated. Companies that successfully democratize their offerings often gain a reputation as brands that care about their customers. This positive association can lead to long-term customer relationships and powerful word-of-mouth marketing – the kind of advertising money can't buy.

From a broader perspective, the democratization of goods and services can contribute to overall economic growth. When more people have access to products and services that improve their quality of life or expand their opportunities, it can have a ripple effect throughout the economy.

As we look to the future, the businesses that will thrive are those that succeed in democratizing goods and services, unlocking previously untapped demand and capturing significant value in the process.

This isn't just a trend; it's a strategic approach for long-term growth, whether achieved through innovative business models or the smart application of technology.

So, when evaluating a business, don't become wrapped up in a narrative about some wonderful ground-breaking technology, a new revolutionary product or a superior service being brought to market.

Kodak invented the first digital camera in 1975, setting the stage for a promising future in digital photography. This could have been a compelling narrative for investors. However, fearing that digital would cannibalize its profitable silver halide film business, Kodak hesitated to embrace the new technology. This reluctance ultimately led to the company's downfall, despite once being a member of the elite Nifty-Fifty stocks. The real democratization of digital photography came later with the introduction of smartphones, particularly Apple's iPhone.

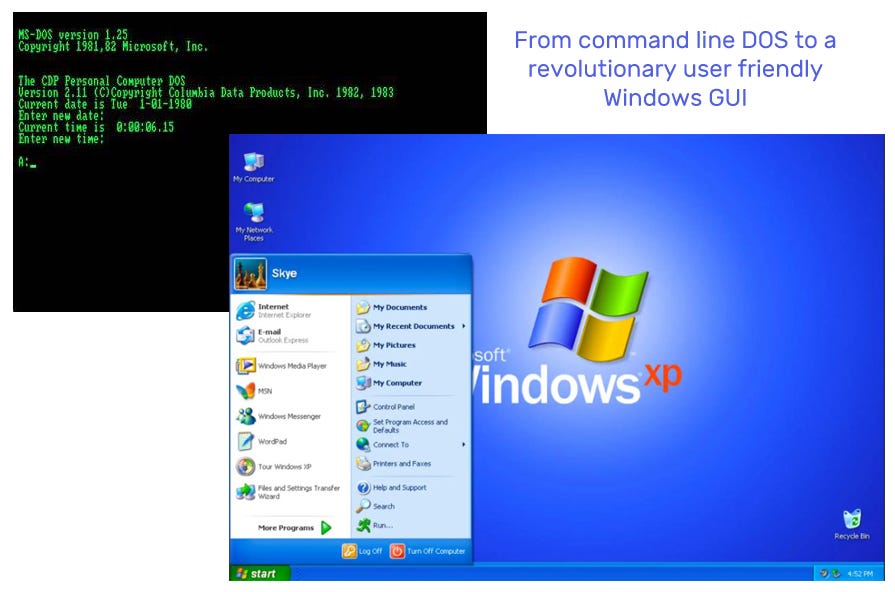

Similarly, Xerox's Palo Alto Research Center (PARC) pioneered revolutionary technologies in the 1970s, including the graphical user interface (GUI). At a time when computers required knowledge of command line DOS, the GUI was a game-changer that made computing accessible to the general public. This too would have been a compelling narrative for investors, yet despite pioneering this groundbreaking technology, Xerox failed to capitalize on it. This opened the door for Bill Gates to borrow the idea and launch his own GUI named Windows. It was Microsoft that democratized computing not Xerox and, with the benefit of hindsight, we know which was the better investment.

In conclusion, it's not narrative but democratization that drives great long-term investments. Focus on businesses that are actively democratizing a market. Hopefully, this will provide you with a new mental model for your investing tool-box.

If you are interested in learning about other golden threads running through the fabric of every successful business, I recommend reading ‘Fabric of Success’.

Why not share in the comments below the names of any businesses which you believe to be democratizing a market today?