Northeast Bank, or is it a Credit Fund?

Revolutionizing Credit with a Community-Centric Banking Approach

DISCLAIMER & DISCLOSURE: The author, James Emanuel, holds a position in Northeast Bank at the date of publication but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Why Should I Be Interested In Northeast Bank?

If you were to consider investing in the banking sector, names like JP Morgan, Bank of America, Wells Fargo, or Goldman Sachs likely come to mind.

However, some of the most compelling opportunities lie in niche banks that fly under the radar and Northeast Bank (Nasdaq: NBN) is one of them.

Before I introduce you to this particular bank, it is important for you to have a high level perspective of the banking industry, which will help you to appreciate what makes Northeast Bank special.

Since the Global Financial Crisis (GFC), U.S. banks have had to reinvent themselves. Stricter regulations requiring costly compliance reshaped their business models, squeezing profits and forcing them to adapt in different ways.

For instance, rather than using the financial markets to mitigate risk, Silicone Valley Bank (SVB) decided to trade duration to boost profitability - by borrowing short (through deposits) and lending long (various forms of debt), SVB was essentially "playing the yield curve". When interest rates surged and the curve inverted, that gamble turned catastrophic, leading to the bank’s collapse.

Fast-growing banks, such as SVB, may enjoy short-term success, but their rapid expansion often leads to lower underwriting standards, reckless lending, or poor asset management - making them dangerous investments.

Other banks took a different approach, doubling down on digital platforms, fee-based services, or subscription models to stabilize revenues. These slow-growing banks can sometimes become undervalued, offering special situation investment opportunities. but these are typically best suited for deep-value banking specialists.

Of the thousands of banks that exist in the US, and indeed globally, most will fall into one of the two categories described above and so most investors are best advised to exclude them from their watchlist.

However, once in a while, something very special appears on the radar - a bank with a business model that isn’t incrementally better, but fundamentally different. Rather than clinging to low-value core banking activities, Northeast Bank pivoted sharply toward credit. The result? A first-class operating model, an exceptional management team, and an impressive performance track record. In a sector where many struggle to find interesting investments, Northeast Bank is a unique story - one worth paying attention to.

The Beauty of Credit Exposure Today

Having explored the nuances of the banking sector, let’s now turn our attention to the shifting landscape that has occurred for investors.

Why is credit risk exposure so attractive right now?

For over a decade - stretching from the 2008 Financial Crisis to 2022 - we lived in an era of extraordinarily low interest rates. During this time, government bond yields sank into negative real territory, meaning institutions were essentially paying borrowers to take their money. Hardly an ideal environment for investing in credit instruments.

With safe returns nonexistent, investors chased yield wherever they could find it - piling into riskier assets like real estate, equities, and even crypto. Cheap borrowing fueled this frenzy, inflating asset prices and creating speculative bubbles across markets.

The result? Equity valuations detached from fundamentals. Consider this: the S&P 500’s current earnings multiple stands at 29.8x, nearly double its historical average of 15x. That means roughly half of today’s equity valuations stem from multiple expansion - driven more by market exuberance than economic reality.

The numbers tell the story:

In 2023, the S&P 500 surged 26%, despite sales growing just 10.8% and earnings rising 13.1%.

In 2024, the index climbed another 25%, even as sales growth slowed to 5% and earnings growth to 9.4%.

Clearly, stock prices are rising faster than corporate performance - classic warning sign.

Additionally, with the S&P 500 capitalized at 29.8x earnings, another red flag is that debt instruments, even risk-free Treasuries, currently have a higher earnings yield than equities.

Will the bubble burst? Maybe. Maybe not. Even if it doesn’t, future shareholder returns are likely to stagnate as fundamentals struggle to catch up with valuations.

This is supported by J.P. Morgan Asset Management, which recently analyzed historical stock market data and plotted a chart illustrating the relationship between starting valuations and subsequent returns. Each square on the chart represents a month from 1988 through late 2014, showing the forward earnings multiple of the S&P 500 at the time and the corresponding annualized return over the following ten years (bringing us up until 2024).

The results reveal a clear pattern: higher earnings multiples consistently lead to lower long-term returns and there are no significant exceptions.

Right now, earnings multiples sit in the top decile of historical observations (to the right of the green bar on the chart) meaning history suggests negative real returns over the next decade for investors buying at today’s inflated levels.

This doesn’t mean avoiding the stock market entirely. The S&P500 is heavily weighted in favour of the magnificent seven stocks and their stretched valuations have skewed the index. So this situation calls for a more strategic approach - selective stock picking or exploring alternative asset classes - such as credit - that were overlooked when interest rates were near zero.

Now imagine finding a bank, which is fairly valued, which provides indirect exposure to the credit market. That would appear to be a home run, which is what attracted me to Northeast Bank - a credit fund operating under the guise of a traditional bank.

With higher rates, credit markets now offer far more attractive risk-adjusted returns than they did just a few years ago. And when it comes to credit investing, few voices carry more weight than Howard Marks, founder of Oaktree Capital. Here’s a short video where he shares his thoughts on this very topic:

Tell Me More About Northeast Bank

[NOTE: Before we dive in to this analysis, it is important to point out that the banking sector is challenging for most investors because of its unique structure - debt is a raw material and revenue is difficult to nail down, so normal financial statement analysis is turned on its head and banks tend not to screen well. For this reason, investing in banks tends to attract specialists who understand their idiosyncratic nature, and most other investors miss out on some wonderful opportunities. Hopefully I can change that here.]

Northeast Bank is a regional bank serving communities in Maine. What sets it apart from other regional banks, however, is its distinctive business model - actively purchasing and originating loans (credit) across the U.S. making it a national bank.

Founded in 1872, Northeast Bank spent most of its history as a typical regional bank. As with most financial institutions, it was negatively impacted by the Great Financial Crisis (GFC) of 2008. Then, in 2010, a group of investors led by Rick Wayne (current CEO) and Patrick Dignan (current COO), took over. They implemented a bold strategy that transformed the bank’s operating model into a powerhouse of profitability.

Their approach? Acquiring small-balance commercial loans at a discount in the secondary market. These loans periodically become available for various reasons, such as financial institutions rebalancing portfolios, raising capital, or divesting non-strategic assets. In some cases, regulatory mandates require the sale of certain assets, while loan books may also emerge from failed banks. Northeast Bank is essentially a highly profitable credit fund disguised as a bank (more on this later).

Wayne and Dignan had already proven this strategy at Capital Crossing Bank, where they generated stellar returns. Between 2000 and 2007, not only were returns strong, but they repurchased around half of the shares outstanding, amplifying investor returns and generating a 23% CAGR over the period.

In 2007 they sold Capital Crossing Bank to Lehman Brothers for ~3x book value, just before the financial crisis hit. Was it luck or foresight? Either way, their timing was impeccable.

After Lehman collapsed, Wayne reassembled his old team and sought to apply the same winning formula, but this time under the banner of Northeast Bank which he and a group of investors were able to acquire in the wake of the GFC.

This combination of expertise, strategy, and execution makes Northeast Bank an exciting investment opportunity worth a closer look.

A Proven Blueprint for Success

Northeast Bank is not the only high-performing niche bank in the U.S. Others have set compelling precedents, offering valuable insights into where Northeast Bank might be headed over the next 5 to 10 years.

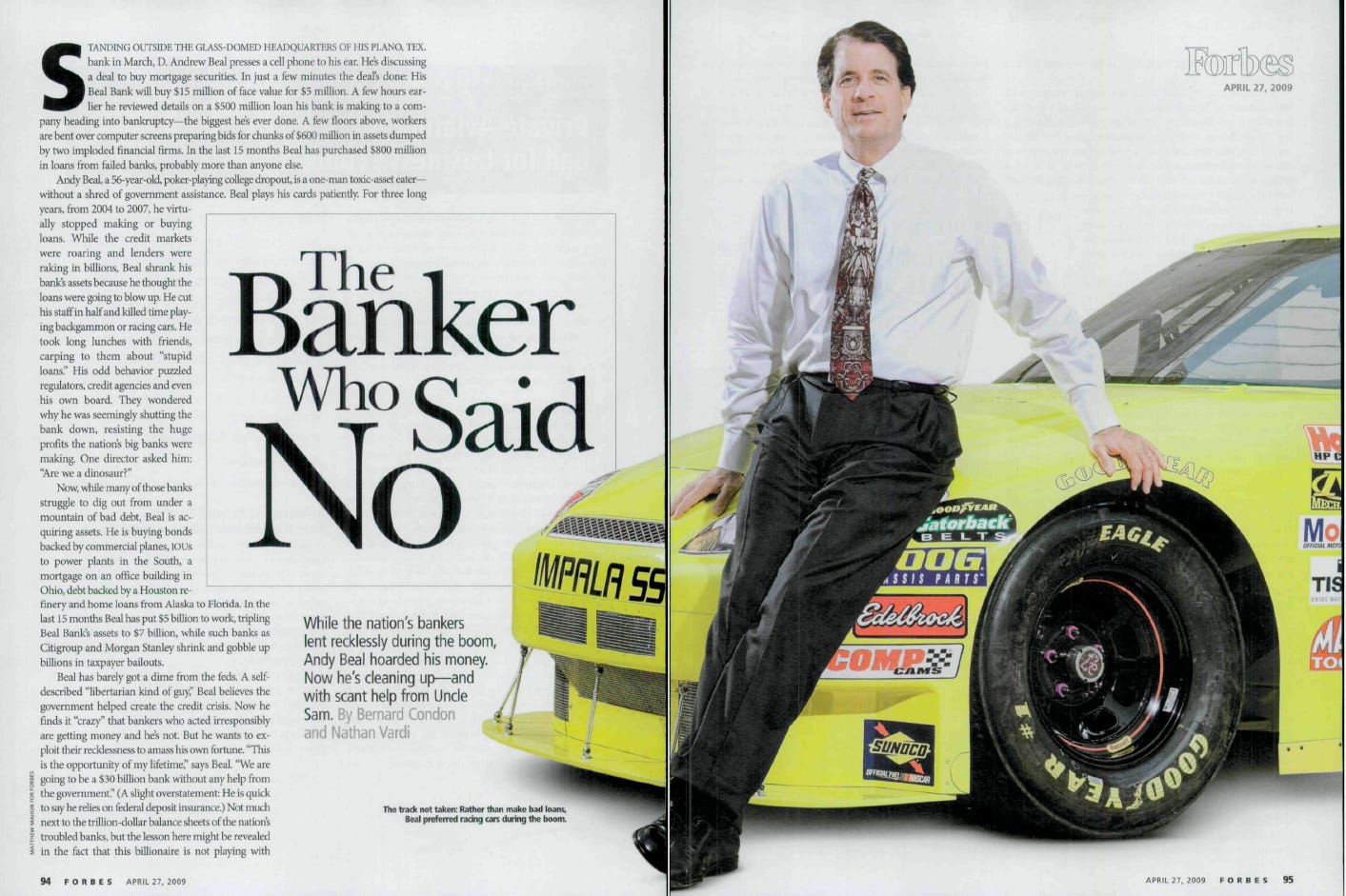

Take, for example, Andy Beal’s Texas-based Beal Bank and the achievements of Frank Holding Jr. at First Citizens Bank - both have delivered outstanding shareholder returns. Beal, in particular, stands out as America’s wealthiest banker, amassing a self-made fortune of over $10 billion through unconventional strategies. If you're interested in learning more, Forbes published an insightful article on him:

While Beal Bank and First Citizens Bank are currently much larger than Northeast Bank, CEO Rick Wayne seems to be cut from the same cloth as Andy Beal and Frank Holding. Some may even say that Wayne has borrowed from the Beale playbook - those familiar with Beal Bank’s approach will likely notice striking similarities as they delve deeper into this analysis

All of this suggests that Northeast Bank is well positioned for continued outperformance. For long-term investors, now may be an opportune moment to get on board and enjoy the ride.

Don’t Judge A Cover By It’s Book

Northeast Bank is committed to book value accretion and has experienced significant growth since its transformation under CEO Rick Wayne, as illustrated in the chart below.

Notably, this growth has not been driven by new equity capital; in fact, just as he did at Capital Crossing Bank, Wayne has reduced the share count at Northeast Bank, from 9.5 million in 2016 to approximately 7.8 million today. He is an intelligent capital allocator. The chart below highlights the steady increase in book value per share over the past decade.

It should be noted that Wayne is not adverse to issuing new equity if doing so would be accretive to the business and its shareholders. In December 2024, Northeast Bank announced an at-the-market (ATM) offering of its voting common stock, aiming to raise up to $75 million. An ATM offering allows the bank to sell shares incrementally at prevailing market prices, providing flexibility to raise capital as needed. The bank intends to use the net proceeds from this offering for general corporate purposes, including supporting additional growth.

Operationally, Northeast Bank maintains a strong efficiency ratio and a return on equity that outpaces many of its peers, demonstrating its disciplined approach to financial performance.

The bank operates with a capital-light structure, consisting of just seven branches and approximately 194 full-time employees - a number that has remained largely unchanged since 2016.

In fact, management embraces a lean, frugal mindset, reminiscent of corporate leaders like Herb Kelleher, Jeff Bezos, Sam Walton, and Tom Murphy, something to be welcomed by investors.

Northeast Bank vs. Financial Select Sector

Northeast Bank has significantly outperformed the Financial Select Sector SPDR (XLF) across all time frames. XLF, which tracks a market-cap-weighted index of S&P 500 financial stocks—including JP Morgan, Visa, Mastercard, Bank of America, Goldman Sachs, and American Express—serves as a useful benchmark (see five-year comparative chart below).

Despite its impressive track record since the transformation, Northeast Bank remains relatively under the radar among investors. This presents a compelling opportunity for those seeking exposure to a differentiated financial institution with a proven strategy.

Moreover, the U.S. banking landscape is shifting, with regional banks poised to capture market share from larger institutions by offering personalized services and innovative financial products. Northeast Bank is well-positioned to capitalize on this trend, particularly through its groundbreaking credit business model.

Northeast Bank’s Unique Business Model

Unlike traditional banks that rely on deposit growth and broad-based lending, Northeast Bank operates with a differentiated two-pronged approach:

1. Community Banking Division

Northeast Bank's Community Banking Division focuses on conventional retail banking, offering personal and business banking products such as checking and savings accounts, credit cards, residential mortgages, and small business loans. Unlike larger banks that prioritize scale and automation, Northeast Bank differentiates itself through local expertise and a customer-centric approach. By deeply understanding the regional economies in which it operates, the bank aligns its financial solutions with the specific needs of its customers.

Northeast Bank combines cutting-edge technology with a human touch to provide tailored financial solutions. The bank leverages advanced AI and machine learning algorithms to assess credit risk in real-time while also offering personalized financial advice to borrowers. This proactive approach helps customers improve their credit health, strengthens long-term relationships, and enables the bank to offer competitive rates while minimizing defaults.

To promote financial inclusion, Northeast Bank has developed a proprietary credit scoring system that extends beyond traditional FICO scores. By incorporating local economic data, employment trends, and community relationships, the bank can extend credit to underserved populations - including small businesses, first-time homebuyers, and individuals with limited credit histories. This strategy not only strengthens community ties but also fosters customer loyalty.

Recognizing the growing demand for sustainable finance, Northeast Bank has expanded its green lending program. The bank provides financing for homeowners seeking to invest in eco-friendly upgrades such as solar panels, enhanced insulation, and other environmentally beneficial initiatives.

Despite its community-oriented initiatives, the Community Banking Division remains a minor part of Northeast Bank’s overall operations, accounting for less than 1% of total lending activity. As shown in the chart below, community banking represents only a small fraction of the bank’s total loan portfolio.

The overwhelming majority of earnings stem from the National Lending Division, reinforcing the idea that Northeast Bank functions more like a credit fund disguised as a bank - an aspect that adds to its appeal from an investment perspective.

2. National Lending Division

The National Lending Division is the bank’s primary revenue driver, specializing in the purchase and origination of commercial real estate (CRE) loans. Despite being a small regional bank geographically based in the Northeast, this division operates nationwide.

National lending bifurcates into two sub-segments:

Originated Loans: These loans are directly structured by Northeast Bank, predominantly with floating interest rates, ensuring adaptability to interest rate fluctuations. SBA loans form a key part of this segment (more on this shortly).

Purchased Loans: The bank acquires performing loans on the secondary market at discounted prices, generating strong cash flows and superior risk-adjusted returns. This strategy offers dual benefits: capital appreciation on the discounted acquisition cost and consistent yield from interest payments.

This model creates a countercyclical balance since opportunities for loan purchases increase during economic downturns, while originations thrive in stronger markets.

As of Q2 2025, the National Lending Division’s loan book stood at $3.6 billion, with two-thirds allocated to purchased loans and one-third to originated loans (see chart above).

Northeast Bank operates in a lending segment that is often overlooked by larger financial institutions. Its loans average around $990,000, with purchased portfolio loans averaging a lower $717,000. Large banks typically bypass these smaller loans due to lower profitability per transaction, while private credit funds prefer larger, bulkier deals.

While other regional banks may be interested in this size of loan, they tend to be community banks with a very narrow focus both geographically and in terms of loan type. In contrast, Northeast Bank’s willingness to acquire a more diverse book of loans gives it an edge. This market inefficiency allows Northeast Bank to acquire high-quality loans with relatively little competition, leading to superior risk-adjusted returns.

The SBA Loans

Another key component of Northeast Bank’s growth strategy includes Small Business Administration (SBA) loans - also known as 7(a) Working Capital Loans - a niche market in which it partners with Newity, a Chicago-based financial solutions provider dedicated to helping American entrepreneurs access capital of up to $500,000.

Newity operates a technology-driven SBA loan platform that processes approximately 10,000 applications each month with speed and efficiency. By combining Newity's expertise in small-dollar lending with Northeast Bank’s status as an SBA Preferred Lender, the partnership creates a mutually beneficial relationship that supports a diverse range of small businesses. Moreover, Newity’s commitment to serving underserved communities aligns with the SBA’s mission and strengthens Northeast Bank’s community-focused approach.

A significant portion of these SBA loans is guaranteed by the government (~75% to 85% guaranteed). The guaranteed portion of SBA loans can be bought and sold on the secondary market, a key part of Northeast Bank's business strategy to generate profits and manage its loan portfolio by balancing risk and complying with regulatory requirements. It typically originates these loans in partnership with Newity, then resells the guaranteed part of the loan capturing a margin of ~8%, while retaining the balance on which it generates net interest income.

The chart below demonstrates how significant the gain on the sale of SBA loans is to the non-interest income of the business. Sequential increases on a quarterly basis are truly impressive. The partnership with Newity, which began recently in August 2021, is still in its infancy and there is a great deal of scope for this part of the business to multiply in size.

Northeast Bank is strategically leveraging its ATM equity funding, mentioned earlier, to materially increase its SBA lending volumes, so this looks like being an excellent catalyst to amplify its compounded growth.

At the end of 2024, the SBA origination market was valued at over $31 billion and has grown at ~6% annually over the past five years. Newity and Northeast Bank's partnership has shown impressive results in this growth area, with Northeast Bank becoming the nation's number-one SBA lender by deal volume in the early part of fiscal 2025.

Management & Growth Strategy

Strong leadership is a cornerstone of Northeast Bank’s investment appeal. CEO Rick Wayne and COO Patrick Dignan have worked together successfully for decades, both at Northeast Bank and previously at Capital Crossing Bank. They have built an enduring and highly successful partnership, consistently delivering shareholder value through strategic decision-making and disciplined execution. Their stability, industry expertise, and deep understanding of the financial landscape provide a solid foundation for continued growth.

The board of directors further enhances this leadership, notably including a former Chief Investment Officer of BlackRock Alternative Investors, who has served as Chairman since 2010. For a financial institution of Northeast Bank’s size, securing such high-caliber leadership is a remarkable achievement. This speaks volumes about the strength of Northeast Bank’s business model and its ability to attract top-tier talent.

CEO Rick Wayne is the bank’s largest shareholder, holding a 7.59% stake worth over $60 million—approximately 7.5 times his total annual compensation. COO Patrick Dignan owns 0.59%, valued at nearly $5 million. Collectively, management controls around 14.5% of Northeast Bank’s stock, ensuring strong alignment with external shareholders.

The leadership team’s compensation structure further reinforces this alignment. Incentive pay consists of a base salary and performance-based rewards, delivered through a combination of cash and stock. The cash portion is tied to pre-tax profitability, while the equity component is based on achieving return-on-assets targets measured over a rolling three-year average.

Beyond Wayne and Dignan, Northeast Bank’s management team brings deep expertise in credit quality and underwriting. This expertise enables them to engage in profitable lending while effectively mitigating risk. Their disciplined approach is reflected in strong financial performance, including consistent net income growth and healthy margins.

Furthermore, the team prioritizes transparency and shareholder engagement, consistently providing strategic insights and operational updates during earnings calls. This commitment to clear communication underscores their focus on maintaining investor confidence and driving long-term results.

Management aims to continue expanding the loan portfolio by targeting opportunistic loan purchases in high-yield segments. Leveraging its reputation as a “strong and reliable counterparty,” Northeast Bank has secured major deals, including the acquisition of $1 billion in loans in late 2022 and an additional $805 million in 2024, showcasing its aggressive growth strategy.

“We have developed a reputation in the loan purchase market as a strong and reliable counterparty. Our experienced, professional, and dedicated team allows us to take advantage of the opportunities that are available to the Bank.”

Rick Wayne, Chief Executive Officer

Looking ahead, several factors could drive further growth for Northeast Bank. Continued stress and consolidation in the banking sector create more opportunities to acquire discounted loans, aligning perfectly with Northeast Bank’s core business strategy.

The more restrictive Federal Trade Commission policies of the Biden administration resulted in a slowdown in merger and acquisition activity in the banking sector. However, with the new Trump administration, a more favourable regulatory environment for consolidation is expected, potentially accelerating the availability of loan books. Perhaps this is another reason that Wayne has mobilized an additional $75 million of at-the-market equity capital in anticipation of more loan books becoming available.

Whatever the future holds, the management team’s track record suggests that the bank will continue to identify and execute on high-return opportunities.

Loan Book Quality: A Disciplined Approach

A key driver of Northeast Bank’s success is its disciplined underwriting strategy, which prioritizes credit quality and risk management.

While the bank’s concentration in commercial real estate loans introduces sector-specific risks, its prudent management approach provides a significant margin of safety. Northeast Bank focuses exclusively on performing, cash-flowing loans with established credit histories, avoiding high-risk assets such as land, construction, and condominium developments.

Because it primarily acquires existing performing loans with documented credit histories, Northeast Bank gains a clearer understanding of asset quality than the original underwriter. This reduces uncertainty and enhances risk-adjusted returns.

Northeast Bank maintains a conservative loan-to-value (LTV) ratio, averaging just 48% as of Q4 2024. This ensures strong collateral coverage, significantly lowering potential credit losses. The bank’s cautious approach has resulted in exceptional credit performance, with minimal defaults and remarkably low charge-offs.

A charge-off occurs when a lender deems a debt unlikely to be collected. As shown in the chart below, net charge-offs (NCO), including those under the Current Expected Credit Losses (CECL) framework introduced by the Financial Accounting Standards Board (FASB) in 2016, have remained between 0.2% and 0.3% of the average loan portfolio at any given time. This consistency highlights the bank’s ability to minimize credit risk while maintaining strong profitability.

Remarkably, in the decade from 2012 to 2023, Northeast Bank’s cumulative net charge-offs (NCO) totaled just $5.3 million - a testament to its strong credit discipline.

Another way to analyze the quality of a bank’s underwriting is to look at its criticized loans - those which regulators or internal risk management teams have identified as being at higher risk of default or impairment.

As of late 2024, Northeast Bank reported criticized loans (including those merely on a watch list) at just 1.4% of its total loan portfolio, indicating a relatively healthy loan book with minimal signs of potential weakness.

Let’s put that in perspective: Covid-19 and a spike in interest rates delivered a double shock to the economy, impacting criticized loan rates across the commercial real estate sector. For instance, many banks have reported significant increases in criticized office loans. New York City's criticized office loan rate rose to 44.5% in Q1 2024, up from 33.5% the previous year. This is not atypical (see chart below). Against this backdrop, Northeast Bank’s 1.4% rate is truly astounding

Northeast Bank has non-performing assets (NPAs), in this case loans, of only 0.8% relative to the industry average of 1.5% as at September 2024. In fact, the industry average has fluctuated over time reaching an all time high of 7.5% in 2010 and a record low of 1.2% in September 2022, so Northeast’s 0.8% is truly exceptional by industry standards.

The low levels of criticized loans and non-performing assets allow Northeast Bank to maintain a strong Loan Loss Reserve (LLR) - a financial buffer set aside to cover potential loan losses - without straining its capital. Additionally, the bank’s lower-than-average capital requirements enhance cash flow efficiency, providing greater financial flexibility.

Competitive Advantages: A Credit Business with a Banking Edge

Northeast Bank operates more like a credit business than a traditional bank, setting it apart from competitors. However, unlike pure credit funds, being a bank it benefits from a lower cost of capital - a key structural advantage. Banks essentially hold a government license to borrow money cheaply and lend it at a premium, generating strong returns on leveraged capital. This dynamic makes Northeast Bank’s model both unique and highly profitable.

Northeast Bank’s lower funding costs enables either higher profit margins or else the ability to outbid competitors in the secondary loan market, as its lower hurdle rate gives it a pricing edge. Either way, the outcome is favourable.

Additionally, when sellers divest loan portfolios, they often prefer a regulated bank over alternative buyers to protect their own reputation. This gives Northeast Bank preferred bidder status, and so privileged access to high-quality loan opportunities.

Last, but by no means least, its nimble operating model means that it has much faster access to capital enabling it to pounce on opportunities that others are too slow to exploit. This is due to its deposit mix, a large proportion of which takes the form of certificates of deposit (CDs) over traditional bank deposits:

The chart above categorizes Northeast Bank’s deposit structure:

Demand and Checking Accounts – Standard accounts allowing withdrawals at any time.

Savings and Money Market Accounts – Higher-yielding accounts with more restricted withdrawal options.

Time-Based Deposits (CDs) – Fixed-term agreements with early withdrawal penalties, offering greater capital stability.

"Banking is, essentially, a government license to borrow money cheaply. Anyone can make loans, but only licensed, government-sanctioned banks can accept deposits. That’s why the legal and economic value of a bank is in gathering deposits from loyal customers"

George Gilder: Writer, economist, and co-founder of the Discovery Institute.

Unlike traditional banks, which must constantly deploy capital to cover operating expenses, Northeast Bank leverages certificates of deposit (CDs) strategically. Since CD deposits cannot generally be increased after the initial deposit, the bank can control the timing of capital deployment, allowing CDs to mature when there are no opportunities for Northeast Bank to deploy capital intelligently. This accordion-like approach to accessing capital provides two key advantages:

Selective Capital Deployment – The bank can be patient, waiting for the right opportunities instead of being forced to lend continuously.

Liquidity and Agility – When lucrative lending opportunities arise, Northeast Bank can quickly mobilize capital, unlike many competitors that are locked into rigid funding structures.

While this method results in non-linear capital deployment and slightly higher deposit costs relative to peers, it grants Northeast Bank a unique competitive edge, ensuring capital is deployed only when it makes financial sense - a flexibility most banks and credit funds lack.

By combining the best attributes of a credit fund and a bank, Northeast Bank enjoys a unique competitive edge that enhances both profitability and market positioning.

That having been said, the originated loan activity is more predictable:

Northeast Bank’s operational agility gives it a significant edge over traditional banking institutions. While many banks rely on a stable but rigid balance sheet structure, Northeast Bank expands and contracts its loan portfolio opportunistically.

This adaptability was particularly evident during the Covid-19 Paycheck Protection Program period, when Northeast Bank leveraged its expertise to originate $3.3 billion in loans and fund $11.2 billion, generating exceptional profits in 2021-2022.

The bank also demonstrated its ability to act decisively by making bids for Silicon Valley Bank and Signature Bank in 2023, both bids were unsuccessful, but it further showcases the management’s opportunistic approach to capital allocation.

Return on Equity: A Cyclical but Strategic Dynamic

Northeast Bank’s business model—acquiring discounted loans using deposits—naturally increases leverage (the ratio of assets to equity) each time a new loan book is acquired. This, in turn, causes return on equity (ROE) to spike.

In the past two years, the bank has made two major acquisitions totaling $1.8 billion, representing 67% of its total loan book. As a result, ROE is currently at a high. However, as these loans mature, leverage will decline unless the bank replenishes its portfolio with new acquisitions, leading to a cyclical oscillation in ROE.

Wayne and his team will not rush to redeploy capital at unattractive rates. While this disciplined approach may lead to temporary declines in ROE, it reflects prudent stewardship of the bank which is to be welcomed, although investors need to factor this into their valuation calculations.

Investment Portfolio: A Counter-Cyclical Buffer

Northeast Bank’s investment portfolio consists of:

U.S. Treasury obligations

Securities from federal agencies

State and municipal government securities

Residential mortgage-backed securities (issued by Fannie Mae, Freddie Mac, and Ginnie Mae)

While some of these investments have maturities of 10+ years, the bank also holds municipal securities with shorter maturities (one year or more) to maintain liquidity.

This portfolio plays a counter-cyclical role, absorbing excess funds when loan demand is low and releasing capital when loan demand is high. This approach ensures the bank can efficiently manage liquidity, support loan growth, and maintain financial flexibility.

Financials and Valuation

Northeast Bank's favourable operating leverage is evident from its 42% revenue growth over the past year, while non-interest expenses rose only 21% (see chart below). This trend suggests expanding margins as the bank scales.

Key financial metrics include:

15% annual credit portfolio growth, with a delinquency rate below industry average

17% return on equity (ROE) - outpacing peers

4.9% net interest margin (NIM), driven by well-timed, high-yielding loan purchases

Efficiency ratio of 42%, well below the industry average1 (lower is better)

Consider Northeast Bank as a credit fund, a special purpose investment vehicle, rather than a bank. It’s modus operandi is to compound its net asset value by reinvesting capital at excellent marginal rates of return on equity. Not only has it achieved this objective over the 15 years of Wayne’s tenure, but it appears able to continue to do so well into the future.

The chart above shows the book value per share since Wayne acquired the bank. The first three or four years were all about restructuring - addressing cost inefficiencies, dealing with value destroying assets and navigating regulatory obstacles. Once this remedial work was complete, Northeast Bank was able to begin scaling into its new operating model and from 2014 the compound growth becomes evident.

Now consider the two very large acquisitions of loans in recent years - approximately $1 billion in loans in late 2022, followed by another $805 million towards the end of calendar 2024, and it becomes clear that this bank is only just getting started.

The bank has been trading well below intrinsic value for the last few years, but as more investors wake up to this wonderful opportunity, the share price is catching up with its true intrinsic value. The share price is up 107% over the past 12 months alone (see chart below).

If we overlay the ‘price-to-book value per share’ on the ‘book value per share’ (below) it is easy to see how undervalued the shares have been as recently as mid 2024. While the stock has traded at around 1.3x book for most of the past five years, today it is capitalized at 2.1x book.

Is this a fair valuation?

At 2x book value, Northeast Bank may appear expensive relative to traditional banks. However, given its capital-light structure and consistently high 17%+ ROE, this valuation is not unreasonable - particularly when factoring in its impressive growth rates. It is no longer the bargain it was 6 months ago, but as Charlie Munger would say, it is better to buy a wonderful company at a fair price than it is to buy a fair company at a wonderful price. Northeast Bank is certainly the former. This bank has delivered an impressive 37% annual earnings per share growth over the past five years, with no signs of slowing down.

Is Northeast Bank a Good Investment?

Northeast Bank is more than just a bank - it’s an innovator in the credit space, driving economic growth in the communities it serves while delivering strong financial returns. With a proven management team, a disciplined underwriting strategy, and a forward-thinking approach, the bank stands out in an industry often weighed down by inefficiency and outdated processes.

With over a century of stability, Northeast Bank combines long-term resilience with the agility to capitalize on modern opportunities. Unlike many traditional banks that struggle with bureaucracy, Northeast operates with a lean, opportunistic model that enables it to generate superior risk-adjusted returns.

Of course, no investment is without risks. The key-man risk tied to CEO Rick Wayne is one to call out, as his leadership has been integral to the bank’s success. However, he is well invested in the business in a personal capacity and seems intent to see his vision through. Despite the bank being over 150 years old, in its current born-again format it has only been operating for 15 years and Wayne should be considered a long-term focused founder CEO. There is also a solid team that sits behind Wayne and so a default succession plan seems to be very much in place.

Northeast Bank is a compelling investment opportunity. Its hybrid banking model, strong underwriting discipline, and ability to deploy capital opportunistically position it well for continued success. Furthermore, Northeast Bank is not adverse to strategic acquisitions and has engaged in opportunistic share buybacks from time to time, further enhancing shareholder value. With a strong foundation, exceptional management and a forward-looking strategy, the bank appears to be at the beginning of a long and prosperous journey.

The efficiency ratio of a bank is calculated as its non-interest expenses divided by total revenues, so the lower the score the better as that suggests better capital efficiency. To put it in perspective, the industry average has fluctuated between an all-time high of 66.6% in December 2007 and a record low of 52.7% in March 2023, so Northeast Bank at 42% is exceptional.

This is a nice overview, but a couple points of clarification:

You say "Northeast Bank is a regional bank serving communities in Maine, New Hampshire, Vermont, and Massachusetts, as its name suggests." Not entirely true. NBN's Community Banking Division is in Maine while the Bank lends Nationally. It does not have branches in New Hampshire, Vermont, or Massachusetts.

You provide a summary of Northeast Bank's Community Banking Division which must have been AI-generated because of how glowing it is in its description. Simply put, there is nothing unique or special about the Community Banking Division other than its deposit pricing which is used to gather capital which ultimately fuel the National Lending Division.

Where did you get the Northeast Bank logo from? Interesting that you were able to find that somewhere... it's very old.

Anyways, nice overview.

Does your thesis remain the same with $MANO ?