Retail Investing | Walmart, Costco or Amazon?

All Great Businesses, But Which Is The Better Investment Opportunity?

Investing in market leading retail has been a winning strategy for decades

Winners have included Walmart, Costco and Amazon

Unsurprisingly, these businesses share common foundations

Why have they succeeded where many others have failed?

How do they stack up against each other?

Should I consider these stocks for my portfolio?

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

Investors Look In The Wrong Places

Warren Buffett and Charlie Munger have always suggested that a business with a ‘moat’ makes the best investment. They also say that a moat is less about the business or the product, and more about the genius of the brain behind the company.

This truism is borne out in fact. Many people have run computer companies, but there was only one Steve Jobs. Many people have run software companies, but there is only one Bill Gates. Many people have run conglomerates, but there is only one Warren Buffett.

Said differently, there is little sense in having a moat to defend your castle from competitors on the outside, if its inhabitants are incapable of maintaining the castle on the inside. Find a business with a king in the castle! That’s the key to success.

Most investors look at spreadsheets of numbers, TAMs or hype in the media to drive investment decisions. They apply little or no thought to who is running the business.

Great ideas are everywhere, but very few people have the genius to deliver on those ideas. Always start with a good understanding of the management and competence of the people at the top. Ultimately, you are investing in their ability above all else.

This article focuses on the retail sector in which millions of companies operate, but most achieve nothing more than mediocrity. This is because they lack the special ingredient of management genius.

It is for this reason that I begin with analysis of the people behind the success of Walmart, Costco and Amazon (Part One below). It is important to understand what makes them tick and how they achieved greatness. Unbeknown to most, they all have a common thread running through them.

Armed with this knowledge, one is far better placed to formulate an opinion on where to invest going forward.

Walmart, Costco and Amazon are all great businesses, but which is the better investment opportunity? I attempt to answer this question (Part Two below).

Part One ~ Management Genius

"Everything that needs to be said has already been said. But since no one was listening, everything must be said again."

André Gide

“The thing that we learn from history, is that people don’t learn from history”

Charlie Munger

When I read these quotes I think about how so few people learn from those that came before them.The exception to the rule is people who achieve greatness, including those that form the subject matter of this article. They read, they study others and they build on the foundations laid by those that came before them.

While I focus on Sam Walton (Walmart), Sol Price, Jim Sinegal (Costco) and Jeff Bezos (Amazon), our story begins nearly three centuries ago with Benjamin Franklin.

Benjamin Franklin (1706-1790)

Ben Franklin was one of the Founding Fathers of the United States of America but most people are unaware that he was also a shrewd businessman who laid the foundations for Walmart, Costco and Amazon.

Franklin recognized the value of thrift and efficiency. He was an early advocate of free trade and believed that businesses should strive to offer a variety of products at affordable prices. He was one of the first to use advertising to promote his products and also a pioneer of the concept of customer service.

This latter point is critically important because every business in this article puts the customer before all else: a customer-first ethos. It was always about providing what was best for the customer. You will see this theme develop throughout this piece.

Franklin’s retail business was known as "Pennsylvania Stores". He ran his business very lean, recognizing the importance of keeping overheads low. He purchased goods in bulk (lowering COGS) and kept his store operations simple (lowering OPEX).

"A penny saved is a penny earned."

“Beware of little expenses; a small leak will sink a great ship."

Benjamin Franklin

Franklin could have sought to enrich himself with fatter profits by keeping his prices in line with the broader market while enjoying lower costs. This kind of approach is what makes most managers mediocre. Most people are not in business to provide what is best for their customers; they are in business to provide what is best for themselves.

Franklin was different. He was always customer-first. So he passed on the cost savings to his customers. He believed in the power of volume sales. By offering a wide range of goods at a fixed price, he was able to offer his customers the same goods that were available elsewhere but at a lower cost. His customers enjoyed achieving a bargain and this created a fly-wheel effect.

Franklin pioneered low cost retail and invented what we know today as the dollar store. His success inspired other entrepreneurs and led to the emergence of chains such as Woolworth's and Kress in the late 19th and early 20th centuries. Today, the dollar store industry continues to thrive, with chains such as Dollar General , Dollar Tree, and Family Dollar dominating the market.

Sam Walton (1918-1992)

Sam Walton founded Walmart in 1962, starting with a single store in Arkansas and growing it into the world's largest retailer (Walmart’s top line last year was bigger than that of Amazon).

Walton used the Franklin model as his foundation and built upon it to offer low prices on a wider selection of products combining a grocery store with a general merchandise store to offer a one-stop shopping experience. He utilized economies of scale to drive down costs and passed the savings on to customers.

The customer is at the heart of everything. Look after the customer and everything else looks after itself.

"The goal as a company is to have customer service that is not just the best, but legendary."

"There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else."

Sam Walton

Sol Price (1916-2009)

Sol Price was an absolute legend in the retail space. He also greatly admired Benjamin Franklin. In a 2001 article, Price said:

"Benjamin Franklin was a man of great vision. He saw the potential of America and helped to shape its future. He was also a man of great action. He didn't just talk about change, he made it happen. I admire his spirit of innovation and his commitment to making the world a better place."

Sol Price

I mention Sol Price in this article because he is the bridge between Sam Walton and Jim Sinegal. He inspired both men and was instrumental in the success of both Walmart and Costco. In fact, Sam Walton’s inspiration for the name Walmart (a combination of his surname and the word Mart) was Sol Price’s business FedMart.

"I guess I've stolen - I actually prefer the word 'borrowed' - as many ideas from Sol Price as from anybody else in the business."

Sam Walton

FedMart was an interesting case in retail evolution.

In the 1960s there existed “fair-trade laws” that were ostensibly designed to protect the mom-and-pop operations from being priced out of the market by the big-boys. As such, retail prices were fixed and it was illegal to undercut those prices. In reality, they were a good way for manufacturers to stifle competition and to collude on price fixing.

Sol Price despised this situation and so found a way around it. In return for becoming members (membership eligibility was initially limited to government employees. hence the name FedMart), the store was not classified as a general retailer and its members (read ‘customers’) had access to discounted products.

In the event that any manufacturer refused to supply FedMart on the basis that it didn’t abide by fair-trade laws, Sol Price would find a lesser known manufacturer of a similar product and apply a FedMart label to the product which he would sell at his customer friendly prices. He did this with Bourbon for example.

And so, out of necessity, the membership retail model and own label branding of third-party products were both born.

That was the seed that was to eventually become Costco.

In 1976, Sol Price founded Price Club.

Price Club was a membership-based warehouse store that sold products in bulk at low prices. The business model was based on the idea of offering products at close to cost prices, with profits coming from membership fees rather than markup on products. This generated a steady stream of recurring revenue which helped to stabilize profits. It also helped Price Club build loyalty with customers.

The membership construct helped to create a sense of exclusivity and value for members. This established a valuable fly-wheel where the discounts on offer attracted more people to become members, and the membership fees enabled the business to offer more discounts. Member retention rates were exceptionally high and as new members joined, the business grew rapidly.

"We're not in business to sell things. We're in business to make our customers happy, to build a relationship with our customers."

"Retailing is a game of pennies, and that's where we win or lose."

Sol Price

Jim Sinegal (born 1936)

For many years Jim Sinegal worked for Sol Price and, in response to a journalist who stated ‘you must have learnt a lot from him’, Sinegal replied “No, that’s inaccurate, I learned everything from Sol Price… He was the smartest businessman I ever met.”

Sinegal and Price co-founded Costco in 1983, building upon the successes of Price Club. Costco was not purely about offering products at low prices, it was about delivering the highest quality products at the best price which took the concept to a new level.

To achieve this, Sinegal developed a stringent set of standards for the products sold at Costco, requiring suppliers to meet strict quality and environmental standards. Costco developed its own brand, known as Kirkland (trivia: Kirkland, Washington, was the location of the first Costco store). Of critical importance is that its own brand was not a budget line but instead sought to offer products of equivalent quality to major brands but at a lower price point. The range of products is enormous including food, clothing, home appliances and even cars. The company has also recently expanded into the provision of car fuel at discounted prices for members only.

In combination this has been a huge success and enabled Sinegal to expand the company's reach beyond the United States. Under his leadership, Costco became a global phenomenon that helped to cement its status as one of the world's leading retailers.

It is worthy of note that Black Friday, the shopping day that follows the Thanksgiving Holiday in November each year, is so named because most retailers operate on very thin profit margins meaning that they don’t break into the ‘black’ until this date, towards the end of the year. Costco is different. Because of its membership model it is profitable on the first day of the year! This enables it to offer wafer thin margins on high quality products that others are unable to compete with. This cements recurring membership fees and is what creates the valuable fly-wheel that drives the Costco success.

The membership model has another huge advantage. Advertising and marketing costs, that make up a large part of the OPEX of most businesses, become almost insignificant at Costco. There is little or no need to advertise when you have members who keep coming back for more! This reduction in the operating costs of the business is largely passed through to the customers in the form of ultra competitive prices with Costco operating on very thin margins when compared to the retail sector as a whole.

"We're in the business of creating loyal customers.”

"The key is to set realistic customer expectations, and then not to just meet them, but to exceed them — preferably in unexpected and helpful ways."

Jim Sinegal

Jeff Bezos (born 1964)

The next iteration of the retail model was the Jeff Bezos online “Everything Store” that we know today as Amazon. It started as an online bookstore in 1994 but quickly expanded to sell a vast array of products, including electronics, clothing, home goods, and much more.

Bezos is a voracious reader and learner, and he is always looking for new ideas and inspiration. He is a huge fan of Sam Walton and has been known to present Walton's autobiography to new senior hires at Amazon making it mandatory reading.

He described both Walton and Price as visionaries and learned a lot from both men, including the importance of "customer focus," "operational excellence," and "long-term thinking."

The Amazon Prime subscription model was almost certainly inspired by Sol Price’s and Jim Sinegal’s membership model.

Amazon benefits from scale and, being an e-commerce retailer, is not restricted by the pace at which others are able to build new bricks and mortar retail units. A customer based almost anywhere can order almost anything without leaving home and have it delivered, often on the same day. So the internet has enabled Amazon to take scale and customer service to a new level.

Bezos further developed his own e-commerce store by creating an online market place in which Amazon offers its own inventory of products alongside those from third-party sellers, for which it collects a sales fee.

The Amazon brand is synonymous with quality on every level. This has driven the company’s success and today Amazon is one of the largest retailers in the world,

"We innovate by starting with the customer and working backwards."

"Your brand is what other people say about you when you're not in the room."

Jeff Bezos

The membership model at Amazon is not quite as slick as that of Costco. Every customer of Costco is required to pay a membership fee (it isn’t optional) and the retailer incurs little or no marginal cost per additional member. Amazon, on the other hand, does not have a mandatory membership model which means that in order to encourage customers to subscribe it needs to offer something extra. This may be faster delivery times and access to Prime TV content, all of which results in significant extra costs for Amazon.

So an Amazon subscription and a Costco membership may be distinguished as being entirely different animals. The Amazon subscription is a bundle of other services which the company seeks to expand over time. Healthcare, known as Amazon Clinic, is the latest service on offer (more on this later).

So it can be seen that Amazon has taken its business well beyond conventional retail. Competitors are now attempting to replicate parts of the Jeff Bezos model. For example, Walmart is investing heavily in e-commerce and now offers a subscription service called Walmart+ which gives members free two-day shipping, access to Walmart Pay, and more.

What comes next in this evolutionary process is difficult to imagine. Perhaps some form of Artificial Intelligence (AI) service offered by the retailer which automates the shopping experience. The Internet of Things (IoT) would certainly enable a computer to work out which groceries in your kitchen had been depleted and so could automatically place an online order to replenish them.

Either way, technologies such as artificial intelligence and augmented reality are likely to be used by retailers to improve the shopping experience for consumers. For example, artificial intelligence could be used to recommend products to consumers based on their past purchases, and augmented reality could create a virtual fitting room when shopping for clothing.

Who is best placed to offer such a service? Arguably it would be Amazon over Costco and Walmart. The former is already an online retailer and has a market leading cloud computing business that would facilitate the delivery of the requisite tech-infrastructure.

Amazon's goal is to become the go-to destination for all of its customers' needs, which are not limited to shopping.

Amazon is investing very heavily in AI and robotics in its warehouses in order to optimize efficiency. It is also expanding its physical presence which will enable it to offer faster delivery times and a wider selection of products to its customers. Last, but by no means least, it is hiring more customer service representatives in order to further improve customer satisfaction.

Andy Jassy succeeded Jeff Bezos as the CEO of Amazon in July 2021, with Bezos becoming Chairman. Jassy has been with the business from the date of its IPO in 1997 when he joined Amazon as a marketing manager. He quickly rose through the ranks, and in 2003, he was named the head of Amazon Web Services (AWS). He certainly knows the business as well as anyone and being endorsed by Bezos to run the business is quite something. AWS is fast becoming the key driver of profitability and it is arguably the skeleton on which the rest of the Amazon business now hangs.

Jassy stated that he is focusing on long-term growth rather than on short-term profits which means that using conventional earnings metrics as a guide to valuation is entirely the wrong approach.

This leads nicely to the next part, the quantitative economics of these businesses.

Part Two: Quantitative Economic Fundamentals

In the interests of brevity, in what is already a long article, I will provide a very high level overview in the battle of the retail giants (I may do a deeper dive write-up at a later date).

Walmart WMT 0.00%↑

Walmart is the world's largest retailer, with more than 11,000 stores in 27 countries. It generates over $600bn top line revenue compared to $235bn at Costco and $415bn at Amazon. In the last financial year Walmart generated more operating income than Amazon and Costco combined. But does that make it the better investment?

It is an exceptionally well run business. Asset turnover is very steady at circa 2.3x year on year, leverage (assets/equity) hovers between 2.5x and 3.0x and adjusted economic earnings margins is consistently just shy of 3% on very steady gross margins of approximately 25%. This produces a return on equity of approximately 19%.

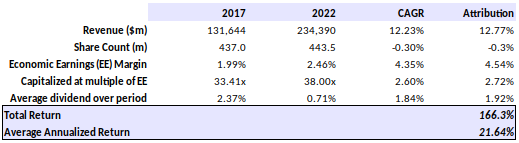

The last five years have been kind to Walmart investors as the business has shown them a 74% total return (11.72% CAGR). As the table below demonstrates, this has been driven by a combination of top line growth, multiple expansion, a reduction in shares outstanding and dividends.

Economic earnings margin contraction has been the only drag on shareholder returns but this is not a bad thing. While OPEX has been very stable, CAPEX has increased but this is growth CAPEX rather than maintenance CAPEX. Walmart has been investing heavily in its online business with a keen focus on e-commerce. It has also been opening new stores and boosting its online presence in emerging markets such as China and India. These initiatives will, it is hoped, be accretive to shareholder returns in future.

The business is currently capitalized at 23.3x my adjusted economic earnings, which is at the top end of the long term average. The reason for this is explained with a little macro economics.

Corporate America was a beneficiary of both the recent ZIRP era and the Tax Cuts and Jobs Act of 2017. A combination of low financing costs and low taxes boosted earnings across the board. EPS number climbed rapidly which resulted in higher share prices. The rapid growth in share prices created a false narrative that growth could continue at that rate which pushed multiples higher. Then the momentum effect caused by passive investment funds distorted the market still further.

That era is now over. Interest rates have normalized with one of the quickest rate hiking cycles seen in 40 years and taxes are likely to climb to fund out of control national debts. So one ought to expect the value expansion of the last 5 years to go into reverse. Said differently, margin contraction is the most likely scenario.

So what should Walmart investors expect over the next 5 years?

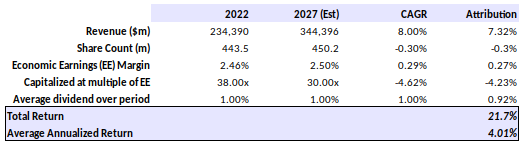

If we assume that top line growth and economic earnings margin both revert to the long term mean of around 3.5% and 2.5% respectively. Let us also assume that the reduction in share count continues at 1.8% per annum and dividends continue at just over 2%. These are all relatively safe assumptions. The big question is what happens to valuation multiples? They won’t stay at 23.3x, that’s for sure. The long term average multiple is closer to 20x and in the current high inflation and higher rates environment even that looks stretched, but lets be generous and call it 20x.

That gives us a total return over the next five years of 13.2% (2.52% CAGR). It doesn’t meet the hurdle rate for any intelligent investor.

As was seen in the first table above, 5.95% or half of the annual 11.72% shareholder return came from multiple expansion. The problem in this situation is that the gains made by others over the last 5 years are likely to be paid for by today’s investors suffering reversion to the mean as multiples contract. I don’t want to be one of those.

The lesson here is never to invest looking in the rear-view mirror. Just because Walmart generated an average annual shareholder return of 11.72% over the past 5 years does not mean that it will be repeated. My expectations are a more modest 2.52% average annualized shareholder return going forward. (Remember, even the best company at the wrong price can be a bad investment: see the Microsoft case study in this article.)

Costco COST 0.00%↑

Costco, founded 1976 and has since grown to over 800 warehouses in 14 countries. It is a wonderful business. As of 2022, Costco is the fifth largest retailer in the world and it is ranked #11 on the Fortune 500 rankings of the largest United States corporations by total revenue.

Costco operates with similar levels of leverage (assets/equity) at around 3.0x. Costco’s gross margin is half that of Walmart, consistently around 12.5%, yet its economic earnings margins are only a little less than that of Walmart at 2.4%. The thing that most distinguishes the two businesses is asset turnover. It has a consistently higher asset turnover than Walmart at 3.5x vs 2.3x and this produces a return on equity of 25% which is far better than the 19% of Walmart.

If the last 5 years were kind to Walmart shareholders, they have been kinder still to investors in Costco. Total return was 166.3% (compounding at 21.64% on average annually, double the return generated by Walmart). This has driven most of shareholder returns, augmented with margin growth, multiple expansion and a small dividend as shown in the table below.

Due to the huge global expansion of Costco, its sales have grown by 78% from $131,644 to $234,390 (12.2% CAGR).

Stock based compensation has acted as a drag on returns. When the company allocates capital to remunerate insiders, that is capital that is not being allocated to accretive growth of the business. Also, despite share repurchases to offset the dilution that flows from stock based compensation, the share count has still expanded diluting investors by 1.5% (0.3% CAGR) which is disappointing. In my humble opinion, for a business that generates so much cash, it really doesn’t need to remunerate insiders with stock. Perhaps it should follow Walmart’s example in this regard.

Great CEOs, such as Mark Leonard and Warren Buffett, encourage insiders to feel as though they have ownership in the success story of the business for which they work and they are expected to buy stock with their own wealth (rather than being gifted stock at the expense of shareholders). This is a true alignment of interest between insiders and shareholders. Stock based compensation is more damaging than many investors know (read here to learn more).

So what should Costco investors expect in the next 5 years?

The business is run with almost military precision and costs are very well managed. OPEX is constantly around 65% of gross profit and net CAPEX at around 15% of gross profit. I estimate that a little less than half of its CAPEX is for maintenance and the remainder is invested for growth, so approximately 1% of the top line is being accretively reinvested YoY at a 25% RoE.

With gross margins very steady and tight discipline around OPEX and CAPEX, I do not see much scope for economic earnings margin expansion. I have assumed that SBC continues as before and the dilution of shareholders occurs at the same annual rate. Dividend yields have been reducing in recent years and, while part of this can be explained by multiple expansion, that doesn’t account for all of it. I suspect it has something to do with the business spending more on repurchases of stock to offset dilution at higher prices as the earnings multiple expanded, which resulted in less capital being available to allocate to dividends (again the shareholder receiving a bad deal due to SBC).

I have assumed that top line growth slows from 12.23% CAGR to 8% for a number of reasons:

The law of large numbers ~ A business with a single customer can double with only one new customer, but when it has many millions of customers its rate of growth slows. No company is able to escape this law, not even the mighty Costco, which will see the number of new stores being opened becoming a smaller percentage of the total stores in operation.

Looming recession forecast for 2023 meaning less disposable income for customers.

Inflation may squeeze margins if not all of the additional input cost can be passed through to the customer.

My assumption are supported by the following excerpt from the most recent corporate results which shows that the rate of sales growth is slowing significantly in the primary markets of the US and Canada. More significantly, Costco’s efforts to penetrate the e-commerce market seem to be failing to gain traction.

So everything really turns on the multiple at which the business is capitalized. A slower rate of growth will impact on the premiums that the market will pay for Costco. I assume a reduction in the multiple at which the business is capitalized to 30x economic earnings (still high and well above the S&P500 average).

If this scenario plays out, the stock returns 21.7% over five years or compounds at an average 4.01% annually. Whether or not my assumptions prove to be accurate, one should certainly not expect a repeat of the 21.6% annualized returns seen over the past 5 years. Once again, avoid rear-view mirror investing.

Costco looks more promising than Walmart but since I am anticipating a slowdown in its underlying economics and a margin contraction, I would rather wait for a better entry point to invest in this wonderful business.

Amazon AMZN 0.00%↑

It is difficult to know where to start with Amazon because today it is not merely an e-commerce retailer. Instead it is a diverse collection of businesses. Additionally it is an international power house generating much of its revenue overseas.

In 2017, North America accounted for 68% of Amazon's total revenue against International sales of 22%. By 2022, North America's share of revenue had declined to 60%, while International's share had increased to 27%.

It was for this reason that earnings were impacted so heavily by the strength of the US Dollar during 2022. All overseas earnings were worth significantly less in Dollar terms. These things are generally mean reverting over the longer term, but need to be understood when looking at short term numbers.

Amazon Web Services (AWS) only accounted for 9% of revenue in 2017 but five years later it had become the second-largest segment, accounting for 13% of revenue. This shift was driven by the rapid growth of Amazon's cloud computing business.

More particularly, as a result of AWS operating on far larger margins than the e-commerce business, it only takes a small amount of additional contribution to revenues for it to make a much larger impact on the bottom line as the charts below demonstrate. This operating leverage is also evident in the Advertising segment of the business. The charts below demonstrate how the red and yellow contributions are far more significant to earnings than they are to revenue.

Despite accounting for only 13% of top line revenue, AWS accounted for over 40% of the bottom line. This is significant for an investor. This kind of operating leverage is exactly what fuels shareholder returns.

For Amazon, gross profit margins are consistently rising, from c.27% ten years ago to over 40% today. At the same time revenue has grown from $75bn to well over $500bn today. Top line growth and multiple expansion has been wonderful for investors over the past decade.

Amazon has borrowed from the John Malone playbook, the business reinvests heavily and deliberately avoids tax bleed. OPEX is consistently around 70% of gross profit and net CAPEX at about 25% of gross profit, hence the small net margin. All of this to say that valuing Amazon based on earnings is difficult and misleading. Conventional valuation metrics paint a misleading picture of the business, as was also the case for Malone at Tele-Communications Inc.

Being a highly diversified conglomerate, Amazon pays no dividend because it has so many opportunities to reinvest capital at highly accretive rates of return.

So, significant adjustments need to be made to GAAP numbers for analytical purposes. While GAAP numbers suggest a negative net income and free cash flow last financial year, my numbers make an adjustment by splitting out maintenance CAPEX from growth CAPEX. The latter is not a cost of doing business today, it is an accretive investment being made for tomorrow, so it shouldn’t be deducted in the calculation of real economic earnings even though the cash has flowed out of the door. Most analysts don’t account for it that way which I believe to be a mistake.

Consider that I offer you two options:

A dividend out of taxed corporate earnings which will then be subject to income tax when you receive it (double taxation) and then you have the frictional costs of reinvesting that money, let us assume back into Amazon stock (so you may be left with 45c reinvested out of every $1 of pre-tax earnings); or

The company pays no dividend and retains the full $1 of pre-tax earnings by utilizing it as growth OPEX/CAPEX with a double digit rate of return (so your equity stake in the business increases by perhaps $1.14 out of every $1 of pre-tax earnings).

Only a fool would select the first option. So that $1 of reinvested capital in lieu of a dividend needs to be accounted for in the analysis in the same manner that you would account for the dividend (i.e. as an element of economic earnings accruing to the shareholder). So I add it back when calculating the real economic earnings of the business for an investor.

Allow me to demonstrate further. Some of that reinvested capital was used in Amazon’s recent acquisition of One Medical, a US company described as a “Netflix-for-healthcare subscription” with around 800,000 members. This is Amazon’s entry into the tele-health market which it now calls Amazon Clinic. The concept is simple: the patient declares their condition by filling out a questionnaire and Amazon will connect them with a doctor to get a treatment plan. The service will initially be launched in 32 US states and is likely to expand. Surely you can see that the money invested in Amazon Clinic today will be very accretive to shareholder returns for many years to come. So as an investor in Amazon, you are now an investor in Amazon Clinic (bonus!)

All of this to say that the numbers need to be broken out to make sense of the business as an investment.

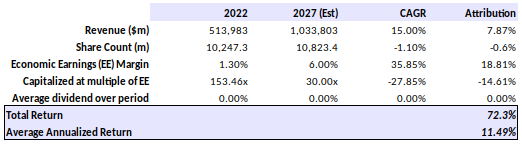

Below you see that in the period from 2017 to 2022 top line grew at a staggering 22.4% CAGR. I say staggering because when your revenue starts at $186bn the law of big numbers usually kicks-in and the rate of growth slows considerably. Not the case at Amazon. This is all down to the continual reinvestment of capital that we just discussed. So, despite the share count expanding by just over 1% per annum (dilution for shareholders), and despite economic earnings margin contracting from 2.05% to 1.30% over the period, and despite what appears to be an eye-watering capitalization multiple of of c.150x, and despite not paying any dividends, shareholders still enjoyed a total return of 68.6% (11% CAGR). I wonder how many investors avoided Amazon because they didn’t understand the numbers.

So over the past 5 years, Costco was the best investment of the three companies that we are looking at. Both Amazon and Walmart generated an annual compounded return of around 11% while Walmart achieved 21%.

But remember my warning about investing by using the rear-view mirror. Just because Walmart proved better in prior years does not mean that it will be superior as an investment going forward. I have already demonstrated my expectations for Costco and Walmart above and neither looks very attractive.

So what should Amazon Investors expect over the next 5 years?

I have assumed top line growth slows, despite there being many catalysts for continued growth (AWS being a market leader in the cloud space plus advertising revenue, tele-health, Prime and e-commerce.) In any event, I have conservatively assumed that sales growth slows from over 22% to 15%. I have also assumed that the no dividend policy continues and that dilution continues at the same rate as before due to the company’s insistence on unnecessarily paying out stock based compensation. My final two assumptions are that the high margin business segments discussed above drive group margins up on an economic earnings basis from 1.3% this year (recent 3.5% average) up to 6%. Finally, conservatively I have assumed that valuation premiums eventually drop and so we see a huge multiple contraction from 153x down to 30x. Under this scenario the total return in the next 5 years would be 72.3% (11.49% annualized return).

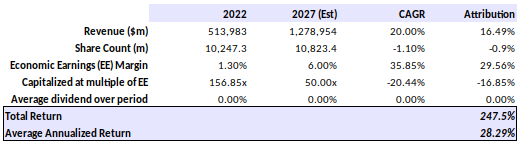

However, if top line growth continues at 20% CAGR and the capitalization multiple compresses to 50x rather than 30x, then the total return would be 247.5% (CAGR 28.29%).

Either way, the asymmetric skew looks very favourable. I struggle to see any scenario in which the investor would have capital at risk of loss. The odds are very heavily skewed to the upside.

Conclusion

All three of these businesses are wonderful operations, there is no question about it.

Each of them has rewarded its shareholders well historically, but going forward Amazon looks by far the best investment prospect at current prices. While Walmart and Costco are likely to compound shareholder returns at single digit rates in coming years, Amazon has the best opportunity to deliver healthy double digit annual returns.

Amazon is the author’s choice, but please do not take this as investment advice. Do your own research and formulate your own opinions prior to investing.

This article proved prescient based on figures released on 5/6 April 2023b by Costco

Costco global same-store sales were -1.1% in March, the first time sales had fallen since April 2020. This breaks down as US -1.5%, Canada -2.4%, International +2.0%. E-commerce comparable sales were a very disappointing -12.7%.

Costco stock fell 2.2% on this news.