Company: SDI Group

HQ: Cambridge, UK

Ticker: (London: SDI)

Market Cap: £99 million GBP (share price 95 pence)

URL: https://sdigroup.com/

Strategy: Buy the dip. Cash generative serial acquirer in niche markets.

Disclaimer:

Views, information and opinions expressed in this analysis are those of the author. They should neither be construed as investment advice nor as a recommendation to buy or sell any particular security. Security specific information should not be relied upon as the basis for your own investment decisions. You must do your own research, seek independent advice and reach your own conclusions.

The author may have a position in securities named in this article and may change those position at any time

SDI Group formerly Scientific Digital Imaging, founded 1984

Serial acquirer

British conglomerate concerned with the design and manufacture of scientific and technology products for use in digital imaging, sensing and control applications. It is a leading supplier of products to a wide range of industries, including life sciences, healthcare, astronomy, manufacturing, precision optics, and art conservation

Total shareholder return 210% in the last 5 years alone

Analysis Contents

The Man Behind The Business

The Business Model

SDI Portfolio of Tortoises

SDI Modus Operandi

Unit Economics

Valuation

Conclusion

1. The Man Behind The Business

Successful investing is as much about the CEO as it is about the company. The man running the company is, de-facto, trustee of your investment capital. His decisions in relation to capital allocation will deliver your investment returns. Never invest in any business without a good understanding of what makes the CEO tick.

To that end, allow me to introduce you to Mike Creedon, CEO of SDI Group Plc.

“SDI was a basket case. It had enjoyed an IPO in 2008 but should never have been floated. They should have just sold it as a trade sell, and I should have stayed in my other job. I looked at the situation, thinking, Why the bloody hell am I here?”

Mike Creedon, CEO

Mike Creedon joined the business in 2010 as CFO only to find that it was very poorly run. He soon discovered that the business would never meet its previously issued targets and, within a year, was forced to issue two profit warnings.

All of this prompted the Chairman to part company with the existing CEO and Creedon effectively assumed the role of both CEO and CFO.

It was a baptism of fire.

But looking back on it now, it is clear that this was a pivotal moment for the business.

Under Creedon’s leadership the company has completely turned around and today it is an attractive investment proposition, as I shall explain.

The original problems with the business were not cash flow related, it was perfectly able to stay afloat. The issue was one of moribund growth. Said differently, the company was stagnating and directionless.

Creedon, who had an M&A background, believed that there was scope for considerable consolidation within the scientific digital imaging market, although he found that there were limited targets within that sector.

So he decided to expand the scope of his expansion plans to include any business with a science and technology tilt. There were, and still are, many small companies in the sector that are each addressing specific niche applications within fragmented markets.

This proved to be the correct approach. If it operates in a niche and makes its own products, margins are less likely to be squeezed and so durable earnings are all but assured. So today SDI targets stable cash-generative and profitable niche businesses with a manufacturing bias.

The result is a diversified group which is neither reliant on a single region nor an individual sector, all of which results in the SDI Group having more stable cash flows through economic cycles. By way of example, when most companies were disrupted by the Covid19 pandemic, SDI had a subsidiary that won a huge order for its specialist equipment being used by PCR (polymerase chain reaction) testers in China. More on this later.

2. The Business Model

There are many small private niche businesses operating in slow-growing markets. These businesses are not on the radar of those investing in the public equity markets and, even if they were, they wouldn’t cause very much excitement. Single digit top line growth is unattractive to myopic investors who seek out short term windfall gains.

The investment herd mentality is to focus on large TAM opportunities and companies that are growing rapidly by claiming greater market share (which implies operating in a fiercely competitive market which doesn't bode well for margins). By comparison, who wants to invest in a small slow moving tortoise?

The key takeaway, as those acquainted with Aesop's tale 'The Tortoise and the Hare' can confirm, is that it's often a prudent choice to place your wager on the tortoise rather than the hare.

While the hare in the business world often sacrifices profitability for rapid top line growth, thereby consuming capital rather than producing it, these small niche tortoise businesses have very favourable economics.

In the science and technology sector they manufacture specialist equipment and they respond to customer needs, selling both directly and via distributors. They are profitable, not very capital intensive and have a captive customer base which lends itself to achieving durable excess returns. Better still, slow growing small niche players attract neither the attention of would-be competitors nor regulators, which removes more key threats to the ongoing success of the enterprise.

The ratio of cash-flow to invested capital is high but being a mature niche player means that capital re-investment opportunities are scarce. Accordingly, the cash generation of these small stand-alone niche companies, which are often run by their founder, is used to fund the lifestyle of the management and is typically not redeployed for growth. With corporate capital constantly being extracted in this way the niche business chugs along churning out cash year after year but showing little or no growth.

Therein lies the wonderful opportunity for SDI Group.

If SDI is able to acquire these niche businesses and to create a portfolio of them, then it can sweep the cash being generated from each and utilize it for future acquisitions (or channel it into organic growth opportunities within individual subsidiaries if any should arise) without impairing the business of the subsidiary that generated the capital. It isn’t necessary to redeploy capital where it was created, and so a diverse portfolio of businesses within this conglomerate enables cash to be deployed where the returns are greatest. It’s all about acting in the best interests of the group and deploying capital effectively.

Augmented with prudent levels of debt, this accelerates value creation and is clever capital allocation (Warren Buffett and Mark Leonard style).

It is for this reason that SDI pays no dividends, also Buffett style. Return of capital should never be confused for return on capital. All of the cash that the group generates is reinvested at highly accretive returns for shareholders.

It has always been the authors view that dividends should be seen as a default option for capital allocation where no other viable alternative exists. This is straight out of the John Malone playbook and Creedon must be commended for his approach in this regard.

So the SDI group portfolio of subsidiaries is growing at a nice rate, currently 17 subsidiaries, with four being added in 2022 alone.

Top line organic growth rates may only be in the single digits, but costs can be curtailed and margin improved if economies of scale are exploited through the collective strength of the group. So far SDI has not focused on this aspect of the business, instead leaving each subsidiary as an autonomous unit. This means that there is untapped valuation uplift potential that exists within the group.

Some people argue that acquisitive growth is not equivalent in terms of achievement to organic growth because anyone can buy growth. But I ask you this: what's the difference between investing in-house to organically grow into a new complimentary product line, and buying another complimentary product line in the guise of a profitable pre-existing niche business? The latter is arguably lower risk because it comes with a customer base and existing durable profitability. Why take the stairs when there is an elevator available?

The key is in understanding the businesses being acquired and so remaining within Creedon’s tight circle of competence. It is also about seeking out synergistic business opportunities which unlock value in both the new business being acquired but also in the collection of businesses already owned. The former is relatively easy, the latter is where the real skill comes in to play (more on this in the next section with reference to LTE Scientific, an SDI subsidiary). All of this to say that running SDI utilizes a very different skill set from that deployed by most organic growth driven companies in terms of capital allocation investment decisions.

It is also worthy of note that specialist niche businesses tend to be relatively tangible asset light which is very favourable, particularly in a high inflation environment for the following reasons:

First, if maintenance CAPEX is low, then more of the available capital may be allocated to growth which compounds at a faster rate.

Second, in an inflationary environment maintenance CAPEX tends to exceed the D&A number recorded on the company accounts because the cost of replacing the asset is greater than its prior cost (this is why EBITDA is entirely unreliable as a means of measuring true economic earnings as it tends to overstate them). By contrast, if you happen to own a niche business with most of their value in intangible assets such as trusted brands and enduring customer relationships, perhaps augmented with intellectual property, maintenance CAPEX is nominal and this inflationary funding issue goes away (click here to read more on this topic).

3. SDI Portfolio of Tortoises

Building on the rationale of the last section of this article, I would like to introduce you to the tortoises in the SDI portfolio.

To provide an idea of the diversity of the group, I shall list some of the business niches in which they operate:

Atik Cameras manufactures highly sensitive cameras for life science, industrial applications and for deep-sky astronomy imaging

Synoptics manufactures scientific instruments based on digital imaging, for the life science research, microbiology and healthcare markets

Graticules Optics is unique in offering photo-lithographic products on glass, film and in metal foil, with the added bonus of coatings, cementing, mounting and small optical assembly

Sentek manufactures off-the shelf and custom-made electro-chemical sensors for water based applications used in laboratory analysis, in food, beverage and personal care manufacture, as well as the leisure industry

Astles Controls Systems is a supplier of chemical dosing and control systems to different manufacturing industries including manufacturers of beverage cans, engineering and motor components, white goods, architectural aluminum and steel

Applied Thermal Control manufactures and supplies a range of chillers, coolers and heat exchangers used within the scientific instrument support market

MPB designs, manufactures and sells a range of flow-meters and control instrumentation with applications in water treatment, power generation, gas and oil production, human medical anesthesia, aviation, pharmaceutical, pollution control, scientific analysis, educational and many other areas

Chell produces solutions incorporating instruments and components such as thermal mass flow meters and controllers and capacitance manometers used in a wide range of sectors from Formula-1 motor racing to the nuclear power industry

LTE Scientific manufactures life science, research and medical equipment, including medium to large capacity autoclaves, environmental rooms and chambers, endoscope drying and storage cabinets, and a range of thermal processing equipment including ovens, incubators, drying cabinets and solution/blanket warming cabinets

Monmouth Scientific manufacturers and supplies clean air solutions

Safelab manufactures fume cupboards for use in laboratories

Scientific Vacuum Systems manufactures Physical Vapour Deposition systems

Uniform Engineering are a trusted partner in precision metal fabrication, metal bending and powder coating

Quantum Scientific Imaging manufactures a range of high performance cameras that have applications in the astronomy and Life Sciences fields

Fraser Anti-Static Techniques manufacturer of anti-static products which eliminate, clean, generate or measure static electricity in a variety of industries including plastics, packaging, printing, food processing, medical and pharma

amongst others

As the group grows, so the synergistic benefits increase. For example LTE Scientific has always purchased chillers for their environmental chambers from a third party, but will in future acquire them from Applied Thermal Control, another group entity. Similarly, LTE Scientific would like to enter the US market and Synoptics has a sales and marketing office established in the US.

It’s a win/win for all concerned. Group revenues increase and costs are invariably lower so margins improve.

4. SDI Modus-Operandi

SDI maintains a target for organic growth in high single-digits, but with acquisitions layered on top, growth has been in the high-teen and low-twenty double digits.

So acquired cash generative businesses flourish and are able to grow organically within the SDI Group, and this generates more cash flows for future acquisitions. So the fly-wheel continues to spin.

In the early years of Creedon’s tenure as CEO, the business raised equity capital through the markets in order to acquire other companies. Today, acquisitions are capable of being funded by a combination of internally generated cash flows and debt. This is good news because not only does that result in a lower aggregate cost of capital, but it also means that investors are not being diluted by an expansion in the share count.

In terms of valuation, SDI seeks to acquire businesses at between 4x and 6x EBIT and has successfully achieved that for all but one of its recent acquisitions. This creates an immediate valuation uplift for SDI, which itself is capitalized at over 12x EBIT. In other words, every $1 spent on acquisitions becomes $2 to $3 on the valuation of the group.

SDI tends to acquire businesses which are founder run, with competent management that wishes to continue operating the business. Often the founder continues, perhaps on a part time or advisory basis. These people simply wish to release the equity locked up in their business as they near retirement and SDI facilitates that.

So, following an acquisition, there is little or no disruption to business-as-usual activity. The founder is able to release equity in his business with the bonus of having safeguarded the future of continuing employees while also being able to continue working as a salaried employee him/herself. Once again, this is a win/win situation for all concerned.

All of the founders who had previously sold to SDI are happy to provide a good reference to those considering following suit.

There is an additional benefit that accrues by virtue of being acquired by SDI. Many of these niche businesses are run by people with engineering or scientific backgrounds, but more often than not they are not financially minded people with business acumen. Often this leads to poor capital allocation decisions and little or no commercial strategy. However, being acquired by SDI enables the scientists and engineers to do what they do best, and to allow the business administration to be outsourced to head office under the supervision of Creedon.

Management is incentivized through bonuses if they exceed targets and they are also ‘golden-handcuffed’ with stock options following the acquisition.

Creedon believes that autonomy motivates people while bureaucracy does the opposite, so he encourages a federated structure. Acquired businesses always retain their independence, brands, and culture. While each subsidiary is run autonomously with their own management teams, accounts together with an operational report are submitted to head office on a monthly basis. Every group business is reviewed individually and monitored against budgets and forecasts.

While the Group operates a decentralized approach to management, it does provide financial support, access to specialist resources, and knowledge sharing on a centralized basis. However the head office has a small staff complement including Creedon as CEO, Ami Sharma the CFO and a financial controller. The senior management team has expanded with the addition of Stephen Brown who joined the Group as Chief Operating Officer on 28 September.

Creedon tends to visit subsidiaries once every four to six weeks, but is careful not to micro-manage or to interfere. The remainder of his time is spent seeking out future acquisition targets.

It is worth noting that Creedon is very cost conscious and not in the least bit materialistic or extravagant. For example, he travels as low cost as possible including driving himself in a hire car to UK subsidiaries and staying in cheap motels. When traveling internationally he uses budget airlines. In this respect he reminds me of Mark Leonard who made a point of not squandering shareholder capital on extravagance and always traveling as cheaply as possible. On the occasions that he wanted to upgrade his business travel he always funded it out of his own pocket because his conscience would not allow him to expense it to the company. This is great to see. A CEO should always focus on managing costs tightly, acting in the best interests of the business and of its investors. Creedon’s approach is a big tick in a key box for any investor.

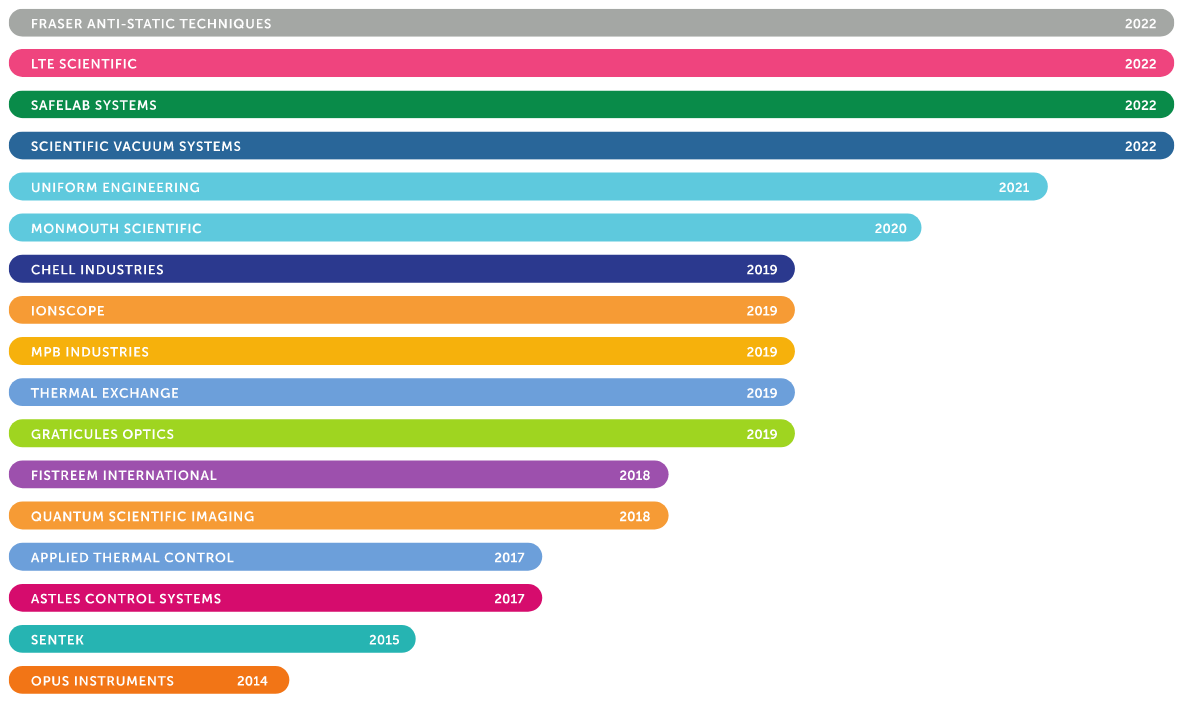

Since 2014 the SDI Group has acquired 17 businesses (see below) and it still has a healthy pipeline of targets.

There can be no doubt, SDI has become a serial acquirer.

As explained above, Creedon had no option but to utilize equity finance during the ZIRP era of cheap money when SDI was capitalized at around 1x book value. Today, with interest rates considerably higher and the group capitalized at between 4x and 6x book, he is utilizing corporate cash and debt for acquisitions. This is unfortunate because had opportunity allowed, it really ought to have been done the other way around. A business ought to look to raise equity finance when the stock is trading at a premium (high multiple) and buy it back when it trades at a discount (low multiple). Similarly, debt is better utilized in a low rate environment. But the SDI business acquisitive business model was embryonic during much of the ZIRP era and so Creedon had little choice in the matter.

It is worthy of note that to date Creedon has never repurchased SDI stock, which implies that he permanently values the businesses of others over his own. This is not surprising given the multiple uplift that he is currently able to achieve on acquisitions. If the SDI multiples contract at any point in the future, repurchasing SDI stock may become the correct capital allocation lever to pull. Time will tell if this happens.

It would be nice if Creedon were able to emulate some of the success of the legendary CEO Henry Singleton. In essence, when the stock-market was over-exuberant, Singleton would use his over priced stock as currency to acquire other companies, thereby crystalizing the windfall delivered by the inefficiency of the market. When the pendulum swung in the other direction and the stock-market became depressed, Singleton would cease buying other businesses and simply repurchase his own discounted stock. The results that he achieved in terms of shareholder returns were truly legendary. Over 25 years, this methodology achieved an average annualized return for his shareholders of 17.9%, in other words every $100k invested became $5.3 million.

When it comes to acquisitions, Creedon certainly excels in his attention to detail. He conducts all of the due diligence on target businesses himself. For example, prior to acquiring Chell Instruments he spent an entire week company’s cafe during which time he was able to meet everybody involved in the business. In his words, he likes to “get under the skin” of the business by talking to staff and reviewing operations himself. He insists on understanding its people and its culture and discovering if it will be a good fit for SDI.

The only external resource used during an acquisition are lawyers and even then, the acquisition agreement used is kept very standard with little or no change introduced for subsequent deals. This keeps the acquisition costs down. Creedon runs a very lean operation.

Creedon is a long term CEO having been with the business for nearly 14 years and with no immediate intention to leave. This is always a favourable attribute in a CEO because he will be looking at the business through a long term lens which very much aligns with the interests of shareholders.

5. Unit Economics

Analyzing a serial acquirer isn’t easy, especially when the company doesn’t publish figures for the individual subsidiaries. That makes a true “sum of the parts” analysis impossible.

It is worth noting that not publishing subsidiary numbers is entirely deliberate. There is no formal requirement for the group to disclose granular financial details and, on a competitive basis, it may be harmful to do so. As such, the decision of the board to hold its cards close to its chest is entirely understandable.

At a group level we are able to make a few observations:

Accretive Value of Acquisitions: New acquisitions (Fraser Anti-Static Techniques, Scientific Vacuum Systems and Safelab Systems) require no integration because each operates independently. As such they become immediately accretive to revenue and earnings. 2022 saw four new acquisitions to add to the 13 subsidiaries that previously formed the group. That’s 31% growth in the number of companies owned by SDI. The size of these subsidiaries, in terms of economic operations, varies and so it is not safe to assume that revenue and earnings will change in the same proportion. It may be more, but it may be less. SDI’s broker, FinnCap, break out some of the numbers in their analysis which shows that:

FY22, only two of the acquired companies contributed to revenues and that was for part of the year accounting for only 3.4% of total revenue

Estimates for FY23 are that all four acquisitions will contribute 24.8% in aggregate to the top line.

For FY24 this is expected to rise to 31.9% of total revenue (pretty much in line with my estimate above).

That answers the question for top line growth, but what about the bottom line?

The most recent acquisitions operate on smaller margins than the group average achieved previously and so this will impact the new group average which implies that earnings will not increase by as much as 31%.

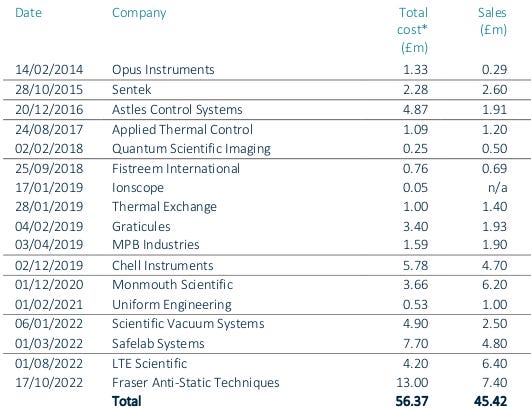

Earnings Yield on Acquisitions: Below is a list of acquisitions and prices paid next to Sales numbers at the time of acquisition. It should be noted that some of these acquisitions came with real estate interests Safelab (£1.2m), LTE Scientific (£1.65m) and Fraser Anti-Static Techniques (£1.76m). Excluding these assets, which SDI may sell and on which they will earn a separate market rent in the interim, we discover the net purchase price paid for the underlying businesses comes down from £56.37m to £51.78m which implies an average Price/Sales multiple down from 1.24x to of 1.14x. On an average economic margin in the range 15% to 20%, this implies an earnings yield for SDI (based on capital invested in the acquisition) of 13.2% to 17.5% before organic growth and any synergistic returns.

Real Estate Interests Acquired: The aforementioned real estate assets now sitting on the SDI balance sheet represent a potential element of hidden value. These sites may be liquidated as non-core assets of the business at some point in the not too distant future. There is also a possibility that they may be repurposed/developed in order to uplift their valuation prior to liquidation. Either way, this would be more capital that the company is able to apply to its acquisitive growth strategy.

Return on Capital Deployed: Looking at the unit economics of two recent acquisitions, Safelab was acquired at 1.6x sales and an EBIT margin of 19.1% (implied EBIT earnings yield 11.9%), while LTE Scientific was acquired at 0.66x sales and an EBIT margin of 6.3% (implied EBIT earnings yield 9.5%). Both of these are well below the group’s average net earnings yield that I calculated in the prior bullet point, which suggests that while recent acquisitions help grow the top line, they come at the expense of return on capital deployed.

Acquisitions Increasing in Size: The Fraser Anti-Static Techniques acquisition was the largest that the group has made to date, at a cost of £16.9m (which included £1.76m of real estate assets and £3.9m cash) so £11.2m net. This on FY21 revenue of £7.4m implies a net capitalization of the business at 1.51x sales. The business appears to operate on a profit margin of circa 16.2%, which implies an earnings yield of 10.73%. Again this is below the historic group average but very much in line with Safelab and LTE Scientific acquisitions.

Does this mean that SDI is sacrificing returns for growth? Perhaps.

Interest rates are now significantly above where they have been over the last decade and equity risk premiums are also much higher (see below). In combination, this suggests that the hurdle rate for acquisitions ought to be higher rather than lower.

Covid19 Tailwinds are Abating: Atik Cameras saw sizeable “one-off” orders of camera systems for PCR testers from a Chinese OEM customer (as mentioned above in Section 1). Since this is non-recurring revenue, Atik revenues will dip from the peak levels seen last year. This will also offset some of the top line gains that flow from recent acquisitions. The semi-annual adjusted operating profit is shown on the chart below which demonstrates how digital imaging has experienced a Covid boost which is extraordinary. A prudent investor ought to expect some kind of reversion to the mean in coming years.

Working capital requirements increased due to the build-up of inventories to mitigate the impact of component shortages and also due to the extraordinarily large order of Atik cameras for China. This was partially offset through the advanced payment received for this large order. In any event, working capital requirements ought to reduce going forward which may release more capital to finance more acquisitions.

Dilution of Investors: This was significant in the past but, I am reliably informed by Creedon, is being curtailed going forward.

Ten years ago, in 2013, SDI had 19 million shares outstanding. Five years later, by 2018, that number had ballooned to 90 million. Over the last five years shareholders have been diluted 29% but the share count seems to have stabilized around 104 million recently.

It is important to understand the reasons for this:

SDI has a “buy and build” strategy. The company chose to fund this, largely through equity issuance over the use of debt (not ideal when interest rates were so low over the past decade, but it is not always easy for small cap businesses to raise debt financing and the management have an overly prudent approach to the use of debt). The good news is that SDI has reached a pivotal moment in its growth path where it is able to fund acquisitions with its own cash flows plus existing debt facilities. So equity fund raising ought to be a thing of the past.

Senior management were issued with equity options in the past which are slowly but surely reaching maturity. It is my understanding that these are not being replaced. Existing employees are paid entirely with cash rather than via stock based compensation which is very welcome news

When a company is acquired by SDI, new employees are granted stock options with a delayed vesting period. This acts as a golden-handcuff which ties them to the business. These are not particularly significant in size, but there is no share repurchase to offset dilution and so this invariably means that the share count will expand marginally in years to come. This is relatively insignificant in the grand scale of things.

Organic Growth and Inflation: Input price increases, particularly labour costs and raw material prices, appear to have been offset by increases in output pricing. The ability to pass through inflation to the customer is a benefit for SDI and is the result of subsidiaries operating in niche fields with limited competition.

However, this does imply that a significant amount of recent top line growth is caused by inflationary price increases. In real terms, discounting inflation, the top line organic growth will be lower than it first appears. For the six months to October 2022 organic top line growth was 3.8% and and so it may have actually been negative in real terms.

6. Valuation

So how do we factor all of these observations into a valuation?

The official audited numbers are shown below, but these require adjustments in order to provide an investor with an accurate picture of the investment opportunity. The approach adopted by SDI in preparing these numbers is entirely correct according to accounting standards, but those standards were not designed with stock-market investors in mind (click here for more). To evaluate an investment properly accountants and their numbers are not particularly useful.

The Profit for the year number shown in the table includes growth CAPEX that is depreciated and amortized in the income statement under operating costs. I tend to add this back because only maintenance CAPEX is a true cost of generating the economic earnings of the business. Growth CAPEX and any merger/restructuring charges are equivalent to an investment that will yield future returns for shareholders. Imagine that you had two identical companies: #1 had not invested by way of growth CAPEX which results in its income statement profitability numbers being higher but its long term prospects not being as good as #2. Using reported numbers would lead you to conclude that #1 deserves a higher valuation than #2, when in fact it ought to be the other way around. So an adjustment is required for SDI.

Similarly, the Cash generated from operations number shown in the table is equally unreliable as a gauge of economic earnings that accrue to shareholders. In the first instance, the calculation begins with the Profit for the year number that we have established as being unreliable for investors. Second, many of the non-cash items that are added back in the cash flow statement are very real costs to the business albeit deferred to, or from, another trading period. Stock based compensation is a case in point but there are others.

My adjusted numbers, which try to capture the true economic earnings of the business from a shareholder’s perspective are shown below. While my methodology is beyond the scope of this article, it is worth mentioning that it attempts to remove volatility in numbers from one year to the next by working on moving averages to calculate trends in the margins being generated by the business and then applying those smoothed numbers to the prevailing top line revenue number.

Let us now consider what has driven the exceptional returns of SDI over the past 5 years. The table below shows that total shareholder returns have been 200% (c.24.6% CAGR) as the share price has ballooned from 32p to 95p (UK pence).

It is worth noting that the share price did, for a while, run way too far ahead of intrinsic value and hit a high of 204p. This was partly driven by poor quality analytics from house-broker FinnCap which, for reasons beyond my comprehension, suggested that the stock was worth 275p.

FinnCap based their conclusions, it would seem, entirely upon peer comparisons and looking exclusively at Judges Scientific Plc (Judges). This is flawed thinking and lazy analysis, but FinnCap’s incentives as a broker are in driving traded volume higher and this is why I habitually ignore broker analysis.

Judges traded at an average earnings multiple of c.15x from 2014 to 2020. The market then experienced a period of irrational exuberance towards the end of 2021 following Covid19 lock-downs with companies such as Tesla being capitalized in the market at well over 1,000x earnings (which was just plain silly). Judges was carried higher in the madness and is still being capitalized at an eye-watering 67x earnings on an LTM basis!

Just because Judges is massively over-valued and temporarily defying gravity, does not mean that SDI should also be similarly over-valued. More likely, Judges will find its true level over time. In fact, having traded at £102 a few months ago, Judges today trades at £88, so this process is well underway.

For me, the prospects for SDI appear to be far better than for Judges so it may be more sensible to value Judges relative to SDI rather than vice versa.

Needless to say, the FinnCap analysis caused the investment herd to blindly stampede before discovering that they were running on thin air. The inevitable subsequently occurred and the share price fell back to earth. Today it trades at 95p, at which level it looks interesting once again.

As a side note, the most recent trading statement of SDI at the end of September states that “Analysts from our Broker Cavendish Capital Markets Limited and from Progressive Equity Research regularly provide research on the Company…” Perhaps this implies that FinnCap have been dropped?

The recent share price correction has certainly opened up SDI as an interesting investment proposition once again. It was Buffett who said, “be fearful when everyone is being greedy, but be greedy when everyone else is being fearful.” The time may have arrived!

Over the past five years, the company has grown its top line at a very impressive 35% CAGR, although most of this is acquisitive growth with only a small percentage being organic. This top line growth contributed to almost 32% shareholder returns, which were then negatively impacted by an expansion in the share count which diluted existing shareholders, a small margin contraction, and a contraction int the multiple at which the market was capitalizing the business. Collectively these shaved 7% off the annual compounded returns of shareholders and resulted in a still impressive 24.6% annualized return.

One should never invest by looking in the rear view mirror. What does the future look like based on what we know?

Well revenue growth will slow. The law of large numbers will see to that. For example, when a company makes its first acquisition, assuming that the company it acquires is the same size as its existing business, then it achieves 100% growth. When it makes its 21st same sized acquisition it only grows by 5%.

So let us assume that SDI is able to grow its revenue over the next five years at 20% CAGR. This would see the top line swell from £68m today to £168m by 2028. This is ambitious, but stay with me.

Management assures me that share count expansion in future will be significantly less than in the past. It will still offer equity to key employees of acquired businesses in order to tie them in and align their interests to those of the group. So let us assume that the share count expands at a much lower rate increasing to 109.4m shares by 2028 reducing the rate of annual dilution from nearly 3% to a mere 1%.

We know that the recent acquisitions operate at lower margins than the group average and so that will inevitably result in margin contraction. I am assuming that economic earnings margins tend from 16.28% down to 15%.

As discussed above, we have seen a multiple contraction over the course of 2023. At its peak the stock was capitalized at over 3x sales which, based on economic earnings margins, was unjustified. Today that multiple is 1.5x which looks much better.

Based on all of these assumptions, we are looking for the market capitalization to expand from £99m today to approximately £252m by 2028.

There are no dividends anticipated so we exclude that from shareholder return calculations (far better to reinvest capital at accretive returns on capital than blindly returning capital to shareholders - the management seem to be a rare breed who actually understand the economics of capital allocation, which for a shareholder is a huge bonus.)

So what does it all mean for investors?

It suggests that the share price in 2028 is likely to be 252p, which against today’s share price of 98p implies a total shareholder return of 142.7% (19.4% CAGR).

If revenue growth cannot be maintained at 20% per annum for the next 5 years, perhaps averaging 15%, then we would be looking at a market cap of £204m (double where we are today) and a 186p share price (all other assumptions remaining unchanged). That represents a total shareholder return of 96.2% (14.4% CAGR).

But a dip in revenue growth for an acquisitive company implies a slow down in the number of acquisitions. So imagine a situation in which growth dipped to 15% because attractive acquisition targets became more difficult to find, leading the management to determine that the best use of the capital being generated is the reduction of share count in lieu of new acquisitions. At its current market capitalization, SDI could feasibly reduce its share count by 22% over the next five years (from 104m shares outstanding to 85.5m). Total shareholder returns would be 151% (20.2% CAGR).

This latter scenario is arguably the best outcome for shareholders so I asked Mike Creedon whether he had ever considered this form of capital allocation. The response was that he had raised the questions of repurchases with the board, but at the moment they are not in favour, instead acquisitions are the priority. I find it encouraging that it is at least being considered and supported by the CEO. It means that it is still a distinct possibility for the future.

7. Conclusion

SDI Group is a very interesting company with a bright future. It’s share price had run too far ahead of intrinsic value but given the recent draw down, this stock is now coming back into play. The valuation now looks like it has the potential to yield nice shareholder returns over coming years.

The danger with any company that fuels growth by way of acquisitions is that it may seek to acquire businesses for the sake of making acquisitions, rather than to provide any kind of strategic advantage. We have already seen recent SDI acquisitions that generate smaller margins which compress the average margin of the group. The management will certainly be tested in this regard.

Now that the share price has dipped to an interesting level, SDI may like to consider acquiring itself on a fractional basis through share repurchases. Why not? If the margins and multiples are more attractive, it would be more accretive to shareholder returns to buy-back SDI stock. It also removes the need to issue stock by way of golden handcuffs to the employees of the acquired entity. Finally, no matter how much due diligence is done, there is always a risk of finding skeletons in the closet when acquiring an external business, but none of that exists when buying one’s own company.

Finally, there are the real estate interests that SDI has inherited with recent acquisitions. These are balance sheet investments with value uplift potential through change of use (commercial to residential), which are likely to generate a small windfall for the company and its shareholders in the years ahead.

All in all, this is an interesting investment opportunity worthy of consideration.

If you like serial acquirers and want to look at others, here is a list of global names for you to consider:

🇨🇦 Alimentation Couche-Tard

🇸🇪 LIFCO

🇨🇦 Constellation Software

🇸🇪 Atlas Copco

🇺🇸 Danaher

🇬🇧 Halma

🇸🇪 Assa Abloy

🇸🇪 Addtech

🇸🇪 Addnode

🇸🇪 AddLife

🇺🇸 United Rentals

🇫🇷 LVMH

🇬🇧 Ashtead Group

🇳🇴 BEWI

🇸🇪 Bergman & Beving

🇬🇧 Diploma

🇸🇪 Lagercrantz

🇸🇪 Indutrade

🇸🇪 Instalco

🇸🇪 Green Landscaping

🇸🇪 Knowit

🇺🇸 AMETEK

🇩🇪 Sartorius

🇺🇸 Middleby Corp

🇸🇪 Swedencare

🇨🇭 SIKA

🇺🇸 Fastenal

🇸🇪 Embracer Group

🇺🇸 Thermo Fisher Scientific

🇸🇪 Fasadgruppen

🇸🇪 Beijer Alma

🇸🇪 BICO

🇨🇦 Topicus

🇸🇪 Sdiptech

🇸🇪 Volati

🇸🇪 Norva24

🇸🇪 HMS Networks

🇺🇸 Watsco

🇺🇸 Atkore

🇸🇪 Hexagon

🇺🇸 Roper Technologies

🇸🇪 Momentum Group

🇺🇸 HEICO

🇺🇸 TransDigm

🇫🇷 Eurofins Scientific

🇬🇧 SDI Group

🇬🇧 Judges Scientific

🇸🇪 NCAB

🇸🇪 Hexatronic

🇸🇪 Teqnion

🇸🇪 Vitec Software Group

🇵🇱 Sygnity

🇸🇪 Storskogen

🇸🇪 ADDvise Group

I am not convinced by the new CEO. He is not cut from the same cloth as Mike Creedon. This company is no longer on my watchlist. It's not about the company, its about who is steering the ship, particularly for a business that is a serial acquirer on a buy and build mission. Creedon was a finance guy, previously CFO who avidly studied the great serial acquirers (Buffett, Leonard, etc). The new guy was formerly a COO, with an engineering background, no prior CEO experience, no finance experience, no M&A experience. I am out. He may prove me wrong, but I'm not betting on a three-legged horse.

Thanks for the detailed write-up. I am not very familiar with the company so forgive my ignorance but I have a question for you. CEO doesn’t want to go over 1xEBITDA in net debt so there is no cash to tap when it comes to debt for acquisitions at the moment. CEO also doesn’t plan to dilute shares significantly. This leaves us with cash generated. In 2023 my back of the napkin maths suggests this was £6.75m in 2023. If this money is used for an acquisition at 4xEBIT then EBIT will increase £1.7m. My question is, are they generating enough cash to produce the 15-20% annualised growth you mention? Again, forgive my ignorance, I am just glancing at the financial statements.

You talk about a dip in revenue growth due to lack of acquisitions resulting in buybacks and this being the best outcome. Why is a lack of acquisitions a good thing, is it not better have plenty of acquisitions to make at 4-6xEBIT than buying back your stock at 12xEBIT?

Thanks