The Vistry Mystery | A Special Situation

Market Leader, Share Price Down 64% In 3 Months, Has It Been Oversold?

Disclaimer & Disclosure: The author has a position in Vistry Group. This post is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and seek professional investment advice before making any investment decisions.

Vistry Group Plc (London: VTY.L)

Market Cap £1.9 billion GBP (share price £5.60)

EV £2.3 billion GBP

EV/EBITDA 6.02x

EV/Sales 0.56x

P/E 7.8x

Float 81.8%

Why Should I Be Interested In Vistry?

Most businesses focus on meeting Wall Street’s demands, giving quarterly guidance, and focusing on short-term results - yet every once in a while a company breaks away from the pack and does things differently. It ignores unwelcome distractions, makes decisions based on long-term objectives and rewards patient investors with outstanding returns.

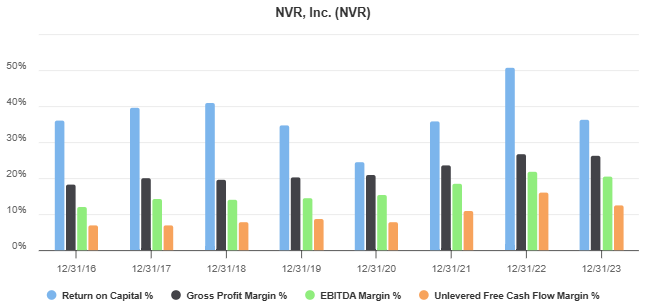

One of those companies is NVR, a U.S. homebuilder that has consistently outperformed the market thanks to its unique approach, disciplined financial management, and shareholder-focused mindset. It has achieved shareholder returns of ~28% CAGR for decades.

Companies like this are rare, and if you are lucky to find one, buy and hold!

This is why there has been a great deal of excitement around Vistry Group, a leading British housebuilder, which has recently switched to a model that resembles that of NVR.

Have we found a rare valuable gem of a business? Or is this just another oasis in a desert full of mediocre companies?

What Makes NVR Unique?

At first glance, NVR might not seem all that special, after all it builds homes and anyone can do that. But it isn’t what NVR does that’s special, it’s how it does it that matters.

After going bankrupt in the 1990s, NVR restructured and adopted a radically different business model. Unlike traditional homebuilders that buy land upfront and hold it as inventory, NVR moved to a capital-light strategy. Now, rather than tying up capital in huge inventories of land, it engages with land developers primarily through Fixed Price Finished Lot Purchase Agreements (LPAs). These typically require NVR to pay a deposit (a quasi option premium), ranging from 5 to 10 percent of the gross development value of the land and then to pay the balance later when the land is developed.

The fact that it focuses on high-quality, customizable homes, typically means that the gross development value of the land will be optimized, contributing to its ability to offer a higher price when bidding for the land in the first instance. The combination of an upfront deposit and a higher price at the conclusion of the deal means that NVR becomes a preferred partner for land owners.

Other than the low capital intensity of this model, it provides the company with complete flexibility as it is able to adapt quickly to market conditions. For instance, NVR may reassess, renegotiate, or withdraw from commitments during housing market downturns with far less value at risk.

In terms of margins, traditional housebuilding can be split into two segments:

Land acquisition

Manufacturing of homes

Unsurprisingly, the manufacturing segment offers far more attractive margins because land held for future development will only appreciate at low single digit percentages each year, typically in line with inflation, so it is not an effective deployment of capital and acts as a drag on the overall earnings of the business.

By avoiding the capital-intensive and low margin allocation of capital to land acquisitions, NVR has been able to generate returns-on-equity of 20% to 40% over the long-term, which is 2 to 3 times better than most of its large competitors.

NVR’s efficiency doesn’t stop there. The company focuses its efforts on specific geographic areas where it has expertise, allowing it to operate with precision and keep costs low. This smart, focused strategy translates into exceptional financial results.

What NVR does with its cash is just as impressive as how it earns it. Instead of chasing expensive acquisitions or paying out large dividends, NVR focuses on buying back its own shares. Over the past two decades, the company has reduced its share count by roughly 80%, often repurchasing 3–10% of shares annually, depending on market conditions. This disciplined capital allocation has created enormous value for long-term shareholders.

For investors, there’s a lot to learn from companies like NVR.

In fact, after a great deal of activism by shareholders, another U.S. builder - D.R. Horton - has transitioned to a capital-light model similar to that of NVR. It now uses options to secure ~75% of its land, a dramatic shift from its previous land-intensive model. The company has effectively transformed from a real estate land ownership business to a high-volume manufacturer of homes, significantly improving its unit economics.

All of this proves that the NVR model is capable of being replicated successfully.

Is Vistry Group a British Version of NVR?

On 11th May 2023, Vistry announced that Paul Whetsell would become a non-executive director of the business. Why is this relevant? From 2008 to 2018, Whetsell was a non-executive director of NVR.

It becomes clear that Vistry has not only been admiring the modus operandi of NVR, but it has actively sought to recruit one of its people.

So who are Vistry Group and will they become a UK version of NVR?

The majority of new homes in Great Britain, over 60% in 2021/22, are built through the speculative model of housebuilding, where developers purchase land in advance of construction and sale, aiming for profit without knowing the final selling price. In contrast, about 30% of homes are built as affordable housing (sold or rented at below market rates) and these are typically funded and procured by public bodies, local governments, or registered housing providers, or supplied by housebuilders through planning obligations.

The speculative model promises higher margins, but entails taking more risk and tying up capital for extended periods as acquired development land subsequently needs to be permissioned for building. The affordable model is lower margin business but with far less risk as the building occurs largely on a pre-sold basis. It is also less capital intensive because the land is often provided by the body commissioning the build.

Vistry is a market leader by volume of units developed each year. It participates in both the speculative model and affordable housing segments of the market. This short video provides a taste of the company that is Vistry:

As recently as the first half of 2023, Vistry was focused on the virtues of carrying a large land bank. In other words it was just another traditional builder. Then, in September 2023, following a strategic review, management seemed to have had an epiphany and began speaking about reducing its land bank, transitioning instead to a capital-light partnership model.

Sound familiar?

This transformation was almost certainly driven by its acquisition of Countryside Properties, a company fully committed to partnering with housing associations, public bodies, and institutional private rental operators.

“In 2023, Vistry established its position as the country’s leading Partnership business. The Group successfully integrated Countryside Partnerships, and … updated its strategy to fully focus on its high growth, capital light Partnerships model.”

Greg Fitzgerald, CEO

Naturally, this shift generated significant market excitement. Investors anticipated substantial improvements in unit economics and drew parallels to the success of NVR. Many U.S. investment funds eagerly boarded what they saw as an express train to high returns.

Unfortunately, reality has been far less rosy. Vistry encountered significant turbulence, issuing three profit warnings within three months in late 2024:

In October 2024, Vistry issued its first profit warning, stating that adjusted profit before tax for the full year 2024 would be around £350 million, down from previous guidance of £430 million. This was due to higher-than-expected costs in its Southern Division.

In November 2024, Vistry further reduced its 2024 profit guidance to around £300 million.

On December 24, 2024, Vistry issued its third profit warning, cutting its 2024 profit guidance to around £250 million due to delays in expected year-end transactions and completions.

This turmoil caused its share price to plummet by nearly 60%.

The company has pointed to a number of factors which it blames for these profit warnings. Some are internal operational issues (discussed later), while others are exogenous factors. But what happened in October that could have been a catalyst for triggering downgrades in profit forecasts?

The key catalyst which occurred in October appears to have been the first budget introduced by the UK’s new Labour government. While the policies may have been well-intentioned, little consideration seems to have been given to their second-order consequences.

The budget included a target to build 1.5 million new homes over the next five years (more on this later). However, significant uncertainties remain. For example, discussions are ongoing between the government and housing associations regarding rent reviews (desperately needed due to increased funding costs in a higher rate environment), plus there is debate about replacing the affordable housing program introduced by the previous government in 2021.

This lack of clarity has left housing authorities - on which Vistry’s partnership model is heavily dependent - paralyzed by indecision. Unfortunately, clear guidance on these issues is unlikely to emerge before Spring 2025 and are unlikely to take effect until sometime after that (perhaps early 2026), prolonging the uncertainty and its impact on Vistry's operations.

This highlights an issue with Vistry’s plans to partner with public sector bodies - they can often act as a drag on performance because they tend to slow everything down - hence the adjustments in Vistry’s profit expectations.

So, in terms of the sell-off in Vistry’s shares, has the market misinterpreted the situation? Does the recent share price collapse represent a golden opportunity to invest in a potential turnaround story poised to deliver exceptional returns in the years ahead? Or was the switch to the partnership model a mistake by Vistry management?

To answer these questions, it’s crucial to take a step back and analyze Countryside Properties, now part of the Vistry Group, which served as the catalyst for the shift to the partnership model.

Before its acquisition, Countryside was already facing significant challenges. The company had issued a profit warning itself and missed its financial targets, with adjusted revenue falling 13% to £658.6 million and adjusted operating profit plummeting 42% to £45.6 million in the six months to March 2022. These struggles led to the ousting of CEO Iain McPherson and prompted a full review of operations by chairman John Martin.

The review revealed several issues, none directly tied to the partnership model. Countryside had expanded too quickly, failing to integrate acquisitions effectively -most notably the 2018 Westleigh deal. Rather than a harmonious group, the business operated as a fragmented collection of "fiefdoms," some of which proved unprofitable. Additionally, the company had poorly allocated capital to its Modern Methods of Construction (MMC) initiative, which focused on modular pre-fabricated building techniques but failed to deliver the anticipated results. These issues were described in the strategic review as "execution-related" and "solvable." In other words, the company had been poorly managed and with the CEO gone, the business could be turned around.

Countryside’s perceived undervaluation attracted activist investors, Inclusive Capital amongst them, which made a £1.5 billion acquisition bid. The board rejected the offer as too low, citing the company’s unique market position and potential. However, ongoing difficulties ultimately led to its acquisition by Vistry Group for a lower figure of £1.25 billion, a move intended to enhance growth prospects by exploiting synergies which it was hoped would strengthen capabilities across all housing tenures, particularly in affordable housing.

Fast-forward to late 2024, and Vistry has now issued three profit warnings in as many months. Has it simply inherited Countryside’s unresolved problems?

In its latest profit warning on December 24, 2024, Vistry cited delays in concluding agreements with partners, although it "forecast" these deals to close in fiscal 2025. Additionally, and of note, it stated that it had withdrawn from several proposed deals, stating that the commercial terms were "not sufficiently attractive."

This comment raises legitimate concerns because the success of the partnership model hinges on Vistry’s ability to deliver on the needs of its partners, such as housing authorities. If Vistry sees the terms of these deals as unattractive it jeopardizes the entire partnership capital-light operating model.

Consider the Meridian Water development project in the London borough of Enfield . Vistry secured the first phase of this multi-billion-pound project in 2020, after Barratt Developments had withdrawn in 2017. Barratt, previously named the council's preferred bidder, was expected to deliver housing, infrastructure, a railway station, and retail space. However, Enfield council’s extensive demands coupled with a limited budget rendered the project financially unviable for Barratt.

This raises a critical question: How is Vistry managing to make such projects financially viable when others could not? With three profit warnings since October, could it be that Vistry has mispriced some of its large-scale projects?

The company’s own statements lend weight to this theory. Remember that Vistry explicitly stated it had pulled deals where the terms were "not sufficiently attractive."

What does this say about its future prospects and its deal pipeline?

Ultimately, has Vistry’s management bitten off more than it can chew?

Vistry Management

Greg Fitzgerald, CEO of Vistry Group, describes himself as a “maniac” workaholic, admitting, “The vast majority of my life I’ve lived to work. I was absolutely 24/7.”

He has recently assumed the additional role of executive chairman. While this dual role is ostensibly a cost-cutting measure, it raises concerns about corporate governance. Without an independent chairman, there is no internal challenge to the CEO’s decisions. Although combining these roles can work - Berkshire Hathaway being a notable example - Fitzgerald is no Warren Buffett.

He left school without qualifications and entered the building trade on a youth training scheme - a school leaver’s apprenticeship. Perhaps this is why he is very supportive of apprenticeships at Vistry today:

Fitzgerald admits to not embracing technology particularly well, admitting that he dislikes receiving or sending emails. He has his personal assistant filter through incoming emails and provide him with a summary of key points. In terms of outgoing communication, he favours a telephone call.

That said, the 60-year-old has enjoyed a long and successful career in the housebuilding sector. In 1997, he co-founded Gerald Wood Homes, later selling it to Galliford Try (now part of the Vistry Group). He then became Galliford Try’s CEO, growing the business both organically and through acquisitions until 2015, when an intriguing twist occurred.

Fitzgerald stepped down as CEO in late 2015, transitioned to executive chairman, before becoming a non-executive director. Within a year he had announced his retirement and left the company in November 2016. The circumstances of his departure are peculiar and raise the question, did he leave willingly, or was he pushed out?

His retirement was brief. By early 2017, just four months later, he became CEO of Bovis Homes, a company grappling with financial difficulties. This raises another interesting question: Why leave a thriving business only to take the helm of a troubled one?

In a further twist to this story, Fitzgerald orchestrated the acquisition of Galliford Try’s housebuilding arm by Bovis Homes, creating what is now the Vistry Group. Was this a strategic move or possibly driven by a personal desire to reclaim the business he once led? Perhaps the acquisition was some form of personal vendetta - we’ll probably never know and I’ll leave you to formulate your own opinion.

Fitzgerald’s deal-making streak didn’t stop there. Just 18 months later, he spearheaded the acquisition of Countryside Properties (more on this later). This move catapulted Vistry to the position of the UK’s largest housebuilder by volume, delivering over 16,000 homes in 2023.

Beyond Vistry, Fitzgerald also owns and chairs Baker Estates, a Devon-based regional housebuilder with an £85 million turnover, further demonstrating his deep roots in the industry.

Known for his brash personality and outsized ego, Fitzgerald isn’t one to cultivate many friendships within the sector. However, Alastair Stewart, an analyst at Progressive Research, compares him to Tony Pidgley, the legendary founder of Berkeley Group, calling Fitzgerald “one of the four best CEOs of any housebuilder in the last three decades.”

Love him or loathe him, Fitzgerald’s career trajectory and leadership style have left an undeniable mark on the UK housebuilding industry.

However, his brash style seems to make for an unhappy board room with a relatively high churn rate. Vistry Group has undergone several changes in senior management over the past year alone:

Jeff Ubben stepped down as a Non-Executive Director in January 2024, replaced by Usman Nabi

Rob Woodward was appointed as Senior Independent Director earlier in 2024

Ralph Findlay stepped down as Chair and Director on May 16, 2024 with Greg Fitzgerald becoming Executive Chair & Chief Executive Officer

Chris Browne stepped down as a Non-Executive Director at the 2024 Annual General Meeting, replaced by Rowan Baker

Earl Sibley, Chief Operating Officer, left the company in December 2024 following the removal of the COO role. Heads needed to roll following the profit warnings and share price collapse, Sibley was the scape goat. The company said scrapping his role will reduce ‘the length of reporting lines’ and allow Fitzgerald, 60, to have more direct oversight of the business.

Fitzgerald has suggested that board-level conflicts and discontent among UK shareholders prompted him to take on the dual role of CEO and Chairman. Whether this move will improve the situation or exacerbate existing issues remains to be seen. Only time will tell.

The key questions now are whether Fitzgerald can steady the ship and, more importantly, whether Vistry can successfully execute its transitional plan.

Fitzgerald is undeniably ambitious. After delivering 16,000 homes in 2023, he has set his sights on making Vistry a 25,000-homes-per-year builder by 2028. Notably, no UK housebuilder has ever surpassed the 20,000-units-per-year mark, making this a bold and unprecedented goal.

He plans to achieve this ambitious growth through the newly adopted partnership model, and his supporters say there is no-one better qualified to pull this off. The partnership model is expected to enable Vistry to deliver affordable housing more effectively - a critical element of the plan.

This focus aligns with the UK government’s increasing affordable housing targets, which should create sufficient demand to support Fitzgerald’s lofty production goals. Whether this strategy will succeed remains to be seen, but the stakes are high for both Fitzgerald and Vistry.

Fitzgerald is certainly backing himself. As recently as 11th August 2024 he bought another 268,957 shares in Vistry at a price of £9.58 (significantly higher than the £5.60 price at which they trade today). His holding in the company of nearly 1.1 million shares (0.33% of the business) has a value of £6.1 million GBP - so he has skin in the game.

The UK Housing Market

Most analysis that I read about Vistry and its competitors contain errors of fact in relation to the housing situation in the UK. Let’s set the record straight.

It is crucial to debunk the prevailing myth, perpetuated by the media and short-sighted politicians, that the UK suffers from a housing shortage. The facts tell a different story.

The table above, based on Government data1, demonstrates that housing stock growth has outpaced population growth.

Census data reveals that in 2021 there were 1.4 million more dwellings than households in England. That’s 6.1% more places to live than households to fill them. This was the case across all regions as shown in the charts below:

The real housing issue in the UK is a lack of ‘affordable’ homes, which is an entirely different problem in both substance and form. Said differently, it isn’t that there’s a lack of homes, but that the homes available are mis-priced and out of reach of those that need them.

You may be wondering how an over supplied market can be over-priced. It’s a good question, so allow me to furnish you with an answer.

Legislative changes beginning with the Housing Act of 1988 introduced assured shorthold tenancies, giving landlords confidence to invest in rental properties without the risk of being stuck with non-compliant tenants. The introduction of buy-to-let mortgages in 1996 further catalyzed the market. As shown by the red arrow below, this was the pivotal moment which caused property price inflation to run too far ahead of wage growth, causing an affordability issue. Back then, the average house price was about 3x the average wage. Today it is around 12x in some parts of the country.

In the mid-1990s, rental yields were as high as 16%, making property an attractive investment. As demand surged, property prices rose, and rental yields fell. Professional landlords gradually withdrew from the market as yields became unattractive, but amateur investors - lured by rising property values - continued to buy, often using re-mortgaging strategies to build leveraged portfolios.

This speculative fervor caused house prices to soar far ahead of wage growth, making homeownership unattainable for many, particularly key workers like nurses, teachers, and police officers. Monetary policies that kept interest rates low and expanded the money supply only worsened the situation, inflating the property bubble even further.

Rather than allowing market corrections, successive governments introduced measures like "Help-to-Buy," which artificially boosted demand, further inflating prices. These policies, aimed at helping first-time buyers, ironically made homes less affordable and benefited speculators and housebuilders instead.

Today, under a new Labour government, there is a renewed push to build affordable homes, with a target of 1.5 million new homes over the next five years. Vistry Group is positioning itself to capitalize on this ambition - its new partnership model will see it pair with local government housing associations to develop the requisite housing at a mutually attractive price point.

However, history casts doubt on these promises. Previous governments have consistently fallen short of their housing targets, and the current government faces significant fiscal challenges, with national debt exceeding 104% of GDP. Recent tax hikes aimed at addressing this debt may stifle economic growth and exacerbate inflation, making it harder for the Bank of England to reduce interest rates - a recession is not entirely beyond the realms of possibility.

Higher interest rates further complicate the housing market. For example, at a 1.5% interest rate, a buyer with a £1,000 monthly budget could afford a mortgage of £810,000. At a 5% rate, that figure plummets to £240,000. This stark reality has left buyers unable to meet sellers' price expectations, leading to a drop in mortgage approvals and stagnation in the market.

As sellers resist lowering prices and buyers cannot afford inflated valuations, equilibrium can only be reached through price corrections. Such a scenario could lead to a wave of distressed sales, particularly among over-leveraged buy-to-let investors.

If house prices correct, the "affordable housing crisis" may resolve itself, but this would come at a significant cost to housebuilders. The gross development value of land held by builders would plummet, leading to a downturn in profitability.

As the biblical story of Joseph teaches, seven years of plenty are often followed by seven years of famine. For British housebuilders, the warning signs are clear - Vistry’s three profit warnings in as many months are ominous indicators that the good years may be coming to an end. Housebuilding is, after all, a cyclical industry.

In its November 2024 trading statement, Fitzgerald states, “…as you've heard from other house builders, market conditions have generally been weaker than we had hoped.”

This is a real risk that any investor needs to properly consider.

Another risk that needs to be documented in this analysis for the sake of completeness relates to an investigation being conducted by the UK Competition and Markets Authority (CMA). In February 2024, following the publication of their general report on the UK housebuilding market2, they decided to launch an investigation into eight major UK housebuilders, which includes Vistry, because the market is somewhat oligopolistic in nature and the CMA has a duty to ensure that the dominant forces in such a market are not exploiting their market power.

The investigation, being conducted under Chapter I of the Competition Act 1998 to determine whether these companies have breached competition law, was due to conclude in December 2024. Given the importance of this investigation and its potential impact on the housing market, it's likely that the CMA will release its findings soon. The outcome could have significant implications for the housebuilding industry and potentially lead to penalties for companies found to have violated competition laws.

Distinguishing Vistry from NVR

Vistry’s move to a capital-light operating model may resemble the approach pioneered by NVR, but the two businesses differ fundamentally on multiple levels.

Gross Development Value of Land Acquired

NVR employs Lot Purchase Agreements, securing the right—but not the obligation—to purchase land from third-party commercial landowners. This model, coupled with its focus on higher-end properties, enables NVR to extract maximum value from each parcel of land and outbid competitors.

In contrast, Vistry operates in the affordable housing sector, targeting lower-cost housing. This inherently limits the gross development value of the land, leaving less value to capture and weakening Vistry’s competitive position when bidding for land.

Type of Partners

NVR collaborates with commercial landowners who operate with a capitalist, profit-driven mindset.

On the other hand, Vistry partners with not for profit housing authorities. These entities are bureaucratic and often prioritize social objectives over economic efficiency. Pairing a profit-oriented private company with public sector partners focused on social housing - a fundamentally socialist construct - creates inherent tensions and does not make for a harmonious marriage.

Permissioning Issues

The UK’s planning system poses significant challenges. In most parts of the world builders are permitted to build anything and anywhere except where rules and regulations prohibit it. However, the UK does it the other way around and requires explicit permission for every development. This results in lengthy, unpredictable, and costly approval processes, which hinder the performance of UK housebuilders.

In contrast, NVR operates in a regulatory environment that facilitates faster returns on investment, translating into higher returns on capital.

Different Market Dynamics

In addition to the dangers of a house price correction, as discussed above, housing associations (Vistry’s intended partners in the affordable housing segment) are experiencing significant financial strain. The Regulator of Social Housing reported a decline in cash reserves, from £5.8 billion pre-pandemic to £4.2 billion in late 2023, with projections of further declines to £2.7 billion by 2025. Due to the higher interest rate environment, many housing associations are approaching interest coverage ratio limits, which will hinder their ability to partner on new developments. Meeting new regulatory requirements relating to fire safety and energy efficiency has also taken its toll on the finances of housing authorities as the entire estate that they manage needs to be made compliant. These financial constraints, driven by inflationary pressures, higher interest rates, and spending on existing stock improvements, may make the housing associations unreliable partners.

NVR does not face these challenges, as it operates independently of public sector partnerships.

Input Costs

Rising build costs in the UK have already contributed to one of Vistry’s recent profit warnings. Inflation, rising wages, and higher National Insurance taxes are exacerbating operating expenses. For example, in October 2024, Vistry revealed it had underestimated total build costs in its southern division by 10%, prompting an independent review.

Geographic Focus

NVR focuses its efforts on specific geographic areas where it has expertise, allowing it to operate with precision and keep costs low. This smart, focused strategy translates into exceptional financial results.

Vistry, in contrast, operates across a wide geographic footprint, leading to underperformance in some regions and dragging down overall group performance.

Capital Allocation

NVR has never paid a dividend, preferring to use surplus capital to buy back stock and reduce equity financing. This disciplined approach has allowed it to repurchase 80% of its outstanding shares, maximizing shareholder value.

Vistry, however, has maintained an average payout ratio of over 50%. This is very British and not conducive to optimizing shareholder returns (explanation of why this is the case).

While it recently announced plans to repurchase £130 million worth of shares, this was before issuing three profit warnings, which have significantly reduced its free cash flow.

Ironically, with a 60% drop in market cap, Vistry’s current share price makes this an ideal time for buybacks. Abandoning its dividend to prioritize share repurchases would be a prudent move, but only time will reveal management’s priorities. Decisions around capital allocation, given prevailing circumstances, will be an interesting test of the competence of Vistry’s management.

Quality of Management

Building on the discussion around capital allocation, and as explained at the beginning of this analysis, NVR ignores Wall Street’s demands, it refuses to give guidance, and is not distracted by short-term earnings targets.

In stark contrast, Vistry has taken a more reactionary approach, catering to external investor pressures. Not only has it fallen into the "dividend trap", but it also unnecessarily issues short-term earnings guidancewhich has now resulted in three calamitous profit warnings.

The disparity in management quality between the two companies extends beyond the executive level. Vistry has also acknowledged issues within its middle management. In a trading statement dated November 8, 2024, Fitzgerald admitted that “management capability in certain areas has been an issue.” He pointed to noncompliance with processes and poor divisional culture as key factors contributing to underperformance.

While the existence of these problems is concerning, Fitzgerald's candid acknowledgment is a step in the right direction. He has initiated a review focused on compliance with processes, the quality of reporting, and, most importantly, the caliber of personnel within the business. Notably, these issues pertain to a specific subset of the company within the South Division.

Fitzgerald has expressed confidence in the company’s ability to standardize best-in-class operational practices across all divisions, stating, “We know what best-in-class operational standards look like as they already exist in other divisions… And those best-in-class standards will become our norm across the entire business.”

The business has grown rapidly by way of acquisitions and so has become something of a management bureaucracy. Fitzgerald acknowledges that, “the issues are a function of too many organizational layers developing. These changes, I'm making, will eliminate these layers”.

Ultimately, only time will reveal if the company is able to learn from its past mistakes.

Financial Performance

NVR’s financial metrics are consistently exceptional. Over the past decade, it has grown revenue, profits, and free cash flow while maintaining low debt. Gross margins exceed 20%, net margins range from 12–15%, and free cash flow margins surpass 11%. Even during the 2008 financial crisis, NVR remained profitable. Its return on invested capital (ROIC) frequently exceeds 20–30%, peaking above 60% in strong market conditions.

Vistry, on the other hand, has seen its financial performance deteriorate significantly since 2020. While its gross and EBITDA margins were once comparable to NVR, they have since declined, and its ROIC has dropped to mid- to high single digits.

It is clear that NVR and Vistry are nothing alike. Ultimately, expecting Vistry to replicate NVR’s success may be a mistake.

Vistry’s shift to a capital-light model appears to be driven at least as much by necessity as it is a strategic choice. If successful, this transition will improve its financial metrics, but it is unlikely to achieve NVR’s level of performance in the near term.

While NVR consistently delivers ROICs around 40%, much of this has been achieved by reducing the denominator through aggressively buying back shares. Vistry may take a decade or more to buy back 80% of its shares, if indeed it intends to ditch its dividend policy in favour of aggressive share repurchases.

Valuation

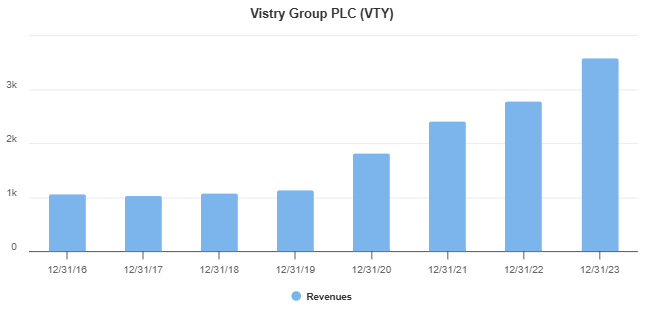

Despite recent challenges, Vistry has achieved consistent top-line growth under the leadership of CEO Fitzgerald. Since his appointment, revenue has grown impressively, reaching £3.5 billion in 2023 - a 350% increase since 2018.

The new operating model focuses on delivering lower-value affordable housing. While this offers less profit per unit compared to Vistry’s legacy approach, it ties up far less capital, promising more consistent returns through property cycles. Fitzgerald has also highlighted the potential for a significantly higher stock market valuation once the model is fully implemented.

The company speaks about fully transitioning to the Partnerships model with the Group focused on a number of initiatives to release capital from slow moving assets on the balance sheet. This excess capital will then be returned to shareholders either in the form of dividends or stock repurchases. It aims for the transition to be completed within the next two years.

In its 2023 Annual report, the company stated that the Group is focused on a returns-based model and delivering an industry leading 40% return on capital employed is a key priority.

It set out medium-term targets for the new strategy:

Return on capital employed of 40%

Revenue growth of 5% to 8%

Operating profit of £800m with a 12%+ operating margin

£1 billion of capital returned to shareholders over next three year

That 40% ROIC number, and 8% top line growth, suggests that Fitzgerald may have been studying NVR and seeks to replicate its model. However, based on the distinguishing factors outlined above, it feels overly optimistic, bordering on naïve on the part of the management - particularly since its ROIC is currently a single digit percentage. As such, I am inclined to take these targets with a pinch of salt.

Vistry’s strategic transformation makes valuation particularly difficult due to the numerous variables at play:

Acquisition Integration: Recent acquisitions could either succeed in driving synergies or fail, creating inefficiencies.

Capital-Light Transition: With no historical data, it’s challenging to predict the performance of the new operating model.

Macroeconomic Factors: Broader economic pressures, such as inflation, interest rates and a possible correction in house prices add further uncertainty.

Capital Allocation: Changes to the company’s capital allocation policy remain largely unknown.

Profit Warnings: Three recent profit warnings further cloud future profitability estimates.

Each of these factors requires significant assumptions. If even one assumption proves incorrect, it could distort valuation estimates. If multiple assumptions are wrong, the resulting valuation could deviate so significantly from reality that it becomes unreliable.

While the new operating model holds promise for Vistry’s long-term growth and profitability, the sheer complexity and uncertainty surrounding its transformation mean that any valuation at this stage should be approached with caution. That having been said, let’s try some monte-carlo style analysis.

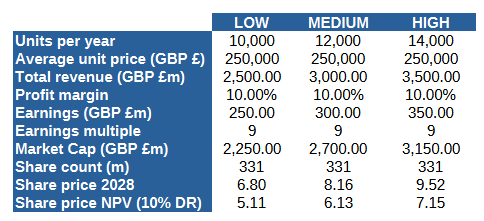

In 2023, the company produced 16,000 housing units at an average price of £276,000 GBP. Fitzgerald aims to produce 25,000 units by 2028.

Scenario 1: Let’s assume that the unit price increases broadly in line with inflation and so reaches £308k by 2028. Also we assume that there is no reduction in the share count. We assume that the partnership model will allow the profit margin to expand to 14% and that the shares re-rate to be capitalized at 12x earnings. The low scenario assumes that production plateaus at 16,000 units. The high scenario assumes Fitzgerald hits his 25,000 units a year target, and medium sits between the two. This implies a significant amount of upside in the share price from current levels of £5.50.

Scenario 2: This is the bull case, with earnings multiples expanding to 14x and the share-count reducing by ~10%.

Scenario 3: This is the bear case, with earnings multiples remains high single digits, there is a correction in the housing market resulting in average prices falling ~16%, demand for affordable homes reduces so output numbers fall, profit margins are 10% and the share-count does not reduce.

Even in the bear case, low scenario, there appears to be very little downside from where the shares are trading today. This suggests an asymmetrically favourable skew.

Let’s consider this from another angle. When Fitzgerald became CEO of Bovis Homes in 2018, the company had a market capitalization of £1.16 billion GBP. Since then, it has acquired Galliford Try for £1.08 billion GBP in 2020 and Countryside for £1.25 billion GBP in 2023. Combined, these acquisitions suggest a business worth £3.5 billion GBP, even before accounting for potential cost synergies.

Yet, despite substantial top line growth and consolidation which has created the UK’s largest volume builder, Vistry’s current market capitalization has fallen to just £1.87 billion GBP for all three businesses combined. Remember that as recently as 2022, a US Private Equity firm offered to buy Countryside alone for £1.5 billion.

Finally, there is the huge land bank that Vistry has. At a rudimentary level, the net asset value of the busines as at the end of 2023 was £3.3 billion, of which £1.9 billion was land. This has remained consistent from year to year.

As such, Vistry may currently be trading at a significant discount to its net assets, meaning that the business, as a going concern, is ascribed no value at all - which can’t be correct.

Unless you believe that Vistry is on the verge of failure, whatever valuation methodology you use, it is difficult not to conclude that this is a mispriced security with significant upside potential.

It is also worth pointing out that at the beginning of December 2024, Vistry was relegated from the FTSE 100 blue chip index to the FTSE 250. This has compounded its share price decline by excluding it from passive funds tracking the FTSE 100. Yet, this situation also presents a potential opportunity: successful execution of the new strategy and operational improvements could prompt Vistry’s reentry into the FTSE 100, driving multiple expansion, a re-rating of the stock and a catalyst for further valuation recovery.

Is Vistry A Good Investment?

Vistry is an investment with lots of hair on it, that’s the undeniable truth, but sometimes fortune favours the brave and the bad news seems to already be in the price.

The other thing worth noting is that profit warnings are often issued in series rather than as a single announcement. Initially, company leaders may underestimate the severity of the issues, leading to an understated first warning. This inevitably results in a second warning, which can be embarrassing for management. By the time a third profit warning becomes necessary, it can seriously damage management’s credibility. To avoid the need for a fourth warning—which would likely result in management losing their jobs—leaders often take a "kitchen sink" approach with the third warning. This involves including all possible bad news in one announcement to ensure no further surprises. However, this approach can cause the pendulum to swing too far, creating excessive pessimism. As a result, the next earnings release often surprises to the upside.

These are the opportunities where investment returns are often strong. High uncertainty causes a price collapse which lowers the risk, a great time to buy - Mohnish Pabrai refers to these as ‘heads I win, tales I don’t lose much’ (click here for an explanation).

However, there are a host of unanswered questions:

Has Greg Fitzgerald bitten off more than he can chew with recent acquisitions?

Has Fitzgerald’s over confidence and ego taken him way out of his depth?

Will Fitzgerald serving both as CEO and Chairman help or hinder the business?

Is the transition to a partnership model the right move?

What do the multiple profit warnings tell us about the company’s troubles?

Is all of the bad news now behind us, or is there more to come?

Where will interest rates settle in 2025 and beyond?

Will the UK housing market crash?

Will the Competitions and Mergers Authority spring any nasty surprises?

One thing is certain: Fitzgerald’s decision to fully embrace the capital-light model, emphasizing high returns with lower capital investment, is straight out of the NVR playbook. However the two businesses are fundamentally different and it would be wrong to assume that Vistry will naturally see the same success that NVR has enjoyed.

This strategic pivot highlights Vistry's commitment to addressing government housing demands while tackling its own operational and financial challenges.

The capital-light model offers several potential advantages: stronger cash flow generation, reduced debt levels and funding costs, greater flexibility to allocate capital for growth or share buybacks, and ultimately higher valuation multiples.

If Fitzgerald's strategy succeeds, Vistry appears significantly undervalued. However, failure to implement the new model effectively could lead to downsizing and possible write-downs of the asset values tied to recent acquisitions, resulting in turbulent times ahead.

This is far from a slam-dunk investment opportunity. It is riddled with risks both internal and external in nature. However, much of the risk seems to already be reflected in the price following the recent 60% draw down.

Ultimately, this represents a special situation investment opportunity. Each of us will need to make up our own mind based on our own individual risk tolerance and perspective of the situation - I hope that this analysis will help in some small way, but don’t rely on it. It is intended for information purposes only and is not investment advice. Please do your own due diligence and seek professional advice if required before investing.

Vistry Plc, full year results for the year ended 31 December 2024

FY24 headlines

· Total completions increased by 7% to 17,225 units (FY23: 16,118 units) with Partner Funded completions up by 18% to 12,633 units (FY23: 10,722 units) and Open Market completions down by 15% to 4,592 units (FY23: 5,396 units), and average selling prices remaining firm

· Delivering high quality much needed new homes is the Group's top priority, and we expect to be awarded a 5-Star HBF Customer Satisfaction rating for the sixth consecutive year in 2025

· The Group significantly underperformed financially in the year, reporting adjusted profit before tax of £263.5m (FY23: £407.3m)

· The issues relating to the forecasting of costs in the South Division were identified during the year and as previously reported, had a total impact of £165m

· Following year end procedures, the phasing of the impact of the South Division has been adjusted to include a £20.5m restatement to prior years and the net impact on FY24 adjusted profit before tax has been revised to £91.5m, as compared to the previously expected £105m

· The Group continued to secure attractive new land and development opportunities throughout FY24, totalling 16,508 (FY23: 15,288) mixed tenure plots

· The Group has increased its building safety provision by £117.1m in FY24 largely due to additional buildings identified as needing remediation. This has driven a net increase in the total provision as at 31 December 2024 of £35.4m to £324.4m (31 December 2023: £289.0m)

· Group net debt position of £180.7m as at 31 December 2024 (31 December 2023: £88.8m)

Cash generation and capital allocation

· Ensuring the Group retains a strong financial position remains a key priority for FY25. The Group expects to deliver improved cash generation resulting in a steady reduction in average net borrowings through the year and a year-on-year reduction in the Group's net debt as at 31 December 2025

· The Group is targeting a c. £200m reduction in excess working capital in FY25, addressing a build-up of Open Market stock units in FY24. Tighter cash controls have been introduced at a site level, and there is weekly monitoring at an executive level

· The Group is also looking at ways to accelerate the cash release from its former Housebuilding landbank with options including bulk sales and discounting under consideration

· In September 2024, the Group announced a total capital distribution of £130m comprising a £55m ordinary distribution in respect of the H1 24 earnings and a £75m special distribution. The Group has completed £38m to date and expects to complete the remaining £92m via share buyback, to be concluded in H1 2026

· Reflecting the performance in FY24, the Group is not proposing any final ordinary distribution in respect of the FY24 adjusted earnings. Future distributions will be made in accordance with Group's capital allocation policy

Government stimulus

· The Government is committed to addressing the country's acute housing crisis and is implementing a range of much-needed demand and supply side initiatives to support this ambition

· The recent announcement of a £2 billion injection of new affordable homes grant funding is very positive, and alongside the £800m of top-up funding previously announced, will drive investment momentum across the affordable housing sector ahead of the launch of the 2026 Affordable Homes Programme

· We have also seen strong progress with supply side initiatives particularly focused on land release and planning

· The Construction Skills Mission Board will address skills shortages, overseeing a £600m package aimed at training 60,000 construction workers by 2029

Current trading and FY25 outlook

· Group's forward order book totals £4.4bn (14 March 2024: £4.6bn), with 65% (FY24: 65%) of forecast FY25 units secured

· The Group sales rate of 0.59 (2024: 0.81) sales per site per week for the year to date is down on prior year reflecting a low volume of Partner Funded transactions in the first quarter

· We expect Partner Funded activity to step-up as the new £2bn of affordable housing funding is allocated, with a greater H2 weighting of Partner Funded delivery for the Group in FY25

· We are expecting overall Partner Funded volumes in FY25 to be at a similar level to FY24, with strong momentum going into FY26

· In the Open Market, we have seen some uptick in our sales rate in the past four weeks and expect this to continue to improve

· Whilst our sales outlets will continue to reduce as we roll-off former Housebuilding sites, we expect to maintain Open Market volumes at a similar level to FY24 in FY25

· We are seeing some upward pressure on build costs and are expecting low single digit build cost inflation in FY25

· The Group continues to expect to make year on year progress in profit in FY25, with profits being more H2 weighted than in prior years. H1 margins will reflect a greater proportion of delivery from lower margin sites and some impact on profit from actions being taken to accelerate cash generation. We expect H2 margin recovery to be driven by the commencement of new higher margin developments and the benefit of operating leverage from higher volumes in the second half

Medium term

· The Group continues to target a 40% return on capital employed, a 12%+ operating margin and revenue growth of 5% to 8% p.a. in the medium term

· The Board remains confident in the Group's differentiated partnerships strategy and expects to see good progress towards the Group's medium-term targets as we see both a step up in partner investment supported by Government policy, and a recovery in the Open Market

One of the best analysis I have read on Vistry that touches many issues that other bullish writeups have missed.