DISCLAIMER & DISCLOSURE: The author holds no position in Blackstone, Apollo or KKR at the date of publication but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Part Two of Our Three-Part Series on Alternative Asset Management Firms

In Part One, we looked at why investing in alternative asset management firms may be the perfect place to allocate your capital when markets are turbulent, geo-political risk is rising and traditional investing models are creaking under the pressure of uncertainty. We wrapped up by comparing the share price performance of four major players in the space:

Blackstone Group (BX) – A global heavyweight with investments spanning private equity, real estate, credit, and hedge funds.

KKR & Co. Inc. (KKR) – A diversified investment firm managing assets across private equity, energy, infrastructure, real estate, and credit, with an increasing focus on Japan.

Apollo Global Management (APO) – Known for its focus on private equity, credit, and real estate.

Brookfield Corporation (BN) – A unique player with a broad portfolio that includes infrastructure, real estate, renewables, and private equity.

Today, in Part Two, we’ll take a closer look at the first three: Blackstone, KKR, and Apollo - the powerhouses of the U.S. alternative investment world. We'll explore their origins, how they make money, and what sets them apart.

In Part Three, we’ll turn our attention to Brookfield, whose structure and strategy are different enough to merit a dedicated deep dive.

1. Blackstone: A Giant That Redefined Alternative Investing

Few firms in the financial world have the scale, adaptability, and track record of Blackstone. From humble beginnings to managing over $1.27 trillion in assets by the end of 2024, Blackstone has grown into the world’s largest alternative asset manager - setting the standard for the industry.

From $400K to the S&P 500

Blackstone’s story began in 1985 with just $400,000 in seed capital. Founders Pete Peterson (who died in 2018) and Steve Schwarzman (current CEO) initially focused on mergers and acquisitions, but they had much bigger ambitions.

The LBO (leveraged buyout) boom of the 1980s opened the door to private equity, and by 1987, Blackstone had raised its first PE fund.

Fast forward to today: Blackstone was the first alternative investment firm to join the S&P 500 and now spans private equity, real estate, credit, hedge fund solutions, and insurance.

A Scalable, Asset-Light Machine

At the core of Blackstone’s business model is an asset-light approach, meaning that it primarily invests client capital rather than its own. This allows for rapid scaling without tying up the firm’s balance sheet. It’s a key reason why Blackstone has outpaced competitors in both size and reach.

Big Bets That Paid Off

Blackstone’s rise is marked by smart, high-impact deals.

One of its early wins was the acquisition of Transtar, a transportation business owned by U.S. Steel - demonstrating Blackstone’s core strategy: buy undervalued assets, improve them, and sell at a premium.

In the 1990s, Blackstone spotted opportunity in the U.S. real estate downturn, snapping up distressed properties and building what would become one of the most powerful real estate portfolios in the world. Today, real estate makes up about 30% of its total AUM.

Blackstone’s ability to integrate expertise across different asset classes sets it apart. For instance, its investment in Hilton Hotels in 2007 - one of the largest LBOs in history - demonstrated how the firm combined both its real estate and private equity expertise to great affect. Despite acquiring Hilton just before the financial crisis, Blackstone’s operational improvements and strategic real estate decisions led to a $14 billion profit upon exit.

Post-2008, when traditional banks pulled back from lending, Blackstone jumped into private credit, acquiring GSO Capital Partners - now the backbone of one of the largest credit arms in the industry.

How Blackstone Makes Money

Blackstone’s revenues come mainly from two sources:

Management fees: Ongoing, stable income tied to assets under management.

Performance fees: Success-based earnings tied to investment returns.

While performance fees used to dominate, Blackstone has shifted toward a more stable revenue mix, with management fees now accounting for two-thirds of income. This shift cushions the business during volatile markets and reduces dependency on exits.

The Power of Perpetual Capital

A major strategic advantage? Perpetual capital - funds that don’t expire. Unlike traditional PE vehicles with fixed time horizons, this capital allows Blackstone to invest for the long haul in assets like real estate and private credit, generating recurring income without facing the pressure of redemptions.

This aligns with a broader industry trend: prioritizing durable, fee-based revenue streams while reducing reliance on exits and market timing.

Size, Brand, and Unmatched Deal-Making

Blackstone’s scale is a competitive weapon. With over $1.27 trillion in AUM (up 8% YoY in 2024), the firm can pursue mega-deals few others can touch. Its name alone draws capital from sovereign wealth funds, pensions, endowments, and high-net-worth investors.

Blackstone has cultivated a well-diversified portfolio. Approximately 32% of AUM is in corporate private equity, another 28% in real estate, 7% in multi-asset investing (hedge fund solutions), and 33% in credit and insurance. This diversification mitigates risks associated with economic cycles and provides flexibility in capital allocation.

Innovating Capital Sources: The Insurance Play

Following the lead of legendary capital allocators like Henry Singleton and Warren Buffett, Blackstone (alongside Apollo) has leaned heavily into the insurance space. Managing insurance company assets gives Blackstone access to steady, long-term capital - particularly useful for investments in private credit and real estate. It also reduces reliance on traditional fundraising cycles. This strategy enhances capital stability and provides an edge over firms still reliant on finite fund structures.

Recent Performance and What’s Next

In Q4 2024, Blackstone reported its best-ever fee-related earnings.

Looking ahead, CFO Michael Chae expects a strong rebound in M&A activity in 2025 accompanied by a healthy dose of private equity exits, whose scarcity in recent years has hindered fund managers' ability to raise money from investors.

In this short video, Jonathan Gray (President and COO) explains the focus on growing private credit and also expanding the number of individual investors with capital allocated to the alternative asset management sector that has until now largely been dominated with institutional capital and that from sovereign wealth funds:

Risks and Leadership Transition

Blackstone’s business model has served it well, but despite its success and perhaps due to its scale, it is not without risks:

Blackstone’s dominance in real estate, credit, and insurance-backed investments may attract unwelcome attention from financial regulators which may impact profitability.

A downturn in real estate or private equity valuations could affect both performance fees and asset values. However, Blackstone has diversified across asset classes and its shift toward fee-based revenue helps cushion against cyclical shocks.

Steve Schwarzman has been instrumental in Blackstone’s success, but leadership is slowly transitioning to John Gray, the firm’s President and COO. With a deep bench of talent, Blackstone appears well-prepared for life beyond Schwarzman.

The Verdict

With alternative investments continuing to gain traction among institutional and retail investors, Blackstone’s brand, expertise, and capital-raising capabilities provide a solid foundation for future success. Its growth trajectory remains robust, fueled by its scale, a diversified asset base and access to perpetual capital. Moreover, its management is first class as demonstrated by its ability to adapt to industry shifts, whether through expanding into new asset classes or refining its revenue model. While risks exist, Blackstone’s model is built for durability. It's not just the biggest name in the alternative asset management space - it’s the blueprint.

2. KKR & Co Inc: The Pioneer of the LBO Model

Back in 1976, three Wall Street bankers—Henry Kravis, Jerome Kohlberg, and George Roberts - set out to change the world of finance. They didn’t just build a firm. They built a movement. Fast forward to the end of 2024, and KKR & Co. is managing $638 billion in assets, up 15% year over year, with eyes firmly set on $1 trillion in AUM within five years.

“We have multiple paths in asset management to surpass $1.0 trillion in the next five years... our priority in 2025 is to monetize the environment that we see coming.“

Scott Nuttall, KKR co-CEO

Barbarians at the Gate and the LBO Boom

The firm’s early success was cemented with the landmark acquisition of Houdaille Industries in 1979, followed by the iconic $31 billion takeover of RJR Nabisco in 1988, which was immortalized in the book ‘Barbarians at the Gate’.

These deals not only established KKR as a leader in private equity but also popularized the leveraged buyout (LBO) model, which became a cornerstone of modern private equity investing.

Evolution of a Winning Formula

The 2008 financial crisis was a reckoning for the LBO model, but also an opportunity. KKR used the turmoil to scoop up distressed assets - but more importantly, it reimagined its business.

Recognizing the limitations of relying solely on private equity, the firm began to diversify its offerings, venturing into credit, real estate, infrastructure, and hedge funds. This diversification has not only reduced the firm’s reliance on any single asset class but also positioned it to capitalize on a broader range of investment opportunities.

The firm also began to diversify geographically, establishing a presence in Europe and Asia - a global expansion that allowed KKR to tap into new markets and access a broader range of investment opportunities.

The firm went public in 2010, giving it permanent capital and the firepower to scale.

Credit Is King

One of KKR’s biggest success stories has been in private credit. With banks pulling back on lending, KKR stepped in with flexible financing solutions for mid-market companies.

The credit business now represents a substantial share of both AUM and fee-related earnings, offering steady, recurring revenue - a major win in a choppy macro environment.

Meanwhile, private equity remains core to the firm. KKR’s flagship funds consistently generate mid-to-high teen IRRs, putting them in the top quartile of the industry. Operational improvement and value creation remain their calling cards.

Infrastructure & Real Assets: Playing the Long Game

KKR’s infrastructure strategy targets critical assets like utilities, transport, and renewables—stable, cash-generating investments that are resilient to economic cycles. It’s a capital allocation approach built for durability.

The Insurance Playbook

A pivotal moment in KKR's evolution was the acquisition of Global Atlantic, a leading retirement and life insurance company spun out of Goldman Sachs. With $150 billion in assets and 2+ million policyholders, this move brought substantial scale to KKR’s balance sheet, enhancing its competitive position in the asset management industry, while also providing a stable and predictable source of capital to fuel its growth.

It allows KKR to invest with a longer time horizon, pursue a broader range of investment opportunities, particularly in illiquid and alternative asset classes and reduce its reliance on fundraising cycles. Additionally, the insurance business provides a steady stream of fee-related earnings, contributing to KKR’s overall financial stability.

It is important to understand that the insurance industry is undergoing a transformation, driven by demographic trends, an aging population, regulatory changes, and the search for yield. Global Atlantic’s expertise in managing long-dated liabilities complements KKR’s investment capabilities, particularly in credit and real assets. By aligning Global Atlantic’s liability profile with KKR’s investment strategies, the firm can optimize its asset allocation and generate attractive risk-adjusted returns. As such, it was the perfect marriage.

By aligning insurance liabilities with its investment strategies, KKR effectively built a private market compounding machine. In this short video, Co-CEO Joseph Bae describes it as laying the groundwork for a “mini Berkshire Hathaway”:

Embracing Innovation

KKR isn’t just about capital. It’s about execution. The firm has invested heavily in tech, AI and data analytics to support smarter investing and portfolio management.

Beyond its internal operations, KKR has been a pioneer in using technology to drive value creation in its portfolio companies. The firm's Capstone team, comprising operational experts, actively works with portfolio companies, driving digital transformation and operational improvements in order to gain a competitive edge.

Financial Performance

KKR posted $22.7 billion in revenue and nearly $4.1 billion in profits over the last twelve months, demonstrating strong earnings growth and capital discipline.

Fee-related earnings (FRE) have increased steadily, reflecting the growth in AUM and the shift toward more fee-generating strategies. AUM growth (18% CAGR since 2010) is driven by strong fundraising across all asset classes, as well as organic growth within existing portfolios.

Its Total Operating Earnings (TOE) - which include recurring streams like fee income, insurance earnings, and returns from strategic holdings - came in at $4.88 per share, with a management target of $7.00 per share by 2026 and rising to $15.00 within 10 years provides an indication of how rapidly this business may grow. Carried interest remains a wild card, but KKR has $7.9 billion in gross unrealized carry - another long-term kicker.

However, to introduce balance to this narrative, not everything has been smooth sailing.

Realized performance income dropped to $1.07 billion in 2024, from $2.18 billion in 2023, thanks in part to slower exits from big holdings like AppLovin and Kokusai Electric.

Real asset proceeds were also softer, reflecting broader market headwinds. And some LBOs haven’t aged well.

Toys “R” Us, TXU, and SunGard are cautionary tales from KKR’s past, where heavy debt and changing environments proved too much. Even Dollar General needed serious restructuring after the 2008 crash.

Rising rates have added more pressure. The ZIRP era is over, and some portfolio companies - like Envision Healthcare, US Fertility, Global Medical Response, Academy Ltd and Charter Next Geneation - have hit turbulence. Leverage is great until it’s not.

Nonetheless, KKR tends to maintain a strong balance sheet, with ample liquidity and low leverage, providing flexibility to pursue strategic initiatives and return capital to shareholders over time.

Big Bets: Where KKR Sees the Future

KKR isn’t just managing money - it’s making bold, strategic moves designed to unlock serious value in the years ahead. During 2024, KKR deployed $60 billion into new investments and continues to plant the seeds for future harvesting at a healthy pace. These “big bets” span across infrastructure, the energy transition, and wealth management, and they’re already showing signs of big potential:

Betting Big on Industrial Infrastructure - KKR has grown its infrastructure portfolio from $13 billion to $77 billion in AUM in just five years. It focuses on industrial infrastructure - mission critical but behind the scenes operations including processing, storage, transport and logistics are all essential, but not the key competence of the business, so they don’t need to own these non-core assets - so KKR is stepping in to buy them. The result? Stable, long-term income streams for KKR and its investors. Infrastructure more generally is a segment that is expected to need $100 trillion of capital by 2040, so there is plenty of room for KKR to grow.

Powering the Energy Transition - Since 2010, KKR has invested $35 billion into climate and sustainability initiatives - and they’re just getting started. The firm is leaning into opportunities in renewable energy, energy efficiency, and the infrastructure needed to support a global shift to cleaner power. With momentum building in the energy transition, this space is set to become even more important in the years ahead.

Winners in the Private Equity Portfolio - KKR has increased its stakes in several strategic companies that it believes can deliver strong, steady returns over time. These include USI Insurance Services, 1-800 Contacts and Heartland Dental. Together, these investments total more than $2.1 billion, with a goal of generating over $1.1 billion in operating earnings by 2030. After a two-year drought beginning in 2022, exit opportunities (both through the IPO and M&A markets) have improved in 2024. KKR and other alternative managers expect the exit market to remain robust in 2025 which ought to help unlock still more value.

Wealth Management: A New Frontier - KKR has also been making waves in wealth management. Its K-Series of perpetual investment vehicles, targeted at high-net-worth individuals and family offices, has grown from $3 billion to $14 billion in AUM in just one year. And the momentum keeps building. KKR has been at the forefront of this trend, launching products such as interval funds and business development companies (BDCs) that provide retail investors with access to its investment strategies. This expansion into the retail market represents a significant growth opportunity, given the vast pool of capital held by individual investors. To that end, KKR recently partnered with Capital Group, tapping into a network of over 200,000 financial advisors. This gives KKR access to a massive new distribution channel - something it hasn’t had before - and helps bring its private market strategies to a much broader investor base.

New Frontiers - The firm is focused on growing its presence in Asia, particularly Japan, leveraging its local expertise and global network to capture new attractive investment opportunities.

Asset-Based Finance (ABF) - This is a subsegment of the credit sector that is expected to reach ~$10.0 trillion by 2030. KKR currently has AUM of ~$66 billion in ABF, so the target addressable market is huge. Of note is that credit overtook Private Equity as KKR’s largest segment in 2021 and shows no sign of slowing.

KKR is placing smart, long-term bets that could pay off in a big way. Through all of these initiatives, it becomes clear that KKR has all the ingredients to fuel long-term sustainable growth.

Risks

As with the other alternative investment firms, there are always general risks. These include increasing competition in the alternative asset management industry, regulatory risk, and the possibility that economic downturns negatively impact both returns and fundraising.

More specifically for KKR, expansion into new markets carries execution risks, particularly in Asia where cultural, political and economic tensions exist.

Additionally, KKR has had a mixed track record with its LBO investments as detailed above. While many of its portfolio companies have thrived, some have faced financial distress or collapse due to the impairment of their balance sheets.

If rates move higher or recession strikes, this would create challenges for KKR. Since the Federal Reserve hiked rates marked an end to the ZIRP era in 2022, several KKR portfolio companies have faced financial distress due to high leverage and rising borrowing costs.

In fact, more generally, the number of corporate failures brought about by private equity leverage methods has been steadily increasing.

All of this to say, the KKR success of the past 15 years may not be so easy to replicate in the years ahead.

The Verdict

KKR has come a long way from its “Barbarians at the Gate” days. It’s no longer just about big buyouts - it’s about building a resilient, diversified, and vertically integrated investment platform.

Yes, the LBO model faces challenges in a higher-rate world. But KKR’s pivot to permanent capital, strategic holdings, and insurance has future-proofed much of its model.

KKR exemplifies a well-rounded investment firm with a storied history and a vision rooted in adaptability and diversified asset management.

If you’re looking for a firm that mixes deep experience, steady cash flow, growth optionality, and private market access, then KKR is hard to ignore.

3. Apollo: A Credit Powerhouse Built on Complexity and Innovation

The Backstory

Apollo Global Management isn’t your average asset manager. Founded in 1990 by Marc Rowan, Leon Black, Josh Harris, and Tony Ressler, Apollo made its name by diving headfirst into the complex and often messy world of credit.

Its origins trace back to the collapse of Drexel Burnham Lambert, the firm that pioneered high-yield bonds under Michael Milken. While others saw chaos, Apollo saw opportunity, capitalizing on the downfall of the junk bond market to create an investment powerhouse specializing in distressed debt.

From the beginning, Apollo’s edge came from its ability to navigate complexity and capitalize on distress. One of its first major moves, its controversial involvement with Executive Life, set the tone. Apollo wasn’t afraid to get its hands dirty, and it knew how to extract value when others couldn’t. This playbook - seeking out complexity, leveraging balance sheet strength, and leaning into credit over equity - remains at the heart of the firm today.

The Executive Life challenges led to the spin-off of Ares Management, which had originally been part of Apollo’s credit business. Legal and reputational fallout from deals such as this played a role in the separation, but it also showed Apollo’s ability to incubate and scale major investment platforms.

Ares has since become an asset management powerhouse in its own right, while Apollo has continued to expand its credit business, doubling down on private lending and asset-backed securities.

Apollo’s ability to navigate complex and distressed situations has led to some of the most notable deals in financial history. The 2008 acquisition of Caesars Entertainment, in partnership with TPG, was one of the largest and most controversial leveraged buyouts ever - valued at $31 billion. Amid the chaos of the financial crisis, Apollo pulled every lever at its disposal to protect its investment, including asset transfers and protracted legal battles. The deal became a defining moment, reinforcing Apollo’s reputation as a firm willing to go the distance in distressed situations.

The Apollo Difference

While Blackstone gained prominence through its dominance in real estate and KKR built its reputation on private equity and leveraged buyouts, Apollo differentiated itself by focusing on creative credit solutions. The firm’s credit segment accounts for the lion’s share of its total AUM, making it one of the largest players in private credit markets.

Apollo went public in 2011 and it now manages ~$750 billion in assets, with plans to reach $1 trillion by 2026 and $1.5 trillion within five years.

Where many alternatives firms stick to the traditional buckets of private equity, real estate, and credit, Apollo thinks differently. It classifies its strategies as Yield, Hybrid, and Equity. This unique classification highlights its emphasis on balance-sheet-driven investing rather than traditional buyout structures.

Apollo was the first among its peers to venture into an insurance-backed perpetual capital model. Its 2008 merger with Athene, a leading annuity provider, occurred more than a decade before the other businesses featured in this analysis sought to replicate the model themselves.

Combining insurance with asset management provided Apollo with a steady inflow of long-term capital - an enviable position in a world where fundraising can be cyclical and uncertain. This integration enables Apollo to originate and hold credit assets directly, reducing its reliance on external deal flow and allowing it to generate consistent spread-related earnings.

The Marc Rowan Era

When Marc Rowan took the helm in 2021 following Leon Black’s exit, he ushered in a bold new era. At Apollo’s 2021 Investor Day, Rowan outlined a vision that went beyond being just an alternative asset manager. He envisioned Apollo as a vertically integrated credit machine, generating proprietary deal flow, not just chasing it.

With Athene in its corner, Apollo doesn't just invest in credit - it originates it. Instead of relying on public markets or banks for deal flow, Apollo builds and controls lending platforms outright. A great example is its acquisition of MidCap, a specialty healthcare lender, which gave it the ability to create investment-grade assets in-house. This means better pricing, better control, and ultimately, better returns.

A cornerstone of this vision is Apollo’s focus on asset origination. With a network of lending platforms, it can generate its own investment-grade credit.

Since there is no alpha to be had in secondary public fixed-income markets, it has focused on originating fixed-income in the private investment grade space, allowing it to generate ~150 basis points excess spread (or alpha). This has enabled it to reduce exposure to higher risk assets including real-estate and public equity. In short, it is able to generate differentiated returns having de-risked its portfolio making it a stable, sustainable model.

Layered on top of achieving better risk adjusted returns, Athene drives costs down by offering a smaller product line. Better still, it adopts a scale economics shared model passing the benefit of its reducing cost base to its customers, fueling more rapid growth and further boosting its outperformance.

This has enabled it to grow it insurance related inflows year on year at an impressive rate:

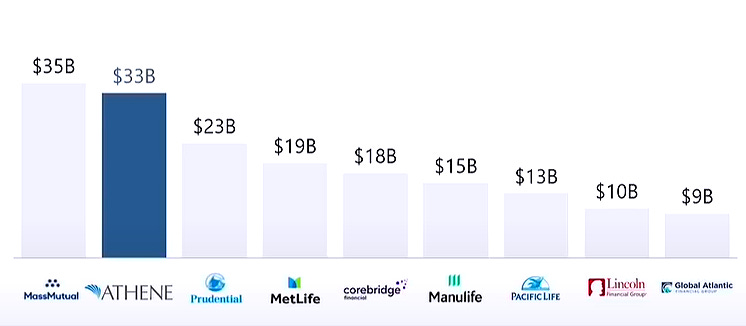

While the rest of the industry has raised ~$28 billion in primary equity capital since 2010, Athene has raised $20 billion alone. As the chart below demonstrates, Athene is now the second most capitalized business in its industry.

This strategy reduces reliance on public markets, minimizes exposure to higher-risk assets, and supports a stable, sustainable model.

In this short video Marc Rowan explains the Apollo business

The Hybrid Model

Over half of Apollo’s capital comes from its own balance sheet. This unique aspect of Apollo's business model is not too dissimilar to that of KKR which is similarly capital heavy.

Many of its strategies are developed and tested using the firm's own capital before being offered to clients. This means that the business cannot scale as rapidly as the likes of Blackstone or Brookfield, both of which operate a more asset light model.

One of the most striking aspects of Apollo’s evolution is its emphasis on asset origination. While many alternative managers rely on banks and public markets for deal flow, Apollo has built a network of proprietary lending platforms that allow it to create investment-grade credit assets in-house. For instance, Apollo’s acquisition of MidCap, a specialty finance company focused on healthcare lending, exemplifies its strategy of controlling credit origination rather than simply participating in secondary markets. This approach gives Apollo greater pricing power and the ability to structure deals that align with its risk-return profile.

Apollo has demonstrated resilience in navigating complex financial structures in very different rate environments. Generally speaking, it is not exposed to duration risk and so the cost of its capital tracks its returns on capital. This means that unlike Blackstone, which has a more diversified asset base across real estate and private equity, and Brookfield with a large real estate and infrastructure portfolio - the value of which is sensitive to rates - Apollo’s model is far less rate sensitive.

Private Credit Meets Private Wealth

Apollo isn’t just focusing on institutional capital. Like Blackstone and Brookfield, it’s expanding into private wealth and retail, offering high-net-worth investors access to alternative credit products. But unlike Blackstone’s real estate-heavy approach, Apollo’s edge lies in private investment-grade credit - yield without the volatility.

Apollo’s appeal to retail investors is also rooted in stability. Many alternative managers chase returns, often at the expense of risk management. Not Apollo. For instance, during the zero-interest-rate era, Apollo loaded up on floating-rate credit structures, a savvy hedge against rising rates. Though this came with slightly lower returns at the time, it paid off handsomely when rates spiked in 2022–23.

Today, with rates higher, Apollo has flipped the script again, reducing its floating-rate exposure from ~30% to just ~7%, prioritizing downside protection.

This ability to adapt, to manage asymmetry, and to focus on risk-adjusted returns is rare. Very few financial companies do this well, which is why Lehman Brothers and Silicon Valley Bank collapsed. Apollo is in an entirely different league.

Risks to Watch

While its approach to leveraging balance sheet assets has driven impressive returns, it also introduces a level of opacity that could make the firm more vulnerable to market shocks. Critics argue that Apollo’s reliance on structured products and asset-backed lending could create unforeseen risks, particularly if liquidity dries up in certain credit markets.

Still, Apollo’s preference for investment-grade credit and its long-dated capital base help mitigate these risks.

A Standout Performer

Since going public in 2011, Apollo’s stock has delivered annualized returns of ~16%, outpacing many of its peers.

With Athene now fully integrated, Apollo enjoys recurring spread-related earnings, which smooth out performance and reduce dependence on fundraising cycles.

Looking ahead, Apollo is targeting 20% CAGR in fee-related earnings, 10% CAGR in spread-related earnings and $21 billion in additional capital generation over the next five years.

That growth is backed by real traction. Since 2010, while the rest of the insurance industry raised ~$28 billion in primary equity capital, Athene raised $20 billion on its own. It’s now the second most capitalized company in the annuity space.

The Bigger Picture: Where Apollo Fits

Imagine investing in a public company that acted as a conduit to high performing private assets that would otherwise be out of reach. Just look at Berkshire Hathaway with its private holdings that include GEICO, Duracell, and BNSF Railway. Or Constellation Software with a portfolio of over 600 private vertical software businesses; or Fairfax Financial which also channels capital into long-term, often private, assets. Every one of these businesses has achieved phenomenal long-term success. Apollo seems to be following a similar, albeit differentiated version of this same playbook.

The Verdict

Looking ahead, Apollo’s focus on asset origination, perpetual capital, and complex credit structures positions it well for continued success. As banks retreat from certain lending activities due to regulatory constraints, Apollo’s ability to fill the gap with creative financing solutions will become increasingly valuable. Moreover, its expansion into private wealth and retail channels provides an additional growth avenue that could further enhance its market position.

Apollo isn’t just another name in alternative investments. It’s a credit-driven, insurance-powered juggernaut, uniquely equipped to thrive in a complex financial world. With a strong track record, a visionary CEO, and a vertically integrated platform that creates its own opportunities, Apollo is redefining what it means to be an alternative asset manager.

For investors seeking exposure to the alternative investment space with a focus on yield and financial innovation, Apollo presents a compelling case that stands apart from KKR, Brookfield and Blackstone. If you are looking for strong long term capital investments in unique assets that offer protection from the volatility of public markets, an escape from the distortions of irrational passive investing and a hedge against inflation, this could be the place for your money.

What Does Berkshire Hathaway Think About The Replication Of Its Model?

At the 2025 Berkshire Hathaway shareholder meeting, Ajit Jain directly addressed the expansion of private equity firms into the insurance sector and their attempts to emulate Berkshire's model. Jain acknowledged that large private equity firms-such as Blackstone, Apollo, and KKR-have aggressively entered the insurance space, particularly focusing on life insurance rather than property and casualty insurance.

Jain was explicit that Berkshire Hathaway can no longer compete with these firms in this area because private equity firms are willing to take on significantly more leverage and credit risk. He stated, “There’s no doubt that private-equity firms have entered this arena, and we find ourselves at a disadvantage. In the past three to four years, we haven’t executed a single deal.” Jain explained that these new entrants are using higher leverage and investing in higher-risk assets, which enables them to generate substantial profits while economic conditions are favorable and credit spreads remain tight.

However, Jain warned of the risks inherent in this approach. He noted that as long as the economy remains strong, these strategies may appear successful, but if conditions deteriorate, the aggressive use of leverage and riskier investments could lead to significant trouble for these firms.

KKR, Blackstone, or Apollo: Who Comes Out on Top?

The truth? There’s no clear winner because it’s not that kind of game.

Yes, they all swim in the same pool of private equity, credit, real assets, and alternatives, but each swims a different stroke and is a champion in its own event.

Trying to rank them is like asking who’s the best Tennis player out of Federer, Nadal, or Djokovic - they’re all legends, just playing a different style of the same game.

What they do have in common is massive scale, a relentless drive to evolve and executive benches stacked with A-list talent who don’t settle for second place.

Their future performance will hinge in part on macro forces - interest rates, inflation, credit cycles - which none of them is able to control. But what’s clear is this: all three are built to play offense, no matter the environment.

Here is a link for Part 3, the final post in this trilogy, where we’ll turn the spotlight on Brookfield Corporation and its asset management arm, BAM - another titan of the alt universe, with a style all its own.