DISCLAIMER & DISCLOSURE: The author holds a position in Brookfield Corporation at the date of publication but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Final Part in the Series on Alternative Asset Management Firms

In Part 1 and Part 2, we covered why this sector is so appealing and took a closer look at three U.S. heavyweights - Blackstone, KKR, and Apollo.

Now, in this last part, we’re shining a spotlight on a wildcard pick: a Canadian-headquartered company with a U.S. based asset management arm. It stands apart from the others with a unique strategy - and at today’s valuations, it may offer the best value and so could be a particularly compelling investment opportunity.

Brookfield Corporation

A Deep Dive into a Complex but Compelling Business

Brookfield Corporation (BN) is a global powerhouse with a famously intricate structure. But underneath that complexity lies a straightforward story: the lion’s share of its value comes from its ownership of one of the world’s premier alternative asset managers - Brookfield Asset Management (BAM).

Of the four companies studied in this series - the others being KKR, Apollo and Blackstone - Brookfield arguably has the most compelling investment thesis at today’s price.

A Global Giant Hiding in Plain Sight

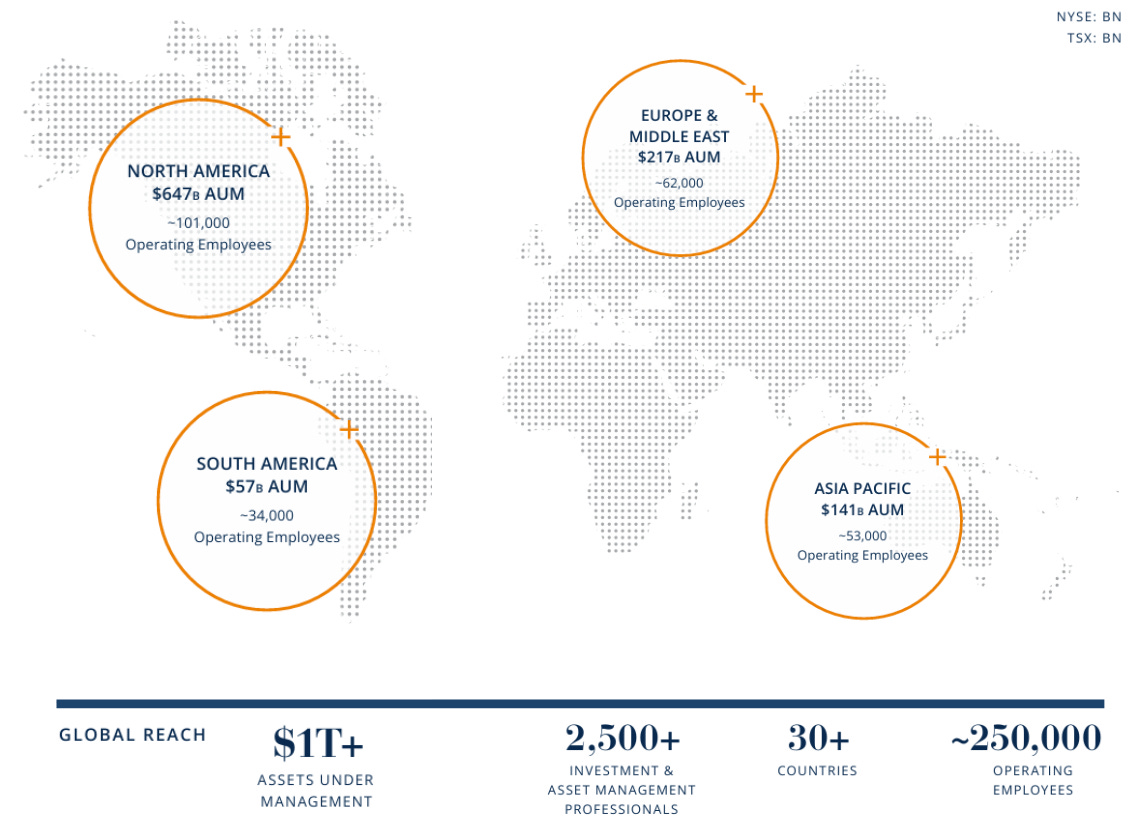

Brookfield might not be a household name like Blackstone or KKR, but it’s quietly become one of the biggest forces in the alternative investment world - managing around $1 trillion in assets and operating at a scale that few can match.

Its story begins back in 1899, where it operated as a utility and infrastructure operator in Brazil. Over the decades, it expanded into a diversified conglomerate, later known as Brascan, before eventually rebranding as Brookfield and relocating to Canada and the U.S.

By the 1970s, Brookfield was shifting focus toward real estate, financial services, hydroelectric power, and other industrial investments. The company’s roots are in directly owning and operating businesses - sometimes with partners, but often on its own. It wasn’t until the late 1990s that Brookfield seriously entered the business of managing money for third parties.

Brookfield didn’t rush into asset management. Instead, it spent decades refining its investment strategy. It sold off cyclical, non-core businesses like mining and timber, and gradually focused on areas with steady, long-term returns. Today, its core investment areas - renewables, infrastructure, real estate, private equity, credit, and insurance solutions - are at the heart of the alternative asset industry.

In other words, Brookfield didn’t just jump on the bandwagon, it evolved over many decades and converged on the optimal model which just happened to be alternative asset management augmented with complimentary businesses that now include - you guessed it - insurance.

Brookfield Corporation is headquartered in Toronto, while Brookfield Asset Management is headquartered in New York (more on this later).

A Capital-Backed Operator

Brookfield differentiates itself from other alternative asset managers by maintaining a high degree of alignment with investors.

Its management team owns approximately 20% of Brookfield equity, and 90% of the senior management’s personal wealth is held in Brookfield. Just like at Berkshire Hathaway, insiders and external shareholders are very much aligned. This creates an owner mindset among insiders which results in a focus on long-term value creation over chasing short-term gains.

What makes Brookfield really unique is its balance sheet-first approach. It invests a significant amount of its own money alongside client capital. This gives it a huge capital base which, combined with deep operational know-how, allows it to move fast and take on massive opportunities that others might shy away from.

Operating in over 30 countries, Brookfield strategically expands by first deploying its own balance sheet capital into new markets. Only after proving that the strategy works does it bring in third-party investors, ensuring high alignment and risk mitigation. A notable example is its expansion into India. Brookfield spent five years researching the market before making its first major investment in 2014. Today, it owns significant real estate and infrastructure assets across the country.

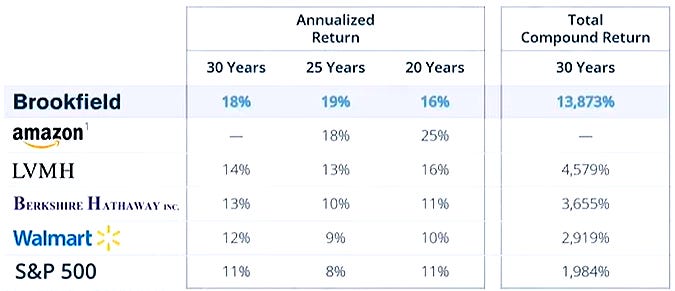

Its historic returns have been exceptional as the table below demonstrates. Better still, the company is arguably in better shape today, with more growth opportunity, than ever before so this growth rate should continue.

It’s a setup that gives Brookfield a real competitive edge and it’s a big reason why its best years still lie ahead.

Smart Structure, First-Class Team

Led by CEO Bruce Flatt since 2002, Brookfield has taken a methodical approach to growth. Flatt, an accountant by training, transformed the firm from a conglomerate into a disciplined asset manager.

He rode the wave of cheap debt to supersize the conglomerate, and for a long time, rising asset values made it appear that he could do little wrong.

He pioneered a structure of perpetual limited partnerships, such as Brookfield Infrastructure Partners and Brookfield Renewable Partners, to house its long-term investments while maintaining liquidity.

These specialized business units grew in number across infrastructure, renewables, real estate, and private equity - many of them are now separately listed.

This structure is a text-book decentralized model that does away with unnecessary bureaucracy and achieves optimal efficiency. It allows for true specialization of labour by enabling each unit to focus on its area of expertise, and its own growth strategy, while still benefiting from the strength of belonging to the broader group.

Built for the World Ahead

It has become a global infrastructure specialist and the largest clean-energy investor in private markets.

As governments grapple with rising debt levels, the public sector is no longer in a position to fund large-scale mission critical infrastructure projects. That’s where Brookfield comes in.

Its access to long-term, patient capital allows it to step into massive infrastructure projects that are too big for most others to take on. From fiber optic networks and toll roads to pipelines and data centers, these projects offer predictable, low-risk income streams for decades to come.

In fact, Brookfield is the largest global owner and builder of renewable infrastructure and data centers. As such, its existing assets, sector-specific investment capabilities, and access to capital make it uniquely positioned to meet the energy demands of the rapidly growing AI sector. Brookfield essentially provides technologically agnostic exposure to growth in AI, with a far better risk-based return on investment.

Despite its immense scale, Brookfield remains relatively under-the-radar compared to peers like Blackstone, KKR, and Apollo. This means that its valuation appears to be far more attractive than that of its U.S. based peers.

Its unique balance-sheet-driven approach, focus on real assets, and history of counter-cyclical investing set it apart and provide it with the potential for explosive growth in the years ahead.

The Counter-Cyclical Playbook

Brookfield isn’t just a buyer of assets - it’s a buyer that manages timing with precision.

“Our goal is to invest capital for our clients in opportunities which have reasonable returns in a downside scenario (6% to 8% on equity), have the potential to generate good returns under most scenarios (12% to 15%), and in the upside cases will generate excellent returns (20% plus). These latter scenarios usually require us to be able to buy right, execute well, and reallocate capital wisely over time.”

Bruce Flatt, CEO

To hit those upper-end returns, Brookfield needs to buy well, execute efficiently, and reallocate capital wisely. That’s where its true edge lies.

CEO Bruce Flatt has long emphasized this disciplined, counter-cyclical approach. When markets are in panic mode and other investors are heading for the exits, Brookfield steps in - often buying high-quality assets at a discount.

Take One Liberty Plaza, for example. Brookfield bought it from a bankrupt developer in 2001 for $432 million. By 2017, when it sold half the building to Blackstone, the property was valued at $1.5 billion - more than triple the original price. Then came the pandemic. With interest rates rising and remote work shaking the office market, values dropped. Rather than retreat, Brookfield leaned in, buying back Blackstone’s stake in 2023 at a heavily discounted $1 billion valuation. A full circle, value-driven play.

Brookfield took a similar approach with its public real estate arm, Brookfield Property Partners. As the stock price sagged during the pandemic and questions swirled around its dividend sustainability, Brookfield saw an opportunity. It bought out public shareholders and took the business private - arguing that the public markets were failing to properly value its sprawling property empire. Now, those real estate earnings flow directly back to the Brookfield group instead of outside investors.

This kind of patient, opportunistic investing works because Brookfield focuses on hard-to-replicate, long-term assets like toll roads, power lines, commercial buildings, and pipelines. These generate steady, often inflation-linked cash flows - a powerful advantage during volatile economic cycles.

“We believe the company has three major competitive advantages: capital availability, operating expertise and our global perspective.”

Bruce Flatt, CEO

It has always been able to spot a distressed asset opportunity and bring it in to its portfolio at an attractive price. Whether it's scooping up prime New York real estate after 9/11 (Brookfield Place) or taking control of mall operator General Growth Properties during the 2008 financial crisis, Brookfield has repeatedly proven it can turn downturns into big wins. It’s a masterclass in capitalizing on fear - and building value for the long term.

Inflation-Resilient by Design

Brookfield’s asset base is well suited to the current economic climate. Why?

Because nationalistic political agendas are inflationary, and that actually helps Brookfield.

Its investments - like power plants, toll roads, and data centers - involve big upfront costs but have low operating expenses and high margins. As inflation drives up revenues (like rent or usage fees), expenses barely move, leading to rising profit margins and growing cash flows.

“Given that our assets generally require high initial capital investment, have relatively low variable costs, and can be leveraged on a low-risk basis, even a small increase in the top-line performance results in a much higher percentage contribution to the bottom line.”

Bruce Flatt, CEO

Not only do the margins improve on income streams, but the capital value of the real assets, which are themselves a product of the income that they yield, also increases. The compounding effect over time becomes ever more meaningful for the owners of these assets.

Brookfield owns one of the world’s largest portfolios of inflation-protected, cash-generating assets - making it a compelling investment opportunity, particularly since it seems to be trading at a huge discount to its intrinsic value calculated on a sum-of-the-parts basis (more on this shortly).

Given nationalist geo-political pressures in evidence at the moment, all of which are inflationary in nature, Brookfield stands out as a great investment in this economic climate.

Concurrently, governments are grappling with huge unprecedented amounts of national debt, both in nominal terms and relative to GDP. This means that there is insufficient public money available to finance huge critical infrastructure - private capital is required.

This is where Brookfield is able to provide capital in quantities that very few others are able to match. It has the scale to apply long-term or permanent capital to fund energy infrastructure, pipelines, fiber-optic cabling, toll roads, data centers, and so much more. These assets promise long-term secure revenue streams and have little or no income risk associated with them.

For instance, Brookfield owns assets are integral to Brazil's energy and water supply, and their scale, long-term contracts, and strategic importance make them challenging for competitors to replicate. These include approximately 3,900 km of natural gas pipelines in Brazil, which are part of its regulated transmission business. The company also owns approximately 2,900 km of operational transmission lines in Brazil, further solidifying its presence in the region's energy infrastructure. Brookfield has a significant water and wastewater operation in Brazil, with concession agreements that have an average remaining term of 22 years. These agreements involve water treatment services, maintenance, and improvements to distribution systems, making them critical infrastructure.

Similarly, Brookfield acquired Colonial Enterprises the holding company of the 5,500-mile FERC-regulated refined-product pipeline system in the U.S.

Brookfield's infrastructure investments also include water utilities and wastewater treatment facilities, such as those operated by Central States Water Resources in the US.

It also has a huge portfolio of renewable energy assets with a 200 GW global development pipeline, including solar, wind, and hydroelectric power. Approximately 40% of this pipeline is in North America, 24% in Europe, and 12% in Australia, with the remainder in Asia Pacific and South America.

“We are often asked why we do not have the same issues that some public equity managers have investing funds as they grow larger. The difference is that infrastructure (as well as real estate and private equity) usually becomes more attractive as investments get larger. The competition for larger acquisitions is less and the sophistication required to operate these assets increases because of their complexity, therefore favoring large and experienced managers. Lastly, the larger assets acquired are generally also higher quality – they often have better counterparties, and stronger management teams. As a result we believe that our infrastructure business can scale to many times the size it is today.”

Bruce Flatt

In this short video, Bruce Flatt explains what makes Brookfield stand apart from other alternative asset managers:

The Heart of the Business: Brookfield Asset Management

Brookfield Corporation is a global investment giant, but its corporate structure can be a bit of a puzzle. At the core of its value, though, is something quite straightforward: Brookfield owns a controlling stake in Brookfield Asset Management (BAM), one of the world’s most successful alternative investment managers. This business has grown from managing just $3 billion in the early 2000s to over $1 trillion in fee-bearing capital today. BAM is now the beating heart of Brookfield, and its simple, capital-light, high-margin model makes it an investor favorite.

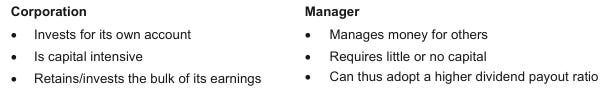

To highlight its value, Brookfield spun out a 25% minority interest in BAM at the end of 2022, listing it on both the TSX and Nasdaq. This separation gave investors two distinct choices: own BAM directly for a pure-play exposure to asset management, or hold onto Brookfield Corporation for a piece of BAM plus a much broader mix of assets. Bruce Flatt, Brookfield’s long-time CEO, explained the logic best when he said,

“Since asset managers don’t need much in the way of facilities, equipment or working capital to do business, we plan for the Manager to pay out approximately 90% of its annual earnings in dividends.”

It’s a win-win arrangement that unlocks value and improves visibility for both businesses.

While BAM earns steady management fees from sovereign wealth funds, pension funds, and high-net-worth individuals, Brookfield’s balance sheet houses equity investments across its infrastructure, real estate, and private equity businesses, generating strong long-term contracted cash flows and inflation indexation.

The parent (Corporation) may be distinguished from BAM (the Manager) on the following basis:

BAM’s margins are poised to expand as the company has bolstered its investment and fine-tuned organizational capabilities in recent years.

The other Parts of Brookfield Corporation

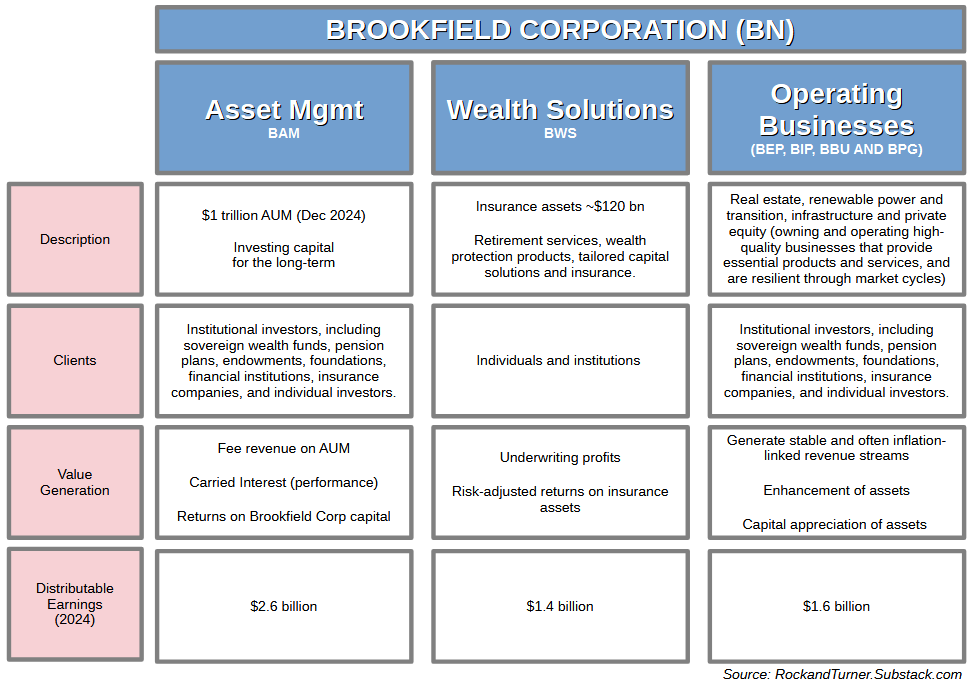

But BAM is only part of the picture. Brookfield Corporation also holds a rich and diverse portfolio of businesses and investments. These include Brookfield Business Partners (its private equity arm), Brookfield Infrastructure Partners (focused on transport, midstream, and data infrastructure), and Brookfield Renewable Partners (which houses its clean energy assets). Then there’s Brookfield Property Group, which oversees a world-class real estate portfolio, and Brookfield Wealth Solutions - a fast-growing business specializing in long-dated annuities and retirement products. All of these businesses generate stable, inflation-protected cash flows and are tightly integrated into Brookfield’s broader strategy.

In summary, the Corporation’s financial interests are spread across:

Ownership stake in BAM

Carried Interest from BAM’s Funds (explained further below)

Capital invested in BAM’s private funds

Brookfield Business Partners (BBU) – its private equity arm

Brookfield Infrastructure Partners (BIP) – transport, midstream, and data infrastructure

Brookfield Renewable Partners (BEP) – clean energy projects

Brookfield Property Group (BPG) – a massive real estate portfolio

Brookfield Wealth Solutions (BWS) – a fast-growing business in long-dated annuities and retirement solutions

The way in which these elements fit together is best visualized using the diagram below, which describes the three segments of the business: Asset Management, Wealth Solutions and Operating Businesses:

Complexity leads to Temporary Undervaluation

Now here’s the part worth noting - Brookfield Corporation is currently valued at around CAD $116 billion, while its 73% ownership in BAM is worth approximately $84 billion. That implies the rest of its business - all those infrastructure, real estate, private equity, and wealth management operations - is being valued at just $31 billion. That feels remarkably low when you consider that BAM only generated about 40% of Brookfield’s total distributable earnings in 2024. Moreover, forecast growth over the next five years is heavily weighted toward other segments, not BAM:

So either BAM is overpriced or else the rest of Brookfield Corporation is being wildly undervalued. We’ll return to look at the valuation of Brookfield Corporation on a sum-of-the-parts basis shortly, so hold that thought.

One area where this disconnect is particularly striking is in something called carried interest - essentially a performance bonus that BAM earns when its funds perform well (discussed in more detail in Part 1 of this series of posts). Brookfield Corporation retained 100% of the carry from legacy funds and earns a large share from new ones, too. In fact, through its ownership of BAM and legacy rights, Brookfield benefits from nearly 82% of all carried interest earned. As assets under management increase - the last five years have seen a 15% CAGR - so too does the carried interest. The longer it has the capital working, the more the returns compound and, in turn, so does the carried interest potential.

But here’s the kicker: carried interest doesn’t show up in earnings right away. It accrues gradually as investments grow in value but only gets recognized once the assets are sold and clients have received their original capital back.

This means there’s a significant amount of unrealized carry sitting on Brookfield’s books - around $30 billion in total, with $10 billion expected to be realized over the next five years and another $20 billion over the following decade. That’s value just waiting to be harvested. The net present value of this cash flow does not seem to feature in the valuation of the company at present. If you were to assign a fair value to that carry - probably close to $21 per share - it would account for nearly 40% of today’s stock price. That’s a major source of potential upside as Brookfield realizes this carried interest when select vintages of BAM’s flagship funds enter key monetization windows.

This significant amount of incremental cash flow will allow Brookfield Corporation to deliver further value for shareholders through either reinvestment in the business or returning capital via opportunistically repurchasing our shares (remember, BAM pays dividends while BN focuses on optimizing for compound growth).

Looking under the Hood

Beyond the numbers, Brookfield’s real assets are nothing short of iconic. It owns and operates landmarks like Brookfield Place and Manhattan West in New York, Canary Wharf in London, and the Ala Moana Center in Honolulu. These aren’t just trophy assets - they generate reliable, long-term income.

What really sets Brookfield apart from traditional private equity firms is its long-term mindset and reinvestment strategy. While many competitors focus on returning earnings to shareholders, Brookfield recycles capital back into its own funds and projects. This has helped it build a formidable balance sheet and maintain flexibility when chasing high-return opportunities.

It’s a long-term compounding machine - constantly reinvesting, growing, and unlocking new value.

And then there’s Oaktree Capital, the credit investment powerhouse co-founded by Howard Marks. Brookfield acquired a majority stake in Oaktree back in 2019, creating a powerful partnership between two of the most respected names in asset management. Oaktree’s strength in credit, particularly distressed debt and high-yield bonds, perfectly complements Brookfield’s expertise in infrastructure, real estate, renewables, and private equity. The result is a broader, more resilient platform with even greater appeal to institutional investors. That Howard Marks chose to partner with Brookfield, when he surely had other options, speaks volumes about the company’s culture and reputation. Together, they can leverage each other’s networks, client relationships, and geographic presence to expand their respective market reach.

The Oaktree merger strengthens Brookfield’s competitive position against other major alternative asset managers like Blackstone, KKR, and particularly Apollo - which has always been heavily credit focused.

Understanding the Numbers

Brookfield’s financials are not easy to digest. This is a complex conglomerate with a great deal of intra-group transaction activity as assets and capital are strategically shuffled around to optimize financial performance.

For instance, it often sells real estate assets to its insurance arm in return for capital to fund further real estate investments. Not only that, but it may create a subsidiary for the purpose of holding a sizeable real estate asset - why? The subsidiary finances the building using significant debt, but here’s the twist: this debt is non-recourse - meaning if the subsidiary defaults, lenders can only go after the building itself, not Brookfield’s other assets. This is great for Brookfield investors but, notwithstanding it being isolated, consolidation rules require Brookfield to show the full amount of that debt on its consolidated balance sheet. Multiply this scenario by hundreds of subsidiaries, each with its own complicated financing structure, and suddenly Brookfield’s balance sheet becomes extraordinarily tricky for investors to decipher.

The intricate trails of paperwork that bind businesses all over the world to the parent corporation in Toronto have created something that is part conglomerate, part hybrid investment company. Formal financial statements are, as even its supporters acknowledge, almost incomprehensible, meaning that stakeholders need to rely on the group to convey where risks lie and how cash flows through its operations. It requires a high degree of trust in management which may make some investors uncomfortable.

However, not only are its shareholder communications exemplary in terms of clarity, but it should also be noted that Brookfield is a fiduciary that manages assets and money for public sector and union pension funds, annuity holders and investment funds. It also runs critical infrastructure, is responsible for huge sums in long-term liabilities, and operates regulated businesses in many jurisdictions. In short, it trades on its name and it cannot afford to damage its reputation - so it is reasonably safe to assume that it operates with the highest degree of integrity.

Mark Carney, the former Bank of England central banker, now Canadian prime minister, chaired Brookfield’s asset management arm for the past four years. Meanwhile, Bruce Flatt has been an exemplary leader of the business for nearly a quarter of a century. Essentially, the people involved in the management of this business are upstanding members of society who have stood the test of time. Impropriety of any kind is highly unlikely.

The company uses its own internal metrics, such as Distributable Earnings Before Realizations (DEBR), to give investors a clearer view of its true earnings power. DEBR is essentially Brookfield’s version of Berkshire Hathaway’s ‘owner earnings’ - it strips out the noise and focuses on cash the business can actually use. Bruce Flatt uses this measure in his shareholder letters to demonstrate the real earnings power of the business.

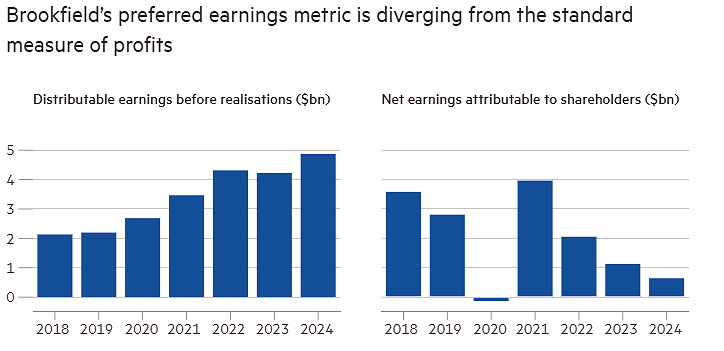

The chart below demonstrates how its adjusted metrics diverge significantly from IFRS statutory earnings, explaining why Brookfield doesn’t currently screen well which helps us to understand why it is so undervalued.

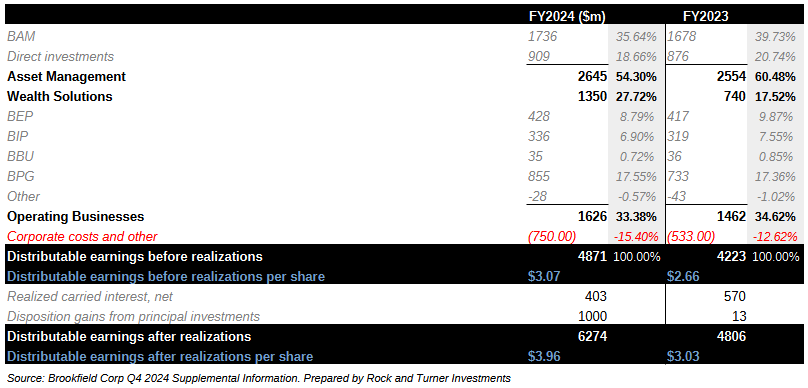

In 2024, Brookfield reported $4.87 billion in DEBR, and it’s targeting $13.5 billion by 2029. That’s almost a threefold increase over five years.

The ‘BR’ part of the acronym tells us that this number doesn’t include carried interest - realized or unrealized - making it a conservative baseline rather than an optimistic projection.

For instance, BPG owns a large number of development assets (~$6 billion) which generate little or nothing in terms of cash flow, so these assets make no contribution to quarterly earnings numbers or to DEBR. However, these will be sold when the time is right. Over the past two years alone, Brookfield sold 192 properties for a combined $27 billion, at a premium of ~3% to their carrying value. It finances most of its real estate using non-recourse debt, meaning each property stands on its own with minimal risk of contagion across the portfolio. This makes asset sales clean and straightforward. This hidden value will materialize as carried interest in due course.

Unlike traditional private equity firms that typically rely on 10-year fund cycles, Brookfield’s perpetual partnerships and long-duration funds provide a predictable and recurring fee stream.

Its listed operating businesses are unique and synergistic to BAM, as they provide a perpetual capital partner with vertically integrated global operating capabilities. They are also managed by BAM – generating perpetual management fees – and pay stable growing distributions to unitholders, of which Brookfield is the largest. They have compounded Funds From Operations (FFO), a measure of cash flows, at ~10% CAGR.

So while the complexity can be overwhelming at first glance, the story underneath is compelling. Brookfield Corporation owns a best-in-class asset manager, a portfolio of world-class real assets, a pipeline of growing earnings, and a huge amount of hidden value in the form of unrealized carry. The market may not fully appreciate all the moving parts today, but over time, as more of that value is realized and distributed, it’s hard to ignore just how powerful this business really is.

Brookfield’s DEBR shown in the table below offer a useful lens into how the business is growing and where that growth is coming from. When you break down the numbers by segment, a few key themes emerge. Every part of the business is expanding, but one area is beginning to stand out: Wealth Solutions. It’s quickly becoming a more prominent contributor to Brookfield’s overall earnings, reflecting both the growing demand for retirement solutions and the company’s successful push into long-duration insurance products.

Realizations are inherently lumpy and unpredictable, so Brookfield leaves them out of its core earnings view. The same goes for unrealized carried interest. Even though there’s a vast amount of carry accruing quietly in the background, none of it is included in DEBR until it’s actually realized.

This accounting approach is conservative but it paints a much more helpful picture of the business’s baseline performance. Crucially, that unrecognized carry isn’t lost - it’s hidden value, steadily building and poised to reward investors when it is harvested. For this reason, an investment in Brookfield Corporation ought to be viewed as a long-term holding, perhaps a buy and hold forever.

The Insurance Playbook

Brookfield is following the playbook that Apollo helped pioneer - investing insurance float into private, investment-grade credit rather than low-yield public bonds. Traditionally, insurers earned profits by underwriting policies and investing their float in conservative public markets. But the alternative asset managers have flipped that model on its head. What used to be a sleepy, actuarial business has now been reimagined as a turbocharged growth engine.

The difference is that Brookfield brings something extra to the table: it already owns a vast empire of assets that are perfect for insurance portfolios - long-dated, cash-yielding, and often indexed to inflation.

Now, they use the float to invest in their own high-return, private assets - turning the insurance company itself into just one more profit center. It’s a strategy not too dissimilar to that deployed at Berkshire Hathaway, which itself drew inspiration from Teledyne. And Brookfield’s CEO, Bruce Flatt, has been very clear: they’re doing it too - but on an even grander scale.

Listen to this short video:

Here’s why Brookfield’s approach is so powerful. Unlike some of its rivals, Brookfield already has massive capital at its disposal. This means it can supercharge the model. Instead of waiting for assets to flow in, Brookfield puts its existing portfolio of long-term, cash-generating real assets - think infrastructure, renewables, and real estate - directly to work for the insurance business. And because it focuses on life insurance and annuity products that stretch over decades, the investments match the liabilities perfectly.

That’s helped fuel explosive growth in Brookfield Wealth Solutions (BWS). Just four years ago, the business managed around $4 billion in float. Today, that figure has ballooned to $120 billion, thanks to strategic acquisitions like American National, Argo, and American Equity Investment Life. The model is simple but effective: underwrite low-risk, long-term annuities - an increasingly popular retirement solution - and invest the premiums in stable, high-return assets that Brookfield already owns or originates.

The retirement macro theme in the U.S. underpins growth in BWS in the years ahead. See this short video:

Naturally, some critics have raised concerns about using policyholder money to power asset manager profits. But Brookfield has a good answer. The assets it transfers into its insurance portfolios aren’t just any investments - they’re among the firm’s best: trophy office buildings in New York and Canada, and high-performing malls. Every transfer is cleared with insurance regulators, with third-party valuations and a thorough review process ensuring the deals are arm’s length and in policyholders' best interest.

And the results speak for themselves. From generating almost nothing a few years ago, Brookfield’s insurance arm now contributes around $1.4 billion in earnings annually, with a clear path to $2 billion within the next two years. By 2029, the company aims to triple the float to $300 billion, potentially generating $5 billion in annual earnings. Key growth drivers include the U.S. annuity market, expansion into the U.K. and Europe, and a push into Japan.

Brookfield also has the advantage of being one of the largest issuers of investment-grade debt in the market alongside a sizeable portfolio of real assets. The ability for Brookfield to selectively invest its insurance investment portfolio in assets it already owns and knows intimately well is a unique competitive synergy with strong financial logic. It allows Brookfield to earn higher returns on equity while policyholders benefit from investments in a lower-risk product - a classic case of using an informational edge to create a win/win scenario.

While critics take issue with these related-party transactions, their objections speak more to their lack of understanding in relation to how companies such as Brookfield optimize risk adjusted returns. All related-party transactions are subject to third-party valuation assessments as well as regulatory oversight and approvals, while funding is based on a prescriptive risk-based capital framework.

There’s another clever synergy here. BAM - the asset manager - invests the insurance float on behalf of BWS. That means Brookfield earns spread income (returns above the cost of insurance liabilities), while BAM generates a steady stream of high-margin, capital-light management fees. It’s a flywheel of value creation that compounds over time.

Leveraging BAM’s differentiated investment capabilities, Brookfield is currently generating a low-to-mid-teens returns on equity. Earnings are poised to expand over the near term as Brookfield repositions an acquired held-to-maturity asset portfolio, inherited through its American Equity Life acquisition. It anticipates accelerating organic origination capabilities over the near term and intends to more than double insurance float to $300 billion by 2029, driving significant increases in cash flows to Brookfield and fee revenue to BAM.

Risks

As a firm heavily invested in real assets, Brookfield is exposed to rising interest rates, which can impact short-term asset valuations as investors chase higher cap rates1. This only impacts assets earmarked for sale. Most of the portfolio is made up of long-term, often permanent investments. In relation to income streams, its holdings typically feature inflation-linked revenue structures, providing a natural hedge against rate hikes.

In respect of its office properties, the evolving work-from-home trends means that demand for office space remains uncertain. However, the firm’s focus on high-quality, long-term leased properties mitigates this risk.

Generally, the business has first class assets and a business model that is sufficiently diversified to weather any storm. There are very few public businesses as robust as this one with such a fortress of a balance sheet.

Valuation

If you’ve ever looked at Brookfield’s official earnings, you might’ve come away scratching your head. Like Berkshire Hathaway, Brookfield reports under IFRS and GAAP accounting rules, which are notorious for making net income numbers look wildly volatile - and, frankly, unhelpful.

But here’s the good news: beneath the noise, the real picture emerges through a clearer lens - distributable earnings. Brookfield reports both Distributable Earnings Before Realizations (DEBR) and plain Distributable Earnings (DE), and these numbers tell a much more consistent story: steady, scalable growth.

Historically, Brookfield’s share price has traded at around 13.5x DE. With analysts forecasting $4.65 in DE for next year, that implies a share price of $62.78 - far higher than where the stock trades today.

And here’s where it gets even more interesting.

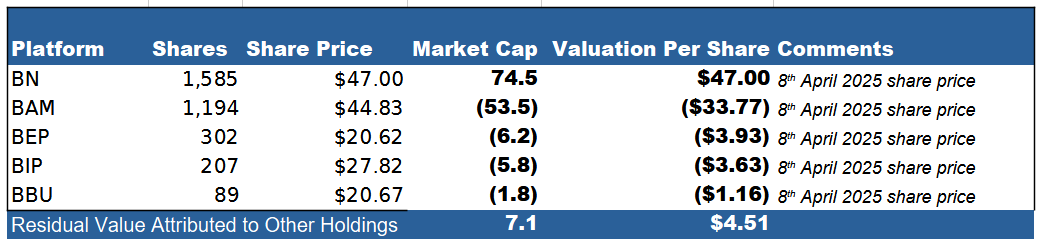

Right now, Brookfield Corporation’s stock price doesn’t seem to recognize the value of its massive empire of unlisted assets. On April 8, 2025, the share price was $47.00. But when you break that down:

Brookfield owns significant stakes in listed affiliates: BAM, BEP, BIP, and BBU.

The value of those public holdings alone accounts for $42.49 of the share price.

That leaves just $4.51 of market-implied value for everything else Brookfield owns - including BWS, carried interest, and various strategic investments.

This is easier to visualize in tabular form, see below:

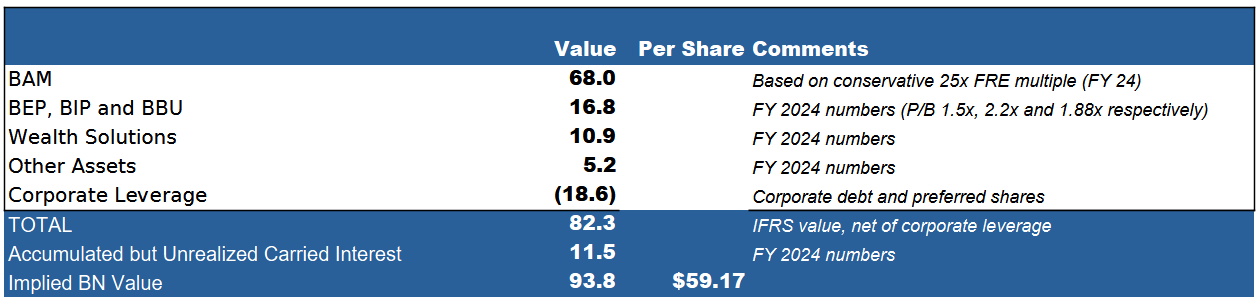

Let’s rebuild the valuation using a more grounded sum-of-the-parts approach:

BAM is valued conservatively at 25x fee-related earnings, landing us roughly where the market has it now.

The value of BEP, BIP, and BBU is calculated using their respective NAVs and price-to-book multiples.

Wealth Solutions, other unlisted assets, and carried interest are included at book value.

Put it all together, and you get an implied price per share of $59.17 - very close to the $62.78 valuation based on next year’s DE. No matter how you slice it, the stock looks deeply undervalued at $47.00.

However, our back of the envelope calculation diverge significantly from the valuation ascribed to the business by insiders. Their valuation supports the assertion that the stock is undervalued, but they believe it is worth closer to $100 a share. At Brookfield’s Q4 2024 earnings call (13th February 2025), CEO Bruce Flatt put it plainly:

“The intrinsic value per share is now approximately $100 per share, which underpins your shares and should allow you to earn a greater return than the underlying performance of our business over time. In addition to that, this offers us an easy way to continue to add value per share by repurchasing shares. In 2024, we repurchased approximately $1 billion of shares with another $200 million to date in '25.”

Evidently, management sees the intrinsic share value being far in excess of our back of the envelope calculations. So why is management so confident that the market is missing something big?

In truth, Brookfield insiders see value-building levers that outsiders may overlook. Here are a few of the big ones:

BWS is growing ~20% per year, driving outsized growth in distributable earnings.

Asset transfers into insurance improve equity values across the group, boosting BAM’s fee base. As the operating business vehicles monetize assets, they de-lever their balance sheet. Management fees paid to BAM are paid on a net asset value basis rather than on asset value, so as the equity on the balance sheet increases so too will BAM’s fees.

Unrealized carried interest isn’t even counted in Brookfield’s books - but it becomes real (and valuable) as assets are monetized. Several mature infrastructure funds are nearing that point.

Cash flows will be reinvested at attractive returns - or used to buy back more undervalued shares if the price stays low.

Low analyst coverage means many investors are still in the dark. But that’s slowly changing.

There is no one better placed to explain this than Bruce Flatt (CEO) and Nick Goodman (President) of Brookfield Corporation:

…and then there’s BAM and the S&P 500

One major rerating catalyst could come from something as simple as index eligibility. Although Brookfield Corporation is Canadian, BAM shifted its headquarters to New York, and its operations are heavily U.S. centric.

In 2025, S&P is reviewing whether companies like BAM should qualify for U.S. index inclusion. If approved, BAM could attract passive investment flows similar to those that helped Blackstone, Apollo, and KKR surge in value.

Given that BAM already delivers more stable, fee-based earnings than many peers, this could be a game-changing revaluation.

… and then there are the growth investments yet to show their full benefit

Brookfield’s long-term growth engine is firing on multiple cylinders. It continues to grow both organically and through strategic acquisitions, expanding its global reach and deepening its expertise across sectors. Its growth investments will bear fruit for years to come and much of the benefit has yet to been seen in the financial figures. This is a rapidly scaling business - a compounding machine.

Here's a year-by-year look at some of that growth expenditure:

2019: Expanding Core Strengths

Oaktree Capital Management: Brookfield acquired a 61.2% stake for $5.2 billion, significantly boosting its presence in alternative asset management - especially in credit markets. This pushed total assets under management beyond $500 billion.

Indian Telecom Infrastructure: Through Brookfield Infrastructure Partners, the company took full ownership of a telecom tower business in India from Reliance Industrial Investments for $3.7 billion, cementing its role in the region’s growing digital infrastructure.

Canadian Mortgage Insurance: Brookfield Business Partners acquired a majority stake in Genworth MI Canada (CAD 2.4 billion), tapping into stable cash flows and growth in the residential mortgage insurance market.

2020: Diversifying Across Industries

BrandSafway: Acquired as part of Brookfield’s private equity strategy, this industrial and commercial services company added significant scale to its portfolio.

Renewable Energy in Europe: Brookfield invested in solar assets across Europe, strengthening its renewable power segment.

Simply Self Storage: For approximately $1.2 billion, Brookfield acquired a premium portfolio of 8 million square feet of self-storage facilities across the U.S., diversifying its real estate exposure.

2021: Strategic Global Reach

American National Group: Brookfield’s insurance business acquired the firm with $25 billion in in-place policies. The deal, closed in early 2022, enhanced Brookfield’s insurance and reinsurance capabilities.

Asia-Pacific Infrastructure: Brookfield completed the acquisition of a data distribution business in New Zealand and took a 45% interest in a global infrastructure services company, expanding its international footprint in infrastructure and industrial services.

2022: Big Bets on the Future

SBB EduCo: Brookfield took a 49% stake in this Swedish social infrastructure platform for SEK 9.2 billion, with potential for further payouts. The investment supports public education facilities.

Transition Fund & Real Estate: It deployed $7 billion through its Transition fund and acquired three real estate companies totaling $9 billion in assets - purchased at significant discounts to replacement cost.

Semiconductors with Intel: Brookfield entered a $30 billion partnership with Intel to develop a cutting-edge semiconductor facility in Arizona, a landmark investment in tech infrastructure.

Deutsche Telekom Towers: A new partnership saw Brookfield take a majority stake in Deutsche Telekom’s German tower business for €17.5 billion, boosting its telecom infrastructure portfolio.

2023: Scaling Capital and Real Estate

India Real Estate: Brookfield acquired a 51% stake in Bharti Enterprises’ four commercial properties for Rs 5,000 crore, expanding its presence in India’s real estate market.

Record Fund Closures: The company raised $12 billion for its largest-ever private equity fund and $6 billion for its third global infrastructure debt fund, reinforcing investor confidence and financial firepower.

2024: Accelerating Innovation and Insurance

American Equity Life (AEL): Brookfield acquired this life insurance firm and began streamlining operations - exiting noncore product lines, improving capital efficiency, and driving annuity growth. Early signs of success suggest more upside as the business scales.

Castlelake: Brookfield invested in this premier asset-backed lender to deepen its capabilities in aviation, specialty finance, and real estate lending - a move expected to boost earnings as fundraising ramps up.

Neoen: In a major renewable energy play, Brookfield agreed to acquire a majority stake in Neoen, a global leader in the renewables space. This deal expands Brookfield’s clean energy platform and positions it for strong future earnings -especially with rising energy demand driven by the AI revolution.

Management is able to model all of these investments on a forward basis and arrive at a net asset valuation based on discounted cash flows. We simply don’t have enough information to be able to do this with any degree of accuracy, so once again, it becomes a question of having to take the management at its word.

Either way, the share price is currently around $47, I have calculated a base case which suggests it ought to be closer to $60 and management is convinced it should be closer to $100. We all agree that it is undervalued - the remaining question is by how much. For a long-term investor, does it really matter?

Is Brookfield a Good Investment?

Brookfield might not dominate headlines like some of its flashier U.S. peers—but don’t let that fool you. This is a global powerhouse playing the long game with extraordinary discipline.

With its unusual structure, massive capital base, and laser focus on real assets, Brookfield is tailor-made for a world defined by inflation, geopolitical tension, and a once-in-a-generation infrastructure boom.

This isn’t just a company riding the wave. It’s making waves and helping shape the future.

The firm’s continued expansion into insurance, renewable energy, and infrastructure will likely sustain its growth trajectory. Backed by a top-tier management team and a long-term capital allocation strategy, Brookfield remains well-positioned to outperform traditional asset managers in an increasingly uncertain global economy.

For investors seeking exposure to a diversified, inflation-resistant and globally integrated alternative asset manager, Brookfield presents a highly attractive opportunity.

Its unique model and track record of compounding capital at approximately 19% per year combined with its undervalued market price means that as the stock re-rates and its multiple expands, investors will earn a greater return than the underlying performance of the business - which is already great. This seems to be more than a solid bet. It’s a standout opportunity.

A cap rate (short for capitalization rate) is a key metric used to estimate the potential return on an investment property. It represents the ratio between a property's net operating income (NOI) - which is the annual income generated from the property after deducting operating expenses - and its current market value or purchase price.

OAKTREE CAPITAL - HOWARD MARKS - BROOKFIELD CORP

Brookfield announced that it will acquire the remaining 26% stake in Oaktree Capital Management for approximately $3 billion. This follows Brookfield’s initial majority stake acquisition in 2019 (~$5 billion) and is positioned to deepen the firm’s foothold in alternative credit and wealth management.

Oaktree Capital Management is widely regarded as one of the world’s leading credit-focused asset managers, particularly known for its expertise in distressed debt, high-yield bonds, and private credit. Founded in 1995 by Howard Marks, Bruce Karsh and a group of former TCW executives, Oaktree built its reputation on a disciplined, contrarian investment philosophy that emphasizes risk control, long-term thinking, and deep value investing.

What makes Oaktree special is its consistent success across credit cycles. The firm is known for stepping into distressed markets when others pull back: buying undervalued or impaired debt at attractive prices and riding recoveries as conditions improve. This approach has produced strong risk-adjusted returns over decades, earning the trust of institutional clients like pension funds and sovereign wealth funds. Beyond performance, Oaktree’s transparent, principle-driven culture, anchored by Marks’ influential memos on market psychology and risk, has made it a thought leader in credit investing and a key player in global alternative asset management.

Howard Marks is one of the greatest investors of modern times, measured not only by the returns he has generated over the course of his career, but also by the quality of his intellect and his humility. Warren Buffett famously said: “When I see memos from Howard Marks in my mail, they’re the first thing I open and read. I always learn something.”

That Howard Marks has chosen Brookfield Corporation to continue his Oaktree Capital legacy speaks volumes about his admiration for the quality of this particular alternative asset manager under the leadership of Bruce Flatt. An investor couldn't ask for more of an endorsement.

Howard Marks will remain on Brookfield’s board, while Oaktree co-CEOs Robert O’Leary and Armen Panossian will lead Brookfield’s credit business.

The funding breakdown for this acquisition places about $1.6 billion on Brookfield Asset Management (New York-based arm) and $1.4 billion on its parent entity.

The transaction is anticipated to close in Q1 of 2026.

This is a major coup for Brookfield Corporation. It isn't just another private credit firm - it is now possibly the best private credit firm in the world, in addition to being a leading global alternative asset manager. Brookfield expects the U.S. to become its largest market by assets, workforce and revenue, with Oaktree’s $209 billion in assets under management bolstering its scale.

"Oaktree will remain central to Brookfield's credit strategy, and we see significant opportunities to grow the franchise and expand what we can offer our clients together," said Howard Marks

GPU-as-a-Service | An ingenious way to play the AI revolution

While AI providers are hemorrhaging cash simply to stay in the game, with little prospect of generating profits anytime soon, the real beneficiaries of the AI revolution are likely to be those providing the picks and shovels.

Brookfield Corporation ($BN) is playing a smart game and they're doing it in a way that’s entirely on-brand for them. Forget the typical venture capital approach of high-risk bets - Brookfield's strategy is all about treating GPU infrastructure as a long-term, stable asset.

Their plan is straightforward yet brilliant: provide GPU as a service to major clients like hyperscalers, large enterprises and governments. This isn't a simple rental agreement. It’s built on 4-5 year take-or-pay contracts, which are essentially a promise from a creditworthy counterparty to pay for the service whether they use it or not. For Brookfield, this means predictable, durable revenue streams - the same kind they generate from their pipelines and power grids. For their clients, it’s a way to access billions of dollars in AI compute power as an operational expense, freeing up their own balance sheets for other priorities.

But Brookfield isn't stopping at the data center. They understand the real value lies in the entire stack. That’s why they plan to own or co-own the hardware that powers these systems. By controlling the GPUs, along with the critical surrounding infrastructure - think advanced liquid cooling, high-speed interconnects, and the power systems themselves - they can capitalize on the strategic value of these assets. This integrated approach allows them to navigate the long build-out times and complex supply chains that are significant barriers to entry for others.

In essence, Brookfield is applying its core competency in building and managing large-scale, essential infrastructure to the most critical technology of our time. It’s a classic infrastructure play, set to position them as a dominant force in the AI ecosystem.