DISCLAIMER & DISCLOSURE: The author holds no position in Medpace at the date of publication but that may change. The views expressed are those of the author and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Why Should I Be Interested In Medpace?

Medpace Holdings (Nasdaq: MEDP) is a Contract Research Organization (“CRO”) headquartered in Cincinnati, Ohio. It presents a compelling investment case as a highly differentiated and well-managed business operating within the resilient and growing pharmaceutical and biotech research and development sector.

Readers familiar with my investment style know that I look for rare high quality companies possessing the ‘golden threads running through the fabric of success’1. Medpace has them in abundance.

While not a household name, Medpace has quietly carved out a significant niche for itself, demonstrating remarkable financial performance and a sustainable competitive advantage that sets it apart from its peers.

A useful way to conceptualize why Medpace is an attractive investment is through the classic “picks and shovels” analogy:

The pharmaceutical and biotech sector is inherently risky. The pursuit of a new drug or treatment involves years, if not decades, of research and clinical trials - all of which consumes enormous amounts of capital, with absolutely no guarantee of success at the end. Even if successful, patents only last for a few years before generic drug manufacturers are legally permitted to copy the recipe, which inevitably slashes margins - so it becomes a race against the clock to generate satisfactory returns on investment before the flood-gates open. While pharma companies are able to spread their bets across a wide array of research projects turning it into a numbers game, small biotech companies may be betting the farm on a single treatment. That’s a high stakes capital intensive game - a process fraught with scientific and regulatory uncertainty that leads to a binary outcome - making it inherently difficult to calculate risk adjusted returns on any particular investment. In many respects it’s often closer to speculating than it is to intelligent investing.

Rather than attempting to pick individual winners among the myriad of pharma and biotech companies developing new drugs, investors can gain exposure to the overall growth of the industry by investing in the companies that provide essential services to all participants. Medpace, as a CRO, supplies the expertise and infrastructure required for clinical trials, making it a critical enabler of drug development. This positioning allows Medpace to benefit from the rising volume and complexity of clinical research, regardless of which specific drugs or companies ultimately succeed. Better still, the clinical trials run for years, sometimes decades and CROs enjoy years of uninterrupted recurring revenue. There are four phases of clinical trials before a drug or treatment is approved and while each is put out to tender, the incumbent from the prior phase has a clear advantage.

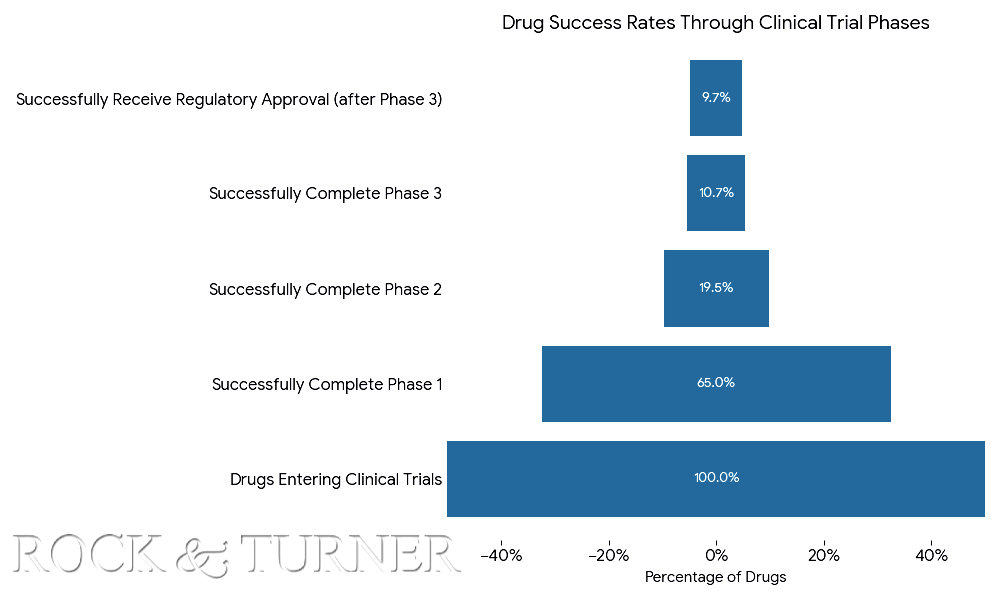

The pyramid diagram below shows that out of every 100 drugs that enter clinical trials, approximately 9.7 will eventually receive regulatory approval. That’s a very high failure rate and a capital intensive endeavour at that - a cost born by the biotech and pharma companies which then need to generate enough of a return on the winners to compensate for the 90.3% of treatments that didn’t make it. However, CROs are not only capital light enterprises, but they generate revenue on the full 100% of drugs entering clinical trials.

"The best business is a royalty on the growth of others, requiring little capital itself."

Warren Buffett

So now I hope you better understand why you should be interested in Medpace, you will naturally want to learn more about this company. So let’s delve into the intricacies of its business model, its unique strategic positioning, the cultural drivers of its success, and its long-term growth prospects. This analysis will also address the current market dynamics, potential risks, and the valuation of the company, ultimately providing a comprehensive overview upon which you may formulate your own opinion.

The CRO Industry

The CRO industry serves drug development companies to manage their clinical trials, a critical and complex part of the FDA approval process in the U.S. and equivalent processes in other jurisdictions.

Back in the 1970s, major pharmaceutical companies managed most clinical development in-house themselves, but over time the industry has gradually shifted toward an outsourced model where specialized third-party providers handle the complex, time consuming work that is clinical research.

The demand for clinical research from each pharma or biotech company ebbs and flows depending on the pace of drug development and which stage in the approval process the company finds itself. So having a permanent in-house clinical research division is inefficient. Instead, the trend towards outsourcing is driven by cost efficiencies, access to specialized expertise and the ability to scale resources as needed – a pay as you go model, rather than enduring inhouse redundancy. Either way, it is captured as Research and Development (R&D) operating expenditure, but that cost line on the income statement is now lower than it used to be.

Large pharmaceutical companies are increasingly focusing on their core competencies of intellectual property (IP) acquisition and commercialization, viewing the management of clinical trials as a non-core, and at times, a commoditized function. There is growing pressure on these companies to improve their return on R&D spending, which has historically been quite low, making the outsourcing proposition even more attractive.

For smaller biotech companies, particularly the wave of new firms spun out of universities and leveraging technologies like AI for drug discovery, partnering with a CRO is not just an option but a necessity. These smaller entities lack the in-house expertise, resources and infrastructure to navigate the rigorous and lengthy clinical trial process on their own.

So, over time, outsourcing has been a secular tailwind for the CRO industry. In the U.S. alone, the pharmaceutical R&D market was estimated at approximately $125 billion last year, with about $65 billion of that being outsourced, with these numbers, and proportions, both trending up and to the right over the medium- to long-term.

Medpace's Strategic Focus

Medpace’s unique full-service, vertically integrated model positions it as a key player in this market capturing a growing share of industry activity as outsourcing penetration increases.

To properly appreciate the Medpace advantage, it is first necessary to understand how others in the CRO industry operate.

The industry is characterized by a “big four” group of leading firms: IQVIA (NYSE: IQV), ICON (Nasdaq: ICLR), PPD Inc (Nasdaq: PPD), Fortrea (Nasdaq: FTRE). These work primarily with the large pharmaceutical companies.

Then there’s Medpace, with several points of differentiation from the big four - it is a mid-sized CRO by revenue and headcount, its customers tend to be the mid to small size biotech companies with little customer exposure to large pharma, and it exclusively offers full-service outsourcing (more on this shortly).

Collectively, the big four plus Medpace (~7% of the market) control approximately half of the market. The remaining half is highly fragmented, comprising numerous smaller providers with limited scale or specialization.

So what does it mean that Medpace is a ‘full-service’ provider?

There are two types of operators in the CRO space:

Functional service providers handle only specific parts of a clinical trial, such as medical writing or site management.

Full-service providers, as the name suggests, manage every aspect of a clinical trial from beginning to end.

Among the five dominant players in the industry, Medpace stands out as the only company to have strategically chosen to operate exclusively as a full-service provider. This is a key differentiator that has profound implications for its business model and financial performance.

The focus on full-service offerings means that Medpace becomes an indispensable partner for its primary customer base - the small to mid-sized biotech companies that most need a comprehensive, end-to-end solution for their clinical trials. These clients typically lack the internal resources and expertise to manage complex clinical trials independently, making them highly dependent on full-service CRO partners.

“full service outsourcing… has the best margins and frankly, a lot of growth potential in biotech… we really want to grow the full-service clinical business… and so we're still focused on that.”

Medpace Investor Call, 2024

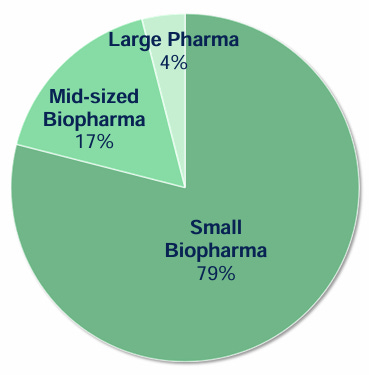

For this reason, approximately 79% of Medpace's clientele falls into the small biopharma category, 17% are mid-sized companies, while large pharma only accounts for 4%.

It is happy to let the big four slug it out to win the big pharma contracts, while it quietly prospers in its own niche with far less competition.

In fact, the large multinational pharma companies generally have existing large volume partnerships that have been defined with the big-four. It’s a bureaucratic process, more political than transactional. Those making the decisions are more concerned with safeguarding their own career, than they are in saving money for the pharma company that they work for. If you are familiar with the saying “no one ever got fired for hiring McKinsey”, a similar dynamic is at play here.

In contrast, smaller biotech companies are much more cost sensitive, they don't have pre-arranged partnerships with CROs, they may be dependent on venture capital and private equity funding and they make choices in a very transactional manner - this is where Medpace is able to shine, both in its full-service offering and its highly competitive pricing.

By concentrating on this segment of the market, Medpace has built deep relationships and a reputation for high-touch, customer service.

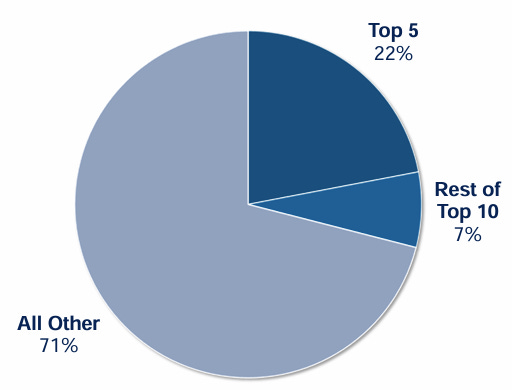

Focusing on small and mid sized biopharma companies also has an added benefit of very low customer concentration risk. The top 5 customers account for 22% of revenue, while the top 10 only account for 29% in total:

This strategic focus on a specific customer segment with a tailored, high-value service offering is the cornerstone of Medpace's success. It has allowed Medpace to build a reputation for excellence and reliability, which is particularly valued by smaller biotech firms that are often betting their entire future on the success of a single drug candidate.

It also positions Medpace to benefit from the ongoing proliferation of venture-backed biotech startups and academic spinouts, many of which are enabled by advances in digital tools and AI-driven drug discovery.

The Golden Threads

The most successful companies are not incrementally better than the competition, but fundamentally different. As mentioned earlier, it is critical to look out for the golden threads woven through the fabric of a company2 as a leading indicator that it is likely to be a great long-term compounding investment.

Medpace's competitive advantages, or golden threads, are not just a matter of strategic differentiation, they are deeply embedded in its operational structure and corporate culture of the business.

1. Technology & AI

One of the most significant differentiators is its complete vertical integration. Medpace owns and operates its entire IT stack, core laboratories and clinical monitoring operations, rather than subcontracting these critical functions.

More particularly, it is actively embracing the AI revolution and leveraging artificial intelligence to enhance the speed, reliability and efficiency of medical imaging analysis in clinical trials:

Its Core Imaging Lab is a recognized leader in using machine learning and AI for tasks such as lesion detection, biopsy scoring, tumor measurement and brain image segmentation. These capabilities reduce variability in image interpretation and accelerate trial timelines.

It has partnered with Medidata to integrate imaging and clinical data into a single platform, streamlining the workflow for sponsors and investigators. For instance, Medidata’s Rave Imaging enables it to build its own quantitative image analysis pipelines directly into its clinical trial workflow and data management systems.

It develops its own technology solutions, such as the proprietary ClinTrak system, which powers all the core data monitoring, collection, and analytics needed to run a clinical trial. It coordinates teams and timelines and is positioned to harness AI for predictive analytics, patient recruitment optimization, and adaptive trial design. ClinTrak has evolved organically through R&D over decades and is not easily replicated - in contrast, most other CROs outsource their technology to expensive vendors, such as Veeva Systems, which not only eats into margins but can never compete with the full integration of ClinTrak.

Beyond the technology, AI is nothing without high quality data. Medpace has a huge data advantage because as a full-service CRO, it manages the entire clinical trial lifecycle, from Phase I through IV, and wholly owns key infrastructure - including central labs, imaging and bioanalytical capabilities. This ensures high data quality, consistency, and seamless integration across all trial phases. Plus, it conducts clinical trials in over 60 countries, providing access to a diverse and expansive dataset that can be used to train and validate AI models. Its approach to data management and its unified Laboratory Information Management System (LIMS) contribute to robust and harmonized datasets, which are essential for effective AI deployment.

2. Scale Economics Shared

As a full-service provider with its own vertically integrated IT stack, Medpace creates a significant low-cost advantage. By not paying a margin to third-party vendors, Medpace can operate more efficiently.

Additionally, unlike many of its competitors that operate out of biotech hubs including New York, Boston, and San Francisco, Medpace operates out of a Cincinnati, Ohio giving it another cost advantage.

This is a well managed business with tight cost control a key part of its operating model.

But frugality alone is never enough - great businesses go one step further and here Medpace also shines. It doesn’t seek to optimize margins, but instead passes cost savings on to its customers. This makes the company more competitive and it drives customer acquisition. It is the best way to grow and is named ‘scale economics shared’3.

Additionally, the bigger and more efficient the business becomes, the lower it drives down its unit costs and the prices it charges its customers, making it very difficult for others to compete. It creates a formidable barrier to entry for would-be competitors.

This model is evident in many of the most successful businesses from Costco and Amazon to TSMC, Southwest Airlines and Geico.

3. Recruitment & Promotion From Within

Headquartered in Ohio, far from the biotech hubs of Boston and San Francisco, Medpace has cultivated a distinct approach to talent management. The company exclusively hires individuals directly out of college and promotes from within, creating a strong sense of loyalty and a deep understanding of the Medpace way of doing things.

Medpace doesn’t like to hire people from other CROs because it does things differently. Bringing in people from competitors would require retraining them and breaking any bad habits that they had formed.

This strategy not only reinforces its low-cost advantage by hiring early-career professionals, but also results in significantly lower employee turnover compared to the industry average. The consistency of the teams working on multi-year contracts is a major selling point for clients and a testament to the success of this cultural model.

The result of this unique culture and operational model is a demonstrable outperformance in key performance metrics - Medpace's revenue per employee is significantly higher than its competitors, a clear indicator of its superior efficiency and productivity. In 2015, with just over 2,000 employees, Medpace generated an average $172k per person - today the headcount is around 6,000 employees generating an average of over $350k each. So, in a decade they have increased their workforce by a factor of 3x and the average revenue per head has doubled.

4. Organic Growth & Capital Allocation

Medpace adopts a disciplined approach to capital allocation. Its aversion to value-destructive M&A and its focus on organic growth have created a more stable and predictable business. While others in the industry grow through acquisition and mergers, all of which are disruptive during the subsequent integration stage and may result in synergistic cost savings including potential redundancies in overlapping roles, Medpace continues without any such disruption. For a pharma or biotech company committing to a multi-year clinical trial with a CRO, that kind of stability is invaluable.

The company has eschewed dividends and instead capital allocation decisions are made opportunistically focusing first on internal reinvestment and then surplus capital is utilized for opportunistic share buybacks, a strategy that has served its shareholders well. This kind of approach is exceedingly rare - it puts the CEO of Medpace in an elite club joining the likes of Singleton, Branson, Malone, Buffett and Bezos - all of whom understand the folly of paying dividends4.

Medpace has taken advantage of the recent downturn in the capital cycle, not through aggressive M&A, but by leveraging its operational discipline, financial strength, and customer-centric approach to win market share from weaker competitors.

Its disciplined approach to growth, together with its reputation for consistency and operational excellence, has made it a preferred partner for sponsors wary of larger CROs undergoing frequent M&A or restructuring, which can introduce uncertainty and operational disruption.

5. Customer-Centric Approach

Its vertical integration leads to a superior and more consistent customer experience. With a unified IT system and a single team managing a project from start to finish, Medpace can offer a seamless and highly coordinated service. The ability to customize its in-house technology for specific projects further enhances its value proposition.

In contrast, most of its rivals which pursue an aggressive M&A strategy find themselves facing issues associated with the integration of disparate businesses, fragmentation of systems and high employee turnover, leading to a less than satisfactory experience for their customers.

Furthermore, Medpace's go-to-market strategy is also a reflection of its customer-centric and disciplined culture. The company is known for offering fixed-price contracts, a rarity in an industry where cost overruns and change requests leading to add-on costs are common pain points for clients.

“We are not going to nickel and dime you if it turns out that we need more remote visits than we originally anticipated, or if there are more CRF pages than we originally anticipated, we're not going to go back and start doing amendments.”

Medpace pricing policy

Medpace will never overpromise and underdeliver. If the customer asks for something that isn’t feasible, perhaps due to budget, timelines or maybe it would be difficult to find patients willing to participate in trials, it will simply decline and not engage. But if it commits to a price and timelines, it stays true to its word on both. This approach provides clients with predictability and transparency, building trust and a strong reputation for delivering on time and on budget.

Before any response to a ‘request for proposal’ is submitted an approval committee comprising the executive team (including the CEO) and senior clinical operations people and medical directors are all engaged.

Awards

Recognized by Forbes as one of America's Most Successful Midsize Companies in 2021, 2022, 2023 and 2024, Medpace is also continually recognized with CRO Leadership Awards from Life Science Leader magazine based on expertise, quality, capabilities, reliability, and compatibility.

Market Opportunity and Growth Trajectory

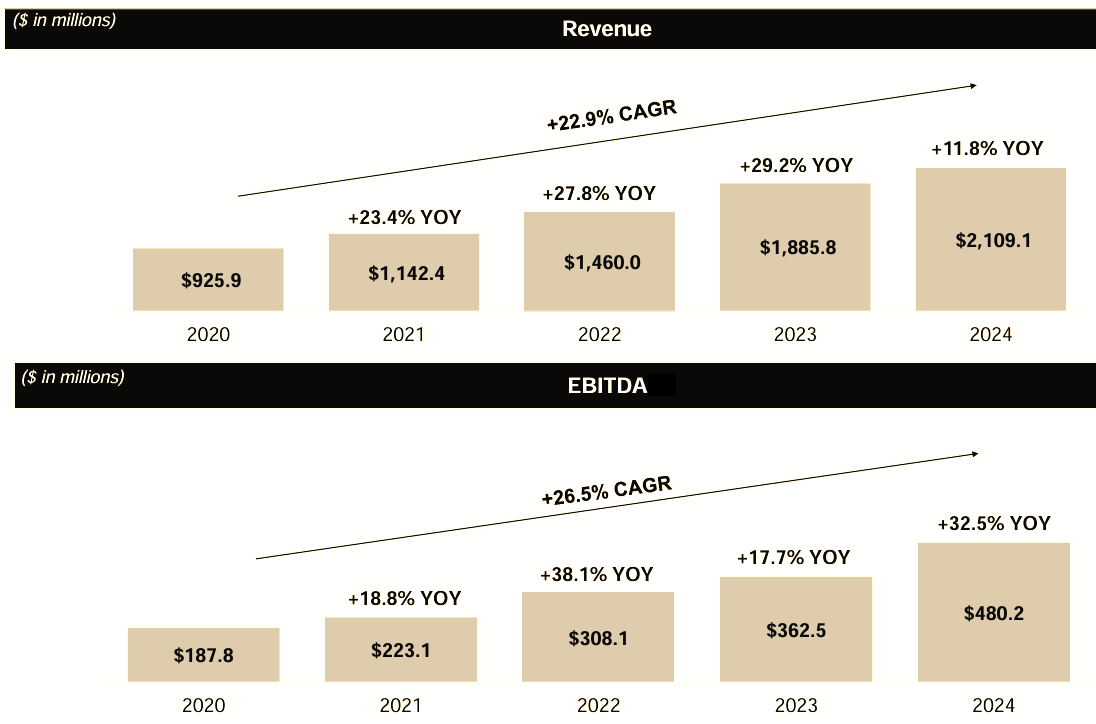

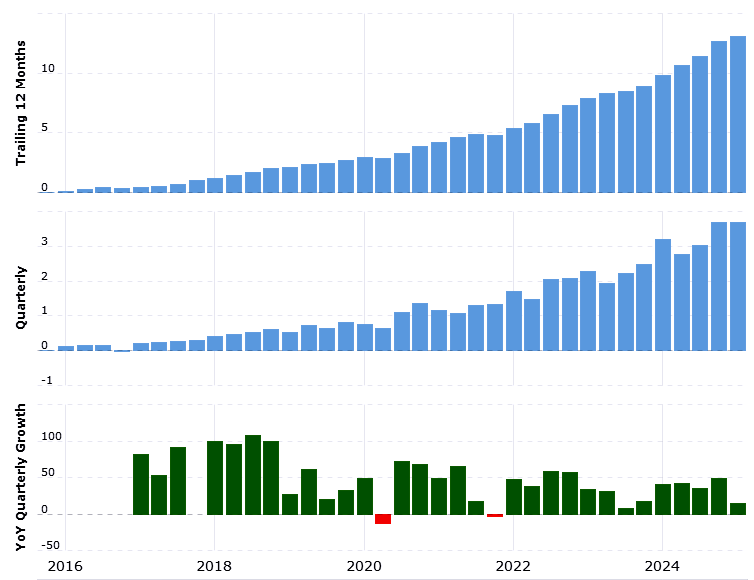

The company's revenue has grown at an impressive 23% CAGR since 2015, a testament to its successful strategy.

While the overall CRO market is expected to grow in the mid-single digits, Medpace is poised to continue to outpace the industry by a significant margin. Even as the largest player in the full-service CRO space, Medpace only holds about 5% of the market share, indicating a tremendous opportunity for further penetration - said differently, it has a long runway for continued growth.

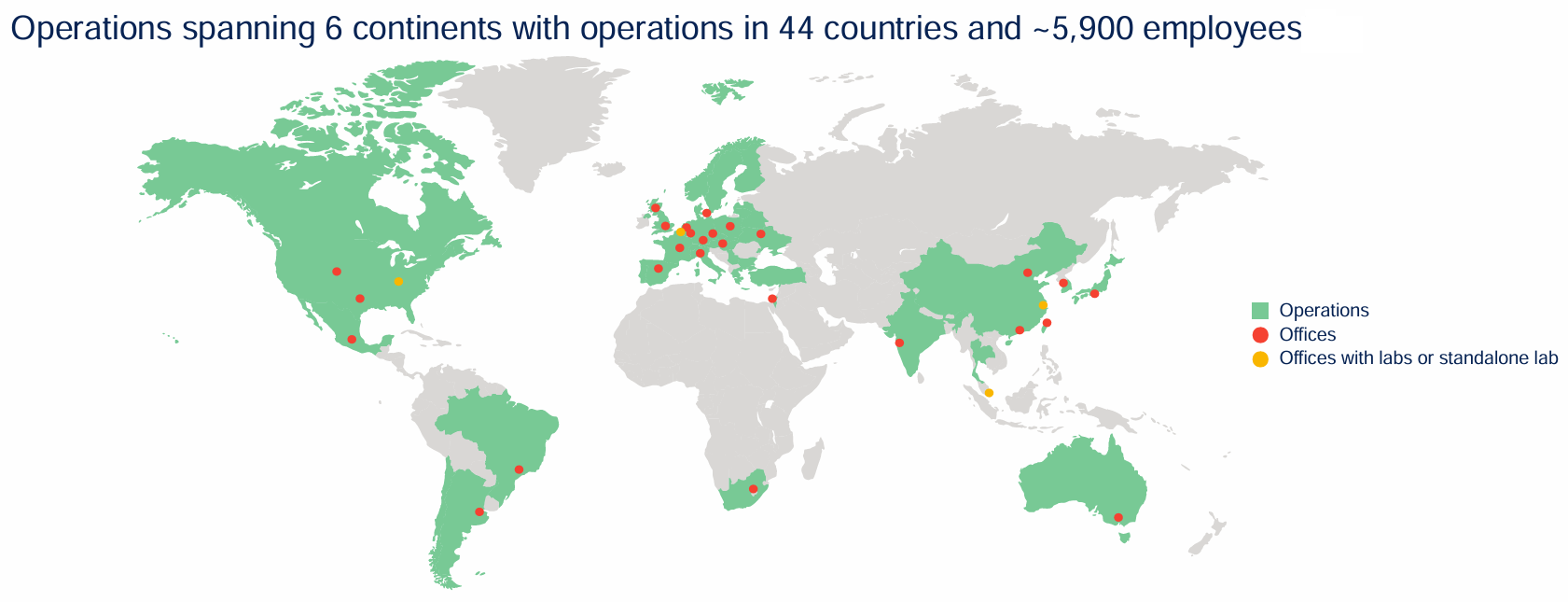

One of the most significant growth opportunities for Medpace lies in expanding its presence in Phase III clinical trials. Historically, the company has had a strong foothold in Phase I and Phase II trials but has often lost out on the larger and more lucrative Phase III contracts. This is partly due to the global nature of Phase III trials and Medpace's relatively smaller international footprint compared to some of its larger competitors. As the company continues to invest in its global capabilities and build out its infrastructure in Asia, Europe, and Latin America, it is well-positioned to capture a larger share of the Phase III market. Success in this area could significantly accelerate its revenue growth, as Phase III trials represent the largest dollar value in the clinical trial process.

Another avenue for growth is winning more business outside of the US - foreign pharmaceutical companies - a market where Medpace is currently underrepresented. It now has true global coverage and central laboratories in four locations: Cincinnati, Ohio; Leuven, Belgium; Shanghai, China; and Singapore (yellow dots on the map). As its international reputation and capabilities grow, so too will its opportunities to partner with a broader range of global clients.

This geographic spread is strategic for Medpace. Historically, Europe has been a world leader in pharmaceutical innovation and development, but that is slowly changing. The regulatory landscape in Europe is stifling pharmaceutical innovation and causing the continent to fall behind. Europe's failure to properly value biopharmaceutical innovation, coupled with a smaller domestic market and restrictive pricing policies, is creating a disincentive for European companies to invest in R&D. Over time, as access to innovative medicines in Europe declines, it is inevitable that clinical trial and R&D capacity will shift to Asia and the U.S.. China has become a crucial market but also an important partner for making future discoveries in the world of medicine due to its lower cost but highly skilled workforce, coupled with its capabilities in data science and artificial intelligence.

Additionally, as discussed above, the ongoing trend of innovation in the biotech sector, fueled by advancements in AI-driven drug discovery and other technologies, is creating a steady stream of new, small biotech companies that are the ideal customers for Medpace. While the biotech funding environment has been challenging in the short term, the underlying pipeline of viable new drugs remains robust, suggesting that the demand for CRO services will certainly rebound.

In fact, the current weakness in the biotech market, characterized by a temporary decline in the number of clinical trials and a difficult funding environment, actually presents an opportunity for a company as strong as Medpace. While its competitors are highly indebted and resorting to layoffs5, Medpace is in a strong financial position to invest for the future. The company is actively deepening its moat and positioning itself to take even more market share when the market inevitably recovers.

Management & Leadership

The influence of founder and CEO August Troendle on Medpace's success cannot be overstated. He is the company’s only ever CEO and Chairman, positions held since its inception in July 1992, giving him a tenure of nearly 33 years.

This remarkable longevity in leadership is extraordinary and speaks to the passion of the man - this is his life’s work. Troendle embodies the long-term, owner-operator mindset that is often a hallmark of exceptional companies. His presence has introduced stability, strategic vision and an ability to adapt to both industry changes and challenges.

Before founding Medpace, Troendle worked at Sandoz (now part of Novartis) from 1987 to 1992, where he served in several senior roles, including Assistant Director, Associate Director, and Senior Associate Director. In these positions, he was responsible for the clinical development of lipid-altering agents. Additionally, from 1986 to 1987, Dr. Troendle was a Medical Review Officer in the Division of Metabolic and Endocrine Drug Products at the U.S. Food and Drug Administration (FDA).

In short, his medical background and regulatory experience have provided him with a strong foundation in both the scientific and regulatory aspects of drug development.

Troendle is the largest shareholder, with a ~19% stake in the company, and at 69 years of age with a net worth of almost $3 billion, he doesn’t need to work. However, he has no immediate plans to step down. Medpace isn’t his job, it’s his passion.

Consider this: Medpace enjoyed its IPO in 2016 and while most founders see a public offering as an opportunity to cash in on their hard work, Troendle was different. He used personal funds to buy a large block of shares directly as part of the initial public offering, purchasing an additional 869,565 shares at the IPO price of $23.00 per share for a total of nearly $20 million. This isn’t a man focused on personal enrichment, it is a leader driven to be winner in his chosen field.

This is no ordinary CEO - in the words of Steve Jobs, ‘he’s a missionary not a mercenary’ - this type of leader is super rare, but when found should be seen as excellent stewards of shareholder capital. I always say that the jockey is more important than the horse. Isn’t Troendle the kind of person you would happily entrust with your investment capital?

His total compensation, ~$8.6 million, is largely performance-based, with only about 10% coming from salary, which speaks to the culture of the company. The value of his shareholding dwarfs his salary, so he is very much aligned with external shareholders.

His deep, hands-on involvement in the day-to-day operations, including participating in daily sales calls and visiting customer sites, ensures that the company's unique culture and high standards are maintained. While some may view his management style as micromanagement, it is this intense focus on the details that has fostered a culture of excellence and execution.

While a founder-led company with such a strong, central figure can raise questions about succession planning, there is a deep bench of long-tenured executive talent at Medpace. As mentioned above, the company exclusively hires individuals directly out of college and promotes from within - it doesn’t engage in M&A and neither does it make senior external hires, so outsiders have no way in. The average tenure of the C-suite is over 16 years, suggesting that the company's culture and operational know-how are well entrenched, succession would be easy to achieve and that the business would be in capable hands should Troendle eventually step down.

Beyond the CEO, other key personnel are:

Jesse Geiger, who joined Medpace in 2007, before becoming CFO in 2011, COO in 2017 and then assuming the role of President in 2021.

Kevin Brady, who joined in 2018 and became CFO in 2021.

Susan Burwig, who joined in 1993 and now serves as the Executive Vice President of Operations.

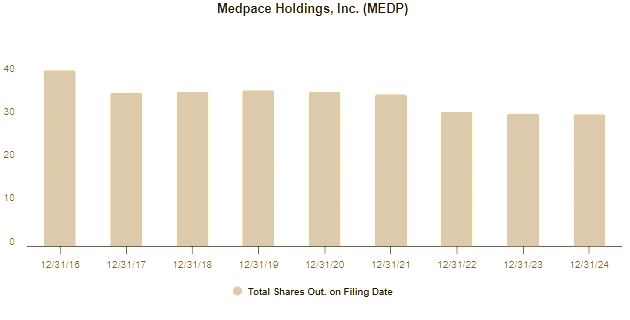

Share Repurchases

There are multiple levers that contribute to shareholder returns and paying down equity capital is key among them.

Share buybacks have been substantial and well-timed, reflecting management’s exceptional capital allocation strategy. Kevin Brady, the CFO, recently confirmed that the company will continue to take an "opportunistic approach" to share repurchases, as they have in the past.

To exemplify, in 2022 when the share price dipped to ~$150, repurchases accelerated and the share count declined 10.68% from 2021 levels. In 2023, the share price had climbed to $200, merely recovering its valuation from two years prior and still deemed to be trading below intrinsic value since the unit economics of the business had continued to improve over that period. So more repurchases followed and the share count declined by a further 5.43% on 2022 levels. The interesting part is that in 2024, when the price peaked at just over $400, the share count actually increased marginally by 0.54%, indicating that management may have considered the shares to be marginally over valued at the point in time. So far in 2025, as the share price has pulled back to $300 and repurchases have ramped-up once again.

As the chart below demonstrates, in 2016 the company had ~40 million shares outstanding and that number is now less than 30 million, a 25% reduction in 8 years, representing a permanent 33% boost to the proportional shareholding of investors that have held through this period.

This trend shows no sign of abating. In Q1 2025, Medpace repurchased 1.19 million shares for $389.8 million and, on April 17, 2025, received board approval for an additional $1.0 billion share repurchase program. This is in addition to the $344.8 million remaining under the previous authorization program.

The company currently has a market capitalization of $9.1 billion and an enterprise value of $8.8 billion, so with $1.345 billion to spend on repurchases, that implies that the share count may reduce by another ~15% (subject to fluctuations in share price).

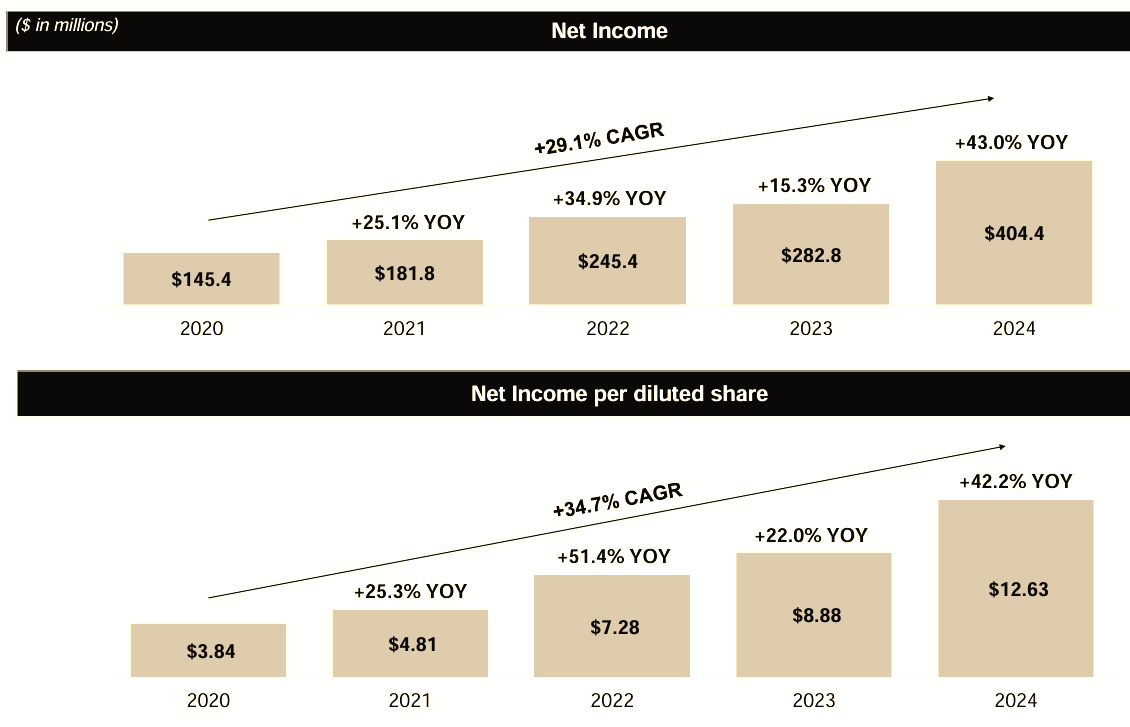

Financial Performance

Historically, Medpace has achieved strong financial performance, high return on equity and consistent revenue growth, even amid industry cycles and uncertainties.

Its superior business model and operational excellence are clearly reflected in its financial performance. Its approach enables tighter quality control, greater operational efficiency and the ability to offer a seamless, end-to-end service to clients. The result is a differentiated value proposition.

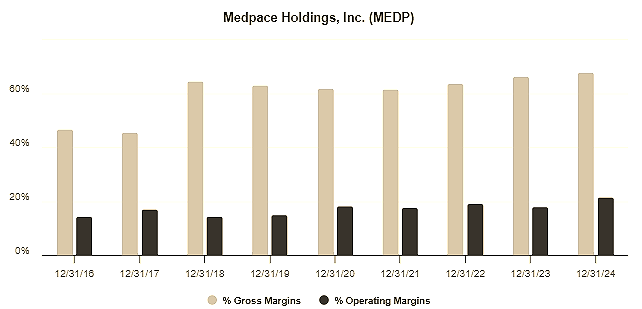

This has enabled Medpace to command premium pricing and deliver superior margins compared to peers who operate with a more fragmented or less integrated business model.

Not only are its margins significantly higher due to its efficiency and the premium nature of its full-service offering, but it has delivered double-digit organic growth, far outpacing its competitors.

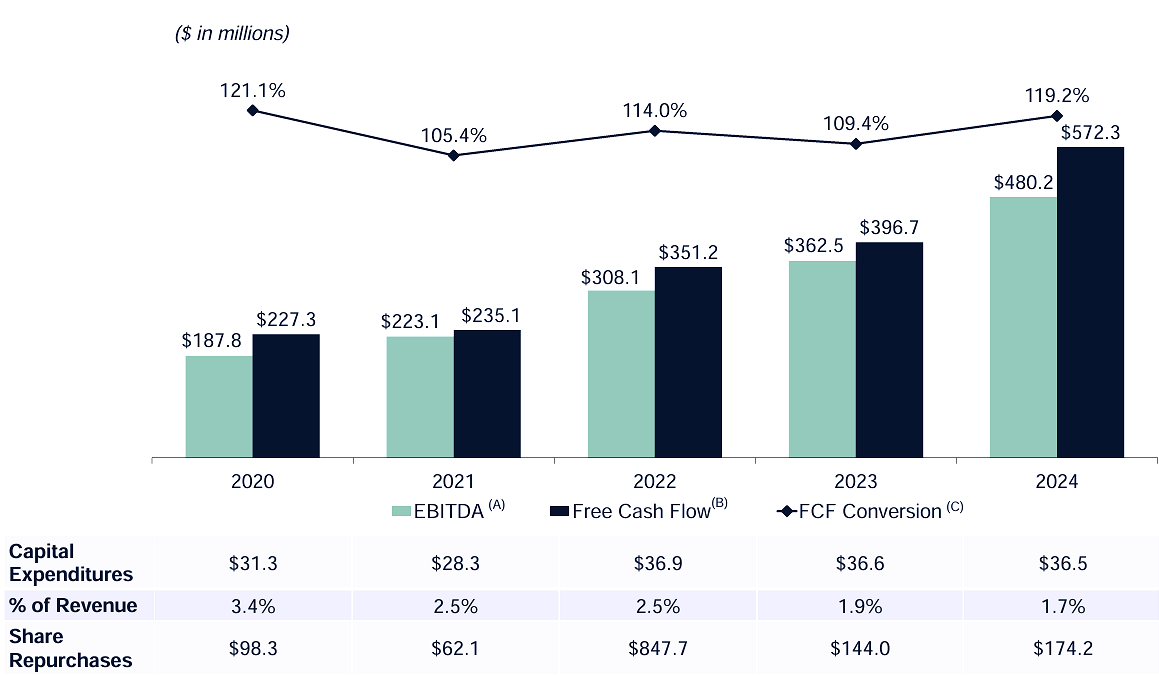

Medpace’s operational discipline, astute capital allocation and the asset-light nature of its business are all key drivers of its financial performance and industry-leading return on invested capital (ROIC), exceeding 50%.

The cash flow profile is particularly attractive. The chart below shows that CAPEX as a percentage of revenue is falling, so as earnings grow, free cash flow conversion is exceptionally strong. As the company generates more cash against a falling CAPEX spend and with no long-term debt to pay down, an aversion to M&A and an unwillingness to pay dividends, surplus capital can be allocated to share repurchases.

A fortress of a balance sheet, with no debt and a significant cash position, provides it with the flexibility to navigate market downturns or invest in future growth as circumstances require. It capitalized on heightened biotech investment and robust demand for clinical research services following the Covid pandemic, and it has happily weathered the downturn during the a sector-wide pullback in biotech funding. While others are feeling the chill of a CRO winter, Medpace has been able to invest in technology, talent and opportunistic share repurchases. Its focus on operational efficiency, cost management and a broad therapeutic and geographic footprint has helped buffer it against some of the cyclical pressures faced by its customers. In short, it is positioned well for both current challenges and an eventual return to stronger growth.

Despite the sector wide downturn, in its first quarter of 2025 Medpace reported revenue reaching $558.6 million, a 9.3% increase on the prior year. GAAP net income rose to $114.6 million ($3.67 per diluted share), up from $102.6 million ($3.20 per diluted share) year-over-year, an 11.7% and 14.7% increase respectively.

The chart below, which shows EPS growth since IPO, demonstrates almost perfect execution, punctuated by an unavoidable blip as the result of the Covid pandemic.

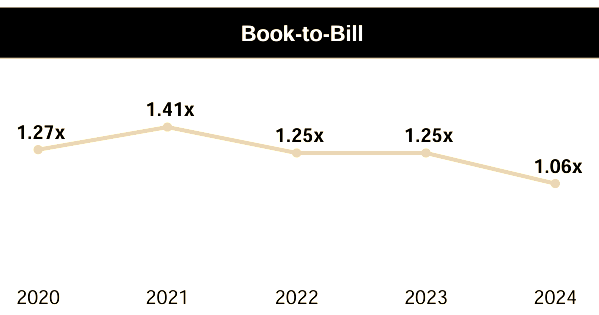

The recent industry slowdown is evident in its numbers - in Q1 2025 the company's backlog decreased 2.1% to $2.85 billion, with net new business awards of $500 million resulting in a book-to-bill ratio6 of 0.90x. The book-to-bill ratio measures the relationship between orders received and orders completed - greater than 1 indicates that more orders were received than completed, suggesting strong growing demand - and vice versa. The long-term run rate is closer to 1.25x (see chart below) and there is no reason that this will not be restored in due course.

For FY 2025, the company forecasts revenue between $2.140 billion and $2.240 billion, representing 1.5% to 6.2% growth over 2024’s $2.109 billion. This guidance suggests continued, albeit slower, expansion in a challenging environment.

Medpace has not provided explicit guidance about when it expects a sector-wide recovery - the variables, both macro-economic and political, are entirely beyond the company’s control and impossible to estimate with any accuracy. As such its current forecasts for 2025 reflect a tempered outlook, acknowledging ongoing uncertainty in biotech funding and macroeconomic headwinds.

Instead, the company appears focused on maintaining stability and operational excellence until external conditions become more favourable.

From a valuation perspective, Medpace trades at a premium to its peers, which is to be expected given its superior financial profile. However, on a historical basis, the company's current valuation is at a significant discount to its peak multiples. Does that make it cheap? No. It trades at around 18x trailing EV to EBIT and is capitalized at a multiple of 24x trailing earnings.

Is that valuation justified for a business with such strong management, good growth prospects, excellent profitability and high returns on capital? You’ll need to decide for yourself.

Risks & Mitigating Factors

No investment is without risk, and it’s important for us to consider the potential challenges facing Medpace.

1. Macro Considerations

The pharmaceutical industry is generally considered non-cyclical because demand for medicines remains relatively stable regardless of economic conditions. People continue to need healthcare and medications even during economic downturns. However, biotech and biopharma investment activity can show cyclical tendencies, especially in terms of venture capital flows and public market funding.

So the most significant near-term risk is the continued weakness in the biotech funding environment.

The current funding slowdown is the result of:

A post-Covid19 correction - biotech stocks were very fashionable when a killer pandemic was raging - capital flowed into the sector and valuations soared, especially among early-stage companies. That was unsustainable and the subsequent deflating of that bubble resulted in capital outflows from the sector - at least temporarily.

Macroeconomic pressures including geo-political tensions, inflation, rising interest rates and a global economic slowdown have a tendency to create a ‘risk-off’ investment environment. The pharma and biotech companies have tightened their belts due to increased operational costs and squeezed profit margins.

Regulatory tightening and uncertainty haven’t helped. Changes in healthcare policy, such as the price caps introduced in the Inflation Reduction Act, could reduce the ROI for pharmaceutical companies, leading to a decrease in R&D investment. Layered on top of this is the unpredictability of the Trump administration in relation to drug pricing and tariffs.

There has also been a reduction in public sector research funding. The public debt crisis in much of the western world has led to public funding schemes, such as those from the NIH in the U.S. or Horizon Europe in the EU, facing cuts or diversion of resources, further limiting available capital for R&D in the pharma and biotech industry.

The current environment is proving especially difficult. The biotech and pharma industries are currently going through one of the worst downturns in their history. A former executive at Icon, one of the leading CROs, describes it as one of the most challenging periods in the past 30 years, aside from the early 2000s patent cliff. Pharma companies are being cautious and methodical with spending, especially in R&D and manufacturing. While biotech R&D used to grow between 8–11% and large pharma around 3–4%, projections have now dropped to just 2–3% growth, with the possibility of flatlining in 2025 and 2026.

Earlier in the year, CROs expected a rebound in the second half, but that optimism has faded. Many mid-sized pharma and biotech firms are delaying projects—keeping work in CROs’ backlogs but pushing actual start dates back by quarters. The delays, driven by uncertainty around tariffs and economic conditions, are translating into outright cancellations.

At the same time, the CRO industry has become brutally competitive. During the COVID boom, demand for staff was so high that CROs could charge premium rates. Now, talent is abundant, and aggressive price-cutting is rampant. Large CROs are fighting over limited business, while smaller players underbid to win contracts. Pharma and biotech companies are taking advantage, shopping around and negotiating multiple rounds of bids.

Looking ahead to 2026 budgets, usually discussed in August and September, uncertainty remains. Pharma companies are under pressure because the pace of new product development isn’t fast enough to replace lost revenue from upcoming patent expirations, so growth and reinvestment in R&D will be necessary. Once the dust settles around policy issues like the Inflation Reduction Act and tariffs, the expectation is that pharma will return to developing new therapies. That will ultimately benefit CROs as the capital cycle shifts and pushes renewed demand against contracted resources on the supply side of the market. But when will this happen? No one knows. It could be the end of 2025 or sometime in 2026. It is unlikely to be beyond that without inflicting economic damage on the pharma sector.

It’s been a perfect storm leading to a shift in investor appetite toward later-stage, lower-risk opportunities with proven clinical data and near-term commercialization prospects.

Early-stage and preclinical firms are finding it much harder to secure funding, leading to a concentration of capital in fewer, larger funding rounds.

The funding cycle in the pharma and biotech space may be simply broken down as follows:

2021: Funding reaches its peak.

2022–2023: Sharp decline in capital funding.

2024: Funding remains constrained.

2025: Cautious recovery begins.

2026–2031: Projected growth and market expansion.

It would appear that we are now at an inflection point. While a prolonged downturn would act as a drag on the growth prospects of Medpace, classic capital cycle theory7 suggests that the strongest companies in a sector not only survive, but they thrive, gaining market share as the weak falter during tough times.

It is important to understand that an R&D drought cannot last much longer. A focus on innovation and R&D in the pharma sector is made all the more urgent by the industry's perennial "patent cliff" challenge. The industry has to replace its products every 14 to 17 years on average, which is when patents expire and generic alternatives enter the market eroding revenue and margins on legacy treatments. Proactive R&D is the only sustainable way to manage the industry's unique business cycle.

2. Artificial Intelligence Implications

Many aspects of the clinical trial process, such as patient recruitment and in-person quality control, are not easily automated, suggesting that the core value proposition of CROs will remain intact.

However, the impact of AI on other parts of this industry cannot be overstated.

Currently AI is acting as a headwind for CROs for two key reasons:

As the post pandemic hype and hysteria around the biotech sector waned, the market witnessed a surge in euphoria around investment in AI, especially generative AI. This has resulted in a significant migration of capital away from traditional biotech and pharma businesses, exacerbating the funding drought for early-stage drug development.

Additionally, as AI demonstrates its potential to dramatically accelerate drug discovery, design and clinical trial optimization, it has raised questions about the future of traditional R&D processes. Investors and industry leaders are now weighing how much to invest in legacy systems versus AI-driven approaches, causing a slowdown in capital flowing into this sector.

However, there can be no doubt that AI will be a highly disruptive force in most industries and drug development is certainly no exception.

AI alone is of limited use, but combined with the decoding the human genome, which unlocks the genetic roots of disease; and the explosion of big data, enabling powerful analytics that fuel precision medicine and accelerate discovery, these three game-changing forces are combining to revolutionize drug development.

For companies that harness its power, it is suggested that AI will reduce the time and cost of bringing a new molecule to the preclinical stage by up to 40%.

Beyond accelerated drug discovery, AI-powered tools, such as digital twin generators, enable companies to design clinical trials with fewer participants, reducing both cost and duration. It also increases the probability of clinical success by facilitating the rapid analysis of large datasets. Then there’s regulatory and commercial efficiency - generative AI is streamlining regulatory submissions and automating documentation, reducing errors and speeding up approvals.

It’s a classic case of Schumpeterian creative destruction. As such, AI offers the opportunity to propel winners to ever greater heights while leaving the rest of the field behind.

So the question becomes, who will be the winners?

As explained in the Golden Threads section above, Medpace is a technologically savvy company and it is certainly well placed to be a primary beneficiary of this evolutionary shift in its industry.

The Competition

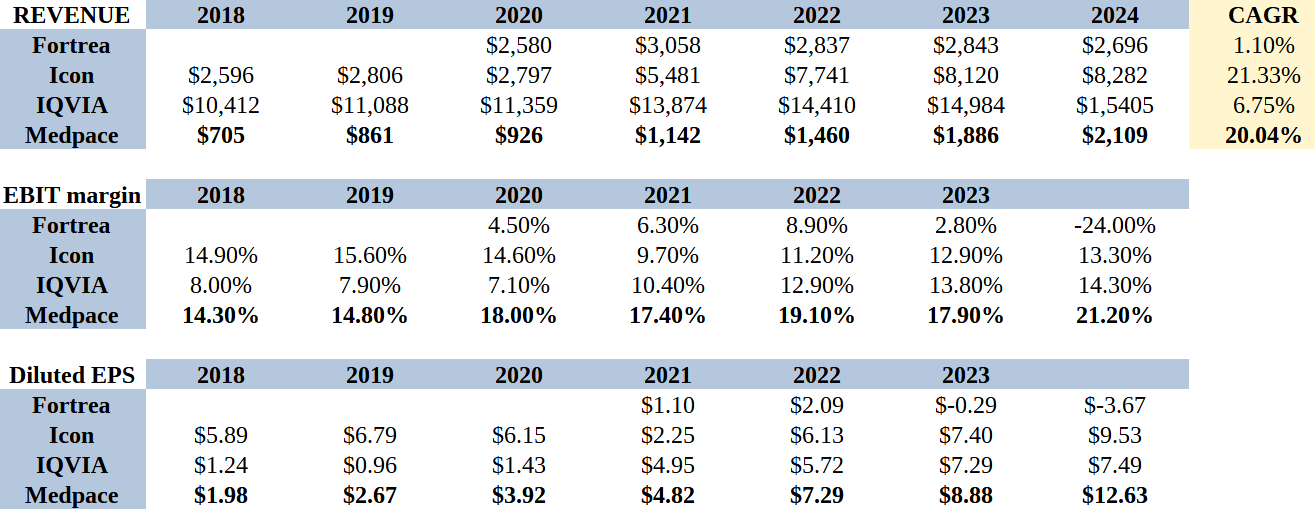

The tables below gives a sense of relativity to this analysis. Looking first at the revenues, Medpace is small relative to its peers, but just look at the growth rates. Now bear in mind that Medpace has achieved this organically while both Icon and IQVIA have acquired most of their growth. Through this lens these growth rates are super impressive.

While these other companies are dependent on finding new acquisition targets to grow, introducing uncertainty to their future growth path, not to mention the associated risks integrating a new business, Medpace will continue to expand organically without these challenges.

Now look at the EBIT (Operating Margins). This is where the Medpace business model truly shines. All of this, combined with share repurchases, translates into far superior earnings per share (EPS).

IQVIA Holdings (IQV) is the largest CRO in the world by revenue and market cap. It resulted from the 2016 merger between Quintiles and IMS Health. The name of the modern company honors the legacy organizations. IQVIA: I (IMS Health), Q (Quintiles), and VIA (by way of).

ICON (ICLR) has a growth by acquisition playbook. In 2014 it acquired Aptiv solutions, followed by MAPI Group in 2017, Symphony Clinical Research, MediNova and Molecular MD in 2019, MedPass in 2020 and PRA in 2021.

Fortrea (FTRE) formerly known as Covance, was spun-off from Labcorp in 2023 but has struggled since the spin-off.

Other large competitors include Charles River Labs (CRL) and PPD, a subsidiary of Thermo Fisher.

With the exception of ICON, which is an Irish business, all other large players named above are U.S. companies.

The remainder of the market is fragmented across hundreds of smaller specialty and regional CROs

Is Medpace A Good Investment?

Medpace Holdings represents a unique and compelling investment opportunity.

While the near-term market environment for biotech funding presents some headwinds, Medpace's strong financial position and the underlying resilience of its business model will allow it to not only weather the storm but also to emerge stronger.

The company has a long runway for growth, driven by market share gains, expansion into Phase III trials, and increasing its international presence.

For those seeking a high-quality, well-managed business with a durable competitive advantage and a clear path for future growth, Medpace Holdings is a standout candidate that warrants serious consideration.

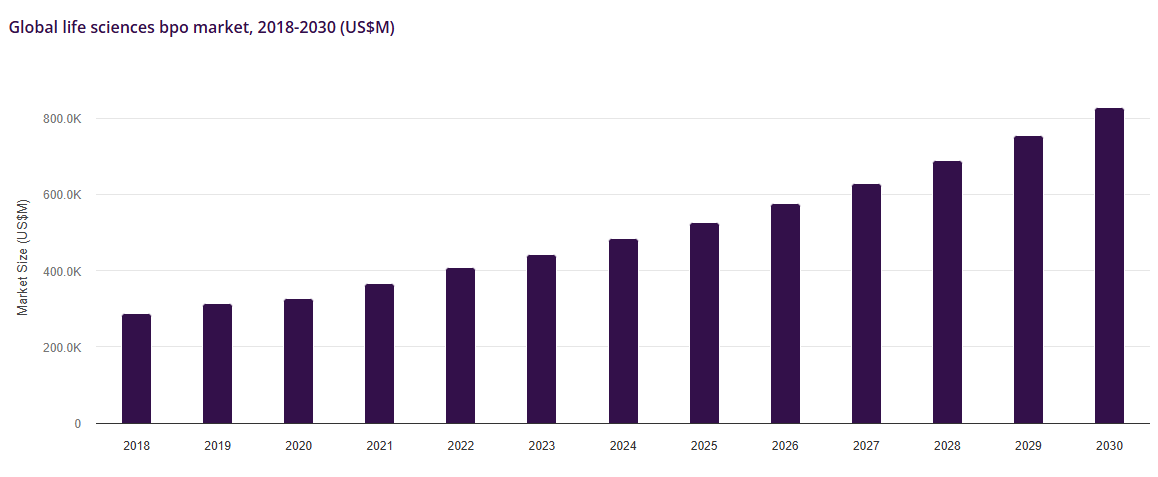

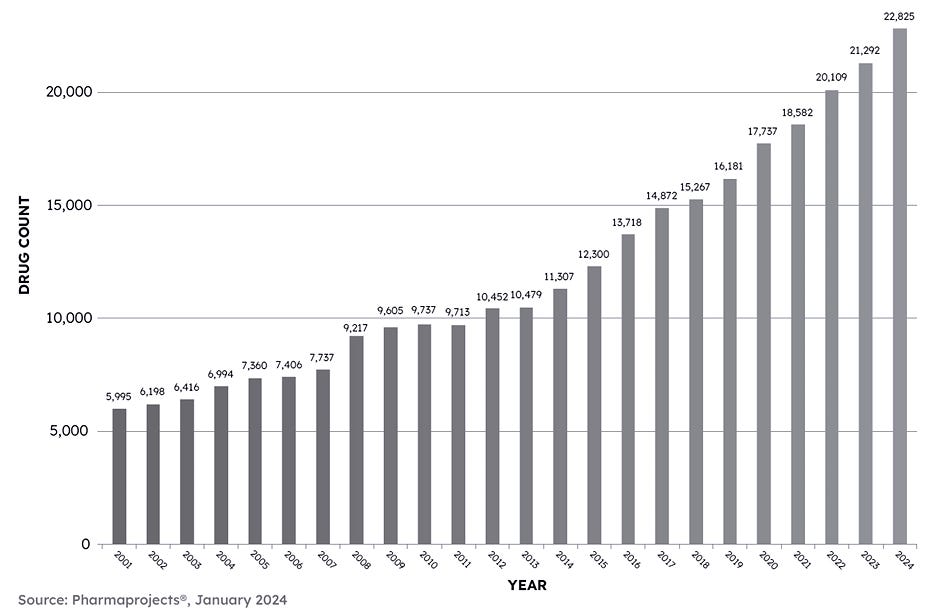

As the chart below demonstrates, there has been an undeniable expansion of innovation and R&D spending in life sciences generally and this is sure to continue, notwithstanding the temporary funding drought.

From an investor’s standpoint, Medpace offers a compelling way to participate in the growth of the biotech sector. By providing the essential infrastructure for clinical trials, Medpace stands to benefit from rising industry activity as a whole. This “industry play” approach allows investors to sidestep the challenge of picking individual molecule winners, instead gaining exposure to the overall expansion in spending trend within life sciences.

What are Golden Threads running through the Fabric of Success? See: https://www.amazon.com/dp/B0D6GWV7T5

Ibid

Scale Economics Shared: https://rockandturner.substack.com/p/mental-model-5-scale-economics-shared

The problem with dividends: https://rockandturner.substack.com/p/how-dividends-destroy-shareholder-value

https://www.fiercebiotech.com/cro/irish-cro-icon-plots-layoffs-after-underwhelming-q3-revenue

https://www.fiercebiotech.com/cro/cros-should-brace-continued-slow-big-pharma-rd-spending-analyst

Book-to-Bill Ratio=Orders Completed/Orders Received

Capital cycle theory: https://rockandturner.substack.com/p/part-1-the-capital-cycle-to-boost

Wow, Medpace ( $MEDP ) up 50% at the open - $466 vs $308 close. Is this a gamma squeeze? Short positions recently spiked to 14.5% of float from 5% due to the cyclical downturn in the pharma industry. The Q2 numbers were good, but no that good. The earnings call was very cautious - no conviction on whether the short term improvement is sustainable. The numbers don't justify the bounce, it looks like short covering. Views?

Medpace Holdings (Nasdaq: MEDP) - Very Strong Q2 Results

Medpace delivered a strong performance in the second quarter of 2025, with revenue rising 14.2% year-over-year to $603.3 million. This growth reflects a solid backlog conversion rate of 21.2%. Net new business awards also saw healthy momentum, increasing 12.6% to $620.5 million, which translated to a net book-to-bill ratio of 1.03x. While backlog dipped slightly to $2.87 billion, the company’s ability to convert and replenish work remains robust.

GAAP net income for the quarter came in at $90.3 million, or $3.10 per diluted share, modestly higher than the $88.4 million, or $2.75 per share, reported a year ago. Net income margin stood at 15.0%, down from 16.7% in the prior-year period, reflecting higher direct costs and SG&A expenses, which rose to $423.3 million and $46.7 million respectively. EBITDA grew 16.2% to $130.5 million, representing a margin of 21.6%, up slightly from 21.3% a year earlier. On a constant currency basis, EBITDA increased by an even stronger 18.5%.

For the first half of 2025, revenue reached $1.16 billion, up 11.8% year-over-year. Net income over the same period was $204.9 million, or $6.79 per diluted share, compared to $190.9 million, or $5.96 per share, in the prior-year period. Year-to-date EBITDA totaled $249.1 million, or 21.4% of revenue, rising 9.3% on a reported basis and 10.1% on a constant currency basis.

On the balance sheet, Medpace reported $46.3 million in cash and cash equivalents as of June 30, 2025, and generated $148.5 million in operating cash flow during the second quarter.

The company remained active in repurchasing 1.75 million shares in Q2 at an average price of $295.59 per share, totaling $518.5 million. In total, 2.95 million shares were repurchased in the first half of the year for $908.4 million, leaving $826.3 million authorized for future repurchases.

Looking ahead, Medpace expects full-year 2025 revenue between $2.42 billion and $2.52 billion, implying growth of 14.7% to 19.5% over 2024. GAAP net income is projected to range from $405 million to $428 million, with EBITDA expected between $515 million and $545 million. This translates to full-year diluted EPS guidance of $13.76 to $14.53, based on approximately 29.4 million diluted weighted average shares outstanding. These figures exclude any future share repurchases beyond June 30.

Medpace will host a conference call at 9:00 a.m. ET, Tuesday, July 22, 2025, to discuss its second quarter 2025 results. To participate in the conference call, interested parties must register in advance by clicking on this link: https://cts.businesswire.com/ct/CT?id=smartlink&url=https%3A%2F%2Fregister-conf.media-server.com%2Fregister%2FBI4890642ec8b743c6ba2ea8ce39f28060&esheet=54293770&newsitemid=20250721342864&lan=en-US&anchor=this+link&index=1&md5=1c9ffeb683971f7c846e7fe436b255b7