Shift4 Payments Inc | Remarkable Story

A 16yr Old Entrepreneur, Crypto, Space Travel and the President of the United States

DISCLAIMER & DISCLOSURE: The author has no position in Shift4 at the time of publication but that may change. The views expressed are those of the author at the time of publication and may change without notice. The author has no duty or obligation to update this information. Some content is sourced from third parties believed to be reliable, but accuracy is not guaranteed. Forward-looking statements involve assumptions, risks, and uncertainties, meaning actual outcomes may differ from those envisaged in this analysis. Past performance is not indicative of future results. All investments carry risk, including financial loss. This analysis is for educational purposes only and does not constitute investment advice or recommendations of any kind. Conduct your own research and seek professional advice before investing.

Guess Who?

This investment thesis led me down some unexpected rabbit holes. Imagine a story that weaves together a 16-year-old entrepreneur, cryptocurrency, space travel, and even the President of the United States. Sounds like something straight out of Elon Musk’s playbook, right? Well, think again - while he does make an appearance, this tale is about someone else entirely.

School Dropout, Age 16, Who Built a $9.3 Billion Empire

Jared Isaacman started Shift4 Payments Inc. (NYSE: FOUR) in 1999 at just 16 years old, working out of his parents’ basement after dropping out of school. Fast forward 25 years, and he’s turned that teenage dream into a $9.3 billion powerhouse. His leadership has been nothing short of extraordinary - scaling Shift4 into a fintech juggernaut while simultaneously chasing even bigger dreams.

Isaacman isn’t just a business mogul. He’s also a space pioneer. In 2021, he commanded Inspiration4, the world’s first all-civilian mission to orbit. His passion for space exploration caught the attention of none other than President Donald Trump, who, in December 2024, tapped him to lead NASA.

"Jared has demonstrated exceptional leadership, building a trailblazing global financial technology company."

Donald Trump, POTUS

On December 4, 2024, Isaacman addressed investors and employees with a heartfelt letter, stating that until his Senate confirmation, he would remain CEO. He wrote, "Shift4 has been my life's work since I was 16 years old, but it is my time to serve and give back to the nation that enabled me to live the American dream."

For investors, Shift4 is more than just a payment processor - it’s a company shaped by a relentless founder with a track record of success. Readers of my Substack know that I admire businesses led by obsessive, visionary leaders. Shift4 is exactly that.

This investment thesis will explore the company’s business model, competitive edge, financial strength, and future prospects. With or without Isaacman at the helm, Shift4’s trajectory remains one of ambition, innovation, and global expansion.

A Visionary-Led Company Going To Infinity and Beyond

Shift4 isn’t just another payment processing company - it’s a disruptive force in financial technology.

What sets Shift4 apart? A relentless focus on innovation, an aggressive global expansion strategy, and a commitment to end-to-end solutions.

With a fully integrated ecosystem that extends beyond payments, Shift4 has carved out a dominant position by combining cutting-edge technology, deep software integrations, and strategic partnerships. Its reach spans restaurants, hospitality, entertainment venues, specialty retail, and e-commerce, making it an essential player in multiple industries.

Its recent acquisition of Global Blue, a specialty payments and technology provider, demonstrates its ambition to grow beyond U.S. borders, strengthening its international footprint.

Shift4: The Company Behind Seamless Transactions

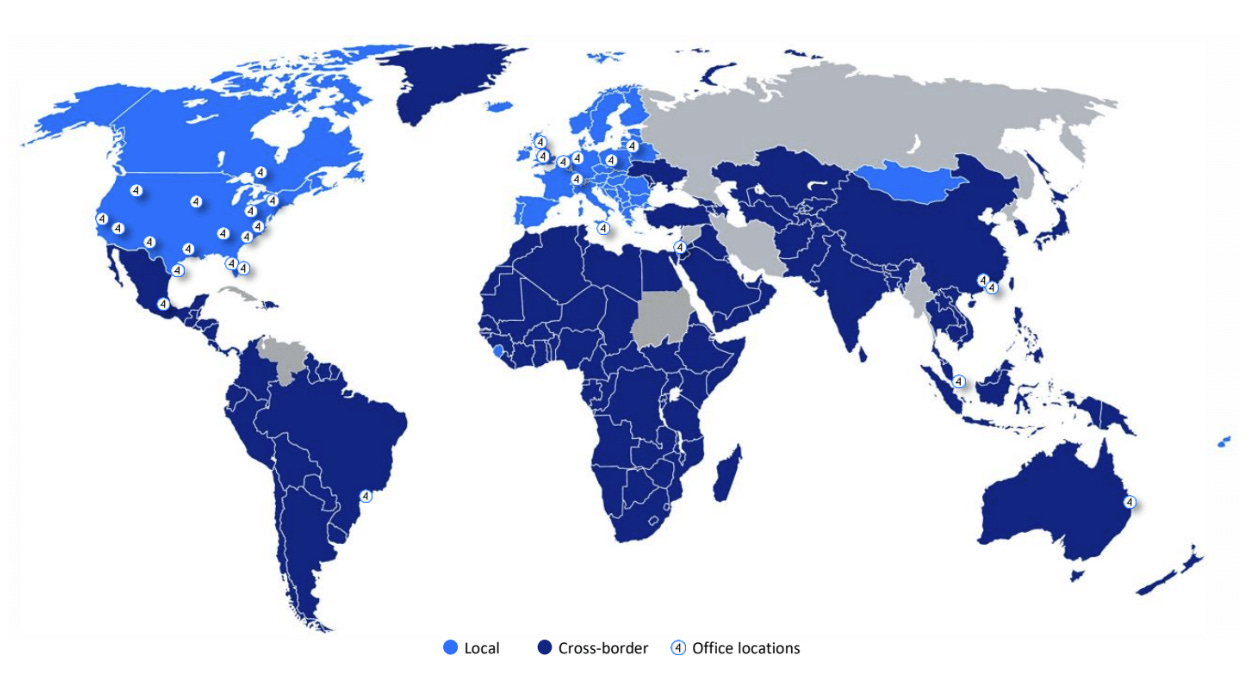

Shift4 Payments is not just another payment processor - it’s a fast-growing, independent fintech leader that’s revolutionizing how businesses handle transactions. While it has firmly established itself in the U.S., its ambitions stretch far beyond, with an aggressive push into global markets (see map below).

At its core, Shift4 delivers an end-to-end payments ecosystem that seamlessly integrates its proprietary payments platform with cutting-edge software solutions. From processing transactions to enhancing security and business intelligence, Shift4 offers merchants everything they need to operate efficiently.

A Payments Platform Built for the Modern World

Shift4’s platform is built for flexibility, supporting a broad spectrum of payment methods—credit cards, debit cards, contactless payments, and mobile wallets like Apple Pay, Google Pay, Alipay, and WeChat Pay. It also prioritizes security with advanced fraud prevention, tokenization, and encryption, ensuring businesses can process payments with confidence.

The company’s revenue model is largely recurring, driven by transaction fees based on payment volume or per-transaction pricing. On top of that, Shift4 monetizes software subscriptions, offering point-of-sale (POS) systems, business intelligence tools, and payment device management.

A Razor-and-Blade Model for Payments

What makes Shift4’s approach so compelling? It operates much like the classic razor-and-blade business model - providing hardware at little to no cost while generating recurring revenue through software, service, and maintenance fees. This strategy makes customer acquisition easier, while ensuring long-term revenue streams for Shift4.

To demonstrate how this works, see the table below which shows the Shift4 SkyTab service fees compared to its primary competitor:

Another key strength is its diverse customer base - no single merchant accounts for more than 3% of its revenue, ensuring stability and reducing risk. And with a vast distribution network of independent software vendors (ISVs), plus an in-house sales and support team, Shift4 has the reach and infrastructure to scale rapidly.

Want to see how it all works? Watch this short video for a closer look at Shift4’s evolution and its unique operating model:

Delivering Record-Breaking Growth

Shift4 Payments continues to deliver standout financial performance, consistently achieving record revenue growth, expanding margins, and strong cash flow generation. Over the past year, the company has posted exceptional results across key financial metrics, reinforcing its position as one of the leaders in the payments industry.

In its latest earnings report, Shift4 shattered expectations, delivering record-breaking numbers across the board:

End-to-end payment volume surged 49% year-over-year to $47.9 billion.

Gross revenue less network fees jumped 50% to $405 million.

Adjusted EBITDA climbed 51% to $205.9 million.

Adjusted free cash flow skyrocketed 78% to $134 million.

Organic gross revenue less network fees grew 26%, reflecting strong momentum across Shift4’s verticals.

Adjusted EPS came in at $1.35, smashing analyst expectations of $1.14.

Notably, the company also delivered positive operating leverage, with both adjusted EBITDA and free cash flow growing faster than revenue. Despite executing multiple acquisitions, Shift4 improved its financial position, reducing its net leverage ratio to 2.5x - a testament to its disciplined capital management.

Overall, Shift4 Payments delivered a strong Q4 2024, exceeding its medium-term guidance and demonstrating robust financial performance, positive operating leverage, and continued vertical expansion.

Shift4’s revenue trajectory continues to impress, fueled by strategic initiatives and operational efficiencies. The company reported Q4 2024 revenue of $887 million, marking a 25.7% increase from the prior year.

With a recurring revenue model anchored in processing fees and software subscriptions, Shift4 benefits from a diversified and scalable financial structure that drives predictable, high-margin cash flow.

Navigating a Fiercely Competitive Landscape

The payments processing industry is a battleground where technological innovation and market share are constantly contested. To maintain its edge, Shift4 must continue pushing the boundaries of innovation, expanding its strategic partnerships, and differentiating itself from competitors.

Shift4 faces competition from both legacy payment giants and emerging fintech disruptors including Adyen, Fiserv, Global Payments, Worldpay, Square, Stripe, PayPal, Toast and Corpay - each specializing in a distinct niche and competing through pricing, product innovation, and global reach.

However, making direct comparisons between these companies is tricky because some competitors are private (limiting access to financial data), while for those where data is available accounting methods distort financial metrics.

For instance, comparing Shift4 to Adyen (Amsterdam: ADYEN), arguably the market leader:

Shift4 includes network fees in its revenue, inflating both revenue and cost of goods sold - this both overstates Shift4’s revenue, but also understates its profit margins relative to a company such as Adyen.

Shift4 grows through acquisitions, which are capitalized, yet it relies on EBITDA as a key metric, excluding both CAPEX and D&A on that CAPEX, which artificially flatters its profitability. Adyen shuns acquisitions and grows entirely organically, expensing all its investment in growth - this impacts income statement earnings and creates a distorted picture of valuation based on profit metrics and earnings multiples.

Restating financial statements for each of these companies to enable side-by-side comparison is well beyond the scope of this analysis, but for investors looking to compare Shift4 against its competitors, these discrepancies need to be accounted for.

Looking beyond quantitative measures at the qualitative aspects of Shift4, it is clear that it has built a strong foundation of competitive advantages:

Robust Technology Platform: A proprietary payments platform, with its extensive software integrations and advanced features, provides a comprehensive and seamless payment processing experience for merchants.

Diversified Merchant Base: Processing payments across restaurants, hospitality, venues, retail, and e-commerce, reducing reliance on any single industry. Notably, Shift4 handles one-third of restaurant and hotel payments in the U.S., serving brands like Hilton, Four Seasons, KFC, and Arby’s.

Unique Pricing Structure: The razor-and-blade model discussed earlier.

Talent Attraction and Retention: Its commitment to creating an inclusive and supportive work environment, along with its competitive compensation and benefits, enables the company to attract and retain top talent, which is crucial for its continued innovation and growth.

Shift4’s Growth Blueprint

Shift4 Payments is executing a multi-pronged growth strategy designed to accelerate its expansion, enhance merchant relationships, and solidify its position in the global payments industry.

Scaling End-to-End Payment Volume

Shift4 aims to accelerate growth by increasing the payment volume processed through its integrated platform across diverse verticals, including restaurants, hospitality, venues, specialty retail, and e-commerce.

Aggressive Merchant Acquisition and Retention

To fuel its expansion, Shift4 is winning new merchants with its scalable, high-value solutions while simultaneously retaining existing customers with powerful tools that improve efficiency and reduce churn.

The company has seen explosive growth in the not-for-profit sector, serving marquee names like University of Miami, Mercy Corps (Europe), and Lupus Research Alliance. In Q4 2024, year-over-year volumes in this sector surged 660%, with full-year volumes up 319%.

Relentless Product & Technology Innovation

Shift4 continuously enhances its product lineup to meet evolving merchant needs, driving higher engagement and transaction volume.

Flagship products like SkyTab and SkyTab AIR are advanced business intelligence tools that empower businesses to operate more efficiently.

The company's investment in AI-driven analytics and fraud prevention further strengthens its value proposition.

Expanding Internationally

Recent acquisitions of Givex and Global Blue have expanded its global footprint, particularly in the European and UK markets, positioning the company to capitalize on cross-border payment opportunities, unlock new merchant acquisition channels and to diversify its revenue streams beyond the US market.

Strategic Partnerships

Shift4’s seamless integration with over 550 software suites reinforces its versatility and broadens its customer reach. The company is deepening relationships with independent software vendors (ISVs), enterprise partners, and technology providers to strengthen its distribution network.

Favorable Industry Trends

The increasing adoption of software-integrated payments and the growing demand for comprehensive payment solutions in both domestic and international markets present significant growth opportunities for Shift4.

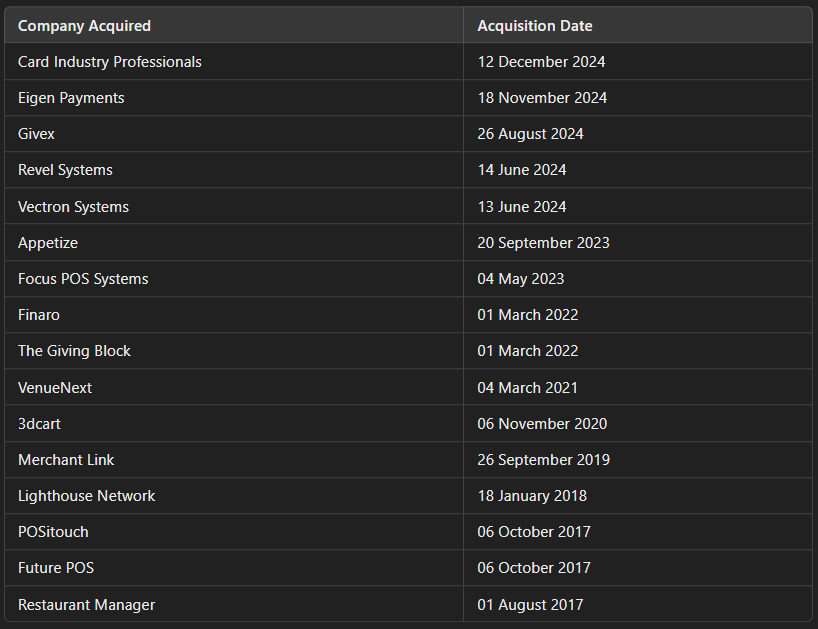

Acquisitions

Shift4 has aggressively expanded through acquisitions, integrating a diverse range of businesses to strengthen its payments ecosystem, enhance technological capabilities, and expand its global footprint. Acquisitions over the past few years include:

In its largest acquisition to date, Shift4 recently announced a $2.5 billion deal to acquire Global Blue, a leading provider of specialty payments and technology solutions. This move enhances its global payments capabilities, integrating tax refund and currency conversion services into its platform. Global Blue’s extensive merchant network and affluent international customer base create powerful network effects, unlocking new cross-sell opportunities. The acquisition is expected to generate $80+ million in revenue synergies by 2027, further solidifying Shift4’s competitive position in the international payments space.

Of note is that every acquisition seems to have been funded with a combination of cash and debt. There is nothing in regulatory filings to suggest that equity is ever used. This is peculiar on a number of levels, not least of which is that the share count has doubled in the past four years (more on this shortly).

While Shift4 has been successful in integrating its acquisitions, in its Q4 2024 earnings call it has noted a nearly 270-basis-point drag on its full-year adjusted EBITDA margins caused by recent acquisitions, which it expects to synergize over the next 12 to 18 months.

Shift4’s Push into Crypto: Why?

In 2022, Jared Isaacman set his sights on the crypto space - His interest wasn’t in speculation and the volatile world of Bitcoin and Ethereum. It was the more pragmatic realm of stablecoin that piqued his interest with real-world applications for blockchain for the payments industry.

Isaacman knew from history that when national currencies spiral into instability - such as Weimar Germany’s hyperinflation (1922-1923) or modern Zimbabwe’s monetary crisis - people instinctively seek stable alternatives for transactions.

Yet despite being labeled “cryptocurrencies,” Bitcoin and similar assets experience extreme valuation swings, making them entirely unsuitable to be used as actual currencies. More importantly, he understood that it was their volatility that made them attractive to a mass of speculators seeking to get rich quickly. Their continuing existence therefore very much relies upon them remaining unstable. This raises a fundamental question: Will popular crypto assets, such as Bitcoin, ever be anything more than a craze for those with a penchant to speculate?

In contrast, Isaacman instinctively understood that stablecoins1 - a subset of cryptocurrencies pegged to other assets, usually the greenback - are inherently stable. They will never become speculative assets but instead possess real world utility, particularly in facilitating cross-border transactions. By enabling the transfer of fiat currency via blockchain, stablecoins provide significant advantages in terms of speed and cost compared to traditional payment networks.

Crucially, Isaacman recognized what many others have overlooked: the true value lies not in the asset itself but in the blockchain technology that underpins it.

To provide an idea of scale, in 2024, stablecoin transfer volumes reached $27.6 trillion, surpassing Visa and Mastercard's combined volumes by 7.7%2. By 2028, businesses are projected to save $26 billion globally through the use of stablecoins, up from $15 billion in 20253.

In countries grappling with runaway inflation that rapidly erodes the purchasing power of local currencies - especially where U.S. dollars are scarce or restricted by currency controls - stablecoins offer a practical solution. For example, Turkish traders in Istanbul’s Grand Bazaar have embraced their use, as have many residents of Nigeria.

This also explains why, following his inauguration as US President, Donald Trump signed an executive order directing officials to draft a regulatory framework for digital assets within six months. The executive order has prevented federal agencies from launching a central bank digital currency (CBDC) and so encouraged private-sector stablecoin development. Federal stablecoin legislation is expected to gain momentum through the course of 20254 .

Unlike Bitcoin, which has a devoted following of anarchists who believe it will replace fiat currency and reshape the global order, stablecoins are fundamentally tied to the existing financial system. Their value is pegged to the U.S. dollar, and Tether - the issuer of the most dominant stablecoin - invests the majority5 of its fiat reserves in U.S. Treasuries, so stablecoins are inextricably linked to, and reliant upon, the existing financial system.

When Donald Trump declared that America would be “the crypto capital of the planet”, the Bitcoin speculators rejoiced, yet they seem to have misunderstood his intention. His executive order backed “the lawful and legitimate dollar-backed stablecoins”6 to bolster the greenback’s dominance among conventional currencies. It isn’t in Donald Trump’s interest to undermine the US dollar, the reserve currency of the world, which gives the US a great deal of power and leverage in global affairs. So Trump’s initiative is not about dismantling fiat currency but about fortifying the dollar’s global supremacy through stablecoin adoption.

Other jurisdictions are also supporting stablecoin adoption:

Isaacman realized that the power of crypto, particularly stablecoin, was not in disrupting fiat currency, but in disrupting existing payment networks. Today, Visa and Mastercard control 80% of all U.S. credit card transactions, with merchants losing ~3% of every sale to interchange fees.

Stablecoins change the equation. Blockchain transactions cost less than a penny and settle instantly. Unlike credit card payments, they bypass traditional networks, eliminating interchange fees. So this could fundamentally reshape the payments industry.

Rather than building a blockchain-based payments system from scratch, Isaacman took a strategic shortcut - an acquisition. This explains why Shift4 acquired The Giving Block, a leading crypto donation platform, wanting to use it as a foundation for crypto-based transactions. The company has since expanded its capabilities creating a blockchain service for the Shift4 business that is token agnostic - it allows merchants to accept payments in any digital currency of their choosing, which enables Shift4 to generate revenue on any kind of digital money.

Shift4 isn’t the only company betting on a stablecoin revolution:

Stripe acquired Bridge, a stablecoin payments startup.

Visa built the Visa Tokenized Asset Platform (VTAP) to help banks issue digital currencies and BBVA, Spain’s second-largest bank, will be among the first to use it.

Mastercard launched its Multi-Token Network (MTN) to facilitate blockchain transactions.

As stablecoins gain regulatory backing and merchant adoption accelerates, Shift4 aims to be at the forefront of this transformation.

“Crypto started off as really focused on trading, and it's now made a big shift toward utility, specifically payments… as people start to think about how to make the dollar faster, cheaper and more global.”

Brian Armstrong, CEO Coinbase

For Shift4, the stablecoin revolution isn’t just a passing trend - it’s an opportunity to redefine payments in the digital age.

Issues for Investors To Consider

While Shift4 Payments boasts impressive financial growth, investors should be aware of some serious red flags - particularly regarding its aggressive equity compensation practices and shareholder dilution.

Shift4’s 2020 Incentive Award Plan has led to massive stock issuances through restricted stock units (RSUs) and performance-based RSUs (PRSUs). As of December 31, 2024, the company had over 2.1 million unvested RSUs and PRSUs, which will be converted into new shares in the coming years.

To offset this dilution, Shift4 has engaged in huge share buybacks - but the numbers tell a troubling story:

In 2023, the company repurchased 1.66 million shares for $105.4 million at an average price of $63.33 per share.

In 2024, it repurchased 1.6 million shares for $145.9 million at an average price of $90.83 per share.

That’s over $250 million spent on buybacks in just two years, yet share count has still increased. Over the past four years, Shift4 has allocated more than $666 million to repurchases - yet the number of diluted shares outstanding has doubled, from 45 million in 2020 to 91 million today.

The result? Existing shareholders have been diluted by 50%, while insiders continue to cash in - raising serious concerns about the integrity of management and whether the company is being run to enrich insiders at the expense of external shareholders.

This excessive compensation may also shed light on how Jared Isaacman financed the Polaris Dawn space mission. Time Magazine reported that Isaacman bankrolled the trip and personally paid $200 million to Elon Musk for four seats aboard the SpaceX craft.

While Isaacman’s estimated $1.9 billion net worth might justify the splurge, who realistically spends 10% of their fortune for a two-day space joyride with three strangers? Given the sheer scale of Shift4’s equity dilution and insider enrichment, it’s not hard to see how shareholders may have, inadvertently, helped foot the bill for his latest thrill-seeking adventure.

Beyond the obvious governance concerns, these practices place a heavy drag on shareholder returns. When a company continuously issues stock to insiders, then spends hundreds of millions repurchasing shares just to limit dilution - and still ends up with double the share count - investors are right to ask: “Who is Shift4 really working for? The shareholders or its insiders?”

However, there’s another way to look at the exploits of Jared Isaacman - not as a red flag, but as a strategic advantage.

Ask yourself: How does a high school dropout end up running NASA? One might assume such a role demands deep expertise in mathematics, astrophysics and aerospace engineering. Yet, here stands Isaacman - a payments entrepreneur with no higher education - at the helm of the U.S. space agency.

Isaacman isn’t just a businessman; he’s a close ally of both Donald Trump and Elon Musk - two of the most powerful figures in politics and technology. Does this present a plausible answer to our question?

Elon Musk needs NASA contracts for SpaceX. Having an insider at NASA could be invaluable for pushing his agenda.

Trump and Musk are vocal cryptocurrency advocates. Shift4, under Isaacman’s leadership, is at the forefront of facilitating crypto transactions.

Shift4 is already processing payments for Musk’s businesses and unconfirmed rumors suggest that it is also used at Trump’s resorts and golf courses.

If these power players are engaged in a high-stakes game of mutual back-scratching, then Isaacman stands to gain tremendously from his seat at the table.

For skeptical investors, this may look like an elite club consolidating power. But for those willing to bet on Isaacman’s connections, Shift4 could be a smart play. It may be uniquely positioned to ride the wave of lucrative opportunities that come from being inside the right circles - a huge benefit for Shift4 shareholders - potentially reaping the rewards of government contracts, exclusive partnerships, and preferential business opportunities.

Is Shift4 Payments A Good Investment?

Shift4 Payments is a formidable player in the fintech space, fueled by relentless innovation, rapid expansion, and a dynamic business model. With a strong integrated ecosystem and impressive financial growth, it presents a compelling investment case -at least on the surface.

Despite its strong fundamentals, Shift4’s share price has dropped over 15% in the past month, reflecting broader weakness in fintech stocks7 compounded by investor sentiment being shaken by the unexpected leadership shift, with CEO Jared Isaacman stepping down to lead NASA.

Does this present an interesting entry point?

Shift4 has built a reputation for strategic, technology-driven acquisitions that have significantly broadened its capabilities and market reach. As these businesses continue to integrate, investors are closely monitoring their impact on revenue growth, profitability, and shareholder returns.

The company’s aggressive expansion strategy has bolstered its position in the industry, but it comes at a cost - high levels of leverage. Shift4’s rapid growth has been fueled by debt. The company’s leverage, measured by total assets-to-equity ratio stands at ~5x, while the total debt-to-equity ratio of 357%.

At a share price of $97.50 it is capitalized at 8.4x book value and 32x earnings, implying an earnings yield of just over 3%. On a leveraged basis, the company is generating ~31% return on equity, but not even that would justify these multiples. If debt levels were to decrease - a necessity - return on equity will trend toward single digits, where we find the returns on assets and capital today.

In short, even with its impressive growth and the recent decline in the share price, this company still looks unjustifiably expensive. Even with its growth trajectory, these valuation multiples appear steep. The company’s potential remains significant, but the price may not justify the risk - at least for now.

Its high levels of debt would arguably not be necessary if the management were not so intent on allocating capital to repurchase stock to mask dilution from egregious levels of stock-based compensation. Given that capital allocation is the most important function of management, consideration ought to be given to the way in which this duty is being discharged. Insider enrichment at the expense of the company’s health raises valid concerns that investors cannot ignore. Governance issues and the dilution of shareholder value are key risks that warrant caution.

Jared Isaacman has been the driving force behind Shift4’s meteoric rise, but with his departure, a leadership void looms. Can Shift4 sustain its trajectory without him at the helm?

Taylor Lauber, President of Shift4, will succeed Jared upon a successful confirmation from the US Senate.

Ultimately, Shift4 is not just another payments company - its rapidly evolving as its environment changes, venturing into uncharted territory. Whether it reaches "infinity and beyond" will depend on execution, leadership, and how well it balances ambition with accountability.

Execution risks, leadership changes, and valuation concerns make this a high-stakes investment. The bottom line? Shift4’s future could be extraordinary, but patience may be key. For investors, the best opportunities often come at the right price - and perhaps that moment hasn’t arrived just yet.

For me, Adyen remains the best investment in the payments space. I analyzed it back in September 2023 and the shares are up 260% since then, but I believe it is only at the start of a long journey, it remains one of the largest positions in my portfolio and I intend to hold it for many years into the future. If you missed that analysis, here is a link:

Perhaps, having read this analysis, you may have a different opinion. I welcome all views and opinions so please do leave comments on this thread and let’s have a discussion.

Tether holds some of its reserves in Bitcoin and is headquartered in El Salvador without a robust regulatory framework.

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, introduced on February 4, 2025, is a bipartisan bill that aims to create a clear regulatory framework for payment stablecoins. This bill establishes clear procedures for institutions seeking licenses to issue stablecoins. The bill mandates that stablecoins must be fully backed on a 1:1 basis with U.S. dollars or other approved high-quality liquid assets. It imposes federal standards on permitted payment stablecoin issuers, including requirements for fully backed reserves, segregation of reserves, monthly certification, and capital and liquidity requirements. These regulatory developments are crucial for traditional banks to feel comfortable embracing stablecoins and other blockchain solutions. As the regulatory landscape becomes clearer, it is expected that more banks will explore stablecoin adoption, potentially transforming the global financial system in the coming years. Bank of America's CEO Brian Moynihan recently stated that the bank would "go into" stablecoins if regulation were passed in the U.S. This suggests that traditional banks are likely to issue their own stablecoins disrupting the wild west environment in which Tether and others currently operate.

The Global X FinTech ETF - a key industry benchmark - declined nearly 8% in February 2025.

So it looks like the appointment of Jared Isaacman as head of NASA - a strange decision as outlined in this analysis - was influenced by Elon Musk as a means to cement the prospects of his SpaceX business. Institutional corruption at its finest, but I guess he wanted something back for the hundreds of millions of dollars invested in the Trump election campaign.

That all seems to have back-fired now. Following the bust-up between Musk and the President, the White House has withdrawn Isaacman as its nominee and Donald Trump said he would announce a new candidate soon.

Full story: https://www.theguardian.com/us-news/2025/jun/01/trump-drops-nasa-nominee-jared-isaacman-scrapping-elon-musks-pick

This whole story sounds like something straight out of a Netflix script. A high school dropout turns into a NASA chief and builds a payments empire along the way. Pretty wild. But honestly, what caught my attention more were the parts the article kind of glossed over.

First off, over 250 million dollars in stock buybacks, and yet the total share count still doubled? That’s not offsetting dilution, that’s basically using investor money to cover up how much stock they’ve handed out. If a company keeps issuing equity to insiders and then borrows cash to buy it back, that’s not innovation. That’s financial gymnastics.

Another thing the article didn’t really explore is why Shift4 avoids raising money by issuing new shares. They always go the debt-plus-cash route. Maybe that made sense back when rates were low, but now? Borrowing at high interest to avoid diluting founders sounds more like they're protecting their own upside than maximizing long-term value.

Look, I’m not saying Shift4 doesn’t have real tech chops. Their integration across restaurants, hotels, and e-commerce is smart. But the real test is whether this company can keep growing once the founder steps away. And now with the CEO off to NASA, what's left is a pile of debt, diluted shareholders, and a new leader Wall Street hasn’t really met yet.

This isn't a moonshot. It's a tightrope walk at 30,000 feet. For investors, unless the price really makes sense, this space adventure might be better watched from the sidelines.