The Value Game, Do You Know The Rules?

Do you consider yourself a Growth Investor or a Value Investor?

Ever heard an investment manager say, “We run a value fund,” or “We focus on growth stocks”? Sounds sharp. Sophisticated, even. But here’s the truth: it’s not true! It's just marketing spin with roots in the world of academia rather than the real world1.

Investing is a simple game made difficult by bad players. Buying great businesses for less than they’re ultimately worth. That’s it. That’s the whole game.

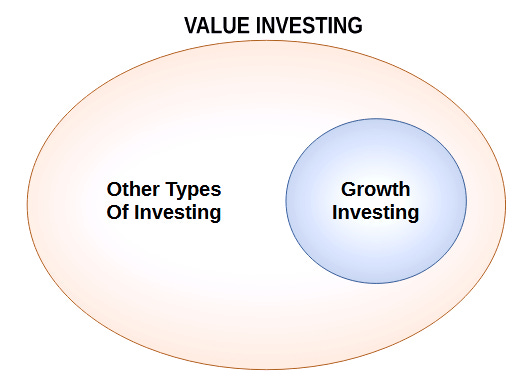

It’s all about the returns we can achieve when we find a business with wonderful economic prospects that is unappreciated by the market. What makes a business worth more than its current market price may be determined by any number of factors - as we shall see shortly. But the artificial divide between value and growth is a false dichotomy. ALL investing is VALUE investing - people are paying for something now in the belief that it is ultimately worth more - and they expect to harvest that value differential. Growth is just one subset of value investing.

So while ‘growth’ investing is ‘value’ investing, not all value investing is growth investing. Let’s explore.

Value Without Growth (Other Types Of Investing)

Many value investments don’t depend on growth at all. In fact, some of the best returns in history have come from companies that weren’t going anywhere, at least in terms of expansion.

Benjamin Graham, the father of value investing, famously hunted for what he called “cigar butt” opportunities. The idea was simple: imagine finding a discarded cigar on the street with just one puff left. It might not offer much, but it costs nothing, and that last puff is pure profit. In investing terms, these were beaten-down companies, often in declining industries, trading at rock-bottom prices. Their earnings, paid out as dividends, could easily surpass the amount paid for the stock over time, making them fantastic bargains despite the lack of growth.

Ironically, tobacco became one of the greatest examples. After the U.S. Surgeon General’s 1964 report linked smoking to lung cancer, smoking rates collapsed from 43% to under 12%, and cigarette sales plunged 70%. Yet Altria Group (MO), the Marlboro maker, turned into one of the most successful investments of the last six decades. A $1,000 investment in 1970 would now be worth over $6 million, an extraordinary 20% annualized return2.

Another category is the “Net/Net” investment, where a company’s liquidation value is far higher than its market price. In the 1970s, Tiffany & Co. was a perfect case. The luxury jeweler owned a Fifth Avenue flagship building, carried on the books at $1 million since 1940, even though Manhattan real estate prices had soared. It also held the famous 128.5-carat Tiffany Diamond, listed at just $1 on the balance sheet, despite having turned down a $2 million offer. And the value of its iconic brand and trademark blue packaging? Also recorded at zero. Investor Peter Cundill spotted the disconnect, bought shares at $10.50, and sold a year later for $19.90, nearly doubling his money. But even he underestimated the upside; Tiffany was sold to Avon Products six months later for $50 per share.

These situations still exist. Macy’s (M) owns 286 properties, including its Herald Square flagship worth over $1 billion. Conservative estimates peg its real estate value between $7.9 and $10.5 billion, more than double its $3.3 billion market cap. Ingles Markets (IMKTA) is in the same boat, with real estate worth far more than its entire stock market valuation. In both cases, the value lies in assets, not growth.

Then there are high-yield investments like certain bonds or other fixed-income instruments. They provide a reliable income stream, but no growth in capital - at maturity, you simply get back your principal.

In each of these examples, there’s clear value, but it has nothing to do with growth. Which is why the next subset, the value investments that do rely on growth, can be so intriguing.

Value With Growth

Too many people think value investing is purely about bargain hunting and that attractive growth stocks are all super expensive, implying that the two are mutually exclusive. But that idea misses a crucial point: value and growth are not opposites.

As Warren Buffett points out, “Growth is simply a component in the calculation of value.”

Traditional metrics, like price to earnings (P/E) ratios and dividend yields, are easy to compare. A low P/E and a fat dividend feel like a steal. But without looking at a company’s quality and growth potential, those numbers mean nothing.

Value is about acquiring more than you are paying for, which has to include an assessment of the rate at which a company compounds and grows.

Picture this:

Company A has a high P/E of 42.

Company B has a low P/E of 10.

Which is better value?

Most people say B. But Company A is growing earnings at 15% a year. B is crawling at 6%. Run the math over a decades or two and A crushes B - even if it looked “expensive” at first.

It’s not about the sticker price - it’s about future returns on your capital.

Think of it this way: you buy a business that reinvests profits at 25% a year. That’s like a supercharged savings account. You money is compounding like wildfire - doubling in three years. Paying a higher multiple up front? Consider it the entry fee for access to a wonderful opportunity. Totally worth it. On the flip side, a stock with a low valuation but little or no growth? That’s a value trap. You may not pay much to get into that opportunity - but your money will stagnate just like being stashed under the mattress. Who wants that? Quality beats cheap - every time!

The numbers back this up. Companies that can consistently reinvest profits at high returns tend to create outsized value over time. If you own a company that earns $1 per share and reinvests it at 25%, that dollar becomes $1.25 in earnings next year, then $1.56 and so on. It may take three years to double your money , but after ten years you are up by nearly 10x, and after two decades you’re up almost 100x. That’s the true engine of long-term wealth creation - not finding cheap looking stocks using a screener. Compounding is exponential and so requires patience.

Even dividend yields, often seen as a hallmark of value, can be misleading. A high dividend might mean a company doesn’t have many attractive reinvestment opportunities. Conversely, a company with no dividends might be reinvesting every dollar into growth projects that deliver double-digit returns. The more they reinvest , the faster your wealth compounds - wouldn't you want them to optimize reinvestment rather than distributing balance sheet capital each year? Reinvested profits are your compounding machine.

If a company is growing profits like crazy and reinvesting at high returns, it deserves a premium. And if the market hasn’t caught on yet? Even better - you’ve found value hidden in a “growth” label.

Here’s where many investors fall into a trap: they think value lies only in the price. But true value lies in what the business delivers over time.

Cheap doesn’t mean good. Expensive doesn’t mean bad. Its what you get for what you pay that matters. Price is what you pay, value is what you get as the Oracle of Omaha reminds us.

Successful investing, then, isn’t about choosing sides in the value vs growth debate. It’s about thinking like a business owner. The key questions become: How much cash will this business generate in the future? How effectively can it reinvest? And what are you paying today for that future stream of cash?

The real insight lies in understanding that to the best investors value and growth are two sides of the same coin.

A cheap looking stock with no growth? Value trap.

A fast grower bought at any price? Speculative gamble.

A quality business with strong reinvestment and a fair price? That’s the sweet spot.

“It’s far better to buy a wonderful business at a fair price than a fair business at a wonderful price.”

Charlie Munger

Labels like “value” and “growth” are for marketing decks, not real investors. They tell us more about the manager than they do about the quality of his fund - either they’re selling a story or they believe their own sell-side hype. Either way, be careful.

In the end, the smartest investors don’t obsess over style. They focus on substance. They look for quality businesses, evaluate future returns, and seek to buy with a margin of safety. Whether the stock is labeled as “value” or “growth” doesn’t matter. What matters is that they’re buying more than they’re paying for.

And that’s what real investing is all about.

Academic paper, VALUE VERSUS GROWTH: THE INTERNATIONAL EVIDENCE, Fama & French 1996

Wealth creation in sunset industries - Cigar Butt investing - https://rockandturner.substack.com/p/wealth-creation-in-sunset-industries